To Get More Information on Energy Recovery Ventilator Market - Request Sample Report

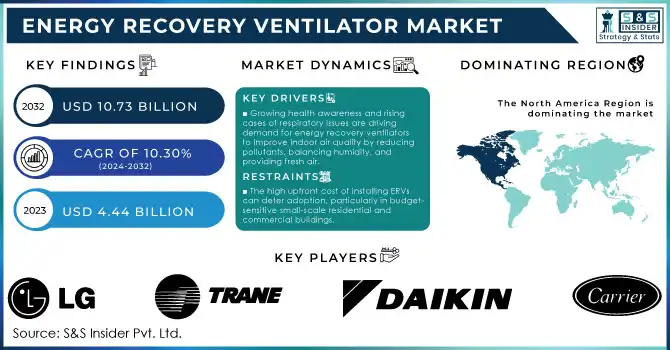

The Energy Recovery Ventilator Market size was estimated at USD 4.44 Billion in 2023 and is expected to reach USD 10.73 Billion by 2032 at a CAGR of 10.30% during the forecast period of 2024-2032.

The Energy Recovery Ventilator market, while playing an increasingly significant role in improving energy efficiency within buildings, faces several challenges that limit its broader adoption. One of the main obstacles is the high initial installation cost, which can deter consumers, particularly in the residential sector. Although Energy Recovery Ventilator offer considerable long-term energy savings, the upfront investment can be a barrier, especially in markets where the financial benefits may not be immediately apparent. In commercial buildings, the capital needed for advanced Energy Recovery Ventilator systems may require additional budget allocation, posing a challenge in regions with limited financial resources. Moreover, integrating Energy Recovery Ventilator into older buildings presents another complication. Retrofitting existing HVAC systems to accommodate Energy Recovery Ventilator can be costly and complex, requiring significant infrastructure changes, which slows adoption in older buildings or low-budget projects compared to new, energy-efficient constructions.

Another issue impacting the Energy Recovery Ventilator market is the lack of standardized regulations across regions, which adds uncertainty to the adoption process. While some areas have implemented green building codes that encourage energy efficiency, inconsistent or limited regulatory support in other regions may restrict the widespread use of energy recovery technologies. Technologically, have made significant progress, but integrating them with other smart building systems, such as IoT-enabled HVAC, still presents compatibility and interoperability challenges. Additionally, the performance of Energy Recovery Ventilator can vary in extreme climates, with temperature fluctuations impacting their effectiveness. Despite these challenges, Energy Recovery Ventilator provide substantial benefits, such as reducing heating and cooling energy costs by up to 30% to 50%, depending on factors like system design, climate, and building type. They also improve indoor air quality by filtering up to 85% of particulate matter and achieving energy recovery efficiencies of 60% to 90%. Furthermore, around 70% of LEED-certified buildings in the U.S. incorporate Energy Recovery Ventilator as part of their sustainability initiatives, and these systems can reduce HVAC loads by 15-25%, extending system lifespans and lowering maintenance costs. In extreme climates, Energy Recovery Ventilator pre-condition incoming air, cutting heating needs by up to 50%, offering significant energy savings and operational advantages.

| Feature | Description | Commercial Products |

|---|---|---|

| Energy Recovery Efficiency | Enables efficient recovery of energy from exhaust air, reducing overall energy consumption in HVAC systems. | Greenheck ERVs, Trane Energy Recovery Units |

| Indoor Air Quality Improvement | Enhances indoor air quality by exchanging stale indoor air with fresh outdoor air, removing contaminants and moisture. | Panasonic Intelli-Balance ERV, RenewAire EV Premium Series |

| Humidity Control | Maintains optimal humidity levels by transferring moisture between incoming and outgoing air streams. | Daikin Heat & Energy Recovery Ventilators, Broan ERV90S |

| Low Noise Operation | Ensures quiet operation suitable for residential and commercial settings, minimizing disruptions. | Mitsubishi Lossnay ERV, Fantech HERO Series |

