Engineering Services Outsourcing Market Report Scope and Overview:

Get More Information on Engineering services outsourcing market - Request Sample Report

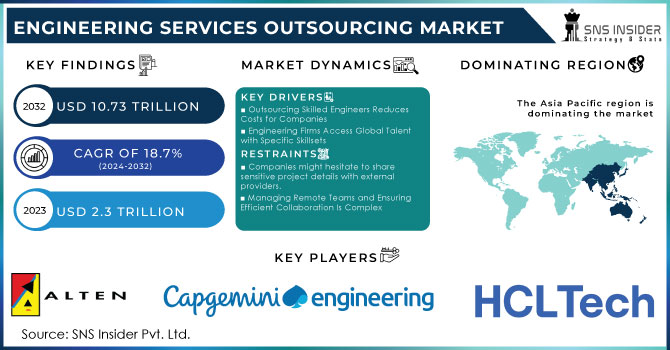

The Engineering Services Outsourcing Market size was valued at USD 2.3 Trillion in 2023. It is expected to hit USD 10.73 trillion by 2032 and grow at a CAGR of 18.7 % over the forecast period of 2024-2032.

Increasing industrial automation, along with the rising adoption of integrated solutions for analysing and designing engineering systems, represents one of the key factors driving the growth of the market. Furthermore, the widespread utilization of engineering systems, such as computer-aided design (CAD), computer-aided engineering (CAE), computer-aided manufacturing (CAM), and electronic design automation (EDA) software, is also driving market growth. This software aid in enhancing the overall efficiencies of the production processes and can be operated by the user over smartphones, laptops, and tablets. Various technological advancements and the incorporation of digital transformational services are acting as other growth-inducing factors. Other factors, including the increasing utilization of strategic outsourcing services by the automotive, marine, and offshore sectors, along with the development of 3D printing solutions, are expected to drive the market further.

There is a rise in preference for the outsourcing of engineering services among small and medium-sized engineering service providers, these services include, new product induction from conceptual design to final product development and validation, process engineering, automation, enterprise asset management, and overall business process enhancement. This attributes to witness lucrative growth of the global engineering services outsourcing market. The engineering offerings outsourcing (ESO) market is growing with developing alliances between Engineering Service Providers (ESPs) and Original Equipment Manufacturers (OEMs). This trend is supported by global R&D Developments, rising demand for modern-day technology in merchandise, and the need to shorten product lifecycles while lowering expenses. The ESO market has evolved to offer smart solutions, shifting from core engineering to embedded solutions integrating automation, analytics, and IoT. Technological advancements have also introduced Platform-as-a-Service (PaaS) models with integrated IT solutions.

Major players in the ESO market are incorporating global delivery systems into their strategies, focusing on core competencies over non-core engineering needs. The emphasis on product lifecycle development has repositioned ESPs within OEM supply chains. ESPs are enhancing service standards through comprehensive engagement portfolios and licensing frameworks that foster innovation and growth. Digitalization across industries, driven by Industry 4.0 initiatives, is boosting demand for advanced industrial solutions like robotics, AI, and ML, expanding ESP service offerings. Industries such as automotive and aerospace, requiring robust manufacturing capabilities, are key clients for digital transformation services. However, newcomers to the ESO market face challenges in establishing themselves due to limited project and technology expertise. Despite opportunities in automation and digitalization, cybersecurity remains a critical concern. Collaboration among end-user enterprises, industry verticals, and service providers involves extensive data exchange, including monitoring data, supply chain management, and quality assurance. This collaboration aims to enhance design, development, and support efficiencies across technology implementation and service delivery.

Engineering Services Outsourcing Market Dynamics

Drivers

-

Companies can get skilled engineers at lower costs as compared to in-house hiring, specially in regions with lower labour costs.

-

Engineering firms can tap into a global pool of talent with specific skillsets not readily available locally.

-

Outsourcing allows companies to quickly scale their engineering workforce up or down based on project needs.

-

Access to specialized engineering expertise that would be too expensive to maintain in-house.

Cost Reduction, Hiring and retaining professional engineers may be a required significant cost. The average annual income for a mid-level engineer within the US is approx. $100,000. This includes earnings, benefits, and overhead charges like workplace space and equipment. By outsourcing to regions with lower charges of labour, businesses can achieve savings. For example, hiring a further professional engineer in India may cost 30-50% much less. This " labour arbitrage" allows companies to stretch their budgets further and devote sources to different important areas. The global of engineering is continuously evolving, disturbing specialized skillsets in niche areas. Many companies face challenges in finding engineers with the precise qualifications they need locally. Outsourcing opens the door for a global talent pool. Platforms like Upwork and Toptal join groups with engineers from around the world, boasting expertise in specific software, technologies, or engineering disciplines. This access to numerous skill sets helps companies to fill essential gaps in their in-house team, accelerate tasks completion, and potentially improve innovation. These drivers work in tandem to unlock several benefits. Lower prices and get right of entry to specialized talent can cause quicker completion of projects, improve the quality of products, and expand profitability. A study of SNS observed that seventy 74% of companies utilizing outsourcing strategies and experience accelerated performance and productiveness.

Restraints

-

Potential for miscommunication due to time zone differences, language barriers, and cultural differences.

-

Companies might hesitate to share sensitive project details with external providers.

-

Ensuring the outsourced work meets the required quality standards can be challenging.

-

Managing remote teams and ensuring efficient project collaboration can be complex.

While engineering process outsourcing offers significant benefits, several factors can hinder smooth collaboration and project success. Communication Challenges, Bridging the gap across time zones, languages, and cultures can be a primary hurdle. A Clutch (2023) study discovered that 73% of corporations skilled communique problems whilst outsourcing software improvement initiatives. This can be even greater pronounced in engineering due to the technical nature of the work. Misunderstandings in instructions, delays due to time zone and cultural nuances differences can lead to mistakes and rework. Ensuring the outsourced work meets the quality standards of the company may be difficult. A 2022 SNS Report found that 27% of companies reported failure of projects because of inadequate quality control all through outsourcing. Factors like varying engineering practices, lack of clear quality benchmarks, and trouble in monitoring remote groups can contribute to quality-related issues. Companies may hesitate to share private confidential details or intellectual property (IP) with external providers. This may be mainly true for advanced technologies or tasks with strategic importance.

Engineering Services Outsourcing Market Segments Analysis

By Application

The manufacturing industry led the market held the revenue share of 20% and contributed USD 441 Bn in 2023. Digitalization is increasingly incorporated across diverse operational processes inclusive of drilling, blasting, crushing, and tunneling. Industrial manufacturers and producers are leveraging cloud infrastructure to modernize IT structures, improve automation, and streamline legacy operations. The companies are increasingly investing in IIOT, The Industrial Internet of Things (IIoT) guarantees decreased downtimes, more desirable fault detection and control, and lower supervision charges.

The healthcare segment grew with an annual growth rate of 18.9% during the forecast period. This growth is increasing due to increasing investments in advanced medical devices, laboratories, and prescribed drugs. Engineering Service Providers (ESPs) have seen sustained demand from various healthcare. Healthcare corporations are increasingly collaborating to enhance clinical capabilities and reduce the cost of operations. For example, Wipro Limited and Amazon Web Services (AWS) started a collaboration to innovate laboratory operations in life sciences. This cloud-based platform aims to improve the process and better collaboration among stakeholders, thus driving the growth of the engineering services outsourcing market in the coming years.

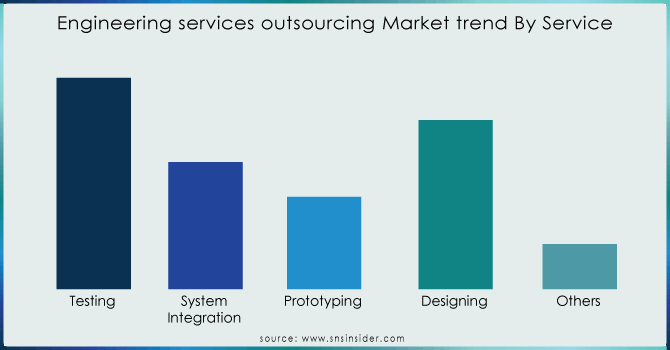

By Service

The 'testing' sub-segment is the lead market and contributed to revenue of 36% In 2023. The need for highly optimized and error-free product prototypes has driven significant growth in testing services. OEMs (original equipment manufacturers) are increasingly partnering with ESPs for software testing to ensure user-friendly interfaces and bug-free software. Additionally, the rising demand to outsource testing services for faster and reduced manual intervention is expected to fuel this segment's development.

The designing sub-segment is projected to grow at a notable compound annual growth rate (CAGR) of 19.13% during the forecast period. This growth is driven by the increasing complexity of designs and the desire to cut costs by outsourcing design work to skilled yet cost-effective professionals. There is a rising trend in industrial, graphic, and architectural design for advanced logistics solutions and tools, which is expected to drive demand for innovative engineering services in the coming years.

Need any customization research on Engineering services outsourcing market - Enquiry Now

By Location

The on-shore segment held more than 55% of the market revenue in 2023 and is projected to maintain its dominance from 2024 to 2032. Political, geopolitical, time zone and cultural obstacles lead OEMs to prefer domestic engineering outsourcing. Onshore outsourcing reduces language obstacles and enhances communication between OEMs and service providers, leading to better product and service delivery.

On the other hand, the off-shore sector is ready for substantial expansion in along with on-shore outsourcing. Elements like worldwide inflation rates, changes in currency values, expenses for training, and an increasing preference for domestic partners all play a part in this expansion. ESPs in international outsourcing contracts must follow various regulatory frameworks. Access to affordable resources and a qualified labor force in countries such as China, India, Malaysia, and Mexico is driving growth in the off-shore sector. The availability of affordable resources and talented employees in nations like China, India, Malaysia, and Mexico is powering the expansion of the offshore industry.

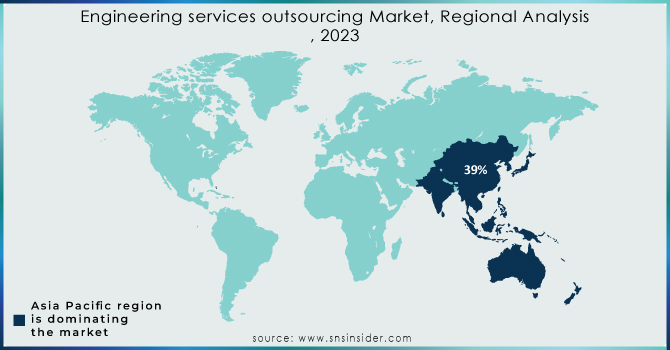

Engineering Services Outsourcing Market Regional Insights

Asia Pacific captured a revenue share of more than 39% of the worldwide market, driven by way of its robust industrial goods production industries and skilled engineering expert's availability in low cost. Countries like South Korea, Australia, Indonesia, and the Philippines have played a major role in the region's dominance. South Korea, acknowledged for its advanced technological infrastructure, specifically in the electronics and automobile industries, draws widespread outsourcing contracts. Australia's growing engineering sector and business environment are also well-suited for outsourcing. The region's growth driven by using increasing demand for technological innovation and integration of embedded software programs in contemporary models.

Europe's engineering service outsourcing (ESO) market is growing with a promising compound annual growth rate (CAGR) of 18.77%. The region's strategic area evolved infrastructure, and skilled group of workers appeal to a growing quantity of outsourcing sports. Spain, specifically, offers aggressive value advantages as compared to other Western European countries, enhancing its attraction for outsourcing contracts. Strong business skills, technological advancements, and a focus on sustainability in addition contribute to the ESO marketplace's expansion in Europe.

South America is poised for rapid increase with a projected CAGR exceeding 18.78% during the forecast period. It is now a top choice for American manufacturers and suppliers looking to outsource, drawing in big companies wanting to set up a presence in the area. South America's appeal as a market for both sides is boosted by factors like its consistent wage inflation and efficient outsourcing processes compared to other offshore destinations.

Key Players in Engineering Services Outsourcing Market

The major players in the market are HCL Technologies Limited, Alten Group, Capgemini Engineering, AKKA, Entelect, Pactera Technology International Ltd., M Group, Aricent Group, Infosys Limited, Tata Elxsi, Fareva, Tata Consultancy Services Limited., Tech Mahindra Limited, Wipro Limited, and others in the final report.

Recent Developments

-

January 2024, Albertsons Media Collective partnered with Capgemini Engineering to enhance its operations. This collaboration focuses on services such as media planning, operations, and content creation. Capgemini will leverage intelligent process automation technology, including AI and robotic process automation, to automate media planning, activation workflows, creative versioning, and optimize live campaign insights.

-

In September 2023, the Alten Group finalized its acquisition of Accord Global Technology Solutions, an engineering services firm based in India. This strategic merger combines Alten’s scale and technological breadth with Accord Global Technology Solutions’ expertise in digital innovation. The acquisition aims to strengthen engineering capabilities and drive technological advancements.

-

August 2023 noticed BrainChip and Tata Elxsi coming together to increase intelligent, electricity-green solutions. Their partnership specializes in integrating Akida technology into medical devices and industrial packages, leveraging BrainChip’s digital neuromorphic technology.

-

In February 2023, Tech Mahindra and the Ministry of Communication and Information Technology (MCIT) of Saudi Arabia signed an MoU to establish a Data and AI and Cloud Centre of Excellence (CoE). The CoE pursuits to enhance small and medium agencies, decorate high-tech knowledge, and create quality task opportunities with the aid of integrating academic and socioeconomic objectives.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.3 Trillion |

| Market Size by 2032 | US$ 10.73 Trillion |

| CAGR | CAGR of 18.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Designing, System Integration, Prototyping, Testing, Others) • By Application (Aerospace, Automotive, Manufacturing, Consumer Electronics, Semiconductors, Healthcare, Telecom, Energy & Utilities, Construction & Infrastructure, Others) • By Location (On-shore, Off-shore) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | HCL Technologies Limited, Alten Group, Capgemini Engineering, AKKA, Entelect, Pactera Technology International Ltd., M Group, Aricent Group, Infosys Limited, Tata Elxsi, Fareva, Tata Consultancy Services Limited., Tech Mahindra Limited, Wipro Limited |

| Key Drivers | • Engineering firms can tap into a global pool of talent with specific skillsets not readily available locally. • Outsourcing allows companies to quickly scale their engineering workforce up or down based on project needs. |

| RESTRAINTS | • Ensuring the outsourced work meets the required quality standards can be challenging. • Managing remote teams and ensuring efficient project collaboration can be complex. |