Extreme Ultraviolet (EUV) Lithography Market Size & Trends:

The Extreme Ultraviolet (EUV) Lithography Market was valued at USD 11.61 billion in 2024 and is expected to reach USD 35.77 billion by 2032, growing at a CAGR of 15.1% from 2025-2032.

The market is driven by technological advancements, increasing semiconductor complexity, and the demand for smaller, more powerful chips. Key trends include rising R&D investments, industry collaborations, and innovations in photomask and resist materials. Supply chain challenges, high costs, and skilled labor shortages impact growth. Government policies in the U.S., China, and the EU play a crucial role. The rise of AI, 5G, and high-performance computing fuels demand. Patent trends, regulatory landscapes, and environmental concerns further shape the market, driving sustainable practices. These factors collectively influence the market's growth and future trajectory.

To Get more information on Extreme Ultraviolet Lithography Market - Request Free Sample Report

Extreme Ultraviolet (EUV) Lithography Market Size and Forecast

-

Extreme Ultraviolet (EUV) Lithography Market Size in 2024: USD 11.61 Billion

-

Extreme Ultraviolet (EUV) Lithography Market Size by 2032: USD 35.77 Billion

-

CAGR: 15.1% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Extreme Ultraviolet (EUV) Lithography Market Trends

-

Rising demand for advanced semiconductor manufacturing at sub-7nm nodes is driving EUV lithography adoption.

-

Increasing use in high-performance computing, AI chips, and 5G devices is boosting market growth.

-

Advancements in EUV scanners, light sources, and photoresists are enhancing resolution and throughput.

-

High capital investment and complexity of EUV systems remain key challenges for broader deployment.

-

Growing collaboration between semiconductor foundries and equipment manufacturers is accelerating innovation.

-

Expansion of fab capacity in response to global chip demand is fueling EUV tool installations.

-

Integration with next-generation chip packaging and 3D architectures is widening application scope.

Extreme Ultraviolet (EUV) Lithography Market Growth Drivers:

-

Increasing Demand for Advanced Semiconductor Chips Drives Growth in the Extreme Ultraviolet Lithography Market

The growing demand for smaller, more powerful, and energy-efficient semiconductor chips is a key driver of the Extreme Ultraviolet (EUV) Lithography market. With industries such as artificial intelligence (AI), high-performance computing, 5G, and the Internet of Things (IoT) requiring advanced processors, semiconductor manufacturers are investing heavily in EUV technology to enhance chip performance and scalability. EUV lithography enables the production of sub-7nm nodes with greater precision, reducing power consumption and improving efficiency. Major chipmakers, including Intel, TSMC, and Samsung, are adopting EUV lithography to maintain a competitive edge and meet the rising demand for high-performance semiconductor devices.

Additionally, increasing investments in R&D and government incentives for semiconductor manufacturing further support market expansion. The rapid shift toward automation, cloud computing, and connected devices has intensified the need for sophisticated chips, making EUV lithography an essential technology in the evolving semiconductor landscape.

Extreme Ultraviolet (EUV) Lithography Market Restraints:

-

High Cost of Equipment and Maintenance Limits Growth in the Extreme Ultraviolet Lithography Market

The high cost associated with EUV lithography systems is a major restraint hampering market growth. EUV lithography machines, primarily supplied by ASML, require significant capital investment, with each system costing hundreds of millions of dollars. Additionally, the complexity of EUV technology results in high operational and maintenance costs, making it financially challenging for small and mid-sized semiconductor manufacturers to adopt. The need for specialized cleanroom environments, ultra-high vacuum chambers, and precision optics further adds to the overall expenses.

Moreover, the limited number of suppliers for key components, such as high-power EUV light sources and photomasks, contributes to high procurement costs and potential supply chain constraints. As a result, only major players like TSMC, Samsung, and Intel can afford large-scale EUV deployment, limiting widespread adoption. The cost barrier remains a significant challenge, slowing down the expansion of EUV lithography in the global semiconductor industry.

