Electric Motorcycles Market Report Scope & Overview

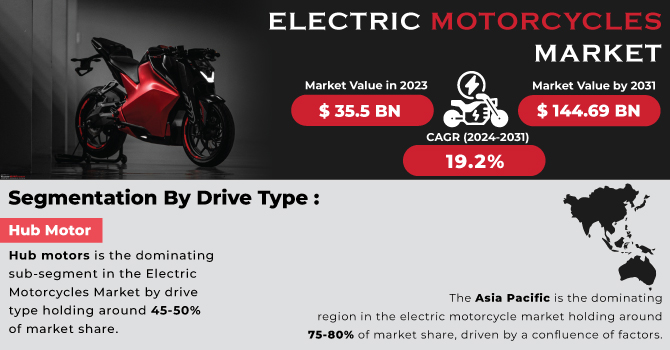

The Electric Motorcycles Market Size was valued at USD 35.5 billion in 2023 and is expected to reach USD 144.69 billion by 2031 and grow at a CAGR of 19.2% over the forecast period 2024-2031.

Environmental concerns are driving the electric motorcycle growth. The consumers are increasingly seeking energy-efficient ways to commute, and they're concerned about the environmental impact of traditional gasoline-powered motorcycles. Rising fuel prices and concerns over fossil fuel reserves further push the market towards electric options. The established motorcycle manufacturers are entering the electric space, while new startups are offering technologically advanced electric motorcycles.

Get More Information on Electric Motorcycles Market - Request Sample Report

The development of charging infrastructure is crucial for electric motorcycle adoption. Fortunately, companies are investing in creating networks of charging stations. Additionally, battery costs are decreasing, and battery management technology is improving, making electric motorcycles more affordable and practical. Manufacturers are incorporating telematics, cellular connectivity, and improved aerodynamics into their designs, creating exciting new possibilities. This shift towards electric vehicles not only reduces reliance on fossil fuels but also helps for developing production facilities that utilize abundant nickel resources for battery production.

MARKET DYNAMICS:

KEY DRIVERS:

Rising fuel costs and supply concerns are driving the electric motorcycle market. With traditional fuel prices fluctuating and inflation on the rise, consumers are seeking cost-effective and efficient transportation options. Electric motorcycles offer a solution, eliminating fuel dependency and providing comparable performance with the benefit of charging at home or on the go. As environmental awareness grows, the demand for electric alternatives to gasoline-powered vehicles, including motorcycles, is increasing.

RESTRAINTS:

The high cost of electric motorcycles is a major problem for the industry's growth. Compared to their fuel-powered counterparts, electric motorcycles remain a less affordable option. Additionally, a lack of skilled technicians poses a technical challenge. Traditional motorcycles have a vast network of mechanics, but the repair infrastructure for electric motorcycles is limited. This scarcity of qualified repair personnel discourages potential buyers, hindering wider adoption.

OPPORTUNITIES:

CHALLENGES:

IMPACT OF RUSSIA-UKRAINE WAR

The ongoing conflict between Russia and Ukraine has disrupted the electric motorcycle market in several ways. The sanctions imposed on Russia have restricted trade, impacting access to crucial raw materials like lithium and nickel, essential for battery production. This shortage could lead to price hikes of around 10-15% for electric motorcycle batteries, a key component affecting overall vehicle cost. The war has diverted resources away from research and development in the electric vehicle sector. This slowdown could hinder advancements in battery technology, a crucial factor for addressing range anxiety among potential customers. The war has disrupted global supply chains, causing delays in the shipment of components and finished electric motorcycles. This could lead to production slowdowns and potential stock shortages in certain regions, impacting overall sales figures. These disruptions come at a time when the electric motorcycle market was experiencing significant growth. Thus, the war in Russia-Ukraine has undoubtedly caused the uncertainty, potentially causing a temporary setback in the industry's momentum.

