Ethylene Carbonate Market Report Scope & Overview:

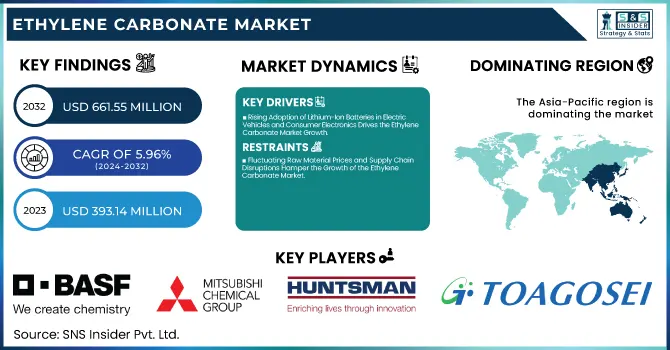

The Ethylene Carbonate Market Size was valued at USD 393.14 Million in 2023 and is expected to reach USD 661.55 Million by 2032, growing at a CAGR of 5.96% over the forecast period of 2024-2032.

To Get more information on Ethylene Carbonate Market - Request Free Sample Report

The ethylene carbonate market is expanding rapidly, fueled by its demand in lithium-ion batteries, lubricants, and coatings. As manufacturers scale up operations, production capacity analysis reveals supply trends and competitive positioning. Fluctuations in raw material prices, particularly ethylene oxide and dimethyl carbonate, impact production costs, influencing market stability. Ongoing investment and expansion activities, including mergers and facility upgrades, are reshaping the industry landscape. Meanwhile, evolving regulatory frameworks and compliance requirements, such as REACH and EPA mandates, drive manufacturing strategies. Growing environmental concerns make environmental impact analysis essential, assessing sustainability efforts and carbon footprints. Our report provides an exclusive insight into these key factors, offering a comprehensive view of the market’s transformation.

Ethylene Carbonate Market Dynamics

Drivers

-

Rising Adoption of Lithium-Ion Batteries in Electric Vehicles and Consumer Electronics Drives the Ethylene Carbonate Market Growth

The increasing adoption of lithium-ion batteries in electric vehicles (EVs) and consumer electronics is a significant driver for the ethylene carbonate market. Ethylene carbonate plays a critical role as an electrolyte solvent in lithium-ion batteries due to its high dielectric constant and superior solubility for lithium salts, which enhances battery performance and lifespan. The growing push for sustainable transportation solutions has accelerated EV production, with government incentives and stringent emission regulations encouraging consumers to switch to electric mobility. Major automotive manufacturers are investing heavily in battery technology advancements, increasing demand for high-purity ethylene carbonate. Additionally, the expanding consumer electronics sector, including smartphones, laptops, and wearables, relies on lithium-ion batteries, further driving market growth. The rising need for energy storage solutions, particularly for renewable energy sources like solar and wind power, is another contributing factor. As battery manufacturers strive to improve efficiency, reduce charging times, and enhance battery durability, the demand for high-performance electrolytes such as ethylene carbonate continues to rise. Research in solid-state and next-generation batteries is also gaining momentum, ensuring that ethylene carbonate remains a crucial component in battery innovations. These factors collectively contribute to the long-term expansion of the ethylene carbonate market, making it a key material in the global shift toward electrification and energy storage.

Restraints

-

Fluctuating Raw Material Prices and Supply Chain Disruptions Hamper the Growth of the Ethylene Carbonate Market

The ethylene carbonate market is highly sensitive to fluctuations in raw material prices, particularly ethylene oxide and dimethyl carbonate, which are derived from petrochemical feedstocks. Any volatility in crude oil prices directly impacts the cost structure of ethylene carbonate production, creating uncertainties for manufacturers. Additionally, disruptions in global supply chains, caused by geopolitical tensions, trade restrictions, or economic downturns, contribute to market instability. The COVID-19 pandemic further exposed vulnerabilities in chemical supply chains, leading to raw material shortages, increased freight costs, and extended lead times. For ethylene carbonate manufacturers, securing a stable and cost-effective supply of raw materials is a major challenge, as price volatility affects profit margins and product pricing strategies. The rising demand for lithium-ion batteries has also intensified competition for high-purity ethylene carbonate, exacerbating supply constraints. Furthermore, unexpected events such as natural disasters, industrial accidents, or regulatory shifts can further disrupt supply chains, adding to market uncertainties. Companies operating in the ethylene carbonate market must develop robust risk management strategies, including diversifying raw material sourcing, securing long-term supplier contracts, and investing in localized production facilities to mitigate the impact of supply chain fluctuations.

Opportunities

-

Growing Research and Development Investments in Bio-Based Ethylene Carbonate Create New Market Prospects

The increasing emphasis on sustainability and environmental responsibility is driving significant research and development (R&D) investments in bio-based ethylene carbonate production. As industries seek to minimize their carbon footprint and dependency on fossil-based feedstocks, the development of renewable and biodegradable solvents has gained traction. Bio-based ethylene carbonate is derived from renewable sources such as biomass-based carbonates or bio-derived ethylene oxide, making it an attractive alternative to petrochemical-derived variants. Governments worldwide are encouraging the shift toward green chemistry and sustainable industrial practices by offering financial incentives, grants, and subsidies to companies investing in bio-based chemical production. Additionally, stringent environmental regulations on carbon emissions and hazardous chemical waste have compelled manufacturers to explore eco-friendly production pathways. The potential applications of bio-based ethylene carbonate extend beyond traditional sectors, finding uses in specialty coatings, biocompatible lubricants, and environmentally friendly polymer additives. Innovations in catalytic processes and fermentation-based synthesis are further enhancing the feasibility of large-scale bio-based ethylene carbonate production, making it more commercially viable. As consumer awareness of sustainable products grows and industries strive to meet corporate sustainability goals, the demand for bio-based ethylene carbonate is expected to rise significantly. This trend provides an opportunity for manufacturers to differentiate their product portfolios, tap into niche high-value markets, and establish themselves as leaders in green chemical solutions.

Challenge

-

Technical Challenges in Large-Scale Production of High-Purity Ethylene Carbonate Create Operational Difficulties

The large-scale production of high-purity ethylene carbonate presents significant technical and operational challenges, particularly in industries such as lithium-ion batteries, pharmaceuticals, and high-performance coatings, where stringent purity requirements must be met. The synthesis of ethylene carbonate requires precise catalytic reactions, advanced purification processes, and rigorous quality control measures to ensure minimal contaminant levels. Even small impurities can lead to performance issues in sensitive applications, such as reduced battery efficiency, altered chemical stability in pharmaceutical formulations, or compromised durability in coatings and adhesives. Scaling up production while maintaining consistent quality and purity levels demands high capital investment in state-of-the-art production facilities, making it difficult for smaller manufacturers to compete. Additionally, process optimization, waste management, and energy efficiency improvements are crucial for cost-effective manufacturing, requiring continuous R&D efforts. Another major challenge is the handling and storage of ethylene carbonate, as it is hygroscopic and can degrade under improper storage conditions, affecting its usability in critical applications. Furthermore, with the global shift toward sustainable chemical processes, manufacturers are under pressure to adopt greener and more energy-efficient production techniques, which adds complexity to large-scale operations. As demand for high-purity ethylene carbonate increases, companies must overcome these production challenges by investing in advanced separation technologies, improving feedstock sourcing strategies, and enhancing overall process efficiency to ensure product consistency and long-term market sustainability.

