Get More Information on Energy Management Systems Market - Request Sample Report

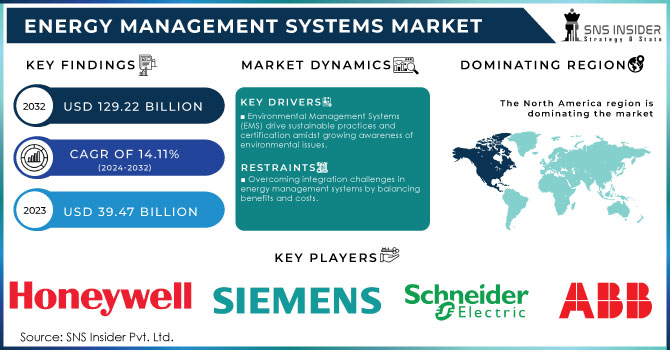

The Energy Management Systems Market size was valued at USD 39.47 Billion in 2023. It is estimated to reach USD 129.22 Billion by 2032, growing at a CAGR of 14.11% during 2024-2032.

The energy management systems (EMS) market has seen significant growth as organizations increasingly seek to optimize their energy usage and reduce costs. These systems offer immediate information on energy usage, pinpoint inefficiencies, and empower informed decisions on energy consumption. One primary factor driving the EMS market's expansion is the increasing understanding of environmental sustainability and the necessity for organizations to lessen their carbon footprint. Governments and regulatory agencies around the globe are implementing more stringent energy efficiency guidelines and rules, leading to an increased uptake of EMS solutions. Significant funding and investments have been made by the U.S. government for the development of EMS. In 2023, the Department of Energy (DOE) at the federal level has been a significant contributor, with the Office of Energy Efficiency and Renewable Energy (EERE) providing approximately USD 4 billion per year for energy efficiency initiatives, including EMS. The American Recovery and Reinvestment Act (ARRA) of 2009 provided major funding for smart grid technologies with a USD 4.5 billion smart grid investment grant program and USD 3.1 billion through the state energy program. In 2023, the Infrastructure Investment and Jobs Act (IIJA) upheld this pattern by allocating significant funds for energy efficiency and conservation initiatives. Companies in different industries are utilizing these systems to meet regulations, reach sustainability targets, and save money by enhancing energy management.

Energy management systems are vital in maximizing energy usage within the industrial sector as manufacturing plants frequently use big machinery and equipment that require substantial amounts of energy. In 2023, around 50% of the major manufacturing companies in the United States have implemented EMS, with smaller and mid-sized firms also showing a significant rise in adoption. As stated by the U.S. Department of Energy, companies that adopt EMS can save 15% on energy each year, leading to significant cost savings and better operational effectiveness. For instance, General Electric's Digital Wind Farm initiative uses EMS to improve energy production efficiency by 10%, and Siemens' Smart Infrastructure division utilizes EMS to simplify energy management across various sites, leading to a 15% decrease in total energy consumption. Furthermore, EMS solutions can help in incorporating renewable energy sources like solar or wind power by managing their inputs together with conventional energy sources.

Drivers

Environmental Management Systems (EMS) drive sustainable practices and certification amidst growing awareness of environmental issues.

The EMS market is driven by the growing awareness of environmental issues and the need for sustainable practices. As the concern for ‘global warming’, pollution, and depletion of resources soar, organizations are under increased pressure to establish eco-friendly practices that are aimed at lowering greenhouse gas emissions and reducing their environmental footprint. Hence, based on this scenario, helps organizations to meet sustainability goals. As it lowers the consumption of energy resources and reduces waste, EMS results in lowering greenhouse gas emissions and therefore, helps the organizations to have a reduced environmental footprint. As a part of CSR goals such as GO Green, an EMS solution is of prime importance. On the other hand, with a focus on sustainability and increased concern for the environment, organizations are looking for certification to do the same. In the process, the focus on environmental-friendly practices is an addition to the manufacturing and business requirements of modern-day organizations that help their products and services to meet the expectations of customers, who are more aware of the consequences of global warming.

