Get More Information on Epoxy Adhesives Market - Request Sample Report

The Epoxy Adhesives Market Size was valued at USD 9.6 billion in 2023 and is expected to reach USD 14.8 billion by 2032 and grow at a CAGR of 4.9% over the forecast period 2024-2032.

The epoxy adhesives market has grown and innovated fast due to the need for high-performance bonding solutions in various industries such as automobiles, construction, aerospace, and electronics. They are known for superior mechanical strength, chemical resistance, and versatility in bonding. Consequently, these adhesives play a critical role where high performance is required in bonding substrates. The current pattern of environmental sustainability also encompasses disassembly for recycling and reusability in shaping the market landscape. As recently as May 2024, a report was published to show how epoxy adhesives adapt to environmental pressures. Companies now focus on developing adhesives that can support the drive toward sustainability of the world, especially for applications in automotive and electronics that could undertake critical end-of-life recycling processes.

Several companies are at the forefront of producing epoxy adhesives specifically designed for certain industries. In the recent August 2024, Master Bond released an epoxy adhesive product that demonstrated extreme acid resistance to answer the highly demanding specifications required by chemical and industrial applications. Specifically, this product draws attention to the rising demand for adhesives that could be employed in quite hostile chemical environments--something that has become important in manufacturing and aerospace. Another notable player in the adhesives market, Panacol released in May 2024 a new media-resistant epoxy adhesive for filter bonding. The rapidly growing demand in the medical area is oriented around chemical and fluid exposure without a loss of performance characteristics. Media resistance makes such adhesives more suitable for medical devices and components, making epoxy adhesives continue to gain momentum in the healthcare domain.

There's been an important growth in innovation in the areas of marine and outdoor. Only last October, WEST SYSTEM launched Six10 Thickened Epoxy Adhesive, something that would be used in marine applications for ease of use, a pre-mixed solution simplifying the bonding process. That would particularly be useful in environments where durability and resistance to water exposure are a must, for example in boat building and repair. These products are evidence of the demand for high-performance product development towards specific applications and niche markets. Capable of enduring severe environmental conditions yet possessing excellent adhesive properties.

Epoxy-based adhesives not only work well in structural applications but they hold the key to occupy an important position in construction and repair segments. In November 2021, Belzona has launched a new epoxy structural adhesive for demanding structural bonding applications. The product comes with high bonding strength and durability to give it the best answer to heavy-duty construction as well as infrastructure projects. With the infrastructural boom across the world- especially in regions such as Asia-Pacific and the Middle East- such developments lead the focus on the requirement of high-strength adhesives equipped with long-term stability in large-scale construction projects.

The developments of epoxy adhesives are going to stay on the rise for the market is diversified and companies are eager to innovate with solutions so that they can be very well suited to different industries. All of these innovations are proof that epoxy adhesives have been applied to meet certain needs of the industries, such as Master Bond's acid-resistant adhesive, Panacol's medical adhesive, and WEST SYSTEM's marine-grade product. In reality, these innovations eventually epitomize the greater versatility of epoxy adhesives, moving them higher up on the ladder of being indispensable materials in industries requiring strong and durable bonding systems.

Drivers:

Increasing Demand in Automotive and Aerospace Sectors Due to Lightweighting and Structural Integrity

The involvement of epoxy adhesives in the automotive and aerospace industries causes a rising need because of their role in enhancing lightweight, fuel efficiency, and structural integrity. They enable bonding dissimilar materials, like metals with composites, and this contributes to improving the strength and toughness of vehicles during extreme conditions. Epoxy adhesives are significantly used in the automotive industry to reduce car weight without sacrificing strength. Where the priority focus is mostly electric and hybrid models, the reduction of weight is vital to increase fuel efficiency and minimize emissions according to very stringent environmental standards. In such a scenario, epoxy adhesives play a crucial role for automobile manufacturers by bringing high-strength bonds to lightweight materials such as aluminum, carbon fibers, and thermoplastics. Epoxy adhesives in aerospace applications are as crucial as they are in aircraft construction, bonding high-strength material. It is superior to others in both thermal and chemical resistance and, therefore fit to offer strong support in high-altitude and highly stressed conditions. It also accounts for decreased aircraft weights in general, thus to higher fuel efficiency and lower operating costs. An increase in global air travel and the automotive market will also continue to drive epoxy adhesives demand due to the growth of both markets, particularly in North America, Europe, and Asia-Pacific.

