Get More Information on Euro 7 Regulations Compliant Market - Request Sample Report

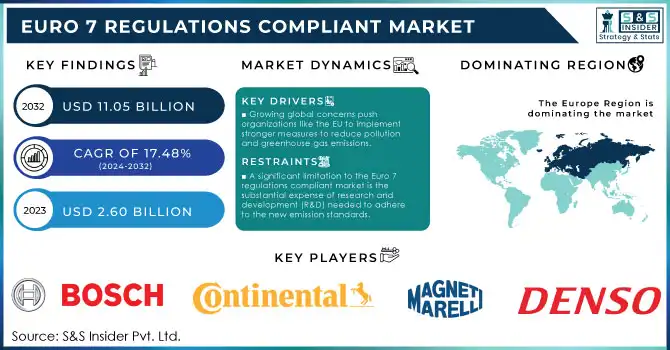

The Euro 7 Regulations Compliant Market Size was valued at USD 2.60 billion in 2023 and is expected to reach USD 11.05 billion by 2032, growing at a CAGR of 17.48% over the forecast period 2024-2032.

The Euro 7 regulations are poised to revolutionize the automotive industry, driving technological innovation and fostering cleaner, more sustainable transportation solutions. As of 2023, the transportation sector is responsible for about 23% of global energy-related CO2 emissions and 28% of end-use energy emissions. Urban transport alone accounts for approximately 40% of end-use energy consumption. These statistics underline the urgent need to address emissions from transport, as CO2 remains in the atmosphere for over a century, significantly contributing to long-term global warming. In addition to CO2, black carbon is another critical pollutant that accelerates climate change, with a warming effect far more potent than CO2, though it stays in the atmosphere for only a few weeks. Reducing black carbon emissions is crucial for slowing the pace of global warming, and it also addresses the immediate health threats posed by particulate matter. Particulate pollution is linked to an increase in respiratory and cardiovascular diseases, contributing to higher mortality rates. The Euro 7 regulations aim to address these challenges by tightening emissions standards, targeting CO2, black carbon, and ground-level ozone.

One of the key drivers of the Euro 7 regulations is the promotion of alternative powertrains, specifically electric vehicles (EVs) and hybrid electric vehicles (HEVs). As car manufacturers strive to comply with these stricter emissions standards, the demand for low-emission and zero-emission vehicles is expected to grow. This shift will spur innovation in battery technology, charging infrastructure, and electric drivetrain components, creating new opportunities for investment and growth within the automotive industry. The Euro 7 regulations will also accelerate the transition toward electrification, making it a pivotal moment for the future of mobility. For regions outside the EU, Euro 7 will serve as a benchmark for setting similar environmental standards. As global awareness of climate change and air pollution increases, other countries may adopt similar regulatory frameworks, further driving the global development of cleaner vehicle technologies.

Drivers

With growing global concerns, organizations like the European Union (EU) face heightened demands to implement significant measures to tackle pollution and lower greenhouse gas emissions.

Euro 7 regulations aim to rectify the deficiencies of earlier emission standards (Euro 6) and further reduce the environmental effects of road transportation. The Euro 7 standards focus on lowering nitrogen oxide (NOx) emissions, particulate matter, and additional pollutants from vehicles, particularly those with diesel and gasoline engines. This has grown increasingly pressing since road transportation is among the major sources of air pollution, especially in city regions. The Euro 7 regulations will aid in reducing vehicle emissions, enhancing air quality, and supporting lasting public health advantages. The demand for tougher environmental regulations worldwide is compelling manufacturers to adjust to new criteria, thereby increasing the need for Euro 7-compliant vehicle technologies and solutions. The enactment of these regulations is in line with the EU's wider climate objectives, such as the European Green Deal, which strives for a carbon-neutral Europe by 2050. As global governments place increasing emphasis on sustainability, companies and automakers are required to adhere to updated emissions regulations, impacting the demand for technologies and products that fulfill Euro 7 standards.

As knowledge of environmental concerns expands, consumer demand for cleaner and more sustainable automobiles is on the rise.

