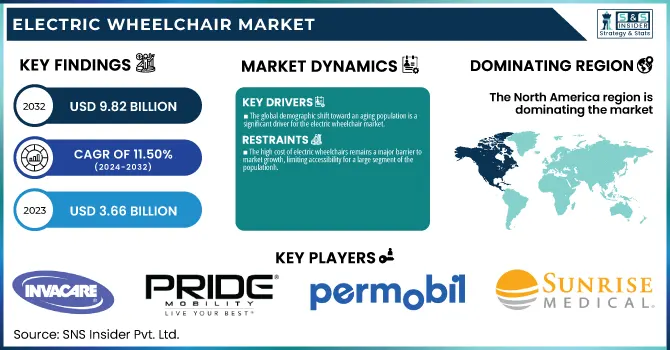

The Electric Wheelchair Market was valued at USD 3.66 billion in 2023 and is expected to reach USD 9.82 billion by 2032, growing at a CAGR of 11.50% from 2024 to 2032.

To Get more information on Electric Wheelchair Market - Request Free Sample Report

The report offers forecasts of the frequency of mobility disabilities, with statistics on the number of people who need electric wheelchairs due to injuries or conditions such as spinal cord trauma, multiple sclerosis, and neuro-musculoskeletal disorders. It reports regional adoption trends (2023) based on influencing factors like the availability of access infrastructure and cost-reimbursement policies dictating demand. The report includes electric wheelchair regional sales volume forecasts, providing history and forecasts. It gives a detailed analysis of healthcare expenditure on mobility aids, dividing expenditures into government funding, private insurance, commercial payers, and out-of-pocket expenses, providing a detailed insight into financial accessibility by region.

Drivers

The global demographic shift toward an aging population is a significant driver for the electric wheelchair market.

The worldwide demographic transition to an aging population is a key driver for the electric wheelchair industry. With rising life expectancy, more of the population is facing mobility issues due to age, and thus, there is a growing need for assistive devices such as electric wheelchairs. The United Nations estimates that the population aged 65 and above will double by 2050 to 1.5 billion. This increase in the number of elderly people is accompanied by a greater incidence of mobility impairments, thus fueling the demand for electric wheelchairs. Companies are meeting this demand by creating models that are designed specifically for older people, with an emphasis on comfort, simplicity of use, and safety features. Government programs and insurance coverage for mobility aids are also contributing to market growth. The increasing use of homecare services is also driving demand for electric wheelchairs, helping elderly people to be independent.

Continuous technological innovations are propelling the electric wheelchair market forward.

Persistent technological advancements are driving the electric wheelchair market. Breakthroughs like longer battery life, light materials, and sophisticated control systems have made electric wheelchairs more efficient and convenient. For example, the merger of artificial intelligence and IoT enabled the creation of intelligent wheelchairs that automatically traverse surroundings and track the patient's health indicators. In March 2024, IIT Madras came up with India's most personalized, natively designed electric standing wheelchair with superior mobility features for users. Such technological advancements not only enhance the users' quality of life but also increase the potential market base, such as persons with more profound mobility disabilities, hence fueling market expansion. In addition, the increasing integration of voice control, brain-machine interfaces, and mobile app connectivity is rendering electric wheelchairs more accessible, promoting autonomy and usability among persons with serious disabilities.

Restraint

The high cost of electric wheelchairs remains a major barrier to market growth, limiting accessibility for a large segment of the population.

The exorbitant price of electric wheelchairs continues to be a significant hindrance to market expansion, restricting access for a significant portion of the population. In contrast to manual wheelchairs, which are reasonably priced, electric wheelchairs feature sophisticated technologies like motorized control systems, lithium-ion batteries, and AI-based navigation, making them very expensive. On average, a basic electric wheelchair can range from USD 1,500 to USD 15,000, depending on specifications and customization. Most people, particularly in developing nations, cannot afford these devices because of low insurance coverage and high out-of-pocket payments. Maintenance and repair costs further contribute to the financial load. Although government initiatives and non-profit organizations offer relief in some areas, access is still a problem. The significant initial investment discourages consumers, hindering market growth, especially in price-conscious economies.

Opportunities

The increasing integration of smart technology and artificial intelligence (AI) in electric wheelchairs presents a significant growth opportunity.

The mounting integration of artificial intelligence (AI) and smart technology in electric wheelchairs is a major growth opportunity. Technologies like autonomous steering, obstacle avoidance, voice control, and IoT connectivity are transforming mobility solutions for the disabled. AI-controlled wheelchairs can optimize user experience through adjusting movement habits, health monitoring, and safety in congested spaces. Firms are putting money into R&D to come up with high-end models designed for users suffering from extreme mobility impairments. Moreover, alliances with healthcare centers and rehabilitation institutions are encouraging the use of these hi-tech wheelchairs. The growing demand for remote-controlled and app-enabled wheelchairs is further propelling the market growth. As governments and insurance providers increasingly acknowledge the value proposition of intelligent mobility solutions, greater funding and subsidies may boost market penetration over the next few years.

Challenges

Lack of infrastructure for wheelchair accessibility remains a significant challenge to market growth.

Although there has been a lot of innovation in electric wheelchairs, poor infrastructure is still a major hindrance to market development. Most places, particularly developing nations, lack appropriate wheelchair-accessible infrastructure like ramps, lifts, and public transport that is accessible to the disabled. As per the World Health Organization (WHO), almost 75 million individuals need a wheelchair in the world, but a significant percentage are mobility-restricted because of inadequate urban planning. Even in developed countries, older buildings and public areas might not be accessible according to standards, restricting the use of electric wheelchairs. This issue dissuades prospective users from purchasing these mobility aids, as their everyday mobility is still restricted. Governments and urban planners must prioritize accessibility improvements to unlock the full potential of the electric wheelchair market. Without proper infrastructure, the benefits of advanced wheelchairs remain underutilized, restricting market expansion.

By Product

The Rear-wheel Drive segment dominated the electric wheelchairs market with a 38.56% market share in 2023 because of its better power, stability, and capacity to operate on different terrain. Rear-wheel drive wheelchairs are liked for use outside because they provide a boost in speed as well as improved control, and thus they are suited for users who need mobility over long distances. Rear-wheel drive models also ensure a better ride, particularly on rough terrain, because they have bigger rear wheels as well as powerful suspension systems. They also have better weight capacities and are, therefore, suitable for a larger market of users who may have major mobility impairments. Rear-wheel drive models are also embraced in healthcare centers as well as at home due to their dependability and adaptability. The prevalence of the rear-wheel drive wheelchair segment is further fueled by firms such as Invacare, Pride Mobility, and Drive Medical, which lead the market through continuous innovation of rear-wheel drive wheelchair models.

The Mid-wheel Drive segment is anticipated to grow the fastest during the forecast period based on its better maneuverability and growing popularity in urban and indoor environments. Mid-wheel drive electric wheelchairs, unlike rear-wheel drive versions, possess a reduced turning radius, which makes them extremely efficient for traveling through narrow spaces like homes, offices, and hospitals. The increasing demand for smaller, easy-to-use mobility solutions, especially among elderly populations in developed and emerging markets, is driving demand. Advances in technology, including better suspension systems that improve stability and ride quality, are also making mid-wheel drive models more appealing to customers. Furthermore, the increasing use of smart and AI-enabled electric wheelchairs is pushing the segment to grow because mid-wheel drives enable greater control and sophisticated automated features, also fueling market growth.

By Age Group

The Geriatric segment dominated the electric wheelchair market with a 54.26% market share in 2023 as a result of the fast increase in the aging population and the widespread presence of mobility-related disorders in elderly people. As reported by the United Nations, the world population aged 65 and above is estimated to exceed 1.5 billion by 2050, with a substantial portion of them having mobility impairments caused by diseases such as arthritis, osteoporosis, and neuromuscular disorders. Electric wheelchairs are a vital option for older persons who have difficulty walking long distances or need support in their activities of daily living. The rising trend toward homecare services rather than institutionalized care has also helped to drive increased demand for electric wheelchairs among the elderly, which allows them to stay independent and mobile. Further, government policies and insurance in North America and Europe have ensured greater accessibility of electric wheelchairs for elderly citizens, adding to the segment's supremacy.

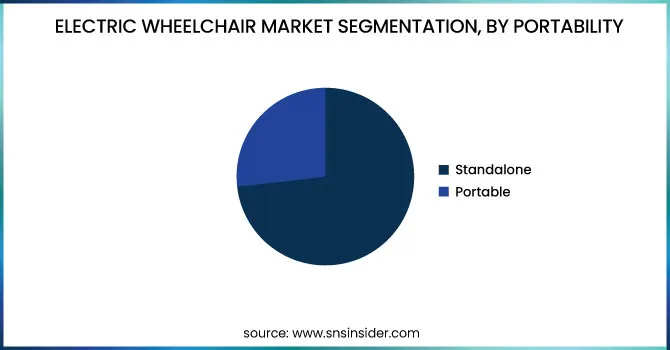

By Portability

The Standalone segment dominated the electric wheelchair market with a 73.22% market share in 2023 as a result of its longer lifespan, high-end features, and extensive use in homecare as well as healthcare facilities. Standalone electric wheelchairs are meant to last longer, with improved battery life, strong motors, and personalized seating arrangements, and therefore suit people with severe mobility issues. These models offer increased stability and comfort over their portable alternatives, a reason why they are a desirable option for everyday use, particularly for geriatric and disabled groups. Standalone electric wheelchairs are also utilized heavily in hospitals, rehabilitation facilities, and assisted living centers, increasing demand. Incumbents like Invacare, Permobil, and Pride Mobility continue to invest in research and development, such as AI integration and intelligent control systems, affirming the segment's dominance. Their stronger construction and higher weight capacity further account for the universal popularity of standalone models compared to portable models.

By End Use

The Homecare segment dominated the electric wheelchair market with a 50.32% market share in 2023 because of the growing desire for in-home patient care and the growing older population that needs mobility support. As the elderly population continues to grow, so does the tendency to age in place, where seniors and persons with disabilities find electric wheelchairs convenient and useful in their homes to provide them with mobility independence. Improvements in the technology of wheelchairs, including remote models and AI-facilitated navigation, made home care feasible and convenient. Insurance coverage, as well as public reimbursement schemes across developed markets of North America and Europe, also cover home-based mobility solutions. The cost-effectiveness of home care over extended hospitalization or assisted living centers has also played a role in the dominance of the segment, with families increasingly investing in quality electric wheelchairs to provide better mobility and comfort for their loved ones.

The Ambulatory Surgical Centers (ASCs) market is anticipated to grow at the fastest rate during the forecast period as a result of the increased volume of outpatient procedures and increased demand for post-surgical mobility solutions. ASCs are increasingly becoming popular cost-saving alternatives to traditional hospitals due to their ability to provide same-day surgeries for orthopedic injuries, spinal disorders, and neurological impairments—most of which need temporary or long-term mobility support. Due to shorter recovery times and growing patient turnover, demand for electric wheelchairs is increasing in ASCs to help with post-operative rehabilitation. The growth of portable, lightweight, and easily moved electric wheelchair designs also meets the needs of patients in ASCs who need assistance with mobility when recovering. Because the number of ASCs is growing around the world, especially in developing nations, demand for electric wheelchairs in ASCs will continue to increase at an exponential rate.

North America dominated the electric wheelchair market with a 38.21% market share in 2023, with its highly developed healthcare system, high level of adoption for sophisticated mobility solutions, and good presence of market leaders. The region has positive government policies, including Medicare and Medicaid reimbursement schemes, which enable easy access to electric wheelchairs for disabled persons and the aged population. Besides, the increasing rate of mobility impairment caused by an aging population and chronic diseases such as arthritis and spinal cord injuries also stimulates demand. Technologically advanced products available, ongoing R&D spending by companies such as Invacare, Pride Mobility, and Permobil, and extensive availability of intelligent wheelchairs drive North America's leadership in the market. In addition, the region boasts highly developed accessibility infrastructure, with a higher rate of adoption of electric wheelchairs in public areas, hospitals, and homecare environments.

Asia Pacific is the fastest-growing region in the electric wheelchairs market, with 12.64% CAGR throughout the forecast period, because of its fast-aging population, growing disposable incomes, and growing awareness of mobility solutions. China, Japan, and India are among the countries experiencing high demand for electric wheelchairs because of government policies favoring disability support and enhancing healthcare access. Moreover, local manufacturing developments and the availability of affordable mobility solutions are making electric wheelchairs more price-friendly in price-conscious markets. The rising incidence of disabilities as a result of accidents and age-related factors is also driving growth. In addition, enhancing urban infrastructure and accessibility policies in nations such as Japan and South Korea are fueling adoption. As more global manufacturers move into Asia Pacific, the market is poised to witness increased growth with the launch of technologically sophisticated and affordable wheelchair models.

Get Customized Report as per Your Business Requirement - Enquiry Now

Invacare Corporation (Storm Series Torque SP, TDX SP2)

Pride Mobility Products Corp. (Jazzy Elite HD, Go Chair)

Permobil (F5 Corpus, M3 Corpus)

Sunrise Medical (Quickie Q500 M, Zippie ZM-310)

Ottobock (Juvo B5, B400)

Drive Medical (Trident HD, Titan AXS)

Hoveround Corporation (MPV5, Teknique XHD)

Golden Technologies (Alante Sport, Compass HD)

Karman Healthcare (XO-202 Standing Wheelchair, Tranzit Go)

Meyra Group (iChair MC S, iChair Sky)

WHILL (Model Ci2, Model Fi)

Merits Health Products (Pioneer 10, Vision Sport)

Shoprider Mobility Products (Streamer Sport, Jimmie Power Chair)

Heartway Medical Products (HP7 Strider, HP8 LX)

KD Smart Chair (Standard Model, Heavy Duty Model)

EZ Lite Cruiser (Standard Model, Deluxe DX12)

Invacare Corporation (Pronto M51, Pronto M41)

DEKA Research & Development Corp. (iBOT PMD, Segway PT)

Mobius Mobility (iBOT PMD, iBOT Personal Mobility Device)

Ekso Bionics (Ekso Indego Personal, EksoUE)

Suppliers (These suppliers play a crucial role in the electric wheelchair market by providing essential components that enhance mobility devices' functionality, comfort, and reliability.) in Electric Wheelchair Market.

PG Drives Technology

REAC

Linak

Living Spinal

HME Medical Shop

Ocelco

Rubicon Mobility

Karman Healthcare

VIVA Mobility Aids

Build My Wheelchair

Recent Development

In August 2024, Invacare partnered with Guinness World Record holder Ian Mackay for his third annual Sea to Sound event. The event, which took place from August 23 through 25, traversed the Olympic Discovery Trail in Port Angeles, Washington, traveling up to 74 miles in three days.

In February 2025, Permobil pointed out the advantages of power tilt-in-space capability in power wheelchairs. This capability enables the user to tilt their entire body back while keeping hip and knee angles constant, which can assist in controlling spasms of the legs and muscle tone irregularities. Possible health advantages are skin protection, pain control, and minimizing swelling of the lower legs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.66 billion |

| Market Size by 2032 | US$ 9.82 billion |

| CAGR | CAGR of 11.50% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Front-wheel Drive, Mid-wheel Drive, Rear-wheel Drive, Others) • By Age Group (Adult, Pediatric, Geriatric) • By Portability (Standalone, Portable) • By End Use (Homecare, Hospitals, Ambulatory Surgical Centers, Rehabilitation Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Invacare Corporation, Pride Mobility Products Corp., Permobil, Sunrise Medical, Ottobock, Drive Medical, Hoveround Corporation, Golden Technologies, Karman Healthcare, Meyra Group, WHILL, Merits Health Products, Shoprider Mobility Products, Heartway Medical Products, KD Smart Chair, EZ Lite Cruiser, DEKA Research & Development Corp., Mobius Mobility, Ekso Bionics, and other players. |

Ans: The Electric Wheelchair Market is expected to grow at a CAGR of 11.50% during 2024-2032.

Ans: The Electric Wheelchair Market was USD 3.66 billion in 2023 and is expected to reach USD 9.82 billion by 2032.

Ans: The global demographic shift toward an aging population is a significant driver for the electric wheelchair market.

Ans: The “Rear-wheel Drive” segment dominated the Electric Wheelchair Market.

Ans: North America dominated the Electric Wheelchair Market in 2023.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Prevalence of Mobility Impairments (2023)

5.2 Adoption Trends of Electric Wheelchairs (2023), by Region

5.3 Electric Wheelchair Sales Volume, by Region (2020-2032)

5.4 Healthcare Spending on Mobility Aids, by Region (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Electric Wheelchair Market Segmentation By Product

7.1 Chapter Overview

7.2 Front-wheel Drive

7.2.1 Front-wheel Drive Market Trends Analysis (2020-2032)

7.2.2 Front-wheel Drive Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Mid-wheel Drive

7.3.1 Mid-wheel Drive Market Trends Analysis (2020-2032)

7.3.2 Mid-wheel Drive Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Rear-wheel Drive

7.4.1 Rear-wheel Drive Market Trends Analysis (2020-2032)

7.4.2 Rear-wheel Drive Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Others

7.5.1 Others Market Trends Analysis (2020-2032)

7.5.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Electric Wheelchair Market Segmentation, By Age Group

8.1 Chapter Overview

8.2 Adult

8.2.1 Adult Market Trends Analysis (2020-2032)

8.2.2 Adult Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Pediatric

8.3.1 Pediatric Market Trends Analysis (2020-2032)

8.3.2 Pediatric Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Geriatric

8.4.1 Geriatric Market Trends Analysis (2020-2032)

8.4.2 Geriatric Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Electric Wheelchair Market Segmentation, By Portability

9.1 Chapter Overview

9.2 Standalone

9.2.1 Standalone Market Trends Analysis (2020-2032)

9.2.2 Standalone Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Portable

9.3.1 Portable Market Trends Analysis (2020-2032)

9.3.2 Portable Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Electric Wheelchair Market Segmentation, By End Use

10.1 Chapter Overview

10.2 Homecare

10.2.1 Homecare Market Trends Analysis (2020-2032)

10.2.2 Homecare Market Size Estimates and Forecasts to 2032 (USD Billion)

10.3 Hospitals

10.3.1 Hospitals Market Trends Analysis (2020-2032)

10.3.2 Hospitals Market Size Estimates and Forecasts to 2032 (USD Billion)

10.4 Ambulatory Surgical Centers

10.4.1 Ambulatory Surgical Centers Market Trends Analysis (2020-2032)

10.4.2 Ambulatory Surgical Centers Market Size Estimates and Forecasts to 2032 (USD Billion)

10.5 Rehabilitation Centers

10.5.1 Rehabilitation Centers Market Trends Analysis (2020-2032)

10.5.2 Rehabilitation Centers Market Size Estimates and Forecasts to 2032 (USD Billion)

11. Regional Analysis

11.1 Chapter Overview

11.2 North America

11.2.1 Trends Analysis

11.2.2 North America Electric Wheelchair Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.2.3 North America Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.4 North America Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.2.5 North America Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.2.6 North America Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.2.7 USA

11.2.7.1 USA Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.7.2 USA Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.2.7.3 USA Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.2.7.4 USA Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.2.8 Canada

11.2.8.1 Canada Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.8.2 Canada Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.2.8.3 Canada Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.2.8.4 Canada Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.2.9 Mexico

11.2.9.1 Mexico Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.2.9.2 Mexico Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.2.9.3 Mexico Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.2.9.4 Mexico Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Trends Analysis

11.3.1.2 Eastern Europe Electric Wheelchair Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.1.3 Eastern Europe Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.4 Eastern Europe Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.1.5 Eastern Europe Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.1.6 Eastern Europe Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.7 Poland

11.3.1.7.1 Poland Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.7.2 Poland Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.1.7.3 Poland Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.1.7.4 Poland Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.8 Romania

11.3.1.8.1 Romania Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.8.2 Romania Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.1.8.3 Romania Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.1.8.4 Romania Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.9 Hungary

11.3.1.9.1 Hungary Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.9.2 Hungary Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.1.9.3 Hungary Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.1.9.4 Hungary Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.10 Turkey

11.3.1.10.1 Turkey Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.10.2 Turkey Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.1.10.3 Turkey Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.1.10.4 Turkey Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.1.11 Rest of Eastern Europe

11.3.1.11.1 Rest of Eastern Europe Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.1.11.2 Rest of Eastern Europe Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.1.11.3 Rest of Eastern Europe Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.1.11.4 Rest of Eastern Europe Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2 Western Europe

11.3.2.1 Trends Analysis

11.3.2.2 Western Europe Electric Wheelchair Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.3.2.3 Western Europe Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.4 Western Europe Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.2.5 Western Europe Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.2.6 Western Europe Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.7 Germany

11.3.2.7.1 Germany Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.7.2 Germany Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.2.7.3 Germany Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.2.7.4 Germany Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.8 France

11.3.2.8.1 France Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.8.2 France Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.2.8.3 France Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.2.8.4 France Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.9 UK

11.3.2.9.1 UK Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.9.2 UK Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.2.9.3 UK Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.2.9.4 UK Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.10 Italy

11.3.2.10.1 Italy Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.10.2 Italy Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.2.10.3 Italy Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.2.10.4 Italy Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.11 Spain

11.3.2.11.1 Spain Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.11.2 Spain Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.2.11.3 Spain Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.2.11.4 Spain Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.12 Netherlands

11.3.2.12.1 Netherlands Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.12.2 Netherlands Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.2.12.3 Netherlands Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.2.12.4 Netherlands Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.13 Switzerland

11.3.2.13.1 Switzerland Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.13.2 Switzerland Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.2.13.3 Switzerland Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.2.13.4 Switzerland Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.14 Austria

11.3.2.14.1 Austria Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.14.2 Austria Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.2.14.3 Austria Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.2.14.4 Austria Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.3.2.15 Rest of Western Europe

11.3.2.15.1 Rest of Western Europe Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.3.2.15.2 Rest of Western Europe Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.3.2.15.3 Rest of Western Europe Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.3.2.15.4 Rest of Western Europe Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4 Asia Pacific

11.4.1 Trends Analysis

11.4.2 Asia Pacific Electric Wheelchair Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.4.3 Asia Pacific Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.4 Asia Pacific Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.4.5 Asia Pacific Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.4.6 Asia Pacific Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.7 China

11.4.7.1 China Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.7.2 China Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.4.7.3 China Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.4.7.4 China Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.8 India

11.4.8.1 India Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.8.2 India Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.4.8.3 India Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.4.8.4 India Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.9 Japan

11.4.9.1 Japan Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.9.2 Japan Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.4.9.3 Japan Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.4.9.4 Japan Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.10 South Korea

11.4.10.1 South Korea Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.10.2 South Korea Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.4.10.3 South Korea Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.4.10.4 South Korea Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.11 Vietnam

11.4.11.1 Vietnam Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.11.2 Vietnam Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.4.11.3 Vietnam Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.4.11.4 Vietnam Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.12 Singapore

11.4.12.1 Singapore Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.12.2 Singapore Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.4.12.3 Singapore Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.4.12.4 Singapore Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.13 Australia

11.4.13.1 Australia Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.13.2 Australia Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.4.13.3 Australia Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.4.13.4 Australia Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.4.14 Rest of Asia Pacific

11.4.14.1 Rest of Asia Pacific Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.4.14.2 Rest of Asia Pacific Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.4.14.3 Rest of Asia Pacific Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.4.14.4 Rest of Asia Pacific Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5 Middle East and Africa

11.5.1 Middle East

11.5.1.1 Trends Analysis

11.5.1.2 Middle East Electric Wheelchair Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.1.3 Middle East Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.4 Middle East Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.5.1.5 Middle East Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.5.1.6 Middle East Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.7 UAE

11.5.1.7.1 UAE Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.7.2 UAE Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.5.1.7.3 UAE Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.5.1.7.4 UAE Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.8 Egypt

11.5.1.8.1 Egypt Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.8.2 Egypt Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.5.1.8.3 Egypt Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.5.1.8.4 Egypt Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.9 Saudi Arabia

11.5.1.9.1 Saudi Arabia Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.9.2 Saudi Arabia Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.5.1.9.3 Saudi Arabia Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.5.1.9.4 Saudi Arabia Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.10 Qatar

11.5.1.10.1 Qatar Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.10.2 Qatar Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.5.1.10.3 Qatar Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.5.1.10.4 Qatar Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.1.11 Rest of Middle East

11.5.1.11.1 Rest of Middle East Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.1.11.2 Rest of Middle East Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.5.1.11.3 Rest of Middle East Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.5.1.11.4 Rest of Middle East Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2 Africa

11.5.2.1 Trends Analysis

11.5.2.2 Africa Electric Wheelchair Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.5.2.3 Africa Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.4 Africa Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.5.2.5 Africa Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.5.2.6 Africa Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2.7 South Africa

11.5.2.7.1 South Africa Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.7.2 South Africa Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.5.2.7.3 South Africa Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.5.2.7.4 South Africa Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2.8 Nigeria

11.5.2.8.1 Nigeria Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.8.2 Nigeria Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.5.2.8.3 Nigeria Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.5.2.8.4 Nigeria Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.5.2.9 Rest of Africa

11.5.2.9.1 Rest of Africa Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.5.2.9.2 Rest of Africa Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.5.2.9.3 Rest of Africa Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.5.2.9.4 Rest of Africa Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6 Latin America

11.6.1 Trends Analysis

11.6.2 Latin America Electric Wheelchair Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

11.6.3 Latin America Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.4 Latin America Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.6.5 Latin America Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.6.6 Latin America Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.7 Brazil

11.6.7.1 Brazil Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.7.2 Brazil Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.6.7.3 Brazil Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.6.7.4 Brazil Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.8 Argentina

11.6.8.1 Argentina Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.8.2 Argentina Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.6.8.3 Argentina Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.6.8.4 Argentina Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.9 Colombia

11.6.9.1 Colombia Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.9.2 Colombia Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.6.9.3 Colombia Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.6.9.4 Colombia Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

11.6.10 Rest of Latin America

11.6.10.1 Rest of Latin America Electric Wheelchair Market Estimates and Forecasts, by Product (2020-2032) (USD Billion)

11.6.10.2 Rest of Latin America Electric Wheelchair Market Estimates and Forecasts, by Age Group (2020-2032) (USD Billion)

11.6.10.3 Rest of Latin America Electric Wheelchair Market Estimates and Forecasts, by Portability (2020-2032) (USD Billion)

11.6.10.4 Rest of Latin America Electric Wheelchair Market Estimates and Forecasts, by End Use (2020-2032) (USD Billion)

12. Company Profiles

12.1 Invacare Corporation

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.2 Pride Mobility Products Corp.

12.2.1 Company Overview

12.2.2 Financial

12.2.3 Products/ Services Offered

12.2.4 SWOT Analysis

12.3 Permobil

12.3.1 Company Overview

12.3.2 Financial

12.3.3 Products/ Services Offered

12.3.4 SWOT Analysis

12.4 Sunrise Medical

12.4.1 Company Overview

12.4.2 Financial

12.4.3 Products/ Services Offered

12.4.4 SWOT Analysis

12.5 Ottobock

12.5.1 Company Overview

12.5.2 Financial

12.5.3 Products/ Services Offered

12.5.4 SWOT Analysis

12.6 Drive Medical

12.6.1 Company Overview

12.6.2 Financial

12.6.3 Products/ Services Offered

12.6.4 SWOT Analysis

12.7 Hoveround Corporation

12.7.1 Company Overview

12.7.2 Financial

12.7.3 Products/ Services Offered

12.7.4 SWOT Analysis

12.8 Golden Technologies

12.8.1 Company Overview

12.8.2 Financial

12.8.3 Products/ Services Offered

12.8.4 SWOT Analysis

12.9 Karman Healthcare

12.9.1 Company Overview

12.9.2 Financial

12.9.3 Products/ Services Offered

12.9.4 SWOT Analysis

12.10 Meyra Group

12.10.1 Company Overview

12.10.2 Financial

12.10.3 Products/ Services Offered

12.10.4 SWOT Analysis

13. Use Cases and Best Practices

14. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Electric Wheelchair Market Key Segments:

By Product

Front-wheel Drive

Mid-wheel Drive

Rear-wheel Drive

Others

By Age Group

Adult

Pediatric

Geriatric

By Portability

Standalone

Portable

By End Use

Homecare

Hospitals

Ambulatory Surgical Centers

Rehabilitation Centers

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The animal genetic market size was USD 6.44 billion in 2023 and is expected to reach USD 11.47 billion by 2032 and grow at a CAGR of 6.62% over the forecast period of 2024-2032.

The Ferritin Testing Market Size was valued at USD 840.40 million in 2023 and is expected to reach USD 1684.34 million by 2032 and grow at a CAGR of 8.05% over the forecast period 2024-2032.

Dermatology Devices Market Size was valued at USD 15.2 Billion in 2023 and is expected to reach USD 40.56 Billion by 2032, growing at a CAGR of 11.54% over the forecast period 2024-2032.

Hemophilia Market Size was valued at USD 13.7 Billion in 2023 and is expected to reach USD 24.2 Billion by 2032, growing at a CAGR of 6.5% over 2024-2032.

Big Data in Healthcare Market size valued at USD 68.56 billion in 2023, projected to reach USD 283.43 billion by 2032, with a CAGR of 16.78% from 2024 to 2032.

Dementia Treatment Market was valued at USD 17.06 billion in 2023 and is expected to reach USD 33.54 billion by 2032, growing at a CAGR of 7.80% from 2024-2032.

Hi! Click one of our member below to chat on Phone