Expanding Construction Industry and Infrastructure Development in Emerging Markets

Growth of epoxy adhesives due to rapid urbanization and infrastructural development in emerging markets mainly for construction works that involve the requirement of high-strength bonding as well as durability of materials, such as concrete, metals, and wood. Epoxy adhesives would play a highly significant role in other applications, such as flooring, structural repairs, and bonding under high-stress conditions. Rapid growth in population and urbanization drive construction activities in Asia-Pacific, Latin America, and the Middle East. The scale at which modern infrastructures like commercial buildings, residential apartments, bridges, and transport infrastructures are being developed has significantly increased and epoxy adhesives are playing a key role in these activities. The excellent mechanical strength of epoxy adhesives along with high chemical resistance, makes it an excellent choice for flooring applications, for waterproofing applications, or to secure any structure. In addition to this excellent performance of epoxy adhesives, they are favored based on their capability for bonding diverse materials because it leaves the flexibility to design in construction. Increased attention to environmental considerations has also influenced the increasing use of epoxy adhesives, which allow a reduction in mass with "energy-saving" materials that can reduce energy consumption while improving sustainability in buildings and infrastructures. As the governments of developing countries continue to put major investments in mega-infrastructure projects, demand for epoxy adhesives will grow continuously.

High Cost of Raw Materials and Production Processes Limiting Market Expansion

High raw material costs to produce epoxy adhesives, such as bisphenol A (BPA) and epichlorohydrin, could be important growth barriers for the market. The products are costly as well as experiencing highly unpredictable pricing, which makes it very difficult to enforce production prices within competitive quotes for the manufacturers in the market. Petrochemical-based raw materials take a big portion of the epoxy adhesives market, and their prices are completely hinged on crude oil prices and chaotic supply chain variations. For example, bisphenol A (BPA) is an important raw material in the production of epoxy resin. Cost fluctuation has been witnessed due to regulatory actions, environmental issues, as well as irregular changes in crude oil prices. Similarly, another vital raw material, epichlorohydrin faces the same problems in terms of cost. Growing raw material costs arising from such fluctuations become problematic to handle for manufacturers who struggle to maintain constant production costs and subsequently recover it through increased end-use costs for the consumers. In addition to this, chemical processes involved during the production of epoxy adhesives also contribute toward an increased cost. High energy consumption and requirements of high end advanced production technologies also tend to increase the overall manufacturing cost, off-putting such an expensive epoxy adhesive to the industries like construction and the automotive industry running on a tight budget. This has led some end-users to turn towards alternative adhesives, for example, polyurethane or acrylics which could be less expensive but at the cost of performance in specific applications.

Increasing Focus on Sustainable and Eco-Friendly Epoxy Adhesives Solutions

Sustainability and eco-friendly products is one of the biggest opportunities for the market for epoxy adhesives. Companies are now focusing on manufacturing bio-based and low-VOC epoxy adhesives so that they can serve those industries interested in reducing their environmental footprint or meeting stringent environmental norms. Sustainability has emerged as a concern for all other industries, too, so the adhesives market cannot be an exception. Epoxy adhesives are generally traditional petroleum-based. It poses severe ecological problems in its production and disposal. However, due to severe regulatory pressure on carbon emissions and usage of hazardous chemicals, manufacturers are looking to alternative versions. Epoxy adhesives based on renewable resources, such as plant-based oils, have gained acceptance. These eco-friendly adhesives have a performance similar to the traditional epoxy adhesives but curtailed environment significantly. Another driver in the low-VOC epoxy adhesives market is the move toward stringent regulations, mainly developed regions such as Europe and North America. Air quality standards are more being put in place in these regions, thereby pointing to a growing demand in areas involving construction, automotive, and electronics for sustainable adhesives that can comply with performance standards and are able to provide green building certifications and environmentally responsible manufacturing. With this trend, the industries of the world are becoming increasingly focused on sustainability. This is one of the biggest opportunities that have been opened to manufacturers in terms of the production of environmentally friendly epoxy adhesives.

