Get E-PDF Sample Report on Fault Detection and Classification Market - Request Sample Report

The Fault Detection and Classification Market size was valued at USD 4.70 billion in 2023 and is expected to grow to USD 10.01 billion by 2032 and grow at a CAGR of 8.83% over the forecast period of 2024-2032.

The growing focus on quality control is a crucial factor driving the growth of the Fault Detection and Classification (FDC) market, as it meets the urgent demand for providing top-notch products in a competitive setting. Currently, manufacturing, semiconductors, and oil and gas sectors are facing challenges to meet strict regulatory requirements and consumer demands, highlighting the importance of upholding product excellence. FDC systems are crucial in this situation as they use sensors, data analytics, and machine learning algorithms to identify abnormalities in manufacturing processes, thanks to their real-time monitoring abilities. By promptly identifying and categorizing errors, these systems assist organizations in quickly implementing corrections, thus mitigating the possibility of faulty products reaching the market. Reducing downtime and improving efficiency and consistency boosts brand reputation. The rise of FDC solutions is backed by the growing use of automation and smart manufacturing technologies, with AI-driven predictive maintenance and real-time analytics gaining importance. With industries placing importance on quality assurance for competitiveness, FDC systems play a crucial role in avoiding process deviations that may lead to expensive recalls, product failures, or harm to the brand. This tendency reflects the larger movement towards utilizing AI and machine learning in manufacturing to improve processes and guarantee greater production outputs, as observed in the semiconductor sector, where AI is being employed to boost efficiency during worldwide chip shortages. Therefore, the need for FDC solutions is expected to increase as the industry places more emphasis on quality and operational excellence.

Recent advancements in predictive maintenance for large-scale solar photovoltaic (PV) plants have been significantly enhanced by a novel machine-learning model developed by scientists from Malaysia and Thailand. This model integrates K-Means clustering and Long Short-Term Memory (LSTM) techniques to improve fault detection and classification, addressing the limitations of traditional operating and maintenance (O&M) systems that rely on manual inspection and data analysis. The K-Means algorithm segments electrical current data from string modules and environmental factors like global irradiance and module temperature into clusters, representing typical behavior with a central mean point. LSTM, trained on historical data, then detects anomalies in the predicted electrical currents of these modules. This technique excels in handling sequential data through its specialized memory cells and gating mechanisms, which capture long-term dependencies and trends. The model, applied to data from a large-scale PV plant in Malaysia monitoring 420 string modules and 8,400 PV modules, achieved a root mean square error (RMSE) of 0.7766. When compared to the benchmark model based on Artificial Neural Networks (ANN), which had a relative error of 4.363%, the LSTM model showed improved precision with a relative error of 4.316%.This advancement is crucial for the fault detection and classification market, which is growing as the demand for efficient and cost-effective maintenance solutions in energy sectors rises. Driven by increasing investments in predictive maintenance technologies and the rising complexity of operational systems in industries like renewable energy.

| Report Attributes | Details |

|---|---|

| Key Segments | • By Fault Type (Dimensional Fault, Surface Defects, Contamination Faults, Process Variability, Others) • By Technique/Technology (Sensor Data Analysis, Statistical Methods, Machine Learning Algorithm, Others) • By Offering (Introduction, Software, Hardware, Services) • By Application (Manufacturing, Packaging) • By End Use (Introduction, Automotive, Electronics and semiconductor, Metals & machinery, Food & packaging, Pharmaceuticals) |

| Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

ADVANTEST CORPORATION, Amazon Web Services, Inc.,Applied Materials, Inc.,CIM Environmental Pty Ltd.,Cognex Corporation, einnoSys Technologies Inc.,INFICON ,KILI TECHNOLOGY,KLA Corporation, Microsoft ,MobiDev ,OMRON Corporation,Qualitas Technologies SAMSUNG SDS ,Siemens AG ,Synopsys, Inc. Teradyne Inc.,Tokyo Electron Limited, Others |

