Enterprise Social Software Market Report Scope & Overview:

Enterprise Social Software Market was valued at USD 17.56 billion in 2023 and is expected to reach USD 92.19 billion by 2032, growing at a CAGR of 20.30% from 2024-2032.

To Get More Information on Enterprise Social Software Market - Request Sample Report

The Enterprise Social Software market has witnessed substantial expansion lately, fueled by the growing requirement for companies to improve collaboration, communication, and productivity among their teams. As of August 2024, 22.8% of U.S. employees, totaling 35.13 million individuals, engaged in remote work at least part-time, according to research. Concurrently, due to the increasing trend of digital transformation, ESS platforms are being incorporated into corporate workflows to enhance knowledge exchange, social engagement, and teamwork. This has resulted in a swift uptake of ESS solutions throughout sectors such as technology, healthcare, finance, and manufacturing. The transition to cloud-based solutions, providing scalability, flexibility, and cost-effectiveness, has additionally driven the market growth.

The need for ESS solutions is anticipated to keep increasing as companies aim to enhance employee involvement and cultivate a more cooperative work environment. Social tools combined with business software facilitate smooth communication, permitting employees to work together more efficiently no matter where they are. Additionally, the increasing emphasis on data-based decision-making and tailored user experiences in ESS platforms is likely to boost demand. With an increasing number of companies aiming to improve their digital environments and optimize communication channels, the market is set for continued expansion.

The future prospects for the ESS market are in the creation of AI-driven collaboration tools, sophisticated analytics, and compatibility with other enterprise systems like customer relationship management and enterprise resource planning. The growing reliance on mobile devices and the Internet of Things also offers fresh opportunities for ESS to enhance its features, allowing employees to interact with social tools. Furthermore, the transition to hybrid work arrangements will increase the demand for versatile and adaptable ESS solutions, presenting new growth prospects for software vendors capable of addressing the changing requirements of contemporary organizations.

Market Dynamics

Drivers

-

The Growing Need for Seamless Communication in Remote and Hybrid Work Models

The move towards remote and hybrid work arrangements has generated an urgent demand for efficient communication and collaboration tools. As companies adopt flexible work setups, staff need tools that facilitate smooth communication among remote teams. Conventional approaches such as email and in-person meetings are insufficient now, creating a need for enterprise social software that enables real-time messaging, video calls, and collaborative document sharing. These platforms help teams remain linked, exchange information, and operate effectively no matter the location. The capacity to sustain productivity, encourage innovation, and preserve company culture in a decentralized setting further propels the use of these tools. As organizations acknowledge the importance of these cohesive solutions in assisting agile, cross-departmental teams, the need for enterprise social software keeps increasing.

-

AI and Automation Revolutionizing Enterprise Social Software for Smarter Collaboration

The incorporation of AI, machine learning, and automation into corporate social software is changing the way companies work together. These technologies facilitate the creation of more intelligent tools that boost productivity and optimize processes. AI-driven functionalities like customized content streams and smart alerts guarantee that employees obtain pertinent information suited to their positions and preferences, boosting engagement and productivity. Machine learning algorithms enhance decision-making by examining patterns and delivering insights from employee interactions and actions. Automated processes streamline repetitive activities, enabling teams to concentrate on essential projects. As businesses seek improved operational efficiency and better collaboration, the demand for sophisticated, AI-powered social software keeps increasing. This movement towards more intelligent, customized tools that facilitate flexible work settings fuels the growth and development of the enterprise social software market.

Restraints

-

High Implementation and Maintenance Costs Hindering Market Growth

Implementing enterprise social software typically requires significant initial investment, both in terms of monetary resources and time. Companies must prioritize customization, guaranteeing that the software conforms to their specific business processes and workflows. Moreover, educating staff to proficiently utilize the platform demands considerable effort and costs, especially in large companies. The continuous maintenance and support needed to ensure the software remains updated and secure can put a strain on budgets, particularly for smaller companies with restricted resources. These elements might deter smaller organizations from embracing enterprise social solutions, as they could find it challenging to rationalize the long-term investment. Consequently, although there are potential advantages, significant implementation and maintenance expenses can pose a substantial barrier to market expansion, especially for companies with strict budget limitations or inadequate IT infrastructure.

