Get More Information on Feed Mycotoxin Detoxifiers Market - Request Sample Report

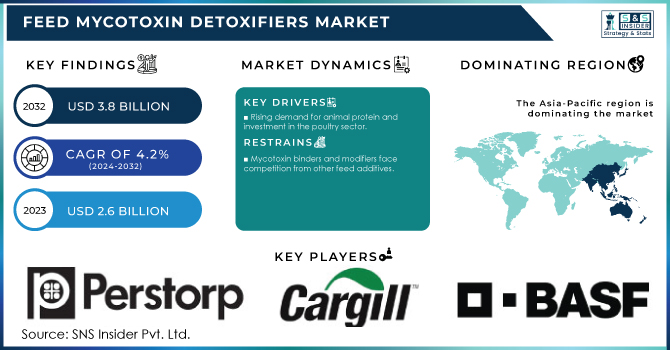

The Feed Mycotoxin Detoxifiers Market size was valued at USD 2.6 Billion in 2023. It is expected to grow to USD 3.8 Billion by 2032 and grow at a CAGR of 4.2% over the forecast period of 2024-2032.

Increasing focus on sustainable agriculture and organic farming practices is notably impacting the natural and organic mycotoxin detoxifiers market growth. With food safety and environmental sustainability becoming key drivers for consumers, the producers are forced to implement practices that improve not only animal health, but also reduce their carbon footprint. These sustainable practices in line with the organic quality of farm produce offer viable alternatives in the form of natural and organic detoxifiers, extracted from plant-based sources or produced by beneficial microbial culture that can help farmers to balance out on synthetic additives.

These toxins can not only harm livestock but also potentially enter the human food chain if contaminated feed is consumed by animals. Feed mycotoxin detoxifiers offer a reliable solution to mitigate these risks, ensuring animal well-being and consumer safety. For example, according to the World Health Organization in 2023 "One Health" focus exemplifies the rising emphasis on animal health's link to human well-being. Mycotoxin mitigation through feed detoxifiers safeguards animal health, potentially reducing the risk of zoonotic diseases.

Furthermore, the expanding global livestock industry presents significant growth. The demand for meat, poultry, eggs, and dairy products is surging due to population growth, rising disposable income, and urbanization. This translates to a larger market for feed additives, including mycotoxin detoxifiers. Additionally, growing awareness among farmers regarding the detrimental effects of mycotoxins on animal performance and production losses is propelling the adoption of these feed additives. Advancements in detoxification technology further enhance the market's potential. The development of new and improved methods for deactivating or binding mycotoxins leads to more effective and efficient feed detoxifiers, solidifying their position as a vital tool in modern animal production. According to the U.S. Department of Agriculture (USDA), organic meat sales in the U.S. surged by over 12% in 2023, reflecting this growing consumer interest.

Drivers

Rising demand for animal protein and investment in the poultry sector.

Consumer preferences are shifting towards poultry due to its affordability compared to other meats, and events like the African swine fever outbreak that reduced pork availability further solidified this trend. This growth is bolstered by substantial investments across the sector. Leading producers like China, with its massive layer hen populations, and companies like Almarai in Saudi Arabia investing heavily in new farms exemplify this commitment. This rise in poultry production necessitates increased feed production, which in turn is expected to drive demand for feed additives in the coming years. Overall, the future of the poultry industry appears bright, fueled by consumer preferences and significant investments.

The rising global demand for animal protein is driving significant growth in the livestock and poultry sectors. Increasing incomes, urbanization, and changing dietary patterns have led to higher consumption of meat, eggs, and dairy products. According to the Food and Agriculture Organization (FAO), global meat consumption increased by 2.3% in 2022, with poultry accounting for over 40% of total meat production. This demand surge is pushing farmers and producers to expand their poultry operations, invest in modern farming techniques, and adopt enhanced feed solutions to meet growing consumer needs. The U.S. Department of Agriculture (USDA) advanced data indicated that decades-high poultry production in the U.S. amounting to 49.2 billion pounds in 2023 resulted from expanding investments in sustainable farming solutions and modernized feed approaches. These investments are designed to enhance efficiency and to answer the growing demand for high-quality animal proteins around the globe.