IMPACT OF ECONOMIC SLOWDOWN

The economic downturns disrupts the electric motorcycle market. During a slowdown, consumer spending weakens, potentially leading to a 15-20% decline in sales. This can be attributed to several factors. The electric motorcycles currently carry a higher price tag compared to traditional gasoline models. In times of economic hardship, budget-conscious consumers might prioritize affordability over environmental benefits. The economic slowdowns can lead to job losses and reduced disposable income, further limiting discretionary spending on non-essential purchases like electric motorcycles. The businesses, a significant segment of the electric motorcycle market for delivery fleets, might delay fleet upgrades due to tighter budgets. Thus, as fuel prices typically rise during economic recoveries, consumers might revisit electric motorcycles as a cost-effective alternative in the long run, leading to a potential market rebound after the slowdown.

KEY MARKET SEGMENTS:

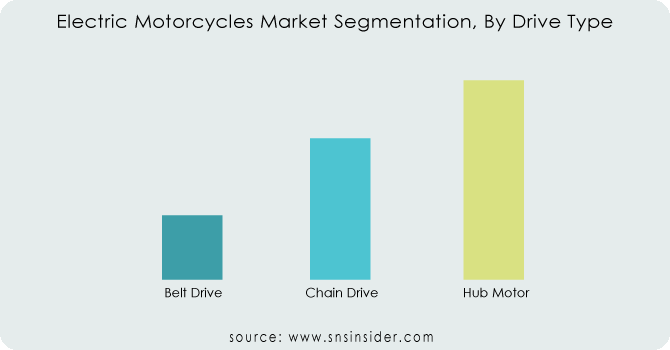

By Drive Type

Hub motors is the dominating sub-segment in the Electric Motorcycles Market by drive type holding around 45-50% of market share. Their ease of installation, strong performance, and affordability make them a favourite for manufacturers. Advantages like high torque, improved handling, and extended range further fuel segment growth. Hub motors' efficiency, compact size, and reduced maintenance needs are making them increasingly popular, leading to a quieter and more enjoyable riding experience.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Battery Type

Lithium-ion (Li-ion) Batteries is the dominating sub-segment in the Electric Motorcycles Market by battery type holding around 80-90% of market share. Li-ion batteries offer superior performance compared to other options. They have a higher energy density, longer lifespan, and faster charging times. While initially more expensive, their advantages outweigh the cost for most manufacturers and consumers.

By End-Use

Personal Use is the dominating sub-segment in the Electric Motorcycles Market by end-use holding around 65-70% of market share. This is driven by factors like increasing environmental consciousness, lower running costs compared to gasoline motorcycles, and government incentives for electric vehicles. However, the commercial segment is expected to grow significantly in the coming years due to the economic benefits electric motorcycles offer for delivery fleets and other commercial applications.

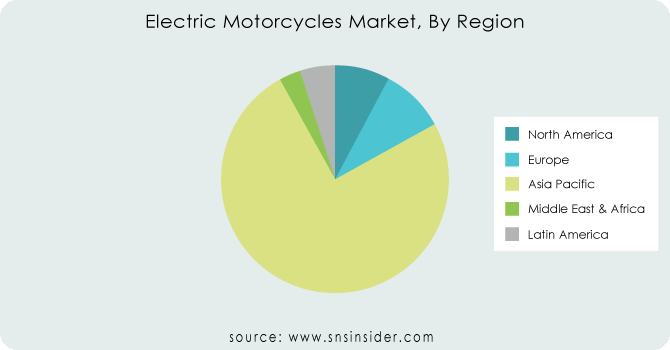

REGIONAL ANALYSES

The Asia Pacific is the dominating region in the electric motorcycle market holding around 75-80% of market share, driven by a confluence of factors. Government incentives and a robust manufacturing base make electric motorcycles more accessible. Additionally, high fuel costs and the dominance of scooters, ideal for electric technology, fuel growth.

Europe is the second highest region in this market, backed by existing electric vehicle infrastructure and stricter emission regulations. However, higher upfront costs and a strong gasoline motorcycle market hinder faster growth.

North America is the fastest growing region in this market. Major investments by manufacturers, rising consumer interest in eco-friendly options, and a focus on high-performance electric motorcycles are propelling this rapid growth.

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

The major key players are Harley Davidson, Lito Motorcycles, Essence Motorcycles, Tacita, Alta Motors, Yadea, Lima, Tailg, Wuyang Honda, Supaq and other key players.

In Jan. 2024: Cleveland's electric motorcycle startup, Land Moto, seeks to elevate its battery tech with a fresh $3 million funding boost, adding to their previous $7 million. Their focus: the head-turning District e-moto, blurring the lines between e-bikes and motorcycles.

In Feb. 2024: Hero MotoCorp and Zero Motorcycles are teaming up to create a new electric motorcycle platform with four models planned. Zero, known for lightweight electric bikes, will bring its expertise to the collaboration. The first motorcycles are expected in 2025.

| Report Attributes | Details |

| Market Size in 2023 | US$ 35.5 Billion |

| Market Size by 2031 | US$ 144.69 Billion |

| CAGR | CAGR of 19.2 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Range (75 Miles, 75-100 Miles, More Than 100 Miles) • By Battery Type (Lead Acid, Lithium-Ion Acid, Nickel metal hydride) • By Voltage Type (Below 24, 24-48, 48-60, Above 60 |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Harley Davidson, Lito Motorcycles, Essence Motorcycles, Tacita, Alta Motors, Yadea, Lima, Tailg, Wuyang Honda, Supaq |

| Key Drivers | • The rise in adoption and the rising sales of electric motorcycles. |

| Market Opportunity | • The government initiatives for climate control. |

Ans: The electric motorcycles market Size was valued at USD 35.5 billion in 2023 and is expected to reach USD 144.69 billion by 2031.

Ans: The estimated CAGR of the market for the forecast period is 19.2%.

Ans: Drive Type, Battery Type, End-Use Type are the three major segments analysed by SNS Insider.

Ans: APAC region will be dominating the market over the forecast period.

Ans: Rising fuel costs, supply uncertainty, and environmental concerns drive electric motorcycle market growth.

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Electric Motorcycles Market Segmentation, By Drive Type

9.1 Introduction

9.2 Trend Analysis

9.3 Belt Drive

9.4 Chain Drive

9.5 Hub Motor

10. Electric Motorcycles Market Segmentation, By Battery Type

10.1 Introduction

10.2 Trend Analysis

10.3 Lithium-ion

10.4 Lead Acid

10.5 Others

11. Electric Motorcycles Market Segmentation, By End-Use

11.1 Introduction

11.2 Trend Analysis

11.3 Personal

11.4 Commercial

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Electric Motorcycles Market, By Country

12.2.3 North America Electric Motorcycles Market Segmentation, By Drive Type

12.2.4 North America Electric Motorcycles Market Segmentation, By Battery Type

12.2.5 North America Electric Motorcycles Market Segmentation, By End-Use

12.2.6 USA

12.2.6.1 USA Electric Motorcycles Market Segmentation, By Drive Type

12.2.6.2 USA Electric Motorcycles Market Segmentation, By Battery Type

12.2.6.3 USA Electric Motorcycles Market Segmentation, By End-Use

12.2.7 Canada

12.2.7.1 Canada Electric Motorcycles Market Segmentation, By Drive Type

12.2.7.2 Canada Electric Motorcycles Market Segmentation, By Battery Type

12.2.7.3 Canada Electric Motorcycles Market Segmentation, By End-Use

12.2.8 Mexico

12.2.8.1 Mexico Electric Motorcycles Market Segmentation, By Drive Type

12.2.8.2 Mexico Electric Motorcycles Market Segmentation, By Battery Type

12.2.8.3 Mexico Electric Motorcycles Market Segmentation, By End-Use

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Electric Motorcycles Market, By Country

12.3.2.2 Eastern Europe Electric Motorcycles Market Segmentation, By Drive Type

12.3.2.3 Eastern Europe Electric Motorcycles Market Segmentation, By Battery Type

12.3.2.4 Eastern Europe Electric Motorcycles Market Segmentation, By End-Use

12.3.2.5 Poland

12.3.2.5.1 Poland Electric Motorcycles Market Segmentation, By Drive Type

12.3.2.5.2 Poland Electric Motorcycles Market Segmentation, By Battery Type

12.3.2.5.3 Poland Electric Motorcycles Market Segmentation, By End-Use

12.3.2.6 Romania

12.3.2.6.1 Romania Electric Motorcycles Market Segmentation, By Drive Type

12.3.2.6.2 Romania Electric Motorcycles Market Segmentation, By Battery Type

12.3.2.6.4 Romania Electric Motorcycles Market Segmentation, By End-Use

12.3.2.7 Hungary

12.3.2.7.1 Hungary Electric Motorcycles Market Segmentation, By Drive Type

12.3.2.7.2 Hungary Electric Motorcycles Market Segmentation, By Battery Type

12.3.2.7.3 Hungary Electric Motorcycles Market Segmentation, By End-Use

12.3.2.8 Turkey

12.3.2.8.1 Turkey Electric Motorcycles Market Segmentation, By Drive Type

12.3.2.8.2 Turkey Electric Motorcycles Market Segmentation, By Battery Type

12.3.2.8.3 Turkey Electric Motorcycles Market Segmentation, By End-Use

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Electric Motorcycles Market Segmentation, By Drive Type

12.3.2.9.2 Rest of Eastern Europe Electric Motorcycles Market Segmentation, By Battery Type

12.3.2.9.3 Rest of Eastern Europe Electric Motorcycles Market Segmentation, By End-Use

12.3.3 Western Europe

12.3.3.1 Western Europe Electric Motorcycles Market, By Country

12.3.3.2 Western Europe Electric Motorcycles Market Segmentation, By Drive Type

12.3.3.3 Western Europe Electric Motorcycles Market Segmentation, By Battery Type

12.3.3.4 Western Europe Electric Motorcycles Market Segmentation, By End-Use

12.3.3.5 Germany

12.3.3.5.1 Germany Electric Motorcycles Market Segmentation, By Drive Type

12.3.3.5.2 Germany Electric Motorcycles Market Segmentation, By Battery Type

12.3.3.5.3 Germany Electric Motorcycles Market Segmentation, By End-Use

12.3.3.6 France

12.3.3.6.1 France Electric Motorcycles Market Segmentation, By Drive Type

12.3.3.6.2 France Electric Motorcycles Market Segmentation, By Battery Type

12.3.3.6.3 France Electric Motorcycles Market Segmentation, By End-Use

12.3.3.7 UK

12.3.3.7.1 UK Electric Motorcycles Market Segmentation, By Drive Type

12.3.3.7.2 UK Electric Motorcycles Market Segmentation, By Battery Type

12.3.3.7.3 UK Electric Motorcycles Market Segmentation, By End-Use

12.3.3.8 Italy

12.3.3.8.1 Italy Electric Motorcycles Market Segmentation, By Drive Type

12.3.3.8.2 Italy Electric Motorcycles Market Segmentation, By Battery Type

12.3.3.8.3 Italy Electric Motorcycles Market Segmentation, By End-Use

12.3.3.9 Spain

12.3.3.9.1 Spain Electric Motorcycles Market Segmentation, By Drive Type

12.3.3.9.2 Spain Electric Motorcycles Market Segmentation, By Battery Type

12.3.3.9.3 Spain Electric Motorcycles Market Segmentation, By End-Use

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Electric Motorcycles Market Segmentation, By Drive Type

12.3.3.10.2 Netherlands Electric Motorcycles Market Segmentation, By Battery Type

12.3.3.10.3 Netherlands Electric Motorcycles Market Segmentation, By End-Use

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Electric Motorcycles Market Segmentation, By Drive Type

12.3.3.11.2 Switzerland Electric Motorcycles Market Segmentation, By Battery Type

12.3.3.11.3 Switzerland Electric Motorcycles Market Segmentation, By End-Use

12.3.3.1.12 Austria

12.3.3.12.1 Austria Electric Motorcycles Market Segmentation, By Drive Type

12.3.3.12.2 Austria Electric Motorcycles Market Segmentation, By Battery Type

12.3.3.12.3 Austria Electric Motorcycles Market Segmentation, By End-Use

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Electric Motorcycles Market Segmentation, By Drive Type

12.3.3.13.2 Rest of Western Europe Electric Motorcycles Market Segmentation, By Battery Type

12.3.3.13.3 Rest of Western Europe Electric Motorcycles Market Segmentation, By End-Use

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Electric Motorcycles Market, By Country

12.4.3 Asia-Pacific Electric Motorcycles Market Segmentation, By Drive Type

12.4.4 Asia-Pacific Electric Motorcycles Market Segmentation, By Battery Type

12.4.5 Asia-Pacific Electric Motorcycles Market Segmentation, By End-Use

12.4.6 China

12.4.6.1 China Electric Motorcycles Market Segmentation, By Drive Type

12.4.6.2 China Electric Motorcycles Market Segmentation, By Battery Type

12.4.6.3 China Electric Motorcycles Market Segmentation, By End-Use

12.4.7 India

12.4.7.1 India Electric Motorcycles Market Segmentation, By Drive Type

12.4.7.2 India Electric Motorcycles Market Segmentation, By Battery Type

12.4.7.3 India Electric Motorcycles Market Segmentation, By End-Use

12.4.8 Japan

12.4.8.1 Japan Electric Motorcycles Market Segmentation, By Drive Type

12.4.8.2 Japan Electric Motorcycles Market Segmentation, By Battery Type

12.4.8.3 Japan Electric Motorcycles Market Segmentation, By End-Use

12.4.9 South Korea

12.4.9.1 South Korea Electric Motorcycles Market Segmentation, By Drive Type

12.4.9.2 South Korea Electric Motorcycles Market Segmentation, By Battery Type

12.4.9.3 South Korea Electric Motorcycles Market Segmentation, By End-Use

12.4.10 Vietnam

12.4.10.1 Vietnam Electric Motorcycles Market Segmentation, By Drive Type

12.4.10.2 Vietnam Electric Motorcycles Market Segmentation, By Battery Type

12.4.10.3 Vietnam Electric Motorcycles Market Segmentation, By End-Use

12.4.11 Singapore

12.4.11.1 Singapore Electric Motorcycles Market Segmentation, By Drive Type

12.4.11.2 Singapore Electric Motorcycles Market Segmentation, By Battery Type

12.4.11.3 Singapore Electric Motorcycles Market Segmentation, By End-Use

12.4.12 Australia

12.4.12.1 Australia Electric Motorcycles Market Segmentation, By Drive Type

12.4.12.2 Australia Electric Motorcycles Market Segmentation, By Battery Type

12.4.12.3 Australia Electric Motorcycles Market Segmentation, By End-Use

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Electric Motorcycles Market Segmentation, By Drive Type

12.4.13.2 Rest of Asia-Pacific Electric Motorcycles Market Segmentation, By Battery Type

12.4.13.3 Rest of Asia-Pacific Electric Motorcycles Market Segmentation, By End-Use

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Electric Motorcycles Market, By Country

12.5.2.2 Middle East Electric Motorcycles Market Segmentation, By Drive Type

12.5.2.3 Middle East Electric Motorcycles Market Segmentation, By Battery Type

12.5.2.4 Middle East Electric Motorcycles Market Segmentation, By End-Use

12.5.2.5 UAE

12.5.2.5.1 UAE Electric Motorcycles Market Segmentation, By Drive Type

12.5.2.5.2 UAE Electric Motorcycles Market Segmentation, By Battery Type

12.5.2.5.3 UAE Electric Motorcycles Market Segmentation, By End-Use

12.5.2.6 Egypt

12.5.2.6.1 Egypt Electric Motorcycles Market Segmentation, By Drive Type

12.5.2.6.2 Egypt Electric Motorcycles Market Segmentation, By Battery Type

12.5.2.6.3 Egypt Electric Motorcycles Market Segmentation, By End-Use

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Electric Motorcycles Market Segmentation, By Drive Type

12.5.2.7.2 Saudi Arabia Electric Motorcycles Market Segmentation, By Battery Type

12.5.2.7.3 Saudi Arabia Electric Motorcycles Market Segmentation, By End-Use

12.5.2.8 Qatar

12.5.2.8.1 Qatar Electric Motorcycles Market Segmentation, By Drive Type

12.5.2.8.2 Qatar Electric Motorcycles Market Segmentation, By Battery Type

12.5.2.8.3 Qatar Electric Motorcycles Market Segmentation, By End-Use

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Electric Motorcycles Market Segmentation, By Drive Type

12.5.2.9.2 Rest of Middle East Electric Motorcycles Market Segmentation, By Battery Type

12.5.2.9.3 Rest of Middle East Electric Motorcycles Market Segmentation, By End-Use

12.5.3 Africa

12.5.3.1 Africa Electric Motorcycles Market, By Country

12.5.3.2 Africa Electric Motorcycles Market Segmentation, By Drive Type

12.5.3.3 Africa Electric Motorcycles Market Segmentation, By Battery Type

12.5.3.4 Africa Electric Motorcycles Market Segmentation, By End-Use

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Electric Motorcycles Market Segmentation, By Drive Type

12.5.3.5.2 Nigeria Electric Motorcycles Market Segmentation, By Battery Type

12.5.3.5.3 Nigeria Electric Motorcycles Market Segmentation, By End-Use

12.5.3.6 South Africa

12.5.3.6.1 South Africa Electric Motorcycles Market Segmentation, By Drive Type

12.5.3.6.2 South Africa Electric Motorcycles Market Segmentation, By Battery Type

12.5.3.6.3 South Africa Electric Motorcycles Market Segmentation, By End-Use

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Electric Motorcycles Market Segmentation, By Drive Type

12.5.3.7.2 Rest of Africa Electric Motorcycles Market Segmentation, By Battery Type

12.5.3.7.3 Rest of Africa Electric Motorcycles Market Segmentation, By End-Use

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Electric Motorcycles Market, By Country

12.6.3 Latin America Electric Motorcycles Market Segmentation, By Drive Type

12.6.4 Latin America Electric Motorcycles Market Segmentation, By Battery Type

12.6.5 Latin America Electric Motorcycles Market Segmentation, By End-Use

12.6.6 Brazil

12.6.6.1 Brazil Electric Motorcycles Market Segmentation, By Drive Type

12.6.6.2 Brazil Electric Motorcycles Market Segmentation, By Battery Type

12.6.6.3 Brazil Electric Motorcycles Market Segmentation, By End-Use

12.6.7 Argentina

12.6.7.1 Argentina Electric Motorcycles Market Segmentation, By Drive Type

12.6.7.2 Argentina Electric Motorcycles Market Segmentation, By Battery Type

12.6.7.3 Argentina Electric Motorcycles Market Segmentation, By End-Use

12.6.8 Colombia

12.6.8.1 Colombia Electric Motorcycles Market Segmentation, By Drive Type

12.6.8.2 Colombia Electric Motorcycles Market Segmentation, By Battery Type

12.6.8.3 Colombia Electric Motorcycles Market Segmentation, By End-Use

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Electric Motorcycles Market Segmentation, By Drive Type

12.6.9.2 Rest of Latin America Electric Motorcycles Market Segmentation, By Battery Type

12.6.9.3 Rest of Latin America Electric Motorcycles Market Segmentation, By End-Use

13. Company Profiles

13.1 Harley Davidson

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Lito Motorcycles

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 Essence Motorcycles

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Tacita

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Alta Motors

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Yadea

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Lima

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 Tailg

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Wuyang Honda

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 Supaq

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Agricultural Tractors Market Size was valued at USD 95.55 billion in 2023 and is expected to reach USD 175.66 billion by 2032 and grow at a CAGR of 7% over the forecast period 2024-2032.

The Automotive Hypervisor Market size was valued at USD 286 Million in 2023 and is now anticipated to grow USD 3480.63 Million by 2032, displaying a compound annual growth rate (CAGR) of 32.02% during the forecast Period 2024-2032.

The Automotive Infotainment Market size was valued at $9.43 billion in 2023 and will reach $20 billion by 2032 and grow at a CAGR of 8.71% by 2024-2032

The Bicycle Market Size was valued at USD 70 billion in 2023 and is expected to reach USD 150.05 billion by 2031 and grow at a CAGR of 10% by 2024-2031

The Electric Scooter Battery Market Size was valued at USD 3.38 billion in 2023 and is expected to reach USD 15.56 billion by 2031 and grow at a CAGR of 21% over the forecast period 2024-2031.

The BMX Bike Market size was estimated at USD 327.75 Million in 2023 and is expected to reach USD 531.04 Million by 2032 at a CAGR of 5.52% during the forecast period of 2024-2032.

Hi! Click one of our member below to chat on Phone