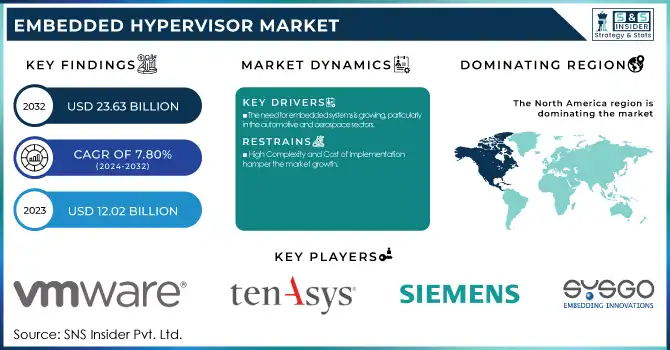

The Embedded Hypervisor Market Size was valued at USD 12.02 Billion in 2023. It is expected to grow to USD 23.63 Billion by 2032 and grow at a CAGR of 7.80% over the forecast period of 2024-2032.

To Get More Information on Embedded Hypervisor Market - Request Sample Report

The increasing use of IoT devices and edge computing solutions is greatly propelling the necessity for embedded hypervisor products. IoT devices work for various applications starting from the smart home, industrial, automotive, and other devices, but hosting all these applications on one device needs a solution to decode this complexity. In this regard, they also have an increasingly essential role played by embedded hypervisors that make the virtualization of the resources within the IoT devices. Hypervisors permit distinct applications or systems to run inside a virtual situation and remain autonomous of each other at the equipment level, making them function together without disturbing one another. This is necessary to ensure that the most important applications, such as security-related applications and real-time data processing, can run without compromising system safety and stability.

Governments worldwide are heavily investing in IoT infrastructure as part of their digital transformation strategies. For instance, the European Union's Digital Compass 2030 initiative aims to significantly expand the use of IoT technologies across various sectors, including transportation, healthcare, and agriculture, by 2030.

In recent years, the new trend of demanding virtualization in embedded systems is due to the necessity of consensus around making systems more efficient, more performant, and more secure irrespective of increasing complexity across various application domains. Embedded systems are vital in applications like automotive, aerospace, healthcare, and industrial automation, where resource optimization is a must. Its virtualization allows multiple OS to run on a single HW platform simultaneously meaning that an embedded system can perform multiple different tasks in isolation at the same time. This allows for maximizing the use of the hardware resources, meaning that one does not require multiple physical devices, which, translates to lower costs, and simplified hardware management.

In the automotive sector, the U.S. National Highway Traffic Safety Administration (NHTSA) emphasizes the use of embedded systems in autonomous vehicles. Virtualization in these systems helps manage multiple functions, such as navigation, safety, and vehicle control, on a single platform. According to the U.S. Department of Transportation (DOT), the U.S. government expects the number of connected vehicles to increase significantly, with over 50 million connected cars on U.S. roads by 2030.

Drivers

The need for embedded systems is growing, particularly in the automotive and aerospace sectors.

Rising demand for cloud-based services and virtualization.

Expansion of the Internet of Things (IoT) and connected devices drives the market growth.

Increasing adoption of Internet of Things (IoT) solutions and connected devices are some of the major growth factors for the market of embedded hypervisors. The proliferation of IoT networks in fields like healthcare, automotive, smart cities, and industrial automation, has made the need for a secure and efficient method of managing these connected devices imperative. Most IoT devices work in resource-constrained environments and to allow multiple functions to run at the same time, they have to make optimum use of hardware resources. This is made possible by hypervisors that, when embedded, will virtualize the hardware so that two or more OSes or applications can run at the same time and API calls made by one do not affect another. By doing this virtualization, the system makes the best use of its resources cuts down hardware overhead costs, and boosts performance. Moreover, considering that IoT networks need to transmit sensitive data, embedded hypervisors also provide critical application isolation and protection, thus providing a protection boundary for some critical applications from potential cybersecurity threats. As the number of connected devices continues to grow exponentially, the requirement for embedded hypervisors to allow smooth and secure working is pushing the market growth through this vertical for the industries.

Restraint

High Complexity and Cost of Implementation hamper the market growth.

The complexity and high costs associated with the implementation of embedded hypervisor technology act as major restraint, limiting the growth of the market. Embedded hypervisors cannot be simply integrated in systems they already are; thus, they require a significant investment in the relevant hardware and software which needs to be provided by expertise consumer partners to these processors. The hypervisor, hardware and different OSs (which run on the platform) have to be able to communicate and work together through this layer, which creates this complexity. In industries such as automotive, healthcare, and aerospace that rely on highly special-purpose and mission-critical embedded systems, existing infrastructure is not easily convertible to a virtualization capability and the effort may also be large.

Opportunities

There are abundant opportunities in emerging sectors such as healthcare, edge computing, automotive electronics, and industrial IoT.

The emergence of new applications, such as autonomous vehicles, smart grids, and medical implants, has revolutionized various industries.

Advancements in processor technology have played a crucial role in driving these technological developments.

By Component

Software held the largest market share around 68% in 2023. The software plays a vital role as an enabler for the virtualization of these Embedded systems. Software hypervisors enable running multiple OSes or apps simultaneously on a single hardware platform, enhancing resource allocation, security, and flexibility, without requiring without requiring more hardware. Their versatility is invaluable in industries like automotive, aerospace, and telecommunications, where an embedded system must perform complex tasks while offering cost and performance optimization. Another reason that hypervisors can operate as software instead of hardware solutions is that they are much easier to update and change, so they are more scalable and can adapt to changing technological needs.

By Enterprise Size

The Large enterprises model held the largest market share around 58% in 2023. It is owing as they offer more resources, and operations on a larger scale, and demand more advanced embedded virtualization solutions. Large enterprises in industries such as automotive, aerospace, telecommunications, and healthcare need powerful, secure, and scalable embedded systems to support their complex applications and business operations. Such enterprises generally possess the financial and technical prowess to deploy embedded hypervisor solutions that reduce resource footprint, improve system performance, and enhance system-wide security. Reacting in most cases, large organizations also work in high regulated and effective industries, like healthcare and defense; embedded hypervisors have a significant impact in these situations for reasonably protecting data and ensuring authentication.

By Application

The automotive sector accounted for the largest market share around 32% in 2023. The explosive growth in connected, autonomous, and electric vehicles led the automotive industry to rapidly adopt embedded hypervisor technology to meet demand for the growing complexity of modern vehicles. Embedded hypervisors allow multiple OS to run at the same time on a single hardware platform without interference, so the OEM can easily combine functions such as infotainment system, ADAS, and autonomous driving functions. Such technology also allows for optimized resource allocation, better system performance and increased security by separating mission critical functions from the non-mission critical ones. Moreover, as automotive makers strive to ensure compliance with stringent safety and regulatory requirements, the embedded hypervisors manage integrated yet complex networks of sensors, cameras, and control units, making them a keystone for next generation automotive developments. As the largest market segment, the automotive industry has led the market adoption of embedded hypervisors and continues to drive investment in IoT, electrification, and automation.

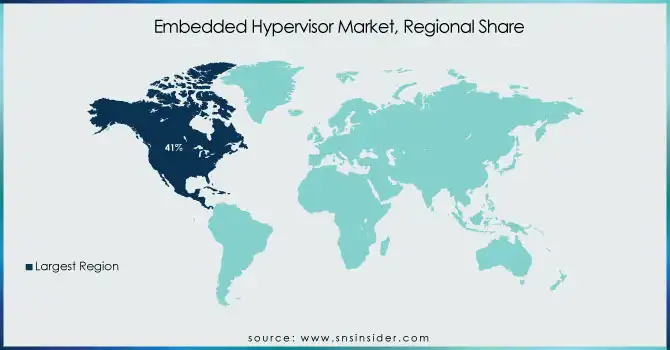

North America region held the largest market share around 41% in 2023. This is owing to owing to the factors such as, superior technological infrastructure, extensive R&D investment, and high concentration of industrial leaders in verticals (automobile, aerospace, defense, and telecommunications) across the U.S. Home to some of the leading automotive manufacturers and tech companies pushing forward autonomous vehicles, smart transportation systems and connected devices, all rooted in embedded hypervisor technology. Moreover, North America has a strong defense and aerospace industry which require high levels of security, reliability, and system performance from embedded systems, further fueling the adoption of virtualization technologies. Digital modernization of U.S. government agencies, and acts such as the National Defense Authorization Act (NDAA) that promote the inclusion of advanced technologies in defense systems, will consolidate the growth of the embedded hypervisors market. Moreover, the increasing adoption of digital transformation in different sectors, keeping in mind the fast-growing IoT landscape in the region, is also fueling the hypervisor solution market to include complex connected networks of devices. North America continues to be the major region for the embedded hypervisor because of its better regulatory environment, heavy technological investment, and the presence of several key industry players.

Do You Need any Customization Research on Embedded Hypervisor Market - Enquire Now

VMware, Inc. (VMware vSphere, VMware Workstation)

TenAsys Corporation (INTEGRITY RTOS, iRMX Real-Time Operating System)

IBM Corporation (IBM PowerVM, IBM z/VM)

Siemens EDA (Mentor Embedded Hypervisor, Veloce Emulation Platform)

QNX Software Systems Limited (QNX Neutrino RTOS, QNX Hypervisor)

WindRiver Systems, Inc. (VxWorks, Wind River Linux)

SYSGO AG (PikeOS, ELinOS Linux)

ENEA (Enea OSE, Enea Linux)

Lynx Software Technologies, Inc. (LynxOS, LynxSecure)

Acontis Technologies GmbH (Xenomai, EtherCAT Master)

Citrix Systems, Inc. (Citrix Hypervisor, Citrix Virtual Apps and Desktops)

Proxmox Server Solutions GmbH (Proxmox Virtual Environment, Proxmox Backup Server)

Microsoft Corporation (Hyper-V, Windows Server)

Green Hills Software (INTEGRITY RTOS, MULTI IDE)

Sierraware (Sierra Hypervisor, Sierra Secure Virtualization)

Acontis Technologies GmbH (Xenomai, EtherCAT Master)

KUKA AG (KUKA.Safe Operation, KUKA.System Software)

Red Hat, Inc. (Red Hat Enterprise Linux, Red Hat Virtualization)

Fujitsu Limited (Fujitsu Cloud Hypervisor, Fujitsu Virtualization Platform)

Aricent (now part of Altran) (Virtualization Solutions, Embedded Software Solutions)

In 2024, VMware, Inc. launched VMware vSphere 8, enhancing its embedded hypervisor capabilities for edge computing and IoT applications, providing improved security, scalability, and resource management for embedded systems in sectors like automotive and telecommunications.

In 2023, TenAsys Corporation released a new version of its INTEGRITY RTOS with enhanced support for virtualization in embedded systems, offering improved safety and security for critical industries like aerospace and automotive.

In 2023, QNX Software Systems Limited enhanced its QNX Hypervisor by adding new features for virtualized safety-critical applications, improving support for ISO 26262 compliance in automotive and aerospace systems.

| Report Attributes | Details |

| Market Size in 2023 | US$ 12.02 Billion |

| Market Size by 2032 | US$ 23.63 Billion |

| CAGR | CAGR of 7.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Services, Software) • By Enterprise Size (Small & Medium Enterprises (SMEs), Large Enterprises) • By Technology (Desktop Virtualization, Server Virtualization, Data Center Virtualization) • By Application (IT & Telecommunications, Automotive, Aerospace & Defense, Industrial, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | VMware, Inc., TenAsys Corporation, IBM Corporation, Siemens EDA, QNX Software Systems Limited, WindRiver Systems, Inc., SYSGO AG, ENEA, Lynx Software Technologies, Inc., Acontis Technologies GmbH, Citrix Systems, Inc., Proxmox Server Solutions GmbH, Microsoft Corporation, Green Hills Software, Sierraware, Acontis Technologies GmbH |

| Key Drivers | • The need for embedded systems is growing, particularly in the automotive and aerospace sectors. • Rising demand for cloud-based services and virtualization. • Expansion of the Internet of Things (IoT) and connected devices |

| Market Restraints | • The market encounters various challenges, including complexity and a steep learning curve, performance overhead. |

Ans: The market is expected to grow to USD 20.47 billion by the forecast period of 2030.

Ans. The CAGR of the Embedded Hypervisor Market for the forecast period 2022-2030 is 7.92%.

Ans: There are three options available to purchase this report,

Features: A non-printable PDF to be accessed by just one user at a time

Features:

C: Excel Datasheet: USD 2,325

1 complimentary analyst briefing session of 30 minutes to be provided post purchase and delivery of the study

Ans: The North America region is dominating the Embedded Hypervisor Market

Ans:

The major players in the market are VMware, Inc., TenAsys Corporation, IBM Corporation, Siemens EDA, QNX Software Systems Limited, WindRiver Systems, Inc., SYSGO AG, ENEA, Lynx Software Technologies, Inc., Acontis Technologies GmbH, Citrix Systems, Inc., Proxmox Server Solutions GmbH, Microsoft Corporation, Green Hills Software, Sierraware, Acontis Technologies GmbH, and others in final report.

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Type

3.2 Bottom-up Type

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Type Benchmarking

6.3.1 Type specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new Age Cohort launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Embedded Hypervisor Market Segmentation, By Component

7.1 Chapter Overview

7.2 Services

7.2.1 Services Market Trends Analysis (2020-2032)

7.2.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Software

7.3.1 Software Market Trends Analysis (2020-2032)

7.3.2 Software Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Embedded Hypervisor Market Segmentation, By Enterprise Size

8.1 Chapter Overview

8.2 Small & Medium Enterprises (SMEs)

8.2.1 Small & Medium Enterprises (SMEs) Market Trends Analysis (2020-2032)

8.2.2 Small & Medium Enterprises (SMEs) Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Large Enterprises

8.3.1 Large Enterprises Market Trends Analysis (2020-2032)

8.3.2 Large Enterprises Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Embedded Hypervisor Market Segmentation, By Technology

9.1 Chapter Overview

9.2 Desktop Virtualization

9.2.1 Desktop Virtualization Market Trends Analysis (2020-2032)

9.2.2 Desktop Virtualization Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Server Virtualization

9.3.1 Server Virtualization Market Trends Analysis (2020-2032)

9.3.2 Server Virtualization Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Data Center Virtualization

9.4.1 Data Center Virtualization Market Trends Analysis (2020-2032)

9.4.2 Data Center Virtualization Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Embedded Hypervisor Market Segmentation, By Application

10.1 Chapter Overview

10.2 IT & Telecommunications

10.2.1 IT & Telecommunications Market Trends Analysis (2020-2032)

10.2.2 IT & Telecommunications Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Automotive

10.3.1 Automotive Market Trends Analysis (2020-2032)

10.3.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Aerospace & Defense

10.4.1 Aerospace & Defense Market Trends Analysis (2020-2032)

10.4.2 Aerospace & Defense Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Industrial

10.5.1 Industrial Market Trends Analysis (2020-2032)

10.5.2 Industrial Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Transportation

10.6.1 Transportation Market Trends Analysis (2020-2032)

10.6.2 Transportation Market Size Estimates and Forecasts to 2032 (USD Billion)

10.6 Others

10.6.1 Others Market Trends Analysis (2020-2032)

10.6.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Embedded Hypervisor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.4 North America Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.2.5 North America Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.6 North America Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.7.2 USA Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.2.7.3 USA Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.7.4 USA Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.8.2 Canada Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.2.8.3 Canada Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.8.4 Canada Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.2.9.2 Mexico Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.2.9.3 Mexico Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.2.9.4 Mexico Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Embedded Hypervisor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.7.2 Poland Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.7.3 Poland Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.7.4 Poland Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.8.2 Romania Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.8.3 Romania Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.8.4 Romania Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turke Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Embedded Hypervisor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.4 Western Europe Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.5 Western Europe Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.6 Western Europe Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.7.2 Germany Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.7.3 Germany Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.7.4 Germany Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.8.2 France Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.8.3 France Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.8.4 France Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.9.2 UK Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.9.3 UK Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.9.4 UK Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.10.2 Italy Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.10.3 Italy Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.10.4 Italy Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.11.2 Spain Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.11.3 Spain Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.11.4 Spain Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.14.2 Austria Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.14.3 Austria Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.14.4 Austria Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Embedded Hypervisor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.4 Asia Pacific Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.5 Asia Pacific Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.6 Asia Pacific Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.7.2 China Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.7.3 China Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.7.4 China Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.8.2 India Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.8.3 India Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.8.4 India Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.9.2 Japan Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.9.3 Japan Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.9.4 Japan Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.10.2 South Korea Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.10.3 South Korea Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.10.4 South Korea Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.11.2 Vietnam Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.11.3 Vietnam Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.11.4 Vietnam Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.12.2 Singapore Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.12.3 Singapore Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.12.4 Singapore Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.13.2 Australia Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.13.3 Australia Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.13.4 Australia Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Embedded Hypervisor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.4 Middle East Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.5 Middle East Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.6 Middle East Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.7.2 UAE Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.7.3 UAE Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.7.4 UAE Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Embedded Hypervisor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.4 Africa Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.2.5 Africa Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.6 Africa Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Afric Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Embedded Hypervisor Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.4 Latin America Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.6.5 Latin America Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.6 Latin America Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.7.2 Brazil Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.6.7.3 Brazil Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.7.4 Brazil Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.8.2 Argentina Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.6.8.3 Argentina Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.8.4 Argentina Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.9.2 Colombia Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.6.9.3 Colombia Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.9.4 Colombia Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Embedded Hypervisor Market Estimates and Forecasts, By Component (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Embedded Hypervisor Market Estimates and Forecasts, By Enterprise Size (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Embedded Hypervisor Market Estimates and Forecasts, By Technology (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Embedded Hypervisor Market Estimates and Forecasts, By Application (2020-2032) (USD Billion)

12. Company Profiles

12.1 VMware, Inc.

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Product / Services Offered

12.1.4 SWOT Analysis

12.2 TenAsys Corporation

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Product / Services Offered

12.2.4 SWOT Analysis

12.3 IBM Corporation

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Product / Services Offered

12.3.4 SWOT Analysis

12.4 Siemens EDA

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Product / Services Offered

12.4.4 SWOT Analysis

12.5 QNX Software Systems Limited

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Product / Services Offered

12.5.4 SWOT Analysis

12.6 WindRiver Systems, Inc.,

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Product / Services Offered

12.6.4 SWOT Analysis

12.7 Sysgo Ag

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Product / Services Offered

12.7.4 SWOT Analysis

12.8 Acontis Technologies GmbH

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Product / Services Offered

12.8.4 SWOT Analysis

12.9 Citrix Systems, Inc.

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Product / Services Offered

12.9.4 SWOT Analysis

12.10 Proxmox Server Solutions GmbH

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Product/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

By Component

Services

Software

By Enterprise Size

Small & Medium Enterprises (SMEs)

Large Enterprises

By Technology

Desktop Virtualization

Server Virtualization

By Application

IT & Telecommunications

Automotive

Aerospace & Defense

Industrial

Transportation

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

Neuromorphic Computing market size was valued at USD 86.9 Million in 2023. It is expected to Reach USD 9356.4 Million by 2032 and grow at a CAGR of 68.27% over the forecast period of 2024-2032.

The Network Security Market was valued at USD 22.2 billion in 2023 and is expected to reach USD 79.7 billion by 2032, growing at a CAGR of 15.29% by 2032.

The Artificial Neural Network Market size was valued at USD 248 million in 2023 and is expected to reach USD 1256 million by 2032, growing at a CAGR of 19.79% over the forecast period of 2024-2032.

The Legal Technology Market Size was valued at USD 26.89 Billion in 2023 and is expected to reach USD 60.04 Billion by 2032 and grow at a CAGR of 9.4% over the forecast period 2024-2032.

The Virtual Meeting Software Market Size was valued at USD 23.87 billion in 2023 and is projected to reach USD 205.69 billion by 2032 with a growing CAGR of 27.12% Over the Forecast Period of 2024-2032.

AI-Driven Personalization in ICT Market was valued at USD XX billion in 2023 and is expected to reach USD XX billion by 2032, growing at a CAGR of XX% from 2024-2032.

Hi! Click one of our member below to chat on Phone