Shoppers are growing more aware of the ecological effects of their buying choices and are progressively looking for sustainable options. This change in consumer habits is leading to the expansion of the Euro 7 regulations-compliant market, as producers need to adjust their product lines to align with the demands of eco-aware consumers. The popularity of electric vehicles (EVs) and hybrid vehicles, known for being more environmentally friendly than conventional internal combustion engine vehicles, is consistently increasing. Although Euro 7 regulations aim to lower emissions from various vehicle types, such as gasoline, diesel, and hybrids, they also present an opportunity for the expansion of electric vehicles and other low-emission options. Shoppers are seeking cars that provide lower emissions, improved fuel economy, and overall diminished environmental impacts. Furthermore, the public's understanding of the lasting health impacts of air pollution is affecting consumer buying choices. Substances like nitrogen oxides (NOx) and particulate matter are associated with respiratory and cardiovascular ailments, leading individuals to prefer vehicles that produce fewer emissions. Consequently, manufacturers are increasingly encouraged to create vehicles that meet Euro 7 standards, providing improved environmental performance to align with changing consumer preferences.

Restraints

A significant limitation to the Euro 7 regulations compliant market is the substantial expense of research and development (R&D) needed to adhere to the new emission standards.

Creating and evaluating cutting-edge technologies, including enhanced exhaust after treatment systems, upgraded fuel injection systems, and different powertrains, necessitates substantial investment from automotive manufacturers. Meeting Euro 7 standards involves intricate engineering solutions, leading to higher development expenses. For instance, the necessity to cut emissions even more while upholding vehicle performance and fuel efficiency adds extra pressure on manufacturers. Small and medium-sized manufacturers, especially, may find it challenging to cope with the financial strain of these R&D investments, which could hinder their competitiveness in the market. Furthermore, the necessary testing and certification procedures can be protracted and expensive. Manufacturers must ensure their vehicles comply with the strict Euro 7 standards before market sale, resulting in additional delays and higher expenses. The significant development expenses might be transferred to consumers as increased vehicle prices, potentially hindering the uptake of Euro 7-compliant vehicles, particularly in cost-sensitive markets.

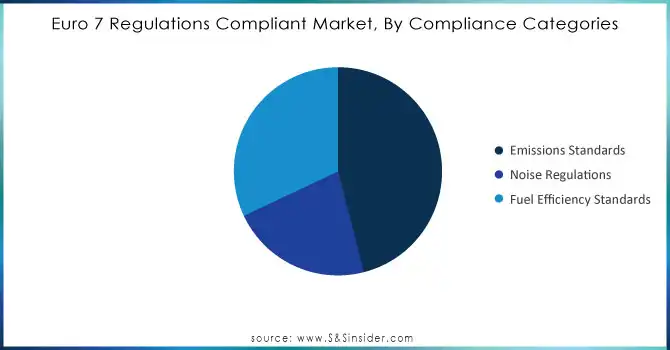

By Compliance Categories

Emissions standards led the market with 46% of the market share in 2023. These regulations seek to minimize harmful vehicle emissions, including carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter, to lessen environmental pollution and enhance air quality. As the Euro 7 regulations take effect, manufacturers must comply with more stringent emission limits than those set by earlier standards. Firms such as Bosch and Denso are significant contributors in this field, offering sophisticated technologies for exhaust after-treatment systems and engine management to guarantee compliance.

Fuel efficiency standards are expected to experience substantial growth from 2024 to 2032. Under the Euro 7 regulations, manufacturers are required to innovate to enhance fuel efficiency by using lighter materials, refining engine designs, and implementing advanced hybrid or electric technologies. The growth of this segment is driven by the rising global need for energy-efficient and economical vehicles due to environmental worries and escalating fuel costs. Firms such as Toyota and Volkswagen are at the forefront of fuel-efficient innovations, utilizing technologies like hybrid powertrains, lightweight materials, and regenerative braking systems.

Need Any Customization Research On Euro 7 Regulations Compliant Market - Inquiry Now

By Vehicle Type

In 2023, passenger vehicles dominated the Euro 7 regulations-compliant market, accounting for 42% of the market share. The Euro 7 regulations require car manufacturers to lower emissions of harmful substances, including nitrogen oxides (NOx) and particulate matter (PM), necessitating that passenger vehicles use advanced technologies such as electric power, hybrid systems, and improved exhaust treatments. Firms like Volkswagen Group and Toyota have taken the lead in advancing these technologies for compliance, which includes integrating hybrid engines and creating electric vehicle (EV) platforms. Volkswagen's ID series and Toyota's Prius serve as examples of cars built with Euro 7-compliant technologies, demonstrating advancements in fuel efficiency and reduced emissions.

