Energy Trading And Risk Management Market Report Scope And Overview:

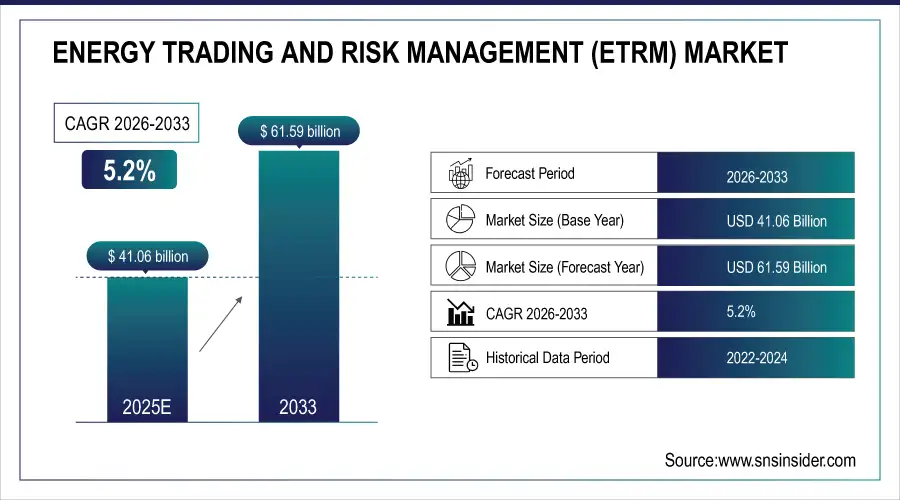

The Energy Trading and Risk Management (ETRM) Market was USD 41.06 billion in 2025E, projected to reach USD 61.59 billion by 2033, growing at a CAGR of 5.2% in the forecasted period 2026-2033.

The Energy Trading and Risk Management (ETRM) market is expected to experience steady growth. A number of important factors are responsible for this expansion. Firstly, the increasing complexity of the energy sector, with fluctuating prices and diverse energy sources like renewables, necessitates sophisticated risk management tools. ETRM systems provide real-time data analysis and portfolio optimization, enabling companies to navigate this volatility. Secondly, the growing adoption of renewable energy sources like wind and solar brings new challenges.

Energy Trading and Risk Management Market Size and Forecast:

-

Market Size in 2025E: USD 41.06 Billion

-

Market Size by 2033: USD 61.59 Billion

-

CAGR: 5.2% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information on Energy Trading And Risk Management Market - Request Sample Report

Key Trends in the Energy Trading and Risk Management Market:

-

Growing digitalization of energy trading operations across utilities, oil & gas companies, and power producers.

-

Increasing reliance on real-time analytics and automated trading platforms for complex commodity markets.

-

Rising integration of AI, ML, and predictive modeling to improve risk assessment and price forecasting.

-

Expansion of renewable energy portfolios driving demand for advanced hedging and volatility management tools.

-

Growing adoption of cloud-based ETRM platforms to enhance accessibility, scalability, and operational cost efficiency.

-

Higher focus on regulatory compliance and audit transparency across global energy markets.

-

Strategic partnerships between ETRM software vendors, cloud providers, and energy companies to enhance platform capabilities.

In April 2024, Allegro Development launched an upgraded cloud-native ETRM suite offering real-time risk analytics and expanded multi-commodity trading support. The update strengthens automation, improves decision-making accuracy, and helps energy traders manage increasing market volatility driven by renewable integration and geopolitical fluctuations.

The U.S. Energy Trading and Risk Management market was valued at an estimated USD 10.8 Billion in 2025E and is projected to reach USD 13.62 Billion by 2033, supported by a growing shift toward digital trading platforms and advanced risk management solutions. Rising energy market volatility, the expansion of natural gas and power trading, and increased adoption of cloud-based ETRM systems continue to fuel market growth across North America.

Energy Trading and Risk Management (ETRM) Market Drivers:

-

Growing Digitalization of Energy Markets and Rising Need for Real-Time Analytics in Trading and Risk Operations

The Energy Trading and Risk Management (ETRM) market is significantly driven by the growing digitalization of global energy markets, which increases the need for real-time insights, automated risk calculations, and advanced analytics-driven decision-making. As renewable energy integration expands, the complexity of trading operations rises due to frequent price fluctuations and increased imbalance risks. This creates a direct requirement for more intelligent, cloud-enabled ETRM platforms capable of handling multi-commodity portfolios, cross-border transactions, and regulatory reporting with greater accuracy. In addition, energy companies are adopting AI-enabled forecasting tools to reduce exposure to market volatility and enhance trade strategy execution. The increasing importance of data-driven decision models, predictive analytics, and automated compliance monitoring is further accelerating the demand for advanced ETRM systems across utilities, oil and gas firms, commodity traders, and energy retailers.

In April 2024, a leading ETRM software provider launched a next-generation cloud-native risk engine with real-time Value-at-Risk (VaR) automation, enabling faster and more precise risk visibility for energy traders.

Energy Trading and Risk Management (ETRM) Market Restraints:

-

High Deployment, Customization, and Integration Costs Restrict Adoption for Mid-Sized Energy Trading Companies

The ETRM market faces significant restraints due to the high deployment and integration costs required to implement modern, cloud-enabled platforms. Energy-trading organizations especially mid-sized firms often struggle with budget limitations that make it challenging to transition from legacy systems to advanced multi-commodity ETRM architectures. Complex modules involving automated risk calculations, regulatory reporting, forecasting, and advanced analytics demand costly customization and prolonged integration timelines. This results in long implementation cycles, intensive training requirements, and increased dependency on specialized IT support. As a result, many mid-tier companies delay digital transformation initiatives, even though legacy systems limit data accuracy, operational speed, and risk visibility. The cost burden creates a direct cause-and-effect relationship: high financial investments restrict adoption, which in turn slows modernization across smaller energy-trading participants.

For example, a Texas-based independent power trader postponed upgrading its outdated ETRM platform because integration with real-time analytics, cloud infrastructure, and compliance modules required several million dollars.

Energy Trading and Risk Management (ETRM) Market Opportunities:

-

Accelerating Renewable Energy Expansion Creates Strong Demand for Advanced ETRM Solutions Supporting Intermittency and Multi-Asset Portfolios

The global shift toward renewable energy presents a major opportunity for the ETRM market, as increasing solar, wind, and battery storage deployment introduces higher market volatility and balancing challenges. Renewable power’s intermittency drives greater uncertainty in intraday trading, imbalance settlement, and price forecasting, creating a direct need for advanced ETRM platforms capable of analyzing real-time grid conditions and optimizing multi-asset portfolios. As energy companies expand clean-energy trading desks and enter environmental certificate markets—such as carbon credits and renewable energy guarantees—the complexity of transactions increases. This results in stronger demand for AI-enabled forecasting, risk-adjusted pricing models, automated reporting, and sophisticated scenario simulations. Additionally, utilities and traders require integrated platforms that unify physical and financial trading operations, enabling better navigation of renewable-driven market fluctuations. These developments create substantial long-term growth opportunities for ETRM vendors offering cloud-based, analytics-rich solutions.

In January 2025, a major European utility deployed an advanced renewable-optimized ETRM module capable of real-time solar and wind output forecasting and automated imbalance risk calculations.

Energy Trading and Risk Management (ETRM) Market Segmentation Analysis

By Type, Services Segment Dominates the ETRM Market in 2025, While Software Segment to Record Strong Growth Through 2033

The Services segment held the dominant share of the ETRM market in 2025. This dominance is driven by the highly specialized nature of energy trading operations, which require extensive implementation, customization, integration, and continuous support services. As ETRM platforms are complex and tailored for multi-commodity trading including power, natural gas, oil, and renewables businesses rely heavily on consulting, training, and managed services to ensure smooth deployment and ongoing optimization. The increasing shift toward cloud-based ETRM environments, coupled with the need for real-time risk analytics, further accelerates demand for professional services that enable seamless system performance and compliance.

The Software segment is expected to record strong growth between 2026 and 2033. Growing market volatility, renewable energy expansion, and real-time trading requirements are increasing the need for advanced ETRM platforms offering automated risk analysis, portfolio optimization, regulatory reporting, and AI-enabled forecasting. Software upgrades and digital transformation initiatives across utilities and energy merchants will continue to propel segment growth throughout the forecast period.

By Application, Power Trading Segment Dominates the ETRM Market in 2025, Renewables Segment to Record Fastest Growth Through 2033

The Power trading segment held the dominant ETRM market share in 2025. Electricity markets experience the highest volatility due to fluctuating demand-supply conditions, grid constraints, renewable energy intermittency, and rapid price movements. As a result, energy companies, utilities, and trading houses rely heavily on ETRM platforms to manage real-time power scheduling, bidding strategies, imbalance settlement, and risk exposure. The complexity of electricity trading across day-ahead, intraday, bilateral, and balancing markets drives the continued adoption of advanced ETRM tools that support precision forecasting, automated trading workflows, and compliance with regional regulatory frameworks.

The Renewables segment is expected to witness the fastest growth from 2026 to 2033. Increasing global solar and wind integration, energy storage expansion, and rising participation in environmental certificate markets require ETRM platforms to model intermittent generation and manage volatility. The shift toward clean energy portfolios accelerates demand for ETRM systems that optimize renewable asset trading, forecast output variability, and automate carbon credit transactions, making renewables the most rapidly expanding application segment.

Energy Trading and Risk Management (ETRM) Market Regional Insights

North America Dominates the ETRM Market in 2025E

North America holds an estimated 42% share of the Energy Trading and Risk Management (ETRM) Market in 2025E, driven by advanced energy trading frameworks, rapid renewable integration, and growing reliance on real-time grid analytics. The region benefits from highly deregulated electricity markets such as PJM, ERCOT, and CAISO, which require sophisticated forecasting, bidding, and risk evaluation tools. Increasing market volatility, expanding natural gas trading, and rising participation in carbon markets further strengthen ETRM adoption across major utilities, commodity traders, and energy merchants, positioning North America as the leading region in modernized trading operations.

Do You Need any Customization Research on Energy Trading And Risk Management Market - Enquire Now

The United States dominates the regional market due to its large-scale wholesale trading volumes, advanced digital infrastructure, and widespread adoption of automated risk management systems. The country’s aggressive shift toward renewable capacity, combined with heightened demand for real-time price forecasting and regulatory compliance reporting, fuels the need for advanced ETRM solutions. Strong presence of leading ETRM software providers and rapid upgrades in data-driven decision tools reinforce the U.S. leadership in transforming energy trading workflows.

Asia Pacific is the Fastest-Growing Region in the ETRM Market in 2025E

Asia Pacific is projected to grow at an estimated CAGR of 6.8% during the forecast period, driven by rapid energy market liberalization, increased renewable generation, and rising complexity in power trading operations. The region’s transition toward competitive electricity markets, expansion of LNG trading, and large-scale adoption of solar and wind assets intensify the need for real-time forecasting, risk analytics, and portfolio optimization tools. Consequently, advanced ETRM solutions are becoming essential across utilities, IPPs, and energy producers, supporting Asia Pacific’s position as the fastest-growing ETRM market.

China is the dominating country in the region, supported by major national reforms enabling spot power markets and market-based pricing structures. China’s massive renewable capacity additions, rising carbon market participation, and digital transformation initiatives across state-owned utilities create significant demand for ETRM systems. The country’s investment in modern grid technologies, coupled with growing LNG and power derivatives trading activity, strengthens its role as the central force driving ETRM adoption across the Asia Pacific region.

Europe ETRM Market Insights, 2025

Europe held a substantial portion of the ETRM market in 2025, driven by extreme energy price volatility, increasing cross-border trading activity, and widespread implementation of renewable energy targets. Escalating electricity price volatility from geopolitical tensions increases risk exposure, compelling European traders to adopt advanced ETRM tools for operational stability. Geopolitical pressures, evolving power market structures, and strict regulatory frameworks such as EMIR and REMIT further accelerated the need for comprehensive risk management tools. Germany dominates the European ETRM landscape due to its leadership in renewable integration, strong trading infrastructure, and high reliance on advanced forecasting and risk evaluation to manage intermittent power flows. Its robust electricity market design and commitment to energy transition solidify its regional leadership.

Middle East & Africa and Latin America ETRM Market Insights, 2025

In 2025, the Middle East & Africa region experienced steady growth in ETRM adoption driven by modernization of national utilities, expansion of oil and gas trading, and rising investment in large-scale solar power projects. Countries such as Saudi Arabia and the UAE embraced digital trading platforms to optimize energy portfolios and improve long-term contract management. Latin America also saw consistent growth, led by Brazil and Chile, where increasing renewable penetration, expanding deregulated electricity markets, and digital transformation initiatives across utilities accelerated ETRM uptake. Both regions are emerging ETRM markets, gradually strengthening their trading, forecasting, and risk management capabilities to support next-generation energy systems.

Energy Trading & Risk Management (ETRM) Market Key Players:

-

OpenLink (ION Group)

-

Triple Point Technology Inc.

-

Allegro Development Corporation

-

SAP SE

-

FIS Global

-

Eka Software Solutions

-

Trayport Limited

-

Amphora Inc.

-

Enuit LLC

-

ABB Ltd.

-

Accenture PLC

-

Brady Technologies (Brady PLC)

-

IGNITE CTRM LLC

-

Energy One Limited

-

Contigo Software Limited

-

Pioneer Solutions LLC

-

Molecule Software Inc.

-

nGenue LLC

-

OATI

-

Capco

Competitive Landscape for the Energy Trading and Risk Management (ETRM) Market

OpenLink (ION Group)

OpenLink, now part of ION Group, is a globally recognized leader in ETRM and CTRM solutions serving energy, commodities, and financial markets. The company provides end-to-end trading, risk, and operations platforms that support power, gas, oil, renewables, and multi-commodity portfolios. Through its integrated architecture, OpenLink enables real-time position visibility, enterprise-wide risk analytics, and automated trade lifecycle management. Its role in the ETRM market is foundational, supporting large utilities, energy traders, and financial institutions with scalable, high-performance technology that enhances decision-making, compliance, and operational efficiency across complex trading environments.

-

In 2025, OpenLink introduced upgraded risk visualization dashboards and enhanced cloud deployment options across its ETRM suite, improving performance, analytics speed, and user workflows for enterprise customers.

Triple Point Technology Inc.

Triple Point Technology is a long-established provider of ETRM systems built for companies managing energy trading, logistics, risk, and supply chain operations. The company specializes in risk-centric solutions that integrate contract management, physical and financial trading, procurement, and regulatory compliance. Its platforms serve oil and gas firms, utilities, commodity traders, and industrial energy users. Triple Point’s role in the ETRM market centers on offering multi-commodity capabilities and robust risk modeling that help organizations navigate market volatility while optimizing trading strategies and operational efficiencies across global energy networks.

-

In 2025, Triple Point enhanced its commodity risk engine with advanced scenario modeling, enabling clients to simulate multi-market exposures and optimize hedging strategies.

Allegro Development Corporation

Allegro Development Corporation is a leading global provider of modern, cloud-enabled ETRM solutions, known for its flexible architecture, real-time analytics, and strong focus on workflow automation. The company supports power, natural gas, crude oil, LNG, NGLs, and renewables trading across front, middle, and back-office functions. Allegro’s role in the ETRM market is influential due to its intuitive user interface, modular design, and strong emphasis on risk transparency, allowing energy companies to streamline trade capture, credit and market risk, settlement, and compliance operations. Its technology is widely used by utilities and traders seeking scalable, data-driven trading systems.

-

In early 2025, Allegro released an AI-assisted trade capture module, reducing manual input errors and improving operational speed for power and gas market participants.

SAP SE

SAP SE is a global enterprise software leader offering integrated ETRM capabilities through SAP Commodity Management and SAP S/4HANA. Its solutions connect trading, procurement, logistics, financials, and risk functions within a unified enterprise ecosystem. SAP’s role in the ETRM market is substantial, providing large utilities, oil and gas firms, and industrial energy users with real-time data insights, automated risk calculations, and end-to-end operational visibility. With deep integration into ERP, finance, and supply chain modules, SAP enables organizations to manage energy exposures, streamline trade settlements, and maintain regulatory compliance while leveraging enterprise-wide analytics for improved strategic planning.

-

In 2025, SAP expanded its ETRM analytics suite with improved predictive risk modeling and enhanced integration between S/4HANA and cloud-based commodity trading modules.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | US$ 41.06 Billion |

| Market Size by 2033 | US$ 61.59 Billion |

| CAGR | CAGR of 5.2% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Software, Service) • By Application (Natural Gas Trading, Coal Trading, Power Trading, Oil Trading, Renewable Energy Trading, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | OpenLink (ION Group), Triple Point Technology Inc., Allegro Development Corporation, SAP SE, FIS Global, Eka Software Solutions, Trayport Limited, Amphora Inc., Enuit LLC, ABB Ltd., Accenture PLC, Brady Technologies (Brady PLC), IGNITE CTRM LLC, Energy One Limited, Contigo Software Limited, Pioneer Solutions LLC, Molecule Software Inc., nGenue LLC, OATI, Capco. |