| Scalability for Building Sizes | Offers scalability to suit various building sizes and requirements, from small residential units to large commercial systems. | LG ERV, Venmar AVS ERV |

| High Efficiency Heat Exchanger | Equipped with high-efficiency heat exchangers to maximize energy transfer between air streams. | Lennox Energy Recovery Ventilators, Zehnder ComfoAir Q |

| Energy-Saving Controls | Incorporates smart controls and sensors to optimize ventilation and reduce energy waste based on occupancy. | Carrier ERVs with Humidi-MiZer Technology, Honeywell TrueFRESH |

| Compact and Lightweight Design | Designed for easy installation in various building configurations, saving space and reducing structural load. | Aldes InspirAIR Compact ERV, S&P EC ERV |

| Compliance with Standards | Meets industry standards like ASHRAE 90.1 and ENERGY STAR® for energy efficiency and indoor air quality. | Ventacity Energy Recovery Ventilators, ERVs from Fujitsu |

| Ease of Maintenance | Features easy access for filter replacement and system maintenance, reducing operational downtime. | YORK Affinity ERV, Aprilaire Energy Recovery Ventilator |

DRIVERS

The growing awareness of health and the rising prevalence of respiratory issues are expected to significantly boost the Energy Recovery Ventilator (ERV) market. As air pollution and respiratory diseases like asthma, allergies, and chronic obstructive pulmonary disease (COPD) increase, the demand for clean indoor air is becoming more critical. According to research that asthma affects 262 million people globally, while COPD causes over 3 million deaths annually. This surge in respiratory issues has intensified the need for improved indoor air quality, with ERVs playing a vital role in addressing these concerns. The U.S. Environmental Protection Agency (EPA) has found that indoor air is often more polluted than outdoor air, prompting individuals and businesses to seek effective air quality solutions. ERVs are designed to filter airborne pollutants such as dust, pollen, and volatile organic compounds (VOCs), while exchanging stale indoor air for fresh outdoor air, all while conserving energy. This combination of health benefits and energy efficiency makes ERVs particularly attractive in residential and commercial spaces. Furthermore, the energy savings offered by ERVs, which can reduce heating and cooling costs by up to 30%, align with global efforts to reduce energy consumption, as buildings are responsible for a significant portion of global energy use. As the demand for cleaner air and energy-efficient solutions rises, the ERV market is set to expand, encouraging innovation and competition among manufacturers, and positioning ERVs as a sustainable choice for healthier indoor environments.

Technological advancements in Energy Recovery Ventilator (ERV) systems are significantly enhancing their efficiency and expanding their functionality, driving greater adoption across industries. Modern ERV systems are now equipped with high-efficiency heat and moisture exchange mechanisms, which allow them to transfer energy between incoming and outgoing air streams with minimal energy loss. This feature is essential in climates where maintaining stable indoor temperatures and humidity levels is critical, helping reduce the overall load on heating, ventilation, and air conditioning (HVAC) systems.

In addition to efficient energy transfer, many of today’s ERV systems include smart sensors that monitor various environmental factors such as temperature, humidity, and air quality. These sensors allow the ERV systems to adjust ventilation rates dynamically, ensuring optimal air quality while conserving energy. Integration with the Internet of Things (IoT) enables real-time performance monitoring, allowing facility managers to track and control ERV operations remotely. This IoT connectivity also allows for predictive maintenance, where the system can alert managers about potential issues before they lead to malfunctions, reducing downtime and maintenance costs. Together, these advancements make ERV systems more attractive to a wide range of industries, particularly those focused on energy efficiency and indoor air quality. From commercial buildings to healthcare facilities, the enhanced functionality of ERVs helps meet the growing demands for sustainable, energy-efficient solutions, supporting both environmental goals and cost savings. As these technologies continue to evolve, ERVs are expected to play an even larger role in modern building systems.

RESTRAIN

In the Energy Recovery Ventilator (ERV) market, the high upfront cost of installation remains a key challenge, particularly for budget-sensitive small-scale residential and commercial buildings. The installation of an ERV system can cost between USD 1,000 and USD 5,000, depending on the building size, complexity, and brand. This is significantly higher than more affordable ventilation solutions like exhaust fans, which typically cost under USD 500 for installation. While ERVs can reduce energy consumption by 10% to 30% in heating and cooling costs, the payback period for the initial investment is often between 3 to 7 years, which can be discouraging for smaller building owners who may not see immediate financial returns. Additionally, while ERVs help lower energy costs by consuming 25% to 50% less energy compared to traditional systems, the ongoing operational and maintenance costs can still be a concern. Furthermore, installing an ERV system in smaller buildings may require modifications to existing HVAC systems, further increasing the initial cost. These extra expenses can be a deterrent for those with limited budgets or space for significant upgrades. As a result, the high upfront costs associated with ERV systems, coupled with the delayed return on investment, make it difficult for smaller-scale residential and commercial properties to justify the expense despite the long-term energy efficiency benefits.

By Type

The ceiling-mount segment of the Energy Recovery Ventilator (ERV) market dominated with over 42% of the market share in 2023. This type is increasingly preferred due to its cost-effectiveness and ease of installation. Ceiling-mounted ERVs leverage existing ducting and wiring systems, reducing installation costs and minimizing the disruption typically associated with wall-mounted units. The reduced invasiveness of this installation method is a significant factor driving the demand, especially in commercial and residential buildings. Ceiling-mounted ERVs also offer better integration with building design, making them suitable for spaces with limited wall space or aesthetic considerations.

By Application

In 2023, the Commercial segment led the Energy Recovery Ventilator (ERV) market, capturing over 52% of the market share. This dominance is driven by the rising demand for energy-efficient solutions across commercial buildings and spaces. Commercial facilities, such as office buildings, schools, hospitals, and retail establishments, are increasingly prioritizing both energy conservation and indoor air quality. ERVs play a crucial role in maintaining a balance between energy efficiency and ventilation by recovering energy from exhausted air and transferring it to incoming fresh air. This helps reduce heating and cooling costs, making ERVs an attractive option for businesses seeking to lower operational costs while complying with sustainability standards. As building regulations become stricter and the emphasis on green building certifications like LEED grows, the demand for ERVs in the commercial sector continues to rise, supporting the segment's growth and dominance in the market.

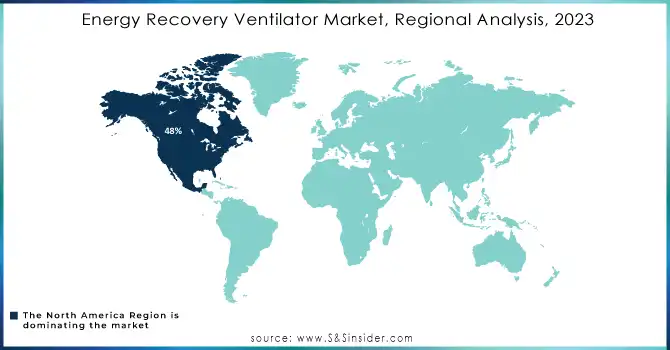

North America region dominated the market share over 48% in 2023, primarily driven by the region's strong focus on energy efficiency and enhancing indoor air quality in both residential and commercial buildings. With cities across the U.S. and Canada experiencing harsh weather conditions, including heavy snowfall, hailstorms, and hurricanes, there is a heightened need for effective ventilation solutions. These extreme climatic conditions often lead to poor indoor air quality, affecting the health and comfort of occupants. The demand for ERVs is further propelled by increasing regulations and green building initiatives aimed at reducing energy consumption. These factors combine to create a favorable environment for the growth of the ERV market in North America, as consumers and businesses look for sustainable solutions to maintain indoor air quality while improving energy efficiency.

Asia Pacific region experience the highest growth rate in the Energy Recovery Ventilator (ERV) market over the forecast period. This growth is driven by rapidly improving living standards in key emerging markets like China, India, South Korea, Malaysia, and Thailand. These countries are undergoing significant urbanization and modernization, with a focus on enhancing the infrastructure of residential and commercial buildings. As energy efficiency becomes a priority in the construction industry, there is a growing adoption of technologies such as ERVs to meet both energy-saving and air quality demands.

Do You Need any Customization Research on Energy Recovery Ventilator Market - Inquire Now

Carrier (United Technologies) – Carrier Energy Recovery Ventilators (ERVs)

Johnson Controls – YORK Energy Recovery Ventilators

Daikin Industries, Ltd. – Daikin Heat Recovery Ventilators (HRV)

Mitsubishi Electric Corporation – Lossnay Energy Recovery Ventilator

Trane – Trane ERV Systems (Thermal and Energy Recovery Ventilators)

LG Electronics – LG ERV (Energy Recovery Ventilation Systems)

Nortek Air Solutions, LLC – Nortek ERV Units (Venmar and Broan brands)

Lennox International Inc. – Lennox HRV/ERV Systems

Greenheck – Greenheck Energy Recovery Ventilators

Fujitsu Limited – Fujitsu Energy Recovery Ventilators

Zehnder Group – Zehnder ComfoAir Energy Recovery Ventilators

Vent-Axia – Vent-Axia HRV (Heat Recovery Ventilators)

Renewaire – Renewaire ERVs and HRVs

Broan-NuTone LLC – Broan ERVs and HRVs

Airxchange, Inc. – Airxchange Energy Recovery Ventilators

Panasonic Corporation – Panasonic ERV (Energy Recovery Ventilation Systems)

Swegon – Swegon Gold and Gold RX ERVs

Koch Industries, Inc. – Koch Energy Recovery Ventilators

Daikin Applied – Daikin Applied ERV and HRV Systems

Robur S.p.A. – Robur Energy Recovery Systems

Suppliers for Famous for high-performance energy recovery ventilation systems for residential and commercial buildings of Energy Recovery Ventilator Market

Zehnder Group

Venmar Ventilation

Panasonic Corporation

Lennox International

Carrier Corporation

Trane Technologies

Daikin Industries

Fantech

Broan-NuTone LLC

S&P USA Ventilation Systems

In February 2024: Panasonic has launched the WhisperComfort 60 Energy Recovery Ventilator (ERV), designed for residential construction and remodeling projects. It provides balanced ventilation with customizable airflow, using powerful DC motors and MERV 13 filters for improved indoor air quality. The ERV features a heat recovery core for energy efficiency and moisture control. It's HVI certified for sound and energy recovery, suitable for wall or ceiling installation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.44 Billion |

| Market Size by 2032 | USD 10.73 Billion |

| CAGR | CAGR of 10.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Wall-Mount, Celling-Mount, Cabinet) • By Application (Residential, Commercial, Others (Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Carrier (United Technologies), Johnson Controls, Daikin Industries, Ltd., Mitsubishi Electric Corporation, Trane, LG Electronics, Nortek Air Solutions, LLC, Lennox International Inc., Greenheck, Fujitsu Limited, Zehnder Group, Vent-Axia, Renewaire, Broan-NuTone LLC, Airxchange, Inc., Panasonic Corporation, Swegon, Koch Industries, Inc., Daikin Applied, Robur S.p.A. |

| Key Drivers | • Growing health awareness and rising cases of respiratory issues are driving demand for energy recovery ventilators to improve indoor air quality by reducing pollutants, balancing humidity, and providing fresh air. • Modern ERV systems, with advanced features like high-efficiency energy exchange, smart sensors, and IoT compatibility, are increasingly efficient and versatile, boosting their adoption across industries. |

| RESTRAINTS | • The high upfront cost of installing ERVs can deter adoption, particularly in budget-sensitive small-scale residential and commercial buildings. |

Ans: The Energy Recovery Ventilator Market is expected to grow at a CAGR of 10.30% during 2024-2032.

Ans: The Energy Recovery Ventilator Market was USD 4.44 Billion in 2023 and is expected to Reach USD 10.73 Billion by 2032.

Ans: Growing health awareness and rising cases of respiratory issues are driving demand for energy recovery ventilators to improve indoor air quality by reducing pollutants, balancing humidity, and providing fresh air.

Ans: The “ceiling-mount” segment dominated the Energy Recovery Ventilator Market.

Ans: North America dominated the Energy Recovery Ventilator Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Manufacturing Output, by Region, (2020-2023)

5.2 Utilization Rates, by Region, (2020-2023)

5.3 Maintenance and Downtime Metrix

5.4 Technological Adoption Rates, by Region

5.6 Export/Import Data, by Region (2023)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Energy Recovery Ventilator Market Segmentation, By Type

7.1 Chapter Overview

7.2 Wall-mount

7.2.1 Wall-mount Market Trends Analysis (2020-2032)

7.2.2 Wall-mount Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Ceiling-mount

7.3.1 Ceiling-mount Market Trends Analysis (2020-2032)

7.3.2 Ceiling-mount Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Cabinet

7.4.1 Cabinet Market Trends Analysis (2020-2032)

7.4.2 Cabinet Labelers Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Energy Recovery Ventilator Market Segmentation, By Application

8.1 Chapter Overview

8.2 Residential

8.2.1 Residential Market Trends Analysis (2020-2032)

8.2.2 Residential Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Commercial

8.3.1 Commercial Market Trends Analysis (2020-2032)

8.3.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Others (Industrial)

8.4.1 Others (Industrial) Market Trends Analysis (2020-2032)

8.4.2 Others (Industrial) Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America Energy Recovery Ventilator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.4 North America Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.5.2 USA Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.6.2 Canada Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Mexico Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe Energy Recovery Ventilator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.5.2 Poland Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.6.2 Romania Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.7.2 Hungary Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.8.2 Turkey Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe Energy Recovery Ventilator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.4 Western Europe Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.5.2 Germany Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.6.2 France Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.7.2 UK Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.8.2 Italy Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.9.2 Spain Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.12.2 Austria Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific Energy Recovery Ventilator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.4 Asia-Pacific Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 China Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 India Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.5.2 Japan Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.6.2 South Korea Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.2.7.2 Vietnam Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.8.2 Singapore Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.9.2 Australia Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East Energy Recovery Ventilator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.4 Middle East Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.5.2 UAE Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.6.2 Egypt Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.8.2 Qatar Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa Energy Recovery Ventilator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.4 Africa Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.5.2 South Africa Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America Energy Recovery Ventilator Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.4 Latin America Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.5.2 Brazil Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.6.2 Argentina Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.7.2 Colombia Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America Energy Recovery Ventilator Market Estimates and Forecasts, By Type (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America Energy Recovery Ventilator Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.1 Carrier (United Technologies)

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Johnson Controls

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Daikin Industries, Ltd.

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Mitsubishi Electric Corporation

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 Trane

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 LG Electronics

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Nortek Air Solutions, LLC

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Lennox International Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Greenheck

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Fujitsu Limited

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Type

Wall-mount

Ceiling-mount

Cabinet

By Application

Residential

Commercial

Others (Industrial)

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Hygienic Pumps and Valves Market Size was esteemed at USD 2.16 billion in 2023 and is supposed to arrive at USD 3.17 billion by 2031, and develop at a CAGR of 4.91% over the forecast period 2024-2031.

The Oil Water Separator Market was estimated at $ 2.70 billion in 2023 and is expected to arrive at $ 3.92 billion by 2032 at a CAGR of 4.23% from 2024-2032.

The Micromachining Market Size was valued at USD 3 Billion in 2023 and is now anticipated to grow $9.19 Billion by 2031, with a CAGR of 5.26% by 2024-2031.

The Smart Factory Market size was valued at USD 116.50 Billion in 2023. It is expected to grow to USD 285.65 Billion by 2032 and grow at a CAGR of 10.50 % over the forecast period of 2024-2032.

Gas Analyzer, Sensor & Detector Market was estimated at USD 4.31 Bn in 2023 and is expected to reach USD 7.40 Bn by 2032, growing CAGR of 6.19% from 2024-2032.

The Electrical Equipment Market was valued at USD 276.89 Billion in 2023, and it is expected to reach USD 312.40 Billion by 2032, registering a CAGR 1.35% of from 2024 to 2032.

Hi! Click one of our member below to chat on Phone