Get more information on EMC Filtration Market - Request Free Sample Report

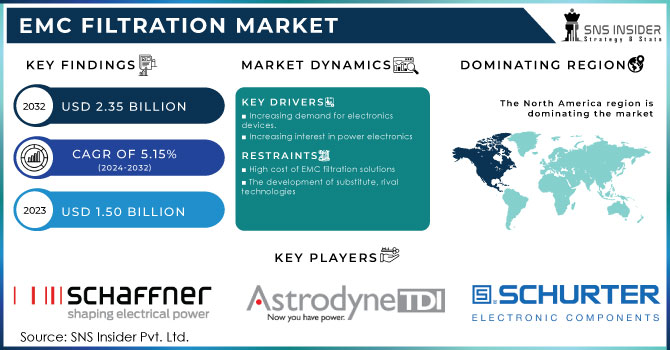

The EMC Filtration Market was valued at USD 1.50 Billion in 2023 and is expected to reach USD 2.35 Billion by 2032, growing at a CAGR of 5.15% over the forecast period 2024-2032.

The EMC filtration market is an important sector that meets the increasing demand for EMI protection in different industries. EMC filtering is crucial in a society that is becoming more and more dependent on electronics. The rise of smart technologies, IoT, and advanced communication systems has increased the risk of electromagnetic disturbances. Various sources, such as power lines, wireless communications, and neighboring electronic devices, can cause these disruptions. Interference of this kind has the potential to result in decreased performance, breakdowns, or total failure of delicate electronic devices. Hence, the EMC filtration market is essential for protecting devices and ensuring their dependable performance. In the United States, the Federal Communications Commission (FCC) and the Federal Aviation Administration (FAA) primarily have authority over regulations on Electromagnetic Interference (EMI). Part 15 of the FCC's regulations establish strict emission thresholds for both unintentional radiators (e.g. computers and TVs) and intentional radiators (e.g. Wi-Fi routers and Bluetooth devices) to avoid disrupting licensed radio services.

One important use of EMC filtration can be seen in the automotive sector, especially with the increasing popularity of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). It is anticipated that in 2024, the trend of increasing adoption of electric vehicles (EVs) in the United States will persist, after a significant 40% rise in new registrations in 2023, reaching approximately 1.4 million EVs. This increase is due to various important factors improved government incentives, especially with modified Clean Vehicle Tax Credit requirements as part of the Inflation Reduction Act, have made top-selling models qualify for large tax credits, leading to a significant rise in sales. Furthermore, there has been a rise in reasonably priced pre-owned electric vehicles in the market, with close to 60% of offerings below USD 30,000, which enhances the accessibility of EVs. As vehicles continue to evolve with advanced electronic features, the EMI risk also grows. An example of this is when electric motors, inverters, and other electronic parts produce EMI that could impact important systems like navigation, braking, and safety features. As a result, car companies are more and more incorporating EMC filters in their designs to reduce these risks, guaranteeing that their vehicles meet strict EMC standards and regulations.

Drivers

The rising demand for advanced EMC filtration solutions in an increasingly electronic and connected world.

The growth of consumer electronics, like smartphones, laptops, wearables, and smart home devices, is a key factor influencing the EMC filtration market. With the increasing presence of electronics in everyday life, it is anticipated that these devices will function seamlessly without emitting or being affected by electromagnetic interference (EMI). Electromagnetic interference can result in performance problems, mistakes, and device malfunctions, which can have costly or dangerous consequences based on the use. EMC filters are crucial parts of modern consumer electronics as they are created to reduce interference. The need for faster data transfer speeds, smaller electronic components, and the emergence of wireless communication technologies worsen the issue of EMI. As these factors grow, the demand for trustworthy EMC filtration solutions also increases to guarantee smooth operation. With the rise of 5G networks, devices must function at higher frequencies, leading to increased EMI risks and creating a demand for more advanced EMC filters. The increase in IoT devices, which depend on strong and continuous connections, is also a major factor, as these devices must function in a busy electromagnetic spectrum. Furthermore, organizations such as the Federal Communications Commission (FCC), European Telecommunications Standards Institute (ETSI), and others require adherence to specific EMI emission standards due to regulatory requirements. Failure to comply can result in product recalls, penalties, or prohibitions, prompting manufacturers to incorporate EMC filtering into their designs.

The growing importance of EMC filters in ensuring safety and reliability in modern vehicles.

With the rise in technology use in modern vehicles, the automotive industry has been booming. Electric and hybrid electrical vehicles, as well as autonomous vehicles, are equipped with complex electronic control systems that are susceptible to EMI causing interference with brake systems, communication between the various modules of the vehicle, and steering operation aiming at safety. These EMC filters are vital for suppressing the interference that might interrupt the operation of electronic components in vehicles.

As the automotive sector transitions to electric power, the amount of high-power electronics in vehicles is rising, and so too are EMI concerns. EMC filters, also known as noise filters are used to protect delicate components from interacting signals. Take electric drivetrains and the associated battery management systems (BMS) that are a feature of every EV on sale today - amongst other functions, these components unleash a whole lot of electromagnetic noise that could interfere with other onboard systems ranging from navigation to infotainment or even vital safety tech like ABS. First and foremost is the inclination of automotive manufacturers to prioritize safety and reliability, a fact that explains the increased demand for EMC filtering. The increasing complexity of modern vehicle architectures and the myriad interconnected devices within vehicles drive demand for advanced EMC filtration to ensure continuous operation.

Restraints

The impact of rapid technological advancements on the growth of the EMC filtration market.

The emergence of rapid technologies may have a significant impact on the growth rate of the EMC filtration market. With the advent of new technologies such as 5G networks and loT, along with rapidly increasing data rates in automotive and healthcare sectors among others, comes the increasing demand for better EMC filtering solutions. While new EMI/RFI challenges due to technology advances drive the need for new filtration methods. EMC filtering companies could also have a hard time staying on track with the ever-fast-advancing technology. More complicated regulatory landscapes, increased costs and extended development times create substantial obstacles when attempting to innovate in response to evolving needs. Conversely, rapid technological advancements could create market growth opportunities for EMC filtration.

by Product Type

EMC Filters held a market share of over 37% in 2023 and led the market. They are essential to protect electronic systems by eliminating unwanted noise and avoiding Electromagnetic Interference (EMI). These are the significant types of filters in the EMC Filtration Market and this is due to their importance in the automotive, telecommunications, consumer electronics, and healthcare industries which have huge demand in the current scenario. For example, companies such as Schaffner and TE Connectivity supply EMC filters for automobiles, to ensure the proper operation of automotive ECUs (Electronic Control Units) thereby minimizing the danger of signal disturbances.

Power quality filters are increasingly in demand and accounted to have a rapid growth rate during 2024-2032, owing to the growing importance of energy efficiency and the requirement for reliable power sources in industrial and commercial sectors. The filters are used to combat various power disturbances including harmonics and variations in voltage; meanwhile, they provide a better solution to protect the operation of sensitive equipment. Key market players including Eaton and ABB provide smart grid, industrial facilities, and commercial building operators with power quality filters that help to enforce energy standards and reduce the risk of power disruptions.

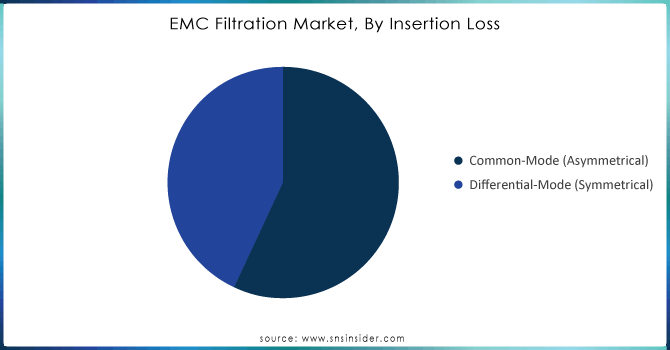

by Insertion Loss

Common-mode (asymmetrical) insertion loss dominated the market in 2023 with over 55% market share. This is mainly due to electromagnetic interference (EMI) that may affect the signal integrity. In the case of common-mode, as the noise couples onto both wires equally, an effective filter is needed to transmit a quality signal. Common-mode filters that are used in power supply systems and data communication lines are supplied off the line by companies such as Schaffner Group, TDK Corporation, etc with their product helping to reduce EMI and improve signal performance.

Differential-mode (common-mode) insertional loss is accounted to have the fastest CAGR during 2024-2032. Differential noise is usually less impactful than common-mode noise in terms of interference but it still demands thorough filtering approaches to maintain signal integrity. In high-speed-data applications, the quality of the differential signal is important to uphold, making a differential-mode filter vital. Leading companies such as Murata Manufacturing Co. and AVX Corporation deliver differential-mode filters that are built into USB or HDMI connectors in which Differential excitations allow for proper operation of those devices within noisy environments.

Need any customization research on EMC Filtration Market - Enquiry Now

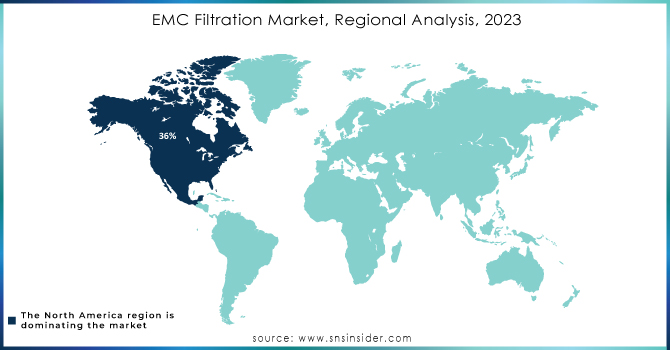

North America led the market in 2023 with a 36% market share, due to its advanced industrial base and strict regulatory standards on EMI. Key companies in the area, such as Parker Hannifin Corporation and Schaffner Holding AG, provide EMC filtration solutions for a range of industries like telecommunications, aerospace, and automotive. The rising use of electric vehicles (EVs) and developments in 5G infrastructure are also boosting the need for EMC filters.

The Asia-Pacific region is experiencing rapid CAGR during the forecast period 2024-2032, due to fast industrialization and urbanization in countries such as China, India, and South Korea. The growth of the electronics and automotive sectors in this area increases the need for EMC filters, particularly with TDK Corporation and Delta Electronics spearheading product innovation. APAC's emphasis on increasing 5G networks, smart infrastructure, and EV manufacturing contributes to substantial growth.

Key Players

The major key players in the EMC Filtration Market are:

Schaffner Holding AG (FN 2090, FN 2410)

Astrodyne TDI (EMI Filter Series AIF, EMI Filter Series AIF07)

Total EMC Products Ltd. (Single-Phase Filters, Three-Phase Filters)

ETS-Lindgren (Series 7000 Filters, Series 8000 Filters)

DEM Manufacturing Ltd. (EMI Suppression Filters, Feedthrough Capacitors)

EPCOS AG (B84143-A-RFI Filter, B84112-RFI Filter)

Schurter Holding AG (FMAB NEO Single-Phase Filter, FMAD NEO Three-Phase Filter)

REO Ltd. (CNW 893 Sine Wave Filter, CNW 942 Sinusoidal Filter)

TE Connectivity Ltd. (Corcom EMI Filters, DE Series EMI Filters)

Premo SA (AC/DC EMC Filters, EMI Suppression Chokes)

TDK Corporation (RSHN Series Power Line Filter, Epcos B84112A)

Curtis Industries (SFC Series RFI Filters, SFA Series EMI Filters)

Murata Manufacturing Co., Ltd. (BNX Series EMI Suppression Filters, NFM Series Feedthrough Filters)

Panasonic Corporation (EZAEG2R16A EMC Filter, K2CM Series EMC Filter)

Laird Performance Materials (EMI Absorber Sheets, Fingerstock EMI Gaskets)

Ohmite Manufacturing (FC4 Series EMI Filters, FCB Series Filters)

Tri-Mag, LLC (AC EMI Filters, DC EMI Filters)

Delta Electronics, Inc. (DMF Series EMI Filters, DEF Series EMI Filters)

YAGEO Corporation (RF101M EMI Filters, PFC Series Filters)

Amphenol Corporation (Dual-Stage EMI Filters, High-Current Power Filters)

Recent Development

May 2023: TDK extended its Flexield family with the launch of IFQ06 ultra-thin magnetic sheets, designed for NFC applications. These sheets offer high permeability and low magnetic loss, providing effective protection against performance-reducing design elements in NFC designs, such as metal objects near antennas.

May 2023: Astrodyne TDI, a leading player in EMC solutions, opened a new manufacturing facility in Penang, Malaysia. This expansion aims to increase production capacity and meet the growing demand for high-quality power conversion and EMC filtration solutions.

April 2023: Schaffner introduced a new EMC solution with the RV Series choke, using ferrite and nanocrystalline core technologies. These chokes enhance noise attenuation in residential EV charging stations, helping designers meet regulatory requirements at a lower cost.

February 2023: Littelfuse acquired Western Automation Research and Development Limited, which specializes in electrical shock protection devices. This acquisition expands Littelfuse’s portfolio in EMC filtration and enhances its offering for high-growth markets.

January 2024: Murata launched a new line of compact EMC filters, designed specifically for use in 5G communication infrastructure. These filters address high-frequency noise issues, critical for stable and interference-free 5G networks.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.50 Billion |

| Market Size by 2032 | USD 2.35 Billion |

| CAGR | CAGR of 5.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (EMC Filters, Power Quality Filters) • by Insertion Loss (Common-Mode (Asymmetrical), Differential-Mode (Symmetrical)) • by Application (Industrial Automation, Building Technologies, Energy & Utilities, EV Charging, Medical, Data Centres, SMPS/Power Supplies, Smart Infrastructure, Energy Storage, UPS, Oil & Gas, Military, Home Appliances) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Schaffner Holding AG, Astrodyne TDI, Total EMC Products Ltd., ETS-Lindgren, DEM Manufacturing Ltd., EPCOS AG, Schurter Holding AG, REO Ltd., TE Connectivity Ltd., Premo SA, TDK Corporation, Curtis Industries, Murata Manufacturing Co., Ltd., Panasonic Corporation, Laird Performance Materials, Ohmite Manufacturing, Tri-Mag, LLC, Delta Electronics, Inc., YAGEO Corporation, Amphenol Corporation |

| Key Drivers | • The rising demand for advanced EMC filtration solutions in an increasingly electronic and connected world. • The growing importance of EMC filters in ensuring safety and reliability in modern vehicles. |

| Restraints | • The impact of rapid technological advancements on the growth of the EMC filtration market. |

Ans: The EMC Filtration Market is expected to grow at a CAGR of 5.15% during 2024-2032.

Ans: The EMC Filtration Market was USD 1.50 Billion in 2023 and is expected to Reach USD 2.35 Billion by 2032.

Ans: The rising demand for advanced EMC filtration solutions in an increasingly electronic and connected world.

Ans: North America dominated the EMC Filtration Market in 2023.

Ans: The common-mode (asymmetrical) segment dominated the EMC Filtration Market.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 EMC Filtration Production Volumes, by Region (2023)

5.2 EMC Filtration Design Trends (Historic and Future)

5.3 EMC Filtration Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. EMC Filtration Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 EMC Filters

7.2.1 EMC Filters Market Trends Analysis (2020-2032)

7.2.2 EMC Filters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.1 1-Phase EMC Filters

7.2.3.1.1 1-Phase EMC Filters Market Trends Analysis (2020-2032)

7.2.3.1.2 1-Phase EMC Filters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.2 3-Phase EMC Filters

7.2.3.2.1 3-Phase EMC Filters Market Trends Analysis (2020-2032)

7.2.3.2.2 3-Phase EMC Filters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.3 DC Filters

7.2.3.3.1 DC Filters Market Trends Analysis (2020-2032)

7.2.3.3.2 DC Filters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.4 IEC Inlets

7.2.3.4.1 IEC Inlets Market Trends Analysis (2020-2032)

7.2.3.4.2 IEC Inlets Market Size Estimates and Forecasts to 2032 (USD Billion)

7.2.3.5 Chokes

7.2.3.5.1 Chokes Market Trends Analysis (2020-2032)

7.2.3.5.1 Chokes Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Power Quality Filters

7.3.1 Power Quality Filters Market Trends Analysis (2020-2032)

7.3.2 Power Quality Filters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3.1 Passive Harmonic Filters

7.3.3.1.1 Passive Harmonic Filters Market Trends Analysis (2020-2032)

7.3.3.1.2 Passive Harmonic Filters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3.2 Active Harmonic Filters

7.3.3.2.1 Active Harmonic Filters Market Trends Analysis (2020-2032)

7.3.3.2.2 Active Harmonic Filters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3.3 Output Filters

7.3.3.3.1 Output Filters Market Trends Analysis (2020-2032)

7.3.3.3.2 Output Filters Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3.4 Reactors

7.3.3.4.1 Reactors Market Trends Analysis (2020-2032)

7.3.3.4.2 Reactors Market Size Estimates and Forecasts to 2032 (USD Billion)

8. EMC Filtration Market Segmentation, by Insertion Loss

8.1 Chapter Overview

8.2 Common-Mode (Asymmetrical)

8.2.1 Common-Mode (Asymmetrical) Market Trends Analysis (2020-2032)

8.2.2 Common-Mode (Asymmetrical) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Differential-Mode (Symmetrical)

8.3.1 Differential-Mode (Symmetrical) Market Trends Analysis (2020-2032)

8.3.2 Differential-Mode (Symmetrical) Market Size Estimates and Forecasts to 2032 (USD Billion)

9. EMC Filtration Market Segmentation, by Application

9.1 Chapter Overview

9.2 Industrial Automation

9.2.1 Industrial Automation Market Trends Analysis (2020-2032)

9.2.2 Industrial Automation Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.1.1 Motor Drives

9.2.1.1 Motor Drives Market Trends Analysis (2020-2032)

9.2.1.2 Motor Drives Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.1.3 Machinery & Equipment

9.2.1.3 Machinery & Equipment Market Trends Analysis (2020-2032)

9.2.1.4 Machinery & Equipment Market Size Estimates and Forecasts to 2032 (USD Billion)

9.2.1.5 Robotics

9.2.1.5 Robotics Market Trends Analysis (2020-2032)

9.2.1.6 Robotics Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Building Technologies

9.3.1 Building Technologies Market Trends Analysis (2020-2032)

9.3.2 Building Technologies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.3.1 HVAC

9.3.3.1.1 HVAC Market Trends Analysis (2020-2032)

9.3.3.1.2 HVAC Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.3.2 Elevators

9.3.3.2.1 Elevators Market Trends Analysis (2020-2032)

9.3.3.2.1 Elevators Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3.3.3 Lighting

9.3.3.3.1 Lighting Market Trends Analysis (2020-2032)

9.3.3.3.2 Lighting Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Energy & Utilities

9.4.1 Energy & Utilities Market Trends Analysis (2020-2032)

9.4.2 Energy & Utilities Market Size Estimates and Forecasts to 2032 (USD Billion)

9.5 EV Charging

9.5.1 EV Charging Market Trends Analysis (2020-2032)

9.5.2 EV Charging Market Size Estimates and Forecasts to 2032 (USD Billion)

9.6 Medical

9.6.1 Medical Market Trends Analysis (2020-2032)

9.6.2 Medical Market Size Estimates and Forecasts to 2032 (USD Billion)

9.7 Data Centers

9.7.1 Data Centers Market Trends Analysis (2020-2032)

9.7.2 Data Centers Market Size Estimates and Forecasts to 2032 (USD Billion)

9.8 SMPS/Power Supplies

9.8.1 SMPS/Power Supplies Market Trends Analysis (2020-2032)

9.8.2 SMPS/Power Supplies Market Size Estimates and Forecasts to 2032 (USD Billion)

9.9 Smart Infrastructure

9.9.1 Smart Infrastructure Market Trends Analysis (2020-2032)

9.9.2 Smart Infrastructure Market Size Estimates and Forecasts to 2032 (USD Billion)

9.10 Energy Storage

9.10.1 Energy Storage Market Trends Analysis (2020-2032)

9.10.2 Energy Storage Market Size Estimates and Forecasts to 2032 (USD Billion)

9.11 UPS

9.11.1 UPS Market Trends Analysis (2020-2032)

9.11.2 UPS Market Size Estimates and Forecasts to 2032 (USD Billion)

9.12 Oil & Gas

9.12.1 Oil & Gas Market Trends Analysis (2020-2032)

9.12.2 Oil & Gas Market Size Estimates and Forecasts to 2032 (USD Billion)

9.13 Military

9.13.1 Military Market Trends Analysis (2020-2032)

9.13.2 Military Market Size Estimates and Forecasts to 2032 (USD Billion)

9.14 Home Appliances

9.14.1 Home Appliances Market Trends Analysis (2020-2032)

9.14.2 Home Appliances Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America EMC Filtration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.4 North America EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.2.5 North America EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.6.2 USA EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.2.6.3 USA EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.7.2 Canada EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.2.7.3 Canada EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.2.8.2 Mexico EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.2.8.3 Mexico EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe EMC Filtration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.1.6.3 Poland EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.1.7.3 Romania EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.1.8.3 Hungary EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.1.9.3 Turkey EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe EMC Filtration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.2.5 Western Europe EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.2.6.3 Germany EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.7.2 France EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.2.7.3 France EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.8.2 UK EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.2.8.3 UK EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.2.9.3 Italy EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.2.10.3 Spain EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.2.13.3 Austria EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia-Pacific

10.4.1 Trends Analysis

10.4.2 Asia-Pacific EMC Filtration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia-Pacific EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.4 Asia-Pacific EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.4.5 Asia-Pacific EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.6.2 China EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.4.6.3 China EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.7.2 India EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.4.7.3 India EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.8.2 Japan EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.4.8.3 Japan EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.9.2 South Korea EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.4.9.3 South Korea EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.4.10.3 Vietnam EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.11.2 Singapore EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.4.11.3 Singapore EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.12.2 Australia EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.4.12.3 Australia EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia-Pacific EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia-Pacific EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East EMC Filtration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.4 Middle East EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.5.1.5 Middle East EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.5.1.6.3 UAE EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.5.1.7.3 Egypt EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.5.1.9.3 Qatar EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa EMC Filtration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.4 Africa EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.5.2.5 Africa EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.5.2.6.3 South Africa EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America EMC Filtration Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.4 Latin America EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.6.5 Latin America EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.6.2 Brazil EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.6.6.3 Brazil EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.7.2 Argentina EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.6.7.3 Argentina EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.8.2 Colombia EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.6.8.3 Colombia EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America EMC Filtration Market Estimates and Forecasts, by Product Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America EMC Filtration Market Estimates and Forecasts, by Insertion Loss (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America EMC Filtration Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Schaffner Holding AG

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 Delta Electronics, Inc

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Astrodyne TDI

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Total EMC Products Ltd.

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 ETS-Lindgren

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 DEM Manufacturing Ltd.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 EPCOS AG

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 Schurter Holding AG

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 TE Connectivity Ltd.

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 TDK Corporation

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Product Type

EMC Filters

1-Phase EMC Filters

3-Phase EMC Filters

DC Filters

IEC Inlets

Chokes

Power Quality Filters

Passive Harmonic Filters

Active Harmonic Filters

Output Filters

Reactors

By Insertion Loss

Common-Mode (Asymmetrical)

Differential-Mode (Symmetrical)

By Application

Motor Drives

Machinery & Equipment

Robotics

Building Technologies

HVAC

Elevators

Lighting

Energy & Utilities

Medical

Data Centers

SMPS/Power Supplies

Smart Infrastructure

Energy Storage

UPS

Oil & Gas

Military

Home Appliances

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Battery Sensor Market size was valued at USD 6.30 billion in 2023 and is expected to reach USD 15.92 billion by 2032 and grow at a CAGR of 10.85% over the forecast period 2024-2032.

The Laser Cladding Market size is expected to be valued at USD 600 Mn in 2023 & will reach USD 1426.38 Mn by 2032 with a growing CAGR of 10.1% by 2024-2032.

The Consumer Network Attached Storage Market Size was valued at USD 5.52 Billion in 2023 and is expected to grow at a CAGR of 12.18% by forecast 2024-2032.

The Radar Sensors for Smart City Applications Market was valued at USD 248.7 Million in 2023 and is expected to reach USD 701.9 Million by 2032, growing at a CAGR of 12.24% from 2024-2032.

The Virtual Mirror Market Size was valued at USD 10.59 Billion in 2023 and is expected to reach USD 76.55 Billion by 2032 and grow at a CAGR of 24.63% over the forecast period 2024-2032.

The 5G mm-Wave Technology Market Size was USD 3.04 billion in 2023 and will reach USD 10.49 Billion by 2032, growing at a CAGR of 14.77% from 2024-2032.

Hi! Click one of our member below to chat on Phone