Challenge:

Strict Regulatory Compliance and Environmental Concerns Impacting Production and Adoption

Strict regulatory compliance about environmental and health safety is a major challenge in complying for the adhesive manufacturers. The regulations regarding volatile organic compounds (VOCs) and hazardous chemicals use are becoming stringent in epoxy adhesives, particularly in North America and Europe. The epoxy adhesives market is heavily regulated with numerous regulations specifically aimed at reducing impacts on the environment as well as health. Adhesives can contribute significantly to VOC emissions, especially during application and curing processes. These release high levels of volatile compounds in the air and cause potential harm to workforce health as contributors to air pollution. Because of these factors, the European Union, U.S., and Japan have regulated VOC emissions in industrial processes. Chemicals used in the production of epoxy adhesives, such as bisphenol A (BPA), attract ever-increasing concern over their adverse health effects. Strict regulatory actions by authorities result in a demand for the usage of fewer harmful substances. Anticipating such laws, manufacturers have had to either reformulate their products or design new products that avoid the usage of such chemicals even better. This has consequently become expensive because compliance would involve more investment in R&D for cheaper productions. Meanwhile, the regulatory ground is always changing and is compelling the manufacturers to be in touch with developments for constant adjustments in formulation. Non-conformance attracts fines, product recalls, and reputational damage. This is an overarching challenge to companies in the epoxy adhesives market.

By Type

The two-component epoxy adhesives segment dominated the Epoxy Adhesives Market in 2023 and accounted for a revenue share of more than 50%. This is because of the high bonding strength and durability provided by two-component adhesives. Hence, it is highly utilized for high-performance applications in the aerospace, automobile, and construction industries. For instance, two-component epoxy adhesives are widely applied in automotive assembly for bonding dissimilar materials like metals and composites to ensure structural integrity and lightweight. Since these adhesives will cure at room temperature, further enhanced chemical and thermal resistance make them a preferred choice in any sector requiring a long-lasting and reliable adhesion solution.

By End-use Industry

The Building & Construction segment dominated the epoxy adhesives market and accounted for the highest revenue share of about 35% in 2023. This is because of the growing demand for high-strength adhesives in construction applications such as flooring, concrete repairs, and structural bonding. Improved bonding and durability benefit these adhesives on projects such as bridges, tunnels, and skyscrapers. For example, in the construction of infrastructural developments, epoxy adhesives are used in bonding metals as well as concrete structures so that the buildings and other large constructions attain long-term durability along with increased structural integrity. This trend has been tremendously increased through the expansion of the infrastructure of modern cities, especially in developing economies.

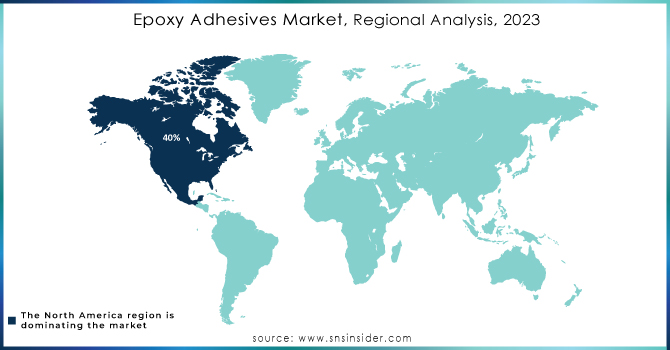

In 2023, North America dominated the Epoxy Adhesives Market with an estimated market share of around 40%. Excellent presence by key industries such as automotive, aerospace, and construction largely utilizes epoxy adhesives because of their outstanding bonding strength and resistance to extreme temperatures. For instance, U.S. automotive producers have lately been embracing epoxy adhesives to create light and strong pieces in manufacturing, in turn keeping the vehicles performing better and conserving fuel. Infrastructure investment by the U.S. government, with the growth in infrastructure projects, has also been an aspect that fuels the demand for epoxy adhesives.

