To get more information on Fertility Services Markett - Request Free Sample Report

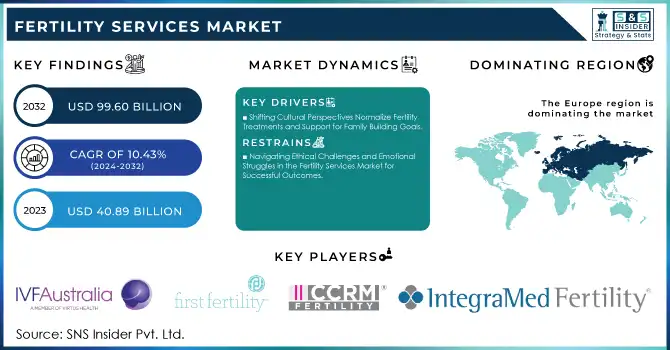

The Fertility Services Market Size was valued at USD 40.89 Billion in 2023 and is expected to reach USD 99.60 Billion by 2032 and grow at a CAGR of 10.43% over the forecast period 2024-2032.

The Fertility service market is growing due to advancements in assisted reproductive technologies and the increasing prevalence of infertility problems. Medical advances such as IVF (in vitro fertilization), ICSI (intracytoplasmic sperm injection), and genetic screening have made treatment more successful and viable as a service. We have also seen years of increased awareness and general acceptance of the services among the public who are either struggling to become pregnant or guaranteeing their fertility.

According to the Centers for Disease Control, IVF cycles are performed more than 330,000 times each year in the USA. Over 70% of these cycles use ICSI where male factor infertility exists, according to the Society for Assisted Reproductive Technology (SART).

A Fertility and Sterility study found that 85% of respondents support some form of health insurance coverage for infertility treatments. Moreover, almost 40% of IVF cycles now involve PGT to improve the chances of successful pregnancies.

The market is also driven by changing societal trends such as delayed parenthood due to the career approach, modified lifestyle changes, and increasing stress causing an impact on fertility. In addition, advancements in fertility preservation techniques including egg and sperm freezing attract those who wish to delay family building for a later time. Services providers are offering far more professional fertility services, as healthcare approaches and social initiatives have begun to reduce shame around infertility and allow at least partial specialization in this way.

The American Society for Reproductive Medicine reported a surge of over 300% in egg-freezing cycles over the past decade. Additionally, a survey by the National Infertility Association found that 70% of respondents feel more comfortable discussing infertility issues now compared to five years ago, indicating a shift in societal attitudes.

Key Drivers:

Shifting Cultural Perspectives Normalize Fertility Treatments and Support for Family Building Goals

One of the other major factors for growth in the Fertility Services market is the changing trend of cultural and social aspects towards parenthood and Family Planning. In several areas, yet one more therapy does aid with having an infant right into the artistic standard and also is coming to be progressively preferred or even needed. People are having kids later to achieve a level of personal and financial comfort, which means many require assisted reproductive services. However, with strides to eliminate stigmas surrounding fertility services, fertility treatments are now a reasonable option for many individuals pursuing their family-building goals. These have contributed towards the normalization of gaining fertility support which has, in turn, affected acceptance people and couples are becoming more inclined to get help with their infertility issues.

According to the CDC, about 12% of women ages 15-44 have difficulty getting pregnant or carrying a pregnancy to term in the U.S. The National Infertility Association reports that 90% of respondents agree that infertility is a medical condition, suggesting growing awareness and acceptance. Daily, over half of those receiving fertility treatment described their family and friends as supportive (80%), a clear change in traditional attitudes around treatment assistance.

Transforming Fertility Services Through Digital Health Solutions and Telemedicine for Enhanced Patient Engagement

Digital health solutions and telemedicine are transforming the fertility services environment as they improve patient convenience cost-effectively. Telemedicine: The same advancements in technology that have helped with diagnosis and treatment also facilitate remote consultations. Telemedicine platforms make it easier for individuals to receive initial evaluations, counseling, and follow-up care from the comfort of their homes. Patients can also get access to education, track their cycles, and receive personalized advice regarding any lifestyle modifications needed via digital health tools. The application of data analytics only adds to the ability to tailor treatment options, increasing success rates through a better understanding of patient-specific issues related to fertility. All of this technology is making fertility care more efficient, available, and able to serve patients in a new, user-friendly manner.

According to research published in Fertility and Sterility, 70% of patients receiving fertility treatments are interested in telehealth for initial consultations and follow-ups.

