To get more information on Erosion and Sediment Control Market - Request Free Sample Report

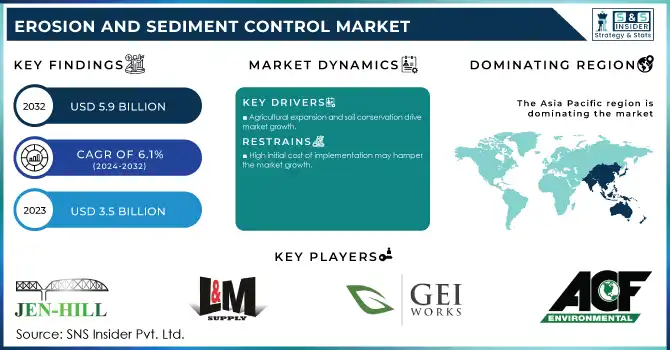

The Erosion and Sediment Control Market size was USD 3.5 billion in 2023 and is expected to reach USD 5.9 billion by 2032 and grow at a CAGR of 6.1% over the forecast period of 2024-2032.

The increased adoption of vegetative erosion control solutions is a significant trend in the Erosion and Sediment Control (ESC) market, driven by their eco-friendly, sustainable, and cost-effective nature. As opposed to mechanical solutions, vegetation-based approaches can restore natural habitats, improve water quality, and enhance biodiversity. Also, they are usually easier to maintain and adapt to environmental changes. As more and more people are conscious of the benefits that environmental sustainability can bring and the need for greener practices, these solutions are fast becoming the default method of controlling erosion, especially in sensitive areas like agricultural fields, construction sites, and areas with the potential for flooding. This is likely to drive the vegetative erosion control products market over the coming years.

The EPA has set specific guidelines under the Clean Water Act to control soil erosion and sedimentation from construction sites. According to the EPA, nearly 70% of water pollution in the U.S. is attributed to sedimentation, often due to erosion.

The growth of the Erosion and Sediment Control (ESC) market, is primarily driven by construction and infrastructure development, as the land must be cleared and landforms altered for large-scale construction projects, increasing soil erosion and sediment runoff. As urbanization and infrastructure expansion continue notably in emerging economies so grows the demand for effective erosion control solutions. Road building, along with housing, and other construction is a big concern in rapidly developing areas of Asia, and Latin America, as it can kick up massive soil disturbances. If the disbursement is not managed, it will lead to sedimentation in the nearby water bodies, in turn affecting the water quality and the aquatic ecosystem. The rising number of developmental projects guided by construction companies to adhere to environmental regulation and control their environmental effect is resulting in the increasing demand for erosion and sediment control solutions, which in turn is positively impacting the growth of the erosion and sediment control market. Besides, increasing attention towards green or sustainable building practices which include options like low impact development (LID) and stormwater management is propelling the demand for ESC products in the construction sector.

The EPA’s National Pollutant Discharge Elimination System (NPDES) program regulates stormwater discharges from construction sites, requiring developers to implement effective erosion and sediment control measures. In 2021, over 100,000 construction sites in the U.S. were subject to these regulations, emphasizing the growing demand for ESC solutions.

Drivers

Agricultural expansion and soil conservation drive market growth.

Soil conservation and agricultural expansion are the prominent drivers towards the growth of the Erosion and Sediment Control (ESC) market, as the agricultural sector continues to face soil erosion and degradation. Increasing food demand worldwide and the conversion of new agricultural areas (especially in developing countries) means greater land disturbance and therefore, if not properly managed, higher rates of soil erosion. This loss can deplete soil nutrients, increase sediment in waterways, and ultimately lower crop yields. Today, governments and organizations across the world have realized that soil conservation is important especially soil erosion-prone areas, encouraging soil conservation through sustainable farming. As a result, the agriculture sector is looking to ESC approaches, including contour farming, cover crops, and vegetative barriers, to reinforce the soil and forestall erosion. Moreover, organizations such as the U.S. Natural Resources Conservation Service (NRCS) as well as the Food and Agriculture Organization (FAO) are also promoting programs that advocate practices that promote soil strength and soil conservation practices because they support soil health and achieve agricultural productivity. Such initiatives have helped promote the use of ESC products including but not limited to geotextiles, mulches, and other erosion-control materials that have become integral to modern agricultural practices. This will be further aided by the evolving environmental policies and the need for better soil conservation methods, yielding a larger market for erosion and sediment control over the forecast period as the demand for sustainable agricultural solutions is fueling.

