Exosomes Market Size & Overview

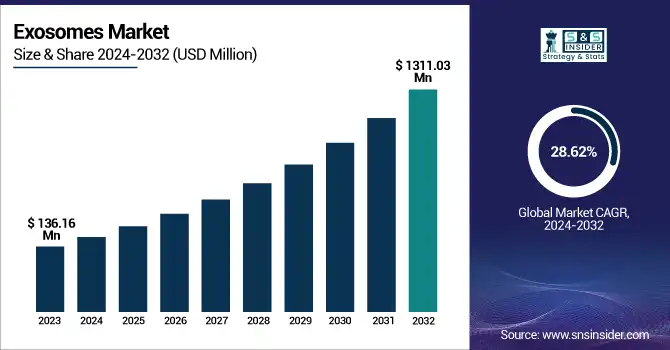

The Exosomes Market size was valued at USD 136.16 Million in 2023 and is expected to reach USD 1,311.03 Million by 2032, growing at a CAGR of 28.62% over the forecast period of 2024-2032.

To Get More Information on Exosomes Market - Request Sample Report

The Exosomes Market is evolving rapidly, driven by key advancements across various sectors. Our report highlights the critical Exosome Isolation Techniques, such as ultracentrifugation and size-exclusion chromatography, enabling better applications in diagnostics and therapeutics. Technological Advancements in Exosome Research have enhanced isolation and characterization methods, expanding their potential uses. Clinical trials and research studies are proving essential in validating exosome-based therapies, especially in cancer and neurodegenerative diseases. The Impact of Artificial Intelligence on Exosome Research is notable, with AI tools improving precision in exosome applications. Additionally, Investment and Funding Trends are fueling innovation, with increased venture capital and government funding supporting the growth of exosome technologies. Our report explores these critical factors shaping the future of the Exosomes Market.

The US Exosomes Market Size was valued at USD 41.77 Billion in 2023 and is expected to reach USD 399.74 Million by 2032, growing at a CAGR of 28.53% over the forecast period of 2024-2032.

The United States Exosomes Market is witnessing rapid growth, driven by technological advancements, increasing research investments, and rising demand for personalized medicine. Key factors fueling this growth include the support from major US research organizations like the National Institutes of Health (NIH) and the growing presence of biotech companies such as Thermo Fisher Scientific, which focuses on advancing exosome isolation and characterization tools. Additionally, collaborations between academic institutions and companies are accelerating the development of exosome-based therapies for cancer and neurodegenerative diseases. Increased funding and regulatory support from the FDA are also contributing to the market's expansion in the US.

Exosomes Market Dynamics

Drivers

-

Increasing Investments in Exosome-Based Research and Development Enhance Market Growth

The Exosomes Market is experiencing accelerated growth due to increased investments in exosome-based research and development. Both public and private sectors are recognizing the therapeutic potential of exosomes, leading to substantial funding in research initiatives. Organizations like the National Institutes of Health (NIH) have earmarked substantial funds for research into exosome-based therapies and diagnostic tools. Private biotech companies, such as Codiak BioSciences, are pioneering efforts in exosome-based therapeutic approaches for treating cancer and neurological disorders, showcasing how investment is driving market innovation. Additionally, exosomes are being explored as potential carriers for gene and RNA-based therapies, which further fuels investment in their development. The influx of capital supports the commercialization of exosome-based diagnostic kits, isolation systems, and clinical therapies. This growing investment in both early-stage research and commercial development is creating a dynamic market environment that accelerates the pace of innovation, ensuring the continuous advancement of exosome technologies. As funding flows into the sector, researchers are discovering new applications for exosomes in drug delivery, personalized medicine, and regenerative therapies, further solidifying the market's growth trajectory.