Light commercial vehicles (LCVs) are expected to become the fastest-growing segment between 2024 and 2032. As Euro 7 regulations aim to implement tighter emission standards, LCV manufacturers are quickly embracing cleaner technologies like electric powertrains and alternative fuel systems. This trend is backed by firms such as Mercedes-Benz with their eSprinter electric van and Ford with the fully electric E-Transit van. These vehicles serve companies that need low-emission options for city deliveries, aligning with sustainability objectives. As the demand for zero-emissions transportation in urban areas grows, LCVs are poised to grow quickly as regulations advocate for cleaner options in commercial transport.

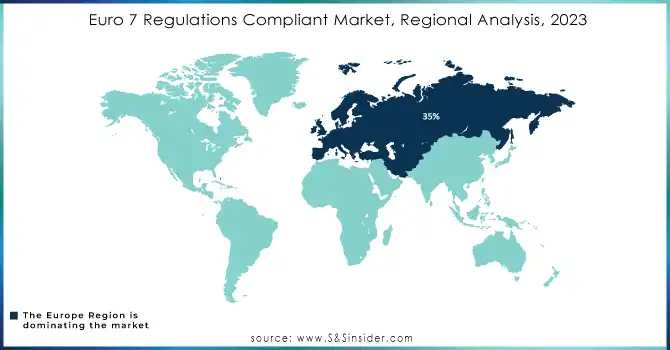

Europe dominated the Euro 7 regulations compliant market in 2023, accounting for approximately 35% of the market share. The introduction of the Euro 7 regulations in Europe is pivotal, focusing on lowering pollutants from vehicles through advanced emission control technologies, such as selective catalytic reduction (SCR) and diesel particulate filters (DPF). Major automotive manufacturers in countries like Germany, the UK, and France are rapidly adopting these technologies to meet compliance standards, benefiting companies like FORVIA, Tenneco, and Johnson Matthey, which offer emission control products tailored for Euro 7 compliance.

North America is expected to be the fastest-growing region in the Euro 7 Regulations Compliant Market from 2024 to 2032, driven by increasing regulatory pressures and the gradual alignment with stricter global emission standards, including Euro 7. U.S. manufacturers are increasingly focusing on adopting sustainable and innovative technologies to meet both regional and international emission standards, particularly in light of the U.S. Environmental Protection Agency's (EPA) more stringent requirements. Companies like Tenneco and Johnson Matthey are already contributing to this transition by offering advanced catalytic converters and filtration systems tailored to North American needs.

The major key players in the Euro 7 Regulations Compliant Market are:

Bosch (Diesel fuel injectors, Gasoline direct injectors)

Continental (Air management system, Exhaust gas sensors)

Magneti Marelli (Emissions control systems, Catalytic converters)

Denso (NOx sensors, EGR valves)

Valeo (Exhaust gas recirculation valves, Sensors)

Delphi Technologies (Fuel injectors, Engine control modules)

ZF Friedrichshafen (Transmission systems, Emission reduction systems)

Hella (Oxygen sensors, Catalytic converters)

Faurecia (Selective catalytic reduction systems, Exhaust gas after-treatment)

Honeywell (Turbochargers, Exhaust gas recirculation systems)

BorgWarner (Turbochargers, Electronic control systems)

Cummins (Selective catalytic reduction systems, Diesel particulate filters)

Schaeffler (Engine components, Emission control systems)

Aisin Seiki (Emission control systems, Automatic transmission components)

Mann+Hummel (Air filters, Emission control components)

Mahle (Pistons, Filters)

Tenneco (Exhaust systems, Catalytic converters)

Wabco (Emission control sensors, Exhaust after-treatment)

Eberspächer (Exhaust systems, Diesel particulate filters)

Johnson Matthey (Catalysts, Emission control technologies)

Siemens (Software for emission control and engine management)

Infineon Technologies (Sensors for exhaust gas measurement)

Autoliv (Airbags and safety sensors for vehicle systems)

STMicroelectronics (Microcontrollers for emission management systems)

NXP Semiconductors (Vehicle electronics, Emission control chips)

Renesas Electronics (Microcontrollers for engine control systems)

Texas Instruments (Sensors, control systems)

Eaton (Emission control and filtration components)

Ricardo (Engine software solutions, Performance optimization tools)

AVL List GmbH (Powertrain simulation software)

July 2024: Bosch has created a test bench for measuring brake emissions that surpasses the standards set by Euro 7.

April 2024: Honeywell announced today that Bosch's latest series of heat pumps will use Honeywell's energy-efficient Solstice refrigerant, which has a low global warming potential (GWP).