Moreover, a study by the National Institutes of Health found that women who used a digital health tool for the management of fertility in 50% of cases were more engaged with their plan belonging to a particular treatment, which consequently enhances adherence and also increases chances of success.

Restrain:

Navigating Ethical Challenges and Emotional Struggles in the Fertility Services Market for Successful Outcomes

Treatments such as IVF and genetic screening are more available than in many other countries, although laws vary widely. This means that some areas have more tightened regulations on procedures or protocols and can pose obstacles for fertility clinics and how the patient can attain such services. Ethical implications are complex, in part due to the larger structures of concerns about embryo handling/growth and genetic modification techniques further complicating this issue societal attitudes affecting politics have slashed service offerings. Now, the second issue is the emotional and psychological impact on individuals and couples going through fertility treatment. It can be very stressful with additional physical and emotional side effects depending on how many treatment cycles are required. These stressors can result in treatment drop-offs and negatively impact patient outcomes if mental health support is not available, which highlights the importance of integrated counselling services at fertility clinics.

By Type

Male infertility dominated the market, accounting for a considerable 54% share in the year 2023 and is projected to register the fastest CAGR during the forecast period of 2024-2032. Among the reasons for this importance and progression are the progressive awareness and diagnosis of infertility issues among men, which are frequently related to lifestyle factors, environmental exposures, or age-related factors. The rising prevalence of circumstances related to male infertility for example erectile dysfunction and also advances in diagnostic tools have been expected to improve the accessibility of alternatives inside aided reproduction technologies programs throughout this strategy, along with within needs regarding sperm retrieval & ICSI occupying an elevated request.

By Treatment

In-vitro fertilization (IVF) dominated the market with an 87% share in 2023. The popularity of IVF can be attributed to its relatively higher success rates compared to other fertility treatments, especially in cases of complex infertility. Modern approaches to IVF such as preimplantation genetic testing combine traditional IVF with additional techniques and are becoming more efficient and accessible due to technological advancements. The combined approach on multiple levels has ensured that IVF is now the gold standard of fertility treatment, especially with people who may have previously had a less successful experience with other forms.

Artificial insemination is predicted to register the fastest CAGR during 2024-2032. It is considered more affordable and less invasive, plus it can be helpful for some individuals with certain types of infertility, particularly if the fertility issue isn't especially severe. It can become a more universal, affordable option in that artificial insemination is also frequently used in instances where individuals have no grave infertility problem. With people becoming more aware of this treatment and embracing it, its demand addition is likely to grow tremendously and will open new doors in the market of fertility services.

By End Use

Fertility clinics accounted for the majority of the fertility services market, with a significant 76% share in 2023. The reason for this dominance is that they specialize in reproductive health, providing all the services required in infertility treatments. Fertility clinics also want to remain equipped with the latest technologies and staffed with top specialists who can personalize care based on the public's healthcare needs. The way they provide an environment with all sensitivity due to one need to trust and go forward for help with fertility issues gives them a well-deserved market position.

Hospitals and other healthcare facilities are anticipated to grow with the fastest rate during the forecast period 2024 to 2032. The expansion is due to various reasons such as the rise in offering fertility services in general healthcare settings, which leads to easy access for a larger population. Because hospitals can provide more ancillary services (e.g. complete check-ups and surgery), it is more convenient for patients. Furthermore, given the heightened awareness of fertility problems and increasing societal demand for fertility treatment, hospitals are expected to widen their services to address this need which is driving market growth over the period.

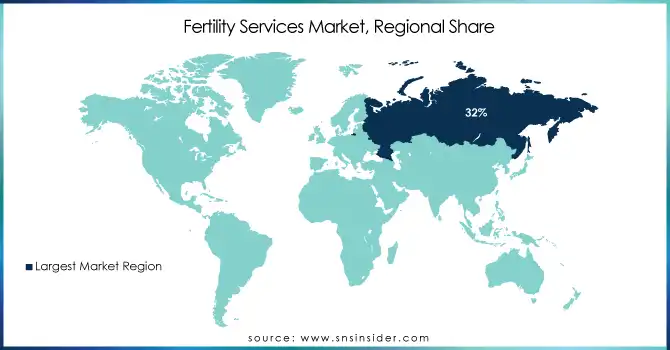

In 2023, Europe held a substantial share of 32% of the global fertility services market as the demand for assisted reproductive technology has increased in recent years owing to a rise in overall childbirths. This leadership is mainly owing to developed health infrastructures, a high level of knowledge about reproductive health, and extensive availability of assisted reproductive technologies. Spain and Denmark are two countries that stand out with quite progressive policies regarding fertility treatments (IVF, etc.), where they have funded IVF procedures via the state and where there are strict regulations on how well a clinic is run. Spain, in particular, is a great place for patients seeking high-quality fertility treatment at low prices to become extreme towards fertility tourism.

