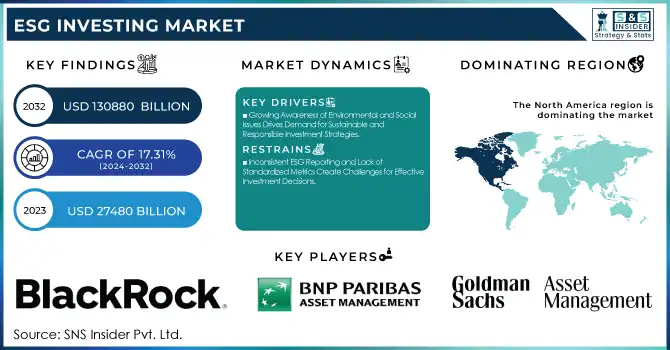

The ESG Investing Market was valued at USD 27,480 billion in 2023 and is expected to reach USD 130,880 billion by 2032, growing at a CAGR of 17.31% from 2024-2032. This growth is fueled by increasing demand for ESG investment funds, with a focus on sustainable and socially responsible practices. Regulatory influence plays a significant role in shaping the market, encouraging transparency and accountability. ESG metrics and scores are becoming integral in evaluating investments, while the adoption rate continues to rise as more investors prioritize sustainability in their portfolios. This report provides an in-depth analysis of these key factors.

To get more information on ESG Investing Market - Request Free Sample Report

Drivers

Growing Awareness of Environmental and Social Issues Drives Demand for Sustainable and Responsible Investment Strategies.

As environmental and social concerns come to the forefront across the world, individuals and institutions alike are becoming increasingly dedicated to making their financial decisions reflect their values. This is evident in an increasing trend towards investments favoring firms with good environmental responsibility, social commitment, and ethical management. The greater emphasis on sustainability has made investors revisit investment portfolios with the aim of benefiting society alongside creating returns. Increasing demand for responsible investments has caused greater incorporation of ESG considerations in making decisions, causing companies to ramp up their ESG practices. Finally, all this awareness is molding a new paradigm of value-creation-through-investments aimed at long-term value and society's benefit.

Restraints

Inconsistent ESG Reporting and Lack of Standardized Metrics Create Challenges for Effective Investment Decisions.

The lack of standardized ESG metrics poses great difficulty for investors seeking to determine and compare the sustainability initiatives of companies. Inconsistent reporting among companies and a lack of widely recognized ESG criteria hinder the ability to measure a company's actual environmental, social, and governance performance. This data variability and reporting heterogeneity create uncertainty that hinders investors from making clear-cut decisions. Consequently, the reputation of ESG investments can be threatened, slowing market expansion and deterring prospective investors looking for unambiguous, credible data. Without standard metrics, investors are confronted with a diversified universe, hindering the mass adoption of ESG-dedicated investment strategies.

Opportunities

Technological Innovations in Data Analytics and Reporting Enhance Accuracy and Transparency in ESG Investment Decisions.

Technological innovations in data analytics and ESG reporting systems are driving significant advances in the accuracy and transparency of ESG metrics. With advances in the technologies, they help investors evaluate and compare firms' environmental, social, and governance practices with increased precision. With greater data-driven information, investors are better able to make informed choices, minimizing uncertainty in the ESG investment market. Moreover, the creation of real-time ESG monitoring and reporting platforms is facilitating the process, enabling easier tracking of ESG performance across sectors. These technologies not only increase investor confidence but also enable companies to enhance their sustainability reporting, ultimately leading to growth in the ESG investing market.

Challenges

Inconsistent ESG Reporting Standards and Lack of Universal Metrics Create Challenges in Comparing Companies for Investment Decisions.

Different companies having different ESG reporting standards present fundamental challenges for investors when considering evaluating and comparing the sustainability practices of companies. The deficit of common metrics and irregular data reporting make it more difficult to evaluate the actual environmental, social, and governance performance of the companies. Consequently, investors are hindered in making informed decisions, and therefore, they hesitate to adopt ESG investment approaches. This discrepancy not only defeats transparency but also restricts the scope for successful capital allocation in the ESG market. The absence of a uniform method makes it difficult for investors to measure the risks and opportunities of ESG investments, thereby slowing market growth and inhibiting the widespread use of sustainable investing practices.