Market Dynamics

Drivers

The incorporation of automation in manufacturing plays a significant role in the expansion of the Fault Detection and Classification (FDC) market, as companies aim to increase efficiency, reduce errors, and improve quality control. Automation has converted many conventional manual processes into data-driven systems, reducing human participation in tasks related to inspection and fault detection. Businesses are utilizing advanced FDC technology to monitor production activities in real time, utilizing sensors, data analysis, and AI analytics to quickly identify and address potential problems. AI-powered FDC systems help to identify discrepancies more accurately than manual inspections, decreasing errors and improving overall product quality. These systems use machine learning algorithms to examine historical data, enabling proactive maintenance by identifying potential equipment issues ahead of time. Advancements in automation in sectors such as semiconductors, automotive, and aerospace enhance productivity and reduce periods of inactivity. Governments around the world are providing incentives and implementing policies to encourage the digital transformation of manufacturing through automation. An example occurred when the U.S. government supported initiatives like "Manufacturing USA" to promote advanced manufacturing technologies such as automation and AI systems. Similarly, the European Union has implemented the "Factories of the Future" initiative to encourage the digitalization of manufacturing processes by integrating automation and AI advancements. The market is further driven by sectors that must meet stricter regulatory standards for quality assurance, particularly in fields such as automotive and aerospace, where precision and safety are vital. As industries increasingly move towards automated systems, there will be a rising demand for robust FDC solutions, leading to the market's continued growth.

With the advancement of manufacturing processes, the growing complexity of these systems is leading to a higher need for Fault Detection and Classification (FDC) solutions. As interconnected machinery, automated robotics, and complex control systems become more common in industries like semiconductors, aerospace, and automotive, the probability of operational errors or system failures has increased. In these advanced industries, accuracy and product excellence are essential, necessitating real-time monitoring to avoid expensive delays and faulty products. Sophisticated FDC systems that use machine learning algorithms and AI analytics are essential for examining large data sets, detecting abnormalities, and categorizing errors. This enables manufacturers to quickly rectify mistakes and put in place measures to guarantee efficiency and adherence to strict quality regulations. Government programs such as those in the United States the advancement of "Advanced Manufacturing Partnership" and Europe's "Industry 4.0" is hastening the digital revolution in manufacturing through encouraging the utilization of AI-powered solutions. With the advancement of global manufacturing processes, the need for reliable FDC systems is expected to rise, guaranteeing that these industries can uphold operational excellence and comply with changing regulatory standards.

Restraints

Despite the progress and practical use of Fault Detection and Classification (FDC) systems, various constraints in the market impede their widespread implementation. The high cost of implementation, especially for small- and medium-sized enterprises (SMEs), is a major hindrance. Implementing FDC systems entails a substantial financial commitment to hardware, including sensors, data acquisition devices, and computing infrastructure. Furthermore, companies with limited resources may face difficulties in acquiring a well-trained workforce necessary for implementing AI-driven analytics and machine learning models. The cost-conscious industries may face delays in adopting these systems due to the financial strain of upkeep and improvements. Another obstacle is the complicated process of incorporating FDC systems with existing legacy infrastructure. Several sectors, particularly in the manufacturing industry, continue to depend on outdated equipment and procedures that do not easily work with advanced data-driven FDC solutions. Updating current systems or adding FDC technologies can be a lengthy and expensive process, sometimes leading to temporary production pauses that may cause financial losses. Challenges are also presented by data security and privacy concerns, particularly in sectors handling sensitive information like aerospace and defense. FDC systems' extensive data streams need proper protection from cyber threats. Businesses are frequently hesitant to embrace sophisticated data-driven solutions because of potential weaknesses in data sharing and storage. The absence of uniformity in the FDC market makes the implementation process more complex. Uniform protocols and standards are necessary for industries to ensure seamless functioning of diverse systems, yet the absence of these standards can impede adoption, especially for global organizations with operations spanning multiple regions.

