To get more information on Fertilizer Spreader Market - Request Free Sample Report

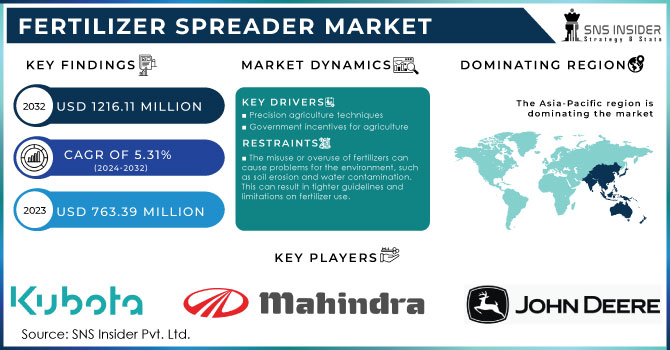

The Fertilizer Spreader Market size was estimated at USD 763.39 million in 2023 and is expected to reach USD 1216.11 million by 2032 at a CAGR of 5.31% during the forecast period of 2024-2032.

The discussed product serves to apply fertilizers or chemicals to lawns in homes, businesses, and public gardens as well as on farms. Nowadays, urbanization, mechanization, and technical improvements are rapidly developing worldwide. Correspondingly, the demand for using sophisticated agricultural equipment is increasing, and the market is accelerating its expansion. Farmers who prefer to apply fertilizers the old-fashioned way face decreased crop productivity because they fail to spread the fertilizer evenly. To be more precise with the use of fertilizer and increase crop productivity are expected to be the leading drivers of market growth. The 1 crore farmers across the country will be initiated into natural farming, supported by certification and branding in next 2 years.

The Four Multiplier Ready models all feature wide, tapered sides for quick filling, with a spread width of up to 120 feet. In just a couple of hours, the Liquid Logic system can be swapped out for a spinner, making year-round use and better ROI. With a 40-gallon/minute hydraulic flow, you get higher rates at faster speeds. Get consistent product control with NL ISO interface no matter which terminal you’re running. Critical sills and cross tubes are made with 304 SS components, providing durability in the long run. The boundary spread feature uses independent spinner speed control to slow one spinner down and keep product in the field. The NL5000 G5 dry nutrient applicator with swath width control saves costs and puts the product exactly where it’s needed. Utilizing a 16-section swath width control through pinpoint fan-frame positioning, the G5 reduces overlap by 10–15% compared to systems without section control. The G5 applicator excels in point rows and anywhere tight, such as terraces, small fields and rolling hills. Independent drinking, left or right side, streamlines spreading away from where it’s not needed, including any acreage already covered. The Last Pass Feature ensures proper placement across the field and minimizes overlap at all times.

The cultivation of several crops is increasing at a drastic rate with the growth in population, which in turn is increasing the usage of autonomous and semi-automatic spreader products for two types; agriculture and landscaping applications. It has been identified in the report of California Farm Bureau, more than 40% of the farmers have faced shortage of many farm operations in the last five years and has been increasing the usage of automated fertilizer spreading equipment. The usage of these products serves the users to reduce human interaction, less time-consuming process and increases the efficiency. Hence, the factors mentioned are expected to drive the fertilizer spreader market growth.

Market Dynamics

Drivers

Precision agriculture methods have become popular in the agricultural sector because they are capable of increasing the overall productivity and reducing the waste of resources. Specifically developed using technologies such as GPS, remote sensing, and data analysis, this approach to monitoring farm activities and managing crops allows for agricultural production to be surveilled and controlled in a very precise manner. One of the instruments that play a critical part in the management of fertilizers in precision farming is the fertilizer spreader, which is intended for distributing fertilizers across a farm plot: “Each product variant is adapted to the type of fertiliser and the area it can cover”. Overfertilizing and under fertilising plants becomes a much less likely issue. Consequently, fertilizers are used with maximum efficiency because of the precision of the application. Many types of crops benefit from precision farming methods. Since precision farming with the help of GPS reduces the volume of fertilisers unaccounted for, their effect on the environment is minimised. The overuse of fertilisers causes the release of harmful gases, whereas their excess runs off into the nearest water sources, leading to the death of fish and other aquatic creatures.

