ELISpot and Fluorospot Assay Market Size Analysis

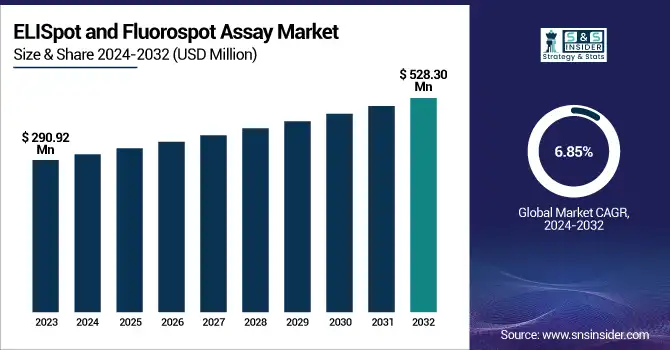

The ELISpot and Fluorospot Assay Market size was valued at USD 290.92 million in 2023 and is expected to reach USD 528.30 million by 2032, growing at a CAGR of 6.85% from 2024-2032.

The ELISpot and Fluorospot Assay Market report provides insights by presenting incidence and prevalence data of immune diseases like tuberculosis, HIV, autoimmune diseases, and cancer, which have a direct influence on assay adoption. The report presents regional research and clinical adoption trends with geographical differences in utilization. The report also presents assay kit and analyzer volume forecasts from 2020 to 2032, monitoring adoption trends across regions. Moreover, it offers in-depth healthcare and research funding analysis, classifying investments into government, commercial, and private sectors. These exclusive statistical observations provide a holistic market overview beyond common growth drivers offered in other reports.

To Get more information on ELISpot and Fluorospot Assay Market - Request Free Sample Report

ELISpot and Fluorospot Assay Market Dynamics

Drivers

-

Rising Prevalence of Infectious and Autoimmune Diseases is driving demand for ELISpot and Fluorospot assays.

The growing prevalence of infectious diseases, including tuberculosis (TB), HIV, viral infections, and autoimmune diseases like rheumatoid arthritis and multiple sclerosis is fueling demand for ELISpot and Fluorospot assays. TB alone infected more than 10.6 million individuals worldwide in 2023, as per the WHO, highlighting the necessity for sophisticated immunodiagnostic technologies. ELISpot assays, in the form of the T-SPOT.TB tests are most commonly used for the detection of tuberculosis because of their high sensitivity and specificity. The increased interest in immune response tracking in autoimmune conditions has also accelerated research uses of these assays. Recent innovations like the development of Fluorospot technology that enables simultaneous measurement of several cytokines are additionally improving test effectiveness. This trend is likely to gain momentum as governments and healthcare organizations invest in even more precise immunological diagnostic tools.

-

Expansion of Immuno-Oncology and Vaccine Research is significantly driving the ELISpot and Fluorospot assay market.

The growth in immuno-oncology and vaccine research is heavily propelling the ELISpot and Fluorospot assay market. As immunotherapy and cancer vaccines gain widespread use, these assays are being made mandatory for assessing T-cell response and cytokine secretion. The international immuno-oncology market is expanding at a very high rate, with an expected yearly growth of more than 12%, resulting in a strong need for high-strength immune-monitoring assays. Additionally, the increased vaccine research, especially post-COVID-19, has amplified the demand for high-throughput immune response testing. Firms such as Oxford Immunotec and Mabtech have introduced advanced ELISpot kits designed specifically for vaccine development, supporting the growth of the market. Furthermore, the recent approval of new immunotherapies by regulatory authorities and the quest for personalized therapy have further strengthened the use of these assays both in clinical practice and research laboratories.

Restraint

-

One of the major restraints in the ELISpot and Fluorospot Assay Market is the high cost and technical complexity associated with assays.

One of the key limitations in the ELISpot and Fluorospot Assay Market is the technical complexity and high cost of these assays. In comparison to standard ELISA or flow cytometry, ELISpot and Fluorospot assays are more specialized equipment, require trained staff, and need to be handled with accuracy, which adds to the cost of overall testing. The cost of assay kits, reagents, and plate reader automation can be prohibitive, particularly for small research laboratories and healthcare providers in low-resource settings. Fluorospot result interpretation also necessitates sophisticated image analysis software, increasing operational difficulty. New automated spot-counting systems have recently been developed to meet these issues, but affordability is still a problem. Though research centers and big biopharmaceuticals continue to embrace these assays, cost factors can hamper widespread adoption in diagnostic labs and emerging markets.

