Get More Information on Electrical Equipment Market - Request Sample Report

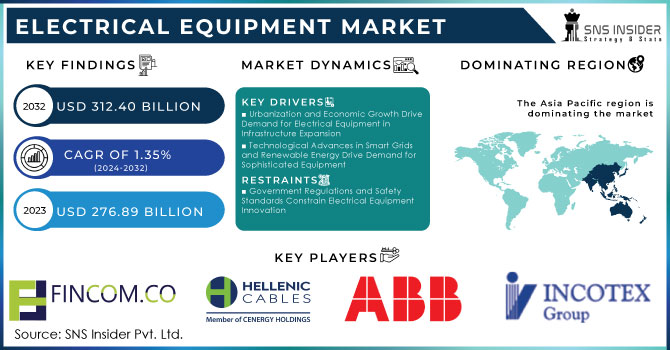

The Electrical Equipment Market was valued at USD 276.89 Billion in 2023, and it is expected to reach USD 312.40 Billion by 2032, registering a CAGR 1.35% of during the period of 2024-2032.

The Electrical Equipment Market includes electricity meters, transformers, switchgear, circuit breakers, and distribution boards. The increase in building permits and housing starts suggests a rise in new constructions. This is significant because new buildings require electrical equipment for functionality So, in June, building permits for privately-owned housing units were issued, at a seasonally adjusted annual rate of 1,446,000 units. This represents a 3.4% increase from May, but a 3.1% decrease from June 2023. Single-family home authorizations declined to 2.3% while permits for multi-family buildings with 5 units or more were estimated at 460,000. Housing starts in June were recorded at 1,353,000, demonstrating a 3% increase from the previous month, but a 4.4% decrease compared to the last year. Single-family starts decreased by 2.2% to 980,000 while multi-family starts were estimated at 360,000 units. The housing completions in June increased significantly to 1,710,000 units, which is 10.1% growth from May, and 15.5% gain from the previous year. Single-family completions amounted to 1,037,000 million, up by 1.8% from the previous month while multi-family completions stood at 656,000. Overall, this is a strong indication of construction activity, which can lead to higher demand for electrical equipment since every new building requires many electrical installations.

Smart grids and smart cities also provide a big sector opening up for the market expansion. Smart grid is the technology that makes it possible to manage and monitor the flow of electricity or power, to make it flow as efficiently and effectively as possible. It needs electrical equipment like smart meters, sensors, and other telecommunication equipment. Smart cities are designed in such a way that different information and communication technologies are used to make urban living more comfortable for the citizens. Opening up of smart cities increases the demand for sophisticated electrical systems and their component parts. The electrical equipment market is definitely booming because of the increasing urbanization and industrialization in developing countries. High frequency of operation is also going to be a reason behind this market increase in the forecast period.

At the same time, smart grids will be able to save 1060 terawatt-hours per year by 2026, compared to 316 terawatt-hours in 2021, and the accelerated growth of efficiency indicator promotes significant investments in smart grid software by energy transmission operators. The total annual turnover of software for this equipment will amount to about 38.3 billion euros by 2026, instead of 11.9 billion euros in 2021. The prevalence of smart meters is noteworthy, especially in Italy, and in the world more than 2 billion certain devices will be used by 2026 instead of 1.1 billion in 2021. An increased integration of smart technologies in the electrical equipment market both in newly constructed facilities and the modernization of the existing infrastructure.

DRIVERS

In Infrastructure expansion rapid urbanization and economic growth globally are fueling the need for new buildings, factories, and transportation networks, all requiring significant electrical equipment.

The growth in world’s population and industry has become urge for new buildings, plants, and a vast network of transportation. Electrical equipment is needed for construction of virtually every big building, canning plant, and any other industrials object. This is especially supposed emerging or developed countries where urbanization processes have reached their peak. This is not surprising that the infrastructure of these countries needs power transmission and switching facilities, electric light, and other advanced electrical systems. Indeed, spreading cities require a prepared grid to distribute energy to residential, commercial, and industrial buildings, each requiring private railroads, highways, and aerodromes. Naturally, enhanced systems are needed for railways for high-speed trains and light rail tracks for trams. Moreover, new plants for green power generation such as solar panels or wind stations do require peculiar electric equipment. Thus, the current growth is not only the major customer for conventional electric components, but also raises the need for new sophisticated components meeting the requirements of modern infrastructure.

Technological advancement innovations in areas like smart grids, renewable energy integration, and energy-efficient solutions are creating a demand for more sophisticated equipment.

The market of electrical equipment is being revolutionized by new technological advances like, Smart grids represent new technology on the market of electrical equipment, which allows real-time monitoring and efficient distribution of energy. The increasing share of power losses in modern grids ruins the necessity of controlling energy distribution and the speed of performing such operations. The increasing use of renewable sources of energy, such as solar panels and wind turbines, for bigger stability and consistency implies using advanced inverters, powerful controllers and battery systems. Both individually and by industries LED lighting represent an energy-efficient solution for cost reduction problem. High efficiency transformers justify their use by efficiently lowering power outages, maintenance and repair costs. On the other hand, the increasing popularity of the Internet of Things requires the use of smarter electrical devices, which could be tailored to optimize their function, increase their durability and communicate among each other. All of the above-mentioned technologies not only satisfy the demand of energy-efficient and powerful electrical equipment on the market, but also provide the precondition for future development, vis. the market of electrical equipment will remain innovative for new technologies even in a long run.

RESTRAIN

Government regulations, including safety standards and environmental mandates, can constrain the design and functionality of electrical equipment, thereby affecting innovation.

The ones for safety standards and ones concerned with the environment being paramount. While many innovations in the sphere of electrical equipment are affected by those standards, much of that influence is actually constraint. Safety standards require difficult testing and certification, which leads to companies wanting to develop some new product or technology having to spend a lot of money developing it and then having it certified. This results in manufacturers being unwilling to invest in something new, to use new materials and technologies in ways that they were not extensively tested. The same happens with regulations related to environmental concerns both reducing hazardous substances and energy use reduction. These regulations actually enable companies to invest in green technologies but also make their production more costly, as well as putting restrictions on it. As such, most companies must balance on the thin edge of compliance with regulation and development of new products, as those new products have to comply with, for example, safety standards and contain less of certain substances. At the same time, the very presence of these regulations gives companies the necessary nudge to make their products safer and with far less negative environmental impact. Hence, these government regulations do indeed affect multiple aspects of products, but many of these influences are factors by which the process of production is being constrained for companies who produce electrical equipment.

By Product

The Electronic and Electrical Wires and Cables has a market share of 42.14% in 2023, and it is crucial for transmitting electricity throughout various applications, which is the main reason of dominance of this segment due to ongoing infrastructure development.

The Wiring Devices is expected to be the fastest growing segment during the forecast period 2024-2032, due to infrastructure expansion, smart home trends, and the rise of Electric Vehicles (EVs) requiring charging stations.

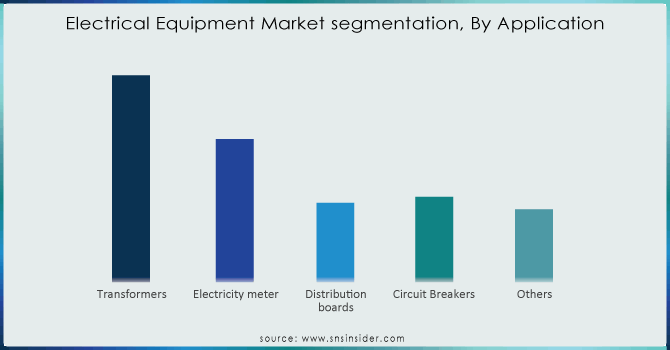

By Applications

The Transformers has a market share of 39.53% in 2023, and dominating this segment due to their vital role in regulating voltage levels for power transmission and distribution across various applications.

The Electricity Meters projected to be the fastest growing segment during the forecast period 2024-2032, these devices track and measure electricity consumption, playing a key role in billing and managing energy usage.

Need any customization research on Electrical Equipment Market - Enquiry Now

By End User

The Industrial currently the leader in terms of revenue share of 44.02% in 2023, due to the extensive use of heavy machinery and industrial processes requiring specialized electrical equipment.

The Commercial projected to be the fastest growing segment during the forecast period 2024-2032, with rising construction of commercial buildings and the increasing focus on energy efficiency through smart electrical equipment.

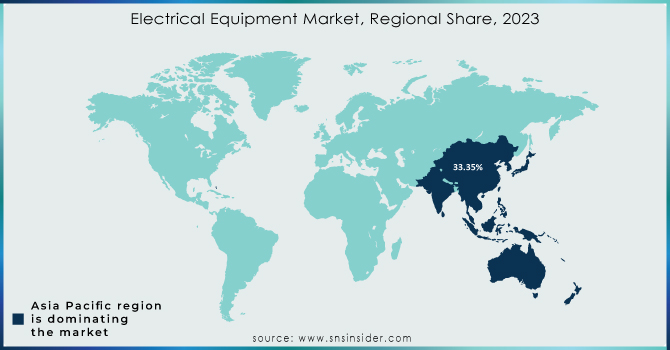

REGIONAL ANALYSIS

Asia-Pacific region is the leader in the global market with a market share 33.35% due to accelerated industrialization and wide-spread urbanization, along with active actions of the governments. In view of rapid urbanization in the region, substantial investment in power grid infrastructure, as well as residential and commercial construction is required.

Asia-Pacific will be the fastest-growing region during the forecasted period with a CAGR 1.42% in 2023. The growth of the disposable income of the population allows increasing consumer spending on electronics and durable goods. In addition, the focus on renewable energy sources, such as solar and wind energy, in the region leads to the increasing demand of the special equipment required for the generation and transmission of electric power.

The major Players are Samel, Solar LED Powers, Hellenic Cables, Incotex Group, Fincom-2, ABB, Datecs, Monbat, Emka, Gamakabela, Octa light, Legrand and other players

Recent Developments

In March 2024: The International Electrical Testing Association (NETA) introduced its Qualified Electrical Equipment Maintenance Contractor and Worker Program at PowerTest24, an annual safety and reliability conference. This initiative responds to the new ANSI-approved NFPA 70B Standard, which mandates and enforces proper electrical equipment maintenance.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 276.89 Billion |

| Market Size by 2032 | US$ 312.40 Billion |

| CAGR | CAGR of 1.35% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Wiring devices, Batteries and accumulators, Electronic and electrical wires and cables, Electrical Lightning, Electric household appliances Others) •By Applications (Transformers, Electricity meter, Distribution boards, Circuit Breakers, Others) •By End User (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samel, Solar LED Powers, Hellenic Cables, incotex Group, Fincom-2, ABB, Datecs, Monbat, Emka, Gamakabela, Octa light, Legrand |

| Key Drivers | • In Infrastructure expansion rapid urbanization and economic growth globally are fueling the need for new buildings, factories, and transportation networks, all requiring significant electrical equipment. • Technological advancement innovations in areas like smart grids, renewable energy integration, and energy-efficient solutions are creating a demand for more sophisticated equipment. |

| RESTRAINTS | • Government regulations, including safety standards and environmental mandates, can constrain the design and functionality of electrical equipment, thereby affecting innovation. |

Ans: The Electrical Equipment Market is expected to grow at a CAGR of 1.35%.

Ans: Electrical Equipment Market size was USD 276.89 billion in 2023 and is expected to Reach USD 312.40 billion by 2032.

Ans: Transformers is the dominating segment by application in the Electrical Equipment Market.

Ans: Technological advancement innovations in areas like smart grids, renewable energy integration, and energy-efficient solutions are creating a demand for more sophisticated equipment.

Ans: Asia-Pacific is the dominating region in the Electrical Equipment Market.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

5. Porter’s 5 Forces Model

6. Pest Analysis

7. Electrical Equipment Market Segmentation, By Product

7.1 Introduction

7.2 Wiring devices

7.3 Batteries and accumulators

7.4 Electronic and electrical wires and cables

7.5 Electrical Lightning

7.6 Electric household appliances

7.7 Others

8. Electrical Equipment Market Segmentation, By Applications

8.1 Introduction

8.2 Transformers

8.3 Electricity meter

8.4 Distribution boards

8.5 Circuit Breakers

8.6 Others

9. Electrical Equipment Market Segmentation, By End User

9.1 Introduction

9.2 Residential

9.3 Commercial

9.4 Industrial

10. Regional Analysis

10.1 Introduction

10.2 North America

10.2.1 Trend Analysis

10.2.2 North America Electrical Equipment Market by Country

10.2.3 North America Electrical Equipment Market by Product

10.2.4 North America Electrical Equipment Market by Application

10.2.5 North America Electrical Equipment Market by End-User

10.2.6 USA

10.2.6.1 USA Electrical Equipment Market by Product

10.2.6.2 USA Electrical Equipment Market by Application

10.2.6.3 USA Electrical Equipment Market by End-User

10.2.7 Canada

10.2.7.1 Canada Electrical Equipment Market by Product

10.2.7.2 Canada Electrical Equipment Market by Application

10.2.7.3 Canada Electrical Equipment Market by End-User

10.2.8 Mexico

10.2.8.1 Mexico Electrical Equipment Market by Product

10.2.8.2 Mexico Electrical Equipment Market by Application

10.2.8.3 Mexico Electrical Equipment Market by End-User

10.3 Europe

10.3.1 Trend Analysis

10.3.2 Eastern Europe

10.3.2.1 Eastern Europe Electrical Equipment Market by Country

10.3.2.2 Eastern Europe Electrical Equipment Market by Product

10.3.2.3 Eastern Europe Electrical Equipment Market by Application

10.3.2.4 Eastern Europe Electrical Equipment Market by End-User

10.3.2.5 Poland

10.3.2.5.1 Poland Electrical Equipment Market by Product

10.3.2.5.2 Poland Electrical Equipment Market by Application

10.3.2.5.3 Poland Electrical Equipment Market by End-User

10.3.2.6 Romania

10.3.2.6.1 Romania Electrical Equipment Market by Product

10.3.2.6.2 Romania Electrical Equipment Market by Application

10.3.2.6.4 Romania Electrical Equipment Market by End-User

10.3.2.7 Hungary

10.3.2.7.1 Hungary Electrical Equipment Market by Product

10.3.2.7.2 Hungary Electrical Equipment Market by Application

10.3.2.7.3 Hungary Electrical Equipment Market by End-User

10.3.2.8 Turkey

10.3.2.8.1 Turkey Electrical Equipment Market by Product

10.3.2.8.2 Turkey Electrical Equipment Market by Application

10.3.2.8.3 Turkey Electrical Equipment Market by End-User

10.3.2.9 Rest of Eastern Europe

10.3.2.9.1 Rest of Eastern Europe Electrical Equipment Market by Product

10.3.2.9.2 Rest of Eastern Europe Electrical Equipment Market by Application

10.3.2.9.3 Rest of Eastern Europe Electrical Equipment Market by End-User

10.3.3 Western Europe

10.3.3.1 Western Europe Electrical Equipment Market by Country

10.3.3.2 Western Europe Electrical Equipment Market by Product

10.3.3.3 Western Europe Electrical Equipment Market by Application

10.3.3.4 Western Europe Electrical Equipment Market by End-User

10.3.3.5 Germany

10.3.3.5.1 Germany Electrical Equipment Market by Product

10.3.3.5.2 Germany Electrical Equipment Market by Application

10.3.3.5.3 Germany Electrical Equipment Market by End-User

10.3.3.6 France

10.3.3.6.1 France Electrical Equipment Market by Product

10.3.3.6.2 France Electrical Equipment Market by Application

10.3.3.6.3 France Electrical Equipment Market by End-User

10.3.3.7 UK

10.3.3.7.1 UK Electrical Equipment Market by Product

10.3.3.7.2 UK Electrical Equipment Market by Application

10.3.3.7.3 UK Electrical Equipment Market by End-User

10.3.3.8 Italy

10.3.3.8.1 Italy Electrical Equipment Market by Product

10.3.3.8.2 Italy Electrical Equipment Market by Application

10.3.3.8.3 Italy Electrical Equipment Market by End-User

10.3.3.9 Spain

10.3.3.9.1 Spain Electrical Equipment Market by Product

10.3.3.9.2 Spain Electrical Equipment Market by Application

10.3.3.9.3 Spain Electrical Equipment Market by End-User

10.3.3.10 Netherlands

10.3.3.10.1 Netherlands Electrical Equipment Market by Product

10.3.3.10.2 Netherlands Electrical Equipment Market by Application

10.3.3.10.3 Netherlands Electrical Equipment Market by End-User

10.3.3.11 Switzerland

10.3.3.11.1 Switzerland Electrical Equipment Market by Product

10.3.3.11.2 Switzerland Electrical Equipment Market by Application

10.3.3.11.3 Switzerland Electrical Equipment Market by End-User

10.3.3.12 Austria

10.3.3.12.1 Austria Electrical Equipment Market by Product

10.3.3.12.2 Austria Electrical Equipment Market by Application

10.3.3.12.3 Austria Electrical Equipment Market by End-User

10.3.3.13 Rest of Western Europe

10.3.3.13.1 Rest of Western Europe Electrical Equipment Market by Product

10.3.3.13.2 Rest of Western Europe Electrical Equipment Market by Application

10.3.3.13.3 Rest of Western Europe Electrical Equipment Market by End-User

10.4 Asia-Pacific

10.4.1 Trend Analysis

10.4.2 Asia-Pacific Electrical Equipment Market by Country

10.4.3 Asia-Pacific Electrical Equipment Market by Product

10.4.4 Asia-Pacific Electrical Equipment Market by Application

10.4.5 Asia-Pacific Electrical Equipment Market by End-User

10.4.6 China

10.4.6.1 China Electrical Equipment Market by Product

10.4.6.2 China Electrical Equipment Market by Application

10.4.6.3 China Electrical Equipment Market by End-User

10.4.7 India

10.4.7.1 India Electrical Equipment Market by Product

10.4.7.2 India Electrical Equipment Market by Application

10.4.7.3 India Electrical Equipment Market by End-User

10.4.8 Japan

10.4.8.1 Japan Electrical Equipment Market by Product

10.4.8.2 Japan Electrical Equipment Market by Application

10.4.8.3 Japan Electrical Equipment Market by End-User

10.4.9 South Korea

10.4.9.1 South Korea Electrical Equipment Market by Product

10.4.9.2 South Korea Electrical Equipment Market by Application

10.4.9.3 South Korea Electrical Equipment Market by End-User

10.4.10 Vietnam

10.4.10.1 Vietnam Electrical Equipment Market by Product

10.4.10.2 Vietnam Electrical Equipment Market by Application

10.4.10.3 Vietnam Electrical Equipment Market by End-User

10.4.11 Singapore

10.4.11.1 Singapore Electrical Equipment Market by Product

10.4.11.2 Singapore Electrical Equipment Market by Application

10.4.11.3 Singapore Electrical Equipment Market by End-User

10.4.12 Australia

10.4.12.1 Australia Electrical Equipment Market by Product

10.4.12.2 Australia Electrical Equipment Market by Application

10.4.12.3 Australia Electrical Equipment Market by End-User

10.4.13 Rest of Asia-Pacific

10.4.13.1 Rest of Asia-Pacific Electrical Equipment Market by Product

10.4.13.2 Rest of Asia-Pacific Electrical Equipment Market by Application

10.4.13.3 Rest of Asia-Pacific Electrical Equipment Market by End-User

10.5 Middle East & Africa

10.5.1 Trend Analysis

10.5.2 Middle East

10.5.2.1 Middle East Electrical Equipment Market by Country

10.5.2.2 Middle East Electrical Equipment Market by Product

10.5.2.3 Middle East Electrical Equipment Market by Application

10.5.2.4 Middle East Electrical Equipment Market by End-User

10.5.2.5 UAE

10.5.2.5.1 UAE Electrical Equipment Market by Product

10.5.2.5.2 UAE Electrical Equipment Market by Application

10.5.2.5.3 UAE Electrical Equipment Market by End-User

10.5.2.6 Egypt

10.5.2.6.1 Egypt Electrical Equipment Market by Product

10.5.2.6.2 Egypt Electrical Equipment Market by Application

10.5.2.6.3 Egypt Electrical Equipment Market by End-User

10.5.2.7 Saudi Arabia

10.5.2.7.1 Saudi Arabia Electrical Equipment Market by Product

10.5.2.7.2 Saudi Arabia Electrical Equipment Market by Application

10.5.2.7.3 Saudi Arabia Electrical Equipment Market by End-User

10.5.2.8 Qatar

10.5.2.8.1 Qatar Electrical Equipment Market by Product

10.5.2.8.2 Qatar Electrical Equipment Market by Application

10.5.2.8.3 Qatar Electrical Equipment Market by End-User

10.5.2.9 Rest of Middle East

10.5.2.9.1 Rest of Middle East Electrical Equipment Market by Product

10.5.2.9.2 Rest of Middle East Electrical Equipment Market by Application

10.5.2.9.3 Rest of Middle East Electrical Equipment Market by End-User

10.5.3 Africa

10.5.3.1 Africa Electrical Equipment Market by Country

10.5.3.2 Africa Electrical Equipment Market by Product

10.5.3.3 Africa Electrical Equipment Market by Application

10.5.3.4 Africa Electrical Equipment Market by End-User

10.5.3.5 Nigeria

10.5.3.5.1 Nigeria Electrical Equipment Market by Product

10.5.3.5.2 Nigeria Electrical Equipment Market by Application

10.5.3.5.3 Nigeria Electrical Equipment Market by End-User

10.5.3.6 South Africa

10.5.3.6.1 South Africa Electrical Equipment Market by Product

10.5.3.6.2 South Africa Electrical Equipment Market by Application

10.5.3.6.3 South Africa Electrical Equipment Market by End-User

10.5.3.7 Rest of Africa

10.5.3.7.1 Rest of Africa Electrical Equipment Market by Product

10.5.3.7.2 Rest of Africa Electrical Equipment Market by Application

10.5.3.7.3 Rest of Africa Electrical Equipment Market by End-User

10.6 Latin America

10.6.1 Trend Analysis

10.6.2 Latin America Electrical Equipment Market by Country

10.6.3 Latin America Electrical Equipment Market by Product

10.6.4 Latin America Electrical Equipment Market by Application

10.6.5 Latin America Electrical Equipment Market by End-User

10.6.6 Brazil

10.6.6.1 Brazil Electrical Equipment Market by Product

10.6.6.2 Brazil Electrical Equipment Market by Application

10.6.6.3 Brazil Electrical Equipment Market by End-User

10.6.7 Argentina

10.6.7.1 Argentina Electrical Equipment Market by Product

10.6.7.2 Argentina Electrical Equipment Market by Application

10.6.7.3 Argentina Electrical Equipment Market by End-User

10.6.8 Colombia

10.6.8.1 Colombia Electrical Equipment Market by Product

10.6.8.2 Colombia Electrical Equipment Market by Application

10.6.8.3 Colombia Electrical Equipment Market by End-User

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Electrical Equipment Market by Product

10.6.9.2 Rest of Latin America Electrical Equipment Market by Application

10.6.9.3 Rest of Latin America Electrical Equipment Market by End-User

11. Company Profiles

11.1 Samel

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 The SNS View

11.2 Solar LED Powers

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 The SNS View

11.3 Hellenic Cables

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 The SNS View

11.4 incotex Group

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 The SNS View

11.5 Fincom-2

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 The SNS View

11.6 ABB

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 The SNS View

11.7 Datecs

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 The SNS View

11.8 Monbat

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 The SNS View

11.9 Emka

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 The SNS View

11.10 Gamakabela

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 The SNS View

12. Competitive Landscape

12.1 Competitive Benchmarking

12.2 Market Share Analysis

12.3 Recent Developments

12.3.1 Industry News

12.3.2 Company News

12.3.3 Mergers & Acquisitions

13. Use Case and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments

By Product

By Applications

By End User

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

The Brake Lathe Machine Market Size was estimated at USD 3.08 billion in 2023 and is expected to arrive at USD 4.66 billion by 2032 with a growing CAGR of 4.7% over the forecast period 2024-2032.

The Variable Displacement Pumps Market Size was estimated at USD 5.47 billion in 2023 and is expected to arrive at USD 7.79 billion by 2032 with a growing CAGR of 4.0% over the forecast period 2024-2032.

CNC Tool & Cutter Grinding Machine Market was valued at USD 3.96 Bn in 2023 and is expected to reach USD 5.42 Bn by 2032, at a CAGR of 3.54% from 2024 to 2032.

The Pump Jack Market Size was estimated at USD 3.77 billion in 2023 and is expected to arrive at USD 5.30 billion by 2032 with a growing CAGR of 3.86% over the forecast period 2024-2032.

The Global Equipment Market size was estimated at USD 1113.90 billion in 2022 and is expected to reach USD 1587.74 billion by 2030 at a CAGR of 4.99% during the forecast period of 2023-2030.

Corrosion Monitoring Market was estimated at USD 351.17 Mn in 2023 and is expected to arrive at USD 916.02 Mn by 2032, at a CAGR of 11.24% from 2024-2032.

Hi! Click one of our member below to chat on Phone