Event Management Software Market Size & Overview:

Get more information on Event Management Software Market - Request Sample Report

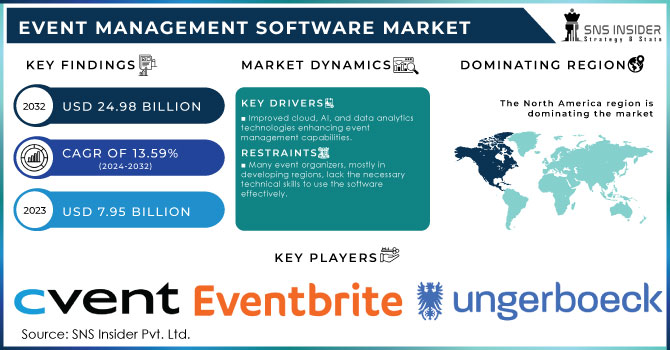

The Event Management Software Market was valued at USD 7.95 billion in 2023 and is expected to reach USD 24.98 billion by 2032, growing at a CAGR of 13.59% from 2024-2032.

The Event Management Software Market is experiencing rapid growth, driven by the increasing demand for efficient event planning solutions, especially in a virtual and hybrid format. This sector comprises software platforms that aid in organizing, advertising, managing, and analyzing events within different industries, such as corporate, entertainment, education, and government. While the demand for them has always existed, the recent advancements in cloud technology, AI, and analytics significantly improved event management approaches and tools. Growth factors also include the higher utilization of digital event solutions after the pandemic, the growing popularity of hybrid events, and the need for business process optimization. Considering the widespread smartphone and internet use, the software accessible via the app is vital. The subsequent integration of social media and streaming activities has also been a considerable growth factor for further market development. However, the governments initiated the most significant growth events, which invested substantial funds in the expansion of the industry.

The U.S., being one of the most technologically advanced countries, claimed $150 billion in 2023 for the enhancement of digital infrastructure, utilizing cloud computing alongside AI. While the funds were not directly invested in the event management software, it inevitably affected the development of digital tools in the industry. India’s government has also invested over $30 billion in the “Digital India” campaign, and China’s $250 billion “New Infrastructure” plan has similar objectives of expanding cloud computing, AI, and 5G within the country.

The number of corporate events, conferences, trade shows, and virtual events continued to grow, affecting the growth of the software segment. Even though the main issues with the type of software, such as data security, and the necessity for high initial funds have not been resolved, the increased use of automation and AI-driven data analytics is expected to make the shift. Overall, the long-term perspectives for the development of the Event Management Software Market are highly favorable.

Event Management Software Market dynamics

Drivers

-

Improved cloud, AI, and data analytics technologies enhancing event management capabilities.

-

Integration of social media and live streaming features boosts event reach and audience engagement.

-

Investments in digital transformation across countries support the adoption of advanced event management platforms.

The growth of the Event Management Software Market is driven by investments in digital transformation. Digital infrastructure, cloud computing, and AI have become the focal points of governments across the globe. These developments have created an environment that accelerates the growth of advanced event management solutions. Solutions have become reliable, providing businesses with technological advancement to plan events.

Modern event management software affords greater connectivity, Artificial Intelligence driven features such as data analytics audience engagement, and real-time feedback. With better digital infrastructure, the reliability of virtual and hybrid events has increased considerably as disruptions become rarer. On the other hand, with continued digital transformation, businesses are adopting these options to plan and organize corporate, educational, entertainment, and public events. In conclusion, governments across the globe's investment in technology are changing how we plan, manage, and experience events.

The presence of social media and live streaming features in event management software provides additional opportunities to increase the impact and the number of users affected by a certain event. Live streaming tools allow overcoming physical boundaries and unite users in one space, no matter where they are located. Integration with social media extends the use of these features and allows sharing on Facebook, Instagram, as well as LinkedIn.

More than 80% of organizers use live streaming in 2023 to maintain their presence on social media and interact with their online audiences. Moreover, the participation rates of the events advertised on social media increased by 34%. With the features of “live streaming” and “social sharing”, the events become more accessible, and the interaction with the audience becomes long-lasting, which is a guarantee of effectiveness.

Restraints

-

Many event organizers, mostly in developing regions, lack the necessary technical skills to use the software effectively.

-

The effective use of online event management tools depends on the availability of a reliable internet infrastructure.

-

Some enterprises may struggle with integrating new event management solutions into the existing enterprise software systems.

Many adopters of new event management solutions may experience difficulties integrating them into their current enterprise software. Such barriers may emerge due to the software’s incompatibility with the established systems, increasing costs, and delays associated with the implementation. The integration issues may hinder the growth of adoption for companies with outdated or rigid IT organizations. For instance, more than 30% of organizations have associated their adoption of the new software with issues with integrating it with an established system, which may impede the software’s implementation and restrict its advantages for business. The users may not be able to leverage the advanced features offered by modern solutions such as real-time analytics, efficient attendance management, or accessing various types of events online through virtual options. Overall, overcoming the barriers to integration and effective use of event management software may benefit businesses by facilitating the adoption process and improving organizational efficiency.

