Enterprise Artificial Intelligence Market Report Scope & Overview:

Get more information on Enterprise Artificial Intelligence Market - Request Free Sample Report

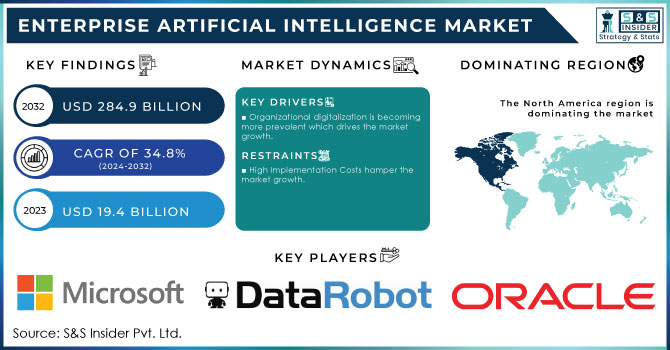

The Enterprise Artificial Intelligence Market Size was valued at USD 19.4 Billion in 2023. It is expected to grow to USD 284.9 Billion by 2032 and grow at a CAGR of 34.8% over the forecast period of 2024-2032.

Enterprise Artificial Intelligence Market is growing due to the fast adoption of artificial intelligence among industries to enhance business efficiency, cut costs, and improve customer experience. AI-powered solutions provide predictive analytics to detect disease trends, enhance diagnostic precision, and streamline patient care reducing hospital readmissions and furthering overall healthcare outcomes. AI plays a role in the financial sector for fraud detection, which uses machine learning algorithms to detect suspicious transactions in real-time and thus minimize risks and protect these assets. Moreover, CPG retailers use AI to provide personalized recommendations based on customer behavior and preferences, boosting customer engagement and loyalty.

For instance, in manufacturing, AI-based automation is used to automate factory production lines and monitor equipment for predictive maintenance while ensuring product quality leading to lower downtimes and cost-boasts. With the aid of AI, all of these sectors are not just becoming more efficient but setting a new norm in the industry that is driving other organizations to follow suit and use AI in their processes. Such widespread use of AI across all the sectors forming the core of world economies enhances not only revenue generation from these businesses but also reflects on overall growth in one place, furthering the Enterprise AI Market since organizations are coming to understand that aiming for innovation, profitability and customer satisfaction boils down to one thing: when implemented effectively this incredible technology can deliver unparalleled benefits.

Additionally, in healthcare, the U.S. Department of Health and Human Services (HHS) reported a 35% increase in AI adoption for predictive analytics applications between 2020 and 2023, emphasizing AI’s growing influence in improving healthcare outcomes through more effective patient management and disease prediction. These statistics reflect the broader, multi-sectoral impact of AI adoption supported by government and industry efforts.

Moreover, digital transformation and data generation speed up in every industry, organizations are dealing with massive amounts of data which can show the signals, trends, and buying patterns of customers. In this regard, AI technology is key to quickly processing, analysing, and interpreting these datasets effectively so that organizations can fully grasp their operations and markets. This has the potential to help companies make informed decisions that lead to improved internal processes, lower costs, and a larger amount of revenue opportunity. For example, predictive AI analytics can enable businesses to more accurately predict demand, tailor customer experiences, and identify disruptions in the supply chain. This leads to a more proactive approach as data-driven decision-making, in return, allows companies to react quicker to changing market conditions, adjust their services accordingly, and have an all-around better performance. Consequently, the strategic deployment of AI to allow enterprises to turn their raw data into valuable insights has become a necessity for those looking to maintain agility and competitiveness in an increasingly data-centric world.

The data-driven decision-making comes from the European Commission, which estimates that data-driven innovation, fueled by AI and advanced analytics, could add €550 billion to the European economy by 2025.

Enterprise Artificial Intelligence Market Dynamics

Drivers

-

Organizational digitalization is becoming more prevalent which drives the market growth.