By Type

ESG Integration dominated the ESG Investing Market with the highest revenue share of about 40% in 2023 due to the increasing recognition of the long-term value created by incorporating environmental, social, and governance factors into investment strategies. Investors are increasingly adopting ESG integration as a core practice, driven by the growing awareness of its impact on risk management, financial performance, and alignment with sustainability goals.

The Green Bonds segment is expected to grow at the fastest CAGR of about 23.82% from 2024-2032, primarily due to increasing demand for sustainable financing solutions to support climate-related projects. The rise in government and corporate green initiatives, along with regulatory push towards cleaner investments, is fueling the popularity of green bonds. These bonds offer investors a way to support environmental sustainability while achieving competitive returns.

By Investor Types

The Institutional Investors segment dominated the ESG Investing Market with the highest revenue share of about 56% in 2023 due to their significant financial resources and growing commitment to sustainable investment practices. These investors, including pension funds, endowments, and asset managers, are increasingly integrating ESG factors into their portfolios, driven by regulatory requirements, risk management strategies, and the desire to align investments with long-term sustainability goals.

The Retail Investors segment is expected to grow at the fastest CAGR of about 20.89% from 2024-2032, driven by increasing awareness and demand for ethical investment options among individual investors. As millennials and Gen Z prioritize sustainability, more retail investors are opting for ESG-aligned investments. The growing availability of ESG-focused investment products and platforms is also making it easier for retail investors to participate in this market.

By Application

The Environmental segment dominated the ESG Investing Market with the highest revenue share of about 34% in 2023 due to increasing global awareness of climate change and environmental degradation. Investors are focusing on companies that prioritize sustainable practices, such as reducing carbon emissions, conserving resources, and promoting renewable energy. Additionally, regulatory pressures and the growing demand for green technologies have significantly boosted investment in environmentally responsible initiatives.

The Integrated ESG segment is expected to grow at the fastest CAGR of about 20.65% from 2024-2032, driven by the rising need for a comprehensive approach that incorporates all ESG factors into investment decisions. Investors are increasingly seeking integrated ESG strategies to better assess risks, opportunities, and long-term value, recognizing that combining environmental, social, and governance elements offers a more holistic investment approach.

North America dominated the ESG Investing Market with the highest revenue share of about 38% in 2023, driven by strong regulatory frameworks, increased investor awareness, and the integration of ESG factors into investment strategies. Major institutional investors, such as pension funds, endowments, and asset managers, are actively incorporating sustainability considerations into their portfolios. Additionally, the region's focus on climate-related policies, corporate transparency, and green financing initiatives has created a robust ESG ecosystem, making it a leader in the market.

Asia Pacific is expected to grow at the fastest CAGR of about 21.03% from 2024-2032, fueled by rapid economic growth, rising awareness of environmental issues, and increasing adoption of sustainable investment practices. Governments across the region are introducing ESG-friendly regulations and green finance initiatives, encouraging companies to prioritize sustainability. Moreover, the growing middle class and young, environmentally-conscious consumers in countries like China and India are driving demand for ESG-aligned products and investments.

Get Customized Report as per Your Business Requirement - Enquiry Now

BlackRock (iShares ESG Aware MSCI USA ETF, BlackRock U.S. Equity ESG ETF)

BNP Paribas Asset Management (BNP Paribas Easy ECPI Global ESG Sustainable Equity, BNP Paribas Sustainable Investment Strategy)

Goldman Sachs Asset Management (GSAM Global ESG Enhanced Equity Fund, Goldman Sachs ESG Global Impact Fund)

J.P. Morgan Asset Management (JPMorgan Sustainable Equity Fund, JPMorgan ESG International Equity Fund)

Morgan Stanley Investment Management (Morgan Stanley Sustainable Equity Fund, MSIM Global Impact Fund)

Northern Trust Asset Management (Northern Trust Global ESG Equity Fund, Northern Trust ESG Fixed Income Fund)

PIMCO (PIMCO ESG Income Fund, PIMCO Total Return ESG Fund)