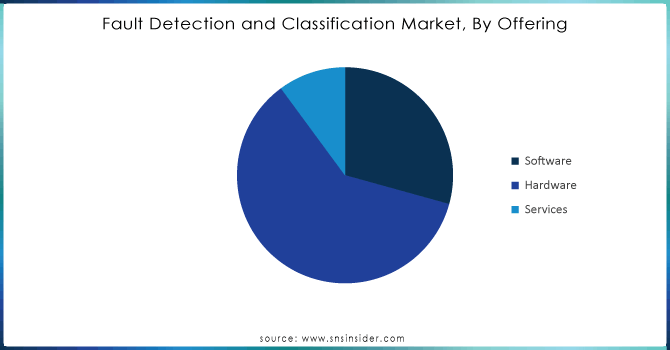

By Offering

Based on offering, Hardware has become the leading segment in the Fault Detection and Classification (FDC) market, accounting for 60% of total revenue in 2023. This substantial percentage highlights the importance of tangible elements in fault detection systems such as sensors, controllers, and diagnostic tools. Hardware is essential for fault detection systems, as it plays a crucial role in supporting the monitoring, data acquisition, and real-time analysis of equipment performance. Sophisticated sensors, like the ones found in cars and factory equipment, are essential for identifying abnormalities and potential malfunctions through constant monitoring of factors such as temperature, vibration, and pressure. Controllers analyze the information from these sensors and use complex algorithms to identify issues and activate measures to prevent or fix them. The hardware sector is experiencing growth due to higher need for dependable and accurate fault detection solutions in several industries such as automotive, electronics, and manufacturing. In automotive settings, hardware components play a crucial role in overseeing engine performance and maintaining safety in advanced driver-assistance systems. In the same way, in the production of semiconductors, hardware is crucial for upholding the accuracy and dependability of manufacturing machinery. The ongoing progress in sensor technology, including the creation of sensors that are more sensitive and long-lasting, continues to drive the growth of the hardware sector. With the rise in automation and smart technologies in industries, the demand for advanced hardware for identifying and categorizing faults is expected to increase, further solidifying its position at the forefront of the market. This pattern shows the overall movement towards improved operational efficiency and predictive maintenance, with strong hardware solutions being essential for maintaining the reliability and longevity of crucial systems.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By End-User

In 2023, the Electronic and Semiconductor industry dominated the Fault Detection and Classification (FDC) market, holding a 31% market share. This importance highlights the sector's crucial requirement for advanced fault detection systems to uphold the reliability and performance of electronic devices and semiconductor manufacturing processes. The demand for advanced FDC solutions is fueled by the rising intricacy of electronic components and the precision needed in semiconductor manufacturing. Texas Instruments and Analog Devices are leading the market by providing advanced solutions to meet these specific needs. For instance, Texas Instruments' LMV321, a low-power op-amp, is created to boost the accuracy and dependability of fault detection setups by enhancing signal precision. Analog Devices' ADXL345 accelerometer also offers precise motion sensing, essential for identifying malfunctions in electronic devices and machinery.In the semiconductor sector, firms like Applied Materials and ASML are utilizing FDC technologies to improve manufacturing efficiency and decrease defects. Applied Materials' Producer platform incorporates sophisticated fault detection features for overseeing and managing semiconductor manufacturing procedures, guaranteeing improved production and quality. ASML, a top provider of photolithography tools, integrates advanced fault detection systems in its EUV lithography machines to handle the intricacies of semiconductor wafer manufacturing. The sector's expansion is also aided by continuous progress in semiconductor technology, like the development of tinier and more efficient chips, leading to a need for more sophisticated fault detection methods. The sector's heavy dependence on advanced FDC solutions is emphasized by the increasing demand for improved quality control and decreased downtime in electronic and semiconductor manufacturing processes, fueling growth.