The Asia Pacific region is expected to grow the fastest CAGR from 2024to2032. Higher disposable incomes, an expanding middle class, along rising consciousness about infertility among the population have been leading to increased growth of this market million-dollar. Countries like India and China are investing more in ART infrastructure and services. In India, for example, the mushrooming of fertility clinics is being driven by the growing demand among its one billion people for IVF and other fertility treatments. Furthermore, government efforts to treat infertility and increase reproductive health will only add fuel to this growth. With changing perspectives on seeking help with reproductive issues, the fertility services market in the Asia Pacific is set to witness lucrative developments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major players in the Fertility Services Market are:

IVF Australia (IVF treatment, Egg freezing)

Fertility First (IVF cycles, Egg donation)

CCRM Fertility (Embryo banking, Fertility preservation)

IntegraMed Fertility (IVF services, Egg donation programs)

Mayo Clinic (IVF services, Fertility counseling)

New Hope Fertility Center (IVF treatment, Natural cycle IVF)

Oregon Reproductive Medicine (IVF services, Sperm donation)

Boston IVF (IVF cycles, Genetic testing)

Reproductive Medicine Associates of New Jersey (IVF services, Egg donation)

Shady Grove Fertility (IVF treatment, Donor egg program)

Zavitz Fertility & Reproductive Health (IVF cycles, Egg freezing)

Clinica de Fertilidad (IVF services, Sperm analysis)

RMA of New York (IVF treatment, Genetic testing)

Piedmont Reproductive Endocrinology Group (IVF services, Egg donation)

SIRM (Surgical egg retrieval, IVF treatment)

Bourn Hall Clinic (IVF cycles, Sperm retrieval)

IVF New Jersey (IVF services, Egg freezing)

Create Fertility (IVF treatment, Sperm donation)

Cleveland Clinic (IVF cycles, Fertility counseling)

The Fertility Center (IVF treatment, Egg freezing)

Some of the Raw Material Suppliers for Fertility Services Companies:

Thermo Fisher Scientific

Merck Group

Fisher Scientific

Hologic Inc.

Irvine Scientific

Sartorius AG

Eppendorf AG

VWR International

Corning Inc.

BD Biosciences

In August 2024, Birla Fertility acquires IVF chain BabyScience in ₹500-crore push for 100 clinics by FY28.

In October 2024, The Ontario government is investing $150 million over two years to expand fertility services, enabling three times more people to qualify for government-funded in vitro fertilization (IVF), announced Finance Minister Peter Bethlenfalvy.

In August 2024, Republican presidential candidate Donald Trump announced that he would mandate government or insurance coverage for IVF fertility treatments if elected in November, a strategy aimed at attracting women and suburban voters.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 40.89 Billion |

| Market Size by 2032 | USD 99.60 Billion |

| CAGR | CAGR of 10.43% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Male Infertility, Female Infertility), • By Treatment (In-Vitro Fertilization (IVF), Artificial Insemination), • By End Use (Fertility Clinics, Hospitals and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IVF Australia, Fertility First, CCRM Fertility, IntegraMed Fertility, Mayo Clinic, New Hope Fertility Center, Oregon Reproductive Medicine, Boston IVF, Reproductive Medicine Associates of New Jersey, Shady Grove Fertility, Zavitz Fertility & Reproductive Health, Clinica de Fertilidad, RMA of New York, Piedmont Reproductive Endocrinology Group, SIRM, Bourn Hall Clinic, IVF New Jersey, Create Fertility, Cleveland Clinic, The Fertility Center |

| Key Drivers | • Shifting Cultural Perspectives Normalize Fertility Treatments and Support for Family Building Goals • Transforming Fertility Services Through Digital Health Solutions and Telemedicine for Enhanced Patient Engagement |

| Restraints | • Navigating Ethical Challenges and Emotional Struggles in the Fertility Services Market for Successful Outcomes |

Ans: The Fertility Services Market is expected to grow at a CAGR of 10.43% during 2024-2032.

Ans: Fertility Services Market size was USD 40.89 billion in 2023 and is expected to Reach USD 99.60 billion by 2032.