State Street Global Advisors (SPYG ESG ETF, State Street Global Advisors ESG Global All Cap Equity Fund)

UBS Group (UBS Sustainable Global Equity Fund, UBS ESG Global Equity Fund)

Vanguard Group (Vanguard ESG U.S. Stock ETF, Vanguard FTSE Social Index Fund)

Blackstone (Blackstone ESG Impact Fund, Blackstone Green Energy Fund)

Franklin Templeton (Franklin Templeton Sustainable Global Equity Fund, Franklin LibertyShares Sustainable Global Dividend ETF)

Invesco (Invesco MSCI Sustainable Future ETF, Invesco ESG Global Equity Fund)

T. Rowe Price (T. Rowe Price Global Impact Equity Fund, T. Rowe Price Sustainable Strategy Fund)

Amundi (Amundi MSCI World ESG ETF, Amundi SRI Global Equity Fund)

Citi Private Bank (Citi Sustainable Impact Fund, Citi Global ESG Equity Fund)

Schroders (Schroders Global Sustainable Growth Fund, Schroders Sustainable Equity Fund)

Legg Mason (Legg Mason ClearBridge Sustainable Growth Fund, Legg Mason Western Asset ESG Fund)

Dimensional Fund Advisors (Dimensional U.S. Sustainability Core 1 ETF, Dimensional Global Sustainability Fund)

Robeco (Robeco Global Sustainable Equities Fund, RobecoSAM Sustainable Development Goals Impact Equities Fund)

In 2023, Goldman Sachs committed to deploying USD 750 billion in sustainable finance initiatives, supporting clients in accelerating the transition to a low-carbon economy and promoting inclusive growth.

In 2024, J.P. Morgan's ESG Insights platform continues to support clients by providing data, research, and firmwide expertise to navigate sustainable investment opportunities, helping accelerate the transition to a low-carbon future.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 27,480 Billion |

| Market Size by 2032 | USD 130,880 Billion |

| CAGR | CAGR of 18.99% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (ESG Integration, Impact Investing, Sustainable Funds, Green Bonds, Others) • By Investor Types (Institutional Investors, Retail Investors, Corporate Investors) • By Application (Environmental, Social, Governance, Integrated ESG) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BlackRock, BNP Paribas Asset Management, Goldman Sachs Asset Management, J.P. Morgan Asset Management, Morgan Stanley Investment Management, Northern Trust Asset Management, PIMCO, State Street Global Advisors, UBS Group, Vanguard Group, Blackstone, Franklin Templeton, Invesco, T. Rowe Price, Amundi, Citi Private Bank, Schroders, Legg Mason, Dimensional Fund Advisors, Robeco |

ANS: ESG Investing Market was valued at USD 27,480 billion in 2023 and is expected to reach USD 130,880 billion by 2032, growing at a CAGR of 17.31% from 2024-2032.

ANS: ESG Integration dominated the market with a 40% revenue share in 2023.

ANS: The Green Bonds segment is expected to grow at the fastest CAGR of 23.82% from 2024-2032.

ANS: The Retail Investors segment is expected to grow at a CAGR of 20.89% from 2024-2032.

ANS: North America dominated the market with a 38% revenue share in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 ESG Investment Funds Growth

5.2 Regulatory Influence

5.3 ESG Metrics and Scores

5.4 Adoption Rate

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. ESG Investing Market Segmentation, By Type

7.1 Chapter Overview

7.2 ESG Integration

7.2.1 ESG Integration Market Trends Analysis (2020-2032)

7.2.2 ESG Integration Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Impact Investing

7.3.1 Impact Investing Market Trends Analysis (2020-2032)

7.3.2 Impact Investing Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Sustainable Funds

7.4.1 Sustainable Funds Market Trends Analysis (2020-2032)

7.4.2 Sustainable Funds Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Green Bonds

7.5.1 Green Bonds Market Trends Analysis (2020-2032)

7.5.2 Green Bonds Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Others

7.6.1 Others Market Trends Analysis (2020-2032)

7.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. ESG Investing Market Segmentation, By Application

8.1 Chapter Overview

8.2 Environmental

8.2.1 Environmental Market Trends Analysis (2020-2032)

8.2.2 Environmental Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Social

8.3.1 Social Market Trends Analysis (2020-2032)

8.3.2 Social Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Governance

8.4.1 Governance Market Trends Analysis (2020-2032)

8.4.2 Governance Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Integrated ESG

8.5.1 Integrated ESG Market Trends Analysis (2020-2032)

8.5.2 Integrated ESG Market Size Estimates and Forecasts to 2032 (USD Billion)

9. ESG Investing Market Segmentation, By Investor Types

9.1 Chapter Overview

9.2 Institutional Investors

9.2.1 Institutional Investors Market Trends Analysis (2020-2032)

9.2.2 Institutional Investors Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Retail Investors

9.3.1 Retail Investors Market Trends Analysis (2020-2032)

9.3.2 Retail Investors Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Corporate Investors

9.4.1 Corporate Investors Market Trends Analysis (2020-2032)

9.4.2 Corporate Investors Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America ESG Investing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.4 North America ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.5 North America ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.6.2 USA ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.6.3 USA ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.7.2 Canada ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.7.3 Canada ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.2.8.2 Mexico ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.2.8.3 Mexico ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe ESG Investing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.6.3 Poland ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.7.3 Romania ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.8.3 Hungary ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.9.3 Turkey ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe ESG Investing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.5 Western Europe ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.6.3 Germany ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.7.2 France ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.7.3 France ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.8.2 UK ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.8.3 UK ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.9.3 Italy ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.10.3 Spain ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.13.3 Austria ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific ESG Investing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.5 Asia Pacific ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.6.2 China ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.6.3 China ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.7.2 India ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.7.3 India ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.8.2 Japan ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.8.3 Japan ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.9.2 South Korea ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.9.3 South Korea ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.10.3 Vietnam ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.11.2 Singapore ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.11.3 Singapore ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.12.2 Australia ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.12.3 Australia ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East ESG Investing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.4 Middle East ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.5 Middle East ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.6.3 UAE ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.7.3 Egypt ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.9.3 Qatar ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa ESG Investing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.4 Africa ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.5 Africa ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.6.3 South Africa ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America ESG Investing Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.4 Latin America ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.5 Latin America ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.6.2 Brazil ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.6.3 Brazil ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.7.2 Argentina ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.7.3 Argentina ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.8.2 Colombia ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.8.3 Colombia ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America ESG Investing Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America ESG Investing Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America ESG Investing Market Estimates and Forecasts, By Investor Types (2020-2032) (USD Billion)

11. Company Profiles

11.1 BlackRock

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 BNP Paribas Asset Management

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Goldman Sachs Asset Management

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 J.P. Morgan Asset Management

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Morgan Stanley Investment Management

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Northern Trust Asset Management

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 PIMCO

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 State Street Global Advisors

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 UBS Group

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Vanguard Group

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

ESG Integration

Impact Investing

Sustainable Funds

Green Bonds

Others

By Investor Types

Institutional Investors

Retail Investors

Corporate Investors

By Application

Environmental

Social

Governance

Integrated ESG

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Lease Management Market size was valued at USD 5.01 Billion in 2023. It is expected to grow to USD 8.44 Billion by 2032 and grow at a CAGR of 6.00% over the forecast period of 2024-2032.

The Mobile Device Management Market Size was USD 9.04 Billion in 2023 and will reach USD 74.90 Billion by 2032 and grow at a CAGR of 26.5% by 2024-2032.

The IT Operations Analytics Market was valued at USD 22.30 billion in 2023 and will reach USD 347.38 billion by 2032, growing at a CAGR of 35.73% by 2032.

The E-discovery Market was valued at USD 13.58 billion in 2023 and is expected to reach USD 31.40 billion by 2032, growing at a CAGR of 9.80% over the forecast period 2024-2032.

The eGRC Market Size was valued at USD 18.1 Billion in 2023 and is expected to reach USD 55.4 Billion by 2032 and grow at a CAGR of 13.22% from 2024-2032.

The Retail Media Platform Market Size was valued at USD 16.1 Billion in 2023 and will reach USD 33.7 Billion by 2032, growing at a CAGR of 8.6% by 2032.

Hi! Click one of our member below to chat on Phone