Another barrier to the broad adoption of online event management tools is the reliance on their effective use on the quality of internet provision. In areas with poor or underdeveloped internet connectivity, the use of such tools may be restricted or even unfeasible in the worst cases. For example, low-quality internet may impede real-time streaming of events or updates provided by organizers as the content may keep freezing, which may be a significant issue for professionals engaging with a diverse source of events online. It is a likely barrier for developing markets, many of which may lack the developed internet infrastructure required for the most effective use of event management solutions. In 2023, more than four-fifths of the rural areas across the world were left without broadband connectivity, which means that organizing events online in such areas may be problematic. The pace of improvements to the telecommunications infrastructure will be a key factor for the future adoption of online event management software, as only having reliable infrastructure in place will allow the management to utilize it to the best effect.

Event Management Software Market Segment Analysis

By Component

The software segment dominated the market and accounted for the largest market share of 65.4% in 2023. Software solutions offer a host of tools and functionalities to help manage various areas of event planning: event selection, financial management, conference scheduling, logistics, vendor management, and task tracking. Over the past years, the software segment has been heavily profiting from the progression of hybrid and virtual events. Software developed specifically for these formats includes virtual exhibitors booths, chat functions, live broadcasting, content distribution, etc. Such platforms help event managers to create compelling digital experiences.

The service segment is expected to witness a CAGR of 12.9% over the forecast period. Services are specially tailored to provide detailed expertise and specialized knowledge in event planning, organizing, and executing. Professional event managers have insights into event design, current event trends, best practices, and innovative industry, and have the experience to deliver an effective, managed event that helps clients meet their objectives.

By Deployment

The cloud-based segment held the largest market share of 62.5% in 2023. The cloud-based event management software enables users to access the software through an internet connection. The software can be used by event managers, administrators, hosts, and participants while on their PCs, smartphones, or tablet devices, enhancing flexibility. This software can support real-time communication, messaging, and managing events while they are underway. More so, cloud-based solutions are designed to run on a high availability mode and maintain high performance through this period, with few, if any, disruptions during critical event operations.

The on-premises segment is expected to grow at a CAGR of 13.1% during the forecast period. With such software, the organization has more control over its event data, as it remains within its premises. The software also does not require access to the internet to access, streamlining access to company or personal data. This setup lends more data security, particularly personal data, as well as more compliance. Since the software is wholly within the organization’s premises, the software can be adjusted to company-specific event management needs, set workflows, and integrated into system processes.

By Enterprise Size

In 2022, the large enterprise segment dominated the market and represented over 53.9% of the market and is expected to continue its dominance over the forecast period. Large enterprises are motivated to provide excellent services and facilitate access for clients, employees, and industry experts. Corporate event management software adoption streamlines resource allocation, planning, supplier contracts, and logistical coordination as well as offers real-time updates. Indeed, such enterprises might be expected to host all types of corporate events, such as meetings, conferences, trade shows, workshops, training programs, and product launches. Identification, ticketing, attendance management, orders, logistic coordination, venue selection, networking, live polling, updates, and reporting are various processes that are supported. Furthermore, such software may be used to send meeting invitations to various stakeholders and access their responses.

The SMEs segment is anticipated to grow at the highest CAGR of 13.0% during the forecast period. One of the key growth factors is the rise in the number of SMEs in the countries, such as India, the U.S., and China. Generally, small and medium-sized enterprises seek to appear credible and present a strong brand to their customers. Event management software includes registration forms, email templates, customizable event sites, and branding alternatives.

By Application

The event organizers and planners segment accounted for a market share of 40.2% in 2023 and is anticipated to dominate the market by 2032. Based on its capabilities, these professionals use event management software to organize, prepare, and carry out the event efficiently. The platform aids them in managing registration, increasing participant commitment, managing advertising, planning logistics, and analyzing the event’s performance. The market is being driven by the rising demand from event organizers and planners for efficient, easy-to-use, and feature-rich software solutions.

Over the forecast period, the corporate segment is expected to expand at a CAGR of 14.9%. For corporate occasions, the reliability, precision, and attentiveness of event management software are critical. Event management software enables organizations to maximize efficiency, automate tasks, and maintain a professional and consistent approach to organizing the event. To be successful, corporate entities must safeguard data and adhere to legal jurisdiction’s data privacy standards. Corporate enterprises need to plan events in many locations with teams from diverse regions. They often display highly classified data belonging to their customers, including their financial data and intellectual property. Thus, privacy laws and data security are a top concern for event management software suite providers.