-

Data Security and Privacy Concerns Limiting Widespread Adoption of Enterprise Social Software Solutions

Enterprise social software manages extensive amounts of sensitive organizational information, which raises considerable worries about data breaches and privacy infringements. As cyberattacks become more frequent and awareness around data privacy grows, companies are wary of using platforms that could put them at risk. Adhering to strict regulations like GDPR and various local data protection laws increases complexity, necessitating that software vendors implement strong security measures and conduct frequent audits. Numerous organizations, especially those in heavily regulated sectors, are reluctant to adopt these tools without assured security protocols established. The potential for legal consequences from failing to comply heightens these worries, causing companies to be hesitant about adopting social software solutions. As a result, the imperative to emphasize data security and uphold privacy regulations is a crucial element hindering the broad acceptance of enterprise social software.

Segment Analysis

By Enterprise Size

In 2023, the Large Enterprises segment dominated the Enterprise Social Software Market with the highest revenue share of approximately 64%. This is largely due to their extensive resource availability, allowing for significant investments in advanced social software solutions. These enterprises benefit from the scalability, customization, and integration capabilities of enterprise-grade platforms, enhancing communication, collaboration, and knowledge sharing across large, dispersed teams. Their need for robust, secure, and compliant tools further drives the adoption of these solutions, reinforcing their market leadership.

The Small & Medium Enterprises segment is expected to grow at the fastest CAGR of about 21.69% from 2024 to 2032. As SMEs increasingly prioritize digital transformation, they seek affordable, scalable solutions that improve collaboration and overall productivity. The rising adoption of cloud-based social software offers SMEs flexibility without hefty upfront costs, making these tools more accessible. Additionally, the growing trend of remote and hybrid work models among SMEs fuels the demand for social software that can enhance communication and team engagement in smaller organizations.

By Deployment

In 2023, the Cloud segment dominated the Enterprise Social Software Market with the highest revenue share of approximately 58%. This dominance can be attributed to the scalability, flexibility, and cost-effectiveness that cloud-based solutions offer. Cloud deployment eliminates the need for on-premise infrastructure, reducing capital expenditures while ensuring quick deployment and easy updates. As businesses increasingly shift to digital-first strategies, the cloud's ability to support remote teams, real-time collaboration, and seamless integrations has made it the preferred choice for enterprises of all sizes.

The Hybrid segment is projected to grow at the fastest CAGR of about 23.73% from 2024 to 2032. This rapid growth is driven by organizations seeking a balance between the flexibility of the cloud and the security of on-premise solutions. Hybrid models allow businesses to leverage cloud capabilities while maintaining sensitive data on private servers, which is especially important for industries with stringent compliance requirements. The demand for such customized, adaptable solutions that cater to both scalability and security needs is fueling the expansion of the Hybrid segment.

By Industry Vertical

In 2023, the BFSI segment dominated the Enterprise Social Software Market with the highest revenue share of approximately 29%. This dominance is driven by the sector's need for secure, efficient communication tools to manage vast amounts of sensitive financial data and improve collaboration across various departments. Enterprise social software in BFSI organizations facilitates faster decision-making, enhances customer service, and strengthens compliance with regulatory standards. As financial institutions continue to invest in digital transformation, these platforms become integral in streamlining operations and maintaining competitive advantage.

The Healthcare and Life Sciences segment, however, is expected to grow at the fastest CAGR of about 22.94% from 2024 to 2032. This rapid growth is attributed to the increasing need for collaboration and real-time communication tools to improve patient care, research, and regulatory compliance. Healthcare organizations are leveraging enterprise social software to facilitate information sharing among medical professionals, streamline administrative tasks, and support data-driven decision-making. As the sector embraces digital tools to manage patient data securely and efficiently, the demand for social software in healthcare continues to rise.

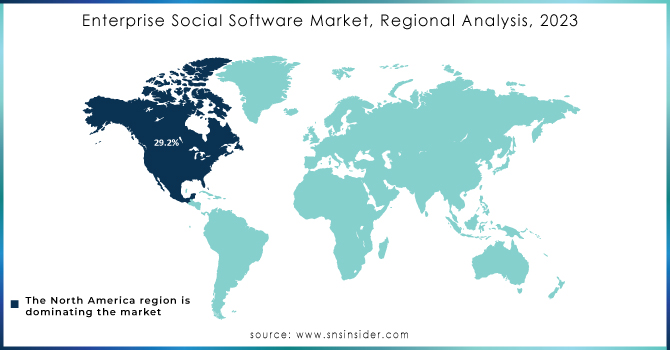

Regional Analysis

In 2023, North America dominated the Enterprise Social Software Market with the highest revenue share of approximately 38%. This dominance is attributed to the region's advanced technological infrastructure, high adoption rates of cloud solutions, and a strong presence of key market players. North American enterprises are early adopters of digital tools and continuously invest in innovative solutions to enhance collaboration, streamline operations, and ensure security. The region's focus on digital transformation, coupled with a robust regulatory framework, has positioned it as a leader in the enterprise social software space.

The Asia Pacific region is expected to grow at the fastest CAGR of about 22.75% from 2024 to 2032. This rapid growth is driven by the region's increasing emphasis on digitalization, particularly in emerging markets like India and China. Businesses in Asia Pacific are rapidly adopting cloud-based social software to improve collaboration and productivity, especially as the demand for flexible work environments rises. Additionally, the growing startup ecosystem and expanding IT infrastructure are fueling the region's shift toward more advanced enterprise solutions, further propelling the market's expansion.

Do You Need any Customization Research on Enterprise Social Software Market - Enquire Now

Key Players

-

Microsoft Corporation (Microsoft Teams, Yammer)

-

Salesforce (Salesforce Chatter, Slack)

-

IBM Corporation (IBM Connections, IBM Watson Workspace)

-

Oracle Corporation (Oracle Social Network, Oracle Cloud)

-

SAP SE (SAP Jam, SAP Business Network)

-

Google LLC (Google Workspace, Google Chat)

-

Atlassian Corporation (Confluence, Trello)

-

Zoho Corporation (Zoho Cliq, Zoho Connect)

-

Meta Platforms, Inc. (Facebook Workplace, Workplace Chat)

-

Cisco Systems, Inc. (Webex, Cisco Jabber)

-

TIBCO Software Inc. (TIBCO Collaborative, TIBCO Cloud Integration)

-

OpenText Corp (OpenText TeamSite, OpenText Exceed)

-

Aurea, Inc. (Jive, Aurea CX)

-

Lithium Technologies, Inc. (Khoros, Lithium Community)

-

Socialtext, Inc. (Socialtext Workspace, Socialtext People)

-

Synacor, Inc. (Zimbra, Synacor Identity Management)

-

VMware, Inc. (VMware Workspace ONE, VMware Horizon)

-

Atos (Atos Digital Workplace, Atos Codex)

-

BroadVision (Clearvale, BroadVision Collaboration Suite)

-

MangoApps (MangoApps Team, MangoApps Enterprise)

-

Bitrix Inc. (Bitrix24, Bitrix24 CRM)

-

Autodesk (AutoCAD, Autodesk BIM 360)

-

Huddle (Huddle, Huddle Workspace)

Recent Developments:

-

In June 2024, Hitachi and Microsoft entered a multibillion-dollar partnership to accelerate business and social innovation through generative AI. The collaboration will integrate Microsoft’s cloud and AI solutions into Hitachi's Lumada platform, focusing on industries like energy and mobility to enhance productivity and sustainability.

-

On January 13, 2025, Atlassian emphasized the transformative role of enterprise social networks in enhancing employee engagement, collaboration, and transparency within organizations. These tools streamline communication, promote cross-departmental teamwork, and foster a sense of community, especially among remote and hybrid teams.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 17.56 Billion |

| Market Size by 2032 | USD 92.19 Billion |

| CAGR | CAGR of 20.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment (On-Premise, Cloud, Hybrid) • By Enterprise Size (Small & Medium Enterprises, Large Enterprises) • By Industry Vertical (Education, Retail, BFSI, Healthcare and Life Sciences, IT and Telecommunications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft Corporation, Salesforce, IBM Corporation, Oracle Corporation, SAP SE, Google LLC, Atlassian Corporation, Zoho Corporation, Meta Platforms, Inc., Cisco Systems, Inc., TIBCO Software Inc., OpenText Corp, Aurea, Inc., Lithium Technologies, Inc., Socialtext, Inc., Synacor, Inc., VMware, Inc., Atos, BroadVision, MangoApps, Bitrix Inc., Autodesk, Huddle. |

| Key Drivers | • The Growing Need for Seamless Communication in Remote and Hybrid Work Models • AI and Automation Revolutionizing Enterprise Social Software for Smarter Collaboration |

| RESTRAINTS | • High Implementation and Maintenance Costs Hindering Market Growth • Data Security and Privacy Concerns Limiting Widespread Adoption of Enterprise Social Software Solutions |