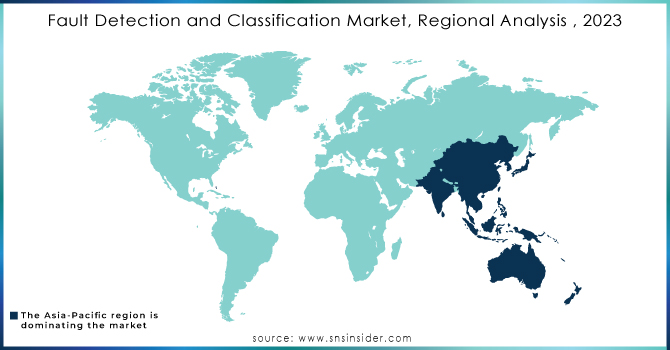

In 2023, Asia-Pacific emerged as the top competitor in the Fault Detection and Classification (FDC) market, capturing a 36% share of revenue. The primary reasons for this control are the strong industrial sector in the area, fast technological progress, and growing funding in automation and smart technologies. Different manufacturing and industrial sectors such as automotive, electronics, and semiconductor industries can be found in the Asia-Pacific region. These sectors depend on advanced fault detection systems to maintain efficiency and reduce downtimes. China, Japan, and South Korea are leading in this trend by heavily investing in advanced manufacturing facilities and making progress in electronics and semiconductor technologies. For example, as China moves towards Industry 4.0 and smart manufacturing, the need for FDC systems is increasing as manufacturers seek to enhance production processes and quality control. Japan, famous for its skills in manufacturing and automotive innovations, has experienced a rise in the use of advanced fault detection technologies to uphold high levels of reliability and safety in its automotive and electronics industries. In the same way, the emphasis on semiconductor production in South Korea has increased the demand for advanced FDC solutions to control intricate manufacturing procedures and maintain quality levels. Government actions and programs intended to encourage technological innovation and industrial automation are also helping to boost the development of the region. Furthermore, there is an increasing need for fault detection systems as data centers and 5G infrastructure continue to grow in the IT and telecommunications industries. In general, Asia-Pacific's strong presence in the FDC market highlights its significance in the worldwide industrial sector and its continuous dedication to technological progress and operational superiority.

The FDC market in North America is witnessing fast growth as the second region, driven by notable technological progress and acceptance in numerous industries. The area's expansion is fueled by its strong industrial structure, a focus on innovation, and significant investment in automation and predictive maintenance technologies. Both the United States and Canada are promoting growth by more frequently implementing FDC systems to improve efficiency, reduce downtime, and guarantee safety. An instance of this is General Electric (GE) taking the lead in incorporating sophisticated fault detection technologies into its industrial machinery. The Predix platform by GE uses cutting-edge analytics and machine learning to identify issues in real-time and anticipate maintenance requirements, enhancing asset performance across industries like manufacturing, energy, and aviation. In the same way, Honeywell has launched the Honeywell Forge platform, utilizing AI and data analysis to provide thorough fault detection and classification solutions for industrial activities. This tool allows companies to oversee and improve their processes instantly, leading to increased productivity and minimized unforeseen disruptions. Rockwell Automation unveiled its FactoryTalk Analytics suite, which features enhanced fault detection functions to support smart manufacturing and industrial automation. The increasing need for these new solutions is further backed by North America's emphasis on smart infrastructure and the increasing use of Industry 4.0 technologies. Increased investments in aerospace, automotive, and energy sectors are fueling the need for more advanced FDC systems in the region. In general, the fast expansion of the FDC market in North America highlights its significance in promoting fault detection technologies and confirms its continuous dedication to operational excellence and technological advancement.