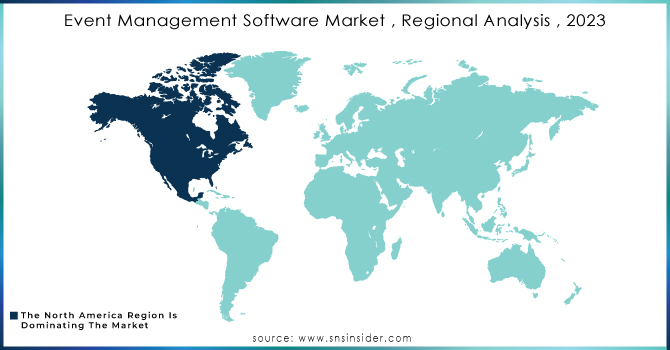

Regional Analysis

In 2023, North America held a market share of about 44.1% of the total revenue. The vendors in North America are the world pioneers and forefront of technological growth. Their products are developed with cutting-edge technologies, including cloud hosting, machine learning, artificial intelligence, mobile apps, data analytics, the Internet of Things, blockchain, and much more. The software is put to use in corporate, government, healthcare, education, non-profit, and entertainment sectors, among other fields for the enhancement of the event experience. The software is also resourceful in the streamlining of operations, increased customer engagement, and the achievement of objectivity and goals of the event.

The vendors in North America, such as in the U.S. and Canada are accustomed to being financially open and have continually ratified their reliability in investing in emerging solutions to guarantee their dependability. The users in the region are demanding that software vendors deploy cutting-edge technologies to keep at par or overpass the novel tools that are coming up every day. The region has the highest active users of the software, combined with the presence of transnational as well as new companies, driving the acceptance of the technology. More organizations are teaming up with suppliers to adopt event management solutions.

Asia Pacific is expected to observe major growth during the projected period. This has contributed to the fact that the adoption of smartphones is growing while the cloud platforms are still being developed. Notably, an increasing number of events have been observed. In addition to musical activity, tradeshows, stand-up comedy shows, and product launches are also on the rise. India, Japan, China, and Australia become major contributors to the Asia-Pacific market of event management software.

Need any customization research on Event Management Software Market - Enquiry Now

Key Players

The major key players are

-

Cvent - (Event Management Platform)

-

Eventbrite - (Ticketing and Event Management Software)

-

Hopin - (Virtual Event Platform)

-

Bizzabo - (Event Experience Platform)

-

Eventzilla - (Event Registration Software)

-

Social Tables - (Event Planning and Diagramming Software)

-

Whova - (Event Management App)

-

Splash - (Event Marketing Software)

-

Asana - (Project Management Tool with Event Management Features)

-

Aventri - (Event Management and Registration Software)

-

Meetup - (Social Networking and Event Planning Platform)

-

RegFox - (Custom Event Registration Software)

-

Ticket Tailor - (Event Ticketing Platform)

-

Swoogo - (Event Registration and Management Software)

-

Showpass - (Event Ticketing and Management Software)

-

Convene - (Virtual and Hybrid Event Platform)

-

Zuddl - (Hybrid Event Management Software)

-

Eventleaf - (Event Registration and Ticketing Software)

-

Tribe - (Community and Event Management Platform)

-

XING Events - (Event Management and Networking Software)

Recent Developments

In April 2023, Cvent, Inc. announced a strategic partnership with Jifflenow, a B2B meeting platform, aimed at simplifying the booking process for in-person meetings at corporate events and tradeshows for customers of both companies.

In April 2023, Eventbrite launched the RECONVENE Accelerator, a mentorship and award program designed to empower and inspire the next generation of event creators. As part of this initiative, the company introduced a panel of judges to select five winners, each of whom will receive $20,000 and a personalized mentorship program from Eventbrite.

| Report Attributes | Details |

| Market Size in 2023 | US$ 7.95 Billion |

| Market Size by 2032 | US$ 24.98 Billion |

| CAGR | CAGR of 13.59% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Deployment (Cloud-based, On-premises)

• By Application (Event Organizers & Planners, Corporate, Government, Education, Others) • By Component (Software, Services) • By Organization Size (Small and Medium-sized Enterprise, Large Enterprise) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cvent, Eventbrite, Hopin, Bizzabo, Eventzilla, Social Tables, Whova, Splash, Asana, Aventri, Meetup, RegFox, Ticket Tailor, Swoogo, Showpass, Convene, Zuddl, Eventleaf, Tribe, XING Events, and others |

| Key Drivers |

• Improved cloud, AI, and data analytics technologies enhancing event management capabilities.

• Integration of social media and live streaming features boosts event reach and audience engagement. |

| Market Restraints |

• Many event organizers, mostly in developing regions, lack the necessary technical skills to use the software effectively.

• The effective use of online event management tools depends on the availability of a reliable internet infrastructure. • Some enterprises may struggle with integrating new event management solutions into the existing enterprise software systems. |