Restraint

Mycotoxin binders and modifiers face competition from other feed additives.

While mycotoxin binders and modifiers offer a targeted approach to address mycotoxin contamination, some livestock producers remain unconvinced of their necessity. They often prioritize other feed additives that deliver broader benefits. Mold inhibitors, for instance, directly target the root cause of the problem by preventing mold growth in the first place. This can significantly reduce the risk of mycotoxin production in stored feed. Additionally, acidifiers create an unfavorable environment for mold and bacteria, further enhancing feed preservation. These strategies, along with other feed preservatives, contribute to improved shelf life and overall feed quality, ultimately benefiting livestock health and profitability. it is important to acknowledge that these alternative approaches might not be a complete solution. Mold inhibitors and preservatives, while effective, may not eliminate the risk of mycotoxin contamination, especially if the contamination occurred before storage.

Opportunity

Increasing demand for feed mycotoxin detoxifiers from the poultry and aquafeed sectors.

The rise of large-scale, intensive farming practices has created a significant growth engine for the feed mycotoxin detoxifier market, particularly within the poultry and aquaculture sectors. These sectors rely heavily on feedlots, confined environments where animals are raised at high densities. This intensive approach, while efficient, creates ideal conditions for mold growth and subsequent mycotoxin contamination in feed. This challenge presents a significant growth opportunity for the feed mycotoxin detoxifiers market. As the demand for poultry meat continues to soar globally, driven by factors like population increase and rising disposable incomes, ensuring the health and safety of these birds becomes paramount. Consumers across regions and income levels are increasingly turning to poultry as a source of protein, further fueling the growth trajectory of this sector.

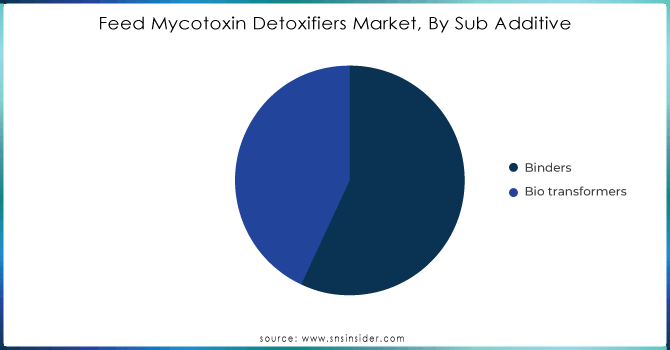

By Sub Additive

The binders held the largest market share around 68% in the market in 2023. The binders have emerged as a critical tool in modern animal feed management. Their popularity stems from a compelling combination of efficacy and affordability. These binders function as a protective shield within the animal's digestive tract, effectively preventing harmful mycotoxins from entering the bloodstream. This intervention plays a vital role in safeguarding livestock health by mitigating the risk of mycotoxin-induced neurological disorders. These disorders, if left unchecked, can manifest in a range of debilitating symptoms, including tremors, seizures, and even death in severe cases. By binding to mycotoxins within the digestive system, binders prevent their absorption, thereby safeguarding animal health and well-being.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Animal Type

The poultry segment held the largest market share around 32% in 2023. Poultry farming takes less space, time, and investment to rear than any other livestock giving a reason for farmers to choose poultry farms. Moreover, poultry meat is a rich source of protein available at lower prices which makes it attractive to health-professional consumers contributing to the growth of the market. The production of poultry reached more than 40 percent of the global meat, driven largely by increasing consumption of chicken and eggs, a recent report released by Food and Agriculture Organization (FAO) has revealed. Supportive government policies and advancements in poultry farming have reinforced this segment leading the market.