Extreme Ultraviolet (EUV) Lithography Market Opportunities:

-

Rising Demand for AI, 5G, and IoT Technologies Creates New Growth Opportunities in the Extreme Ultraviolet Lithography Market

The increasing adoption of artificial intelligence (AI), 5G connectivity, and the Internet of Things (IoT) presents significant growth opportunities for the EUV lithography market. These technologies require advanced semiconductor chips with higher processing power, energy efficiency, and miniaturized designs, which can be efficiently produced using EUV lithography. As industries shift towards smart devices, autonomous vehicles, and cloud computing, semiconductor manufacturers are under pressure to develop next-generation chips that support complex workloads. EUV lithography plays a crucial role in enabling the fabrication of transistors at nanoscale levels, ensuring better performance and lower power consumption.

Additionally, governments worldwide are investing in semiconductor manufacturing capabilities to strengthen domestic supply chains and reduce reliance on foreign imports. With continuous advancements in AI-driven applications and 5G infrastructure expansion, the demand for EUV-enabled semiconductor production is expected to rise, creating lucrative opportunities for market players and driving technological innovation in the industry.

Extreme Ultraviolet (EUV) Lithography Market Challenges:

-

Limited Availability of Skilled Professionals Challenges the Growth of the Extreme Ultraviolet Lithography Market

One of the major challenges facing the EUV lithography market is the shortage of highly skilled professionals required for operating and maintaining these complex systems. EUV lithography involves intricate processes, including high-precision optics, vacuum technology, and extreme ultraviolet light source generation, all of which demand specialized expertise. However, the semiconductor industry faces a significant talent gap, with a limited pool of engineers and technicians trained in EUV technology. The steep learning curve associated with EUV systems further exacerbates this issue, making it difficult for companies to scale operations effectively.

Additionally, ongoing technological advancements necessitate continuous upskilling, adding to workforce training costs. The shortage of skilled professionals impacts production efficiency, increases downtime, and delays technological advancements. To address this challenge, industry leaders and academic institutions must collaborate on training programs, apprenticeships, and workforce development initiatives to ensure a steady supply of skilled personnel for EUV lithography operations.

Extreme Ultraviolet (EUV) Lithography Market Segment Analysis

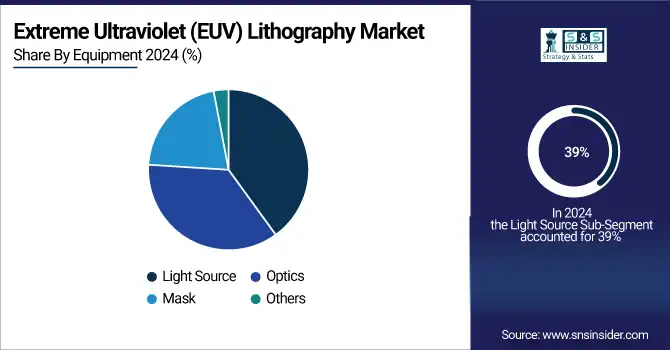

By Equipment, light source segment dominates the Extreme Ultraviolet Lithography market, mask segment is expected to grow fastest.

The Light Source segment accounted for the largest revenue share of 39% in 2024 within the Extreme Ultraviolet Lithography market, driven by the increasing demand for high-intensity, stable, and efficient EUV light sources essential for advanced semiconductor manufacturing. The EUV light source plays a critical role in achieving high-resolution patterning, enabling the production of sub-7nm and next-generation semiconductor nodes.

Moreover, Ushio Inc. and Gigaphoton Inc. are also actively developing advanced laser-produced plasma (LPP) light sources to enhance output power and stability. The rising adoption of AI, 5G, and high-performance computing applications has fueled demand for EUV lithography, increasing investments in light source innovations.

The Mask segment is projected to grow at the highest CAGR of 16.4% during the forecast period in the Extreme Ultraviolet Lithography market, owing to increasing advancements in EUV photomasks that enable higher precision and defect-free chip production. EUV masks are crucial in defining circuit patterns with extreme accuracy, making them indispensable for sub-7nm node manufacturing. Major semiconductor players, including Toppan Photomasks Inc., ZEISS Group, and AGC Inc., are driving innovations in EUV photomasks.

For instance, ZEISS Group, in collaboration with ASML, has developed advanced EUV pellicles that protect photomasks from contamination while maintaining high transmission efficiency.

Additionally, Toppan Photomasks Inc. introduced next-generation EUV mask blanks with reduced defects, improving overall lithography yield. The shift toward more complex chip architectures and increasing production of AI and 5G chips are accelerating the demand for defect-free, high-durability masks. As semiconductor fabrication processes become more intricate, investments in EUV mask development will continue to rise, ensuring enhanced pattern fidelity and manufacturing efficiency.

By End-Use, IDM segment dominates the Extreme Ultraviolet Lithography market, foundries segment is expected to grow fastest.

The Integrated Device Manufacturer (IDM) segment dominated the Extreme Ultraviolet (EUV) Lithography market with a 63% revenue share in 2024, driven by major semiconductor giants investing heavily in EUV technology for advanced chip production. IDMs, which design, manufacture, and sell semiconductor devices, have been at the forefront of EUV adoption to meet the growing demand for high-performance computing, AI, and 5G applications. Intel, Samsung Electronics, and Micron Technology have significantly expanded their EUV-based fabrication lines to maintain technological leadership.

Additionally, Micron Technology invested over $100 billion in next-generation DRAM manufacturing using EUV lithography to strengthen its memory chip portfolio. With IDMs increasingly relying on EUV technology for sub-5nm chip production, continued advancements in EUV systems, photomasks, and process nodes will drive market expansion and semiconductor innovation.

The Foundries segment is expected to grow at the highest CAGR of 16.06% during the forecast period, driven by rising demand for contract chip manufacturing and advanced semiconductor nodes. Foundries specialize in high-volume semiconductor fabrication for fabless companies, making them crucial for the expansion of EUV lithography. Leading foundries such as Taiwan Semiconductor Manufacturing Company (TSMC), GlobalFoundries, and Semiconductor Manufacturing International Corporation (SMIC) have significantly invested in EUV technology to enhance their chip production capabilities. TSMC, the world’s largest foundry, aggressively expanded its 3nm and 2nm process nodes, leveraging EUV lithography to achieve higher transistor densities and energy efficiency. The growing need for AI chips, autonomous vehicles, and IoT devices is accelerating foundry demand, ensuring sustained growth in EUV-based semiconductor manufacturing.

Extreme Ultraviolet (EUV) Lithography Market Regional Analysis

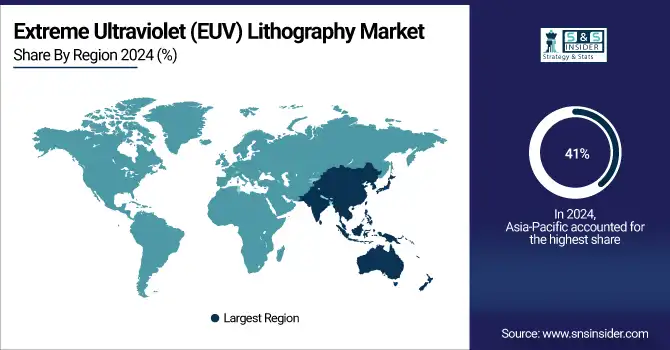

Asia Pacific Extreme Ultraviolet (EUV) Lithography Market Insights

In 2024, Asia-Pacific led the Extreme Ultraviolet (EUV) Lithography market, holding an estimated market share of 41%, driven by the presence of major semiconductor manufacturers and aggressive investments in cutting-edge lithography technology. The region is home to industry giants like Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, and Semiconductor Manufacturing International Corporation (SMIC), which have heavily invested in EUV for sub-7nm and 3nm chip production.