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.60 Billion |

| Market Size by 2032 | USD 11.05 Billion |

| CAGR | CAGR of 17.48% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Compliance Categories (Emissions Standards, Noise Regulations, Fuel Efficiency Standards) • By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles) • By Engine Type (Internal Combustion Engine, Hybrid Engine, Electric Engine) • By Technology (Exhaust Aftertreatment, On-Board Diagnostics, Alternative Fuels) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bosch, Continental, Magneti Marelli, Denso, Valeo, Delphi Technologies, ZF Friedrichshafen, Hella, Faurecia, Honeywell, BorgWarner, Cummins, Schaeffler, Aisin Seiki, Mann+Hummel, Mahle, Tenneco, Wabco, Eberspächer, Johnson Matthey |

| Key Drivers | • With growing global concerns, organizations like the European Union (EU) face heightened demands to implement significant measures to tackle pollution and lower greenhouse gas emissions. • As knowledge of environmental concerns expands, consumer demand for cleaner and more sustainable automobiles is on the rise. |

| RESTRAINTS | • A significant limitation to the Euro 7 regulations compliant market is the substantial expense of research and development (R&D) needed to adhere to the new emission standards. |

Ans: The Euro 7 Regulations Compliant Market is expected to grow at a CAGR of 17.48% during 2024-2032.

Ans: The Euro 7 Regulations Compliant Market was USD 2.60 Billion in 2023 and is expected to Reach USD 17.48 Billion by 2032.

Ans: With growing global concerns over climate change, countries and regional organizations like the European Union (EU) face heightened demands to implement significant measures to tackle pollution and lower greenhouse gas emissions.

Ans: The Emissions Standards segment dominated the Euro 7 Regulations Compliant Market.

Ans: Europe dominated the Euro 7 Regulations Compliant Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Compliance Adoption Rate, by Region

5.2 Regulation Impact on Product Development, by Region

5.3 Technological Advancements

5.4 Security and Compliance Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Euro 7 Regulations Compliant Market Segmentation, By Compliance Categories

7.1 Chapter Overview

7.2 Emissions Standards

7.2.1 Emissions Standards Market Trends Analysis (2020-2032)

7.2.2 Emissions Standards Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Noise Regulations

7.3.1 Noise Regulations Market Trends Analysis (2020-2032)

7.3.2 Noise Regulations Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Fuel Efficiency Standards

7.4.1 Fuel Efficiency Standards Market Trends Analysis (2020-2032)

7.4.2 Fuel Efficiency Standards Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Euro 7 Regulations Compliant Market Segmentation, By Vehicle Type

8.1 Chapter Overview

8.2 Passenger Cars

8.2.1 Passenger Cars Market Trends Analysis (2020-2032)

8.2.2 Passenger Cars Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Light Commercial Vehicles

8.3.1 Light Commercial Vehicles Market Trends Analysis (2020-2032)

8.3.2 Light Commercial Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Heavy Commercial Vehicles

8.4.1 Heavy Commercial Vehicles Market Trends Analysis (2020-2032)

8.4.2 Heavy Commercial Vehicles Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Euro 7 Regulations Compliant Market Segmentation, By Engine Type

9.1 Chapter Overview

9.2 Internal Combustion Engine

9.2.1 Internal Combustion Engine Market Trends Analysis (2020-2032)

9.2.2 Internal Combustion Engine Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Hybrid Engine

9.3.1 Hybrid Engine Market Trends Analysis (2020-2032)

9.3.2 Hybrid Engine Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Electric Engine

9.4.1 Electric Engine Market Trends Analysis (2020-2032)

9.4.2 Electric Engine Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Euro 7 Regulations Compliant Market Segmentation, by Technology

10.1 Chapter Overview

10.2 Exhaust Aftertreatment

10.2.1 Exhaust Aftertreatment Market Trends Analysis (2020-2032)

10.2.2 Exhaust Aftertreatment Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 On-Board Diagnostics

10.3.1 On-Board Diagnostics Market Trends Analysis (2020-2032)

10.3.2 On-Board Diagnostics Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Alternative Fuels

10.4.1 Alternative Fuels Market Trends Analysis (2020-2032)

10.4.2 Alternative Fuels Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Euro 7 Regulations Compliant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.2.4 North America Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.5 North America Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.2.6 North America Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.2.7.2 USA Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.7.3 USA Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.2.7.4 USA Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.2.8.2 Canada Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.8.3 Canada Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.2.8.4 Canada Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.2.9.2 Mexico Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.2.9.3 Mexico Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.2.9.4 Mexico Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.1.7.2 Poland Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.7.3 Poland Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.1.7.4 Poland Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.1.8.2 Romania Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.8.3 Romania Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.1.8.4 Romania Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.2.4 Western Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.5 Western Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.2.6 Western Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.2.7.2 Germany Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.7.3 Germany Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.2.7.4 Germany Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.2.8.2 France Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.8.3 France Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.2.8.4 France Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.2.9.2 UK Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.9.3 UK Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.2.9.4 UK Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.2.10.2 Italy Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.10.3 Italy Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.2.10.4 Italy Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.2.11.2 Spain Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.11.3 Spain Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.2.11.4 Spain Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.2.14.2 Austria Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.14.3 Austria Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.2.14.4 Austria Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4 Asia-Pacific

11.4.1 Trends Analysis

11.4.2 Asia-Pacific Euro 7 Regulations Compliant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia-Pacific Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.4.4 Asia-Pacific Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.5 Asia-Pacific Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.4.6 Asia-Pacific Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.4.7.2 China Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.7.3 China Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.4.7.4 China Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.4.8.2 India Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.8.3 India Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.4.8.4 India Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.4.9.2 Japan Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.9.3 Japan Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.4.9.4 Japan Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.4.10.2 South Korea Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.10.3 South Korea Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.4.10.4 South Korea Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.4.11.2 Vietnam Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.11.3 Vietnam Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.4.11.4 Vietnam Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.4.12.2 Singapore Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.12.3 Singapore Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.4.12.4 Singapore Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.4.13.2 Australia Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.13.3 Australia Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.4.13.4 Australia Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia-Pacific Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia-Pacific Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia-Pacific Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Euro 7 Regulations Compliant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.5.1.4 Middle East Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.5 Middle East Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.5.1.6 Middle East Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.5.1.7.2 UAE Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.7.3 UAE Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.5.1.7.4 UAE Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.5.2.4 Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.5 Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.5.2.6 Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Euro 7 Regulations Compliant Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.6.4 Latin America Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.5 Latin America Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.6.6 Latin America Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.6.7.2 Brazil Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.7.3 Brazil Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.6.7.4 Brazil Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.6.8.2 Argentina Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.8.3 Argentina Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.6.8.4 Argentina Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.6.9.2 Colombia Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.9.3 Colombia Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.6.9.4 Colombia Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Euro 7 Regulations Compliant Market Estimates and Forecasts, By Compliance Categories (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Euro 7 Regulations Compliant Market Estimates and Forecasts, By Vehicle Type (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Euro 7 Regulations Compliant Market Estimates and Forecasts, By Engine Type (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Euro 7 Regulations Compliant Market Estimates and Forecasts, by Technology (2020-2032) (USD Billion)

12. Company Profiles

12.1 Bosch

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Continental

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Magneti Marelli

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Denso

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Valeo

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Delphi Technologies

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 ZF Friedrichshafen

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Hella

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Faurecia

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Honeywell

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Compliance Categories

Emissions Standards

Noise Regulations

Fuel Efficiency Standards

By Vehicle Type

Passenger Cars

Light Commercial Vehicles

Heavy Commercial Vehicles

By Engine Type

Internal Combustion Engine

Hybrid Engine

Electric Engine

By Technology

Exhaust Aftertreatment

On-Board Diagnostics

Alternative Fuels

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Automotive Keyless Entry Systems Market Size was valued at USD 1.98 billion in 2023 and is expected to reach USD 4.78 billion by 2031 and grow at a CAGR of 9.92% over the forecast period 2024-2031.

The Dashboard Camera Market Size was USD 4.0 Billion in 2023 and is expected to reach $10.8 Billion by 2032, growing at a CAGR of 11.50% from 2024-2032.

Electric Commercial Vehicle Market Size was valued at USD 71.51 billion in 2023 and is expected to reach USD 521.92 billion by 2032 and grow at a CAGR of 24.74% over the forecast period 2024-2032.

The Automotive Actuators Market Size was USD 20.3 Billion in 2023 and is expected to reach USD 32.4 Bn by 2032, growing at a CAGR of 5.34% by 2024-2032.

The Automotive Wheel Rims Market Size was USD 42.36 billion in 2023 and is expected to hit USD 87.55 billion by 2031 and grow at a CAGR of 9.5% by 2024-2031

The Electric Cargo Bikes Market Size was valued at USD 2.12 billion in 2023 and is expected to reach USD 4.95 billion by 2031 and grow at a CAGR of 11.2% over the forecast period 2024-2031.

Hi! Click one of our member below to chat on Phone