Epilepsy Device Market Report Scope & Overview:

Get More Information on Epilepsy Device Market - Request Sample Report

The Epilepsy Device Market was valued at USD 0.75 billion in 2023 and is expected to reach USD 1.18 billion by 2032, growing at a CAGR of 5.15% from 2024-2032.

The epilepsy device market has seen remarkable growth in recent years, fueled by technological advancements and a rising global awareness of epilepsy management. This growth is primarily driven by the increasing prevalence of epilepsy worldwide, including nearly 3 million U.S. adults and about 456,000 U.S. children aged 17 and younger affected by active epilepsy in 2024, according to the CDC, creating a greater need for more effective diagnostic tools and treatment options. As a result, devices such as wearable seizure monitors, neurostimulation systems, and EEG machines have gained prominence, transforming how epilepsy is both monitored and treated. These devices enable earlier detection, better management of seizures, and ultimately improved patient outcomes, all of which contribute to the market’s continued expansion.

In addition to technological innovations, there is a growing demand for non-invasive treatment options, particularly in the form of neurostimulation devices like responsive neurostimulation (RNS) and transcranial magnetic stimulation (TMS). These devices provide patients with alternatives to traditional drug treatments, offering a way to reduce seizure frequency and intensity without the need for invasive surgery. This shift toward non-invasive treatments is helping to drive the market further, as more patients seek options that reduce side effects and improve quality of life. As ongoing research and development continue to refine these devices, the market is expected to see an increase in more advanced, reliable solutions for managing epilepsy.

Looking to the future, the epilepsy device market holds exciting opportunities, especially with the integration of artificial intelligence (AI) and machine learning technologies. AI models for EEG classification using convolutional neural networks (CNNs) have achieved a specificity of 90% and an accuracy of 88.3%, while seizure prediction models have demonstrated a sensitivity of 96.8% and a specificity of 95.5% according to the National Library of Medicine. These innovations are paving the way for devices that can predict and even prevent seizures, adding a new level of precision to epilepsy treatment.

MARKET DYNAMICS

DRIVERS

-

Enhanced Quality of Life Through Innovative Epilepsy Devices Market Meeting the Growing Demand for Better Seizure Management

The demand for devices that improve seizure management has risen due to patients’ desire for more control over their condition and a reduction in their dependence on medications. Innovative devices such as seizure monitors, neurostimulation implants, and wearable sensors allow for continuous tracking of seizures and real-time alerts, facilitating immediate intervention when necessary. Neurostimulation implants deliver targeted electrical impulses to the brain, helping reduce seizure frequency. Wearable sensors provide convenient, real-time data to patients and healthcare providers, offering valuable insights into seizure patterns. These technologies help improve seizure control and contribute to a better quality of life, offering an appealing alternative to traditional, more invasive treatments. As patients increasingly seek less invasive, more efficient solutions, the market for epilepsy devices continues to grow.

-

Growing Demand for Epilepsy Devices Market Due to the Aging Population and Increased Susceptibility to Seizures

As the global population ages, the incidence of epilepsy among older adults has increased, leading to a rising demand for devices that can effectively manage the condition in elderly patients. Age-related changes in the brain, along with underlying health conditions, make older individuals more susceptible to developing epilepsy. Devices such as seizure monitoring systems, neurostimulation implants, and wearable sensors are becoming crucial tools in managing seizures in elderly patients. These devices help provide real-time data, reduce the frequency of seizures, and offer continuous monitoring, which is essential for patients who may experience cognitive decline or have difficulty communicating during episodes. As the elderly population grows, there is a greater need for advanced, non-invasive technologies that offer better seizure control and enhance the overall quality of life for older patients with epilepsy.

RESTRAINTS

-

Side Effects, Complications, and Device Malfunctions Posing Challenges to the Growth of the Epilepsy Device Market

The adoption of epilepsy devices, particularly neurostimulation technologies like Vagus Nerve Stimulation and Responsive Neurostimulation, is often hindered by potential side effects and complications. Infections, device malfunctions, and difficulties in adjusting stimulation levels can lead to patient discomfort and safety concerns, reducing long-term therapy compliance. Additionally, some patients may experience adverse reactions such as throat irritation, hoarseness, or discomfort from implanted devices. The possibility of complications associated with surgery, device failure, or malfunction increases the burden on healthcare systems and patients. These risks can deter both healthcare providers and patients from opting for device-based treatments, thereby slowing the market growth of epilepsy devices. Addressing these concerns through improved technology and better patient management will be critical for market expansion.

-

Limited Public Awareness and Accessibility of Epilepsy Device Market Hindering Growth in Developing Countries

In many developing countries, the epilepsy device market faces significant challenges due to a lack of public awareness and limited availability of specialized equipment. Many individuals suffering from epilepsy remain undiagnosed or receive inadequate treatment due to insufficient knowledge about available therapies, including advanced medical devices. Furthermore, the high cost of epilepsy devices and the lack of infrastructure to support their distribution limit access for patients in low-income regions. Without widespread education on the benefits of these devices, both healthcare providers and patients may be unaware of alternative treatments to traditional medications. This limited access and knowledge gap significantly restrict the growth potential of the epilepsy device market in developing countries. Efforts to raise awareness and improve distribution channels will be crucial to overcoming these barriers.

SEGMENT ANALYSIS

BY END USER

In 2023, the Hospitals segment led the epilepsy device market, securing around 69% of the revenue share. This dominance is attributed to hospitals' comprehensive infrastructure, advanced medical technology, and specialized epilepsy care. With the capacity for both diagnosis and treatment, hospitals remain the go-to option for device implementation. Furthermore, their established referral networks ensure a consistent flow of patients, driving market growth.

The Neurology Centers segment is expected to grow at the fastest CAGR of 6.56% from 2024 to 2032. This growth is fueled by the increasing preference for specialized care focused on neurological disorders like epilepsy. Neurology centers provide expert, personalized treatment, positioning them as a key choice for patients seeking advanced therapy. As awareness of epilepsy devices expands, these centers are set to become crucial drivers of market expansion.

BY PRODUCT TYPE

In 2023, the Conventional Devices segment led the epilepsy device market, securing about 46% of the revenue share. Their dominance stems from the widespread adoption of established technologies like Vagus Nerve Stimulation (VNS) and Responsive Neurostimulation (RNS). These devices are well-regarded for their proven effectiveness in managing seizures, making them the preferred choice among healthcare providers.

The Wearable Devices segment is expected to grow at the fastest CAGR of 6.06% from 2024 to 2032, fueled by rising demand for convenience and real-time monitoring. Wearable devices like seizure-detection smartwatches allow patients to track their condition continuously and alert caregivers instantly. With increasing technological advancements and growing patient preference for more personalized care, wearable devices are gaining significant traction. This trend is expected to accelerate their growth in the coming years.

BY TECHNOLOGY

In 2023, the Deep Brain Stimulation (DBS) segment led the epilepsy device market with a 40% revenue share. DBS devices are highly effective in treating drug-resistant epilepsy, especially in patients unresponsive to traditional medications. Their ability to significantly reduce seizure frequency and improve patients’ quality of life has garnered widespread clinical acceptance. As a result, DBS continues to dominate the market, offering proven results in managing complex epilepsy cases.

The Responsive Neurostimulation (RNS) segment is projected to grow at the fastest CAGR of 4.23% from 2024 to 2032, driven by its personalized treatment approach. RNS devices provide on-demand brain stimulation, offering targeted seizure control tailored to each patient’s needs. As the technology improves and clinical outcomes support its effectiveness, RNS is gaining popularity. This innovation is set to drive rapid growth in the coming years, offering promising advancements in epilepsy care.

REGIONAL ANALYSIS

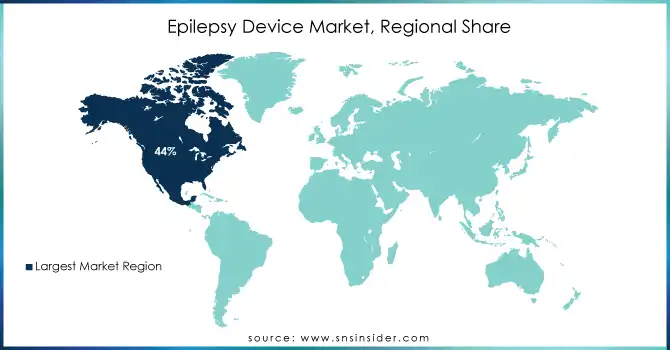

In 2023, North America dominated the epilepsy device market, capturing approximately 44% of the revenue share. This dominance can be attributed to the region's advanced healthcare infrastructure, high adoption of cutting-edge technologies, and a large patient population seeking innovative epilepsy treatments. Additionally, the strong presence of key market players and robust reimbursement policies in the U.S. have significantly contributed to market growth. North America's well-established medical systems and research-driven healthcare environment continue to make it the leading market for epilepsy devices.

The Asia Pacific region is expected to grow at the fastest CAGR of 6.93% from 2024 to 2032, driven by increasing awareness and rising healthcare investments. Rapid urbanization, improving healthcare infrastructure, and growing access to advanced medical technologies are fueling the demand for epilepsy devices in the region. Moreover, a large, underserved patient population and the rising prevalence of epilepsy are further accelerating the market's expansion. As awareness and access to specialized care increase, Asia Pacific is poised for significant growth in the epilepsy device market.

Get Customized Report as per Your Business Requirement - Enquiry Now

LATEST NEWS-

-

DUBLIN, Jan. 8, 2024- Medtronic plc, a global leader in healthcare technology, today announced that its Percept RC Deep Brain Stimulation system has received approval from the U.S. Food and Drug Administration.

-

LivaNova announced on December 11, 2024, that it will present new data at the American Epilepsy Society (AES) Annual Meeting, focusing on the effectiveness of its Vagus Nerve Stimulation (VNS) Therapy for drug-resistant epilepsy patients.

KEY PLAYERS

-

Medtronic plc (Percept PC Neurostimulation System, SynchroMed II Infusion System)

-

Boston Scientific Corporation (VNS Therapy System, Responsive Neurostimulation (RNS) System)

-

LivaNova PLC (Vagus Nerve Stimulation Therapy, SenTiva Neurostimulator)

-

Abbott Laboratories (Epilepsy Monitoring System, Neurostimulation for Epilepsy)

-

Natus Medical Incorporated (Nicolet EEG System, Vivo Test System)

-

Masimo Corporation (Masimo SET, Root Patient Monitoring System)

-

Compumedics Limited (NeuroMap System, SleepView System)

-

Cadwell Industries (Easy EEG System, Cascade Neurodiagnostic Systems)

-

Empatica, Inc. (Embrace2 Watch, Empatica E4 Wristband)

-

ADInstruments (LabChart Software for EEG, PowerLab Data Acquisition System)

-

Neuropace, Inc. (RNS System, Neurostimulation System for Epilepsy)

-

Blackfount Technologies, Inc. (NeuroSweet, Seizure Monitoring Device)

-

BrainDx Limited (BrainDx Epilepsy Diagnosis System, Neuro-Electroencephalography System)

-

NeuroSky Inc. (MindWave Mobile EEG Headset, NeuroSky EEG Neurotechnology)

-

BrainCo (BrainCo Neurotech Device, FocusEDU EEG Device)

-

Spire Health (Spire Stone, Spire Health Tag)

-

Epibright LLC (Epibright Seizure Detection System, Seizure Alert Device)

-

Neurolief, Inc. (Relivion, Neuromodulation Device for Epilepsy)

-

NeuroBoosted Technologies Corporation (NeuroBoosted Brain Stimulation Device, Epilepsy Treatment Device)

-

Medpage Ltd (Seizure Detection Technology, Epilepsy Monitoring Device)

-

Koninklijke Philips NV (Philips EEG System, Philips Neurodiagnostics Solution)

-

Nihon Kohden Corporation (EEG/EP System, NeuroStar Transcranial Magnetic Stimulation)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.75 Billion |

| Market Size by 2032 | USD 1.18 Billion |

| CAGR | CAGR of 5.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By End User (Hospitals, Neurology Centers, Others) • By Product Type (Wearable Devices, Conventional Devices, Implantable Devices) • By Technology (Vagus Nerve Stimulation, Responsive Neurostimulation, Deep Brain Stimulation, Accelerometry) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic plc, Boston Scientific Corporation, LivaNova PLC, Abbott Laboratories, Natus Medical Incorporated, Masimo Corporation, Compumedics Limited, Cadwell Industries, Empatica, Inc., ADInstruments, Neuropace, Inc., Blackfount Technologies, Inc., BrainDx Limited, NeuroSky Inc., BrainCo, Spire Health, Epibright LLC, Neurolief, Inc., NeuroBoosted Technologies Corporation, Medpage Ltd, Koninklijke Philips NV, Nihon Kohden Corporation |

| Key Drivers |

• Enhanced Quality of Life Through Innovative Epilepsy Devices Meeting the Growing Demand for Better Seizure Management • Growing Demand for Epilepsy Devices Due to the Aging Population and Increased Susceptibility to Seizures |

| RESTRAINTS |

• Side Effects, Complications, and Device Malfunctions Posing Challenges to the Growth of the Epilepsy Device Market • Limited Public Awareness and Accessibility of Epilepsy Devices Hindering Market Growth in Developing Countries |