The use of these devices in precision agriculture contributes to farmers’ cost savings. Since the tools are designed in such way that the fertilizers are used in a precise amount, there is less waste of the input and thus the reduced expenditure on the use of various resources on an agricultural field. Moreover, the properly input materials and uniformly grown crops are of higher market value. Moreover, the developed technologies that are commonly integrated into the design of the fertilizer spreaders such as Variable Rate Technology further add to efficacy: its sensors constantly examine the rows of a crop and dictate the applicator to either increase or decrease the application rates of fertilizers. These remote sensors asses the type of soil, and detect the presence or absences of nutrient and the needs of crops. The use of these implements becomes increasingly common in precision agriculture which is beneficial for those farmers whose aim is to attain higher productivity, reduce their costs, and develop environment-friendly approaches to agriculture.

The Governments provide financial supports to farmers in the form of subsidies and other incentives in order to lower the initial cost burden on the farmers facilitating them to go for modern-day tools and technologies that have resulted in increased productivity and efficiency. The fertilizers spreaders are designed to use the fertilizer in such a way that it could have an even distribution of fertilizers across the field of cultivation supporting proper sunlight and air to let into the inner portion of the crops. These advances have definitely more efficient and productive than the convectional way or older way of fertilizing and spreading seeds which increases waste and the yield level simply declines. Governments are aware of the fact that if they want to ensure food security and sustainability of the country, then they must encourage the farmers to go for innovative tools and technologies, which help increase productivity and efficiency.

There are different types of subsidies such as direct financial supports, tax breaks, providing low-interest loans, and grants. Each type of support has to be given to the farmers depending on their requirement and the purpose for which they are looking to receive the support. The subsidies provided by the Government reduce the cost factor involved in the use of new tools and technologies thereby facilitating the farmers to move from traditional ways to innovative methods of cultivation and growth. The Government programmes contain training and educating people to know about the new technologies and how they could make use of them in the most efficient manner providing the maximum output.

The government supports the purchase and adoptive of machinery like fertilizer spreaders, several advantages are realized. This is because it will make operations across fields more efficient and also cheaper due to reduced labor costs. As a result, it will be easier to train employees on better uses of machinery like fertilizers meaning that the quality and quantity of farm yields will improve. Lastly, the application process will be better and this will reduce over-application and leaching into environments which will reduce incidences of eutrophication thereby guaranteeing a cleaner environment. This means that government subsidies and incentives in use of such machinery ensures the growth and sustainability of the agricultural sector thereby economic growth.

Restraints

One of the reasons governments around the world are introducing or simply considering changes in the legislation regarding the use of fertilizers is the significant risk to the environment that is associated with their misuse or overuse. In particular, soil erosion and water contamination seem to be some of the major nuisances causing significant damage to ecosystems and the population living there. The application of too much fertilizer to the soil results in the fast depletion of this latter, and the dust and humus that give the soil structure and fertility erode. It is the improper structure that promotes the rapid spread of water running down surface soil. Moreover, the water running through underlay canals and pipes, collecting fertilizers on the way, enters the rivers, lakes, seas, and oceans, resulting in the growth of harmful algal blooms and hypoxia. Therefore, the adverse environmental impact associated with the use of fertilizers calls for more accurate regulations and guidelines limiting this factor.

By Type

The Broadcast spreader segment is expected to be the largest category at a CAGR of around 4.6% during the forecast period. The broadcast spreader is the key aspect of the spreader market growth to an extent, the broadcasting spreader results in on-going product development contribution that spreads fertilizer over the farms, public gardens, commercial turf application, golf course, and home lawns. broadcast spreader smaller than the hopper of drop spreader. The drop spreader segment is expected to witness significant growth due to it carefully determines to make sure different parts of the lawn and garden receive an even coverage. Moreover, it is easy and simple to use and highly accurate when compared with broadcasting spreader and works well in lawns or spaces up to 5,000 square feet.

