Electronic Nose (E-Nose) Market Size & Overview:

Get more information on Electronic Nose (E-Nose) Market - Request Sample Report

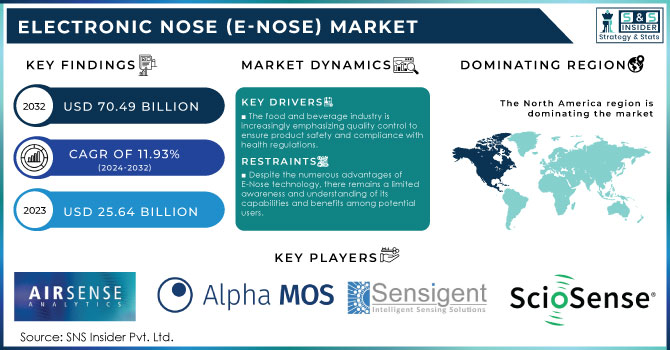

The Electronic Nose (E-Nose) Market Size was valued at USD 25.64 Billion in 2023 and is expected to reach USD 70.49 Billion by 2032, growing at a CAGR of 11.93% over the forecast period 2024-2032.

In the healthcare sector, E-Nose technology is gaining traction, particularly in the diagnosis of diseases. This innovative electronic nose (E-nose) technology has shown significant promise in diagnosing and differentiating various respiratory diseases, as numerous studies have highlighted. For instance, patterns of exhaled volatile organic compounds (VOCs) can effectively distinguish between chronic obstructive pulmonary disease (COPD) and non-small cell lung cancer (NSCLC), achieving a cross-validation value (CVV) of 85%. Moreover, patients with NSCLC can be differentiated from healthy controls with a CVV ranging from 80% to 90% through duplicate measurement analyses. E-Nose technology also demonstrates distinct VOC profiles between asthma and COPD patients, boasting an impressive accuracy of 96%. This technology further validates its findings by achieving high sensitivity and specificity in differentiating asthma phenotypes. Additionally, E-Nose applications extend to distinguishing COPD patients based on alpha-1 antitrypsin deficiency and airway bacterial colonization.

In the context of obstructive sleep apnea syndrome (OSAS), studies report a sensitivity of 78% and specificity of 70% in discriminating OSAS from non-OSAS patients, with further research revealing that obese patients with OSAS can be identified with a CVA of 97.4%. The significant interest in E-Nose technology for diagnosing and monitoring airway obstructive diseases underscores its potential as a valuable tool in clinical practice. Moreover, E-Nose applications extend beyond healthcare to infectious diseases, demonstrating the ability to identify specific VOC profiles for conditions such as ventilator-associated pneumonia and bacterial sinusitis, with sensitivities of 88% and 72%, respectively. Given these advancements and the growing body of evidence supporting the effectiveness of E-Nose technology, the market for E-Nose devices is poised for substantial growth, driven by their non-invasive diagnostic capabilities and potential to enhance disease monitoring and phenotyping.

In the security and defense sectors, E-Nose technology is also employed for detecting explosives and hazardous substances. E-Noses can identify specific VOCs characteristic of certain explosives, making them invaluable tools for airport security and military applications. Their ability to provide rapid and accurate detection is crucial for preventing potential threats and enhancing safety measures in high-risk environments.

E-Nose Market Dynamics

Drivers

-

The food and beverage industry is increasingly emphasizing quality control to ensure product safety and compliance with health regulations.

The e-nose detects hazardous or poisonous gas which is not possible for human sniffers. Nowadays the e-nose has provided external benefits to a variety of commercial industries, agriculture, biomedical, food, & various scientific research. Due to increased consumer awareness of food safety on a global scale, businesses are putting money into E-Nose technology to improve the quality of their products and uphold their brand image. Using E-Noses in food processing, packaging, and distribution aids in decreasing waste and lowering the chances of recalls. Manufacturers can streamline processes and detect any deviations in quality immediately by utilizing real-time monitoring of food & beverage products. For example, the French manufacturer AlphaMOS e-nose, also known as FOX 4000, was employed alongside PCA and DFA analyses to differentiate between beer and wines contaminated with off-flavors such as 1-hexanol, ethyl acetate, 4-ethylphenol, octanol, and 2,3,4-trichloroanisole (TCA) following dehydration and dealcoholization of the samples. This proactive strategy doesn't just safeguard consumer well-being but also boosts customer contentment and allegiance, resulting in higher sales. With stricter food & beverage safety regulations being implemented by governments, the demand for innovative technologies such as E-Noses is predicted to increase. Businesses that choose to invest in these technologies will probably have a competitive advantage due to their dedication to quality and safety.

-

Growing concerns about air quality, pollution, and environmental sustainability are driving the adoption of E-Noses for environmental monitoring.

E-noses are used for a variety of environmental purposes, such as overseeing emissions from industrial plants, evaluating air quality in cities, and identifying dangerous gases during natural catastrophes. Air pollution stands as the most significant environmental threat to human health globally, contributing to approximately 8.43 million premature deaths each year, according to the British Medical Journal. This alarming statistic underscores air pollution's status as the fourth deadliest health risk worldwide, as reported by the Institute for Health Metrics and Evaluation (IHME). Notably, the impact is disproportionately felt in low- and middle-income countries, where nine out of ten deaths attributed to outdoor air pollution occur. Tragically, this crisis also claimed the lives of around 570,000 children under the age of five each year, highlighting the vulnerability of the youngest members of society. Recognizing pollutants and pinpointing their origins allows officials to quickly address environmental dangers and enforce successful mitigation tactics. The demand for efficient monitoring solutions is on the rise due to the stricter environmental regulations and initiatives being implemented by governments globally to address climate change. E-Noses provide a cost-efficient and non-intrusive method for evaluating air quality, appealing to government organizations, non-governmental organizations, and private companies dedicated to environmental sustainability. Furthermore, the public is becoming more conscious of environmental concerns, resulting in a greater need for transparency in air quality information. E-Noses offer immediate data that can be shared with the public, promoting trust and accountability among stakeholders. The increasing emphasis on environmental surveillance is predicted to greatly enhance the E-Nose industry.

Restraints

-

Despite the numerous advantages of E-Nose technology, there remains a limited awareness and understanding of its capabilities and benefits among potential users.

Many sectors continue to depend on conventional analysis methods and may not appreciate the benefits that E-Noses can offer to their operations. The intricacy of E-Nose systems and the requirement for expertise in data interpretation can also add to a hesitation in embracing this technology. Potential users might worry about the potential disruption to their operations or lack confidence in the reliability of E-Nose systems. Furthermore, the specialized use of E-Nose applications could result in misconceptions about its versatility in various industries. For instance, even though E-Noses are being more frequently used in monitoring environmental and food safety, their use in healthcare is not as widely acknowledged. It is essential to undertake more education and awareness initiatives to tackle these challenges. With the emergence of additional case studies and success stories, along with the availability of training programs, awareness of E-Nose technology is expected to increase, resulting in higher adoption rates.

Electronic Nose Market Segmentation Outlook

by Type

Embedded sensors dominated the market in 2023 with over 55% market share, as they are being incorporated into various systems for purposes such as monitoring air quality, evaluating food quality, and ensuring industrial safety. These sensors are frequently included in stationary or automated systems, offering uniform and instantaneous data analysis. Their ability to detect volatile organic compounds (VOCs) with high levels of precision and dependability makes them well-suited for industries such as agriculture, pharmaceuticals, and manufacturing. For example, Alpha MOS and Airsense Analytics utilize embedded sensors in automated food quality control systems to maintain product consistency and safety.

Portable devices are anticipated to grow at a faster rate during 2024-2032, due to their adaptability and simplicity in different field uses. These small gadgets are perfect for conducting tests in agriculture, monitoring the environment, and diagnosing medical conditions on location. Their ability to move quickly allows for swift testing and instant outcomes, providing convenience in situations where stationary setups may not work. Aryballe Technologies and Plasmion have created portable E-Nose devices for field researchers to detect soil conditions or for medical professionals to use in diagnostic breath analysis applications.

by Technology

Metal Oxide Semiconductor Sensors (MOS) held a 41% market share and led the electronic nose (E-Nose) market in 2023, because of their strong performance, affordability, and ability to detect various volatile organic compounds (VOCs). These sensors work by detecting alterations in resistance due to gas adsorption on their surface, making them appropriate for use in food quality assessment, environmental surveillance, and healthcare diagnosis. Figaro Engineering Inc. provides various MOS sensors for air quality monitoring systems, aiding industries and municipalities in meeting environmental regulations.

Quartz Crystal Microbalance (QCM) is considered to become the fastest-growing segment during 2024-2032, because of its ability to detect very small mass changes, allowing for the detection of even tiny amounts of target analytes with high sensitivity and accuracy. QCM sensors use the concept of changes in resonance frequency in quartz crystals when gas molecules are absorbed, making them well-suited for medical diagnostics, environmental monitoring, and food safety applications.

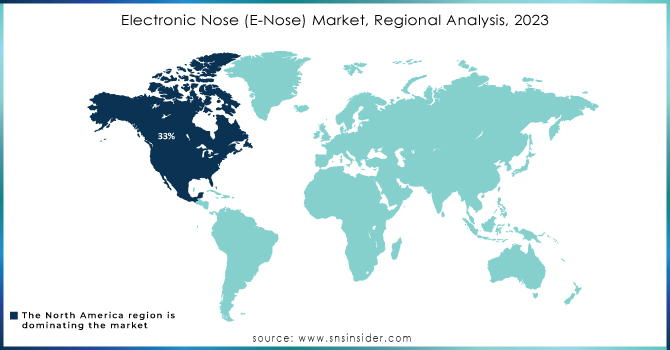

Electronic Nose (E-Nose) Market Regional Analysis

North America led in 2023 with a 33% market share in the electronic nose (E-Nose) market due to advanced technological infrastructure and substantial investments in research and development. The area features prominent companies such as Smiths Detection, which incorporates E-Nose technology into security systems for threat detection. Furthermore, Airocide incorporates E-Nose technology into its air purifiers, increasing safety in diverse settings. The increasing need for E-Nose usage in monitoring food quality, the environment, and healthcare strengthens North America's position as a leader.

Asia-Pacific is expected to register the fastest CAGR during 2024-2032, because of Increasing industrialization and growing concern for environmental and health safety. Nations such as China and India are quickly embracing E-Nose technologies for uses in ensuring food safety and quality. For example, NanoSensors in India for agricultural use and Tsinghua University for health diagnostics. The increasing demand for scent identification in different sectors, such as pharmaceuticals and petrochemicals, continues to drive market growth.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key players in the Electronic Nose (E-Nose) Market are:

-

Airsense Analytics (e-nose® 1, e-nose® 4)

-

E-Nose Company (E-Nose System, E-Nose Sensor)

-

Alpha MOS (Heracles II, Astro 2)

-

Odotech (Odor Control Systems, Odor Monitoring Solutions)

-

Sensigent (SensiScope, SensiData)

-

E-Nose Technology (E-Nose Laboratory, E-Nose Pro)

-

SCIOsense (SCIOsense E-nose, SCIOsense Data Cloud)

-

Cambridge Sensotec (Rapidox 3100, Rapidox 2100)

-

G.A.S. Sensing (GAS SENSORS, G.A.S. E-nose)

-

ScentDetect (ScentDetect 1.0, ScentDetect 2.0)

-

Sensing Solutions (E-nose 1000, E-nose 2000)

-

Tellspec (Tellspec Food Scanner, Tellspec Analyzer)

-

Sensory Analytics (Sensory Analysis System, E-Nose Scanner)

-

E-Nose Lab (E-Nose Research System, E-Nose Sensor Suite)

-

Airsense (E-nose 2, E-nose 5)

-

Cortexica (Cortexica Platform, Cortexica E-nose)

-

Platometrics (Platometrics E-Nose, Platometrics Sensor System)

-

Molecular Vision (MV E-Nose, MV Aroma Analyzer)

-

Fruity Fresh (Fruity E-nose, Fresh Scanner)

-

Vairus (Vairus E-nose, Vairus Analyzer)

Suppliers of Raw Materials/Components

-

Honeywell

-

BASF

-

3M

-

NXP Semiconductors

-

Texas Instruments

-

STMicroelectronics

-

Avery Dennison

-

DuPont

Recent Development

-

February 2024: Portable Electronic Nose (PEN) was announced by Airsense as an extremely small identification system for gases and gas mixtures. It uses a disparate set of gas electronic sensors and can be used in multi-disciplinary application, environmental, and healthcare applications.

-

November 2023: Alpha MOS launched AROMA 2023, a new upgraded E-Nose for sensory analysis in the food and beverage industries. It provides improved detection and a better user interface for faster assessments.

-

August 2023: Introducing a new version of their odor monitoring technology, Odotech further expands real-time monitoring possibilities for waste management. It was presented as a tool to assist municipalities in managing more effectively odor emissions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 25.64 Billion |

| Market Size by 2032 | USD 70.49 Billion |

| CAGR | CAGR of 11.93% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Embedded Sensors, Portable Devices) • By Technology (Metal Oxide Semi-Conductor Sensors (MOS), Quartz Crystal Microbalance (QCM), Conducting Polymers (CP), Surface Acoustic Wave (SAW), Others) • By End User (Military and Defense, Healthcare, Food and Beverage, Waste Management (Environmental Monitoring), Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Airsense Analytics, Enose Company, Alpha MOS, Odotech, Sensigent, eNose Technology, SCIOsense, Cambridge Sensotec, G.A.S. Sensing, ScentDetect, Sensing Solutions, Tellspec, Sensory Analytics, eNose Lab, Airsense, Cortexica, Platometrics, Molecular Vision, Fruity Fresh, Vairus |

| Key Drivers | • The food and beverage industry is increasingly emphasizing quality control to ensure product safety and compliance with health regulations. • Growing concerns about air quality, pollution, and environmental sustainability are driving the adoption of E-Noses for environmental monitoring. |

| RESTRAINTS | • Despite the numerous advantages of E-Nose technology, there remains a limited awareness and understanding of its capabilities and benefits among potential users. |