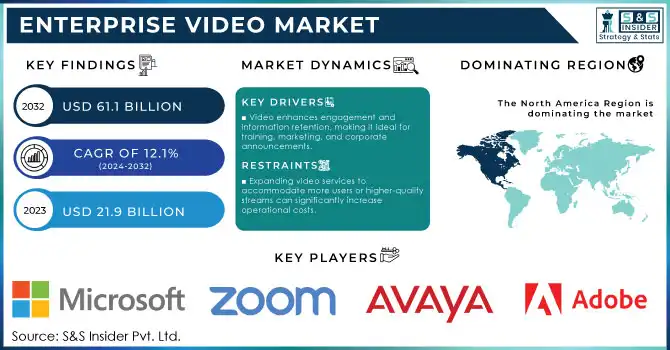

Enterprise Video Market Size & Overview:

Get more information on Enterprise Video Market - Request Free Sample Report

Enterprise Video Market Size was valued at USD 21.9 Billion in 2023 and is expected to reach USD 61.1 Billion by 2032, growing at a CAGR of 12.1% over the forecast period 2024-2032.

The enterprise video market is driven by the growing emphasis on seamless corporate communication, especially in remote and hybrid work settings. According to recent government statistics, video conferencing adoption increased by over 70% in the corporate sector in 2023, fueled by incentives for digital transformation in small and medium enterprises (SMEs). The U.S. Department of Commerce reported a 45% surge in tax credits for businesses adopting advanced communication technologies, further bolstering market growth. Additionally, the European Commission’s Digital Decade initiative aims to enable 90% of businesses by 2030 digitally, supporting video solutions for collaboration. Governments globally recognize enterprise video platforms as essential for improving operational efficiency, reducing travel-related emissions, and ensuring data security compliance in regulated sectors like BFSI and healthcare.

The demand for on-demand video streaming is driving market growth as organizations increasingly use it for training and development. These videos, pre-recorded by trainers or colleagues, provide detailed learning resources. Businesses also leverage enterprise video platforms for external functions such as sales, marketing, customer training, and public event broadcasts. Educational institutions are adopting video content to enhance learning experiences, using multimedia for webinars and courses. The rise in smartphone usage and high-speed internet has further encouraged the use of video for education. Technological advancements, particularly in video streaming APIs, propel the market. APIs enable the integration of multiple platforms, delivering seamless customer experiences and supporting the development of apps for on-demand video content.

Enterprise Video Market Dynamics

Drivers

-

Remote and hybrid work models drive the adoption of video conferencing tools like Zoom and Microsoft Teams for real-time, face-to-face collaboration. These tools enhance team productivity and communication, especially for geographically dispersed teams.

-

Enterprise video solutions are increasingly integrated with tools like CRM and project management platforms, streamlining workflows. This integration improves operational efficiency and fosters a cohesive digital workspace.

-

Video enhances engagement and information retention, making it ideal for training, marketing, and corporate announcements.

The shift towards hybrid and remote work paradigms has transformed the corporate communication scenario, with enterprise video solutions acting as a key element in preserving collaboration and the continuity of work. As per a 2024 report, more than 74% of organizations have been integrated with video conferencing platforms for seamless remote communication, highlighting the critical role of these tools in modern workplaces. A good example of this is Zoom, Microsoft Teams, and Google Meet, which have grown exponentially because they simulate in-office communication in the online world. Microsoft Teams reported an active daily user base of over 300 million in 2024, driven by its integration with productivity tools like Microsoft Office and its adaptability for remote learning and large-scale webinars.

These tools improve organizational efficiency by allowing people across different teams to collaborate in real-time. According to a recent study, teams that use video conferencing for day-to-day project management have a 25% lower chance of a project being delayed than teams that still rely solely on asynchronous communication methods for their day-to-day operations. Moreover, enterprise video has been adopted in other business sectors such as education and healthcare for e-learning and telemedicine. Telehealth also saw a 38% increase in adoption in 2024 and video-based consultations became the core mode of delivering virtual care. This shift highlights the increasing importance of enterprise video solutions within various sectors, spurred on by strong demand for flexible and instant communication.

Restraints

-

High-quality video streaming demands significant bandwidth, often straining corporate networks. Firms in regions with poor internet infrastructure face challenges in delivering uninterrupted video services.

-

Expanding video services to accommodate more users or higher-quality streams can significantly increase operational costs.