Asia-Pacific region dominated the feed mycotoxin detoxifiers market in 2023, and held a 35% market share. This dominance can be attributed to two key factors, high feed production and a vast animal population within the region. These factors create a significant demand for mycotoxin mitigation strategies. Moreover, due to rapid population growth, increasing urbanization, and rising disposable incomes. These factors have led to a surge in demand for affordable protein sources like poultry meat and eggs. Countries like China, India, and Indonesia are major contributors, with large-scale investments in poultry farming and feed production to meet growing domestic consumption. According to the Food and Agriculture Organization (FAO), Asia-Pacific accounted for over 40% of global poultry production in 2022. Additionally, supportive government policies, such as subsidies and modernization programs, have accelerated the expansion of the poultry industry in the region.

Key Players

Key Manufacturers

Cargill (Promote)

BASF (Mycofix)

ADM (Synergize Detox)

Bayer (MycoGuard)

Perstorp (ProSid MI 700)

Chr. Hansen (BioPlus)

Kemin (TOXFIN)

Nutreco (Selko Toxo)

Adisseo (Microvit)

Alltech (Mycosorb A+)

Novus International (Solis)

Biomin (Mycofix Plus)

Impextraco (Elitox)

Norel (Nor-Guard)

Global Nutritech (NutriTox)

Olmix (MT.X+)

Anpario (Neutox)

Evonik (GutCare)

Orffa (Excential Toxin Plus)

Neovia (Secur-Atox)

Key Users

JBS S.A.

CP Foods

WH Group

BRF S.A.

New Hope Group

Smithfield Foods

Vion Food Group

Perdue Farms

NongHyup Feed

In February 2024, Cargill's analyzed over 350,000 samples from feed plants, farms, and storage locations, equips them with crucial data to make informed decisions about using additives to mitigate these risks.

In May 2024, Bayer has partnered with G+FLAS, a South Korean biotech company. Together, they'll use gene editing to develop vitamin D3-enriched tomatoes. This is a big deal, as vitamin D deficiency affects millions globally, especially in regions with limited winter sun.

In March 2024, Cargill captured over 15,000 tonnes of CO2 equivalents in 2023 through regenerative agriculture practices. This marks a significant increase from the 1,000 tonnes captured the prior year.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.3 Billion |

| Market Size by 2032 | US$ 3.8 Billion |

| CAGR | CAGR of 4.2% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sub Additive (Binders, Biotransformers) • By Animal Type (Aquaculture, Poultry, Ruminants, Swine) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Impextraco, Bayer, ADM, Cargill, BASF, Perstorp, Kemin, Biomin, Norel, Nutreco, Adisseo, Chr. Hansen, Global Nutritech, Alltech, Novus International, and Other Players. |

| DRIVERS | • Increased mycotoxin exposure rates in cattle |

| Restraints | • Existence of possible replacements |

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Due to disturbances in the worldwide supply chain, COVID-19 has had a detrimental effect on the manufacture of all chemicals, especially Feed Mycotoxin Detoxifiers. This is as a result of the travel bans and worldwide lockdown put in place to stop the coronavirus from spreading. The production of feed mycotoxin detoxifiers has been constrained as a result of the pandemic's effects on the animal feed industry. As a result of their widespread use in a range of animals, including livestock, horses, companion animals, and others, feed mycotoxin detoxifiers have a direct bearing on the expansion of the market for them.

Ans: Mycotoxin detoxifiers' effects are the challenges faced by the Feed Mycotoxin Detoxifiers Market.

Ans: Existence of possible replacements are the restraints for Feed Mycotoxin Detoxifiers Market.