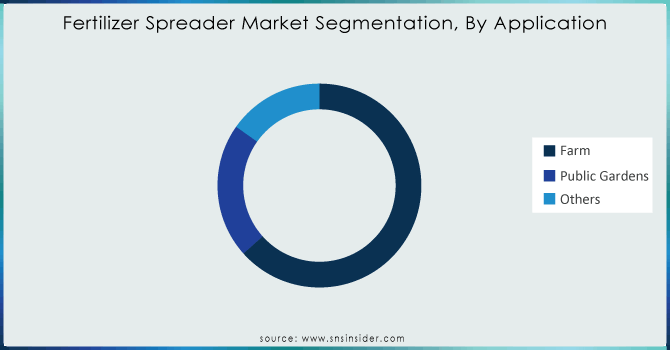

By Application

The farm segment is estimated to see a largest market growth 63.40% in 2023, as “there are a less farm worker same as raise in the usage of these products in all farming operations”. This category uses the produced spreaders on most of the land, and especially for spreading fertilizers throughout the aspect. It leads to proper distribution of the fertilizers which enable sustainable productions. In addition, the value of the spreaders is cheap for both small and big farms.

The public gardens segment is estimated to see a steady growth of especially in the countries such as France, India, Italy, and others. In the public gardens, small spreader or the handheld spreaders are used for spreading the chemicals or fertilizers.

Need any customization research on Fertilizer Spreader Market - Enquiry Now

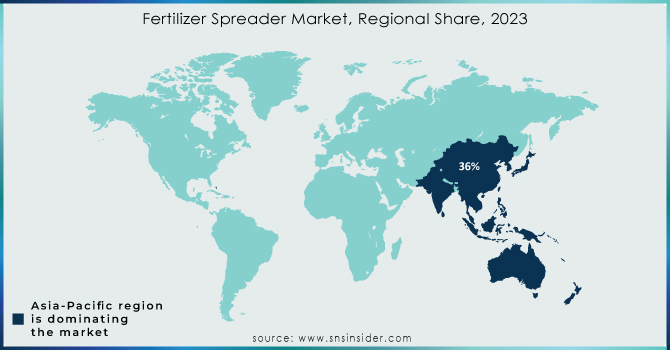

Regional Analysis

Asia-Pacific region is leading the market 36% in 2023. This is owing to the expanding acreage under agricultural domain notably in the developing economies such as India and China. Growing awareness, more personal disposable money, increased reliance on fertilizers to boost crop yield, and increased government backing are some of the other major elements promoting the expansion of this region.

The major key players Deere & Company, Kubota Corporation, Mahindra & Mahindra Ltd, Agco Corporation, CNH Industrial N.V, Claas KGaA mbH, Bucher Industries AG (KUHN Group), Adams Fertilizer Equipment, Dalton AG Inc, Teagle Machinery Ltd, Bogballe A/S, are and Others Players

Recent Development

In May 2023: Jacto, an agricultural machinery company, showcased revolutionary fertilizer spreading and spraying equipment at NAMPO 2023. The Uniport 5030 NPK fertilizer spreader was the star of this Nampo edition

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 763.39 Mn |

| Market Size by 2032 | US$ 1216.11 Mn |

| CAGR | CAGR of 5.31% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Drop Spreader, Broadcast Spreader) • By Application(Farm, Public Gardens, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Deere & Company, Kubota Corporation, Mahindra & Mahindra Ltd., Agco Corporation, CNH Industrial N.V., Claas KGaA mbH, Bucher Industries AG, Adams Fertilizer Equipment, Dalton AG Inc, Teagle Machinery Ltd, Bogballe A/S |

| Key Drivers | • Precision agricultural output and cut down on resource waste, precision agriculture techniques are growing in popularity. Spreaders for fertilizer are an essential part of precision farming. • In many nations, government subsidies and incentives for the agricultural industry encourage farmers to embrace cutting-edge farming techniques, including the use of machinery like fertilizer spreaders. |

| RESTRAINTS | • The misuse or overuse of fertilizers can cause problems for the environment, such as soil erosion and water contamination. This can result in tighter guidelines and limitations on fertilizer use. |

Ans: The Fertilizer Spreader Market is expected to grow at a CAGR of 5.31%.

Ans: Fertilizer Spreader Market size was USD 763.39 Million in 2023 and is expected to Reach USD 1216.11 Million by 2032.

Ans: Farm is the dominating segment by application in the Fertilizer Spreader Market.

Ans: Precision agricultural output and cut down on resource waste, precision agriculture techniques are growing in popularity. Spreaders for fertilizer are an essential part of precision farming.

Ans: Asia-Pacific is the dominating region in the Fertilizer Spreader Market.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Fertilizer Spreader Market Segmentation, By Type

7.1 Introduction

7.2 Drop Spreader

7.3 Broadcast Spreader

8. Fertilizer Spreader Market Segmentation, By Application

8.1 Introduction

8.2 Farm

8.3 Public Gardens

8.4 Others

9. Regional Analysis

9.1 Introduction

9.2 North America

9.2.1 Trend Analysis

9.2.2 North America Fertilizer Spreader Market by Country

9.2.3 North America Fertilizer Spreader Market, by Type

9.2.4 North America Fertilizer Spreader Market, by Application

9.2.5 USA

9.2.5.1 USA Fertilizer Spreader Market, by Type

9.2.5.2 USA Fertilizer Spreader Market, by Application

9.2.6 Canada

9.2.6.1 Canada Fertilizer Spreader Market, by Type

9.2.6.2 Canada Fertilizer Spreader Market, by Application

9.2.7 Mexico

9.2.7.1 Mexico Fertilizer Spreader Market, by Type

9.2.7.2 Mexico Fertilizer Spreader Market, by Application

9.3 Europe

9.3.1 Trend Analysis

9.3.2 Eastern Europe

9.3.2.1 Eastern Europe Fertilizer Spreader Market by Country

9.3.2.2 Eastern Europe Fertilizer Spreader Market, by Type

9.3.2.3 Eastern Europe Fertilizer Spreader Market, by Application

9.3.2.4 Poland

9.3.2.4.1 Poland Fertilizer Spreader Market, by Type

9.3.2.4.2 Poland Fertilizer Spreader Market, by Application

9.3.2.5 Romania

9.3.2.5.1 Romania Fertilizer Spreader Market, by Type

9.3.2.5.2 Romania Fertilizer Spreader Market, by Application

9.3.2.6 Hungary

9.3.2.6.1 Hungary Fertilizer Spreader Market, by Type

9.3.2.6.2 Hungary Fertilizer Spreader Market, by Application

9.3.2.7 Turkey

9.3.2.7.1 Turkey Fertilizer Spreader Market, by Type

9.3.2.7.2 Turkey Fertilizer Spreader Market, by Application

9.3.2.8 Rest of Eastern Europe

9.3.2.8.1 Rest of Eastern Europe Fertilizer Spreader Market, by Type

9.3.2.8.2 Rest of Eastern Europe Fertilizer Spreader Market, by Application

9.3.3 Western Europe

9.3.3.1 Western Europe Fertilizer Spreader Market by Country

9.3.3.2 Western Europe Fertilizer Spreader Market, by Type

9.3.3.3 Western Europe Fertilizer Spreader Market, by Application

9.3.3.4 Germany

9.3.3.4.1 Germany Fertilizer Spreader Market, by Type

9.3.3.4.2 Germany Fertilizer Spreader Market, by Application

9.3.3.5 France

9.3.3.5.1 France Fertilizer Spreader Market, by Type

9.3.3.5.2 France Fertilizer Spreader Market, by Application

9.3.3.6 UK

9.3.3.6.1 UK Fertilizer Spreader Market, by Type

9.3.3.6.2 UK Fertilizer Spreader Market, by Application

9.3.3.7 Italy

9.3.3.7.1 Italy Fertilizer Spreader Market, by Type

9.3.3.7.2 Italy Fertilizer Spreader Market, by Application

9.3.3.8 Spain

9.3.3.8.1 Spain Fertilizer Spreader Market, by Type

9.3.3.8.2 Spain Fertilizer Spreader Market, by Application

9.3.3.9 Netherlands

9.3.3.9.1 Netherlands Fertilizer Spreader Market, by Type