Restraints

-

Regulatory Challenges Associated with Exosome-Based Products Create Market Barriers

Exosome-based products face regulatory challenges that impede their widespread adoption in the market. Given their biological origin and the variety of applications they encompass, exosomes are classified as both diagnostic and therapeutic products, creating complexity in their regulatory evaluation. The U.S. Food and Drug Administration (FDA) and other regulatory bodies require extensive data on the safety, efficacy, and manufacturing processes of exosome-derived products before granting approval. The regulatory landscape is still evolving, with exosome-based therapeutics and diagnostic tools often falling into gray areas of regulation. This creates uncertainty for companies attempting to bring exosome products to market. Additionally, the long and costly process of conducting preclinical and clinical trials to demonstrate safety and efficacy can delay the availability of exosome-based therapies. With the growing number of companies entering the exosome space, the competition for regulatory approval is intensifying, and the risk of regulatory hurdles is high. Until more defined regulatory pathways are established, the development and commercialization of exosome-based products could remain slow and unpredictable, affecting the overall growth of the market.

Opportunities

-

Increasing Focus on Exosome Research for Infectious Disease Management Offers New Avenues

Exosome research is increasingly being explored for its potential in managing infectious diseases, offering new avenues for the Exosomes Market. Exosomes have the ability to transport bioactive molecules, including viral antigens and immune modulators, making them promising candidates for vaccine development and therapeutic interventions. For example, exosomes are being studied as potential delivery vehicles for vaccines that can stimulate a targeted immune response without the need for traditional adjuvants. In addition, exosomes derived from patients' cells may be used to treat viral infections, such as COVID-19, by enhancing the body's immune response or delivering antiviral agents directly to infected cells. Organizations like the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO) have identified exosomes as a potential tool for fighting emerging infectious diseases. As global health concerns continue to rise, the demand for innovative solutions to combat infectious diseases will only increase, creating opportunities for companies to develop exosome-based products. The growing investment in this area is likely to lead to breakthroughs in exosome research, paving the way for new applications in infectious disease management.

Challenge

-

Technical Hurdles in Scaling Up Exosome Production Impact Market Dynamics

Scaling up the production of exosomes from laboratory research to large-scale commercial manufacturing remains a significant challenge. Although exosome isolation and characterization techniques have improved, producing exosomes in sufficient quantities with high purity remains difficult. Technologies like ultracentrifugation, despite being the most common, are labor-intensive and not ideal for large-scale production. Newer methods such as microfluidic systems are promising but still not widespread enough for mass production. Furthermore, the consistency of exosome properties during large-scale production, such as their size, composition, and functionality, is critical for their therapeutic applications. Fluctuations in quality could lead to product failures or regulatory setbacks, particularly when developing exosome-based therapeutics. To address these challenges, companies must invest in more efficient, scalable production methods, and optimize existing techniques. Until reliable and cost-effective large-scale production methods are developed, the Exosomes Market may face limitations, especially in the commercial availability of exosome-based products.

Exosomes Market Segmentation Analysis

By Product

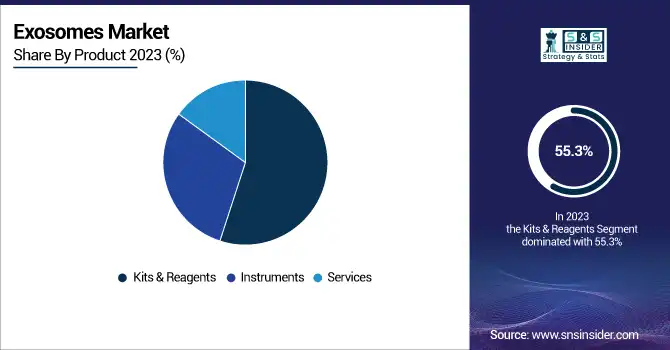

In 2023, Kits & Reagents dominated the Exosomes market with a market share of 55.3%. This dominance can be attributed to the increasing demand for exosome isolation and characterization in both research and clinical settings. Exosome isolation kits are widely used in diagnostic applications, especially in biomarker discovery and cancer research, where exosomes are valuable for non-invasive diagnostics. For example, companies like Thermo Fisher Scientific and Bio-Techne Corporation have developed advanced kits and reagents that cater to both researchers and clinicians for efficient isolation and analysis of exosomes. These products are essential in helping scientists isolate high-purity exosomes for use in clinical trials and treatment development. Moreover, the growing focus on liquid biopsy techniques, which utilize exosomes to detect cancer markers, has significantly bolstered the demand for these kits. The National Institutes of Health (NIH) has funded several studies emphasizing exosome biomarkers for cancer, further promoting the use of these reagents in advanced diagnostics.

