Energy Efficient Motor Market Report Scope & Overview:

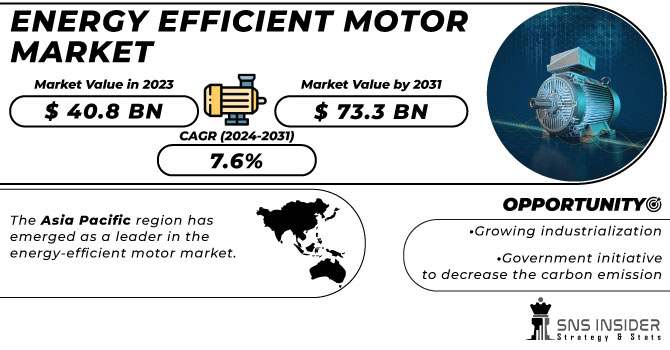

The Energy Efficient Motor Market size was valued at USD 40.8 billion in 2023 and is expected to grow to USD 73.3 billion by 2031 with a growing CAGR of 7.6% over the forecast period of 2024-2031.

The market for energy-efficient motors is a rapidly growing industry that is gaining traction worldwide. These motors are designed to consume less energy while still providing the same level of performance as traditional motors. This not only saves money on energy costs but also reduces carbon emissions, making them an environmentally friendly option.

Get More Information on Energy Efficient Motor Market - Request Sample Report

The demand for energy-efficient motors is driven by various factors, including government regulations, rising energy costs, and increasing awareness of the need for sustainable practices. As a result, many industries, including manufacturing, HVAC, and transportation, are adopting these motors to improve their energy efficiency and reduce their carbon footprint. In addition to their environmental benefits, energy-efficient motors also offer financial benefits. They have a longer lifespan than traditional motors, require less maintenance, and can save businesses significant amounts of money on energy bills over time.

An energy-efficient motor is a device that converts electrical energy into mechanical energy with minimal energy loss. This type of motor is designed to operate at a higher level of efficiency, resulting in lower energy consumption and reduced operating costs. By utilizing advanced technologies and materials, energy-efficient motors can achieve higher power densities, lower heat dissipation, and longer lifetimes than traditional motors. These motors are widely used in various applications, including HVAC systems, industrial machinery, and electric vehicles. With the increasing demand for energy conservation and sustainability, the use of energy-efficient motors is becoming more prevalent in today's world.

Market Dynamics

Drivers

-

Favorable government regulations

-

Increasing demand for energy-efficient solutions

With the ever-increasing energy costs, both businesses and consumers are seeking ways to minimize their energy consumption and save money. One of the most effective solutions to this problem is the use of energy-efficient motors, which can significantly reduce energy consumption by up to 50%. By investing in these motors, businesses, and consumers can not only save money but also contribute to a greener environment. This factor increases the demand for energy-efficient motors and drives the market for the same.

Restrain

-

High initial cost associated with these types of motors

Opportunities

-

Growing industrialization

-

Government initiative to decrease the carbon emission

The government's initiative to reduce carbon emissions presents a significant opportunity for the energy-efficient motor market. This presents a chance for companies to invest in and develop innovative technologies that can help reduce carbon emissions and promote sustainability. By leveraging this opportunity, businesses can not only contribute to a cleaner environment but also benefit from increased demand for energy-efficient motors.

Challenges

-

Lack of awareness among consumers

Impact of COVID-19

One of the main challenges faced by the energy-efficient motor market during the Covid 19 pandemic is the disruption in the supply chain. The pandemic has caused delays in the delivery of raw materials and components, which has led to a shortage of finished products. This has resulted in increased prices and reduced availability of energy-efficient motors. Another factor that has affected the energy-efficient motor market is the reduced demand for energy. During a pandemic, it was observed that around 12% of energy demand is reduced which ultimately affects energy-efficient motors as the pandemic has caused a slowdown in economic activity, which has led to a decrease in demand for energy-efficient motors. This has resulted in a decrease in sales and revenue for companies operating in this market. Furthermore, changes in consumer behavior have also impacted the energy-efficient motor market. With the pandemic forcing people to work from home, there has been a shift in the demand for energy-efficient motors from commercial to residential applications. This has led to a change in the marketing strategies of companies operating in this market.

Impact of Russia-Ukraine War:

The ongoing conflict between Russia and Ukraine has further destabilized an already volatile energy market due to the Covid-19 pandemic. Due to this Russia-Ukraine conflict European gas and electricity wholesale prices have skyrocketed by 115% and 138%, respectively. As a result, the need for energy-efficient motors has increased, driving up demand for these products. The energy-efficient motor market is a critical component of the global energy industry, as it plays a vital role in reducing energy consumption and greenhouse gas emissions. However, the Russia-Ukraine conflict has disrupted the supply chain of energy-efficient motors, leading to a shortage of these products in the market. The economic sanctions imposed on Russia have also made it challenging for companies to do business with Russian manufacturers of energy-efficient motors. This disruption has resulted in a decline in the production and distribution of energy-efficient motors, which has had a negative impact on the growth of the market.

Impact of Recession:

The global market for energy-efficient motors has been impacted by the current economic climate, with businesses and consumers alike seeking to reduce their expenses. However, governments worldwide are recognizing the importance of energy efficiency and are taking steps to encourage its adoption. This has led to a surge in demand for energy-efficient motors in certain regions, which is expected to continue in the coming years. The final report will provide further insights into this trend.

Key Market Segmentation

By Type:

-

AC Motors

-

DC Motors

By Power Output Rating:

-

<1 kW

-

1-2.2 kW

-

2.2-375 kW

-

>375 kW

By Efficiency level:

-

Standard Efficiency (IE1)

-

High Efficiency (IE2)

-

Premium Efficiency (IE3)

-

Super Premium Efficiency (IE4)

By Installation Type:

-

Open Drip Proof Motors

-

Totally Enclosed Fan Cooled Motors

By Application:

-

Compressors

-

HVAC

-

Refrigeration

-

Fans

-

Pumps

-

Material Processing

By End-user:

-

Commercial

-

Industrial

-

Residential

-

Agriculture

-

Automotive

-

Aerospace & Defense

Regional Analysis

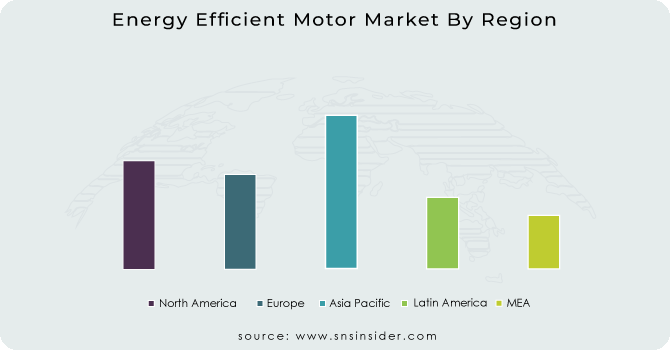

The Asia Pacific region has emerged as a leader in the energy-efficient motor market. One of the key drivers of the energy-efficient motor market in the Asia Pacific region is the increasing demand for energy-efficient solutions. As the region's population and economy continue to grow, so does the demand for energy. This has led to a greater focus on energy efficiency, as businesses and governments seek to reduce their energy consumption and carbon footprint. Advancements in technology have also played a significant role in the growth of the energy-efficient motor market in the Asia Pacific region. Manufacturers have developed new technologies that allow motors to operate more efficiently, reducing energy consumption and costs. These advancements have made energy-efficient motors more accessible and affordable, driving demand in the region. Finally, government initiatives promoting sustainable practices have also contributed to the growth of the energy-efficient motor market in the Asia Pacific region. Governments have implemented policies and regulations that encourage businesses to adopt energy-efficient solutions, such as tax incentives and subsidies. This has created a favorable environment for the growth of the energy-efficient motor market in the region.

North America is projected to experience the highest CAGR in the energy-efficient motor market during the forecast period. This is owing to the increasing demand for energy-efficient solutions in various industries, such as automotive, construction, and manufacturing. Additionally, the region has stringent regulations and policies in place to promote the adoption of energy-efficient technologies, further driving the growth of the market. Furthermore, North America has a well-established infrastructure and technological advancements, which enable the development and implementation of energy-efficient motors. The region also has a high level of awareness and concern for environmental sustainability, leading to a growing demand for eco-friendly solutions.

Need any customization research on Energy Efficient Motor Market - Enquiry Now

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

Key Players

The major players are ABB, Hoyer Motors, Mitsubishi Electric, Rockwell Automation, Cg Power and Industrial Solutions Ltd., Siemens, Toshiba Corporation, Wolong Electric Group Co. Ltd, Shanghai Top Motor Co. Ltd., Kirloskar Electric, Bharat Bijlee, and other key players mentioned in the final report.

ABB-Company Financial Analysis

Recent Development:

-

On September 21, 2022, Mitsubishi Electric Corporation made an exciting announcement. They have collaborated with Toshiba Mitsubishi-Electric Industrial Systems Corporation (TMEIC) to create an innovative electrical motor-design support system. This system incorporates Mitsubishi Electrics Maisart®* AI technology, which significantly reduces the time required to produce electrical motor designs. This technology achieves the same performance as conventional design methods, which were previously deployed manually by skilled engineers.

-

In 2020, Toshiba Corporation also made a significant contribution to the industry. They developed a new magnetic material that delivers major improvements in motor efficiency at a minimal cost. This material has the potential to reduce power consumption significantly, which is necessary for achieving a low-carbon future. This development is a step towards a more sustainable future, and it is exciting to see companies like Toshiba leading the way.

| Report Attributes | Details |

| Market Size in 2023 | US$ 40.8 Bn |

| Market Size by 2031 | US$ 73.3 Bn |

| CAGR | CAGR of 7.6% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (AC Motors and DC Motors) • By Power Output Rating (<1>375 kW), By Efficiency level (Standard Efficiency (IE1), High Efficiency (IE2), Premium Efficiency (IE3), Super Premium Efficiency (IE4)) • By Installation Type (Open Drip Proof Motors and Totally Enclosed Fan Cooled Motors) • By Application (Compressors, HVAC, Refrigeration, Fans, Material Handling, Pumps, and Material Processing) • By End-user (Commercial, Industrial, Residential, Agriculture, Automotive, and Aerospace & Defense) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | ABB, Hoyer Motors, Mitsubishi Electric, Rockwell Automation, Cg Power and Industrial Solutions Ltd., Siemens, Toshiba Corporation, Wolong Electric Group Co. Ltd, Shanghai Top Motor Co. Ltd., Kirloskar Electric, Bharat Bijlee |

| Key Drivers | • Favorable government regulations • Increasing demand for energy-efficient solutions |

| Market Opportunities | • Growing industrialization • Government initiative to decrease the carbon emission |