9.3.3.9.2 Netherlands Fertilizer Spreader Market, by Application

9.3.3.10 Switzerland

9.3.3.10.1 Switzerland Fertilizer Spreader Market, by Type

9.3.3.10.2 Switzerland Fertilizer Spreader Market, by Application

9.3.3.11 Austria

9.3.3.11.1 Austria Fertilizer Spreader Market, by Type

9.3.3.11.2 Austria Fertilizer Spreader Market, by Application

9.3.3.12 Rest of Western Europe

9.3.3.12.1 Rest of Western Europe Fertilizer Spreader Market, by Type

9.3.2.12.2 Rest of Western Europe Fertilizer Spreader Market, by Application

9.4 Asia-Pacific

9.4.1 Trend Analysis

9.4.2 Asia Pacific Fertilizer Spreader Market by Country

9.4.3 Asia Pacific Fertilizer Spreader Market, by Type

9.4.4 Asia Pacific Fertilizer Spreader Market, by Application

9.4.5 China

9.4.5.1 China Fertilizer Spreader Market, by Type

9.4.5.2 China Fertilizer Spreader Market, by Application

9.4.6 India

9.4.6.1 India Fertilizer Spreader Market, by Type

9.4.6.2 India Fertilizer Spreader Market, by Application

9.4.7 Japan

9.4.7.1 Japan Fertilizer Spreader Market, by Type

9.4.7.2 Japan Fertilizer Spreader Market, by Application

9.4.8 South Korea

9.4.8.1 South Korea Fertilizer Spreader Market, by Type

9.4.8.2 South Korea Fertilizer Spreader Market, by Application

9.4.9 Vietnam

9.4.9.1 Vietnam Fertilizer Spreader Market, by Type

9.4.9.2 Vietnam Fertilizer Spreader Market, by Application

9.4.10 Singapore

9.4.10.1 Singapore Fertilizer Spreader Market, by Type

9.4.10.2 Singapore Fertilizer Spreader Market, by Application

9.4.11 Australia

9.4.11.1 Australia Fertilizer Spreader Market, by Type

9.4.11.2 Australia Fertilizer Spreader Market, by Application

9.4.12 Rest of Asia-Pacific

9.4.12.1 Rest of Asia-Pacific Fertilizer Spreader Market, by Type

9.4.12.2 Rest of Asia-Pacific Fertilizer Spreader Market, by Application

9.5 Middle East & Africa

9.5.1 Trend Analysis

9.5.2 Middle East

9.5.2.1 Middle East Fertilizer Spreader Market by Country

9.5.2.2 Middle East Fertilizer Spreader Market, by Type

9.5.2.3 Middle East Fertilizer Spreader Market, by Application

9.5.2.4 UAE

9.5.2.4.1 UAE Fertilizer Spreader Market, by Type

9.5.2.4.2 UAE Fertilizer Spreader Market, by Application

9.5.2.5 Egypt

9.5.2.5.1 Egypt Fertilizer Spreader Market, by Type

9.5.2.5.2 Egypt Fertilizer Spreader Market, by Application

9.5.2.6 Saudi Arabia

9.5.2.6.1 Saudi Arabia Fertilizer Spreader Market, by Type

9.5.2.6.2 Saudi Arabia Fertilizer Spreader Market, by Application

9.5.2.7 Qatar

9.5.2.7.1 Qatar Fertilizer Spreader Market, by Type

9.5.2.7.2 Qatar Fertilizer Spreader Market, by Application

9.5.2.8 Rest of Middle East

9.5.2.8.1 Rest of Middle East Fertilizer Spreader Market, by Type

9.5.2.8.2 Rest of Middle East Fertilizer Spreader Market, by Application

9.5.3 Africa

9.5.3.1 Africa Fertilizer Spreader Market by Country

9.5.3.2 Africa Fertilizer Spreader Market, by Type

9.5.3.3 Africa Fertilizer Spreader Market, by Application

9.5.2.4 Nigeria

9.5.2.4.1 Nigeria Fertilizer Spreader Market, by Type

9.5.2.4.2 Nigeria Fertilizer Spreader Market, by Application

9.5.2.5 South Africa

9.5.2.5.1 South Africa Fertilizer Spreader Market, by Type

9.5.2.5.2 South Africa Fertilizer Spreader Market, by Application

9.5.2.6 Rest of Africa

9.5.2.6.1 Rest of Africa Fertilizer Spreader Market, by Type