Restraint

High initial cost of implementation may hamper the market growth.

High initial implementation cost high upfront investment cost required for certain erosion control solutions can be a major restraint in the Erosion and Sediment Control (ESC) market, especially for smaller construction companies, farmers and businesses in developing regions. Many erosion control techniques, like geotextiles, sediment control barriers, hydroseeding, and erosion control blankets, involve significant material and labor costs. This can make things very difficult for those companies operating with a string budget or limited manpower. Besides, some new ESC technologies and items might also require regular upkeep expenditure which would keep piling the overall cost burden on the owner. On a more micro scale, these costs may deem as too great for some not-so-large projects or operations, resulting in delays in utilizing an effective erosion control measure to avoid a larger problem in the future.

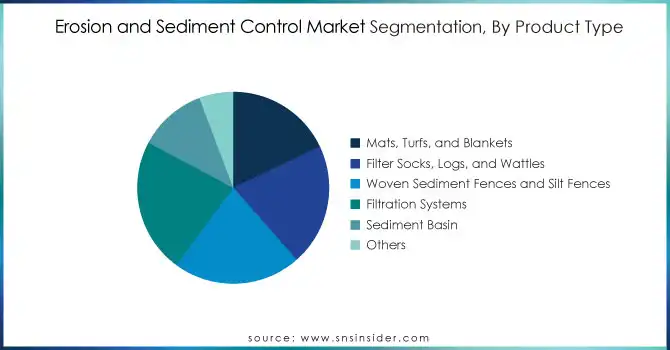

By Product Type

Mats, turfs, and blankets fastest growing segment at a highest CAGR of 6.51% in 2023. It is due to their easy installation and versatility over a wide range of application areas. These products, especially for erosion control mats (ECMs) and turf reinforcement mats (TRMs), are commonly used for soil and erosion control in construction, agriculture, and land reclamation. Mats, turfs, and blankets are also popular, as they can be used to create instant ground cover, shielding the soil from wind and water erosion, fostering vegetation establishment. Usually applied to lands with high erosion and sediment risk areas, like slopes, highway, and disturbed land. Also, they are not as complex as other erosion control solutions when it comes to installation and maintenance. Their customization for specific soils and environmental conditions drives their use in different industries.

By End-User Industry

Highway and road construction held the largest market share around 29.62% in 2023. These types of construction have considerable environmental repercussions on soil stability and water quality. Land disturbances associated with large-scale road and highway construction can contribute to erosion and sedimentation to surface waters. As such, proper erosion and sediment control is essential to maintaining environmental compliance and to protecting the land from degradation. With government and regulatory agencies imposing stringent environmental standards to safeguard water resources, construction firms must deploy ESC solutions including sediment barriers, silt fences, and erosion control blankets to minimize these risks

Asia Pacific held the largest market share around 42.40% in 2023. Due to rapid industrialization, urbanization, and infrastructure development in several countries, the Erosion and Sediment Control (ESC) market has the largest market share of Asia-Pacific region. Rapid development in construction and agriculture, specifically in countries that are a part of China, India, Japan, and Southeast Asian countries, will necessitate the demand for proper erosion control products in the region. Highways, railways, and urban development have created huge land disturbance; agricultural development to meet the increasing food demand has also caused greater soil disturbance and put them at higher risks of erosion and sedimentation. To minimize damage from the adverse environmental effects of these activities, regional governments have built up rigorous environmental regulations and sustainability policies, thereby bolstering the demand for ESC products. Besides, the countries in Asia-Pacific are investing significantly in sustainable development and green building practices, which focus on erosion control techniques to preserve the environment. Another contributing factor to the region's dominance is the availability of affordable ESC solutions and increased awareness of the environmental impacts of erosion. Consequently, the Asia-Pacific market is projected to exhibit the highest growth where the demand for erosion and sediment control products continues to mount due to investments from the public as well as private sector.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

Triton Environmental (Silt Fence, Erosion Control Mat)

ACF Environmental (Silt Fence, Erosion Control Blankets)

Silt Management Supplies (Sediment Control Tubes, Erosion Control Products)

Construction Eco Services (Silt Fence, Erosion Control Blankets)

Geosolutions, Inc. (Turf Reinforcement Mats, Geotextiles)

GEI Works (Silt Fence, Erosion Control Products)

SMI Companies (Sediment Barriers, Erosion Control Mats)

L & M Supply (Sediment Control Products, Erosion Control Blankets)

Aussie Erosion Pty Ltd (Erosion Control Blankets, Sediment Control Products)

Jen-Hill Construction Materials (Silt Fencing, Erosion Control Matting)

Royal Environmental (Erosion Control Blankets, Turf Reinforcement Mats)

North American Green (Turf Reinforcement Mats, Erosion Control Blankets)

TenCate Geosynthetics (Geotextiles, Erosion Control Blankets)

Curlex (Erosion Control Blankets, Silt Fencing)

EnviroSeal (Sediment Control Logs, Silt Fence)

Rantec Corporation (Erosion Control Blankets, Sediment Control Barriers)

Propex GeoSolutions (Geotextiles, Erosion Control Blankets)

Keymark Enterprises (Sediment Control Products, Erosion Control Matting)

Erosion Control Products, Inc. (Silt Fence, Straw Wattles)

Acme Environmental (Silt Fence, Erosion Control Mats)

Recent Development:

In 2023: Triton Environmental launched an innovative biodegradable silt fence product aimed at reducing environmental impact, aligning with increasing demand for sustainable solutions in the ESC market.

In 2023: Silt Management Supplies introduced an advanced sediment control tube that improves filtration and reduces maintenance costs, designed for use in construction, mining, and infrastructure projects.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.5 Billion |

| Market Size by 2032 | USD 5.9 Billion |

| CAGR | CAGR of 6.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By product type ( Mats, Turfs, and Blankets, Filter Socks, Logs, and Wattles, Woven Sediment Fences and Silt Fences, Filtration Systems, Sediment Basin, Others) • By end-user industry ( Highway and Road Construction, Energy and Mining, Government and Municipality, Landfill Construction and Maintenance, Infrastructure Development, Industrial Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Triton Environmental, ACF Environmental, Silt Management Supplies, Construction Eco services, Geosolutions, Inc (US)., GEI Works (US), SMI Companies, L & M Supply (US), Aussie Erosion Pty Ltd (Australia), Jen-Hill Construction Materials |

| Key Drivers | • Agricultural expansion and soil conservation drive market growth. |

| Restraints | • High initial cost of implementation may hamper the market growth. |

Ans: Triton Environmental (US), ACF Environmental (US), Silt Management Supplies (US), Construction Eco services (US), Geosolutions, Inc (US)., GEI Works (US), SMI Companies (US), L & M Supply (US), Aussie Erosion Pty Ltd (Australia), Jen-Hill Construction Materials (US) are the major key players of Erosion and Sediment Control Market.

Ans: Manufacturers, Consultant, aftermarket players, association, Research institute, private and universities libraries, suppliers and distributors of the product.

Ans: Government's growing commitment and regulations' alignment are the opportunity for Erosion and Sediment Control Market.

Ans: Agricultural expansion and soil conservation drive market growth. An increase in industrialization and The need for appropriate residential areas are the drivers for Erosion and Sediment Control Market.

Ans: The Erosion and Sediment Control Market size was USD 3.5 billion in 2023 and is expected to reach USD 5.9 billion by 2032 and grow at a CAGR of 6.1% over the forecast period of 2024-2032.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

3.1 Market Driving Factors Analysis

3.1.2 Drivers

3.1.2 Restraints

3.1.3 Opportunities

3.1.4 Challenges

3.2 PESTLE Analysis

3.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 By Production Capacity and Utilization, by Country, By Type, 2023

5.2 Feedstock Prices, by Country, By Type, 2023

5.3 Regulatory Impact, by l Country, By Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 By Type Benchmarking

6.3.1 By Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion Plans and New Product Launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Erosion and Sediment Control Market Segmentation, By Product Type