Ethylene Carbonate Market Segmental Analysis

By Form

Liquid ethylene carbonate dominated the market in 2023 with a market share of 55.2%. The dominance of the liquid form is attributed to its widespread use in lithium-ion battery electrolytes, lubricants, and coatings, where its superior solvency and stability offer significant performance benefits. According to the International Energy Agency (IEA), the global electric vehicle market surged by over 35% in 2023, driving the demand for high-purity liquid ethylene carbonate in battery electrolytes. Additionally, the U.S. Environmental Protection Agency (EPA) has promoted the shift toward low-VOC coatings and sustainable lubricants, further accelerating the adoption of liquid ethylene carbonate in eco-friendly formulations. The Asian Clean Energy Coalition has also emphasized the role of high-performance solvents in advancing green energy storage solutions, reinforcing the dominance of liquid ethylene carbonate in multiple high-growth sectors.

By Application

Lithium battery electrolyte dominated the ethylene carbonate market in 2023 with a market share of 35.7%. The rapid expansion of electric vehicles (EVs) and energy storage solutions has made lithium battery electrolytes the largest application segment. According to the European Battery Alliance, lithium-ion battery production in Europe increased significantly in 2023, with companies like Northvolt and CATL expanding their manufacturing facilities. The U.S. Department of Energy (DOE) has also allocated $3.5 billion for domestic lithium-ion battery production, further strengthening demand for ethylene carbonate as a critical electrolyte solvent. With its high dielectric constant and low volatility, ethylene carbonate plays a crucial role in enhancing battery efficiency, stability, and cycle life, solidifying its dominance in this sector.

By End-use

The automotive sector dominated the ethylene carbonate market in 2023 with a market share of 38.6%. The increasing adoption of electric vehicles (EVs) and hybrid vehicles has driven significant demand for ethylene carbonate in lithium-ion battery electrolytes and lubricants. According to the International Council on Clean Transportation (ICCT), global EV sales exceeded 14 million units in 2023, with governments such as China, the U.S., and Germany implementing aggressive EV adoption policies and subsidies. Automakers like Tesla, BYD, and Volkswagen have expanded their battery production capacities, leading to increased consumption of ethylene carbonate in battery manufacturing and thermal management systems. Moreover, the European Union’s push for carbon-neutral mobility by 2035 has further reinforced the automotive sector’s reliance on ethylene carbonate, making it the dominant end-use industry.

Ethylene Carbonate Market Regional Analysis

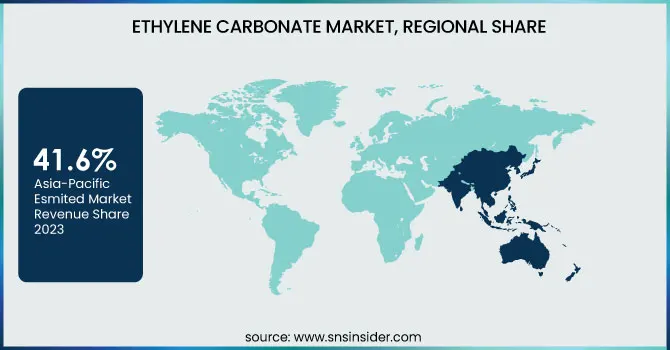

Asia Pacific dominated the ethylene carbonate market in 2023 with a market share of 41.6%. This dominance is driven by the booming electric vehicle (EV) industry, rapid industrialization, and strong lithium-ion battery production in China, Japan, and South Korea. China, the largest contributor, accounted for over 60% of global lithium-ion battery production in 2023, supported by major manufacturers such as CATL, BYD, and LG Energy Solution. According to the China Association of Automobile Manufacturers (CAAM), EV sales in China surged by 37% in 2023, fueling demand for ethylene carbonate in battery electrolytes. Japan and South Korea are key players in battery technology, with Panasonic and Samsung SDI investing in advanced battery materials. Government incentives, such as China’s New Energy Vehicle (NEV) subsidies and South Korea’s Green Growth Initiative, have accelerated the adoption of ethylene carbonate in various industrial applications, solidifying Asia Pacific’s leadership in the market.

North America emerged as the fastest-growing region in the ethylene carbonate market, with a significant growth rate during the forecast period. This growth is driven by increasing investments in EV production, energy storage systems, and sustainable lubricants, particularly in the United States and Canada. The U.S. Department of Energy (DOE) has allocated $3.5 billion for domestic lithium-ion battery manufacturing, attracting companies like Tesla, General Motors, and Ford, which are expanding battery production facilities. Additionally, the Bipartisan Infrastructure Law (BIL) has set aside $7.5 billion for EV charging infrastructure, accelerating demand for high-performance electrolytes in batteries. Canada, with its abundant lithium resources and strategic agreements with battery manufacturers, is emerging as a key supplier of battery raw materials. The North American market’s expansion is further fueled by stringent environmental regulations promoting low-emission lubricants and coatings, making the region a rapidly growing hub for ethylene carbonate applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Ethylene Carbonate, Propylene Carbonate, Dimethyl Carbonate)

-

Mitsubishi Chemical Group Corporation (Ethylene Carbonate, Propylene Carbonate, Ethyl Methyl Carbonate)

-

Huntsman International LLC (Ethylene Carbonate, Propylene Carbonate, Urethane Intermediates)

-

Toagosei Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Speciality Acrylates)

-

Oriental Union Chemical Corporation (OUCC) (Ethylene Carbonate, Propylene Carbonate, Ethylene Glycol)

-

Shandong Shida Shenghua Chemical Group Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Dimethyl Carbonate)

-

Shandong Senjie Cleantech Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Lithium Battery Electrolyte Solvents)

-

Lotte Chemical (Ethylene Carbonate, Propylene Carbonate, Polycarbonate Resins)

-

Taixing Taida Fine Chemical Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Lithium Battery Electrolytes)

-

Zibo Donghai Industries Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Solvent-Grade Carbonates)

-

Shandong Haike Chemical Group (Ethylene Carbonate, Propylene Carbonate, Dimethyl Carbonate)

-

Shandong Lixing Chemical Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Chemical Intermediates)

-

Dongying Hi-Tech Spring Chemical Industry Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Battery-Grade Carbonates)

-

Liaoning Ganglong Chemical Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Methyl Carbonate Esters)

-

Anhui Haoyuan Chemical Group Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Industrial Solvents)

-

Inner Mongolia Yuan Xing Energy Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Battery-Grade Solvents)

-

Hubei Xian Lin Chemical Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Lithium Battery Chemicals)

-

Hengyang New Material Technology Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Specialty Chemicals)

-

Shandong Jiahong Chemical Co., Ltd. (Ethylene Carbonate, Propylene Carbonate, Dimethyl Carbonate)

-

Ube Industries Ltd. (Ethylene Carbonate, Propylene Carbonate, High-Purity Electrolytes)

Recent Highlights

-

March 2024: Dow announced plans for a new carbonate solvents facility on the U.S. Gulf Coast to support lithium-ion battery production. The project, backed by the U.S. Department of Energy, will capture over 90% of carbon emissions, aligning with Dow’s decarbonization strategy.

-

December 2024: Asahi Kasei started operations at its new electrolyte solution plant in China to meet the rising demand for lithium-ion battery materials, enhancing supply chain efficiency for the electric vehicle market.

-

December 2024: Sailboat commenced commercial production of high-purity ethylene carbonate and dimethyl carbonate, key solvents for lithium-ion battery electrolytes, strengthening the supply chain for electric vehicle battery manufacturing.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 393.14 Million |

| Market Size by 2032 | USD 661.55 Million |

| CAGR | CAGR of 5.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Form (Solid, Liquid) •By Application (Lubricants, Surface Coatings, Lithium Battery Electrolyte, Plasticizers, Others) •By End-use (Automotive, Industrial, Oil & Gas, Medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Mitsubishi Chemical Group Corporation, Huntsman International LLC, Toagosei Co., Ltd., Oriental Union Chemical Corporation (OUCC), Shandong Shida Shenghua Chemical Group Co., Ltd., Shandong Senjie Cleantech Co., Ltd., Lotte Chemical, Taixing Taida Fine Chemical Co., Ltd., Zibo Donghai Industries Co., Ltd. and other key players |