Key Players

Some of the Major Key player in Fault Detection and classification Market offer product and offering

In March 2023, Samsung SDS launched an AI-powered FDC solution for transportation. The solution is designed to help transportation companies detect and classify faults in vehicles & infrastructure, improving safety and efficiency.

In August 2023, Synopsys, Inc. launched Synopsys Software Risk Manager, a powerful new application security posture management (ASPM) solution. Software Risk Manager enables security and development teams to simplify, align and streamline their application security testing across projects, teams and application security testing (AST) tools.

On March 7, 2024, FLIR, a Teledyne Technologies company, launched the Si2-Series acoustic imaging cameras, including the Si2-Pro, Si2-LD, and Si2-PD, designed to detect air and gas leaks, mechanical faults, and partial discharges. These industrial-grade cameras feature enhanced image quality, increased sensitivity, and longer battery life, making them top performers for fault detection.

| Report Attributes | Details |

|

Market Size in 2023 |

USD 4.70 billion |

|

Market Size by 2032 |

USD 10.01 billion |

|

CAGR |

CAGR of 8.83 % From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Market Drivers |

• Automation-driven growth in Fault Detection and Classification (FDC) Market boosted by Quality Control improvements through Digital Transformation •The Rising Complexity in Manufacturing Driving the Demand for Fault Detection and Classification. |

|

Market Restraints |

• Obstacles that are impeding the growth of the Fault Detection and Classification (FDC) Market. |

Ans: Asia-Pacific dominated the Fault Detection and Classification Market in 2023.

Ans: The Hardware segment dominated the Fault Detection and Classification Market.

Ans: The major growth factor of the Fault Detection and Classification Market is the increasing adoption of advanced technologies like AI and machine learning for predictive maintenance and real-time monitoring.

Ans: The Fault Detection and Classification Market size was valued at USD 4.70 billion in 2023 and is expected to grow to USD 10.01 billion by 2032 and grow at a CAGR of 8.83% over the forecast period of 2024-2032.

Ans: The Fault Detection and Classification Market grow at a CAGR of 8.83% over the forecast period of 2024-2032.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Fault Detection and Classification System Adoption, 2020-2032, by Region

5.2 Fault Detection and Classification Standards Compliance, by Region

5.3 Fault Detection and Classification Technology Adoption, by Region

5.4 Consumer Preferences, by Region

5.5 Aftermarket Trends (Data on fault detection and classification maintenance, parts, and services)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Fault Detection and Classification Market Segmentation, by Fault Type

7.1 Chapter Overview

7.2 Dimensional Fault

7.2.1 Dimensional Fault Market Trends Analysis (2020-2032)

7.2.2 Dimensional Fault Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Surface Defects

7.3.1 Surface Defects Market Trends Analysis (2020-2032)

7.3.2 Surface Defects Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Contamination Faults

7.4.1 Contamination Faults Market Trends Analysis (2020-2032)

7.4.2 Contamination Faults Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Process Variability

7.5.1 Process Variability Market Trends Analysis (2020-2032)

7.5.2 Process Variability Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Fault Detection and Classification Market Segmentation, By Technique/Technology

8.1 Chapter Overview

8.2 Sensor Data Analysis

8.2.1 Sensor Data Analysis Market Trends Analysis (2020-2032)

8.2.2 Sensor Data Analysis Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Statistical Methods

8.3.1 Statistical Methods Market Trends Analysis (2020-2032)

8.3.2 Statistical Methods Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Machine Learning Algorithm

8.3.1 Machine Learning Algorithm Market Trends Analysis (2020-2032)

8.3.2 Machine Learning Algorithm Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Others

8.3.1 Others Market Trends Analysis (2020-2032)

8.3.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Fault Detection and Classification Market Segmentation, by offering

