Electronic Packaging Market Report Scope & Overview:

Get more information on Electronic Packaging Market - Request Sample Report

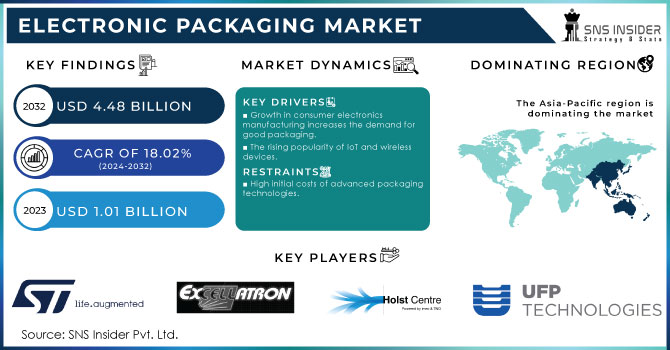

The Electronic Packaging Market size was valued at USD 1.01 billion in 2023 and is expected to reach USD 4.48 billion by 2032 and grow at a CAGR of 18.02% over the forecast period 2024-2032.

The electronic packaging market is a key sector within the electronics industry as it is a huge market with a variety of products and technologies used to protect electronic components and interconnect them. Effective and high-quality electronic and semiconductor packaging is designed to protect components from a variety of harmful impacts and prevent water, electrostatic discharge, harsh weather conditions, dust, corrosion, and other impacts from damaging electronic products like smartphones, TVs, tablets, set-top boxes, and digital media adapters, etc. In the U.S., the Department of Commerce announced that it is launching a competition in 2023 with up to USD 1.6 billion in funding, which was authorized by the Clearing House Interbank Payments System (CHIPS) and Science Act. This funding is intended to sponsor semiconductor advanced packaging research and development activities. CHIPS for America group of agencies plans to give four or five awards of about USD 150 million for each of its five R&D focus areas.

It is used in a variety of army and aerospace facilities packed with semiconductor devices such as information handling units, information screen systems, and aircraft control units because it allows for reduced board area, weight, and routing complexity at the PCB level. Electronic packaging includes communication ICs, memory power management devices, analog, digital, and mixed-signal ICs to drive applications in clinical diagnostics, therapy, and medical imaging, as well as die shrinks in the same package to improve product upgradeability. Integrating electronics expands human interface possibilities, and higher density efficient battery technologies imply that the electronic packaging market share will grow significantly in the forecast years.

Electronic Packaging Market Dynamics

Drivers

-

Growth in consumer electronics manufacturing increases the demand for good packaging.

The development of consumer electronics, such as smartphones, tablets, laptops, smartwatches, and home entertainment systems, has increased technological advancement and end-users desire for product performance, aesthetics, and low-weight packaging solutions. As a result, developmental trends of electronics involve increasing miniaturization and performance of devices, requiring highly advanced and intricate packaging solutions that would ensure high-density integration of several functionalities and feasible operation in various environments reflected in thermal management and reaction to electromagnetic and radiofrequency fields.

For example, smartphone packaging is highly developing with each new model. Each new generation of smartphones is expected to perform at higher levels, with longer battery life, advanced camera functions, 5G capabilities, and support for biometric authentication solutions. All these developments should be packed in a limited space of height of the size of the average smartphone size that would permit their operation together with minimum expected overheating by users and interference with proper functioning of other devices due to electromagnetic and radiofrequency fields.

-

The rising popularity of IoT and wireless devices.

IoT refers to the concept of connecting different industrial devices and systems to the Internet for data collection, processing, and communication among various devices. The range of such applications includes different devices and systems for smart homes, industrial automation, healthcare, agriculture, etc., which requires advanced packaging to make these devices more reliable, efficient, and operatively connectable. Smart homes comprise IoT technologies for producing smart thermostats, security cameras, smart lighting, refrigerators, and virtually any other household item. These devices are supposed to operate in different climate zones, therefore, the packaging solution in such cases should be able to endure significant changes in temperature, humidity electromagnetic emission, and other impacts.

Industrial automation IoT includes various sensors, actuators, machines, and control systems connected for monitoring and improving manufacturing processes 24/7. Such devices are used in harsh environmental conditions, including high temperatures, fluctuations, and vibrations, exposure to different chemical components, which implies much more reliable and resistant packaging. In such applications, molded interconnect devices and chip-on-board technology can be very useful for IoT industrial packaging, allowing for reliable contact and continuous operative data exchanges.

Restraints

-

High initial costs of advanced packaging technologies.

Advanced packaging solutions, such as wafer-level packaging, SiP, 3D packaging, and FOWLP, are complicated in terms of implementation, requiring more effort and using more sophisticated devices and materials. Existing manufacturing costs already affect the price of production. Furthermore, the cost of individual solutions may fluctuate depending on the context of their implementation. The high cost of advanced packaging technologies may become prohibitive for markets such as consumer electronics and the automotive market, where consumers look for material designs with an optimal price-to-quality relationship. The initial setup for the advanced packaging system may be high. For instance, for the 3D packaging and TSV technology to work, certain expensive tools are needed, such as lithography with light sources, wire bonding, flip-chip bonding tools, and alignment assembly equipment. The potential costs of bonding tools and lithography equipment can reach as high as USD 10.82 million, while accuracy tools may cost around USD 1.82 million. Setting up the materials and implementing the manufacturing techniques of advanced packaging technologies are also very expensive.

Electronic Packaging Market Segment Overview

By Type

The corrugated boxes segment market share was over 38% in 2023. Their dominance persists as they have become the backbone for electronic product packaging because they are strong, versatile, and cost-effective. More importantly, the structure of corrugated cardboard, a fluted medium joined to two outer liners, creates an excellent cushioning and shock-absorbing effect, required to protect the delicate electronic devices during transit and handling. It is also worth mentioning that the feature of being convertible into any shape, style, and size allows for accurate fitment of the particular device to minimize the damage risk.

The bags and pouches segment has a faster CAGR during the forecast period 2024-3032. Bags and pouches have gradually become an essential part of electronic packaging. They not only serve as a cover but also act as protection from surrounding influences, presentation of the product, symbol of the product, and material for preserving and shipping logistics. Altogether, it should be resistant to different physical and chemical influences. For small electronic components, it may be an antistatic bag saving the product from static energy.

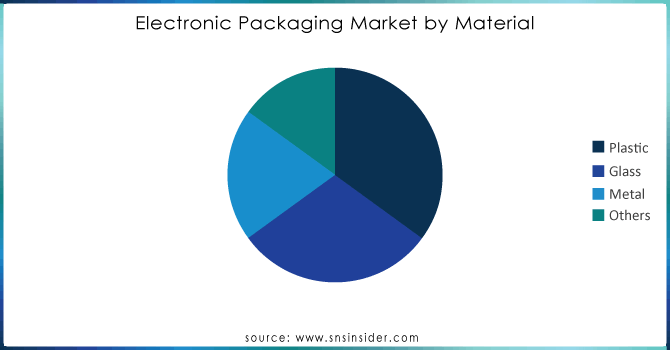

By Material

The plastic segment dominated with a market share of over 35% in 2023 and it is also the fastest-growing segment during the forecast period 2024-2032. Plastics have long since been an important material in electronic packaging. Exposure to sensitive electronic hardware and the benefits plastics provide in spill and shock resistance make them ideal in specialized cases. These materials are often polyethylene, polypropylene, and PVC as they insulate and defend against moisture and dust, both of which can cause electrical shorting. Polycarbonate’s transparency and remarkable resistance to impact make it excellent for sequestering the displays in any electronics.

Get Customized Report as per your Business Requirement - Request For Customized Report

Electronic Packaging Market Regional Analysis

Asia-Pacific led the market in 2023 with more than 40% market share. The presence of numerous electronic packaging firms providing electronic packaging material and technology, such as Samsung, LG, and Taiwan, further drives the market in the region even more. Additionally, the escalating population and soaring disposable income in the region are two primary reasons for the advancing demand for consumer electronics, which propels the electronic packaging market in the region even further. China led the market in 2023, followed by India. Furthermore, government-supported programs and investments to boost cutting-edge technology and the establishment of solutions for semiconductor packaging drive the market. North America is growing s during the forecast period 2024-2032.

KEY PLAYERS:

The key players in the electronic packaging market are STMicroelectronics, UFP Technologies, Excellatron Solid State, Holst Centre, Dordan Manufacturing Company, AMETEK, Canatu, Front Edge Technology, Infinite Power Solutions, Sealed Air Corporation & Other Players.

Recent Development

-

January 2024: INEOS Styrolution launched Zylar EX350, a new grade of methyl methacrylate butadiene styrene materials. Zylar EX350 provides a balance of stiffness and toughness and is suitable for carrier tapes used in the packaging of electronic components.

-

September 2023: SCHOTT announced the microelectronic packages designed for the aerospace market. These packages are lightweight and offer reliable protection for electronic components. The weight of the Schott Hermes packages is reduced by up to two-thirds compared to traditional Kovar-based packaging.

-

May 2024: American Packaging Corporation announced the opening of a second production unit for digitally printed flexible packaging in Wisconsin. The equipment of the second unit incorporates digital printing, laminating, and pouch-making technology and specializes in rapid order fulfillment.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.01 billion |

| Market Size by 2032 | USD 4.48 billion |

| CAGR | CAGR of 18.02% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Corrugated Boxes, Thermoformed Trays, Blister Packs And Clamshells, Paperboard Boxes, Bags And Pouches, Protective Packaging) • By Material (Plastic, Glass, Metal, Others) • By Packaging Technology (Through Hole Mounting, Chip Scale Packages, Surface Mount Technology) • By End-User (Consumer Electronics, Automotive, Aerospace & Defense, Telecommunication) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | STMicroelectronics, UFP Technologies, Excellatron Solid State, Holst Centre, Dordan Manufacturing Company, AMETEK, Canatu, Front Edge Technology, Infinite Power Solutions, Sealed Air Corporation |

| Key Drivers | • Growth in consumer electronics manufacturing increases the demand for good packaging. • The rising popularity of IoT and wireless devices. |

| RESTRAINTS | • High initial costs of advanced packaging technologies. |