Ans: A major growth factor of the Fertility Services Market is the increasing awareness and acceptance of assisted reproductive technologies, leading more individuals and couples to seek fertility treatments. Additionally, advancements in medical technologies and techniques have significantly improved success rates, driving demand for these services.

Ans: The Male Infertility segment dominated the Fertility Services Market in 2023.

Ans: Europe dominated the Fertility Services Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Fertility Services Success Rates of Treatments, by Region, (2020-2023)

5.2 Fertility Services Technology Advancements, by Region, (2020- 2023)

5.3 Fertility Services Treatment Cycles, by Region

5.4 Fertility Services Trends in Treatment Types, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Fertility Services Market Segmentation, by Type

7.1 Chapter Overview

7.2 Male Infertility

7.2.1 Male Infertility Market Trends Analysis (2020-2032)

7.2.2 Male Infertility Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Female Infertility

7.3.1 Female Infertility Market Trends Analysis (2020-2032)

7.3.2 Female Infertility Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Fertility Services Market Segmentation, by Treatment

8.1 Chapter Overview

8.2 In-Vitro Fertilization (IVF)

8.2.1 In-Vitro Fertilization (IVF) Market Trends Analysis (2020-2032)

8.2.2 In-Vitro Fertilization (IVF) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Artificial Insemination

8.3.1 Artificial Insemination Market Trends Analysis (2020-2032)

8.3.2 Artificial Insemination Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Fertility Services Market Segmentation, by End Use

9.1 Chapter Overview

9.2 Fertility Clinics

9.2.1 Fertility Clinics Market Trends Analysis (2020-2032)

9.2.2 Fertility Clinics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Hospitals and Others

9.3.1 Hospitals and Others Market Trends Analysis (2020-2032)

9.3.2 Hospitals and Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Fertility Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.2.5 North America Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.2.6.3 USA Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.2.7.3 Canada Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.2.8.3 Mexico Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Fertility Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.1.6.3 Poland Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.1.7.3 Romania Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Fertility Services Market Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Fertility Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.2.5 Western Europe Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.2.6.3 Germany Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.2.7.3 France Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.2.8.3 UK Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.2.9.3 Italy Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.2.10.3 Spain Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.2.13.3 Austria Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Power Management Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Fertility Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.4.5 Asia Pacific Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.4.6.3 China Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.4.7.3 India Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.4.8.3 Japan Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.4.9.3 South Korea Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.4.10.3 Vietnam Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.4.11.3 Singapore Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.4.12.3 Australia Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Fertility Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.5.1.5 Middle East Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.5.1.6.3 UAE Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Fertility Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.5.2.5 Africa Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Fertility Services Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.6.5 Latin America Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.6.6.3 Brazil Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.6.7.3 Argentina Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.6.8.3 Colombia Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Fertility Services Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Fertility Services Market Estimates and Forecasts, by Treatment (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Fertility Services Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11. Company Profiles

11.1 VF Australia

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

11.2 Fertility First

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

11.3 CCRM Fertility

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

11.4 IntegraMed Fertility

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

11.5 Mayo Clinic

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

11.6 New Hope Fertility Center

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

11.7 Oregon Reproductive Medicine

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

11.8 Boston IVF

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

11.9 Reproductive Medicine Associates of New Jersey

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11.10 Shady Grove Fertility

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Male Infertility

Female Infertility

By Treatment

In-vitro fertilization (IVF)

Artificial Insemination

By End Use

Fertility Clinics

Hospitals and Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Healthcare Revenue Cycle Management Market Size was USD 137.44 billion in 2023, projected to grow at a CAGR of 11.72%, reaching USD 372.16 billion by 2032.

The Large Molecule Bioanalytical Testing Services Market Size was valued at USD 1.98 billion in 2023 and is expected to reach USD 4.55 billion by 2032 and grow at a CAGR of 9.70% over the forecast period 2024-2032.

Veterinary Hospital Market Size was valued at USD 58 billion in 2023 and is expected to reach USD 107.73 billion by 2032, growing at a CAGR of 7.13% over the forecast period 2024-2032.

Animal Disinfectant Market Size was valued at USD 3.64 Billion in 2023 and is expected to reach USD 6.95 billion by 2032, growing at a CAGR of 7.46% over the forecast period 2024-2032.

Medical Writing Market was valued at USD 4.3 billion in 2023 and is expected to reach USD 10.5 billion by 2032, growing at a CAGR of 10.45% over the forecast period 2024-2032.

The Wearable Breast Pumps Market size was USD 565.1 million in 2023, projected to hit USD 1149.63 million by 2032, growing at 8.2% CAGR.

Hi! Click one of our member below to chat on Phone