Ethylene Vinyl Acetate Market Report Scope & Overview:

Get E-PDF Sample Report on Ethylene Vinyl Acetate Market - Request Sample Report

The Ethylene Vinyl Acetate Market Size was valued at USD 11.0 billion in 2023 and is expected to reach USD 19.2 billion by 2032 and grow at a CAGR of 6.4% over the forecast period 2024-2032.

The Ethylene Vinyl Acetate market is currently experiencing significant growth, driven by its diverse applications across industries such as packaging, footwear, and renewable energy. The material is highly valued for its flexibility, toughness, and UV resistance, making it ideal for use in products like solar panels, packaging films, adhesives, and footwear. A major factor driving the demand for Ethylene Vinyl Acetate is the increasing adoption of renewable energy solutions, particularly solar energy, which relies heavily on the material for the encapsulation of photovoltaic cells. In January 2024, Braskem and Fkur entered into a distribution agreement for bio-based Ethylene Vinyl Acetate in Europe. This move emphasizes a shift towards more sustainable and eco-friendly materials in the market, catering to the growing demand for products that reduce environmental footprints.

Technological advancements are also influencing the market, particularly with the development of more efficient and environmentally friendly production processes. For example, in September 2024, Mitsui Chemicals announced improvements in its Ethylene Vinyl Acetate resin production technology, aiming to enhance both performance and sustainability. These advancements align with increasing pressure from both regulatory bodies and consumers for more energy-efficient, low-carbon materials. Furthermore, the growing demand for packaging materials, particularly driven by the surge in e-commerce, is fueling the market expansion. The ongoing shift toward bio-based and higher-performance Ethylene Vinyl Acetate is expected to continue to drive innovation and growth across various industries.

Ethylene Vinyl Acetate Market Dynamics:

Drivers:

-

Increasing Adoption of Bio-Based Ethylene Vinyl Acetate in the Packaging and Renewable Energy Sectors Drives Market Growth

The growing adoption of bio-based Ethylene Vinyl Acetate in key sectors such as packaging and renewable energy is significantly driving the market. This trend is largely fueled by the rising demand for eco-friendly materials as both manufacturers and consumers place greater emphasis on sustainability. For instance, Braskem’s partnership with Fkur in January 2024 for distributing bio-based Ethylene Vinyl Acetate in Europe is a direct response to the demand for green alternatives, especially in packaging and renewable energy applications. Solar panels, which use Ethylene Vinyl Acetate for photovoltaic cell encapsulation, are increasingly favored as clean energy solutions. Additionally, the pressure from governments and consumers to reduce the environmental impact of products is encouraging companies to invest in sustainable materials like bio-based Ethylene Vinyl Acetate. This shift helps to reduce the carbon footprint and reliance on fossil fuels, promoting a circular economy and boosting growth in markets across Europe and beyond.

-

Technological Advancements in Ethylene Vinyl Acetate Production Improve Performance and Environmental Impact

Technological advancements in Ethylene Vinyl Acetate production are another key driver for market growth. Innovations in resin production technologies, such as the ones announced by Mitsui Chemicals in September 2024, aim to improve the material's performance while reducing its environmental impact. By enhancing the resin's properties, companies can create higher-quality products that meet the growing demand for more efficient, durable, and sustainable materials. These technological improvements also play a critical role in addressing the increasing regulatory pressures on manufacturers to adopt environmentally responsible production practices. The ability to produce Ethylene Vinyl Acetate more efficiently not only benefits the environment but also results in cost savings for manufacturers, further fueling the market’s expansion. As more companies look to meet sustainability targets and consumer expectations, continued innovation in production technologies is expected to be a major catalyst for the Ethylene Vinyl Acetate market’s growth in the coming years.

Restraint:

-

Fluctuating Raw Material Prices and Supply Chain Disruptions Impact Ethylene Vinyl Acetate Production Costs

Fluctuating raw material prices and supply chain disruptions represent a significant challenge for the Ethylene Vinyl Acetate market. The production of Ethylene Vinyl Acetate relies heavily on petrochemical feedstocks, which are subject to price volatility due to factors such as geopolitical tensions, natural disasters, and shifts in global oil prices. For instance, during the Russia-Ukraine war, supply chains were disrupted, impacting the availability of raw materials and pushing prices higher. This uncertainty increases production costs for manufacturers, which may ultimately be passed on to consumers in the form of higher prices. Furthermore, these fluctuations can create instability within the market, making it difficult for companies to plan and invest strategically. As the global supply chain recovers from past disruptions, manufacturers must find ways to mitigate these cost fluctuations to ensure stable market growth and competitiveness.