By Indication

The Cancer indication dominated the Exosomes market in 2023, with an estimated market share of 40.5%. Cancer research has significantly increased the use of exosomes as biomarkers and potential therapeutic agents. Exosomes are considered promising diagnostic and prognostic biomarkers for cancers due to their ability to carry RNA, proteins, and other molecules related to tumors. Major pharmaceutical companies, such as Codiak BioSciences and Thermo Fisher Scientific, have been investing heavily in developing exosome-based technologies for cancer diagnosis and treatment. The National Cancer Institute (NCI) has conducted research on exosome-based platforms for non-invasive cancer diagnostics, further validating their potential. With advancements in liquid biopsy technologies, exosomes are increasingly being used to detect early-stage cancers, which is a significant reason for the market's growth in this area.

By Application

In 2023, the Biomarkers application segment dominated the Exosomes market with a market share of 48.7%. Exosomes are rich in biomolecules that are crucial for biomarker discovery, especially for diseases like cancer and neurodegenerative disorders. The ability of exosomes to carry RNA, DNA, proteins, and lipids makes them ideal candidates for use in diagnostic applications. Companies such as Exopharm and Bio-Techne have developed technologies focused on exosome isolation and characterization to identify disease-specific biomarkers. In addition, government-funded initiatives, such as the U.S. Department of Defense’s Biomarker Discovery Program, have further highlighted exosomes as a leading platform for non-invasive disease detection. Their widespread application in cancer diagnostics, neurological disorders, and inflammation is the key driver behind the biomarker segment's dominance.

By End User

The Pharmaceutical & Biotechnology Companies segment dominated the Exosomes market in 2023, with a market share of 55.2%. These companies are leading the adoption of exosome-based technologies for drug delivery, gene therapy, and therapeutics development. Exosomes are being explored for their ability to carry therapeutic payloads, making them a significant component of drug delivery systems. Miltenyi Biotec and Lonza are major players in providing solutions for exosome-based therapies, particularly for pharmaceutical applications. The Food and Drug Administration (FDA) has also recognized the potential of exosomes in cell and gene therapies, driving pharmaceutical companies to invest in research and development. Furthermore, exosome-based products are increasingly used for clinical trials, drug testing, and therapeutic innovations, contributing to the dominance of this segment.

In 2022, Pharmaceutical and biotechnology companies segment is expected to dominate the market growth of 49.5% during the forecast period owing to the rising demand for extracellular vesicle-based medicines and vaccines. Furthermore, various pharmaceutical and biotechnology businesses are forming alliances and collaborations to improve large-scale production. For example, in January 2023, Sartorius AG announced a collaboration with RoosterBio to develop downstream purification methods for exosome synthesis. Similarly, Sartorius BIA Separations and Exopharm formed a partnership in November 2022 to improve large-scale medicinal exosome production and commercialization.

Exosomes Market Regional Outlook

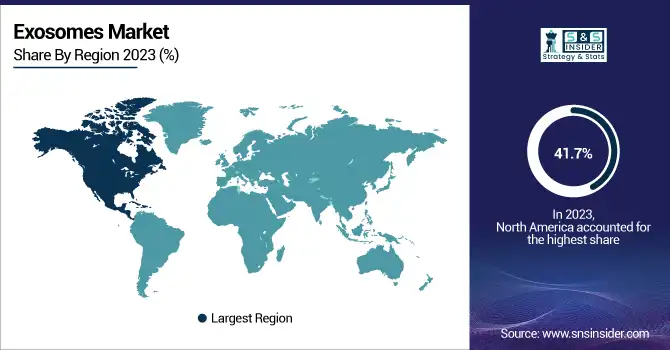

North America dominated the Exosomes market in 2023, holding a market share of 41.7%. This can be attributed to the strong presence of pharmaceutical and biotechnology companies and the well-established research infrastructure in the U.S. The U.S. has a leading position in exosome-related research, with numerous academic institutions and biotech firms working on exosome isolation and diagnostic tools. The National Institutes of Health (NIH) has been actively funding exosome research, contributing to the growth of the market. Companies like Thermo Fisher Scientific and Codiak BioSciences are headquartered in North America, providing critical innovations in exosome isolation, characterization, and therapeutic applications. In addition, the FDA’s support for exosome-based gene therapies and drug delivery systems has reinforced North America's dominance. The U.S. market alone accounts for a significant share of the regional market, making it the leader in exosome diagnostics and therapeutics.