One of the primary factors driving market development is the increasing digitization of end-use industries. Furthermore, as a result of new technologies such as edge computing, augmented and virtual reality (AR/VR), industrial robots, self-driving cars, digital manufacturing, industrial internet of things (IIOT), and digital manufacturing, the manufacturing industry has seen tremendous growth. These technologies help to improve the personalization, flexibility, and agility of manufacturing processes. Furthermore, the development of trustworthy cloud computing infrastructures, as well as developments in dynamic AI solutions for preventative maintenance, consumer behavior research, and the detection of fraud and threats, are propelling market expansion. Furthermore, the broad product usage across numerous firms for analyzing and interpreting large amounts of data is favorably impacting market growth. Another factor driving development is the increasing need for AI in the healthcare industry, which is driven by its ability to analyze massive amounts of genetic data and deliver more accurate treatment and accident prevention. Furthermore, the market is expected to rise as a consequence of ongoing improvements in robotics and intelligent virtual assistants, rising disposable incomes, and the implementation of several government programs encouraging industrial automation.

Restraint

-

High Implementation Costs hamper the market growth.

The significant initial costs of implementation are a major cause preventing the adoption of Artificial Intelligence (AI) based technologies, especially for smaller enterprises. The up-front cost includes updating technology such as infrastructure, and software licenses, or hiring and training employees for computer science and machine learning. These expenditures can add up quickly, placing a new financial strain on organizations that may already be stretched thin with their budgets. The issue here is that smaller enterprises might find it difficult to commit enough resources to AI solutions, inhibiting their competitiveness in the tech-centric market. This financial stress limits the penetration of AI technologies within such companies and also their growth. Consequently, a lot of the smaller businesses could refrain from launching AI initiatives and ultimately lose out on operational efficiencies or innovations that accompany such technologies all the while leaving bigger, financially unfortunate corporations to play even more vital roles.

Enterprise Artificial Intelligence Market Segmentation Overview

By Deployment

The Cloud held the largest market share around 66% in 2023. It is because of its aforementioned flexibility, scalability, and cost-effective nature it is suited perfectly for AI solution-performing businesses. Cloud-based AI provides organizations with affordable access to state-of-the-art computation power and machine learning technologies without the burden of costly infrastructure investments like traditional on-premises systems. Most major developed cloud providers such as AWS, Google Cloud, and Microsoft Azure have extensive offerings for AI-as-a-Service, enabling businesses to rapidly deploy and scale AI applications as demand dictates. The cloud also allows AI tools to work across platforms and departments more easily, fostering stronger collaboration and data sharing between organizations. It is useful for companies that have a lot of data to process because cloud platforms provide the infrastructure required to store and process massive amounts of data in the cloud, eliminating maintenance responsibilities. Additionally, cloud providers continuously upgrade their AI capabilities, allowing businesses to always leverage the latest technologies and developments in machine learning and data analytics. Hence, these benefits place cloud-based AI as the go-to option and a stronghold in the market as more enterprises seek agility, cost savings, and speedy rollout.

By Technology

The NLP held the largest market share around 32% in 2023. NLP has become one of the largest market segments as its applications include not only understanding and analysis but also generation and representation of human language. NLP is used by businesses for customer service automation, sentiment analysis, and chatbots to improve communication between systems and people. NLP is especially useful for working with data in an unstructured format, including emails, social media posts from awareness to feedback processing, and even documents so that companies can gain insights from it. NLP consumption of large volumes of text-based data makes it indispensable for industries that rely on interaction-heavy text. NLP is here to stay as it continues to expand within the AI space with the rise of demand for smarter and more efficient communication.

By End-Use

In 2023, the IT & Telecommunications segment was responsible for holding the largest share. The early adopting nature of the IT and Telecom sectors along with the high amount of data generated by these sectors contribute towards a higher share of the market. These industries are using AI to optimize network performance, bolster cybersecurity, and automate customer service. In the age of 5G and IoT, IT and Telecom companies are continuously embedding AI to improve connection and control over complicated infrastructures. By integrating AI solutions into large-scale operations, they have become pioneers in AI technology.

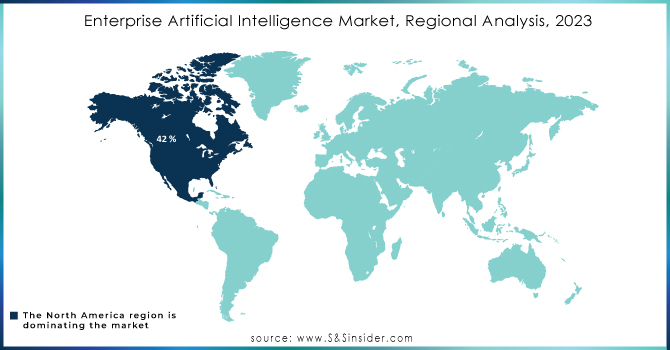

Enterprise Artificial Intelligence Market Regional Analysis

North America held the largest market share around 42% in 2023. It is owing to favorable technology infrastructure, strong investment tendency towards artificial intelligence (AI) research and development as well as early adoption from various industries. With all of the big tech companies and AI hot-shots in the European technology ecosystem i.e. Google, Microsoft, IBM, and Amazon, and their continuous research initiatives or product development efforts towards State-of-the-Art levels. A strong presence of venture capital (which the U.S. has) and government funding also push AI forward. Initiatives such as the American AI Initiative focus on enhancing research and development of artificial intelligence to make sure that the United States is leading AI search innovation worldwide. It is indeed true that industries across North America, spanning healthcare, finance, manufacturing and retail have adopted AI solutions at a breather pace than other parts of the world owing to the growing necessity for better operational efficiency, customer experience enhancement, and competitive edge over rivals. The regulatory environment in India is also a lot more agile compared to other parts of the world allowing for much faster and impactful development and adoption of enterprise AI solutions, as they have all the skills at hand. The combination of these factors also pushes North America at the forefront of the Enterprise AI Market where enterprises are Capitalizing on the region's growth with Artificial Intelligence underlining several use cases driving operational efficiency & business growth.

Need any customization research on Enterprise Artificial Intelligence Market - Enquiry Now

Key Players in Enterprise Artificial Intelligence Market

-

SAP SE (SAP AI Core, SAP Leonardo)

-

DataRobot, Inc. (DataRobot Automated Machine Learning, DataRobot MLOps)

-

Microsoft Corporation (Azure AI, Microsoft Cognitive Services)

-

Oracle Corporation (Oracle AI, Oracle Digital Assistant)

-

NVidia Corporation (NVIDIA AI Enterprise, NVIDIA Clara)

-

Amazon Web Services, Inc. (AWS) (AWS SageMaker, AWS Rekognition)

-

Intel Corporation (Intel OpenVINO, Intel Xeon Scalable Processors with AI)

-

Hewlett Packard Enterprise (HPE Ezmeral Machine Learning Ops, HPE GreenLake for AI)

-

IBM Corporation (IBM Watson, IBM Cloud Pak for Data)

-

Alphabet Inc. (Google) (Google Cloud AI, TensorFlow)

-

C3.ai, Inc. (C3 AI Suite, C3 AI CRM)

-

Wipro Limited (Wipro HOLMES, Wipro AI Studio)

-

Apple Inc. (Core ML, Siri Intelligence)

-

IPsoft Inc. (Amelia, 1Desk)

-

Salesforce, Inc. (Salesforce Einstein, Tableau AI)

-

Adobe Inc. (Adobe Sensei, Adobe Experience Platform AI)

-

ServiceNow, Inc. (Now Intelligence, Predictive Intelligence)

-

SAP HANA Cloud Services (SAP HANA Cloud, SAP Business AI)

-

Zoho Corporation (Zia, Zoho Analytics AI)

-

Alibaba Cloud (ET Brain, Alibaba AI Platform)

Recent Development:

-

In 2023, Microsoft Corporation launched Azure OpenAI Service, integrating powerful language models like GPT-4 into Azure, providing enterprises with advanced AI tools for application development.

-

In 2023, IBM Corporation released Watsonx, a new enterprise-grade AI and data platform, aimed at simplifying the building, tuning, and scaling of AI for enterprises, enhancing their data analysis capabilities.

-

In 2023, NVIDIA Corporation announced the NVIDIA DGX Cloud, allowing enterprises to access AI supercomputing capabilities via the cloud, designed for training and deploying large AI models.

| Report Attributes | Details |

| Market Size in 2023 | US$ 19.40 Billion |

| Market Size by 2032 | US$ 284.9 Billion |

| CAGR | CAGR of 34.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Deployment • By Organization Size • By Technology • By Application Area • By End-use |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | SAP SE, DataRobot, Inc., Microsoft Corporation, Oracle Corporation, NVidia Corporation, Amazon Web Services, Inc., Intel Corporation, Hewlett Packard Enterprise, IBM Corporation, Alphabet, C3.ai, Inc., Wipro Limited, Apple Inc, IPsoft Inc. |

| Key Drivers | • Organizational digitalization is becoming more prevalent. |

| Market Restraints | • A tiny number of AI experts |