Endoscope Reprocessing Market Report Scope & Overview:

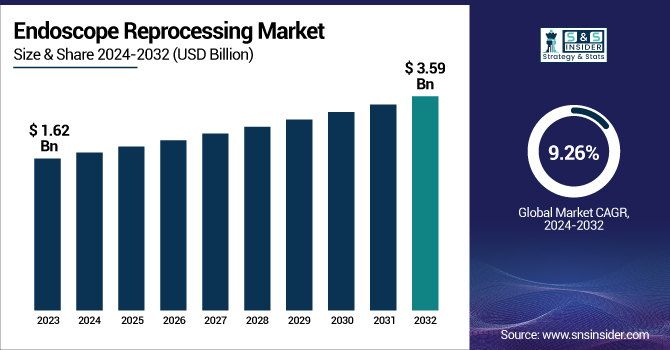

The Endoscope Reprocessing Market is expected to grow at a 9.26% compound annual growth rate (CAGR) from 2024 to 2032, from its valuation of USD 1.62 billion in 2023 to USD 3.59 billion. This report indicates the local prevalence of endoscopy-related infection and ongoing demand for rigorous reprocessing procedures. The research considers the number of endoscopes available and their utilization frequency in various healthcare settings such as hospitals, surgical facilities, and clinics, demonstrating a need to uphold tight cleaning standards. Moreover, the report examines regulatory compliance and accreditation trends, with increasing compliance with CDC guidelines and Joint Commission standards transforming institutional practices. We also examine healthcare expenditures on infection control, breaking it down by region and payer type to uncover disparities in funding and prioritization. The base of endoscope reprocessing systems installed experiences steady growth among regions from 2020 to 2032, further sustained by upcoming trends for reprocessing staff training and certification to reduce human error.

To Get more information on Endoscope Reprocessing Market - Request Free Sample Report

The US Endoscope Reprocessing Market is expected to grow at a compound annual growth rate (CAGR) of 8.38% during the period 2024-2032, from its 2023 value of USD 0.48 billion to USD 0.98 billion. In the United States, the market is driven by strong regulatory control, rising investment in automated reprocessing technologies, and a stronger focus on staff credentialing to prevent patient harm and minimize hospital-acquired infections.

Market Dynamics

Drivers

-

The increasing number of endoscopic procedures and rising awareness of infection control are majorly fueling the demand for endoscope reprocessing systems.

The number of endoscopic procedures is rising globally, with a rising tide of gastrointestinal, respiratory, and urological illnesses. For example, based on the American Society for Gastrointestinal Endoscopy, more than 20 million GI endoscopies are carried out every year in the U.S. alone. This increased volume requires stringent reprocessing criteria to avoid cross-contamination and healthcare-associated infections (HAIs). Furthermore, there is increasing compliance with regulations published by agencies like the CDC, AAMI, and the Joint Commission that focus on high-level disinfection (HLD) and traceability in reprocessing processes. Hospitals and ambulatory centers increasingly use automated endoscope reprocessors (AERs) for compliance and to reduce human error. The increase in multidrug-resistant organisms (MDROs) and endoscope-related infection outbreaks, like the duodenoscope-associated CRE (Carbapenem-resistant Enterobacteriaceae) cases, has also spurred investments in sophisticated reprocessing equipment. In addition, the incorporation of digital traceability technologies, leak testing, and drying cabinets is being prioritized to enhance safety. Overall, these trends are driving healthcare facilities to upgrade and enhance their reprocessing capacity, infection prevention, and equipment longevity as a central operational imperative.

Restraints

-

The market is hampered by the high initial and operating expenses of endoscope reprocessing devices despite increasing demand.

An important limitation to the use of advanced endoscope reprocessing machines on a large scale is the requirement of substantial capital investment, particularly for automated models. Automated Endoscope Reprocessors (AERs), drying ovens, and sophisticated tracking systems can range in price from USD 30,000 to USD 70,000 per machine, excluding installation and regular maintenance costs. For community hospitals and outpatient facilities, especially in Third World countries, these costs can be expensive. Additionally, reprocessing involves not just the equipment but also regular use of disinfectants, enzymatic detergents, water purification systems, and sterilization accessories, which contribute to ongoing expenses. The sophistication of the systems also involves heavy investment in personnel training and certification courses, which again strain budgets. Another important cost consideration is compliance with ever-tighter regulations, which usually means that facilities must upgrade equipment to keep pace with changing standards. Although cost savings in the long run are usually mentioned, the initial expense hurdle deters smaller providers from making the shift from manual to automated systems. Consequently, manual reprocessing, which is more prone to contamination and human error, remains in use, constraining the wider market penetration of more efficient reprocessing technologies.

Opportunities

-

Automation integration and technological evolution provide new channels for growth toward enhancing endoscope reprocessing efficacy and safety.

With infection prevention emerging as a top focus in healthcare, the need for intelligent, data-driven reprocessing systems is presenting fertile ground for innovation. Industries are increasingly introducing reprocessors equipped with real-time cycle monitoring, barcode-based traceability, and automated leak checking. One prominent avenue includes the convergence of artificial intelligence (AI) and Internet of Things (IoT) technologies to streamline processes and enhance safety compliance. AI can assist in reprocessing data analysis to identify process deviations, anticipate maintenance requirements, and enhance turnaround time. For instance, AI-powered dashboards can notify technicians if a particular scope hasn't finished a required step, minimizing the likelihood of human error. In addition, intelligent drying and storage cabinets with HEPA filtration and humidity detection keep scopes sterile after reprocessing. Advances in sustainable chemical formulations and water conservation also contribute to sustainability objectives, presenting manufacturers with a new value proposition. Increased emphasis on centralized sterile processing departments (CSPDs) within large hospitals also presents opportunities for packaged, scalable solutions. As regulations become more stringent, hospitals will increasingly employ intelligent, closed-loop reprocessing systems that offer ready-to-audit records, resulting in a high demand for digital and automated solutions.

Challenges

-

Although there have been advances in technology, the reprocessing process is still prone to mistakes owing to its complexity and reliance on trained staff.

The endoscope reprocessing process is complex, encompassing numerous steps—pre-cleaning, leak testing, manual cleaning, disinfection or sterilization, rinsing, drying, and storage. Every step has to be performed in precise adherence to manufacturer instructions and infection control guidelines. Even a minor departure from these can affect patient safety. A 2022 article in Infection Control & Hospital Epidemiology reported that as many as 25% of flexible endoscopes used regularly could be reprocessed incorrectly because of human mistakes or a lack of proper training. With or without automation, some steps, particularly manual cleaning, are still dependent on staff consistency and accuracy. The difficulty increases in high-volume hospitals where personnel shortages, shift changes, and fatigue exacerbate the risk of incomplete reprocessing. Also, differences in endoscope design, such as from duodenoscopes to bronchoscopes, require special handling, rendering universal reprocessing protocols challenging. Regulatory compliance audits and inspections also put pressure on facilities with insufficient administrative support or digital monitoring. Even with AI-based systems, without proper training and process standardization, errors continue. Thus, achieving seamless, error-free reprocessing remains a big challenge, especially in cost-constrained or short-staffed healthcare settings.

Segmentation Analysis

By Product

High-Level Disinfectants and Test Strips contributed the maximum revenue share of 28.8% in 2023, leading the market because of their pivotal position in the fundamental disinfection process. These are crucial for endoscope reprocessing safety and efficacy, particularly considering the increased concerns related to endoscopy-associated infections. High-level disinfectants, including glutaraldehyde, peracetic acid, and ortho-phthalaldehyde (OPA), are used extensively because of their broad-spectrum antimicrobial action. Test strips, however, provide proper monitoring of disinfectant concentration levels, and this improves infection control protocol compliance. The prevalent use of manual reprocessing in most healthcare facilities also supports the high demand for these products.

The Automated Endoscope Reprocessors (AERs) segment is expected to expand at the highest rate during the forecast period. This expansion is a result of increased movement toward automated processes to decrease human error and enhance reprocessing consistency. AERs provide validated, reproducible, standardized cleaning and disinfection cycles with low risk for contamination. Under increasing regulatory and hospital accreditation initiatives, healthcare environments are investing heavily in AERs to remain compliant with infection prevention guidelines as well as maintain streamlined workflows.

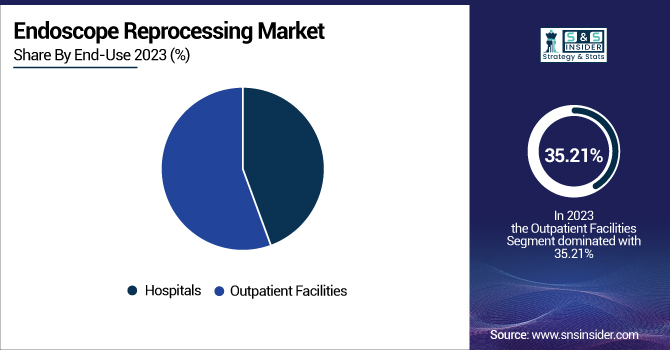

By End-Use

Outpatient facilities dominated the market with the highest revenue share of 55.6% in 2023, spurred by the rise in minimally invasive procedures conducted outside of the hospital. Specialty clinics and ambulatory surgical centers need cost-efficient and economical reprocessing solutions because of increased patient throughput. The growth of outpatient GI and urology facilities at a rapid rate has also driven demand for smaller, rapid-turnaround reprocessing systems. In addition, the lower operating and infrastructure costs in outpatient facilities make them preferable for regular diagnostic endoscopy, increasing segment dominance further.

At the same time, hospitals are projected to be the highest-growing segment, fueled by growing use of centralized reprocessing units and increased procedural sophistication in tertiary care. Hospitals handle a wider variety of endoscope types, such as sophisticated devices like duodenoscopes and bronchoscopes, which necessitate sophisticated reprocessing systems and rigorous compliance. Further, hospitals face mounting pressure to meet rigorous infection control requirements and regulatory audits, leading to investments in high-end AERs, traceability systems, and drying/storage technologies.

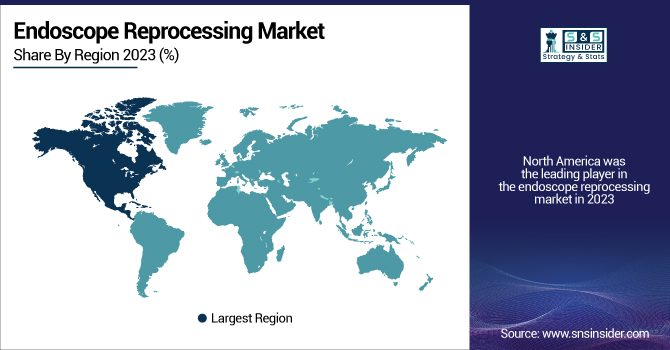

Regional Analysis

North America was the leading player in the endoscope reprocessing market in 2023, owing to the well-developed healthcare infrastructure, stringent infection control standards, and high procedural volumes in the region. The extensive utilization of advanced reprocessing equipment in U.S. and Canadian hospitals and outpatient facilities has been a major driver for market growth. Moreover, regulatory agencies like the Centers for Disease Control and Prevention (CDC) and the U.S. Food and Drug Administration (FDA) still urge tighter compliance with reprocessing procedures, pushing facilities to implement automated systems and digital traceability solutions. Industry leaders are also headquartered in this region, fueling innovation and quicker technology adoption.

Europe is expected to exhibit the highest growth rate in the forecast period due to rising healthcare spending, heightened awareness regarding healthcare-associated infections (HAIs), and the rising volume of endoscopic procedures in Germany, the U.K., France, and Italy. Regulatory focus from associations such as the European Society of Gastrointestinal Endoscopy (ESGE) is also increasing the use of high-level disinfection and AERs. Furthermore, continued hospital infrastructure modernization and deployment of centralized sterile processing units are driving endoscope reprocessing systems demand forward at a rapid pace. Increasing investment in AI-driven reprocessing and compliance software further makes Europe the central growth nexus in the world market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Cantel Medical – Advantage Plus, Rapicide OPA-28, RapidAER, BioShield Scope Transport System

-

Fortive Corporation (Advanced Sterilization Products - ASP) – EVOTECH Endoscope Cleaner and Reprocessor, CIDEZYME XTRA Enzymatic Detergent, CIDEX OPA Solution

-

Olympus Corporation – OER-Pro, ETD Double Endoscope Washer Disinfector, OFP Endoscope Flushing Pump, Olympus Storage Cabinets

-

Ecolab – Sekusept, Soluscope Cleaner and Disinfectants, Revital-Ox RESERT High-Level Disinfectant, Revital-Ox Enzymatic Detergent

-

Getinge AB – ED-Flow, GSS67H Washer Disinfectors, Getinge Assured Wash Monitors

-

STERIS – Reliance Endoscope Reprocessors, SYSTEM 1 Express Sterile Processing System, Verify Cleanliness Indicators, EndoDry Drying and Storage System

-

Steelco S.p.A. – EW 1 S MAXI, DS 610 CL, ED 100 Drying Cabinet

-

ARC Group of Companies Inc. – Enzymatic Cleaners, High-Level Disinfectants, Scope Transport & Storage Solutions

-

Metrex Research, LLC. – MetriCide OPA Plus, EmPower Enzymatic Detergent, CaviWipes

-

Shinva Medical Instrument Co., Ltd. – WD-GI Series Endoscope Washer Disinfector, WD-E Series, Endoscope Drying Cabinets

-

Belimed – WD 290 IQ, ECS Scope Reprocessors, Scope Drying and Storage Cabinets

Recent Developments

- In March 2025, Nanosonics Ltd.'s Coris system received de novo clearance from the U.S. FDA for its ability to enhance cleaning outcomes and reduce infection risk in flexible endoscopes. The system is particularly effective in cleaning the complex channels of endoscopes, which are prone to biofilm buildup, marking a significant advancement in endoscope reprocessing technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.62 billion |

| Market Size by 2032 | USD 3.59 billion |

| CAGR | CAGR of 9.26% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [High-Level Disinfectants And Test Strips, Detergents And Wipes, Automated Endoscope Reprocessors (AERs), Endoscope Drying, Storage, And Transport Systems, Others] • By End-Use [Hospitals, Outpatient Facilities] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cantel Medical, Fortive Corporation (Advanced Sterilization Products - ASP), Olympus Corporation, Ecolab, Getinge AB, STERIS, Steelco S.p.A, ARC Group of Companies Inc., Metrex Research, LLC, Shinva Medical Instrument Co., Ltd., Belimed. |