The Asia Pacific region emerged as the fastest-growing region in the Exosomes market in 2023, driven by the expanding pharmaceutical and biotechnology sectors in countries like China and India. Governments in the region, such as China’s National Natural Science Foundation (NSFC), have been funding exosome-based research, particularly for drug delivery systems and biomarker development. In China, companies like Qiagen and Miltenyi Biotec are collaborating with local institutions to develop exosome-based platforms for disease diagnostics. India has also seen growth in biotech firms focusing on exosome isolation technologies, driven by increasing investments in healthcare and biomarker research. The demand for non-invasive diagnostics and cancer therapies is driving the rapid adoption of exosome-based products, particularly in the emerging markets of Southeast Asia, contributing to the region's fast growth.

Do You Need any Customization Research on Exosomes Market - Enquire Now

Key Players in the Exosomes Market

-

Aethlon Medical, Inc. (Aethlon Hemopurifier, Exosome Enrichment Kits)

-

Anjarium Biosciences AG (Anjarium Exosome Therapeutic Platform, Anjarium Exosome Isolation)

-

Bio-Techne Corporation (Exosome Isolation Kits, Exosome ELISA Kits)

-

Clara Biotech (ExoQuick, Exosome Purification Kits)

-

Codiak BioSciences (Engex Exosome Platform, Exosome-based Immunotherapy)

-

Creative Biolabs (Exosome Isolation Kits, Custom Exosome Production Service)

-

Everzom (Exosome-based Drug Delivery, Exosome Isolation Kits)

-

Exopharm (Exosome-based Delivery Platform, Exosome Isolation and Characterization Kits)

-

Fujifilm Holdings Corporation (Exosome Isolation Kits, Exosome Storage Solutions)

-

ILIAS Biologics, Inc. (ILIAS Exosome-Based Drug Delivery Platform, Exosome Engineering Services)

-

INOVIQ (Exosome Detection Kits, ExoTEST for Cancer Diagnostics)

-

Lonza (Exosome Isolation Kit, Lonza Exosome Culture Media)

-

Miltenyi Biotec (MACS Exosome Isolation Kits, Exosome Characterization Tools)

-

Norgen Biotek Corp. (Exosome RNA Isolation Kit, Exosome Isolation Reagent)

-

QIAGEN (QIAprep Exosome Kit, QIAzol Lysis Reagent for Exosome RNA)

-

Rion, Inc. (Exosome Purification Kit, Exosome-based Regenerative Solutions)

-

RoosterBio, Inc. (Exosome Isolation Kits, MSC-derived Exosome Products)

-

Thermo Fisher Scientific, Inc. (ExoEasy Exosome Isolation Kit, Thermo Scientific Exosome Analysis Kits)

-

Unchained Labs (ExoTag Exosome Isolation Kit, ExoView Exosome Characterization System)

-

Danaher Corporation (Beckman Coulter) (Cytomics FC500 Flow Cytometer, Exosome Isolation Kits)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 136.16 Million |

| Market Size by 2032 | USD 1,311.03 Million |

| CAGR | CAGR of 28.62% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Kits & Reagents, Instruments, Services) •By Indication (Cancer, Neurodegenerative diseases, Cardiovascular diseases, Infectious diseases, Others) •By Application (Biomarkers, Vaccine Development, Tissue Regeneration, Others) •By End User (Pharmaceutical & biotechnology companies, Hospitals & diagnostics centers, Academic & research institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | RoosterBio, Inc., Codiak BioSciences, Everzom, Exopharm, Rion, Inc., ILIAS Biologics, Inc., Unchained Labs, INOVIQ, Clara Biotech, Creative Biolabs and other key players |