Ans: Feed Mycotoxin Detoxifiers Market size was USD 2.2 billion in 2023 and is expected to Reach USD 3.3 billion by 2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Sub Additive, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Feed Mycotoxin Detoxifiers Market Segmentation, by Sub Additive

7.1 Chapter Overview

7.2 Binders

7.2.1 Binders Market Trends Analysis (2020-2032)

7.2.2 Binders Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Bio transformers

7.3.1 Bio transformers Market Trends Analysis (2020-2032)

7.3.2 Bio transformers Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Feed Mycotoxin Detoxifiers Market Segmentation, by Animal Type

8.1 Chapter Overview

8.2 Aquaculture

8.2.1 Aquaculture Market Trends Analysis (2020-2032)

8.2.2 Aquaculture Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Poultry

8.3.1 Poultry Market Trends Analysis (2020-2032)

8.3.2 Poultry Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Ruminants

8.4.1 Ruminants Market Trends Analysis (2020-2032)

8.4.2 Ruminants Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Swine

8.5.1 Swine Market Trends Analysis (2020-2032)

8.5.2 Swine Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.2.4 North America Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.2.5.2 USA Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.2.6.2 Canada Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.2.7.2 Mexico Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.1.5.2 Poland Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.1.6.2 Romania Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.2.4 Western Europe Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.2.5.2 Germany Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.2.6.2 France Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.2.7.2 UK Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.2.8.2 Italy Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.2.9.2 Spain Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.2.12.2 Austria Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.4.4 Asia Pacific Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.4.5.2 China Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.4.5.2 India Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.4.5.2 Japan Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.4.6.2 South Korea Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.2.7.2 Vietnam Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.4.8.2 Singapore Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.4.9.2 Australia Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.5.1.4 Middle East Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.5.1.5.2 UAE Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.5.2.4 Africa Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.6.4 Latin America Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.6.5.2 Brazil Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.6.6.2 Argentina Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.6.7.2 Colombia Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Sub Additive (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Feed Mycotoxin Detoxifiers Market Estimates and Forecasts, by Animal Type (2020-2032) (USD Billion)

10. Company Profiles

10.1 Cargill

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Product / Services Offered

10.1.4 SWOT Analysis

10.2 BASF

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Product / Services Offered

10.2.4 SWOT Analysis

10.3 ADM

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Product / Services Offered

10.3.4 SWOT Analysis

10.4 Bayer

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Product / Services Offered

10.4.4 SWOT Analysis

10.5 Perstorp

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Product / Services Offered

10.5.4 SWOT Analysis

10.6 Chr. Hansen

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Product / Services Offered

10.6.4 SWOT Analysis

10.7 Kemin

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Product / Services Offered

10.7.4 SWOT Analysis

10.8 Nutreco

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Product / Services Offered

10.8.4 SWOT Analysis

10.9 Adisseo

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Product / Services Offered

10.9.4 SWOT Analysis

10.10 Alltech

10.10.1 Company Overview

10.10.2 Financial

10.10.3 Product / Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Sub Additive

Binders

Bio transformers

By Animal Type

Poultry

Ruminants

Swine

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Fructooligosaccharides Market Size was valued at USD 2.6 billion in 2023, and is expected to reach USD 5.5 billion by 2032, and grow at a CAGR of 8.7% over the forecast period 2024-2032.

The Biocompatible Coatings Market Size was valued at USD 16.23 Billion in 2023 and is expected to reach USD 41.18 Billion by 2032, growing at a CAGR of 10.90% over the forecast period of 2024-2032.

Rare Earth Metals Market size was valued at USD 7.66 billion in 2023 and is expected to reach USD 16.26 billion by 2032, at a CAGR of 8.75% from 2024-2032.

Polyethylene Foams Market Size was valued at USD 3.39 billion in 2022, and expected to reach USD 5.45 billion by 2030, and grow at a CAGR of 6.1 % over the forecast period 2023-2030.

Calcium Carbonate Market size was USD 45.6 billion in 2023 and is expected to reach USD 79.8 billion by 2032 and grow at a CAGR of 6.4% from 2024 to 2032.

Aerosol Market Size was valued at USD 85.4 Billion in 2023 and is expected to reach USD 150.2 billion by 2032, growing at a CAGR of 6.5% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone