Enterprise WLAN Market Report Scope & Overview:

The Enterprise WLAN Market was valued at USD 19.32 billion in 2024 and is expected to reach USD 68.64 billion by 2032, growing at a CAGR of 17.26% from 2025 to 2032.

Get More Information on Enterprise WLAN Market - Request Sample Report

The Enterprise WLAN market has been experiencing significant growth due to the increasing need for businesses to maintain reliable and high-performance wireless local area networks (WLANs). With 74% of companies planning to make remote work a permanent fixture post-pandemic, the demand for robust wireless connectivity has surged. The growing reliance on cloud-based services further fuels this demand. As more devices connect to the network, including the forecasted 3.8 billion Wi-Fi devices to ship in 2023 alone, companies are turning to WLAN solutions that offer scalability and flexibility. This rapid expansion necessitates advanced security measures, and businesses are prioritizing enhanced network security. WLAN solutions are evolving to meet these needs with advanced encryption and access controls, ensuring both performance and protection.

key trends of the Enterprise WLAN market:

-

Rapid market growth driven by digital transformation and cloud adoption

-

Strong uptake of Wi-Fi 6/6E with early adoption of Wi-Fi 7 on the horizon

-

Increasing demand for AI-driven and cloud-managed WLAN solutions

-

Integration of zero-trust security and advanced encryption in WLAN

-

Hardware (APs, routers, switches) leading, but software and services rising fast

-

High growth in Asia-Pacific (China, India) with strong demand in North America and Europe

-

Expansion of WLAN use in education, healthcare, retail, logistics, and smart cities

-

SMEs are adopting managed WLAN services, while large enterprises deploy AI-powered networks

As the market grows, significant opportunities lie ahead for industries such as healthcare, education, and retail, where wireless connectivity is essential for operations. With the advent of Wi-Fi 6 and the anticipated launch of Wi-Fi 7, businesses will demand next-generation WLAN solutions that offer greater speed, capacity, and efficiency. 473 million Wi-Fi 6E devices are expected to ship in 2024, with over 18% of all Wi-Fi 6 device shipments anticipated to be Wi-Fi 6E. This highlights the growing demand for advanced WLAN technologies. Additionally, the emerging IEEE 802.11be Wi-Fi 7 standard, promising extremely high throughput, is set to drive even greater performance. These developments create a prime opportunity for vendors to innovate and offer solutions that meet the specific needs of various sectors. By delivering advanced, secure, and easily deployable networks, businesses can capitalize on these opportunities, ensuring long-term growth and success in the evolving enterprise WLAN market.

Enterprise WLAN Market Driver:

-

Growing Demand for Mobility and Remote Work Solutions Driving the Expansion of the Enterprise WLAN Market

The surge in mobile and remote work has become a significant driver for the Enterprise WLAN market. As businesses increasingly embrace flexible work models, the need for robust wireless networks to support mobile devices, laptops, and remote connections has grown. Employees from diverse locations, including home offices and co-working spaces, demand seamless, high-performance connectivity to access corporate resources and collaborate efficiently. To meet these needs, enterprises are investing in advanced WLAN infrastructure to ensure reliable, secure, and high-speed connections. The shift to mobile-first and cloud-based work environments requires WLAN solutions that provide scalability and flexibility. Consequently, businesses are upgrading their networks to accommodate the growing number of connected devices, supporting both on-premises and remote workforce needs, which drives the demand for enhanced WLAN technologies.

-

Advancements in Wi Fi Technology The Role of Wi Fi 6 and Wi Fi 6E in Driving Enterprise WLAN Market Growth

The adoption of newer Wi Fi standards, particularly Wi Fi 6 and Wi Fi 6E, is transforming the Enterprise WLAN market by offering significant improvements in speed, capacity, and overall network efficiency. These advancements allow enterprises to support a higher volume of connected devices without compromising network performance, addressing the growing demand for seamless connectivity. Wi Fi 6 and Wi Fi 6E enhance user experience by reducing latency and congestion, particularly in high density environments such as offices, conference rooms, and large campuses. The improved data throughput and greater bandwidth offered by these technologies make them ideal for enterprises that rely on data heavy applications, cloud computing, and IoT devices. As businesses increasingly prioritize faster, more reliable network performance, the adoption of Wi Fi 6 and Wi Fi 6E continues to accelerate the demand for next generation WLAN solutions.

Enterprise WLAN Market Restraints:

-

High Initial Investment in Deploying Advanced WLAN Infrastructure Hindering Market Growth for Small and Medium-Sized Enterprises

The cost of deploying advanced WLAN infrastructure, including equipment, installation, and ongoing maintenance, can be significant, particularly for small and medium-sized enterprises. These organizations often face budget constraints that make it challenging to invest in the latest wireless networking technologies, such as Wi-Fi 6 or Wi-Fi 6E, which require considerable upfront costs. In addition to purchasing the necessary hardware, there are also costs associated with network design, integration, and training personnel to manage the system effectively. Over the expected life of this WLAN investment, the cost is about USD 1,700 for each of the current laptop users, which can be a substantial financial commitment for businesses with limited resources. The financial burden of upgrading or replacing outdated WLAN systems can be a major deterrent. As a result, some enterprises may delay network upgrades or opt for lower-cost, less efficient alternatives, hindering the adoption of next-generation WLAN solutions in certain market segments.

-

Complexity in Network Management Poses Challenges for Enterprises in Adopting Advanced WLAN Solutions

Managing and optimizing large-scale WLAN systems can be complex, requiring specialized skills and continuous monitoring to ensure optimal performance and security. Enterprises with extensive WLAN networks need to regularly configure, troubleshoot, and maintain their systems to ensure they are functioning efficiently, which demands highly skilled IT staff. Additionally, as networks expand to support more devices and applications, the complexity of managing them grows, especially in high-density environments. Continuous monitoring is crucial to detect performance issues, security threats, and potential vulnerabilities, but many enterprises may not have the resources or expertise to handle these tasks effectively. As a result, businesses may face operational challenges or delays in optimizing their WLAN infrastructure, which can hinder the broader adoption of advanced networking solutions, especially for those with limited IT support capabilities.

Enterprise WLAN Market Segmentation Analysis:

-

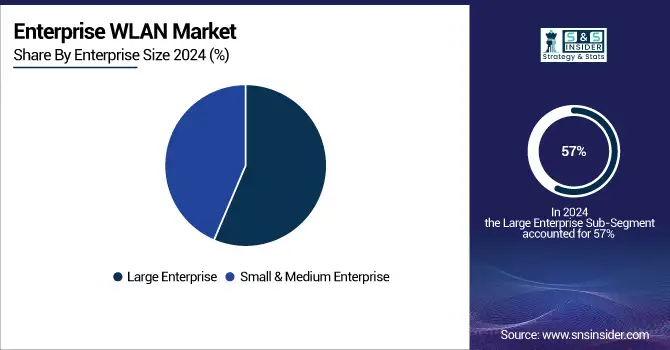

By Enterprise Size, Large enterprises dominate the market, while SMEs are emerging as the fastest-growing segment.

The Large Enterprise segment dominated the Enterprise WLAN market in 2024, capturing the highest revenue share of about 57%. This dominance can be attributed to the substantial investments these enterprises make in upgrading their networking infrastructure to support large-scale operations. With the growing number of connected devices, data-intensive applications, and remote workforces, large enterprises require robust WLAN solutions to ensure seamless connectivity, enhanced security, and scalability across multiple locations. Their established budgets and need for high-performance systems drive this strong market presence.

The Small and Medium Enterprise segment is expected to grow at the fastest CAGR of about 18.81% from 2025 to 2032. This rapid growth is driven by the increasing adoption of affordable and scalable WLAN solutions that cater to the unique needs of SMEs. As these businesses digitalize operations and embrace mobile and remote work models, the demand for reliable, cost-effective networking solutions is rising. The ability of modern WLAN technologies to deliver high performance at lower costs is empowering SMEs to upgrade their networks, propelling their swift growth in the market.

-

By Industry, IT & Telecom lead the market, while Healthcare is expanding at the fastest pace.

The IT and Telecommunications segment dominated the Enterprise WLAN market in 2024, capturing the highest revenue share of about 25%. This dominance stems from the increasing demand for high-performance, reliable networks in data centers, service providers, and telecom infrastructure. As these companies expand their services, they require advanced WLAN solutions to support large-scale operations, handle growing data traffic, and ensure secure, uninterrupted connectivity for their global customer bases.

The Healthcare segment is poised to grow at the fastest CAGR of about 20.64% from 2025 to 2032. This growth is driven by the increasing reliance on wireless technologies to support medical devices, telemedicine, and electronic health records in hospitals and clinics. As healthcare providers seek to improve operational efficiency and patient care, the need for secure, high-speed, and reliable WLAN networks is accelerating, making the healthcare sector one of the fastest-growing adopters of advanced wireless solutions.

-

By Component, Hardware remains the largest segment, while Services are growing the quickest.

The Hardware segment dominated the Enterprise WLAN market in 2024, holding the highest revenue share of about 45%. This dominance is driven by the growing need for physical networking equipment, such as routers, access points, and switches, to support high-speed, reliable wireless networks. As businesses continue to invest in infrastructure upgrades, the demand for advanced WLAN hardware capable of handling increased data traffic and providing seamless connectivity is fueling this segment’s strong market position.

The Services segment is expected to grow at the fastest CAGR of about 18.81% from 2025 to 2032. This growth is driven by the increasing demand for professional services, including network design, installation, maintenance, and management, as enterprises seek to optimize their WLAN systems. As businesses prioritize security, performance, and scalability, the need for specialized expertise to ensure smooth deployment and ongoing support is becoming essential, driving significant expansion in the services sector of the market.

Enterprise WLAN Market Regional Analysis:

-

North America Enterprise WLAN Market Insights

In 2024, North America dominates the Enterprise WLAN Market with an estimated share of 35%, driven by strong digital transformation, widespread cloud adoption, and rising demand for secure, high-performance wireless networks. The region benefits from advanced IT infrastructure, rapid deployment of IoT devices, and strong enterprise investments in hybrid work environments, making it the leading market for next-generation WLAN solutions.

Do You Need any Customization Research on Enterprise WLAN Market - Enquire Now

-

United States Leads Enterprise WLAN Market in North America

The U.S. dominates the North American market due to its large base of multinational enterprises, strong adoption of AI-driven WLAN solutions, and rapid growth in hybrid and remote work models. The presence of major WLAN vendors, continuous investments in R&D, and nationwide digital infrastructure upgrades further reinforce the U.S. as the leading country driving WLAN adoption in the region.

-

Asia Pacific Enterprise WLAN Market Insights

Asia Pacific is the fastest-growing region in the Enterprise WLAN Market with an estimated CAGR of 19.42% in 2024, fueled by rapid digitalization, urbanization, and smart city initiatives. Enterprises across the region are embracing mobile-first, affordable, and scalable WLAN solutions to meet the demands of expanding digital economies, driving strong momentum in industries such as manufacturing, education, and retail.

-

China Leads Enterprise WLAN Market Growth in Asia Pacific

China dominates the Asia Pacific market, supported by large-scale deployment of Wi-Fi 6/6E across industries and aggressive government-backed digital infrastructure projects. Its leadership is reinforced by rapid smart city development, massive enterprise modernization, and domestic tech giants driving WLAN innovation, positioning China as the key growth engine for enterprise wireless solutions in the region.

-

Europe Enterprise WLAN Market Insights

In 2024, Europe is expected to hold a significant share of the Enterprise WLAN Market, driven by strong digital transformation, regulatory compliance requirements, and the adoption of Industry 4.0. Enterprises in the region are prioritizing secure, GDPR-compliant wireless networks to enable scalability and operational efficiency, with steady demand coming from manufacturing, healthcare, and digitalization initiatives in the public sector.

-

Germany Dominates Europe’s Enterprise WLAN Market

Germany leads the European market due to its advanced industrial base, strong investment in Industry 4.0, and high adoption of enterprise-grade WLAN solutions. Strict data security regulations, combined with the country’s focus on automation and connected manufacturing, reinforce Germany’s leadership in driving WLAN growth across Europe.

-

Latin America and Middle East & Africa Enterprise WLAN Market Insights

In 2024, Latin America and the Middle East & Africa (MEA) are expected to show steady growth in the Enterprise WLAN Market, supported by government-backed digital transformation initiatives, the rapid expansion of mobile connectivity, and the growing adoption of smart infrastructure projects. Enterprises in both regions are increasingly investing in scalable, cost-effective WLAN solutions to enhance connectivity and enable business modernization.

-

Regional Leaders in Latin America and MEA

Brazil dominates the Latin American market, driven by expanding digital economies, enterprise modernization, and adoption of cost-efficient WLAN technologies. In MEA, the UAE leads the market, supported by its ambitious smart city projects, investment in advanced IT infrastructure, and growing demand for secure, high-performance wireless connectivity across sectors such as healthcare, finance, and public services.