Get Customized Report as per Your Business Requirement - Enquiry Now

Additionally, China’s aggressive push for semiconductor self-sufficiency through Made in China 2025 and Japan’s advancements in EUV photomasks and resist materials have further strengthened Asia-Pacific’s dominance. The region’s well-established semiconductor ecosystem and continued investments in EUV manufacturing infrastructure are expected to sustain its market leadership in the coming years.

North America Extreme Ultraviolet (EUV) Lithography Market Insights

North America is the fastest-growing region in the EUV Lithography market, with an estimated CAGR of 16.3%, fueled by strong government incentives, rising domestic chip production, and technological advancements. The U.S. CHIPS and Science Act, which allocated USD 52 billion to bolster semiconductor manufacturing, has accelerated EUV adoption by companies like Intel, Micron Technology, and GlobalFoundries. Intel, in particular, has been aggressively investing in EUV for its Intel 4 and Intel 3 process nodes, ensuring higher transistor density and improved power efficiency.

Additionally, Micron Technology has integrated EUV lithography into next-generation DRAM production, strengthening its position in the global memory market. With increasing demand for AI, cloud computing, and high-performance processors, North American chipmakers are expanding their EUV-based fabrication lines. Collaborations with ASML for high-NA EUV technology further enhance the region’s growth potential, positioning North America as the fastest-growing market in EUV lithography.

Europe Extreme Ultraviolet (EUV) Lithography Market Insights

Europe plays a pivotal role in the Extreme Ultraviolet (EUV) Lithography Market, driven by advanced research, strong semiconductor supply chains, and supportive government initiatives. The region is home to ASML Holding NV in the Netherlands, the leading global supplier of EUV lithography systems, alongside key contributors like Carl Zeiss AG and SUSS MicroTec. Europe’s focus on innovation, chip independence, and strategic collaborations strengthens its influence in next-generation semiconductor manufacturing.

Middle East & Africa and Latin America Extreme Ultraviolet (EUV) Lithography Market Insights

The Middle East & Africa and Latin America in the Extreme Ultraviolet (EUV) Lithography Market are emerging regions with growing potential. In MEA, rising digital transformation, government technology initiatives, and diversification beyond oil drive gradual adoption, supported by partnerships with global players. In Latin America, Brazil and Mexico lead growth through expanding electronics, automotive demand, and R&D initiatives. Though large-scale EUV production remains limited, both regions are positioning as future contributors to semiconductor advancements.

Extreme Ultraviolet (EUV) Lithography Market Competitive Landscape:

ASML Holding NV

ASML Holding NV is the world leader in photolithography systems, providing EUV and DUV lithography solutions critical for next-generation semiconductor manufacturing. The company’s advanced technology enables production of smaller, faster, and more energy-efficient chips for memory, logic, and AI applications. ASML’s continuous innovation in optics, metrology, and computational lithography positions it as a cornerstone of the global semiconductor ecosystem.

- 2025: ASML opened for the first time at SEMICON India, showcasing its holistic lithography portfolio combining EUV systems, computational lithography software, metrology, and inspection tools to support India’s advancing chip manufacturing ecosystem.

-

2025: ASML / SK Hynix assembled the industry’s first commercial High-NA EUV system (NXE:5200B) at SK Hynix’s Icheon fab, enabling advanced DRAM prototyping with 0.55 numerical aperture optics and simplified lithography processes.

-

2024: ASML and imec inaugurated a High-NA EUV lithography lab at ASML’s Veldhoven headquarters, granting chipmakers access to the prototype EXE:5000 tool for pre-commercial process development.

-

2023: ASML shipped the first High-NA EUV modules (TWINSCAN EXE:5000) to Intel, marking a pivotal technology milestone toward next-generation chip resolution and throughput.

Carl Zeiss AG

Carl Zeiss AG, through its semiconductor division, specializes in high-precision optical systems for EUV lithography, enabling smaller nodes, higher transistor density, and scalable chip production. ZEISS supports leading semiconductor manufacturers with optics that enhance resolution, throughput, and manufacturability. Its partnership with ASML ensures integration of innovative optical solutions for High-NA EUV tools, solidifying its role as a critical contributor to next-generation semiconductor manufacturing.

-

2024: ZEISS unveiled its optical system for the High-NA EUV tool developed with ASML poised to enable triple transistor density and scalable serial production beginning 2025.

TSMC

Taiwan Semiconductor Manufacturing Company (TSMC) is a leading semiconductor foundry, renowned for process innovation, advanced node fabrication, and sustainable manufacturing practices. The company integrates cutting-edge EUV lithography and energy-efficient technologies to support next-generation chips for AI, 5G, and high-performance computing. TSMC focuses on environmental sustainability while advancing semiconductor performance, positioning itself as a global leader in green and high-precision chip manufacturing.

-

2025: TSMC is developing a 150 kW mixed hydrogen fuel cell to convert EUV residual hydrogen into electricity, aiming for fully green energy recovery and more sustainable semiconductor manufacturing.

Canon Inc.

Canon Inc. is a global technology company providing advanced imaging, optics, and precision equipment for semiconductor manufacturing. Its lithography solutions, including nanoimprint and photolithography systems, enable high-resolution patterning for next-generation chips. Canon focuses on enhancing productivity, miniaturization, and process efficiency, supporting global electronics and IT sectors in producing high-performance semiconductors with precise and reliable patterning capabilities.

-

2024: Canon shipped its FPA-1200NZ2C nanoimprint lithography system to the Texas Institute for Electronics enabling 14 nm patterning via imprint technology.

Nikon Corporation

Nikon Corporation develops advanced lithography systems for semiconductor manufacturing, emphasizing high-resolution imaging, overlay accuracy, and enhanced throughput. Nikon’s tools support memory, logic, and high-performance electronics production, enabling smaller nodes and higher productivity. By integrating innovative optics and immersion technologies, Nikon strengthens semiconductor manufacturing efficiency and quality, contributing to next-generation chip production globally.

-

2023: Nikon released the NSR-S636E ArF Immersion Scanner, offering ≤38 nm resolution, enhanced overlay accuracy, and 10–15% higher throughput—boasting highest productivity in Nikon’s lithography systems history.

Key Players

Some of the major players in the Extreme Ultraviolet Lithography Market are:

-

Carl Zeiss AG

-

NTT Advanced Technology Corporation

-

ADVANTEST CORPORATION

-

Ushio Inc.

-

AGC Inc.

-

Lasertec Corporation

-

TOPPAN Inc.

-

Canon Inc.

-

Nikon Corporation

-

Intel Corporation

-

Taiwan Semiconductor Manufacturing Company Limited

-

Samsung Electronics Co. Ltd.

-

Toppan Photomasks Inc.

-

ZEISS Group

-

Broadcom Inc.

-

SK Hynix Inc.

-

GlobalFoundries Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 11.61 Billion |

| Market Size by 2032 | USD 35.77 Billion |

| CAGR | CAGR of 15.1% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment (Light Source, Optics, Mask, Others) • By End Use (Integrated Device Manufacturer (IDM), Foundries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ASML Holding NV, Carl Zeiss AG, NTT Advanced Technology Corporation, KLA Corporation, ADVANTEST CORPORATION, Ushio Inc., SUSS MicroTec SE, AGC Inc., Lasertec Corporation, TOPPAN Inc., Canon Inc., Nikon Corporation, Intel Corporation, Taiwan Semiconductor Manufacturing Company Limited (TSMC), Samsung Electronics Co. Ltd., Toppan Photomasks Inc., ZEISS Group, Broadcom Inc., SK Hynix Inc., GlobalFoundries Inc. |