9.1 Chapter Overview

9.2 Software

9.2.1 Software Market Trends Analysis (2020-2032)

9.2.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Hardware

9.3.1 Hardware Market Trends Analysis (2020-2032)

9.3.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.1 Cameras

9.3.1.1Cameras Market Trends Analysis (2020-2032)

9.3.1.2 Cameras Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.2 Frame Grabbers

9.3.2.1 Frame Grabbers Market Trends Analysis (2020-2032)

9.3.2.2 Frame Grabbers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.3 Optics

9.3.3.1 Optics Market Trends Analysis (2020-2032)

9.3.3.2 Optics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.4 Processors

9.3.4.1 Processors Market Trends Analysis (2020-2032)

9.3.4.2 Processors Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Services

9.4.1 Services Market Trends Analysis (2020-2032)

9.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Fault Detection and Classification Market Segmentation, By Application

10.1 Chapter Overview

10.2 Manufacturing

10.2.1 Manufacturing Market Trends Analysis (2020-2032)

10.2.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

10.2.1 Assembly Verification

10.2.1.1 Assembly Verification Market Trends Analysis (2020-2032)

10.2.1.2 Assembly Verification Market Size Estimates and Forecasts to 2032 (USD Billion)

10.2.2 Flaw Detection

10.2.2.1 Flaw Detection Market Trends Analysis (2020-2032)

10.2.2.2 Flaw Detection Market Size Estimates and Forecasts to 2032 (USD Billion)

10.2.3 Fabrication Inspection

10.2.3.1 Fabrication Inspection Market Trends Analysis (2020-2032)

10.2.3.2 Fabrication Inspection Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Packaging

10.3.1 Packaging Market Trends Analysis (2020-2032)

10.3.2 Packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3.1Grading

10.3.1.1 Grading Market Trends Analysis (2020-2032)

10.3.1.2 Grading Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3.2 Label Validation

10.3.2.1 Label Validation Market Trends Analysis (2020-2032)

10.3.2.2 Label Validation Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3.3 Container/Packaging Inspection

10.3.3.1 Container/Packaging Inspection Market Trends Analysis (2020-2032)

10.3.3.2 Container/Packaging Inspection Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Fault Detection and Classification Market Segmentation, By End-User

11.1 Chapter Overview

11.2 Automotive

11.2.1 Automotive Market Trends Analysis (2020-2032)

11.2.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

11.3 Electronic and semiconductor

11.3.1 Electronic and semiconductor Market Trends Analysis (2020-2032)

11.3.2 Electronic and semiconductor Market Size Estimates and Forecasts to 2032 (USD Billion)

11.4 Metals & machinery

11.4.1 Metals & machinery Market Trends Analysis (2020-2032)

11.4.2 Metals & machinery Market Size Estimates and Forecasts to 2032 (USD Billion)

11.5 Food & packaging

11.5.1 Food & packaging Market Trends Analysis (2020-2032)

11.5.2 Food & packaging Market Size Estimates and Forecasts to 2032 (USD Billion)

11.6 Pharmaceuticals

11.6.1 Pharmaceuticals Market Trends Analysis (2020-2062)

11.6.2 Pharmaceuticals Market Size Estimates and Forecasts to 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Fault Detection and Classification Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.2.4 North America Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.2.5 North America Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.2.6 North America Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.2.7 North America Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.2.8.2 USA Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.2.8.3 USA Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.2.8.4 USA Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.2.8.5 USA Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.2.9.2 Canada Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.2.9.3 Canada Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.2.9.4 Canada Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.2.9.5 Canada Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.2.10.2 Mexico Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.2.10.3 Mexico Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.2.10.4 Mexico Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.2.10.5 Mexico Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.1.8.2 Poland Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.1.8.3 Poland Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.8.4 Poland Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.8.5 Poland Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.1.9.2 Romania Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.1.9.3 Romania Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.9.4 Romania Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.9.5 Romania Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.1.10.2 Hungary Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.1.10.3 Hungary Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.1.11.2 Turkey Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.1.11.3 Turkey Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.1.12 Rest of Eastern Europe

