Embedded Security Market Size & Trends:

The Embedded Security Market Size was valued at USD 7.07 Billion in 2023 and is expected to reach USD 12.52 Billion by 2032 and grow at a CAGR of 6.60% over the forecast period 2024-2032.

The embedded security market is experiencing significant growth in the digital era, driven by the rising adoption of connected devices and the expansion of the Internet of Things (IoT) ecosystem. With over 18.8 billion IoT devices globally and more than 400 active IoT platforms, the need for robust security solutions has never been more critical. IoT devices, from smart home gadgets to industrial sensors, often function in vulnerable environments, exposing them to cyber threats.

Embedded Security Market Size and Forecast

-

Market Size in 2023: USD 7.07 Billion

-

Market Size by 2032: USD 12.52 Billion

-

CAGR: 6.60% from 2024 to 2032

-

Base Year: 2023

-

Forecast Period: 2024–2032

-

Historical Data: Not Provided

Get more information on Embedded Security Market - Request Sample Report

Embedded Security Market Trends:

-

Rapid growth of IoT devices is driving embedded security adoption, with over 30 billion connected devices expected globally, increasing demand for hardware-level protection.

-

Rising cyberattacks on connected systems are pushing adoption of secure MCUs and TPMs, as over 60% of OEMs integrate embedded security in new designs.

-

Expansion of automotive and industrial IoT is fueling demand for secure chips, with embedded security usage in vehicles growing at over 18% CAGR.

-

Increasing regulations for data protection and device authentication are accelerating deployment, especially in healthcare and payments, where 70%+ devices require encryption.

-

Integration of secure elements and cryptographic processors is improving device resilience, reducing breach risks by up to 40% in embedded systems.

Advanced embedded security technologies, such as secure boot, hardware-based encryption, and trusted execution environments, play a vital role in safeguarding these devices against breaches, ensuring the integrity and safety of critical systems. This is especially important in sectors like healthcare, where wearables and remote monitoring tools handle sensitive patient data, demanding stringent security measures.

The financial services sector is another major contributor to the growth of the embedded security market. In 2024, average daily transaction volumes exceeded 500 million in September, up from 483 million in August, highlighting the increasing reliance on digital payment systems, ATMs, and point-of-sale (POS) terminals. Embedded security solutions, including hardware security modules (HSMs) and tamper-resistant chips, are essential to prevent fraud and ensure compliance with regulatory standards. As cyber threats continue to evolve, the demand for scalable, innovative embedded security solutions will surge, enabling industries to protect sensitive data and maintain consumer trust. This growth underscores the embedded security market’s critical role in advancing secure digital transformation across sectors.

Embedded Security Market Drivers

-

A key factor propelling the embedded security market is the rising occurrence and complexity of cybersecurity threats.

Cyberattacks, such as hacking, phishing, malware, and data breaches, have created an immediate demand for enhanced security protocols, particularly for embedded systems. Embedded devices frequently manage sensitive information like personal details, financial records, or industrial control systems, positioning them as prime targets for attackers. For example, connected vehicles, healthcare devices, and intelligent home systems can frequently be susceptible to cyber threats if they do not have strong security measures. The increasing frequency of prominent breaches, like the hacking of intelligent devices, shows the urgent demand for secure embedded systems. Hackers taking advantage of weaknesses in these devices can lead to financial losses, harm to reputation, and potentially even physical injury, particularly in industries such as healthcare and automotive. To reduce these risks, embedded security solutions are now essential. These solutions offer encryption, secure boot methods, trusted execution environments (TEEs), and hardware security components such as secure elements (SE) and hardware security modules (HSMs), guaranteeing data integrity and privacy.

-

The automotive sector is experiencing a transition towards self-driving cars (AVs), which depend significantly on the embedded systems market for functionality.

These systems manage multiple essential elements of AVs, such as navigation, communication, and control mechanisms. The intricate nature and interrelation of autonomous vehicles present various security issues, as these systems are susceptible to cyberattacks that might jeopardize their safety and operation. Self-driving cars are fitted with sensors, cameras, and communication technologies that continuously gather and relay information. If these systems are breached, assailants might gain command of the vehicle, resulting in disastrous crashes or larceny. To guarantee the safety and dependability of AVs, integrated security is crucial. Technologies like secure boot, encryption, and hardware security modules are employed to secure communication channels, protect software from modifications, and guarantee that the vehicle’s systems operate properly in all situations.

Embedded Security Market Restraints

-

A significant challenge facing the embedded security market is the lack of standardization in security protocols and technologies.

With various manufacturers and developers offering different embedded security solutions, there is no universal standard for securing embedded systems. This lack of consistency can lead to confusion, interoperability issues, and difficulties in implementing security across diverse devices and platforms. For example, security mechanisms such as encryption algorithms, secure boot processes, and authentication methods can vary significantly across different manufacturers and industries. This can make it difficult for businesses to select the best solution for their needs, as there is no single framework for ensuring compatibility and security across all systems. Furthermore, the absence of standardized security solutions can lead to gaps in security, as devices with different security protocols may be more vulnerable to attacks.

Embedded Security Market Segmentation Outlook

by Offering

The hardware segment dominated in 2023 with 48% in the embedded security market due to the increasing demand for secure, physical components in devices like IoT systems, automotive electronics, and consumer electronics. Hardware-based security solutions are known for their ability to provide robust, tamper-resistant protection, which is crucial in protecting against various security breaches. This segment includes components like secure elements, trusted platform modules (TPMs), and hardware security modules (HSMs) that offer secure data storage, encryption, and cryptographic functions. Companies like Infineon Technologies and NXP Semiconductors lead in hardware solutions, providing secure microcontrollers and hardware chips embedded in devices to protect sensitive information.

The services segment is projected to be the fastest-growing during 2024-2032, due to the rising demand for ongoing protection against evolving cyber threats. As cybersecurity risks continue to increase, organizations need to continuously update and manage their security systems. This segment encompasses services such as security consulting, managed security services, risk assessments, and software updates, which help companies maintain strong protection over time. Service providers like Gemalto (now part of Thales Group) and Synopsys offer consulting and managed security services tailored for embedded systems, helping businesses strengthen their defense mechanisms against hacking, data breaches, and cyberattacks.

by Security Type

The payment segment led the embedded security market in 2023 with a 46% market share due to the increasing demand for secure transactions in e-commerce, mobile payments, and contactless payments. This growth is driven by the need to protect sensitive financial data and prevent fraud in digital transactions. Embedded security solutions like Secure Elements (SEs) and Trusted Platform Modules (TPMs) ensure data encryption, authentication, and secure storage of payment credentials. Companies like Gemalto (Thales) provide advanced solutions such as secure payment cards and digital wallets, which enhance transaction security. Visa and Mastercard also use embedded security to protect payment systems globally.

The authentication and access management segment is projected to grow at a rapid rate during 2024-2032, due to increasing cybersecurity concerns, with businesses seeking more reliable authentication methods to prevent unauthorized access. This segment includes technologies like multi-factor authentication (MFA), biometrics, and hardware-based authentication (e.g., fingerprint sensors or facial recognition). Companies like Microsoft and Okta provide embedded solutions that ensure secure access to enterprise systems and cloud environments. Apple also uses embedded security in Face ID and Touch ID to authenticate users, providing robust security for personal devices.

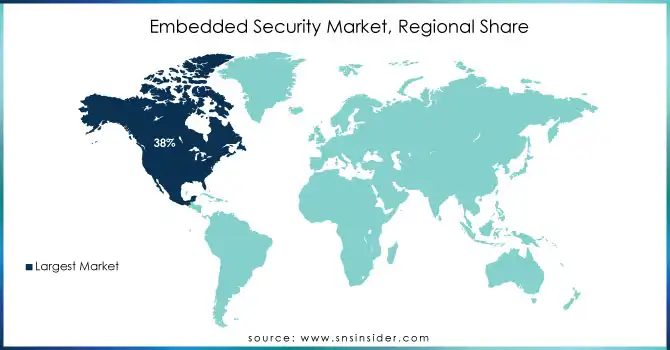

Embedded Security Market Regional Analysis

North America dominated the embedded security market, holding a 38% market share in 2023. The U.S., in particular, has robust demand for secure embedded systems in industries like automotive, aerospace, and consumer electronics. Major companies such as Intel, Qualcomm, and Texas Instruments contribute to the growth of the market through their innovative embedded security solutions, including secure processors and encryption technologies. Additionally, North America benefits from strong regulatory support, which encourages the implementation of embedded security measures in IoT devices, ensuring protection against cyber threats. Companies like Lockheed Martin and Honeywell also incorporate embedded security solutions in aerospace and defense applications, bolstering regional demand.

APAC is anticipated to be the fastest-growing region in the embedded security market between 2024 and 2032. The rapid growth of industries such as automotive, consumer electronics, and telecommunications in countries like China, India, Japan, and South Korea contributes to this expansion. APAC benefits from the increasing adoption of IoT devices, smart home systems, and industrial automation, all of which require robust embedded security solutions to protect data and devices. Companies such as Samsung and Sony are leading the charge, incorporating embedded security technologies in their smartphones, wearables, and consumer electronics. China’s increasing push for self-reliance in technology, coupled with significant investments in 5G infrastructure, is another factor propelling the demand for embedded security solutions.

Get Customized Report as per your Business Requirement - Request For Customized Report

Embedded Security Market Players are:

-

Infineon Technologies (OPTIGA Trust M, OPTIGA TPM)

-

NXP Semiconductors (EdgeLock SE050, LPC55S69)

-

STMicroelectronics (STM32 Secure, STSAFE-A100)

-

Qualcomm (Snapdragon Secure, Qualcomm Mobile Security)

-

Microchip Technology (Trust Platform, ATECC608A)

-

Renesas Electronics (RA Secure, RXv2)

-

Arm Holdings (Cortex-M55, Arm TrustZone)

-

Texas Instruments (CC3200, Tiva C Series)

-

Broadcom (CryptoAuth, BCM4330)

-

SecureRF (SecureRF’s Embedded Cryptographic Engine, RFID Security)

-

On Semiconductor (SecurEdge, NCS5630)

-

Thales Group (nShield Edge, SafeNet Authentication)

-

Maxim Integrated (MAXQ1061, MAXQ2030)

-

Cypress Semiconductor (now part of Infineon) (CYASSIST, CY8CMBR3108)

-

Atmel (now part of Microchip) (ATSHA204A, SAM D21)

-

Microsemi (now part of Microchip) (Secure Embedded Platform, SmartFusion2)

-

MicroVision (Embedded Vision System, Security Camera Technology)

-

Gemalto (now part of Thales) (IDPrime 940, SafeNet HSM)

-

Spyrus (SPYRUS Secure Flash Drive, SPYRUS Hardware Security Module)

-

HID Global (iCLASS SE, FIDO U2F)

Suppliers providing components to manufacturers:

-

Analog Devices

-

Infineon Technologies

-

NXP Semiconductors

-

ON Semiconductor

-

Broadcom

-

Maxim Integrated

-

Rohm Semiconductor

-

Texas Instruments

-

Microchip Technology

-

Vishay Intertechnology

Recent Development

-

June 2023: Infineon Technologies AG revealed the introduction of its Edge Protect embedded security solution. The updated software solution features four types of security settings for customer needs in IoT applications, arranged by escalating security features.

-

April 2024: Infineon Technologies AG revealed that its latest PSOC™ Edge E8x MCU product line has been developed to achieve the top certification level offered by the Platform Security Architecture (PSA) Certified program, which serves as a framework for embedded security.

-

February 2023: NXP Semiconductors has unveiled the EdgeLock SE051H, a secure element crafted for Matter, enhancing the industry's most extensive portfolio of Matter devices.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 7.07 Billion |

| Market Size by 2032 | USD 12.52 Billion |

| CAGR | CAGR of 6.60% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Hardware, Software, Services) • By Security Type (Authentication And Access Management, Payment, Content Protection) • By Application (Wearables, Smartphones, Automotive, Smart Identity Cards, Industrial, Payment Processing And Card, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Infineon Technologies, NXP Semiconductors, STMicroelectronics, Qualcomm, Microchip Technology, Renesas Electronics, Arm Holdings, Texas Instruments, Broadcom, SecureRF, On Semiconductor, Thales Group, Maxim Integrated, Cypress Semiconductor, Atmel, Microsemi, MicroVision, Gemalto, Spyrus, HID Global |

| Key Drivers | • A key factor propelling the embedded security market is the rising occurrence and complexity of cybersecurity threats. • The automotive sector is experiencing a transition towards self-driving cars (AVs), which depend significantly on the embedded systems market for functionality. |

| RESTRAINTS | • A significant challenge facing the embedded security market is the lack of standardization in security protocols and technologies. |