One key restraint in the enterprise video market is bandwidth and network constraints, which can significantly impact video streaming quality and user experience. For example, video conferencing and streaming in real-time requires large amounts of bandwidth to function properly without dropping audio or video. However, many organizations, particularly those in developing regions or with outdated infrastructure, struggle with limited network capacity. This issue can result in buffering, delays, and poor video resolution, undermining the effectiveness of video solutions for corporate communications, training, or collaboration. Additionally, the rapidly growing number of remote workers and devices connecting to corporate networks makes this even more complex, introducing congestion and performance issues. To address these issues, organizations need to significantly invest in improving their network infrastructure or begin to implement more advanced compression and optimization technologies, leading to increased operational overhead and costs. Such restrictions represent an obstacle to the smooth integration of video solutions, hindering adoption rates and user satisfaction.

Enterprise Video Market Segment analysis

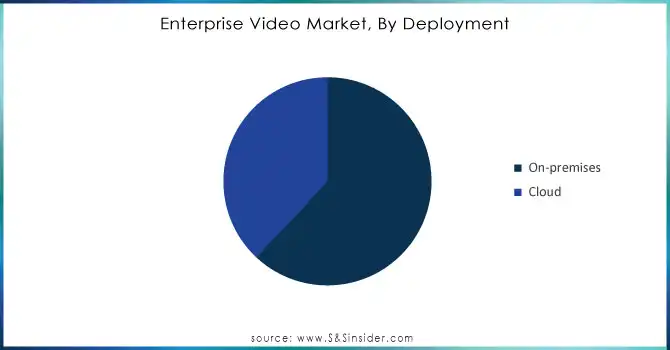

By Deployment

In 2023, the on-premises segment held a 62% revenue share driven by industries prioritizing security and control over data. Depending on the strict nature of data protection laws like those defined by GDPR for Europe and HIPAA for the U.S., sectors like BFSI and healthcare function on the increased transparency to perform on-premises deployment. In 2023, 78% of healthcare organizations secured sensitive data using on-premises video solutions. In the U.S., government-funded advances in cybersecurity, putting $2 billion into secure IT systems and further driving the desirability for an on-premise solution. Such a trend is in line with industries where breaches of privacy could lead to expensive fines and reputational damage.

Need any customization research on Enterprise Video Market - Enquiry Now

By Delivery Techniques

The adaptive streaming segment dominated the market and captured 34% of the revenue share in 2023, as it is scalable and facilitates optimal viewing experience on a wider range of devices and under different network conditions. Adaptive streaming technologies play a crucial role in training modules and corporate communications. Around the world, governments have begun creating initiatives for internet infrastructure, such as the more recent Digital India program, which has been scaling up high-speed connectivity, with 20% more gaining access in rural areas, for more efficient video delivery. The rise of 5G technology also played a critical role, with 5G coverage doubling in North America and Asia-Pacific by 2023.

By End-use

In 2023, the BFSI (Banking, Financial Services & Insurance) segment held a revenue share at 25.0% of the enterprise video market, owing to the large adoption of video solutions for customer engagement and workforce training. This need for customer dialogue, while needing to stay compliant with dense regulatory environments, meant that more and more financial institutions turned to secure video conferencing platforms as a way to strengthen customer relationships. For instance, the Dodd-Frank Act in the USA imposes extensive compliance and transparency requirements, forcing banks and financial companies to use secure communication tools such as video conferencing for real-time consultations and financial advisory services. European central banks use video platforms to help cross-border cooperation and financial institution collaboration. This goes in line with the wider efforts by the European Central Bank to encourage digital innovations business efficiency and cost savings across the broader sector. The interactive and personalized experiences that video solutions provide have made them an essential part of product demonstrations, customer onboarding, and remote advisory services.

Enterprise video systems also became crucial for compliance training when employees had to be trained on financial regulations and new protocols required to operate in a regulated environment. Both instances in which video technology is being used i.e. for customer-facing operations and internal processes, have stressed the importance of video technology in the BFSI segment, therein aiding the share of revenue of this segment in the market.

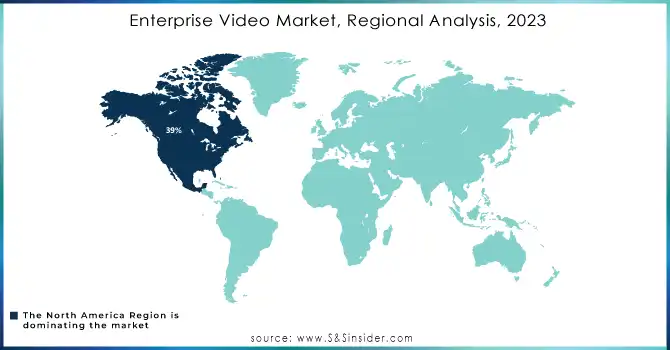

Regional Insights

North America remained the highest revenue-generating region in Enterprise Video Market, accounting for more than 39% of the revenue share in 2023. The impressive growth of advanced video solutions can be attributed to the large-scale adoption of these solutions in major areas like BFSI, healthcare, and education. Enterprise video platforms were employed by companies to facilitate hybrid working, increase the efficiency of employee training, and improve customer engagement. For example, the USA CARES Act, helping small and medium enterprises (SMEs) to adopt digital technologies, contributes a lot to increasing market growth with the help of government initiatives. North America established itself as a leader in the market, led by the presence of major technology companies and an early embrace of innovative solutions.

Meanwhile, Asia-Pacific emerged as the fastest-growing region with a significant compound annual growth rate (CAGR) between 2024 and 2032. This rapid growth in the region is fuelled by substantial investments in digital infrastructure by governments and the private sector. China’s Internet Plus program has placed traditional industries in the Internet boat and increased the application of video technologies in retail, manufacturing, and education. Moreover, Initiatives such as India’s Digital India program improved internet access and spread digital literacy, which made enterprise video solutions widely adopted. Growing adoption of mobile internet and deployment of 5G services in countries including Japan and South Korea are further fuelling the regional market growth.

Key Players

Service Providers / Manufacturers:

-

Cisco Systems, Inc. (Cisco Webex, Cisco Meeting Server)

-

Microsoft Corporation (Microsoft Teams, Azure Media Services)

-

Zoom Video Communications, Inc. (Zoom Meetings, Zoom Webinar)

-

Poly (formerly Polycom) (Poly Studio X50, RealPresence Group Series)

-

Avaya Inc. (Avaya Spaces, Avaya Equinox)

-

BlueJeans by Verizon (BlueJeans Events, BlueJeans Meetings)

-

Adobe Systems Incorporated (Adobe Connect, Adobe Presenter)

-

Kaltura, Inc. (Kaltura Video Platform, Kaltura Virtual Classroom)

-

Brightcove Inc. (Video Cloud, Brightcove Beacon)

-

VMware, Inc. (VMware Workspace ONE, VMware App Volumes)

Users of Enterprise Video Services and Products

-

JPMorgan Chase & Co.

-

Amazon

-

Walmart Inc.

-

Pfizer Inc.

-

Accenture Plc

-

IBM Corporation

-

Deloitte Touche Tohmatsu Limited

-

Procter & Gamble Co. (P&G)

-

Samsung Electronics Co., Ltd.

-

Tesla, Inc.

Recent Developments

-

In January 2024, Zoom introduced its application for Apple Vision Pro, enhancing video conferencing by integrating it with users' physical environments. This innovation allows teams to feel more connected and engaged during virtual meetings, using the expansive canvas of Apple Vision Pro to create an immersive experience that blurs the line between in-person and remote interactions.

-

July 2023, Cisco Systems introduced an AI-enhanced collaboration suite to improve enterprise communication efficiency.

-

May 2023, Microsoft launched an upgraded Teams platform, integrating real-time transcription for video conferences.

| Report Attributes | Details |

| Market Size in 2023 | USD 21.9 Billion |

| Market Size by 2032 | USD 61.1 Billion |

| CAGR | CAGR of 12.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solutions, Services) • By Deployment Mode (On-Premises, Cloud) • By Application (Corporate Communications, Training & Development, Marketing & Client Engagement) • By Delivery Technique (Downloading/Traditional Streaming, Adaptive Streaming, Progressive Downloading) • By Organization Size (SMEs, Large Enterprises) • By Vertical (Telecom, BFSI, Healthcare and Life Sciences, Media and Entertainment, Education, Retail and Consumer Goods, IT and ITeS, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Cisco Systems, Inc., Microsoft Corporation, Zoom Video Communications, Inc., Poly (formerly Polycom), Avaya Inc., BlueJeans by Verizon, Adobe Systems Incorporated, Kaltura, Inc., Brightcove Inc., VMware, Inc. |

| Key Drivers | •Remote and hybrid work models drive the adoption of video conferencing tools like Zoom and Microsoft Teams for real-time, face-to-face collaboration. These tools enhance team productivity and communication, especially for geographically dispersed teams. •Enterprise video solutions are increasingly integrated with tools like CRM and project management platforms, streamlining workflows. •This integration improves operational efficiency and fosters a cohesive digital workspace. Video enhances engagement and information retention, making it ideal for training, marketing, and corporate announcements. |

| Market Restraints | •High-quality video streaming demands significant bandwidth, often straining corporate networks. Firms in regions with poor internet infrastructure face challenges in delivering uninterrupted video services. •Expanding video services to accommodate more users or higher-quality streams can significantly increase operational costs. |