Engineered Plastics Market Report Scope & Overview:

The Engineered Plastics Market Size was valued at USD 128.49 billion in 2025 and is expected to reach USD 225.80 billion by 2035 and grow at a CAGR of 5.80% over the forecast period 2026-2035.

The electrical and electronics industry is a major driver for the engineered plastics market. It also majorly drives the market due to its remarkable insulating properties, flame retardance, and high durability, making it a more suitable product inside an electronic gadget. For consumer electronics, smart devices, and electrical components where safety and performance are a prime concern engineered plastics are the best selection.

Recent developments highlight the growing demand in this sector. For instance, in 2023, companies like BASF and SABIC introduced new high-performance engineered plastics tailored for electrical applications, such as fiber optics and electrical connectors. These materials offer improved heat resistance and mechanical strength, essential for modern electronic devices.

In 2024, BASF launched a new type of Ultramid Advanced N, a high-performance polyamide created for application in electronics and electrical parts. This new grade provides improved heat resistance and mechanical stability, meeting the growing need for long-lasting and secure materials in the fast-expanding electronics industry.

Market Size and Forecast:

-

Market Size in 2025E USD 128.49 Billion

-

Market Size by 2035 USD 225.80 Billion

-

CAGR of 5.80% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

Get more information on Engineered Plastics Market - Request Sample Report

Engineered Plastics Market Trends:

-

Increasing adoption of engineered plastics in medical devices due to biocompatibility, sterilizability, and stiffness.

-

Regulatory approvals, such as FDA clearance for PEEK and medical-grade polycarbonate, boosting confidence in medical use.

-

Growth in 3D printing applications with engineered plastics enabling personalized implants and faster production.

-

Rising R&D investments in healthcare innovation driving material advancements.

-

Emphasis on advanced materials by healthcare authorities to enhance patient outcomes.

The U.S. Engineered Plastics market size was valued at an estimated USD 45.80 billion in 2025 and is projected to reach USD 73.19 billion by 2035, growing at a CAGR of 4.8% over the forecast period 2026–2033. Market growth is driven by increasing demand from the automotive, aerospace, electronics, and medical device industries due to the superior mechanical, thermal, and chemical properties of engineered plastics. Rising adoption of lightweight and durable materials for fuel efficiency, electronic miniaturization, and high-performance applications further accelerates market expansion. Additionally, continuous innovations in polymer formulations, growing use of sustainable and bio-based plastics, and strong participation from key U.S. manufacturers support the steady growth outlook of the U.S. engineered plastics market during the forecast period.

Engineered Plastics Market Growth Drivers:

Advancements in Medical applications drive the market growth.

Rising demand from the engineered plastics market due to increasing acceptance in medical applications, fueled by its biocompatibility as well as sterilizability and stiffness that are indispensable for the manufacture of medical devices. The U.S. Food and Drug Administration has approved the use of various engineered plastics such as Polyether Ether Ketone and medical-grade polycarbonate for the safety, and performance they offer to medical devices developed using them. For instance, in 2023, One major new offering was a PEEK-based material specially tailored for making 3D printing medical implant parts which helps in personalized implants and reduces the manufacturing time.

Engineered Plastics Market Restraints:

Fluctuation in the cost of raw materials restrains market growth.

Changes in the price of raw materials greatly inhibit the expansion of the engineered plastics industry. Crude oil, a key ingredient for numerous plastics, can experience fluctuating prices because of geopolitical tensions, disruptions in the supply chain, and shifts in global demand. These fluctuations in prices may raise manufacturing expenses, posing challenges for manufacturers in keeping pricing and profitability stable. Consequently, growth in the market is limited, particularly in sectors such as automotive and electronics, which rely on cost-effectiveness to stay competitive. This fluctuation also affects extended agreements and financial strategy, posing additional obstacles to market stability.

Engineered Plastics Market Segment Analysis:

By Type

Acrylonitrile Butadiene Styrene segments held the largest market share market around 42.45% in 2025. Its exceptional balance of properties, including outstanding impact resistance, excellent chemical compatibility, and facile processing, has propelled it to the forefront. ABS's ability to maintain dimensional stability under various conditions further enhances its appeal. As a result, it finds extensive application across sectors such as automotive, electronics, appliances, and construction. Moreover, it is tough, chemical resistant, easy to process, and dimensionally stable for a wide range of applications. The presence of these characteristics, combined with the superiority it represents at low cost have positioned ABS as a leading engineering plastic across other demand and use. Thus, it boosts the demand in the market.