12.3.1.12.1 Rest of Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.1.12.2 Rest of Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.1.12.3 Rest of Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.1.12.4 Rest of Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.12.5 Rest of Eastern Europe Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Fault Detection and Classification Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.2.4 Western Europe Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.2.5 Western Europe Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.6 Western Europe Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.7 Western Europe Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.2.8.2 Germany Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.2.8.3 Germany Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.8.4 Germany Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.8.5 Germany Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.2.9.2 France Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.2.9.3 France Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.9.4 France Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.9.5 France Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.2.10.2 UK Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.2.10.3 UK Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.10.4 UK Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.10.5 UK Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.2.11.2 Italy Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.2.11.3 Italy Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.11.4 Italy Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.11.5 Italy Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.2.12.2 Spain Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.2.12.3 Spain Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.12.4 Spain Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.5 Spain Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.2.15.2 Austria Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.2.15.3 Austria Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.15.4 Austria Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.15.5 Austria Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.3.2.16 Rest of Western Europe

12.3.2.16.1 Rest of Western Europe Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.3.2.16.2 Rest of Western Europe Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.3.2.16.3 Rest of Western Europe Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.3.2.16.4 Rest of Western Europe Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.16.5 Rest of Western Europe Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.4 Asia-Pacific

12.4.1 Trends Analysis

12.4.2 Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.4.4 Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.4.5 Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.4.6 Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.7 Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.4.8.2 China Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.4.8.3 China Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.4.8.4 China Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.8.5 China Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.4.9.2 India Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.4.9.3 India Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.4.9.4 India Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.9.5 India Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.4.10.2 Japan Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.4.10.3 Japan Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.4.10.4 Japan Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.10.5 Japan Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.4.11.2 South Korea Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.4.11.3 South Korea Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.4.11.4 South Korea Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.11.5 South Korea Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.4.12.2 Vietnam Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.4.12.3 Vietnam Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.4.12.4 Vietnam Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.12.5 Vietnam Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.4.13.2 Singapore Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.4.13.3 Singapore Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.4.13.4 Singapore Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.13.5 Singapore Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.4.14.2 Australia Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.4.14.3 Australia Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.4.14.4 Australia Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.14.5 Australia Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.4.15 Rest of Asia-Pacific

12.4.15.1 Rest of Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.4.15.2 Rest of Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.4.15.3 Rest of Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.4.15.4 Rest of Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.4.15.5 Rest of Asia-Pacific Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.5 Middle East and Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Fault Detection and Classification Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.5.1.4 Middle East Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology (2020-2032) (USD Billion)

12.5.1.5 Middle East Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.6 Middle East Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.7 Middle East Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.5.1.8.2 UAE Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology (2020-2032) (USD Billion)

12.5.1.8.3 UAE Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.8.4 UAE Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.8.5 UAE Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.5.1.9.2 Egypt Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.5.1.9.3 Egypt Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.5.1.11.2 Qatar Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.5.1.11.3 Qatar Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.5.1.12 Rest of Middle East

12.5.1.12.1 Rest of Middle East Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.5.1.12.2 Rest of Middle East Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.5.1.12.3 Rest of Middle East Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.5.1.12.4 Rest of Middle East Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.12.5 Rest of Middle East Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Fault Detection and Classification Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.5.2.4 Africa Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.5.2.5 Africa Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.5.2.6 Africa Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.7 Africa Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.5.2.8.2 South Africa Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.5.2.8.3 South Africa Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.5.2.10 Rest of Africa

12.5.2.10.1 Rest of Africa Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.5.2.10.2 Rest of Africa Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.5.2.10.3 Rest of Africa Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.5.2.10.4 Rest of Africa Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.10.5 Rest of Africa Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Fault Detection and Classification Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.6.4 Latin America Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.6.5 Latin America Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.6.6 Latin America Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.6.7 Latin America Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.6.8.2 Brazil Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.6.8.3 Brazil Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.6.8.4 Brazil Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.6.8.5 Brazil Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.6.9.2 Argentina Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.6.9.3 Argentina Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.6.9.4 Argentina Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.6.9.5 Argentina Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.6.10.2 Colombia Fault Detection and Classification Market Estimates and Forecasts, By Technique/Technology(2020-2032) (USD Billion)