Moreover, the Asia-Pacific region emerged as the fastest growing region in 2023 with a growth rate of 8% in 2023. The increase in the Asia-Pacific region will be driven by tremendous growth in the manufacturing industry, mainly led by countries such as China and India, which manufacture a higher volume of consumer products, electronics, and automotive components that entail high-performance adhesives. This is also augmenting demand in the epoxy adhesives market in the electronics industry of China due to the growing production of smartphones, as well as other electronic items, where epoxy adhesives are used widely for purposes like assembly and encapsulation. Growth in the construction sector is also substantially bringing growth in the consumption of epoxy adhesives in the economies of developing regions, thus further supporting the growth curve for the epoxy adhesives market.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

3M (Scotch-Weld Epoxy Adhesive DP420, Scotch-Weld Epoxy Adhesive DP190)

Ashland (Aroset 3033, Epon 828)

Bostik (Bostik 930, Bostik 771)

Dow (DOW epoxy adhesive 850, DOW epoxy adhesive 856)

DuPont (Epoxy 407, Epoxy 454)

H.B. Fuller Company (Flextra 30, Swift 2000)

Henkel AG & Co. KGaA (Loctite Hysol 9460, Loctite EA 3478)

Mapei S.P.A (Mapeflex EP 21, Ultrabond Eco 360)

Panacol-Elosol GmBH (Structalit 202, Epoxy 123)

Parker Hannifin Corp (Parker Epoxy 1, Parker Epoxy 2)

Permabond LLC (Permabond ET539, Permabond 910)

Sika AG (Sikadur 32, Sikaflex 291)

Aremco Products, Inc. (Aremco 203, Aremco 558)

ARKEMA (Crisben 11, Epotal 720)

Huntsman Corporation (Araldite 2011, Araldite 2020)

Lord Corporation (Lord 7701, Lord 7702)

Master Bond Inc. (Master Bond EP21, Master Bond EP42)

Oligo Polymer GmbH (Oligo Epoxy 2, Oligo Epoxy 3)

Tesa SE (Tesa 62013, Tesa 62025)

Wacker Chemie AG (Elastosil E43, SilGel 612)

|

Report Attributes |

Details |

|---|---|

|

Market Size in 2023 |

US$ 9.6 Billion |

|

Market Size by 2032 |

US$ 14.8 Billion |

|

CAGR |

CAGR of 4.9% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (One-component, Two-component, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

3M, Ashland, Bostik, Dow, H.B. Fuller Company, Henkel AG & Co. KGaA, Mapei S.P.A, Parker Hannifin Corp, Permabond LLC, Sika Ag, DuPont, Panacol-Elosol GmBH and other key players |

|

Drivers |

• Increasing Demand in Automotive and Aerospace Sectors Due to Lightweighting and Structural Integrity |

|

Restraints |

•High Cost of Raw Materials and Production Processes Limiting Market Expansion |

Ans: The Epoxy Adhesives Market is expected to grow at a CAGR of 4.9%.

Ans: Epoxy Adhesives Market size was USD 9.64 billion in 2023 and is expected to Reach USD 14.13 billion by 2031.

Ans: Increasing demand for construction, electric vehicles, electronics, and healthcare fuel the epoxy adhesives market's growth.

Ans: Strict environmental regulations are significantly impacting the landscape of epoxy adhesive production in North America and Europe.

