Energy Efficient Building Market Report Scope & Overview:

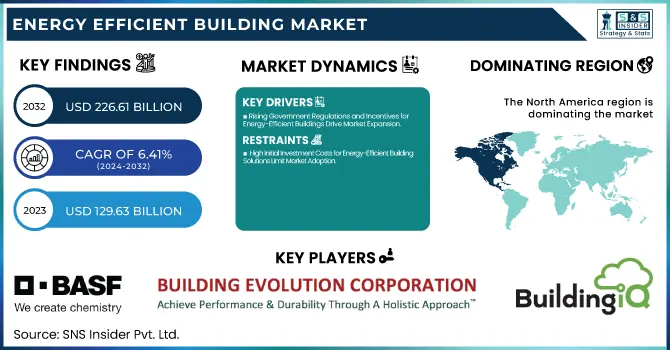

The Energy Efficient Building Market size was valued at USD 129.63 billion in 2023 and is expected to reach USD 226.61 billion by 2032, growing at a CAGR of 6.41% over the forecast period 2024-2032.

To Get more information on Energy Efficient Building Market - Request Free Sample Report

The energy-efficient building market is experiencing significant growth, driven by increasing environmental concerns, stringent government regulations, and rising awareness of sustainable construction. The adoption of advanced insulation materials, energy management systems, and smart technologies is reshaping the industry. Companies are investing heavily in innovative solutions to enhance building efficiency, reduce energy consumption, and lower carbon emissions. ABB partnered with the World Green Building Council in January 2024 to accelerate the development of energy-efficient buildings across Europe, emphasizing the role of digitalization and automation in sustainable construction. Johnson Controls has been expanding its portfolio of energy-efficient HVAC systems to cater to the growing demand for smart building solutions. Saint-Gobain and Kingspan Group are introducing high-performance insulation materials to improve energy efficiency in both commercial and residential buildings. Owens Corning and Rockwool International A/S are focusing on advanced thermal insulation solutions to minimize energy loss. India is making significant strides in energy-efficient housing, as highlighted in October 2024, with passive design techniques and sustainable materials being integrated into large-scale residential projects. Additionally, in January 2025, a $35 million fund was announced to support developers in building and renovating energy-efficient rental housing, further encouraging sustainable development.

Technological advancements and collaborative efforts are shaping the future of energy-efficient buildings. Schneider Electric and Honeywell are leading advancements in building automation and smart energy management systems, optimizing energy consumption through AI-driven solutions. High-performance buildings are gaining traction, as noted in an October 2024 report, where the adoption of smart energy systems and intelligent design is driving sustainability in urban development. In December 2023, a study highlighted the importance of sustainable designs in minimizing energy consumption, reinforcing the need for innovative strategies in commercial and residential projects. Covestro AG and BASF SE are investing in energy-efficient coatings and polyurethane insulation materials to enhance thermal performance. Europe is strengthening its commitment to energy efficiency, as seen in a January 2025 report detailing how energy-efficient buildings are crucial to achieving long-term sustainability goals. The momentum is further supported by organizations such as the UNDP, which, in December 2024, outlined six key lessons for future smart energy-efficient buildings, emphasizing data-driven decision-making and integrated renewable energy solutions. Dow Inc. and Knauf Insulation are also playing a key role in developing advanced insulation products that contribute to overall energy savings. With continuous investments in technology and policy support, the market is poised to accelerate the transition toward sustainable and energy-efficient infrastructure.

Energy Efficient Building Market Dynamics

Drivers

-

Rising Government Regulations and Incentives for Energy-Efficient Buildings Drive Market Expansion

Growing awareness among consumers and businesses about energy efficiency and its impact on sustainability is driving demand for energy-efficient buildings. Businesses are increasingly adopting green building solutions to achieve sustainability targets and reduce operational costs. Large corporations, including Johnson Controls, Schneider Electric, and Honeywell, are integrating smart building management systems to optimize energy use and minimize waste. The rising popularity of net-zero energy buildings, which generate as much energy as they consume, is further propelling the market. Consumers are also prioritizing energy-efficient homes equipped with smart thermostats, LED lighting, and high-performance insulation. The trend of green leasing, where tenants seek energy-efficient properties to reduce their carbon footprint, is becoming prevalent in the commercial real estate sector. This shift toward sustainability is significantly contributing to the expansion of the energy-efficient building market.

-

Increasing Consumer Awareness and Corporate Sustainability Goals Fuel Market Growth

Restraints

-

High Initial Investment Costs for Energy-Efficient Building Solutions Limit Market Adoption

One of the major barriers to the widespread adoption of energy-efficient buildings is the high upfront cost associated with energy-efficient materials, smart building technologies, and renewable energy systems. Advanced insulation materials, energy-efficient HVAC systems, and automated energy management solutions often require significant capital investment, making them less accessible to small-scale developers and homeowners. While long-term energy savings offset these costs, many stakeholders hesitate due to budget constraints and limited access to financing options. Retrofitting existing buildings with energy-efficient upgrades can also be costly, deterring property owners from investing in green renovations. Additionally, integrating smart technologies requires skilled labor and technical expertise, further adding to implementation expenses. The high initial investment remains a challenge, slowing the rate of adoption in price-sensitive markets.

Opportunities

-

Expansion of Green Building Initiatives and Net-Zero Energy Construction Drives Market Growth

The increasing emphasis on green building certifications and net-zero energy construction presents significant growth opportunities for the energy-efficient building market. Countries worldwide are implementing sustainability targets that encourage the development of net-zero buildings, which generate as much energy as they consume. Certifications such as LEED, BREEAM, and WELL Building Standard promote the use of energy-efficient materials, smart energy management systems, and renewable energy integration. Governments are also supporting green infrastructure projects through incentives and subsidies, creating a favorable market environment. Leading companies such as Kingspan Group, Rockwool International A/S, and Saint-Gobain S.A. are focusing on developing next-generation insulation and energy-efficient materials to align with these initiatives. The growing shift toward net-zero energy buildings will drive demand for innovative energy-efficient solutions.

Challenge

-

Complexity of Retrofitting Existing Buildings with Energy-Efficient Technologies Creates Implementation Challenges

Retrofitting existing buildings with energy-efficient technologies presents significant challenges due to structural limitations, high costs, and technical complexities. Older buildings often lack the infrastructure to support advanced insulation, smart energy management systems, and renewable energy integration. Retrofitting requires extensive modifications, such as upgrading HVAC systems, replacing inefficient windows, and installing smart lighting and automation systems. These upgrades can be disruptive, requiring temporary displacement of occupants and additional labor-intensive processes. Moreover, ensuring compatibility between legacy systems and new technologies adds complexity to retrofitting projects. Companies such as Honeywell and Johnson Controls are developing tailored retrofitting solutions, but widespread adoption remains slow due to logistical hurdles and cost constraints. Addressing these challenges is crucial to accelerating the transition toward energy-efficient buildings.

Energy Efficient Building Market Segment Analysis

By Type

HVAC dominated the energy-efficient building market in 2023 with a market share of 35%. The heating, ventilation, and air conditioning (HVAC) systems play a crucial role in maintaining indoor comfort while consuming a significant amount of energy. The increasing emphasis on energy efficiency has driven the development and adoption of advanced HVAC technologies that reduce energy consumption and improve operational efficiency. Modern HVAC systems incorporate features such as variable refrigerant flow, smart thermostats, and advanced control systems that optimize energy usage according to occupancy and environmental conditions. For instance, smart thermostats allow users to set temperature schedules that align with their daily routines, significantly reducing energy waste when buildings are unoccupied. Additionally, energy recovery ventilators enhance indoor air quality while minimizing energy loss. Government incentives and regulations encouraging the installation of energy-efficient HVAC systems further contribute to their popularity. As businesses and homeowners seek to lower energy bills and minimize their carbon footprint, the demand for high-efficiency HVAC solutions continues to grow, solidifying HVAC's position as the leading segment in the energy-efficient building market.

By Material

Polyisocyanurate (PIR) dominated the energy-efficient building market in 2023 with a market share of 25%. PIR insulation is known for its exceptional thermal performance and is widely used in various building applications, including roofs, walls, and floors. One of the key advantages of PIR insulation is its high R-value, which indicates superior resistance to heat flow, making it an ideal choice for improving the energy efficiency of buildings. With energy codes becoming increasingly stringent, builders and architects are opting for PIR as it helps meet and exceed these standards. The lightweight and easy-to-install nature of PIR also simplifies construction processes and reduces labor costs. Additionally, PIR insulation is often used in commercial applications, where energy efficiency is a primary concern due to the high energy demands of large buildings. Recent innovations in PIR technology, such as the development of more environmentally friendly formulations, have further enhanced its appeal. As the market for energy-efficient buildings continues to expand, the demand for PIR insulation is expected to grow, reinforcing its dominant position in the materials segment.

By End-use

Commercial buildings dominated the energy-efficient building market in 2023 with a market share of 45%. The commercial sector, encompassing office buildings, retail spaces, and industrial facilities, represents a significant portion of energy consumption globally. As energy prices rise and environmental awareness increases, businesses are increasingly prioritizing energy-efficient practices to reduce costs and enhance their sustainability profiles. Many commercial buildings are being retrofitted with energy-efficient technologies such as LED lighting, advanced HVAC systems, and smart building management systems that monitor and optimize energy usage. These upgrades not only contribute to lower operating costs but also improve occupant comfort and productivity. Additionally, regulatory pressures and government incentives aimed at promoting energy efficiency further drive the adoption of sustainable practices in the commercial sector. Companies are recognizing that energy-efficient buildings can also enhance their marketability and brand reputation, making them more attractive to tenants and investors. As a result, the commercial end-use segment continues to lead the energy-efficient building market, reflecting a growing commitment to sustainability and resource conservation in the business community.

Energy Efficient Building Regional Analysis

In 2023, North America dominated the energy-efficient building market in 2023 with a market share of 40%. This dominance can be attributed to the strong regulatory frameworks, growing environmental awareness, and the presence of key players in the region. The United States, in particular, has implemented stringent building codes that require commercial and residential buildings to adhere to energy efficiency standards, driving the demand for energy-efficient solutions. For example, the U.S. Green Building Council’s LEED (Leadership in Energy and Environmental Design) certification has become a benchmark for energy-efficient buildings, incentivizing both new constructions and retrofitting of existing buildings. Additionally, Canada has set ambitious goals for reducing carbon emissions, with programs such as the Canadian Green Building Council’s Zero Carbon Building program encouraging the use of energy-efficient materials and systems. The market is further bolstered by government incentives, rebates, and tax credits for adopting energy-efficient technologies. Moreover, the growing trend of sustainable buildings among corporate offices and industrial facilities has contributed to North America's dominant market share. These initiatives, alongside technological advancements in energy-efficient HVAC systems, lighting, and insulation, have solidified North America's position as the leader in the energy-efficient building market.

On the other hand, Asia-Pacific was the fastest growing region in the energy-efficient building market in 2023, with a CAGR of 9%. The rapid urbanization and industrialization in countries like China, India, and Japan are driving the growth of energy-efficient buildings in the region. In China, the government has made significant strides in promoting energy efficiency through its “13th Five-Year Plan for Ecological and Environmental Protection,” which includes measures to improve the energy performance of buildings. The country is investing heavily in green building projects and retrofitting existing structures to meet new energy standards. India, too, has seen a rise in energy-efficient buildings, particularly with the introduction of its Energy Conservation Building Code (ECBC) and initiatives like the Smart Cities Mission, which emphasizes sustainability. Japan’s commitment to reducing carbon emissions has led to the widespread adoption of energy-efficient building technologies. As a result, the Asia-Pacific region is experiencing robust growth in energy-efficient buildings, driven by both government policies and an increasing awareness among consumers and businesses about the environmental and economic benefits of energy-efficient buildings. With governments across the region prioritizing green building practices, the market is expected to continue growing at a rapid pace in the coming years.

Fastest Growing Region in 2023:

Asia-Pacific emerged as the fastest growing region in the energy-efficient building market in 2023, with a CAGR of 9%. The rapid urbanization and industrialization in countries like China, India, and Japan are driving the growth of energy-efficient buildings in the region. In China, the government has made significant strides in promoting energy efficiency through its “13th Five-Year Plan for Ecological and Environmental Protection,” which includes measures to improve the energy performance of buildings. The country is investing heavily in green building projects and retrofitting existing structures to meet new energy standards. India, too, has seen a rise in energy-efficient buildings, particularly with the introduction of its Energy Conservation Building Code (ECBC) and initiatives like the Smart Cities Mission, which emphasizes sustainability. Japan’s commitment to reducing carbon emissions has led to the widespread adoption of energy-efficient building technologies. As a result, the Asia-Pacific region is experiencing robust growth in energy-efficient buildings, driven by both government policies and an increasing awareness among consumers and businesses about the environmental and economic benefits of energy-efficient buildings. With governments across the region prioritizing green building practices, the market is expected to continue growing at a rapid pace in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ABB Group (Building Automation Systems, Energy Management Solutions)

-

Ameresco Inc (Energy Efficiency Services, Renewable Energy Solutions)

-

Architectural Energy Corporation (Energy Modeling Software, Building Performance Analysis Tools)

-

BASF SE (Insulation Materials, Energy-efficient Coatings)

-

Building Evolution Corporation (Energy Management Systems, Energy Efficiency Consulting Services)

-

Building IQ (Building Energy Optimization Software, Smart Building Solutions)

-

Cleantech Group (Clean Energy Solutions, Sustainability Consulting)

-

Covestro AG (Polyurethane Insulation Materials, Energy-efficient Coatings)

-

Dow Inc. (Thermal Insulation Products, Building Energy Management Solutions)

-

EnerNOC (Energy Management Software, Demand Response Solutions)

-

Energy Panel Structures (Energy-efficient Wall Systems, Insulated Panel Systems)

-

Fletcher Building (Building Insulation Materials, Energy-efficient Construction Solutions)

-

GAF Materials Corporation (Roofing Insulation, Energy-efficient Roofing Systems)

-

Honeywell (Building Automation Systems, Energy Management Solutions)

-

Johnson Controls (HVAC Systems, Building Automation Solutions)

-

Johnson Controls, Inc. (Energy-efficient HVAC Systems, Building Management Systems)

-

Kingspan Group (Insulation Products, High-performance Building Materials)

-

Knauf Insulation (Mineral Wool Insulation, Thermal Insulation Products)

-

Rockwool International A/S (Stone Wool Insulation, Acoustic Insulation Products)

-

Saint-Gobain S.A. (Insulation Materials, Energy-efficient Building Products)

Recent Development:

-

December 2024: ABB partnered with the World Green Building Council to promote sustainable energy-efficient buildings across Europe, focusing on advancing energy-saving technologies and solutions.

-

December 2023: Saint-Gobain S.A. reached an agreement with SOPREMA to sell 75% of its stake in the polyisocyanurate (PIR) insulation business in the UK under the Celotex brand. SOPREMA, a European manufacturer, specializes in PIR insulation.

-

July 2023: Kingspan Insulated Panels North America introduced QuadCore Technology as the standard for all its panels used in cold storage. This advanced insulation core offers a leading R-value of R-9.0 per inch, significantly improving thermal efficiency compared to high-quality PIR and PUR, with up to 60% better performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 129.63 Billion |

| Market Size by 2032 | US$ 226.61 Billion |

| CAGR | CAGR of 6.41% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (HVAC, Lighting, Building Controls, Water Efficiency, Water Heating, Building Envelope, Others) •By Material (Glass Wool, Mineral Wool, Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Cellulose, Polyisocyanurate (PIR), Polyurethane (PUR), Others) •By End-Use (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Saint-Gobain S.A., Owens Corning, Johns Manville, Kingspan Group, Rockwool International A/S, BASF SE, Dow Inc., Honeywell, Johnson Controls, Schneider Electric and other key players |

| Key Drivers | •Rising Government Regulations and Incentives for Energy-Efficient Buildings Drive Market Expansion •Increasing Consumer Awareness and Corporate Sustainability Goals Fuel Market Growth |

| Restraints | •High Initial Investment Costs for Energy-Efficient Building Solutions Limit Market Adoption |