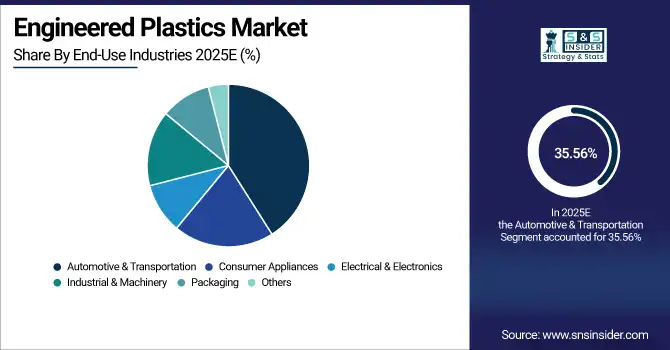

By End-Use Industries

The automotive & transportation held the largest market share around 35.56% in 2025. because they are used in massive quantities to improve a multitude of automobile performance, safety, and fuel efficiency attributes. These are made of engineered plastics like polycarbonate and polyamide due to their lightweight nature that helps in cutting down the weight of an entire vehicle therefore giving rise to better fuel efficiency. In addition, they provide a combination of high strength and stiffness with low weight at competitive cost performance plus features including improved durability or impact resistance compared to incumbent solutions as well as production benefits such as extra design flexibility all key advantages for automotive components from interior panels and bumpers through to under-the-hood parts.

Engineered Plastics Market Regional Analysis:

North America Engineered Plastics Market Insights

Asia Pacific held the highest market share in the engineered plastics market at about 46.56% in 2025. The leading market in the engineered plastics market is followed by Asia-Pacific due to the robust industrial base as well as rapid economic growth. The leading contributors, however, driven by their large automotive, electronics, and construction sectors will be countries like China, India, or Japan. This region holds significant strength in manufacturing and technology development, which makes it the largest hub for engineered plastics production & consumption. The rapid urbanization and infrastructure development in China also drive demand for these materials, while the growth of the automotive and electronics industries is a factor in widening market opportunities in India. The relatively low production costs in the region, as well as supportive government policies on industrial growth and innovation, ensure that it commands a competitive edge within the global marketplace. Asia-Pacific region's strength in both industrial demand, economic growth, and strategic investments makes the biggest contribution towards driving the engineered plastics market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Asia Pacific Engineered Plastics Market Insights

The Asia Pacific engineered plastics market is witnessing strong growth, fueled by expanding automotive, electronics, and medical industries. Rapid industrialization, urbanization, and increasing adoption of lightweight materials for fuel efficiency and sustainability drive demand. Countries like China, India, Japan, and South Korea lead consumption, supported by strong manufacturing bases. Additionally, rising consumer electronics penetration and healthcare innovations enhance market potential, positioning the region as a global hub for engineered plastics innovation and production.

Europe Engineered Plastics Market Insights

Europe represents a mature market for engineered plastics, driven by stringent environmental regulations, sustainability initiatives, and innovation in automotive and aerospace sectors. The region focuses on lightweight, high-performance materials to reduce emissions and meet regulatory standards. Demand from medical technology, renewable energy, and electric vehicles further supports growth. Strong R&D activities, combined with regulatory support for recycling and advanced materials, make Europe a leader in specialty applications. Germany, France, and the U.K. are central contributors to this evolving market.

Latin America (LATAM) and Middle East & Africa (MEA) Engineered Plastics Market Insights

The LATAM and MEA engineered plastics market is steadily expanding, supported by industrial development, infrastructure growth, and increasing adoption in automotive and construction sectors. In Latin America, countries like Brazil and Mexico are driving consumption with growing automotive manufacturing and consumer electronics demand. In the Middle East and Africa, rising investments in healthcare, oil & gas, and packaging industries stimulate usage. Although adoption levels are lower compared to Asia and Europe, these regions hold significant untapped potential for long-term market growth.

Engineered Plastics Market Key Players:

-

LANXESS AG (Germany)

-

BASF SE (Germany)

-

Mitsubishi Chemical Holdings Corporation (Japan)

-

Evonik Industries AG (Germany)

-

The Dow Chemical Company (US)

-

Solvay S.A. (Belgium)

-

LG Chem Ltd.

|

Report Attributes |

Details |

|---|---|

| Market Size in 2025 | USD 128.49 Billion |

| Market Size by 2035 | USD 225.80 Billion |

| CAGR | CAGR of 5.80% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By type (Acrylonitrile Butadiene Styrene, Polyamide, Polycarbonate, Thermoplastic Polyester, Polyacetal, Fluoropolymer, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

|

Company Profiles |

SABIC (Saudi Arabia), LANXESS AG (Germany), Covestro AG (Germany), BASF SE (Germany), Mitsubishi Chemical Holdings Corporation (Japan), Celanese Corporation (US), Evonik Industries AG (Germany), The Dow Chemical Company (US), Solvay S.A. (Belgium), LG Chem Ltd. |