7.1 Chapter Overview

7.2 Mats, Turfs, and Blankets

7.2.1 Mats, Turfs, and Blankets Trends Analysis (2020-2032)

7.2.2 Mats, Turfs, and Blankets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Filter Socks, Logs, and Wattles

7.3.1 Filter Socks, Logs, and Wattles Market Trends Analysis (2020-2032)

7.3.2 Filter Socks, Logs, and Wattles Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Woven Sediment Fences and Silt Fences

7.4.1 Woven Sediment Fences and Silt Fences Trends Analysis (2020-2032)

7.4.2 Woven Sediment Fences and Silt Fences Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Filtration Systems

7.5.1 Filtration Systems Trends Analysis (2020-2032)

7.5.2 Filtration Systems Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Sediment Basin

7.6.1 Sediment Basin Market Trends Analysis (2020-2032)

7.6.2 Sediment Basin Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Trends Analysis (2020-2032)

7.7.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Erosion and Sediment Control Market Segmentation, by End-User

8.1 Chapter Overview

8.2 Highway and Road Construction

8.2.1 Highway and Road Construction Market Trends Analysis (2020-2032)

8.2.2 Highway and Road Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Energy and Mining

8.3.1 Energy and Mining Market Trends Analysis (2020-2032)

8.3.2 Energy and Mining Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Government and Municipality

8.4.1 Government and Municipality Market Trends Analysis (2020-2032)

8.4.2 Government and Municipality Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Landfill Construction and Maintenance

8.5.1 Landfill Construction and Maintenance Market Trends Analysis (2020-2032)

8.5.2 Landfill Construction and Maintenance Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Infrastructure Development

8.6.1 Infrastructure Development Market Trends Analysis (2020-2032)

8.6.2 Infrastructure Development Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Industrial Manufacturing

8.7.1 Industrial Manufacturing Market Trends Analysis (2020-2032)

8.7.2 Industrial Manufacturing Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Erosion and Sediment Control Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.2.4 North America Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.2.5.2 USA Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.2.6.2 Canada Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Erosion and Sediment Control Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Erosion and Sediment Control Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.6.2 France Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Erosion and Sediment Control Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.5.2 China Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.5.2 India Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.5.2 Japan Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.9.2 Australia Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Erosion and Sediment Control Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Erosion and Sediment Control Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.2.4 Africa Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Erosion and Sediment Control Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.6.4 Latin America Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Erosion and Sediment Control Market Estimates and Forecasts, By Product Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Erosion and Sediment Control Market Estimates and Forecasts, by End-User (2020-2032) (USD Billion)

10. Company Profiles

10.1 Triton Environmental

10.1.1 Company Overview

10.1.2 Financial

10.1.3 By Product Type / Services Offered

10.1.4 SWOT Analysis

10.2 ACF Environmental

10.2.1 Company Overview

10.2.2 Financial

10.2.3 By Product Type / Services Offered

10.2.4 SWOT Analysis

10.3 Silt Management Supplies

10.3.1 Company Overview

10.3.2 Financial

10.3.3 By Product Type / Services Offered

10.3.4 SWOT Analysis

10.4 Construction Eco services

10.4.1 Company Overview

10.4.2 Financial

10.4.3 By Product Type / Services Offered

10.4.4 SWOT Analysis

10.5 Geosolutions, Inc

10.5.1 Company Overview

10.5.2 Financial

10.5.3 By Product Type / Services Offered

10.5.4 SWOT Analysis

10.6 GEI Works

10.6.1 Company Overview

10.6.2 Financial

10.6.3 By Product Type / Services Offered

10.6.4 SWOT Analysis

10.7 SMI Companies

10.7.1 Company Overview

10.7.2 Financial

10.7.3 By Product Type / Services Offered

10.7.4 SWOT Analysis

10.8 L & M Supply

10.8.1 Company Overview

10.8.2 Financial

10.8.3 By Product Type / Services Offered

10.8.4 SWOT Analysis

10.9 Aussie Erosion Pty Ltd.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 By Product Type / Services Offered

10.9.4 SWOT Analysis

10.10 Jen-Hill Construction Materials

10.10.1 Company Overview

10.10.2 Financial

10.10.3 By Product Type / Services Offered

10.10.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

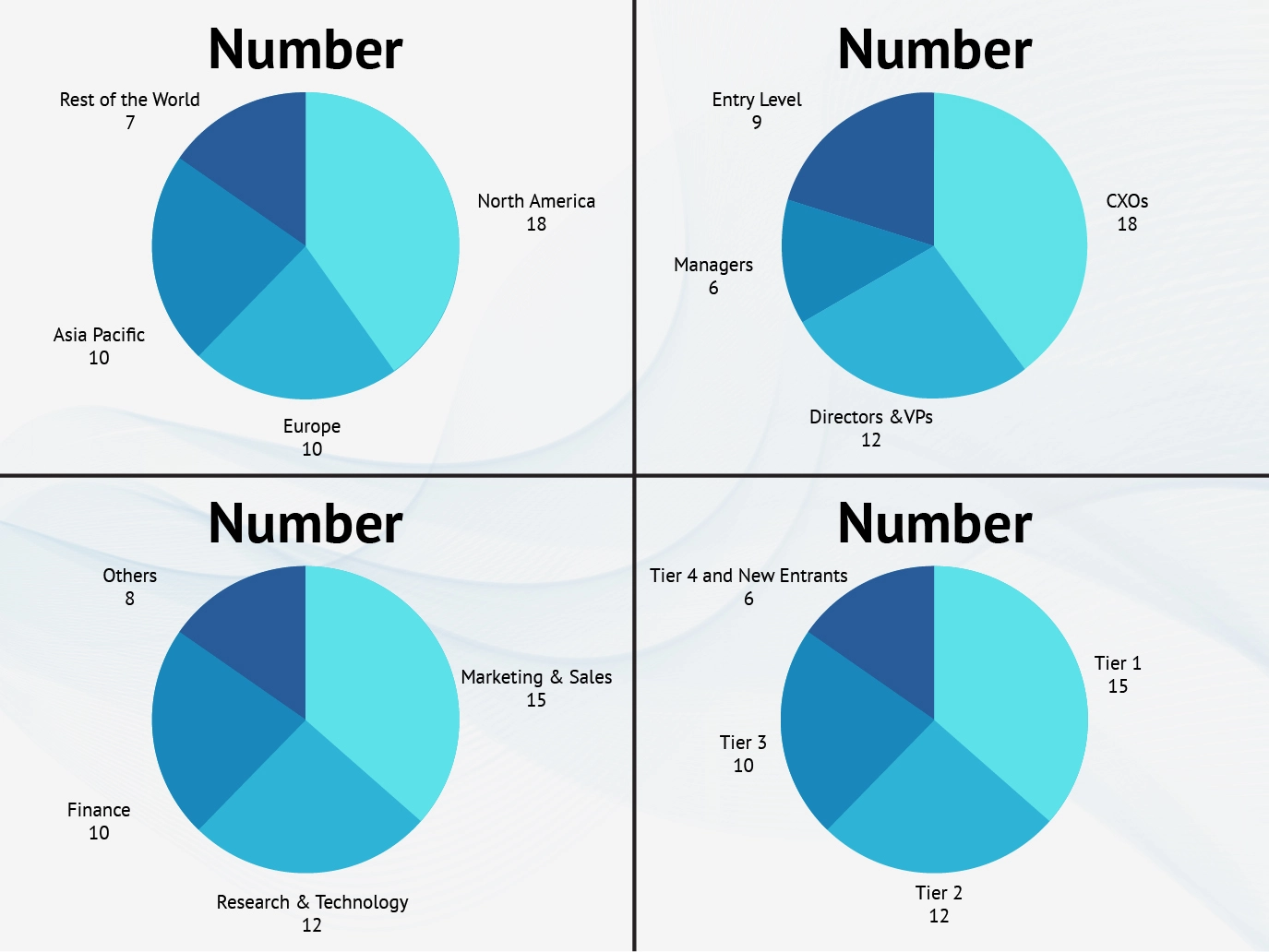

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

Mats, Turfs, and Blankets

Filter Socks, Logs, and Wattles

Woven Sediment Fences and Silt Fences

Filtration Systems

Sediment Basin

Others

By End-User

Highway and Road Construction

Energy and Mining

Government and Municipality

Landfill Construction and Maintenance

Infrastructure Development

Industrial Manufacturing

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)