Government policies and regulations driving the adoption of energy management systems as a global perspective on compliance and incentives.

Government policies and regulations promoting energy efficiency and sustainability play an equally important role as other drivers. Numerous countries have already imposed rather stringent regulations to cut down energy consumption and reduce greenhouse gas emissions, which, in turn, has provided a solid background for EMS to be implemented. For instance, there are regulations such as the Energy Efficiency Directive in the European Union and the Energy Policy Act in the United States, with many other countries having their counterparts. All of these docs require that proper energy management and periodic reporting be implemented. In many cases, the state provides certain incentives, subsidies, and tax benefits for companies investing in energy-efficient equipment, tools, and software. In addition, many international agreements and obligations such as the Paris Agreement made it clear that the signatory countries have to reduce their carbon emissions, and it is up to each government on how to incentivize the legal entities to adopt EMS. Therefore, even if the adopted regulations do not require energy management software to be used, it is still a strategy for many companies to stay ahead of the curve and invest in modern EMS solutions to be fully compliant in the potential future.

Restraints

Overcoming integration challenges in energy management systems by balancing benefits and costs.

The market can be hindered due to the complexity of integration and implementation of EMS. It is viable to integrate any energy management system with the existing infrastructure of any organization, and technologies, possessing a plethora of both advantages and weak points. The former implies data integration and its compatibility with other platforms and devices, as well as the necessity of hiring personnel with the required qualifications in the field. The way to perform the integration is liable for simplification, including the addition of a supervisory program together with time slides, giving administrators time to come up with a possible conclusion, thus avoiding any abrupt disturbances to technologies and networking. The downside, however, remains the need for EMS customization surrounding specific customers’ requirements, which can increase the cost of implementation and effectiveness.

Addressing data security and privacy concerns by ensuring compliance and protection against cyber threats.

One of the major restraints for the EMS market is related to data security and privacy concerns. Energy management systems are used to collect, generate, and process data regarding energy consumption, assets operations, devices, and users. The management and security of this data are crucial since broken data protections could result in unauthorized access, data leakage, or data misappropriations. Before acquiring an energy management system, the organization should ensure that data security is compliant with data protection requirements and that the operator has implemented relevant systems and measures that secure the data from various cyber threats or violations. When the organization is not confident in these issues, it is reluctant to adopt an EMS system due to potential data security breaches. This issue could be addressed by paying more attention to security features, constant auditing, and updating of EMS systems according to the best practices and in compliance with standards.

By Type

The industrial energy management systems (IEMS) segment dominated in 2023 with over 65% because of the high energy needs and possible cost reductions in manufacturing, oil and gas, and other sectors. IEMS solutions assist industrial facilities in maximizing energy efficiency, cutting operational expenses, and meeting strict environmental guidelines. For example, Siemens' SIMATIC Energy Manager allows for monitoring energy consumption in real-time in industrial facilities, assisting in reducing expenses and emissions. The EMS market is led by the industrial sector's ongoing emphasis on sustainability and energy efficiency.

The home energy management systems (HEMS) are accounted to have a rapid growth rate during the forecast period. HEMS solutions enable homeowners to supervise and manage energy usage using connected devices such as smart thermostats, lighting, and appliances. Key players in the HEMS market, such as Google Nest and Honeywell, offer products that can easily be integrated into home networks. For example, the thermostat from Google Nest changes energy usage depending on how many people are in the house, which has made it a well-liked application in the expanding smart home industry.

