Get E-PDF Sample Report on Emollients Market - Request Sample Report

The Emollients Market size was valued at USD 1.70 billion in 2023. It is estimated to hit USD 2.61 billion by 2032 and grow at a CAGR of 4.9% over the forecast period of 2024-2032.

Emollients are substances that are used to moisturize and soften skin care products, making them more supple and smooth. These products are widely used in various sectors, including cosmetics, pharmaceuticals, and personal care. Emollients play a crucial role in maintaining skin health and preventing dryness and irritation. They form a protective barrier on the skin's surface, preventing moisture loss and enhancing its natural hydration. This helps to alleviate skin conditions such as eczema, psoriasis, and dermatitis.

In 2023, Croda launched a new product Emollient 22 that is a high-performance emollient that provides long-term hydration of the skin. It is targeted specifically for use on sensitive skin and is free from allergens which could be an irritant to most consumers. Apparently, its investments in research have made it one of the leading companies to come up with a variety of skincare products.

Moreover, according to the U.S. Food and Drug Administration (FDA), skin diseases like eczema and psoriasis affect over 31.6 million Americans, boosting the demand for therapeutic emollients in the U.S. market.

The demand for emollients has been steadily increasing due to the growing awareness of skincare and personal grooming. With the rise in disposable income and changing lifestyles, consumers are increasingly seeking products that enhance their appearance and overall well-being. This has led to a surge in the demand for emollients in the beauty and personal care industry.

In recent years, there has been a shift towards natural and organic emollients, driven by the rising demand for sustainable and eco-friendly products. Consumers are becoming more conscious of the ingredients used in their skincare products and are opting for natural alternatives. This trend has prompted manufacturers to develop emollients derived from plant-based diet sources, such as shea butter, coconut oil, and jojoba oil.

In 2023, Ashland introduced Nature-Silk Emollient, a bio-based, multifunctional ingredient derived from sugarcane. It caters to consumers seeking both natural ingredients and sustainable practices. The product’s eco-friendly profile supports the rising demand for plant-based, skin-friendly ingredients in personal care formulations.

Drivers

The emollients market is surging due to increasing requirements, mainly in the cosmetics and personal care industry. They serve a vital role in the industry by providing an enhanced material of texture and feel in several cosmetic products. Emollients are recognized for their superior ability to moisturize and smoothen the skin and are in high demand in the manufacturing of skin creams, lotions, and others, which result in a lavish product for the users. In addition, the personal care industry is experiencing a rise in the demand for vegetable emollients due to changes in the attitude of people and their shifting concerns about the usage of natural and organic products that are perceived to be safe and environmentally friendly. Subsequently, the emollients have continued to be in demand as people have become more conscious of issues concerning the skin and the need to take beneficial care of it.

Restraint

Stringent regulations and guidelines imposed by regulatory bodies on the use of certain emollients

Potential side effects and allergies associated with the use of emollients

One of the most essential concerns connected with emollients is the potential risks of their usage. These substances are designed to nourish and keep the skin hydrated. Nevertheless, there are people who might develop some side effects. For example, a person can get some irritations or a red or an itching reaction as a result of their usage. Another possible response is an aggravation of some severe conditions related to the skin, such as dermatitis or eczema. All these side effects can be very uncomfortable and can discourage many people from continuing to use emollients. Another issue related to allergy can further worsen the situation. There are many substances, such as fragrances, some particular oils, or even preservatives that can trigger allergies in some people. In case of developing an allergy to one or several of the emollient components, a person will most probably have hives, skin rashes, or even problems with breathing. For these reasons, some people may refuse to use emollients, which can increase the challenge and limit the potential market growth.

Opportunities

Expanding market for natural and organic emollients due to the rising preference for sustainable and eco-friendly products

Increasing demand for emollients in emerging economies with a growing middle-class population

By Type

The esters segment held the largest market share around 42.3% in 2023. The reason for the dominating role is the presence of a variety of applications, which make esters a striking example of all-purpose and general-purpose moisturizers. Whether it is a lotion, cream, or serum, the esters can be added to all these textures with no worries. These compounds excellently work as emulsifiers, which are responsible for mixing all the components and keeping them from separating. As a result, the quality of the substance is considerably improved, and it has a longer shelf life, which is attractive to both customers and manufacturers. Furthermore, esters have shown outstanding compatibility with most of the common skincare ingredients. Using them in combination with such active agents as vitamins, antioxidants, or anti-aging agents, the product achieves a better effect, which is the reason why they are so popular.

By Form

The liquid segment held the largest share around 70% in 2023. The reason for liquid emollients’ dominance is their broad application across various industries, such as cosmetics, pharmaceuticals, and personal care. Oils and esters can be effectively formulated into creams, lotions, and serums, among other products, ensuring a creamier texture and better spreadability onto the skin. They are also absorbed quickly and do not feel greasy, so as a result, they are popular in moisturizers, sunscreens, and anti-aging creams. Moreover, liquid emollients are ongoingly gaining popularity because of their natural origins, such as coconut oil, jojoba oil, and olive oil.

By Application

The skin care segment held the largest share around 40% in 2023. There has been an increasing interest in skin care which has led to the increased awareness regarding skin care regression and the increase in the prevalence of such skin problems as eczema, dermatitis, and dry skin. Emollients are important ingredients in any moisturizing cream, lotion, ointment et cetera. In this application, they help maintain the barrier or function of the skin, such as preventing loss of moisture. There are currently increasing demands for such skin products as anti-aging, sensitive skin, and all-natural skincare products, and with them, there has been increased use of emollients as they impart softening soothing and protective effects.

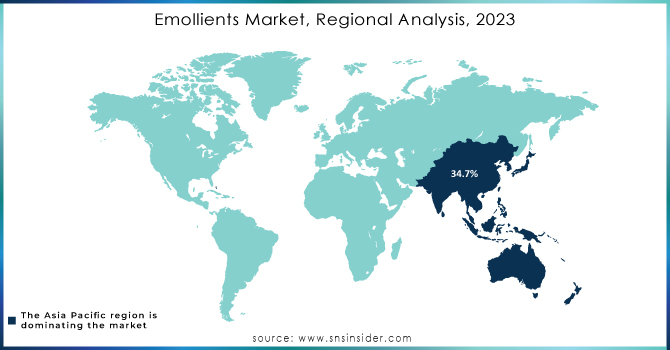

Asia Pacific dominated the emollients market with the highest revenue share of about 34.7% in 2023. The Asia Pacific boasts a population that accounts for nearly 60% of the global population, establishing it as the clear majority. Emollients play a crucial role as key ingredients in a wide range of personal care products, including shampoos, conditioners, moisturizers, lotions, and deodorants, among others. The region's increasing consumption of such products is anticipated to propel market growth. This surge in demand is primarily attributed to the rising popularity of cosmetics products. Millennials and young adults in the region are displaying a remarkable inclination toward personal care products, leading to a surge in demand. Recognizing this trend, numerous companies have been launching personal care products specifically targeting this demographic. For instance, in June 2022, Shiseido introduced Sidekick, a new skincare line tailored for Gen-Z men in the Asia Pacific region. This exemplifies the industry's response to the growing demand among young adults and millennials.

North America is expected to grow with a CAGR of about 5.1% in the emollients market during the forecast period. This growth is attributed to the increasing demand for personal care and cosmetic products in the United States. According to L'Oréal's report for 2021, the United States serves as a significant catalyst for the cosmetics industry's expansion. The emollient market in this region is expanding due to the rapid evolution of consumer lifestyles and the increasing emphasis on beauty and wellness. Moreover, the market growth in North America is further propelled by the ever-changing consumer habits and the growing awareness surrounding beauty and wellness. Additionally, the rising consumer expenditure on skincare cosmeceuticals and anti-aging products also contributes to the market's expansion in this region.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Procter & Gamble (P&G) – (Olay Regenerist Moisturizer)

Johnson & Johnson – (Aveeno Daily Moisturizing Lotion)

Eastman Chemical Company – (Eastman Sustane SAIB)

Evonik Industries AG – (TEGOSOFT AC MB)

BASF SE – (Cetiol Ultimate)

The Lubrizol Corporation – (Carbopol Ultrez 20 Polymer)

Sasol – (LIPOCHEM)

Hallstar – (HallStar GMS SE)

Croda International Plc – (Crodamol ISIS)

Clariant – (Plantasens Olive LD)

Ashland Inc. – (Nature-Silk Emollient)

Stepan Company – (NEOBEE M-5 Cosmetic Emollient)

Oleon Health and Beauty – (Radia 7306)

Solvay – (Rheozan SH)

Vantage Specialty Chemicals – (Liponate GC)

Kao Corporation – (Emolient EX)

Innospec Inc. – (Iselux)

Gattefossé – (Emulium Mellifera MB)

Seppic (Air Liquide) – (Montanov 82)

Dow Inc. – (DOWSIL 556 Cosmetic Grade Fluid)

In June 2023, Oleon is focusing on the development of ingredients through enzymatic esterification. One of their recent launches is Radia 7199ACT, a texture enhancer, and emollient, as well as the fatty ester Jolee 7749ACT, which is beneficial for both skin and hair.

In March 2023, Clariant responded to the growing interest and knowledge of skincare among consumers worldwide by introducing Plantasens Pro LM, a new natural emollient. This product provides a luxurious, rich, and nurturing sensation to the skin during and after application.

In September 2022, BASF announced the partnership with RiKarbon, focusing on the development of emollients derived from bio-waste. This collaboration builds upon the successful research and development efforts of RiKarbon Inc., aiming to create new environmentally friendly emollients for personal care products.

In June 2022, Evonik expanded its manufacturing capacity in Shanghai to produce TEGOSOFT® MM MB.

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.70 Billion |

| Market Size by 2032 | US$ 2.61 Billion |

| CAGR | CAGR of 4.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Esters, Fatty Acids, Ethers, Fatty Alcohols, Silicones, and Others) • By Form (Solid and Liquid) • By Application (Skin Care, Oral Care, Hair Care, Deodorants, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | P&G, Johnson & Johnson, Eastman Chemical Company, Evonik Industries AG, BASF SE, The Lubrizol Corporation, Sasol, Hallstar, Croda International PLC, Clariant, Ashland Inc., Stepan Company, Oleon Health and Beauty, Solvay, Vantage Speciality Chemicals |

| Key Drivers |

• Growing awareness about the benefits of emollients in maintaining healthy skin |

| Market Restraints |

• Stringent regulations and guidelines imposed by regulatory bodies on the use of certain emollients |

Ans: The Emollients Market was valued at USD 1.70 billion in 2023.

Ans: The expected CAGR of the global Emollients Market during the forecast period is 4.9%.

Ans: The Skin Care application segment dominated the Emollients Market with the highest revenue share of about 40.2% in 2023.

Ans: China held the largest market share in the Asia Pacific region in 2023.

Ans: Yes, you can buy reports in bulk quantity as per your requirements. Check Here for more details.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by l Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Emollients Market Segmentation, by Type

7.1 Chapter Overview

7.2 Esters

7.2.1 Esters Market Trends Analysis (2020-2032)

7.2.2 Esters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Fatty Acids

7.3.1 Fatty Acids Market Trends Analysis (2020-2032)

7.3.2 Fatty Acids Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Ethers

7.4.1 Ethers Market Trends Analysis (2020-2032)

7.4.2 Ethers Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Fatty Alcohols

7.5.1 Fatty Alcohols Market Trends Analysis (2020-2032)

7.5.2 Fatty Alcohols Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Silicones

7.6.1 Silicones Market Trends Analysis (2020-2032)

7.6.2 Silicones Market Size Estimates and Forecasts to 2032 (USD Billion)

7.7 Others

7.7.1 Others Market Trends Analysis (2020-2032)

7.2.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Emollients Market Segmentation, by Form

8.1 Chapter Overview

8.2 Solid

8.2.1 Solid Market Trends Analysis (2020-2032)

8.2.2 Solid Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Liquid

8.3.1 Liquid Market Trends Analysis (2020-2032)

8.3.2 Liquid Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Emollients Market Segmentation, by Application

9.1 Chapter Overview

9.2 Skin Care

9.2.1 Skin Care Market Trends Analysis (2020-2032)

9.2.2 Skin Care Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Oral Care

9.3.1 Oral Care Market Trends Analysis (2020-2032)

9.3.2 Oral Care Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Hair Care

9.4.1 Hair Care Market Trends Analysis (2020-2032)

9.4.2 Hair Care Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 Deodorants

9.5.1 Deodorants Market Trends Analysis (2020-2032)

9.5.2 Deodorants Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Others

9.6.1 Others Market Trends Analysis (2020-2032)

9.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Emollients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.2.5 North America Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.2.6.3 USA Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.2.7.3 Canada Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.2.8.3 Mexico Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Emollients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.6.3 Poland Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.7.3 Romania Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Emollients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.5 Western Europe Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.6.3 Germany Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.7.3 France Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.8.3 UK Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.9.3 Italy Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.10.3 Spain Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.13.3 Austria Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Emollients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.5 Asia Pacific Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.6.3 China Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.7.3 India Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.8.3 Japan Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.9.3 South Korea Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.10.3 Vietnam Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.11.3 Singapore Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.12.3 Australia Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Emollients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.5 Middle East Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.6.3 UAE Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Emollients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.2.5 Africa Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Emollients Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.6.5 Latin America Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.6.6.3 Brazil Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.6.7.3 Argentina Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.6.8.3 Colombia Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Emollients Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Emollients Market Estimates and Forecasts, by Form (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Emollients Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 P&G

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Johnson & Johnson

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Eastman Chemical Company

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Evonik Industries AG

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 BASF SE

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 The Lubrizol Corporation

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Sasol

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Hallstar

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Croda International PLC

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Clariant

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

By Polymer

By Application

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

Europe

Asia Pacific

Middle East & Africa

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The Humectants Chemical Market was USD 13.03 Billion in 2023 and is expected to reach USD 21.45 Billion by 2032, growing at a CAGR of 5.70% from 2024 to 2032.

The Renewable Chemicals Market size was valued at USD 128.3 billion in 2023 and is expected to reach USD 337.8 billion by 2032, growing at a CAGR of 11.4% over the forecast period 2024-2032.

The Smart Coatings Market was USD 4.9 billion in 2023 and is expected to reach USD 25.6 billion by 2032, growing at a CAGR of 20.1 % from 2024 to 2032.

Oilfield Chemicals Market was USD 28.5 billion in 2023 and is expected to reach USD 40.2 billion by 2032, growing at a CAGR of 3.9 % from 2024 to 2032.

Explore the Fatty Acids Market, covering key applications in food, pharmaceuticals, and cosmetics. Learn about the growing demand for omega-3, oleic acid, and stearic acid, and how advancements in sustainable sourcing are driving the market across various

The Industrial Wastewater Treatment Chemicals Market Size was valued at USD 15.28 billion in 2023, and is expected to reach USD 23.58 billion by 2032, and grow at a CAGR of 5.66% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone