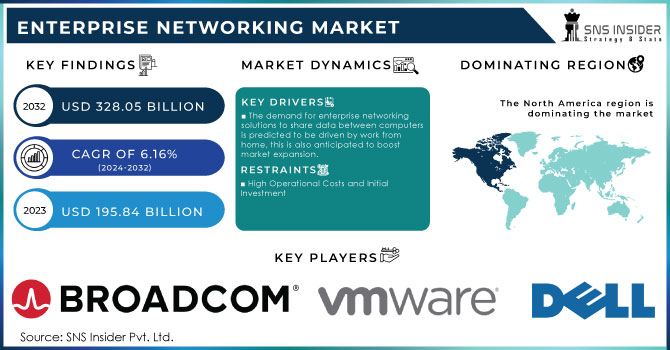

The Enterprise Networking Market Size was valued at USD 153.51 Billion in 2023 and is expected to reach USD 284.44 Billion by 2032 and grow at a CAGR of 7.1% over the forecast period 2024-2032.

Get more information on Enterprise Networking Market - Request Free Sample Report

The Enterprise Networking Market is a rapidly evolving sector that serves as the backbone of modern business operations, enabling seamless communication, data transfer, and resource sharing across organizations. With the proliferation of digital transformation initiatives, the demand for advanced networking solutions has surged, driving market growth. The market encompasses various components such as Ethernet switches, routers, wireless LAN (WLAN), software-defined networking (SDN), and security solutions.

The proliferation of artificial intelligence (AI) applications demands substantial networking infrastructure upgrades to handle the increased data traffic and low-latency requirements. Major industry players, including Nvidia, Cisco, and Lumen Technologies, are investing in advanced networking equipment and software to meet these demands. Cisco Systems, for instance, has raised its annual revenue forecast, attributing this to the heightened demand for data center products like Ethernet switches and routers, essential for AI workloads.

This growth is further supported by the increasing need for secure and efficient networking solutions to accommodate the rising number of connected devices and the expansion of cloud services. The integration of AI and machine learning into network management is also enhancing operational efficiency, contributing to the market's expansion. Overall, the enterprise networking market is poised for continued growth, driven by technological advancements and the escalating demand for high-performance networking infrastructure.

Key Drivers:

Increasing Adoption of Cloud Computing Solutions Across Industries Fuels the Growth of the Enterprise Networking Market

The increasing reliance on cloud computing is a major growth driver for the Enterprise Networking Market. As businesses continue to move their workloads to cloud platforms, there is an escalating need for high-performance, secure, and scalable networks to handle cloud traffic and support cloud-based applications. This shift is motivating enterprises to adopt software-defined networking (SDN) and cloud-based networking solutions like SD-WAN. These technologies optimize the performance of cloud applications, reduce operational costs, and enhance flexibility by offering centralized control over the network. Cloud adoption also increases the demand for infrastructure solutions that ensure smooth and secure data transfer between on-premises systems and cloud environments. As industries such as BFSI, healthcare, and education embrace cloud computing to improve operational efficiency and customer experiences, their need for robust networking infrastructure becomes more pronounced.

Additionally, cloud-based networking solutions allow businesses to scale their networks quickly and efficiently to meet growing demands, contributing significantly to the expansion of the enterprise networking market.

Proliferation of IoT Devices Across Various Sectors Drives Growth in the Enterprise Networking Market.

The proliferation of Internet of Things (IoT) devices is rapidly reshaping the Enterprise Networking Market. The growing adoption of IoT technologies in industries like healthcare, manufacturing, and transportation necessitates advanced networking solutions capable of handling large volumes of data generated by these connected devices. IoT deployments require networks that can support real-time data transfer, low latency, and high bandwidth to ensure efficient device communication and enable data analytics. For example, in healthcare, IoT-enabled devices such as wearables and remote monitoring systems generate continuous streams of data that need to be processed and analyzed in real time.

This demands highly efficient and reliable enterprise networks that can securely manage the vast amount of data coming from multiple IoT endpoints. To address these needs, businesses are investing in next-generation networking technologies such as 5G, edge computing, and advanced SDN. The need for more interconnected devices, smarter infrastructure, and improved automation is expected to fuel continued growth in the enterprise networking market.

Restrain:

High Initial Deployment Costs and Complexity of Managing Advanced Networking Solutions Limit Market Expansion.

Despite the rapid growth of the Enterprise Networking Market, high initial deployment costs and the complexity of managing advanced networking solutions pose significant challenges. The investment required to build and maintain robust networking infrastructures, especially for cutting-edge solutions like SD-WAN, 5G, and IoT integration, can be substantial. For small and medium-sized businesses (SMBs), the upfront costs of deploying these technologies may be prohibitive, limiting their ability to adopt such solutions.

Furthermore, the integration of modern networking solutions with legacy systems often involves technical challenges, requiring skilled professionals to manage network transitions smoothly. This complexity increases the overall operational costs for enterprises. The shortage of skilled networking professionals further compounds these challenges, leading to delays in network deployments and inefficient network management. Additionally, maintaining security across advanced, multi-layered networks adds another layer of complexity and cost, which can deter organizations from fully adopting next-generation networking solutions. These factors are limiting the widespread adoption of enterprise networking solutions, especially among smaller enterprises, and could slow market growth in the short term.

By Infrastructure Type

In 2023, the Outsourced Infrastructure segment of the Enterprise Networking Market captured the largest revenue share, accounting for 64.00%. This growth is attributed to the increasing trend of organizations outsourcing their network management and maintenance to specialized third-party service providers. Outsourcing offers businesses the ability to reduce costs, gain access to expertise, and leverage cutting-edge technologies without the overhead of managing the network in-house.

For instance, Cisco introduced Cisco SD-WAN solutions that allow enterprises to outsource their network management while benefiting from enhanced security and performance. Similarly, Fortinet has been expanding its FortiGate series, which integrates advanced firewall capabilities and is often deployed in outsourced networks to ensure security and compliance.

The In-House Infrastructure segment in the Enterprise Networking Market is experiencing rapid growth, with the largest CAGR of 7.89% projected over the forecast period 2024-2032. This growth is driven by the increasing preference of enterprises to retain control over their network infrastructure, ensuring data security, compliance, and the ability to customize network solutions according to specific business needs.

For example, Arista Networks has recently launched the Arista 7280R Series switches, designed for enterprise data centers and networks that demand high performance and low latency. These products cater to the growing demand for in-house network management, where enterprises require robust and flexible network solutions.

By Equipment

In 2023, the Ethernet Switch segment commanded the largest revenue share in the Enterprise Networking Market, holding 42.00%. This dominance is largely driven by the growing demand for reliable, high-performance networking infrastructure that can support the increasing volumes of data and interconnected devices within enterprise networks. Ethernet switches are essential components of modern networks, enabling seamless communication between devices and providing high-speed data transfer, which is crucial for businesses to maintain efficiency.

For instance, Cisco launched the Catalyst 9000 Series, a family of switches designed for enterprise-grade networks, offering enhanced security features, automation, and scalability.

The WLAN segment is poised to grow at the fastest rate within the Enterprise Networking Market, with an expected CAGR of 8.74% over the forecasted period. This growth can be attributed to the increasing need for flexible, scalable, and cost-effective network solutions that support mobile devices and remote work. WLANs provide enterprises with the ability to connect devices wirelessly, reducing the reliance on wired infrastructure and enabling greater mobility within the workplace.

Companies like Aruba Networks and Cisco have been driving innovation in the WLAN space. Aruba recently launched the Aruba 500 Series Access Points, which offer advanced security and improved performance for large-scale deployments.

In 2023, North America emerged as the dominant region in the Enterprise Networking Market, holding a significant market share of 37%. The region accounted for a substantial portion of the overall market due to the widespread adoption of advanced networking technologies, robust IT infrastructure, and the presence of leading technology companies. The presence of major players like Cisco, Juniper Networks, Hewlett Packard Enterprise, and Arista Networks has further driven the market’s growth. For instance, Cisco’s launch of advanced Ethernet switches and SD-WAN solutions has significantly contributed to the region's market share.

Additionally, the rise of cloud computing, and IoT, and the increasing need for secure networking solutions have spurred demand for enterprise networking products. Furthermore, North America’s mature infrastructure, rapid adoption of 5G, and growing data center needs continue to foster the market's expansion.

The Asia Pacific region is recognized as the fastest-growing region in the Enterprise Networking Market, with an estimated CAGR of 8.67% over the forecasted period. This rapid growth is driven by the region’s increasing digitalization, large-scale infrastructure development, and the growing adoption of cloud-based networking solutions. For example, companies in China and India are investing heavily in SD-WAN, WLAN, and IoT technologies to cater to the growing needs of businesses.

Furthermore, the rise of smart cities, digital enterprises, and increased internet penetration in emerging economies like India are creating new opportunities for enterprise networking solutions. As organizations in the APAC region embrace digital transformation, the demand for high-speed, reliable, and secure networking solutions is expected to grow, making APAC the fastest-growing region in the Enterprise Networking Market.

Need any customization research on Enterprise Networking Market - Enquire Now

Some of the major players in the Enterprise Networking Market are:

In April 2024, Fortinet unveiled the latest version of its FortiOS operating system alongside significant enhancements to its cybersecurity platform, the Fortinet Security Fabric. These updates integrate networking and security seamlessly, while the Security Fabric improvements introduce new capabilities, including generative AI, data protection, managed services, and unified agent features.

In February 2024, Broadcom subsidiary VMware announced advancements across its Software-Defined Edge portfolio, encompassing 5G, SD-WAN, SASE, and Edge Compute. These innovations are designed to help communication service providers (CSPs) modernize their networks and create new revenue-generating services.

In January 2024, Cisco Systems partnered with Kyndryl to develop scalable security solutions. The collaboration introduced a new security edge service, which, when combined with enterprises' existing SD-WAN offerings, provides a robust foundation for transitioning to SASE architecture.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 153.51 Billion |

| Market Size by 2032 | US$ 284.44 Billion |

| CAGR | CAGR of 7.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment (Ethernet Switch, Enterprise Routers, WLAN, Network Security) • By Infrastructure Type (In-House, Outsourced) • By Deployment Mode (Cloud-based, On-premises) • By Organization Size (Large Enterprises, Small and Medium-sized) • By End User (Aerospace and Defense, Education, Media and Communication, Healthcare, BFSI, Transportation and Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Broadcom, Hewlett Packard Enterprise, Juniper Networks, Extreme Networks, Inc., Huawei, Fortinet, Cloudflare, Inc., Alcatel-Lucent Enterprise, Arista Networks, Riverbed Technology, Check Point Software Technologies Ltd., SolarWinds Corporation, F5 Networks, Palo Alto Networks, Pica8, Versa Networks, Aryaka Networks Inc., A10 Networks, Inc., Cato Networks Ltd. |

| Key Drivers | • Increasing Adoption of Cloud Computing Solutions Across Industries Fuels the Growth of the Enterprise Networking Market • Proliferation of IoT Devices Across Various Sectors Drives Growth in the Enterprise Networking Market |

| Restraints | • High Initial Deployment Costs and Complexity of Managing Advanced Networking Solutions Limit Market Expansion |

Ans: The Enterprise Networking Market is expected to grow at a CAGR of 7.1% during 2024-2032.

Ans: The Enterprise Networking Market size was USD 153.51 billion in 2023 and is expected to Reach USD 284.44 billion by 2032.

Ans: The major growth factor of the Enterprise Networking Market is the increasing adoption of digital transformation and cloud-based solutions across industries.

Ans: Outsourced dominated the Enterprise Networking Market.

Ans: North America dominated the Enterprise Networking Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Network Traffic Growth, by Region

5.2 Enterprise Networking Spend by Industry, 2023

5.3 Adoption Rates of Key Technologies

5.4 Workforce Mobility Trends, by Region (2020-2032)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Enterprise Networking Market Segmentation, By Equipment

7.1 Chapter Overview

7.2 Ethernet Switch

7.2.1 Ethernet Switch Market Trends Analysis (2020-2032)

7.2.2 Ethernet Switch Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Enterprise Routers

7.3.1 Enterprise Routers Market Trends Analysis (2020-2032)

7.3.2 Enterprise Routers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 WLAN

7.4.1 WLAN Market Trends Analysis (2020-2032)

7.4.2 WLAN Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Network Security

7.5.1 Network Security Market Trends Analysis (2020-2032)

7.5.2 Network Security Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Enterprise Networking Market Segmentation, By Infrastructure Type

8.1 Chapter Overview

8.2 In-House

8.2.1 In-House Market Trends Analysis (2020-2032)

8.2.2 In-House Market Size Estimates and Forecasts To 2032 (USD Billion)

8.3 Outsourced

8.3.1 Outsourced Market Trends Analysis (2020-2032)

8.3.2 Outsourced Market Size Estimates and Forecasts To 2032 (USD Billion)

9. Enterprise Networking Market Segmentation, By Deployment Mode

9.1 Chapter Overview

9.2 Cloud-based

9.2.1 Cloud-based Market Trends Analysis (2020-2032)

9.2.2 Cloud-based Market Size Estimates and Forecasts To 2032 (USD Billion)

9.3 On-premises

9.3.1 On-premises Market Trends Analysis (2020-2032)

9.3.2 On-premises Market Size Estimates and Forecasts To 2032 (USD Billion)

10. Enterprise Networking Market Segmentation, By Organization Size

10.1 Chapter Overview

10.2 Large enterprises

10.2.1 Large Enterprises Market Trends Analysis (2020-2032)

10.2.2 Large Enterprises Market Size Estimates and Forecasts To 2032 (USD Billion)

10.3 Small and medium-sized

10.3.1 Small and medium-sized Market Trends Analysis (2020-2032)

10.3.2 Small and medium-sized Market Size Estimates and Forecasts To 2032 (USD Billion)

11. Enterprise Networking Market Segmentation, By End User

11.1 Chapter Overview

11.2 Aerospace and Defense

11.2.1 Aerospace and Defense Market Trends Analysis (2020-2032)

11.2.2 Aerospace and Defense Market Size Estimates and Forecasts To 2032 (USD Billion)

11.3 Education

11.3.1 Education Market Trends Analysis (2020-2032)

11.3.2 Education Market Size Estimates and Forecasts To 2032 (USD Billion)

11.4 Media and Communication

11.4.1 Media and Communication Market Trends Analysis (2020-2032)

11.4.2 Media and Communication Market Size Estimates and Forecasts To 2032 (USD Billion)

11.5 Healthcare

11.5.1 Healthcare Market Trends Analysis (2020-2032)

11.5.2 Healthcare Market Size Estimates and Forecasts To 2032 (USD Billion)

11.6 BFSI

11.6.1 BFSI Market Trends Analysis (2020-2032)

11.6.2 BFSI Market Size Estimates and Forecasts To 2032 (USD Billion)

11.7 Transportation and Logistics

11.7.1 Transportation and Logistics Market Trends Analysis (2020-2032)

11.7.2 Transportation and Logistics Market Size Estimates and Forecasts To 2032 (USD Billion)

11.8 Others

11.8.1 Others Market Trends Analysis (2020-2032)

11.8.2 Others Market Size Estimates and Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Enterprise Networking Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.2.4 North America Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.2.5 North America Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.6 North America Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.7 North America Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.2.8.2 USA Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.2.8.3 USA Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.8.4 USA Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.8.5 USA Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.2.9.2 Canada Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.2.9.3 Canada Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.9.4 Canada Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.9.5 Canada Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.2.10.2 Mexico Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.2.10.3 Mexico Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.2.10.4 Mexico Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.2.10.5 Mexico Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Enterprise Networking Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.1.8.2 Poland Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.1.8.3 Poland Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.8.4 Poland Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.8.5 Poland Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.1.9.2 Romania Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.1.9.3 Romania Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.9.4 Romania Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.9.5 Romania Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Enterprise Networking Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.2.4 Western Europe Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.2.5 Western Europe Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.6 Western Europe Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.7 Western Europe Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.2.8.2 Germany Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.2.8.3 Germany Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.8.4 Germany Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.8.5 Germany Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.2.9.2 France Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.2.9.3 France Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.9.4 France Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.9.5 France Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.2.10.2 UK Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.2.10.3 UK Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.10.4 UK Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.10.5 UK Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.2.11.2 Italy Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.2.11.3 Italy Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.11.4 Italy Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.11.5 Italy Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.2.12.2 Spain Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.2.12.3 Spain Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.12.4 Spain Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.12.5 Spain Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.2.15.2 Austria Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.2.15.3 Austria Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.15.4 Austria Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.15.5 Austria Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Enterprise Networking Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.4.4 Asia Pacific Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.4.5 Asia Pacific Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.6 Asia Pacific Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.7 Asia Pacific Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.4.8.2 China Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.4.8.3 China Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.8.4 China Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.8.5 China Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.4.9.2 India Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.4.9.3 India Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.9.4 India Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.9.5 India Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.4.10.2 Japan Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.4.10.3 Japan Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.10.4 Japan Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.10.5 Japan Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.4.11.2 South Korea Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.4.11.3 South Korea Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.11.4 South Korea Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.11.5 South Korea Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.4.12.2 Vietnam Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.4.12.3 Vietnam Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.12.4 Vietnam Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.12.5 Vietnam Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.4.13.2 Singapore Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.4.13.3 Singapore Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.13.4 Singapore Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.13.5 Singapore Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.4.14.2 Australia Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.4.14.3 Australia Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.14.4 Australia Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.14.5 Australia Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5 Middle East and Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Enterprise Networking Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.5.1.4 Middle East Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.5.1.5 Middle East Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.6 Middle East Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.7 Middle East Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.5.1.8.2 UAE Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.5.1.8.3 UAE Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.8.4 UAE Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.8.5 UAE Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Enterprise Networking Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.5.2.4 Africa Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.5.2.5 Africa Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.6 Africa Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.7 Africa Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Enterprise Networking Market Estimates and Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.6.4 Latin America Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.6.5 Latin America Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.6 Latin America Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.7 Latin America Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.6.8.2 Brazil Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.6.8.3 Brazil Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.8.4 Brazil Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.8.5 Brazil Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.6.9.2 Argentina Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.6.9.3 Argentina Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.9.4 Argentina Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.9.5 Argentina Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.6.10.2 Colombia Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.6.10.3 Colombia Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.10.4 Colombia Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.10.5 Colombia Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Enterprise Networking Market Estimates and Forecasts, By Equipment (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Enterprise Networking Market Estimates and Forecasts, By Infrastructure Type (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Enterprise Networking Market Estimates and Forecasts, By Deployment Mode (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Enterprise Networking Market Estimates and Forecasts, By Organization Size (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Enterprise Networking Market Estimates and Forecasts, By End User (2020-2032) (USD Billion)

13. Company Profiles

13.1 Cisco Systems.

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Broadcom

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 Hewlett Packard Enterprise

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Juniper Networks

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Extreme Networks, Inc.

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 Huawei

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Fortinet

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Cloudflare, Inc.

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Alcatel-Lucent Enterprise

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Arista Networks

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

MARKET SEGMENTATION

By Equipment

Ethernet Switch

Enterprise Routers

WLAN

By Infrastructure Type

In-House

Outsourced

By Deployment Mode

Cloud-based

On-premises

By Organization Size

Large enterprises

Small and medium-sized

By End User

Aerospace and Defense

Education

Media and Communication

Healthcare

BFSI

Transportation and Logistics

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest Of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Telecom Expense Management Market was valued at USD 3.69 billion in 2023 and will reach USD 11.17 billion by 2032, growing at a CAGR of 13.14% by 2032.

The Philippines GCC Market was valued at USD 32.50 billion in 2023 and is expected to reach USD 67.97 Billion by 2032, growing at a CAGR of 12.04% over the forecast period 2024-2032.

Social Media Listening Market was valued at USD 8.36 billion in 2023 and is expected to reach USD 27.63 billion by 2032, growing at a CAGR of 14.27% by 2032

Deep Learning Market was valued at USD 72.31 billion in 2023 and is expected to reach USD 858.69 billion by 2032, growing at a CAGR of 31.69% by 2032.

The 5G IoT Market Size was valued at USD 10.76 Billion in 2023 and is expected to reach USD 208.48 Billion by 2032 and grow at a CAGR of 39.0% over the forecast period 2024-2032.

The Service Virtualization Market Share was USD 745.8 Million in 2023 and will reach USD 2853.1 Million by 2032, growing at a CAGR of 16.1% by 2024-2032.

Hi! Click one of our member below to chat on Phone