Competitive Landscape Enterprise WLAN Market:

CommScope

CommScope is a global network infrastructure provider offering connectivity solutions across wired and wireless communications. The company designs and manufactures enterprise networking products, including access points, controllers, and cloud-managed platforms that power modern digital workplaces. In the Enterprise WLAN Market, CommScope plays a vital role through its RUCKUS portfolio, delivering high-performance Wi-Fi solutions optimized for scalability, security, and dense user environments. Its emphasis on AI-driven management, seamless connectivity, and advanced security features positions CommScope as a key player enabling enterprises to meet growing demands for reliable wireless networks in smart campuses, hospitality, and large-scale business operations.

-

In September 2024, CommScope unveiled its RUCKUS Pro AV portfolio, which includes wired and wireless networking solutions for high-end AV installations, featuring Wi-Fi 6/7 access points, ICX switches, and cloud-based monitoring tools.

Cisco

Cisco Systems is a worldwide leader in networking, cybersecurity, and digital communications technologies, offering solutions that underpin global IT infrastructure. In the Enterprise WLAN Market, Cisco stands as a dominant player with its extensive portfolio of wireless access points, controllers, and cloud-based management platforms under Cisco Meraki and Catalyst. The company drives innovation through Wi-Fi 6/6E adoption, AI-powered analytics, and zero-trust security integration, enabling enterprises to enhance performance, reliability, and scalability. Cisco’s global reach, strong enterprise relationships, and ongoing investments in next-generation wireless technologies solidify its leadership in supporting digital transformation and hybrid work connectivity needs worldwide.

-

In 2024, Cisco introduced its Wi-Fi 7 solution, focusing on intelligent, secure, and seamless connectivity for businesses. This new platform enhances user experience with AI-powered optimization, offering secure hybrid and cloud solutions.

Enterprise WLAN Market Key Players:

-

CommScope Holding Company, Inc. (Ruckus ZoneFlex, SmartZone Controllers)

-

D-Link Corporation (DWL Series Access Points, DXS Series Switches)

-

Dell Inc. (PowerConnect Switches, Dell EMC Networking Solutions)

-

Huawei Technologies Co., Ltd. (AirEngine Access Points, CloudCampus Solutions)

-

Cisco Systems, Inc. (Catalyst Access Points, Meraki Cloud-Managed APs)

-

Juniper Networks, Inc. (Mist AI Access Points, EX Series Switches)

-

LANCOM Systems GmbH (LANCOM Access Points, LANCOM Wireless ePaper Solutions)

-

Extreme Networks, Inc. (ExtremeWireless APs, ExtremeCloud IQ)

-

Fortinet, Inc. (FortiAP Access Points, FortiGate Secure Wireless LAN)

-

New H3C Technologies Co., Ltd. (Magic Series APs, iMC Intelligent Management Center)

-

Aerohive Networks (HiveManager, Aerohive Access Points)

-

Mojo Networks (Cognitive WiFi, Cloud-Managed APs)

-

Ubiquiti Networks (UniFi AP Series, EdgeSwitch)

-

ADTRAN (Bluesocket vWLAN, ProCloud WiFi)

-

Allied Telesis (TQ Series APs, Autonomous Management Framework)

-

Cambium Networks (cnPilot APs, cnMaestro Management Platform)

-

NEC Corporation (NEC Access Points, NEC Software-Defined Networking Solutions)

-

Nokia Corporation (AirScale Wi-Fi APs, Nokia Cloud Managed Wi-Fi)

-

Zebra Technologies (WiNG APs, Zebra WLC Controllers)

-

HPE (Aruba Networks) (Aruba Instant APs, Aruba Central)

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 19.32 Billion |

| Market Size by 2032 | USD 68.64 Billion |

| CAGR | CAGR of 17.26% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services) • By Enterprise Size (Small & Medium Enterprise, Large Enterprise) • By Industry (Banking, Financial Services and Insurance, Healthcare, Retail, IT and Telecommunications, Other End-user Verticals) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | CommScope Holding Company, Inc., D-Link Corporation, Dell Inc., Huawei Technologies Co., Ltd., Cisco Systems, Inc., Juniper Networks, Inc., LANCOM Systems GmbH, Extreme Networks, Inc., Fortinet, Inc., New H3C Technologies Co., Ltd., Aerohive Networks, Mojo Networks, Ubiquiti Networks, ADTRAN, Allied Telesis, Cambium Networks, NEC Corporation, Nokia Corporation, Zebra Technologies, HPE (Aruba Networks), Avaya Inc., ALE International |