Ans: Asia Pacific is expected to hold the largest market share in the global Epoxy Adhesives Market during the forecast period.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Region, 2023

5.2 Feedstock Prices, by Country, by Region, 2023

5.3 Regulatory Impact, by Country, by Region, 2023

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Epoxy Adhesives Market Segmentation, by Type

7.1 Chapter Overview

7.2 One-component

7.2.1 One-component Market Trends Analysis (2020-2032)

7.2.2 One-component Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Two-component

7.3.1 Two-component Market Trends Analysis (2020-2032)

7.3.2 Two-component Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Others

7.4.1 Others Market Trends Analysis (2020-2032)

7.4.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Epoxy Adhesives Market Segmentation, by End-use Industry

8.1 Chapter Overview

8.2 Building & Construction

8.2.1 Building & Construction Market Trends Analysis (2020-2032)

8.2.2 Building & Construction Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Transportation

8.3.1 Transportation Market Trends Analysis (2020-2032)

8.3.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Marine

8.4.1 Marine Market Trends Analysis (2020-2032)

8.4.2 Marine Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Automotive

8.5.1 Automotive Market Trends Analysis (2020-2032)

8.5.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Wind Energy

8.6.1 Wind Energy Market Trends Analysis (2020-2032)

8.6.2 Wind Energy Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Electrical & Electronics

8.7.1 Electrical & Electronics Market Trends Analysis (2020-2032)

8.7.2 Electrical & Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Epoxy Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.4 North America Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.5.2 USA Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.6.2 Canada Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Epoxy Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Epoxy Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.6.2 France Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4 Asia Pacific

9.4.1 Trends Analysis

9.4.2 Asia Pacific Epoxy Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia Pacific Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.4 Asia Pacific Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 China Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 India Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.5.2 Japan Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.9.2 Australia Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.4.10 Rest of Asia Pacific

9.4.10.1 Rest of Asia Pacific Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia Pacific Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Epoxy Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Epoxy Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.4 Africa Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Epoxy Adhesives Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.4 Latin America Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Epoxy Adhesives Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Epoxy Adhesives Market Estimates and Forecasts, by End-use Industry (2020-2032) (USD Billion)

10. Company Profiles

10.1 3M

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Ashland

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Bostik

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Dow

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 H.B. Fuller Company

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 Henkel AG & Co. KGaA

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Mapei S.P.A

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 Parker Hannifin Corp

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Permabond LLC

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Sika Ag

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.11 DuPont

10.11.1 Company Overview

10.11.2 Financial

10.11.3 Products/ Services Offered

10.11.4 SWOT Analysis

10.12 Panacol-Elosol GmBH

10.12.1 Company Overview

10.12.2 Financial

10.12.3 Products/ Services Offered

10.12.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

One-component

Two-component

Others

By End-use Industry

Building & Construction

Transportation

Marine

Automotive

Wind Energy

Electrical & Electronics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Emulsion Polymer Market Size was valued at USD 31.38 Billion in 2023 and is expected to reach USD 54.68 Billion by 2032 and grow at a CAGR of 6.4% over the forecast period 2024-2032.

The Glycerol Derivatives Market Size was USD 16.0 Billion in 2023 and is expected to reach USD 28.4 Bn by 2032 and grow at a CAGR of 6.6% by 2024-2032.

The Chloromethanes market size was USD 4.62 Billion in 2023 and is expected to reach USD 6.82 Billion by 2032 and grow at a CAGR of 4.41 % from 2024 to 2032.

The Glass Manufacturing Market Size was USD 118.9 billion in 2023 and is expected to reach USD 210.1 billion by 2032 and grow at a CAGR of 6.5% by 2024-2032.

The 3D Printing Plastics Market Size was valued at USD 1.6 billion in 2023 and is expected to reach USD 10.0 billion by 2032 and grow at a CAGR of 22.6% over the forecast period 2024-2032.

Paint Protection Film Market was USD 529.40 Million in 2023 and is expected to reach USD 894.80 Million by 2032, growing at a CAGR of 6.01 % from 2024-2032.

Hi! Click one of our member below to chat on Phone