Opportunities

-

Growing Adoption of Automated and High-Throughput ELISpot and Fluorospot Assays a significant opportunity for the Market.

The growing need for automated and high-throughput ELISpot and Fluorospot assays represents a significant market opportunity. Automation of these assays increases accuracy, minimizes human error, and increases reproducibility, which makes them very attractive for clinical and research use. High-throughput systems facilitate large-scale immune monitoring in vaccine development, infectious disease research, and immuno-oncology research, responding to the expanding demand for quick and efficient immune response analysis. Moreover, pharmaceutical and biotech firms are investing in next-generation assay platforms with AI-driven image analysis to simplify data interpretation and enhance assay sensitivity. The use of automated ELISpot and Fluorospot technologies in diagnostic laboratories and research centers will grow the market. With automation advancing further, these developments will fuel increased adoption, enhancing efficiency and scalability in immunological research.

Challenges

-

One of the major challenges in the ELISpot and Fluorospot Assay Market is the lack of standardization and reproducibility in assay results across different laboratories.

A major challenge of the ELISpot and Fluorospot Assay Market is non-standardization and lack of reproducibility in assay outcomes in different laboratories. Assay performance varies because of variations in the preparation of the samples, plate coating protocols, incubation terms, and methods of counting spots. Manual protocols in assay performance may involve human error, influencing the consistency of results. Furthermore, variations in reagents, detection antibodies, and assay protocols between manufacturers bring about variations in test results, making it difficult to compare inter-laboratories. To overcome this challenge, measures are being taken toward standardized assay guidelines and automated image analysis systems. There is an initiative by regulatory bodies and industry players to harmonize protocols, but there is still difficulty in gaining universal reproducibility. The requirement for rigorous quality control procedures and assay validation remains a top priority to improve reliability and clinical utility.

ELISpot and Fluorospot Assay Market Segmentation Analysis

By Product

The Assay Kits segment dominated the ELISpot and Fluorospot Assay Market with a 48.56% market share in 2023 as they found broad applications in immunological studies, disease diagnosis, and vaccine design. They provide a reliable, standardized, and convenient way to detect single-cell immune responses and are vital for infectious disease monitoring, autoimmune disease studies, and cancer immunotherapy research. The growing incidence of infectious and chronic diseases has spurred demand for such kits in both research and clinical environments. Also, the fact that such a variety of assay kits, ranging from cytokine detection kits to those analyzing T-cell response, is available has helped to establish their leadership in the market. The growth of the segment is also supplemented by advancements in technology about assay automation, reproducibility, and sensitivity, which allow researchers to achieve accurate results with less hands-on effort.

The Analyzers segment is expected to expand at the fastest rate in the ELISpot and Fluorospot Assay Market with the highest CAGR owing to the rising use of high-throughput screening and automated systems. With laboratories and research centers looking to become more efficient and minimize human errors, sophisticated analyzers that provide real-time imaging, automated cell counting, and multiplexing are in great demand. The demand for analyzers is also driven by the growth of immunotherapy research, vaccine development initiatives, and the requirement for quicker and more precise immune response evaluation. Furthermore, the convergence of AI-powered image analysis and cloud storage solutions is transforming the process of conducting ELISpot and Fluorospot assays. Consequently, the segment is anticipated to see high-level investments from major industry players, fueling innovation and mass adoption.

By Application

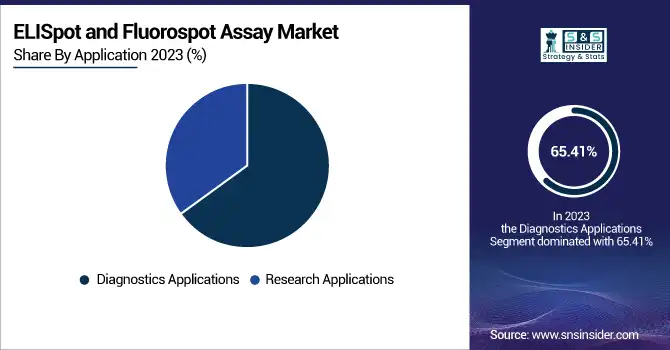

The Diagnostics Applications segment dominated the ELISpot and Fluorospot Assay Market with a 65.41% market share in 2023 because of the growing application of these assays for disease detection, immune monitoring, and clinical diagnosis. ELISpot and Fluorospot assays are applied extensively for infectious disease diagnosis like tuberculosis, and immune monitoring in diseases like HIV, cancer, and autoimmune diseases. The increasing need for early and accurate disease detection, combined with improved assay sensitivity and specificity, has fueled hospital, clinical laboratory, and diagnostic center adoption. In addition, government support for immunodiagnostics through regulatory clearances has fortified this segment's leadership. The increase in diagnostic use in personalized medicine, in which immune response assessment is key, has also solidified the segment's leadership.

The research applications segment is experience to exhibit the fastest growth throughout the forecast period, stimulated by the increasing need for immunological research, vaccine creation, and research on cancer immunotherapy. Due to the increased funding of biomedical and life science research, pharmaceutical and academic institutions are aggressively making use of ELISpot and Fluorospot assays to analyze immune responses at the cellular level. New vaccine development, especially in reaction to pandemic threats and emerging infectious diseases, has further increased market growth in this segment. Increased interest in T-cell-based immune response research for immuno-oncology and autoimmune disease studies is also driving demand. Advances in technology, including multiplexing ability and automation in research applications, are increasing assay efficiency, driving further growth in this segment over the forecast period.

By End Use

The hospital and clinical labs segment dominated the ELISpot and Fluorospot Assay market with a 47.25% market share in 2023 with the immense patient volume seeking immune monitoring of the response and disease diagnosis. These are the primary healthcare centers for diagnosing infectious diseases, autoimmune diseases, and cancer, for which ELISpot and Fluorospot assays are indispensable to analyze the immune status. The availability of well-equipped labs, sophisticated diagnostic facilities, and trained healthcare personnel increases the uptake of these assays in clinical labs and hospitals. Moreover, rising government and private investments in healthcare, as well as reimbursement policies favoring immunodiagnostic testing, have further consolidated this segment's leadership. The increasing rate of tuberculosis, HIV, and other immune system diseases has also fueled greater demand for accurate and speedy diagnostic techniques, thereby consolidating the market's dominance.

ELISpot and Fluorospot Assay Market Regional Insights

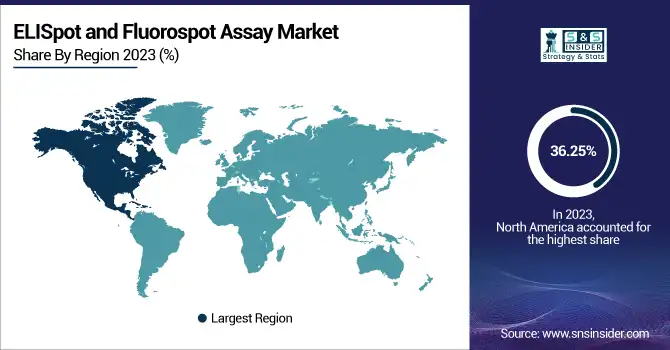

North America dominated the ELISpot and Fluorospot assay market with a 36.25% market share in 2023, with its well-developed healthcare and research facilities, large amounts of funding for immunological studies, and strong market presence of major players. The region also boasts a high rate of adoption of sophisticated immunoassay technologies due to the rising demand for precision medicine and immunotherapy applications. Government support and grants from institutions like the National Institutes of Health (NIH) complement infectious disease, oncology, and vaccine development research as well, where these assays find extensive application. The region's highly regulatory environment also guarantees superior diagnostic and research solutions, which makes North America the largest market for ELISpot and Fluorospot assays. The increasing emphasis on the detection of diseases at an early stage, combined with robust partnerships between academic institutions and biotech firms, further solidifies its leadership.

Asia Pacific is experiencing the fastest growth in the ELISpot and Fluorospot Assay Market with a 7.95% CAGR throughout the forecast period, as a result of growing investments in healthcare infrastructure, increasing immunological research, and increasing incidence of infectious and autoimmune diseases. China, India, and Japan are quickly embracing sophisticated immunodiagnostic methods to aid vaccine development, cancer research, and autoimmune disease diagnosis. Government policies encouraging biotechnology growth and the growing presence of global and regional market players are driving market growth. The region's expanding pharmaceutical and biopharmaceutical sector is also driving demand for high-throughput immune response assays. The reduced expense of clinical trials and research in Asia Pacific, coupled with increasing awareness of personalized medicine and immunotherapy, is further fueling market growth, and hence it is the most vibrant region for ELISpot and Fluorospot assay adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the ELISpot and Fluorospot Assay Market

-

Becton, Dickinson, and Company (BD ELISPOT Assay System, BD FluoroSpot Assay Kit)

-

U-CyTech biosciences (Human IFN-γ ELISPOT Kit, Monkey IL-4 FluoroSpot Kit)

-

Cellular Technologies Limited (CTL) (ImmunoSpot Human IFN-γ ELISPOT Kit, ImmunoSpot Human IL-2/IL-4 FluoroSpot Kit)

-

Mabtech AB (Human IFN-γ ELISpotPRO Kit, Human IL-2/IL-4 FluoroSpot Kit)

-

Abcam (Human IFN-γ ELISPOT Kit, Human IL-17A/IL-22 FluoroSpot Kit)

-

Oxford Immunotec (T-SPOT.TB Test, T-SPOT.COVID Test)

-

Bio-Techne Corporation (Human IFN-γ ELISpot Kit, Human IL-10/IL-12 FluoroSpot Kit)

-

Autoimmun Diagnostika GmbH (AID) (AID iSpot ELISPOT Plate Reader, AID iSpot Spectrum FluoroSpot Reader)

-

Lophius Biosciences GmbH (T-Track ELISPOT Kit, T-Track CMV FluoroSpot Kit)

-

Bio-Connect B.V. (Human TNF-α ELISPOT Kit, Human IL-5/IL-13 FluoroSpot Kit)

-

Thermo Fisher Scientific (Mabtech Human IFN-γ ELISpot Kit, Mabtech Human IL-2/IL-4 FluoroSpot Kit)

-

PerkinElmer Inc. (ATPlite Luminescence Assay System, LANCE Ultra TR-FRET Assay)

-

R&D Systems (Human IFN-γ ELISPOT Kit, Human IL-17/IL-22 FluoroSpot Kit)

-

Enzo Life Sciences (Human IFN-γ ELISPOT Kit, Human IL-4/IL-5 FluoroSpot Kit)

-

MilliporeSigma (Merck KGaA) (ELISpot Plate Reader System, FluoroSpot Multi-Analyte Assay Kit)

-

ImmunoDiagnostics Limited (Human IFN-γ ELISPOT Kit, Human IL-21/IL-22 FluoroSpot Kit)

-

ALPCO (Human IFN-γ ELISPOT Kit, Human IL-10/IL-12 FluoroSpot Kit)

-

RayBiotech Life, Inc. (Human IFN-γ ELISPOT Kit, Human IL-6/IL-8 FluoroSpot Kit)

-

Cell Sciences (Human IFN-γ ELISPOT Kit, Human IL-2/IL-5 FluoroSpot Kit)

-

ZellBio GmbH (Human IFN-γ ELISPOT Kit, Human IL-4/IL-10 FluoroSpot Kit)

Suppliers (These suppliers play a crucial role in the global availability and quality assurance of ELISpot and FluoroSpot assay products.)

-

Thermo Fisher Scientific

-

Merck KGaA (MilliporeSigma)

-

Bio-Techne Corporation (R&D Systems)

-

Mabtech AB

-

PerkinElmer Inc.

-

Abcam

-

BioLegend

-

Enzo Life Sciences

-

Autoimmun Diagnostika GmbH (AID)

-

Cellular Technologies Limited (CTL)

Recent Development in the ELISpot and Fluorospot Assay Market

-

In February 2025, BD announced that it will be separating its Biosciences and Diagnostic Solutions business to drive strategic focus and growth. The action is expected to simplify operations and possibly affect their products in the immunoassay space, such as ELISpot and FluoroSpot assays.

-

In April 2024, U-CyTech Biosciences was awarded as a leading company in the ELISpot and FluoroSpot assay market, adding greatly to the development of immunological research and clinical diagnostics.

-

In February 2024, CTL was recognized as one of the leading companies in the ELISpot and FluoroSpot assay market, contributing significantly to the development and distribution of the assays.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 290.92 million |

| Market Size by 2032 | US$ 528.30 million |

| CAGR | CAGR of 6.85% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Assay Kits, Analyzers, Ancillary Products) • By Application (Research Applications, Diagnostics Applications) • By End Use (Hospital and Clinical Labs, Academic and Research Institutes, Biopharmaceutical Company) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Becton, Dickinson and Company, U-CyTech biosciences, Cellular Technologies Limited (CTL), Mabtech AB, Abcam, Oxford Immunotec, Bio-Techne Corporation, Autoimmun Diagnostika GmbH (AID), Lophius Biosciences GmbH, Bio-Connect B.V., Thermo Fisher Scientific, PerkinElmer Inc., R&D Systems, Enzo Life Sciences, MilliporeSigma (Merck KGaA), ImmunoDiagnostics Limited, ALPCO, RayBiotech Life, Inc., Cell Sciences, ZellBio GmbH, and other players. |