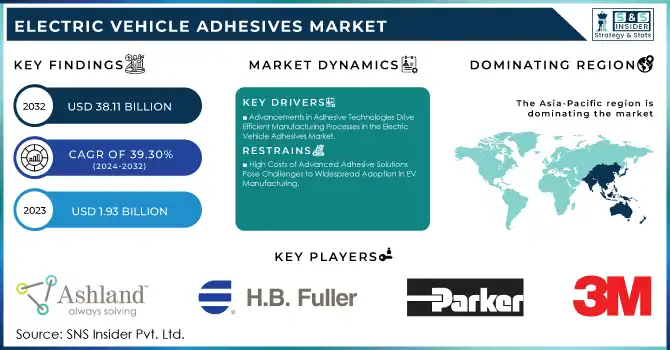

The Electric Vehicle Adhesives Market Size was valued at USD 1.93 billion in 2023 and is expected to reach USD 38.11 billion by 2032 and grow at a CAGR of 39.30% over the forecast period 2024-2032.

Get more information on Electric Vehicle Adhesives Market - Request Sample Report

The Electric Vehicle (EV) Adhesives Market is witnessing significant growth, driven by the increasing demand for lightweight materials in EVs to enhance energy efficiency. Adhesives are critical for joining dissimilar materials, ensuring structural integrity, and improving thermal management in battery systems. This dynamic market is characterized by advancements in adhesive formulations to cater to the evolving needs of EV manufacturers. Factors such as the push for sustainable solutions, improved performance in extreme conditions, and compatibility with automated production processes are driving innovation. For instance, Henkel introduced a thermally conductive injectable adhesive in May 2023 to address thermal management challenges in EV battery systems. Similarly, Bostik showcased its advanced adhesive solutions at the India Battery Show in October 2023, underlining the industry's commitment to developing products tailored to battery assembly and durability.

Leading companies are taking strides to expand production capacities and innovate to meet demand. In May 2024, Dow commenced operations at its new adhesive and gap filler production line in Ahlen, Germany, enhancing its capability to serve the European EV market. H.B. Fuller, in the same month, strengthened its product portfolio by acquiring ND Industries, focusing on specialty adhesives critical for automotive applications. By October 2024, LG Chem introduced high-performance adhesive solutions, aligning with the industry's focus on lightweighting and environmental sustainability. Additionally, DuPont’s Megum W series has been pivotal in advancing sustainable adhesive solutions for automotive mobility. February 2025 witnessed growing interest in advanced additives for EV adhesives and sealants, as reflected in trends towards developing eco-friendly and high-performance materials to support electrification efforts globally. These developments underscore the rapid technological evolution and strategic expansions shaping the EV adhesives market.

Drivers:

Advancements in Adhesive Technologies Drive Efficient Manufacturing Processes in the Electric Vehicle Adhesives Market

Advancements in adhesive technologies are revolutionizing manufacturing processes in the electric vehicle market. Adhesives provide an efficient solution for bonding dissimilar materials, such as metals, composites, and plastics, which are integral to the lightweight designs of modern EVs. By eliminating the need for traditional fasteners and welds, adhesives contribute to significant weight reductions, leading to improved energy efficiency and vehicle performance. Additionally, advanced adhesives offer enhanced durability and resistance to environmental factors, ensuring longer vehicle life cycles. These technologies also align with automation trends, enabling faster and more precise assembly processes. For instance, automated adhesive dispensing systems are streamlining production lines and reducing labor-intensive practices. The continuous development of thermally conductive adhesives further highlights their critical role in battery thermal management, a key factor in ensuring safety and operational efficiency. As manufacturers seek to meet stringent performance and regulatory requirements, adhesive technologies are becoming indispensable, driving their demand in the EV industry.

Increasing Consumer Demand for Electric Vehicles Accelerates the Growth of Adhesives in Automotive Applications

Stringent Regulations Promoting Lightweight Materials Propel the Demand for Advanced Adhesives in EV Manufacturing

Stringent regulations aimed at reducing carbon emissions and improving fuel efficiency are driving the demand for advanced adhesives in EV manufacturing. Governments worldwide are mandating the use of lightweight materials to minimize environmental impact, prompting automakers to replace traditional bonding methods with adhesives. Adhesives enable the use of lightweight substrates like aluminum and composites, which are essential for meeting regulatory requirements. Furthermore, their ability to distribute stress evenly across bonded surfaces enhances vehicle durability and crash safety. Regulatory frameworks, particularly in regions like Europe and North America, are fostering innovations in adhesive technologies that align with sustainability goals. For instance, low-VOC (volatile organic compound) adhesives are gaining traction due to their environmental compliance and superior performance. These regulations not only encourage adhesive adoption but also drive manufacturers to invest in research and development, resulting in advanced products that cater to evolving industry needs.

Restraint:

High Costs of Advanced Adhesive Solutions Pose Challenges to Widespread Adoption in EV Manufacturing

Opportunity:

Expansion of EV Infrastructure Creates New Opportunities for Adhesives in Charging Stations and Components

Growing Focus on Sustainability Drives Demand for Eco-Friendly Adhesives in the EV Market

The growing emphasis on sustainability in the automotive industry presents a significant opportunity for eco-friendly adhesives in EV manufacturing. With increasing regulatory pressure and consumer awareness, manufacturers are shifting toward materials that minimize environmental impact. Eco-friendly adhesives, often made from renewable resources or featuring recyclable properties, are gaining traction as a sustainable alternative to conventional bonding methods. These adhesives not only reduce the carbon footprint of EV production but also align with global sustainability goals, enhancing their appeal to environmentally conscious consumers. Adhesive producers are investing in research and development to create products that meet performance requirements while adhering to stringent environmental standards. This focus on sustainability is unlocking new opportunities in the market, particularly among automakers looking to enhance their green credentials.

Consumer and Market Sentiment Analysis for Electric Vehicle Adhesives Market

|

Aspect |

Sentiment/Findings |

|

Consumer Awareness of Adhesive Technologies |

Consumers are increasingly aware of the role of adhesives in enhancing EV performance and sustainability. |

|

Perception of Sustainability in Adhesive Solutions |

There is a growing demand for adhesives with low environmental impact, influencing market decisions. |

|

Consumer Preferences for Lightweight EV Components |

Consumers prioritize lightweight components for better vehicle efficiency, which adhesives can provide. |

|

Impact of Safety Standards on Adhesive Adoption |

Strict safety standards have led to an increased reliance on adhesives in EV manufacturing for better structural integrity. |

|

Willingness to Pay for Eco-friendly Adhesives |

Consumers show a willingness to pay a premium for eco-friendly adhesives, especially in regions with strong environmental consciousness. |

The consumer sentiment in the Electric Vehicle Adhesives Market is increasingly shaped by awareness of sustainability, safety, and the demand for lightweight components. There is a growing recognition of the importance of adhesive technologies in enhancing EV performance, especially in terms of durability and energy efficiency. Consumers also show strong preferences for eco-friendly adhesive solutions, which not only align with environmental concerns but also meet stricter safety standards required in electric vehicle manufacturing. Furthermore, the willingness to pay for premium eco-friendly adhesives highlights the evolving consumer mindset towards sustainable and efficient materials in EV production.

By Resin Type

In 2023, the epoxy resin segment dominated the Electric Vehicle Adhesives Market with a market share of 38%. Epoxy adhesives are particularly valued in the automotive industry for their exceptional mechanical strength, durability, and excellent adhesion properties across a variety of substrates. Their ability to withstand harsh environmental conditions, including temperature variations and exposure to chemicals, makes them highly suitable for critical applications in electric vehicles. For instance, epoxy adhesives are commonly used in battery assembly and structural bonding, ensuring that components remain secure and intact during operation. Leading manufacturers, such as Henkel and 3M, have developed innovative epoxy formulations that not only meet the performance requirements of modern electric vehicles but also address specific industry needs, such as low VOC emissions and improved processing times. These advancements have solidified epoxy's position as the preferred choice among OEMs and suppliers, contributing significantly to its market dominance. As the electric vehicle market continues to expand, the demand for reliable, high-performance adhesive solutions like epoxies is expected to grow, further enhancing their critical role in vehicle assembly.

By Vehicle Type

In 2023, the Battery Electric Vehicle (BEV) segment dominated the Electric Vehicle Adhesives Market with a market share of 55%. The growing production and adoption of BEVs are significantly driven by the global transition towards sustainable and eco-friendly transportation solutions. This surge in demand for electric vehicles has heightened the need for specialized adhesives that can effectively bond critical components such as battery packs, body panels, and interior elements. For instance, leading manufacturers like Tesla and Nissan prioritize the use of advanced adhesives to ensure the integrity and safety of their battery systems, which are vital for overall vehicle performance. These adhesives not only enhance structural stability but also contribute to energy efficiency by reducing overall vehicle weight. Additionally, the innovation of adhesive technologies that cater specifically to BEVs, such as thermally conductive adhesives, showcases the industry's commitment to improving vehicle safety and efficiency. As the market for BEVs continues to grow, the demand for effective adhesive solutions that meet the unique challenges of electric vehicle manufacturing is anticipated to increase, further solidifying the dominance of this segment.

By Substrate

In 2023, the composite substrate segment dominated the Electric Vehicle Adhesives Market with a market share of 40%. Composites are increasingly preferred in the automotive sector due to their lightweight yet strong properties, which significantly enhance the performance and efficiency of electric vehicles. The use of composite materials helps in reducing overall vehicle weight, thereby improving energy consumption and extending the driving range of electric vehicles. Adhesives formulated specifically for composites provide excellent bonding capabilities essential for structural components and body panels. Manufacturers like DuPont and H.B. Fuller have developed specialized adhesive solutions that cater to the unique challenges presented by composite materials, such as differing thermal expansion rates and surface preparation needs. These advancements in adhesive technology ensure that the bonds formed are not only robust but also withstand the stresses encountered in various operating conditions. As electric vehicle manufacturers increasingly focus on utilizing lightweight materials to meet performance goals and regulatory requirements, the demand for effective adhesive solutions for composite substrates is projected to continue growing, reinforcing the segment's leading position.

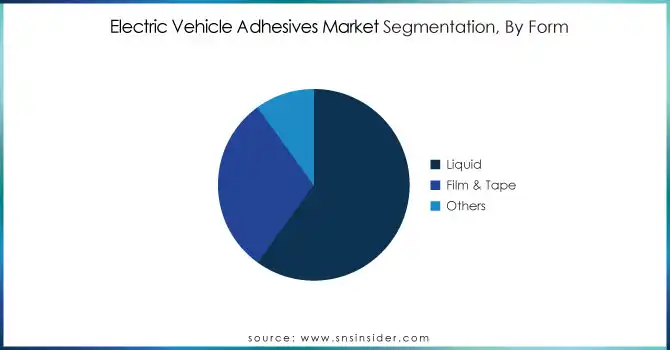

By Form

In 2023, the liquid form segment dominated the Electric Vehicle Adhesives Market, capturing a market share of 60%. Liquid adhesives are widely utilized across the automotive industry for their versatility and ease of application, making them an ideal choice for a variety of assembly processes. Their ability to penetrate and bond effectively with different substrates allows manufacturers to achieve strong and durable joints in electric vehicles. Brands like Sika and 3M have introduced liquid adhesive formulations that cater to the specific needs of electric vehicle assembly, including fast curing times, improved flow characteristics, and strong adhesion to various materials such as metals, plastics, and composites. Additionally, liquid adhesives often have lower application costs compared to other forms, such as films and tapes, making them more attractive to manufacturers looking to optimize production efficiency. As the electric vehicle market expands, the demand for liquid adhesives that meet stringent performance and environmental standards is expected to rise, further solidifying their position as the leading form of adhesive used in the industry.

By Application

In 2023, the powertrain system segment dominated the Electric Vehicle Adhesives Market, with a market share of 30%. Adhesives used in powertrain systems are crucial for ensuring the secure assembly of various components, including electric motors, battery systems, and drivetrains, where reliability and performance are paramount. The demand for high-performance adhesives that can withstand extreme temperatures and mechanical stress has led to innovations in adhesive formulations specifically designed for powertrain applications. Leading manufacturers such as Henkel and Lord Corporation have developed specialized adhesive solutions that address the unique challenges of bonding in powertrain systems, ensuring strong and durable connections that enhance the overall performance and safety of electric vehicles. These adhesives not only facilitate the assembly process but also contribute to the efficiency and longevity of the powertrain, making them a critical component in electric vehicle design. As the electric vehicle market continues to grow, the need for reliable adhesive solutions in powertrain systems is expected to increase, further reinforcing the significance of this application segment.

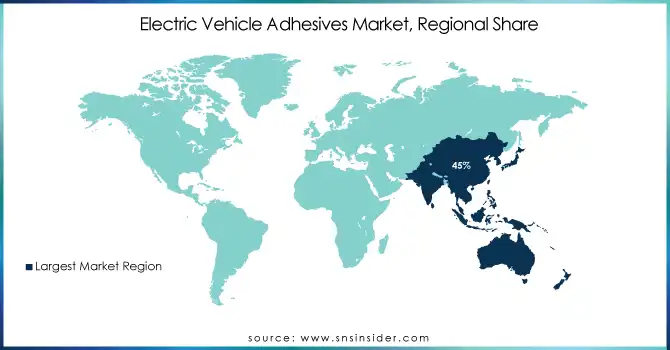

In 2023, Asia-Pacific dominated the Electric Vehicle Adhesives Market with a market share of 45%. The region’s dominance is primarily driven by the rapid growth of the electric vehicle (EV) industry, particularly in countries like China, Japan, and South Korea. China remains the largest market for electric vehicles, with EV sales surpassing 6.9 million units in 2022, representing over 50% of global EV sales. This surge in demand has significantly boosted the need for specialized adhesives used in battery systems, powertrain assembly, and vehicle body parts. Japan and South Korea also contribute heavily to the market due to the presence of major automotive manufacturers like Toyota, Honda, Hyundai, and Kia, who are increasingly adopting advanced adhesive solutions to enhance the performance and safety of their EVs. Additionally, key adhesive manufacturers such as Henkel, 3M, and Dow are focusing on expanding their production capacities in these countries to cater to the growing demand from the EV sector. The Asia-Pacific region’s strong foothold in electric vehicle manufacturing and its ability to innovate in adhesive technologies solidify its dominant position in the market.

Moreover, in 2023, Europe emerged as the fastest-growing region in the Electric Vehicle Adhesives Market, with a CAGR of 20%. The continent is experiencing a rapid transition to electric vehicles, driven by stringent government regulations and strong consumer demand for cleaner transportation solutions. Countries like Germany, France, and the United Kingdom are leading the shift, with EV sales in Germany reaching over 1 million units in 2022, a 15% increase compared to the previous year. This growth is supported by the European Union's aggressive environmental targets, which aim to have at least 30 million electric vehicles on the road by 2030. The demand for electric vehicles in Europe has consequently raised the need for high-performance adhesives, especially in powertrain systems, battery assembly, and body construction, where adhesive solutions are critical for ensuring safety, efficiency, and weight reduction. Major automotive players in the region, such as Volkswagen, BMW, and Renault, are also investing heavily in EV production and, in turn, increasing their reliance on advanced adhesives to meet the specific requirements of electric vehicles. The growing adoption of adhesive technologies by these manufacturers is expected to continue driving market growth in Europe, positioning the region as the fastest-growing in the global Electric Vehicle Adhesives Market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

3M (3M Scotch-Weld Epoxy Adhesive DP420, 3M DP8810NS Structural Adhesive)

Ashland Inc. (AquaPolymers, Hexion EPON Resin)

DAP Global Inc. (DAP 3.0 Sealant, DAP Premium Clear Sealant)

H.B. Fuller (FullerBond 2168, FullHPR 2101)

Henkel AG & Co. KGaA (Loctite EA 3472, Loctite 9460)

Illinois Tool Works Inc. (ITW Devcon 5 Minute Epoxy, ITW Plexus MA300)

Kingspan Group (Kingspan Tarec Adhesive, Kingspan SF100)

LOCTITE (part of Henkel AG & Co. KGaA) (Loctite 406, Loctite EA 3478)

Paroc Group (Paroc XPS Sealant, Paroc Firestop Systems)

Parker Hannifin Corporation (Parker LORD 201, Parker LORD 200)

Permabond (Permabond ET500, Permabond A136)

PPG Industries, Inc. (PPG Lamineer 8150, PPG ULTRA-STRIKE adhesive)

Sika AG (SikaPower 4720, Sikaflex-221)

Specialty Polymer Co. (SPC-SS-GD, SPC-HS-300)

Sherwin-Williams Company (Sherwin-Williams 3M Adhesives, Sherwin-Williams 10-300)

Texwipe (part of ITW) (Texwipe DuraClean Adhesive, Texwipe CleanSeal)

The Dow Chemical Company (Dowsil 732 Sealant, Dow Adhesive D-521)

Trelleborg AB (Trelleborg Engineering Adhesives, Trelleborg Sealing Solutions)

Wacker Chemie AG (Wacker Elastosil, Wacker SilGel)

Weicon GmbH & Co. KG (Weicon Sealant, Weicon Bond 300)

Automotive OEMs (Original Equipment Manufacturers)

Sealant and Coating Providers

Automotive Aftermarket Suppliers

Recent Developments

May 2024: H.B. Fuller expanded its specialty solutions portfolio by acquiring ND Industries, strengthening its position as a leader in adhesives. ND Industries brought expertise in fastener locking and sealing solutions for automotive, electronics, and aerospace applications.

September 2023: H.B. Fuller showcased its innovative packaging solutions at PACK EXPO Las Vegas, focusing on efficiency and sustainability. The event highlighted its technology platform designed to support sustainable and streamlined packaging for brands and manufacturers.

February 2024: Henkel established its first innovation and technology center in Latin America, located in Jundiaí, São Paulo. The center aimed to drive collaboration, develop advanced adhesive solutions, and serve as a hub for training and customer interaction in the region.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.93 Billion |

| Market Size by 2032 | US$ 38.11 Billion |

| CAGR | CAGR of 39.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Resin Type (Epoxy, Polyurethane, Silicone, Acrylic, Others) •By Vehicle Type (Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV)) •By Substrate (Plastic, Composite, Metals, Others) •By Form (Liquid, Film & Tape, Others) •By Application (Powertrain System, Optical Element, Sensors & Communication, Body Frame, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, Illinois Tool Works Inc., H.B. Fuller, Parker Hannifin Corporation, Sika AG, 3M, Ashland Inc., Wacker Chemie AG, Kingspan Group, Permabond, Paroc Group, DAP Global Inc., PPG Industries, Inc. and other key players |

| Key Drivers | •Increasing Consumer Demand for Electric Vehicles Accelerates the Growth of Adhesives in Automotive Applications •Stringent Regulations Promoting Lightweight Materials Propel the Demand for Advanced Adhesives in EV Manufacturing |

| Restraints | •High Costs of Advanced Adhesive Solutions Pose Challenges to Widespread Adoption in EV Manufacturing |

Ans: The Electric Vehicle Adhesives Market is expected to grow at a CAGR of 39.3%

Ans: The Electric Vehicle Adhesives Market Size was valued at USD 1.93 billion in 2023 and is expected to reach USD 38.11 billion by 2032

Ans: The growing emphasis on sustainability, expansion of EV infrastructure, and rising demand for custom adhesive solutions are driving market growth in the Electric Vehicle Adhesives sector.

Ans: The adoption of adhesive applications in emerging EV markets is constrained by a lack of awareness and expertise, leading to a continued reliance on traditional bonding methods and insufficient technical proficiency.

Ans: Asia-Pacific dominated the Electric Vehicle Adhesives Market with a 45% share, driven by the rapid growth of the EV industry in China, Japan, and South Korea, and supported by major manufacturers expanding production to meet the rising demand for specialized adhesives.

Table of Contents:

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production and Sales Volumes, 2020-2032, by Region

5.2 Resin Type Adoption Rates, by Region

5.3 Innovation and R&D Spending, by Region

5.4 Regulatory Impact, by Region

5.5 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Electric Vehicle Adhesives Market Segmentation, By Resin Type

7.1 Chapter Overview

7.2 Epoxy

7.2.1 Epoxy Market Trends Analysis (2020-2032)

7.2.2 Epoxy Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Polyurethane

7.3.1 Polyurethane Market Trends Analysis (2020-2032)

7.3.2 Polyurethane Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Silicone

7.4.1 Silicone Market Trends Analysis (2020-2032)

7.4.2 Silicone Market Size Estimates and Forecasts to 2032 (USD Billion)

7.5 Acrylic

7.5.1 Acrylic Market Trends Analysis (2020-2032)

7.5.2 Acrylic Market Size Estimates and Forecasts to 2032 (USD Billion)

7.6 Acrylic

7.6.1 Acrylic Market Trends Analysis (2020-2032)

7.6.2 Acrylic Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Electric Vehicle Adhesives Market Segmentation, By Vehicle Type

8.1 Chapter Overview

8.2 Battery Electric Vehicle (BEV)

8.2.1 Battery Electric Vehicle (BEV) Market Trends Analysis (2020-2032)

8.2.2 Battery Electric Vehicle (BEV) Market Size Estimates And Forecasts To 2032 (USD Billion)

8.3 Plug-in Hybrid Electric Vehicle (PHEV)

8.3.1 Plug-in Hybrid Electric Vehicle (PHEV) Market Trends Analysis (2020-2032)

8.3.2 Plug-in Hybrid Electric Vehicle (PHEV) Market Size Estimates And Forecasts To 2032 (USD Billion)

8.4 Hybrid Electric Vehicle (HEV)

8.4.1 Hybrid Electric Vehicle (HEV) Market Trends Analysis (2020-2032)

8.4.2 Hybrid Electric Vehicle (HEV) Market Size Estimates And Forecasts To 2032 (USD Billion)

9. Electric Vehicle Adhesives Market Segmentation, By Substrate

9.1 Chapter Overview

9.2 Plastic

9.2.1 Plastic Market Trends Analysis (2020-2032)

9.2.2 Plastic Market Size Estimates And Forecasts To 2032 (USD Billion)

9.3 Composite

9.3.1 Composite Market Trends Analysis (2020-2032)

9.3.2 Composite Market Size Estimates And Forecasts To 2032 (USD Billion)

9.4 Metals

9.4.1 Metals Market Trends Analysis (2020-2032)

9.4.2 Metals Market Size Estimates And Forecasts To 2032 (USD Billion)

9.5 Others

9.5.1 Others Market Trends Analysis (2020-2032)

9.5.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

10. Electric Vehicle Adhesives Market Segmentation, By Form

10.1 Chapter Overview

10.2 Liquid

10.2.1 Liquid Market Trends Analysis (2020-2032)

10.2.2 Liquid Market Size Estimates And Forecasts To 2032 (USD Billion)

10.3 Film & Tape

10.3.1 Film & Tape Market Trends Analysis (2020-2032)

10.3.2 Film & Tape Market Size Estimates And Forecasts To 2032 (USD Billion)

10.4 Others

10.4.1 Others Market Trends Analysis (2020-2032)

10.4.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

11. Electric Vehicle Adhesives Market Segmentation, By Application

11.1 Chapter Overview

11.2 Powertrain System

11.2.1 Powertrain System Market Trends Analysis (2020-2032)

11.2.2 Powertrain System Market Size Estimates And Forecasts To 2032 (USD Billion)

11.3 Optical Element

11.3.1 Optical Element Market Trends Analysis (2020-2032)

11.3.2 Optical Element Market Size Estimates And Forecasts To 2032 (USD Billion)

11.4 Sensors & Communication

11.4.1 Sensors & Communication Market Trends Analysis (2020-2032)

11.4.2 Sensors & Communication Market Size Estimates And Forecasts To 2032 (USD Billion)

11.5 Body Frame

11.5.1 Body Frame Market Trends Analysis (2020-2032)

11.5.2 Body Frame Market Size Estimates And Forecasts To 2032 (USD Billion)

11.6 Others

11.6.1 Others Market Trends Analysis (2020-2032)

11.6.2 Others Market Size Estimates And Forecasts To 2032 (USD Billion)

12. Regional Analysis

12.1 Chapter Overview

12.2 North America

12.2.1 Trends Analysis

12.2.2 North America Electric Vehicle Adhesives Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.2.3 North America Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.2.4 North America Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.5 North America Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.2.6 North America Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.2.7 North America Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.8 USA

12.2.8.1 USA Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.2.8.2 USA Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.8.3 USA Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.2.8.4 USA Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.2.8.5 USA Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.9 Canada

12.2.9.1 Canada Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.2.9.2 Canada Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.9.3 Canada Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.2.9.4 Canada Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.2.9.5 Canada Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.2.10 Mexico

12.2.10.1 Mexico Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.2.10.2 Mexico Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.2.10.3 Mexico Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.2.10.4 Mexico Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.2.10.5 Mexico Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3 Europe

12.3.1 Eastern Europe

12.3.1.1 Trends Analysis

12.3.1.2 Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.1.3 Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.1.4 Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.5 Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.1.6 Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.1.7 Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.8 Poland

12.3.1.8.1 Poland Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.1.8.2 Poland Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.8.3 Poland Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.1.8.4 Poland Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.1.8.5 Poland Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.9 Romania

12.3.1.9.1 Romania Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.1.9.2 Romania Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.9.3 Romania Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.1.9.4 Romania Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.1.9.5 Romania Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.10 Hungary

12.3.1.10.1 Hungary Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.1.10.2 Hungary Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.10.3 Hungary Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.1.10.4 Hungary Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.1.10.5 Hungary Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.11 Turkey

12.3.1.11.1 Turkey Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.1.11.2 Turkey Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.11.3 Turkey Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.1.11.4 Turkey Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.1.11.5 Turkey Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.1.12 Rest Of Eastern Europe

12.3.1.12.1 Rest Of Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.1.12.2 Rest Of Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.1.12.3 Rest Of Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.1.12.4 Rest Of Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.1.12.5 Rest Of Eastern Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2 Western Europe

12.3.2.1 Trends Analysis

12.3.2.2 Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.3.2.3 Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.2.4 Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.5 Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.2.6 Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.2.7 Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.8 Germany

12.3.2.8.1 Germany Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.2.8.2 Germany Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.3 Germany Electric Vehicle Adhesives Market Estimates And Forecasts, By Material Vehicle Vehicle Type (2020-2032) (USD Billion)

12.3.2.8.4 Germany Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.2.8.5 Germany Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.9 France

12.3.2.9.1 France Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.2.9.2 France Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.9.3 France Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.2.9.4 France Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.2.9.5 France Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.10 UK

12.3.2.10.1 UK Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.2.10.2 UK Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.10.3 UK Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.2.10.4 UK Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.2.10.5 UK Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.11 Italy

12.3.2.11.1 Italy Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.2.11.2 Italy Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.11.3 Italy Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.2.11.4 Italy Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.2.11.5 Italy Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.12 Spain

12.3.2.12.1 Spain Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.2.12.2 Spain Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.12.3 Spain Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.2.12.4 Spain Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.2.12.5 Spain Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.13 Netherlands

12.3.2.13.1 Netherlands Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.2.13.2 Netherlands Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.13.3 Netherlands Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.2.13.4 Netherlands Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.2.13.5 Netherlands Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.14 Switzerland

12.3.2.14.1 Switzerland Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.2.14.2 Switzerland Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.14.3 Switzerland Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.2.14.4 Switzerland Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.2.12.5 Switzerland Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.15 Austria

12.3.2.15.1 Austria Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.2.15.2 Austria Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.15.3 Austria Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.2.15.4 Austria Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.2.15.5 Austria Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.3.2.16 Rest Of Western Europe

12.3.2.16.1 Rest Of Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.3.2.16.2 Rest Of Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.3.2.16.3 Rest Of Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.3.2.16.4 Rest Of Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.3.2.16.5 Rest Of Western Europe Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4 Asia Pacific

12.4.1 Trends Analysis

12.4.2 Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.4.3 Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.4.4 Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.5 Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.4.6 Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.4.7 Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.8 China

12.4.8.1 China Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.4.8.2 China Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.8.3 China Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.4.8.4 China Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.4.8.5 China Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.9 India

12.4.9.1 India Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.4.9.2 India Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.9.3 India Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.4.9.4 India Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.4.9.5 India Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.10 Japan

12.4.10.1 Japan Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.4.10.2 Japan Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.10.3 Japan Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.4.10.4 Japan Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.4.10.5 Japan Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.11 South Korea

12.4.11.1 South Korea Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.4.11.2 South Korea Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.11.3 South Korea Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.4.11.4 South Korea Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.4.11.5 South Korea Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.12 Vietnam

12.4.12.1 Vietnam Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.4.12.2 Vietnam Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.12.3 Vietnam Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.4.12.4 Vietnam Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.4.12.5 Vietnam Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.13 Singapore

12.4.13.1 Singapore Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.4.13.2 Singapore Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.13.3 Singapore Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.4.13.4 Singapore Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.4.13.5 Singapore Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.14 Australia

12.4.14.1 Australia Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.4.14.2 Australia Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.14.3 Australia Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.4.14.4 Australia Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.4.14.5 Australia Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.4.15 Rest Of Asia Pacific

12.4.15.1 Rest Of Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.4.15.2 Rest Of Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.4.15.3 Rest Of Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.4.15.4 Rest Of Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.4.15.5 Rest Of Asia Pacific Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5 Middle East And Africa

12.5.1 Middle East

12.5.1.1 Trends Analysis

12.5.1.2 Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.1.3 Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.5.1.4 Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.1.5 Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.5.1.6 Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.1.7 Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.8 UAE

12.5.1.8.1 UAE Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.5.1.8.2 UAE Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.1.8.3 UAE Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.5.1.8.4 UAE Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.1.8.5 UAE Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.9 Egypt

12.5.1.9.1 Egypt Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.5.1.9.2 Egypt Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.9.3 Egypt Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.5.1.9.4 Egypt Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.1.9.5 Egypt Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.10 Saudi Arabia

12.5.1.10.1 Saudi Arabia Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.5.1.10.2 Saudi Arabia Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.10.3 Saudi Arabia Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.5.1.10.4 Saudi Arabia Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.1.10.5 Saudi Arabia Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.11 Qatar

12.5.1.11.1 Qatar Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.5.1.11.2 Qatar Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.11.3 Qatar Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.5.1.11.4 Qatar Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.1.11.5 Qatar Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.1.12 Rest Of Middle East

12.5.1.12.1 Rest Of Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.5.1.12.2 Rest Of Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.1.12.3 Rest Of Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.5.1.12.4 Rest Of Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.1.12.5 Rest Of Middle East Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2 Africa

12.5.2.1 Trends Analysis

12.5.2.2 Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.5.2.3 Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.5.2.4 Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.5 Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.5.2.6 Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.2.7 Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.8 South Africa

12.5.2.8.1 South Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.5.2.8.2 South Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.8.3 South Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.5.2.8.4 South Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.2.8.5 South Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.9 Nigeria

12.5.2.9.1 Nigeria Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.5.2.9.2 Nigeria Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.9.3 Nigeria Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.5.2.9.4 Nigeria Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.2.9.5 Nigeria Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.5.2.10 Rest Of Africa

12.5.2.10.1 Rest Of Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.5.2.10.2 Rest Of Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.5.2.10.3 Rest Of Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.5.2.10.4 Rest Of Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.5.2.10.5 Rest Of Africa Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6 Latin America

12.6.1 Trends Analysis

12.6.2 Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Country (2020-2032) (USD Billion)

12.6.3 Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.6.4 Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.5 Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.6.6 Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.6.7 Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.8 Brazil

12.6.8.1 Brazil Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.6.8.2 Brazil Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.8.3 Brazil Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.6.8.4 Brazil Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.6.8.5 Brazil Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.9 Argentina

12.6.9.1 Argentina Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.6.9.2 Argentina Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.9.3 Argentina Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.6.9.4 Argentina Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.6.9.5 Argentina Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.10 Colombia

12.6.10.1 Colombia Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.6.10.2 Colombia Electric Vehicle Adhesives Market Estimates And Forecasts, By Vehicle Type (2020-2032) (USD Billion)

12.6.10.3 Colombia Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.6.10.4 Colombia Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.6.10.5 Colombia Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

12.6.11 Rest Of Latin America

12.6.11.1 Rest Of Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Resin Type (2020-2032) (USD Billion)

12.6.11.2 Rest Of Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.6.11.3 Rest Of Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Substrate (2020-2032) (USD Billion)

12.6.11.4 Rest Of Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Form (2020-2032) (USD Billion)

12.6.11.5 Rest Of Latin America Electric Vehicle Adhesives Market Estimates And Forecasts, By Application (2020-2032) (USD Billion)

13. Company Profiles

13.1 Henkel AG & Co. KGaA

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.2 Illinois Tool Works Inc.

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.3 H.B. Fuller

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.4 Parker Hannifin Corporation

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.5 Sika AG

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.6 3M

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.7 Ashland Inc.

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.8 Wacker Chemie AG

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.9 Kingspan Group

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.10 Permabond

13.12.1 Company Overview

13.12.2 Financial

13.12.3 Products/ Services Offered

13.12.4 SWOT Analysis

14. Use Cases and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Resin Type

Epoxy

Polyurethane

Silicone

Acrylic

Others

By Vehicle Type

Battery Electric Vehicle (BEV)

Plug-in Hybrid Electric Vehicle (PHEV)

Hybrid Electric Vehicle (HEV)

By Substrate

Plastic

Composite

Metals

Others

By Form

Liquid

Film & Tape

Others

By Application

Powertrain System

Optical Element

Sensors & Communication

Body Frame

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The 2-Ethyl-3,4-ethylenedioxythiophene Market size was USD 20.55 million in 2023 and is expected to reach USD 29.25 million by 2032 and grow at a CAGR of 4.00% over the forecast period of 2024-2032.

Laminating Adhesives Market Size was valued at USD 3.54 Billion in 2023 and is expected to reach USD 5.80 Billion by 2032 and grow at a CAGR of 5.64% over the forecast period 2024-2032.

The Pentanediamine Market Size was valued at USD 1,176.1 Million in 2023 and is expected to reach USD 19,725.5 Million by 2032, growing at a CAGR of 36.8% over the forecast period of 2024-2032.

Hollow Fiber Membranes Market was valued at USD 2.46 billion in 2023 and is expected to reach USD 8.52 billion by 2032, at a CAGR of 14.85% from 2024-2032.

The Malonic Acid Market size was valued at USD 111.42 Million in 2023 and is expected to reach USD 142.95 Million by 2032, growing at a CAGR of 2.81% over the forecast period of 2024-2032.

The Bioinsecticides Market Size was valued at USD 99.4 million in 2023, and is expected to reach USD 258.3 million by 2032, and grow at a CAGR of 11.2% over the forecast period 2024-2032.

Hi! Click one of our member below to chat on Phone