12.6.10.3 Colombia Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.6.10.4 Colombia Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.6.10.5 Colombia Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

12.6.11 Rest of Latin America

12.6.11.1 Rest of Latin America Fault Detection and Classification Market Estimates and Forecasts, By Fault Type(2020-2032) (USD Billion)

12.6.11.2 Rest of Latin America Fault Detection and Classification Market Estimates and Forecasts, Technique/Technology (2020-2032) (USD Billion)

12.6.11.3 Rest of Latin America Fault Detection and Classification Market Estimates and Forecasts, By offering (2020-2032) (USD Billion)

12.6.11.4 Rest of Latin America Fault Detection and Classification Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12.6.11.5 Rest of Latin America Fault Detection and Classification Market Estimates and Forecasts, By End-User(2020-2032) (USD Billion)

13. Company Profiles

13.1 ADVANTEST CORPORATION

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services offered

13.1.4 SWOT Analysis

13.2 Amazon Web Services, Inc.

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services offered

13.2.4 SWOT Analysis

13.3 Applied Materials, Inc.

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services offered

13.3.4 SWOT Analysis

13.4 CIM Environmental Pty Ltd.

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services offered

13.4.4 SWOT Analysis

13.5 Cognex Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services offered

13.5.4 SWOT Analysis

13.6 einnoSys Technologies Inc.

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services offered

13.6.4 SWOT Analysis

13.7 INFICON

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services offered

13.7.4 SWOT Analysis

13.8 KILI TECHNOLOGY

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services offered

13.8.4 SWOT Analysis

13.9 KLA Corporation

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services offered

13.9.4 SWOT Analysis

13.10 AI Microsoft

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services offered

13.10.4 SWOT Analysis

13.11 MobiDev

13.11.1 Company Overview

13.11.2 Financial

13.11.3 Products/ Services offered

13.11.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Fault Type

Dimensional Fault

Surface Defects

Contamination Faults

Process Variability

Others

By Technique/Technology

Sensor Data Analysis

Statistical Methods

Machine Learning Algorithm

Others

By Offering

Software

Hardware

Cameras

Cameras, by format

Area scan cameras

Line scan cameras

Cameras, by frame rate

Sensors

CCD sensor

CMOS sensors

CMOS sensor

Frame Grabbers

Optics

Processors

Services

By Application

Manufacturing

Assembly Verification

Flaw Detection

Fabrication Inspection

Packaging

Grading

Label Validation

Container/Packaging Inspection

By End-User

Automotive

Electronic and semiconductor

Metals & machinery

Food & packaging

Pharmaceuticals

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia-Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia-Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Wirewound Variable Resistors Market was valued at 1.48 Billion in 2023 and is projected to reach USD 2.48 Billion by 2032, growing at a CAGR of 4.37% from 2024 to 2032.

The Underwater Robotics Market Size was valued at USD 4 billion in 2023 and is expected to grow at a CAGR of 14.59% to reach USD 13.59 billion by 2032.

The Human Machine Interface Market Size was USD 5.59 Billion in 2023 and will reach USD 12.49 Billion by 2032 and grow at a CAGR of 9.54% by 2024-2032.

DC Chargers Market Size was valued at USD 95.14 Billion in 2023 and is projected to reach USD 288.08 Billion by 2032, growing at a CAGR of 13.10% by 2024-2032.

The Touch Screen Display Market Size was valued at USD 76.36 billion in 2023 and is expected to grow at a CAGR of 10.95% to reach USD 194.44 billion by 2032.

The Non-dispersive Infrared Market Size was valued at $600 million in 2023 & is expected to reach $1199.4 million by 2032 & grow at a CAGR of 8.0% by 2024-2032.

Hi! Click one of our member below to chat on Phone