9.5.2.6.2 Rest of Africa Fertilizer Spreader Market, by Application

9.6 Latin America

9.6.1 Trend Analysis

9.6.2 Latin America Fertilizer Spreader Market by Country

9.6.3 Latin America Fertilizer Spreader Market, by Type

9.6.4 Latin America Fertilizer Spreader Market, by Application

9.6.5 Brazil

9.6.5.1 Brazil Fertilizer Spreader Market, by Type

9.6.5.2 Brazil Fertilizer Spreader Market, by Application

9.6.6 Argentina

9.6.6.1 Argentina Fertilizer Spreader Market, by Type

9.6.6.2 Argentina Fertilizer Spreader Market, by Application

9.6.7 Colombia

9.6.7.1 Colombia Fertilizer Spreader Market, by Type

9.6.7.2 Colombia Fertilizer Spreader Market, by Application

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Fertilizer Spreader Market, by Type

9.6.8.2 Rest of Latin America Fertilizer Spreader Market, by Application

10. Company Profiles

10.1 Deere & Company

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

10.1.4 The SNS View

10.2 Kubota Corporation

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 The SNS View

10.3 Mahindra & Mahindra Ltd.

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 The SNS View

10.4 Agco Corporation

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 The SNS View

10.5 CNH Industrial N.V.

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 The SNS View

10.6 Claas KGaA mbH

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 The SNS View

10.7 Bucher Industries AG

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 The SNS View

10.8 Adams Fertilizer Equipment

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 The SNS View

10.9 Dalton AG Inc

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 The SNS View

10.10 Teagle Machinery Ltd

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Products/ Services Offered

10.10.4 The SNS View

11. Competitive Landscape

11.1 Competitive Benchmarking

11.2 Market Share Analysis

11.3 Recent Developments

11.3.1 Industry News

11.3.2 Company News

11.3.3 Mergers & Acquisitions

12. USE Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Drop Spreader

Broadcast Spreader

By Application

Farm

Public Gardens

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automatic Labelling Machine Market size was valued at USD 2.8 Billion in 2023 & Will Reach USD 3.76 Billion by 2031, with a CAGR of 3.78% by 2024-2031.

The Carbide Tools Market size was estimated at USD 9.32 billion in 2023 and is expected to reach USD 16.25 billion by 2032 at a CAGR of 6.14% during the forecast period of 2024-2032.

The Autonomous Mobile Robots Market size was valued at $1.77 Billion in 2023 & will Reach $6.56 Billion by 2031, displaying a CAGR of 17.8% by 2024-2031.

The Solenoid Valve Market size was valued at USD 4.98 billion in 2023 and is expected to grow to USD 7.05 billion by 2032 and grow at a CAGR of 3.94% over the forecast period of 2024-2032.

The Air Duct Market Share was valued at USD 9.67 Billion in 2023 & is now anticipated to grow to USD 13.83 Billion by 2031, with a CAGR of 4.58% by2024-2031.

The Electrochromic Window Market Size was esteemed at USD 32.47 billion in 2023 and is supposed to arrive at USD 98.91 billion by 2031 and develop at a CAGR of 14.95% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone