Emulsion Polymer Market Report Scope & Overview:

The Emulsion Polymer Market Size was valued at USD 31.38 Billion in 2023 and is expected to reach USD 54.68 Billion by 2032 and grow at a CAGR of 6.4% over the forecast period 2024-2032.

Get More Information on Emulsion Polymer Market - Request Sample Report

The Emulsion Polymer Market is continuously developing with new formulation and production technologies. Recent innovations have focused on enhancing product performance and versatility across various industries. For example, in May 2024, SNF expanded its portfolio by launching Natursol EMI Lite, an advanced inverse emulsion polymer designed for applications in personal care. This product improves texture and performance in emulsions, an indication of the increasing application of emulsion polymers for improving the sensory experience of cosmetics. In October 2024, Lubrizol also launched the November CS polymer, a dual emulsion stabilizer that provides stability with enhanced sensory effects in formulations like skincare and suncare products. It can support a wide range of textures and achieves excellent performance even in emulsifier-free systems, thus being a good addition to the market.

Additionally, Dow selling its Southern Africa plant in August 2024 to Ansol Gulf presents another strategy for market adjustment in responding to demand for more localized production and improved efficiency for a supply chain in the emulsion polymer business. The deal demonstrates the need for more regional production capacity in emulsion polymers across the global marketplace. These examples underscore the growing interest in product innovation, regional production strategies, and sustainable practices in emulsion polymer development, which continues to fuel the market growth as companies expand their portfolios of advanced solutions uniquely tailored to the needs of end-users.

.png)

Get Customized Report as per Your Business Requirement - Request For Customized Report

Emulsion Polymer Market Dynamics

KEY DRIVERS:

-

Growing Preference for Low-VOC and Sustainable Products Drives Emulsion Polymer Market Expansion

Growing awareness of environmental sustainability and the need to reduce VOC emissions have significantly driven the adoption of emulsion polymers. Emulsion polymers are water-based, thus more environmentally friendly compared to solvent-based counterparts. The U.S. EPA and the European Union have set strict policies to reduce VOC emissions, compelling manufacturers to opt for sustainable alternatives. For example, the paints and coatings industry, one of the main consumers of emulsion polymers, has seen an increasing demand for low-VOC and zero-VOC formulations. In May 2023, Research indicates that consumer interest in sustainable products is increasingly on the rise. Over 60% of consumers will make purchasing decisions based on factors related to sustainability, and 50% will pay more for sustainable products. This trend is especially very popular in packaging, which is an industry that heavily relies on green products such as low-VOC emulsion polymers. The rising demand for sustainable products directly reflects the increase in low-VOC and bio-based polymers in the construction, textile, and packaging industries.

-

Rapid Urbanization and Construction Activities Propel Demand for Emulsion Polymers in Paints and Adhesives

Urbanization and infrastructural advancement are some of the factors raising construction activity around the globe. Emulsion polymers are widely used in paints, coatings, and adhesives due to their excellent adhesion, durability, and resistance to water. The emerging economies in Asia-Pacific like China and India will boost the construction boom with an increased demand for architectural coatings as well as sealants. These products not only enhance aesthetic appeal but also provide long-term protection to buildings and structures. Besides, government initiatives for affordable housing and smart city projects amplify the need for high-performance materials like emulsion polymers.

Asia-Pacific's rapid urbanization is changing the face of the region, with urban populations growing by about 1 million people every week. Cities will be home to 55% of the population in 2030. This means that large-scale construction projects are fueling the ever-increasing demand for materials like paints and coatings, where emulsion polymers play a crucial role. The environment-friendly and durable nature of these polymers makes them essential in modern infrastructure, especially for sustainable urban developments in the growing cities across the region.

RESTRAIN:

-

Volatile Raw Material Prices Pose Challenges to Emulsion Polymer Market Stability

The emulsion polymer market continues to face price volatilities of raw materials that include styrene, butadiene, and acrylic monomers. These materials are sourced as petrochemicals and subject to price volatilities of crude oil, logistics, and other supply chain breaks. Fluctuating factors can create a negative impact of volatility on the profit margin from manufacturing and increase the end cost of products. For instance, in periods of high prices of crude oil, there is usually an increase in the price of raw materials leading to an increase in the products, thus affecting demand from those industries sensitive to cost. It also gives rise to non-renewable resources for a sustainable long-term future which further fuels the demand for alternative materials. Such an unstable nature of raw material pricing imposes a considerable constraint on the otherwise rapidly growing emulsion polymer market.

Raw material price fluctuations, especially for key petrochemical-based components such as styrene and butadiene, are challenges the emulsion polymer market faces. For instance, there have been huge price fluctuations with styrene at times exceeding USD 1,500 a ton, which has implications on manufacturing costs. Moreover, global crude oil price volatility usually raises these costs. The increase in bio-based alternatives is one way to counteract these price fluctuations, with bio-based material adoption in some industries growing by 15-20% annually. Still, raw material price instability is a significant constraint on market growth.

Emulsion Polymer Market Segments

BY TYPE

In 2023, the Acrylic Polymer Emulsion segment held the largest revenue share of 44.00% in the emulsion polymer market, the versatility of their applications in paints, coatings, adhesives, and textiles has driven the market. Acrylic polymer emulsions find high value in superior properties including durability, weather resistance, and compatibility with eco-friendly formulations, which is in line with the growing global demand for sustainable solutions. Major firms such as BASF SE and Dow have been leading the pack for product innovation in this area.

The SB Latex segment is projected to grow at the fastest CAGR of 8.39% during the forecast period, increasing demand for paper coatings, carpets, and adhesives for its flexibility, strength of adhesion, and lower cost is fueling growth. Companies like Synthomer and Trinseo are leading innovation; their products, such as Synthomer's XSB Latex, give excellent performance for coated paper and packaging. Trinseo's latex technology innovation will support lightweight, recyclable paper solutions. Its growth is directly proportional to that of the packaging and paper industries, which are also booming due to e-commerce and sustainability trends. This rapid growth further cements the importance of SB Latex in diversifying the emulsion polymer market, especially in applications that emphasize lightweight, durable, and sustainable materials.

BY APPLICATION

The Paints & Coatings segment dominated the emulsion polymer market in 2023, accounting for 42.00% of total revenue. This growth is supported by the rising demand for water-based, low-VOC coatings in construction, automotive, and industrial applications. Companies like PPG Industries and AkzoNobel have also developed innovative solutions that address both sustainability and performance needs. For instance, PPG's Aquacron line focuses on durability with eco-friendly formulations, while AkzoNobel's Ecosure series targets green building projects. Such advancements support regulatory pressure to be environmentally compliant and therefore reinforce the importance of this segment in the emulsion polymer market at large.

The Adhesives & Sealants segment is projected to grow at the fastest CAGR of 8.38% during the forecasted period, driven by increasing demand in the packaging, construction, and automotive segments. Henkel and 3M are developing more innovative products. For instance, the Henkel Loctite adhesives are made of water-based adhesives emphasizing strength and sustainability. So does 3M develop innovative sealants for lightweight constructions Hence, this segment witnessed high growth due to the growing demand for flexible, strong, and environment-friendly bonding solutions, and it plays a vital role in expanding the emulsion polymer market in a sustainable as well as performance-centric environment.

Emulsion Polymer Market Regional Analysis

In 2023, the Asia Pacific region dominated the emulsion polymer market, accounting for an estimated 33% market share. The primary reasons for this hegemony are rapid industrialization, urbanization, and infrastructural development, largely across China, India, and other Southeast Asian countries. High growth rates in the construction, automotive, and packaging segments across the region propel emulsion polymers, more particularly in paints, coatings, and adhesives. To name a few examples, major players such as BASF and Arkema have invested in additional Asian manufacturing facilities to capitalize on the demand for water-based, environmental solutions, which further secured its top position.

In 2023, the North American emulsion polymer market is projected to grow at a robust rate, with an estimated CAGR of over 8% during the forecast period from 2024 to 2032. The primary driver behind this growth is the growth in demand for emulsion polymers in construction, automotive, and packaging applications. There has been strong demand for water-based, low-VOC polymers in paints, coatings, adhesives, and sealants in the United States, driven by growing eco-friendly solutions and infrastructure development in the country. For example, several major construction projects, such as the $210 million South San Francisco Civic Center and the University of Illinois at Chicago’s $95 million Center for the Arts, are expected to drive further demand for emulsion polymers, particularly in coatings and adhesives.

Key players

Some of the major players in the Emulsion Polymer Market are:

-

Synthomer (Synthomer 3341, Synthomer 5790)

-

OMNOVA Solutions (Versaflex® 101, Covinax® 1810)

-

Allnex GMBH (Rheobuild® 1000, Beckosol® 66)

-

Arkema (Coatex® 110, Rhodopas® 260)

-

DIC CORPORATION (DIC-EMUL® 8050, DIC-EMUL® 1010)

-

BASF SE (Acresin® 600, Joncryl® 678)

-

Celanese Corporation (Vinac® 1535, Celvol® 530)

-

Wacker Chemie AG (Vinnapas® 2050, Elastodur®)

-

Momentive (Silres® BS 100, Momentive® EPX 1000)

-

Mallard Creek Polymers (MC-509, MC-504)

-

Solvay (Rhovanil®, Rheomer® 10)

-

Clariant (Dispersogen® S-200, Hostaflon® PFPE)

-

Asahi Kasei Corporation (S-LEC®, Alpolic®)

-

BATF Industry Co., Ltd. (BATF 8610, BATF 8800)

-

JSR Corporation (JSR-4100, JSR 1010)

-

Koninklijke DSM N.V. (NeoCryl® A-1079, NeoCryl® A-2000)

-

Shanxi Sanwei Group Co., Ltd. (SSW-2210, SSW-3220)

-

Dow (Dow Latex 250, Dow Latex 543)

-

Trinseo S.A. (NeoCryl® A-1079, Toughseal® 9000)

-

Wacker Chemie AG (Vinnapas® 8000, Elastodur® 9000)

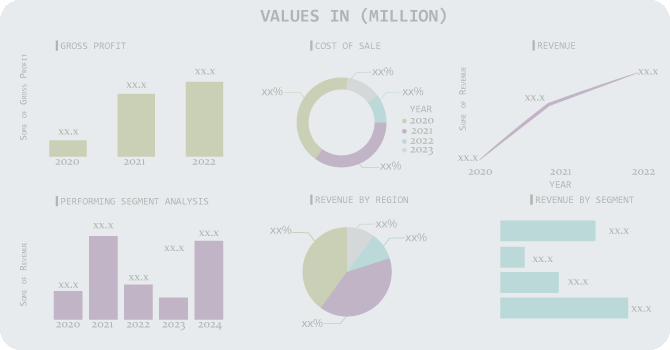

Celanese Corporation-Company Financial Analysis

RECENT TRENDS

-

In October 2023 Asahi Kasei announced that it will invest in high-end coating equipment for its HiporeTM lithium-ion battery separators. The additions will be installed at the company's existing plants in the U.S., Japan, and South Korea with operations targeted to commence in early fiscal 2026.

-

In June 2023, Avient Corporation and BASF announced the partnership to add Color grades of Ultrason high-performance polymers to the global portfolio. This partnership will bring noteworthy benefits to customers in the consumer and food service, electrical and electronics (E&E), and healthcare industries by supplying holistic technical support from a base polymer through to the finished printed end product.

-

In May 2023, Arkema purchased Polytec PT (Germany), a manufacturer of thermal interface materials for batteries and engineering adhesives serving the electronics market.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 31.38 Billion |

| Market Size by 2032 | US$ 54.68 Billion |

| CAGR | CAGR of 6.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Acrylic Polymer Emulsion, Vinyl Acetate Polymer Emulsion, SB Latex, Others) • By Application (Paints & Coatings, Adhesives & Sealants, Paper & Paperboard, Others) • By End-Use Industry (Building & Construction, Automotive, Chemicals, Textile & Coatings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Synthomer, OMNOVA Solutions, Allnex GMBH, Arkema, DIC CORPORATION, BASF SE, Celanese Corporation, Wacker Chemie AG, Momentive, Mallard Creek Polymers, Solvay, Clariant, Asahi Kasei Corporation, BATF Industry Co., Ltd., JSR Corporation, Koninklijke DSM N.V., Shanxi Sanwei Group Co., Ltd., Dow, Trinseo S.A., Wacker Chemie AG. |

| Key Drivers | • Growing Preference for Low-VOC and Sustainable Products Drives Emulsion Polymer Market Expansion • Rapid Urbanization and Construction Activities Propel Demand for Emulsion Polymers in Paints and Adhesives |

| Restraints | • Volatile Raw Material Prices Pose Challenges to Emulsion Polymer Market Stability |