Opportunity:

-

Growing Demand for Sustainable Energy Solutions Creates Opportunities for Ethylene Vinyl Acetate in Solar Panel Applications

The growing demand for sustainable energy solutions presents a significant opportunity for the Ethylene Vinyl Acetate market, particularly in the solar energy sector. Ethylene Vinyl Acetate is a key material used in the production of solar panel encapsulants, which help protect photovoltaic cells from environmental factors. As countries around the world strive to meet renewable energy goals and reduce dependence on fossil fuels, the demand for solar panels continues to rise. This is reflected in the increasing investments in solar energy infrastructure and technologies. Ethylene Vinyl Acetate’s unique properties, such as UV resistance and durability, make it an ideal material for enhancing the lifespan and efficiency of solar panels. As governments and organizations focus on expanding renewable energy sources, Ethylene Vinyl Acetate manufacturers have a unique opportunity to capitalize on the booming solar energy market by offering more sustainable and efficient products.

Challenge:

-

Rising Regulatory Pressures on Sustainability Practices Pose Challenges for Ethylene Vinyl Acetate Manufacturers

Rising regulatory pressures regarding sustainability practices pose a significant challenge for the Ethylene Vinyl Acetate market. Governments worldwide are enforcing stricter environmental regulations, requiring companies to meet higher standards for reducing carbon emissions and using renewable materials. As a result, Ethylene Vinyl Acetate manufacturers are increasingly facing compliance costs and the need to invest in cleaner production technologies. For instance, companies are being urged to reduce their reliance on fossil-based raw materials and shift towards bio-based alternatives, which are often more expensive to produce. This transition requires substantial investments in research and development, as well as changes to existing production processes. Additionally, the heightened consumer demand for greener products puts further pressure on manufacturers to innovate and meet sustainability expectations. While these regulations drive long-term positive change, the short-term challenges they present can hinder growth and profitability for Ethylene Vinyl Acetate producers.

Ethylene Vinyl Acetate Market Segmentation Overview

By Type

In 2023, the low-density segment dominated the Ethylene Vinyl Acetate market, accounting for approximately 50% of the total market share. Low-density Ethylene Vinyl Acetate is widely used in various applications due to its flexibility, softness, and durability, making it a preferred choice in industries such as packaging, footwear, and solar energy. This segment's strong market position is driven by the high demand for flexible films and packaging materials, where low-density Ethylene Vinyl Acetate's properties are particularly beneficial. Additionally, the increasing adoption of solar panels, which use low-density Ethylene Vinyl Acetate for photovoltaic cell encapsulation, has further contributed to its dominance.

By Application

In 2023, the film segment dominated the Ethylene Vinyl Acetate market, holding a revenue share of around 40%. Ethylene Vinyl Acetate films are crucial in various industries, including packaging and solar energy, due to their excellent transparency, flexibility, and UV resistance. The packaging sector, in particular, has been a significant driver of growth for this segment, as Ethylene Vinyl Acetate films are commonly used for food packaging and protective wraps. Furthermore, the growing demand for solar energy solutions, where Ethylene Vinyl Acetate films are used to encapsulate solar cells, has further strengthened the position of the film application segment.

By End-Use Industry

In 2023, the packaging industry dominated the Ethylene Vinyl Acetate market with a market share of 35%. The demand for Ethylene Vinyl Acetate in packaging is primarily driven by its excellent properties such as flexibility, durability, and resistance to moisture and UV rays, which make it ideal for use in flexible packaging films, food wraps, and protective coatings. With the growing trend of e-commerce and consumer preference for convenient packaging solutions, the packaging sector continues to expand, boosting the demand for Ethylene Vinyl Acetate. Additionally, sustainable packaging solutions using bio-based Ethylene Vinyl Acetate are gaining traction, contributing to the growth of this segment.

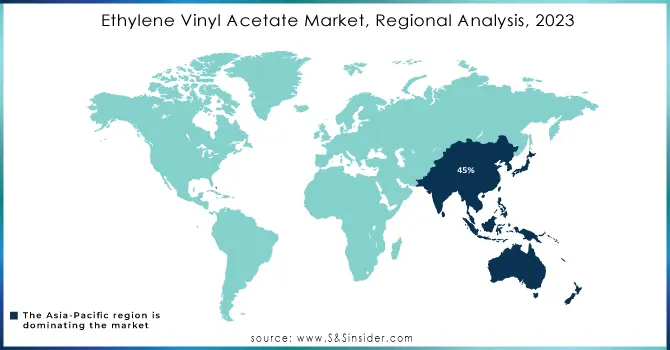

Ethylene Vinyl Acetate Market Regional Analysis

In 2023, the Asia-Pacific region dominated the Ethylene Vinyl Acetate market, capturing approximately 45% of the total market share. This dominance is attributed to the region’s robust industrial activities, especially in key sectors like packaging, automotive, and electronics, which are major consumers of Ethylene Vinyl Acetate. The demand for solar energy solutions in countries like China, India, and Japan, where Ethylene Vinyl Acetate is used for encapsulating photovoltaic cells, has significantly contributed to the market’s growth. Additionally, the rapid industrialization in emerging economies and the increasing adoption of sustainable packaging solutions in the region have driven demand. Countries like China, being one of the largest manufacturers of solar panels, have further boosted the use of Ethylene Vinyl Acetate in renewable energy applications, solidifying the region’s position as the largest market for the material.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent Developments

September 2024: Mitsui Chemicals expanded its EVA production capacity in Japan to meet the growing demand for renewable energy solutions, especially for solar panels. The new production line supports both domestic and global markets.

January 2024: Grew Energy announced plans to establish manufacturing facilities for EVA sheets and glass for solar panels, aiming to reduce material costs and enhance accessibility to solar energy technology.

Key Players in Ethylene Vinyl Acetate Market

-

Arkema SA (Lotader, Orevac)

-

BASF SE (Luvocom, Ecovio)

-

Celanese Corporation (Ateva, Celanese EVA)

-

Clariant AG (Hostaflex, Licocene)

-

DowDuPont (Engage, Affinity)

-

Exxon Mobil Corporation (Escor, Vistalon)

-

Innospec (Innospec EVA, Innospec Additives)

-

Infineum International Limited (Infineum EVA, Infineum Additives)

-

LyondellBasell Industries Holdings B.V. (Hostalen, Lupolen)

-

Braskem (Braskem EVA, Braskem Flex)

-

Formosa Plastics Corporation (Formosa EVA, EVA Resin)

-

LG Chem Ltd. (LG EVA, Hytrel)

-

Mitsubishi Chemical Corporation (Mitsubishi EVA, Denka EVA)

-

SABIC (Ultrathene, LLDPE)

-

Sinopec Limited (Sinopec EVA, Daqing EVA)

-

Sumitomo Chemical Co., Ltd. (Sumitomo EVA, Sumika EVA)

-

TotalEnergies (TotalEnergies EVA, Adflex)

-

Tosoh Corporation (Tosoh EVA, Tosoh Flex)

-

UBE Industries, Ltd. (UBE EVA, UBE Resin)

-

Westlake Chemical Corporation (Westlake EVA, Westlake Flex)

Raw Material Suppliers:

-

ExxonMobil

-

LyondellBasell

-

SABIC

-

Dow Chemical

EVA Resin Manufacturers:

-

Eastman Chemical Company

-

DuPont

-

LG Chem

-

Mitsui Chemicals

Solar Panel Manufacturers:

-

First Solar

-

JinkoSolar

-

Trina Solar

-

LONGi Solar

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 11.0 Billion |

| Market Size by 2032 | US$ 19.2 Billion |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Low density, Medium density, High density) • By Application (Film, Injection molding, Extrusion coating, Printing ink, Others) • By End-Use Industry (Packaging, Footwear, Automotive, Construction, Electronics, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Arkema SA, Celanese Corporation, Exxon Mobil Corporation, LyondellBasell Industries Holdings B.V., Infineum International Limited, DowDuPont, Innospec, Clariant AG, BASF SE, Braskem and other key players |

| Key Drivers | • Increasing Adoption of Bio-Based Ethylene Vinyl Acetate in the Packaging and Renewable Energy Sectors Drives Market Growth • Technological Advancements in Ethylene Vinyl Acetate Production Improve Performance and Environmental Impact |

| RESTRAINTS | • Fluctuating Raw Material Prices and Supply Chain Disruptions Impact Ethylene Vinyl Acetate Production Costs |