Embedded Systems Market Report Scope & Overview:

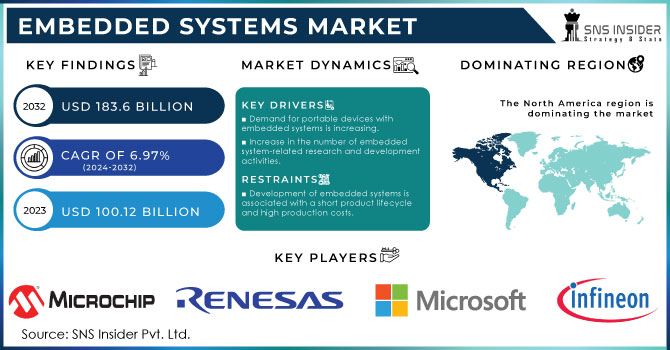

The Embedded Systems Market Size was valued at USD 103.79 billion in 2023 and is expected to reach USD 178.30 billion by 2032 and grow at a CAGR of 6.20% over the forecast period 2024-2032.

The embedded systems market is experiencing significant growth, spurred by advancements in autonomous vehicles, electric vehicles (EVs), and safety technologies such as Advanced Driver Assistance Systems (ADAS). These systems are integral to enhancing vehicle connectivity, fuel efficiency, and safety, managing critical functions like engine control units (ECUs) and infotainment systems. The integration of AI and machine learning is further driving the sophistication of these systems, enabling real-time monitoring and decision-making in modern vehicles, which may contain up to 70 microcontrollers. The demand for systems that control ABS, airbags, and adaptive cruise control is increasing as vehicle electrification accelerates. Additionally, the rising focus on sustainability, with 74% of Original Equipment Manufacturers (OEMs) prioritizing electric vehicle plans, is influencing the market's direction. Technologies like virtualized hardware labs, which speed up development, are set to further fuel market growth. As innovations in safety, performance, and eco-friendly technologies continue to evolve, the automotive embedded systems market is expected to thrive.

Embedded Systems Market Size and Forecast

-

Market Size in 2023: USD 103.79 Billion

-

Market Size by 2032: USD 178.30 Billion

-

CAGR: 6.20% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: 2020-2022

Get more information on Embedded Systems Market - Request Sample Report

Embedded Systems Market Trends:

-

Growing adoption of IoT-connected devices is driving demand for embedded systems, with over 30 billion IoT devices expected to be active globally by 2030.

-

Rising use of embedded systems in automotive electronics and ADAS, as electronics content now accounts for 35–40% of total vehicle cost.

-

Increasing deployment in industrial automation and smart manufacturing, contributing to productivity gains of 20–25% through real-time control and monitoring.

-

Expansion of edge computing is accelerating embedded processor demand, with over 50% of enterprise data expected to be processed at the edge.

-

Focus on low-power, high-performance microcontrollers is growing, reducing energy consumption by 30% in battery-operated and portable devices.

Embedded Systems Market Drivers

-

Exploring the Role of AI and Decentralization in Shaping the Future of Embedded Security Systems

The growing demand for embedded security systems is driving market expansion, as the adoption of connected devices and IoT increases. With cyber threats becoming more sophisticated, integrated security solutions within embedded systems have become essential for protecting sensitive data across sectors like automotive, healthcare, and finance. The rise of AI and machine learning enhances these systems, optimizing threat detection and performance. However, as AI models become widespread, securing them becomes a challenge, with generative AI increasing the attack surface. By 2027, it’s expected that 75% of employees will acquire or modify technology outside of IT's control, further decentralizing cybersecurity decision-making. This shift requires flexible strategies for comprehensive risk management. Despite technological advancements, human behavior remains a core challenge, with 74% of security breaches involving a human element. As such, human-centric security strategies will become increasingly vital in 2024 to improve security culture.

Embedded Systems Market Restraints

-

High development costs, regulatory hurdles, cybersecurity risks, and a shortage of skilled professionals hinder the embedded systems market's growth.

The embedded systems market faces key restraints, with high development costs being the primary challenge. Building complex systems, particularly those integrating advanced technologies like AI and machine learning, requires substantial investment. This challenge is compounded by the need to meet strict industry standards and regulations, increasing the complexity of development. Furthermore, as cybersecurity threats evolve, maintaining and upgrading systems becomes a continual task. The market also suffers from a shortage of skilled professionals, further delaying progress and contributing to cost overruns. These factors create significant hurdles to the efficient growth of the market.

Embedded Systems Market Segment Analysis

By Component

The hardware segment dominates the embedded systems market, holding around 63% of the market share in 2023. This dominance is driven by the increasing demand for microcontrollers, sensors, processors, and other essential components that power embedded systems across various industries, such as automotive, consumer electronics, and industrial automation. The rapid advancements in IoT devices and the rise of connected technologies further amplify the need for high-performance hardware, fueling market growth. Additionally, innovations in energy efficiency, miniaturization, and integration are enhancing the functionality and performance of embedded hardware, solidifying its pivotal role in the market.

By Type

The standalone embedded systems segment holds a dominant 39% share of the embedded systems market in 2023, driven by their ability to operate independently and efficiently. These systems are self-contained and specialized for particular tasks, offering reliability in a range of applications such as consumer electronics, automotive, medical devices, and industrial machinery. Their distinct functionality, ease of integration, and scalability make them well-suited for industries that require dedicated, purpose-built solutions. The growing demand for efficient, reliable systems in sectors like healthcare and automation is further contributing to the segment's dominance in the market.

Embedded Systems Market Regional Analysis

North America holds the largest share of the embedded systems market, representing approximately 39% of the total revenue in 2023. The region benefits from rapid technological advancements and extensive demand in industries like automotive, healthcare, consumer electronics, and aerospace. Strong investment in IoT, AI, and automation further drives the adoption of embedded systems. Additionally, the presence of leading technology companies and a robust infrastructure for research and development contribute to North America's dominance. The increasing focus on smart devices, connected solutions, and cutting-edge systems is expected to maintain this market leadership moving forward.

Asia-Pacific is expected to be the fastest-growing region in the embedded systems market from 2024 to 2032. Key countries like China, India, Japan, and South Korea are driving this growth. China’s advancements in smart city technologies, India’s burgeoning IT industry, and Japan and South Korea’s leadership in automotive and robotics applications are pivotal. Additionally, government investments and strong manufacturing bases, coupled with growing demand for IoT, AI, and automation, are fueling the region's rapid expansion. Asia-Pacific’s market is further supported by an increasing focus on technological innovation and regional R&D efforts.

Need any customization research on Embedded Systems Market - Enquire Now

Embedded System Companies are:

-

Renesas Electronics – Microcontrollers, Automotive ICs

-

STMicroelectronics – Automotive ICs, Sensors, Power Management ICs

-

Infineon Technologies – Automotive ICs, Power Semiconductors

-

Texas Instruments – Analog ICs, Embedded Processors

-

Qualcomm – Mobile SoCs, Wireless Communication Chips

-

NXP Semiconductors – Automotive ICs, Security Solutions, Microcontrollers

-

Microchip Technology – Microcontrollers, Analog ICs, Memory

-

Analog Devices – Analog, Mixed-Signal, and Digital Signal Processing ICs

-

Intel Corporation – Processors, Memory, Data Center Solutions

-

Advanced Micro Devices – CPUs, GPUs, APUs

-

Broadcom – Semiconductors, Networking Chips

-

Cisco Systems – Networking Hardware, Telecommunications Equipment

-

Samsung Electronics – Semiconductors, Displays, Consumer Electronics

-

IBM – Mainframes, Cloud Solutions, AI Chips

-

Micron Technology – Memory and Storage Solutions

-

Qualcomm Technologies International – Wireless Chipsets, Bluetooth Solutions

-

ON Semiconductor – Power Management ICs, Automotive Semiconductors

-

Broadcom Inc. – Networking, Wireless Communication Chips

-

MediaTek – Mobile SoCs, Wireless Communication Solutions

-

Nvidia Corporation – Graphics Processing Units (GPUs), AI Chips

List of Suppliers that provide raw materials and components for embedded systems:

-

Intel

-

Qualcomm

-

NXP Semiconductors

-

STMicroelectronics

-

Broadcom

-

Texas Instruments

-

Analog Devices

-

Microchip Technology

-

Renesas Electronics

-

Infineon Technologies

Recent Development

-

On January 2025, Honda and Renesas partnered to develop a high-performance SoC for software-defined vehicles, targeting 2,000 TOPS AI performance and power efficiency. The SoC integrates multi-die chiplet technology and AI accelerators to support autonomous driving and centralized ECUs.

-

On September 2024, STMicroelectronics announced the FIPS 140-3 certification for its STSAFE-TPM trusted platform modules (TPMs), the first cryptographic modules to achieve this certification. These TPMs provide secure protection for critical systems in PCs, servers, IoT devices, and automotive applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 103.79 Billion |

| Market Size by 2032 | USD 178.30 Billion |

| CAGR | CAGR of 6.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software) • By Type (Standalone Embedded Systems, Real-Time Embedded Systems, Network Embedded Systems, Mobile Embedded Systems) • By Application (Consumer Electronics, Medical Equipment, Industrial Automation, Automotive Systems, Aerospace & Defense Technologies, Telecommunications, Smart Devices, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Renesas Electronics, STMicroelectronics, Infineon Technologies, Texas Instruments, Qualcomm, NXP Semiconductors, Microchip Technology, Analog Devices, Intel Corporation, Advanced Micro Devices, Broadcom, Cisco Systems, Samsung Electronics, IBM, Micron Technology, Qualcomm Technologies International, ON Semiconductor, Broadcom Inc., MediaTek, Nvidia Corporation. |

| Key Drivers | • Exploring the Role of AI and Decentralization in Shaping the Future of Embedded Security Systems |

| Restraints | • High development costs, regulatory hurdles, cybersecurity risks, and a shortage of skilled professionals hinder the embedded systems market's growth. |