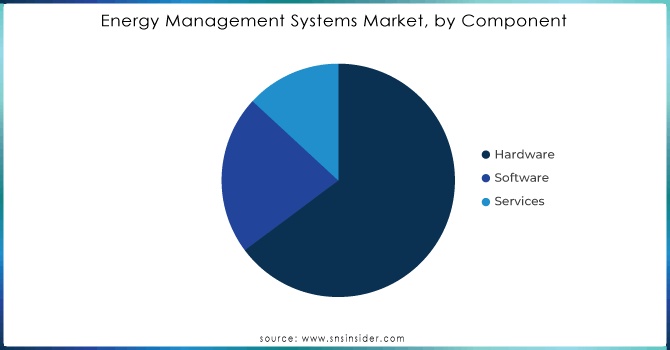

By Component

The hardware segment held a market share of 60% in 2023 and led the market. This is because hardware components like sensors, meters, controllers, and smart devices form the backbone of any energy management system. These components enable real-time data collection, monitoring, and control of energy use, making them indispensable in industrial, commercial, and residential applications. For instance, Schneider Electric provides hardware solutions such as energy meters and IoT sensors, which are integral to energy-saving operations in manufacturing plants.

The software segment is the fastest-growing in the EMS market from 2024-2032. Software solutions, such as energy analytics platforms, allow for deeper insights into energy usage patterns, facilitating predictive maintenance, optimization, and regulatory compliance. Cloud-based energy management software, like Siemens' Desigo CC, enables remote monitoring and real-time data analytics, offering businesses the flexibility to manage energy consumption efficiently.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Deployment

The on-premises segment had a major market share of 55% in 2023 as it allows businesses to have more oversight of their energy data and infrastructure. Organizations choose on-premises EMS for strict data privacy rules and sectors like manufacturing and utilities needing direct energy system control. It offers great flexibility, enabling businesses to customize solutions to fit their specific requirements, particularly when managing substantial energy usage. Siemens Desigo CC is an extensive on-site EMS used by big buildings to enhance energy usage, cut expenses, and fulfill compliance standards.

The cloud segment is to become the fastest-growing segment during the forecast period because of its ability to scale, adapt, and minimize initial expenses. Cloud-based EMS provides real-time monitoring and analytics, enabling businesses to remotely access data, optimize energy usage, and lower operational expenses. Cloud EMS solutions are popular among SMEs and companies with multiple sites because they are easy to deploy and require minimal hardware. Organizations frequently use Schneider Electric’s EcoStruxure, a cloud-based platform for managing energy, to easily, remotely, and affordably handle energy needs.

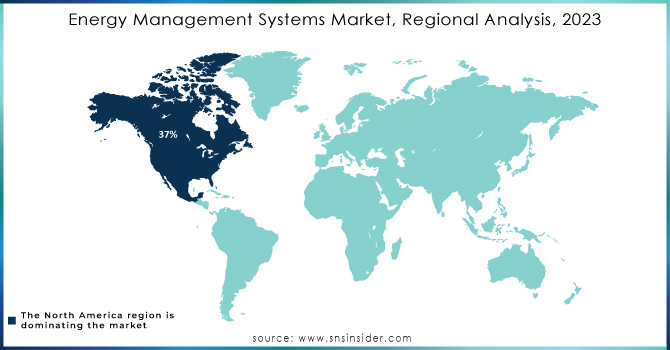

North America led the energy management systems (EMS) market in 2023 with a 37% market share because of its advanced technology and supportive energy efficiency regulations. Both the United States and Canada play important roles by providing encouragement and requirements to implement energy-efficient systems. High levels of energy usage in the industrial and commercial sectors in the region lead to a need for EMS solutions in various industries such as manufacturing, retail, and data centers. Honeywell and Johnson Controls are important participants, offering combined EMS solutions to enhance energy efficiency in commercial buildings and industrial sites.

Asia-Pacific is going to experience rapid growth during 2024-2032 due to fast urbanization, industrialization, and rising energy consumption. Nations such as China, India, and Japan are making significant investments in smart grid infrastructure and sustainable energy solutions to address increasing energy needs and environmental guidelines. Government efforts in APAC to decrease carbon emissions and encourage the adoption of renewable energy are driving growth in the region. Major companies such as Siemens and ABB offer EMS solutions for overseeing energy distribution and consumption in significant undertakings like smart cities and renewable energy farms.

The key players in the Energy Management Systems market are:

Siemens (Desigo CC, Sentron Power Manager)

Schneider Electric (EcoStruxure Power, PowerLogic ION9000)

General Electric (GE) (GE Digital Energy, GE Grid Solutions)

Honeywell (Honeywell Forge, Energy Manager)

Johnson Controls (Metasys, BCPro)

ABB (ABB Ability Energy Manager, OPTIMAX)

Emerson (DeltaV, Ovation)

Rockwell Automation (FactoryTalk EnergyMetrix, PowerFlex Drives)

Eaton (Power Xpert, Foreseer)

IBM (TRIRIGA, Maximo Asset Management)

Siemens Gamesa (SgREg, EnergyThru)

Delta Electronics (DeltaGrid EMS, Delta Energy Online)

Honeywell International (Building Management Solutions, Tridium)

Mitsubishi Electric (EneScope, EcoWebServer III)

Enel X (JuiceNet, EMS Virtual Power Plant)

GridPoint (GridPoint Energy Manager, Advanced Energy Storage)

Panasonic (Smart Energy Gateway, RESU Home Battery)

Cisco (EnergyWise, Connected Grid)

Huawei (FusionSolar Smart PV, eM3000 Smart Meter)

Legrand (Energy Intelligence, WattStopper)

June 2024: Advancing its commitment to bringing smart, sustainable technologies to homes in the U.S. and Canada, ABB today launches the new ReliaHome Smart Panel, its first residential energy management software platform in these markets.

January 2024: Honeywell launched Advance Control for Buildings, a building management system that can use a building’s existing wiring “to give building managers more control over the efficiency of their buildings.

July 2024: GreenPowerMonitor 8 has launched an advanced Energy Management System 9 designed specifically for renewable power plants. This new tool “represents a giant leap forward in these facilities’ operational efficiency”, in sync with the global goal of increasing renewable energy capacity.

May 2024: Honeywell has made a significant update to its Forge Energy Management System, now housing AI and Big Data analytics and adding sensor and equipment controls for commercial buildings.

March 2023: Schneider Electric has introduced the EcoStruxure Energy Hub, designed to provide real-time monitoring and control of energy consumption in industrial facilities.

December 2023: ABB announced its digital suite for energy management, which is focused on facilitating the integration of renewable energy sources and IoT devices.

November 2023: General Electric presented a new improved version of Grid IQ Energy Management Software designed for utilities and power grids. It features advanced grid optimization capabilities that ensure efficient management.

October 2023: Honeywell disclosed its AI energy management system for industrial users, equipped with predictive analytics and energy forecasting functions.

| Report Attributes | Details |

| Market Size in 2023 | USD 39.47 Billion |

| Market Size by 2032 | USD 129.22 Billion |

| CAGR | CAGR of 14.11% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Industrial energy management systems (IEMS), Building energy management systems (BEMS), Home energy management systems (HEMS)) • By Component (Hardware, Software, Services) • By Deployment (Cloud, On-premises) • By End User (Residential, Energy & Power, Telecom & IT, Manufacturing, Retail, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Siemens, Schneider Electric, General Electric (GE), Honeywell, Johnson Controls, ABB, Emerson, Rockwell Automation, Eaton, IBM, Siemens Gamesa, Delta Electronics, Honeywell International, Mitsubishi Electric, Enel X, GridPoint, Panasonic, Cisco, Huawei, Legrand |

| Key Drivers | • Environmental Management Systems (EMS) drive sustainable practices and certification amidst growing awareness of environmental issues. • Government policies and regulations driving the adoption of energy management systems as a global perspective on compliance and incentives. |

| RESTRAINTS | • Overcoming integration challenges in energy management systems by balancing benefits and costs. • Addressing data security and privacy concerns by ensuring compliance and protection against cyber threats. |

Ans: The Energy Management Systems Market is expected to grow at a CAGR of 14.11% during 2024-2032.

Ans: Energy Management Systems Market size was USD 39.47 billion in 2023 and is expected to Reach USD 129.22 billion by 2032.

Ans: The rising awareness of environmental impact is the major growth factor of the Energy Management Systems Market.

Ans: The Industrial energy management systems (IEMS) segment dominated the Energy Management Systems Market.

Ans: North America dominated the Energy Management Systems Market in 2023.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Energy Management Systems Wafer Production Volumes, by Region (2023)

5.2 Energy Management Systems Design Trends (Historical and Future)

5.3 Energy Management Systems Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Energy Management Systems Market Segmentation, by Type

7.1 Chapter Overview

7.2 Industrial energy management systems (IEMS)

7.2.1 Industrial Energy Management Systems (IEMS) Market Trends Analysis (2020-2032)

7.2.2 Industrial Energy Management Systems (IEMS) Market Size Estimates and Forecasts to 2032 (USD Million)

7.3 Building energy management systems (BEMS)

7.3.1 Building Energy Management Systems (BEMS) Market Trends Analysis (2020-2032)

7.3.2 Building Energy Management Systems (BEMS) Market Size Estimates and Forecasts to 2032 (USD Million)

7.4 Home energy management systems (HEMS)

7.4.1 Home Energy Management Systems (HEMS) Market Trends Analysis (2020-2032)

7.4.2 Home Energy Management Systems (HEMS) Market Size Estimates and Forecasts to 2032 (USD Million)

8. Energy Management Systems Market Segmentation, by Component

8.1 Chapter Overview

8.2 Hardware

8.2.1 Hardware Market Trends Analysis (2020-2032)

8.2.2 Hardware Market Size Estimates and Forecasts to 2032 (USD Million)

8.3 Software

8.3.1 Software Market Trends Analysis (2020-2032)

8.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Million)

8.4 Services

8.4.1 Services Market Trends Analysis (2020-2032)

8.4.2 Services Market Size Estimates and Forecasts to 2032 (USD Million)

9. Energy Management Systems Market Segmentation, by Deployment

9.1 Chapter Overview

9.2 Cloud

9.2.1 Cloud Market Trends Analysis (2020-2032)

9.2.2 Cloud Market Size Estimates and Forecasts to 2032 (USD Million)

9.3 On-premises

9.3.1 On-premises Market Trends Analysis (2020-2032)

9.3.2 On-premises Market Size Estimates and Forecasts to 2032 (USD Million)

10. Energy Management Systems Market Segmentation, by End User

10.1 Chapter Overview

10.2 Residential

10.2.1 Residential Market Trends Analysis (2020-2032)

10.2.2 Residential Market Size Estimates and Forecasts to 2032 (USD Million)

10.3 Energy & Power

10.3.1 Energy & Power Market Trends Analysis (2020-2032)

10.3.2 Energy & Power Market Size Estimates and Forecasts to 2032 (USD Million)

10.4 Telecom & IT

10.4.1 Telecom & IT Market Trends Analysis (2020-2032)

10.4.2 Telecom & IT Market Size Estimates and Forecasts to 2032 (USD Million)

10.5 Manufacturing

10.5.1 Manufacturing Market Trends Analysis (2020-2032)

10.5.2 Manufacturing Market Size Estimates and Forecasts to 2032 (USD Million)

10.6 Retail

10.6.1 Retail Market Trends Analysis (2020-2032)

10.6.2 Retail Market Size Estimates and Forecasts to 2032 (USD Million)

10.7 Healthcare

10.7.1 Healthcare Market Trends Analysis (2020-2032)

10.7.2 Healthcare Market Size Estimates and Forecasts to 2032 (USD Million)

10.8 Others

10.8.1 Others Market Trends Analysis (2020-2032)

10.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Million)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Energy Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.2.3 North America Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.4 North America Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.2.5 North America Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.6 North America Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.7 USA

11.2.7.1 USA Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.7.2 USA Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.2.7.3 USA Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.7.4 USA Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.8 Canada

11.2.8.1 Canada Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.8.2 Canada Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.2.8.3 Canada Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.8.4 Canada Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.2.9 Mexico

11.2.9.1 Mexico Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.2.9.2 Mexico Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.2.9.3 Mexico Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.2.9.4 Mexico Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Energy Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.1.3 Eastern Europe Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.4 Eastern Europe Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.5 Eastern Europe Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.6 Eastern Europe Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.7 Poland

11.3.1.7.1 Poland Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.7.2 Poland Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.7.3 Poland Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.7.4 Poland Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.8 Romania

11.3.1.8.1 Romania Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.8.2 Romania Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.8.3 Romania Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.8.4 Romania Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.9.2 Hungary Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.9.3 Hungary Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.9.4 Hungary Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.10.2 Turkey Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.10.3 Turkey Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.10.4 Turkey Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.1.11.2 Rest of Eastern Europe Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.1.11.3 Rest of Eastern Europe Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.1.11.4 Rest of Eastern Europe Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Energy Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.3.2.3 Western Europe Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.4 Western Europe Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.5 Western Europe Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.6 Western Europe Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.7 Germany

11.3.2.7.1 Germany Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.7.2 Germany Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.7.3 Germany Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.7.4 Germany Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.8 France

11.3.2.8.1 France Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.8.2 France Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.8.3 France Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.8.4 France Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.9 UK

11.3.2.9.1 UK Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.9.2 UK Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.9.3 UK Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.9.4 UK Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.10 Italy

11.3.2.10.1 Italy Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.10.2 Italy Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.10.3 Italy Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.10.4 Italy Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.11 Spain

11.3.2.11.1 Spain Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.11.2 Spain Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.11.3 Spain Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.11.4 Spain Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.12.2 Netherlands Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.12.3 Netherlands Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.12.4 Netherlands Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.13.2 Switzerland Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.13.3 Switzerland Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.13.4 Switzerland Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.14 Austria

11.3.2.14.1 Austria Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.14.2 Austria Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.14.3 Austria Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.14.4 Austria Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.3.2.15.2 Rest of Western Europe Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.3.2.15.3 Rest of Western Europe Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.3.2.15.4 Rest of Western Europe Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4 Asia-Pacific

11.4.1 Trends Analysis

11.4.2 Asia-Pacific Energy Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.4.3 Asia-Pacific Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.4 Asia-Pacific Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.5 Asia-Pacific Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.6 Asia-Pacific Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.7 China

11.4.7.1 China Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.7.2 China Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.7.3 China Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.7.4 China Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.8 India

11.4.8.1 India Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.8.2 India Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.8.3 India Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.8.4 India Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.9 Japan

11.4.9.1 Japan Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.9.2 Japan Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.9.3 Japan Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.9.4 Japan Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.10 South Korea

11.4.10.1 South Korea Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.10.2 South Korea Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.10.3 South Korea Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.10.4 South Korea Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.11 Vietnam

11.4.11.1 Vietnam Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.11.2 Vietnam Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.11.3 Vietnam Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.11.4 Vietnam Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.12 Singapore

11.4.12.1 Singapore Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.12.2 Singapore Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.12.3 Singapore Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.12.4 Singapore Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.13 Australia

11.4.13.1 Australia Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.13.2 Australia Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.13.3 Australia Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.13.4 Australia Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.4.14 Rest of Asia-Pacific

11.4.14.1 Rest of Asia-Pacific Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.4.14.2 Rest of Asia-Pacific Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.4.14.3 Rest of Asia-Pacific Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.4.14.4 Rest of Asia-Pacific Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Energy Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.1.3 Middle East Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.4 Middle East Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.5 Middle East Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.6 Middle East Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.7 UAE

11.5.1.7.1 UAE Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.7.2 UAE Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.7.3 UAE Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.7.4 UAE Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.8.2 Egypt Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.8.3 Egypt Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.8.4 Egypt Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.9.2 Saudi Arabia Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.9.3 Saudi Arabia Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.9.4 Saudi Arabia Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.10.2 Qatar Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.10.3 Qatar Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.10.4 Qatar Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.1.11.2 Rest of Middle East Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.1.11.3 Rest of Middle East Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.1.11.4 Rest of Middle East Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Energy Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.5.2.3 Africa Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.4 Africa Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.2.5 Africa Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.6 Africa Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.7.2 South Africa Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.2.7.3 South Africa Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.7.4 South Africa Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.8.2 Nigeria Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.2.8.3 Nigeria Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.8.4 Nigeria Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.5.2.9.2 Rest of Africa Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.5.2.9.3 Rest of Africa Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.5.2.9.4 Rest of Africa Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Energy Management Systems Market Estimates and Forecasts, by Country (2020-2032) (USD Million)

11.6.3 Latin America Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.4 Latin America Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.6.5 Latin America Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.6 Latin America Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.7 Brazil

11.6.7.1 Brazil Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.7.2 Brazil Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.6.7.3 Brazil Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.7.4 Brazil Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.8 Argentina

11.6.8.1 Argentina Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.8.2 Argentina Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.6.8.3 Argentina Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.8.4 Argentina Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.9 Colombia

11.6.9.1 Colombia Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.9.2 Colombia Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.6.9.3 Colombia Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.9.4 Colombia Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Energy Management Systems Market Estimates and Forecasts, by Type (2020-2032) (USD Million)

11.6.10.2 Rest of Latin America Energy Management Systems Market Estimates and Forecasts, by Component (2020-2032) (USD Million)

11.6.10.3 Rest of Latin America Energy Management Systems Market Estimates and Forecasts, by Deployment (2020-2032) (USD Million)

11.6.10.4 Rest of Latin America Energy Management Systems Market Estimates and Forecasts, by End User (2020-2032) (USD Million)

12. Company Profiles

12.1 Siemens

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Schneider Electric

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 General Electric (GE)

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Honeywell

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Johnson Controls

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 ABB

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Emerson

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Rockwell Automation

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Eaton

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 IBM

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Type

Industrial energy management systems (IEMS)

Building energy management systems (BEMS)

Home energy management systems (HEMS)

By Component

Hardware

Software

Services

By Deployment

Cloud

On-premises

By End User

Residential

Energy & Power

Telecom & IT

Manufacturing

Retail

Healthcare

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Semiconductor Intellectual Property Market Size was valued at USD 7.04 Billion in 2023 and is expected to reach USD 15.68 Billion by 2032 and grow at a CAGR of 9.77% over the forecast period 2024-2032.

The Battery-free Sensors Market Size was valued at USD 41.46 Million in 2023 and is expected to grow at a CAGR of 25.21% to reach USD 313.64 Million by 2032

The LED Modular Display Market was valued at USD 7.43 Billion in 2023 and is expected to reach USD 22.99 Billion by 2032, growing at a CAGR of 13.39% over the forecast period 2024-2032.

The Smart Robot Market size was valued at USD 13.39 billion in 2023, It is expected to hit USD 111.6 billion & growing at 26.63% CAGR by forecasts 2024-2032

The Solid State Battery Market size is expected to be valued at USD 83.20 Million in 2023. It is estimated to reach USD 1953.07 Million by 2032 with a growing CAGR of 42% over the forecast period 2024-2032.

The IoT Node and Gateway Market Size was valued at USD 478.12 billion in 2023 and is expected to reach USD 1459.33 billion by 2032 and grow at a CAGR of 13.2% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone