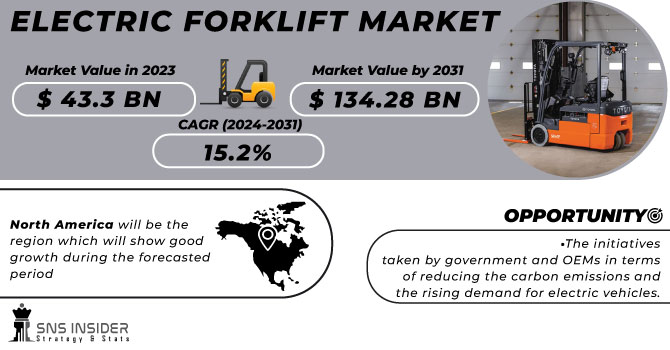

The Electric Forklift Market size is expected to reach USD 134.28 Billion by 2031, the value for the year 2023 was recorded USD 43.3 Billion and the CAGR is expected to be 15.2% over the forecast year 2024-2031.

Many firms have switched to electric forklifts as a result of the demand for lower greenhouse gas emissions and a move towards greener energy sources. Compared to forklifts driven by diesel or propane, they have zero emissions at the point of usage, making them more environmentally friendly. Compared to forklifts powered by internal combustion engines, electric forklifts frequently use less energy and cost less to operate. They have fewer moving parts, need less maintenance, and typically cost less to run than petroleum.

Get More Information on Electric Forklift Market - Request Sample Report

The performance and longevity of electric forklifts have been greatly enhanced by the introduction of lithium-ion batteries. These batteries are a more appealing alternative for businesses since they have longer run periods, quicker recharge times, and longer lifespans. The use of electric forklifts and other electric vehicles is being encouraged by numerous governments throughout the world through the implementation of incentives, tax credits, and laws. This has prompted companies to move to electric substitutes. The adoption of electric forklifts is being driven by some sectors, including manufacturing, logistics, and warehousing. Electric forklifts are a great option because these businesses frequently need indoor equipment that can function in limited locations without emitting any pollution. Electric forklifts are becoming increasingly sophisticated in terms of technology. To increase productivity and efficiency, they could have elements like telematics, IoT integration, and automation capabilities. Market competition is on the rise as more manufacturers enter the market in response to the rising demand for electric forklifts. As a result of this rivalry, options may become more accessible and technology may advance.

The market for electric forklifts is not regionally exclusive. It is a global market with room for expansion in both advanced and developing nations. The accessibility of infrastructure for charging electric forklifts is essential. Businesses are purchasing charging equipment to support their fleets of electric forklifts. To fulfil the unique requirements of diverse industries and End Uses, manufacturers offer a wide selection of electric forklift models with a variety of capacities and configurations.

Driver

The rising technology advancement and the increasing concern for sustainability factor.

Electric forklifts are far quieter than those powered by internal combustion engines, which is useful in settings where noise is a concern, such as warehouses and retail locations. Compared to forklifts fueled by fuel, electric forklifts often have lower operating expenses. They use less fuel, are less expensive to maintain, and are more energy-efficient. Compared to forklifts powered by internal combustion engines, electric forklifts have fewer moving components, necessitating less frequent maintenance. They do not require fuel filter replacements or oil changes. Compared to forklifts powered by internal combustion engines, electric forklifts often have a longer lifespan. Their durability is due in part to the absence of engine wear and tear.

Opportunity

The initiatives taken by government and OEMs in terms of reducing the carbon emissions and the rising demand for electric vehicles.

Due to their greater energy density, increased cycle life, and quick charging capabilities, lithium-ion batteries were dominating the market for electric forklifts. To provide better performance and less downtime, manufacturers are progressively including lithium-ion battery alternatives in their forklift models. Electric forklifts are increasingly integrating telematics and the Internet of Things (IoT). These solutions made it possible to monitor forklift performance in real-time, execute preventive maintenance, and gain data-driven insights to streamline fleet operations and cut expenses. As an alternate power source for electric forklifts, some manufacturers were looking into hydrogen fuel cell technology. Hydrogen fuel cells are appropriate for heavy-duty End Uses since they have lengthy running times and quick refueling.

Challenge

The supply chain constraints which cause shortages of parts.

Businesses frequently cut back on capital expenditures during a recession, including purchases of new machinery like electric forklifts. As a result, the market for electric forklifts might experience a fall, which would result in lower sales for producers. In an economic crisis, businesses may decide to postpone or delay replacing or expanding their fleets of forklifts in order to save money. For manufacturers and dealers, this may influence sales and revenue. Companies facing financial hardship may give cost-efficiency and cost savings more attention. Despite the higher initial cost, electric forklifts may still be preferable due to their reduced operational expenses when compared to forklifts powered by internal combustion engines.

Impact of Russia Ukraine

Given that Russia and Ukraine are major producers of the raw materials and parts necessary to make a variety of industrial equipment, including electric forklifts, supply chains may be affected by the situation in Ukraine. Production delays and higher manufacturing costs could result from problems with the availability of components or materials. Geopolitical disputes frequently result in economic uncertainty, which can have an impact on corporate investments and decisions. Until the area has more stability, businesses may be more hesitant to make capital investments, including the purchase of electric forklifts. Changes in exchange rates can affect how much it costs to import electric forklifts and related parts. Volatility in exchange rates can have an impact on manufacturers' and distributors' pricing and profitability, thereby raising prices for consumers.

By Product

Counterbalance

Warehouse

By Class

I

II

III

By End Use

Industrial

Food & Beverage

Logistics

Retail

Others

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

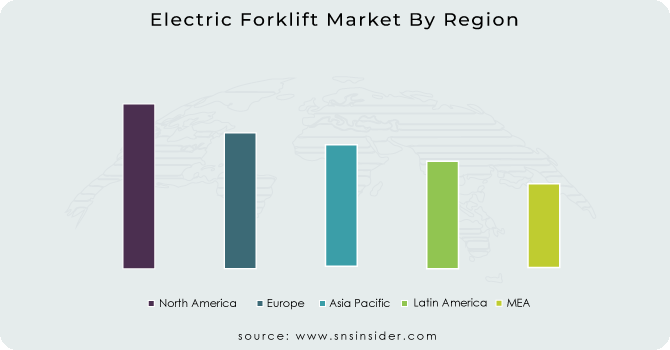

North America will be the region which will show good growth during the forecasted period, Electric forklift use has increased significantly in the United States and Canada due to environmental legislation and incentives for electric cars. Growing lithium-ion battery technology, which allows longer runtimes and quicker charging, is one example of a trend.

European nations are putting more of an emphasis on lowering emissions and promoting the use of electric vehicles, especially forklifts. Early adopters of electric forklift technology include Germany, the UK, and the Nordic nations. Regulations supporting sustainability in the European Union may encourage increased adoption.

APAC will be the region with the highest growth rate because China, which has a sizable industrial sector and rising environmental concerns, is a prominent player in the global market for electric forklifts. With an emphasis on cutting-edge battery technologies, Japan has also embraced electric forklifts. As Southeast Asian nations modernize their manufacturing and logistics sectors, they are gradually adopting electric forklifts.

Need any customization research on Electric Forklift Market - Enquiry Now

The major key players are Toyota, Kion Group, Jungheinrich, Mitsubishi, Crown Equipment, Anhui, Komatsu, Hangcha, Doosan Industrial Vehicle and others.

| Report Attributes | Details |

| Market Size in 2023 | US$ 43.3 Billion |

| Market Size by 2031 | US$ 134.28 Billion |

| CAGR | CAGR of 15.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product (Counterbalance, Warehouse), • by Class (I, II, III), • by End Use (Industrial, Food & Beverage, Logistics, Retail, Others), |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Toyota, Kion Group, Jungheinrich, Mitsubishi, Crown Equipment, Anhui, Komatsu, Hangcha, Doosan Industrial Vehicle |

| Key Drivers | • The rising technology advancement and the increasing concern for sustainability factor |

| Market Restraints | • The supply chain constraints which cause shortages of parts. |

Ans: The Electric Forklift Market size is expected to reach USD 152.30 Bn by 2030, the value for the year 2022 was recorded USD 56.89 Bn.

Ans: The CAGR growth rate is expected to be 13.1% over the forecast period 2023-2030.

Ans: This market is divided into three segments by product, by class, and by End use.

Ans: The major key players are Toyota, Kion Group, Jungheinrich, Mitsubishi, Crown Equipment, Anhui, Komatsu, Hangcha, Doosan Industrial Vehicle and others.

Ans: Businesses frequently cut back on capital expenditures during a recession, including purchases of new machinery like electric forklifts.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Research Methodology

3. Market Dynamics

3.1 Drivers

3.2 Restraints

3.3 Opportunities

3.4 Challenges

4. Impact Analysis

4.1 Impact of Russia-Ukraine war

4.2 Impact of Ongoing Recession

4.2.1 Introduction

4.2.2 Impact on major economies

4.2.2.1 US

4.2.2.2 Canada

4.2.2.3 Germany

4.2.2.4 France

4.2.2.5 United Kingdom

4.2.2.6 China

4.2.2.7 Japan

4.2.2.8 South Korea

4.2.2.9 Rest of the World

5. Value Chain Analysis

6. Porter’s 5 forces model

7. PEST Analysis

8. Electric Forklift Market, By Product Type

8.1 Counterbalance

8.2 Warehouse

9. Electric Forklift Market, By Class

9.1 I

9.2 II

9.3 III

10. Electric Forklift Market, By End Use

10.1 Industrial

10.2 Food & Beverage

10.3 Logistics

10.4 Retail

10.5 Others

11. Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 North America Electric Forklift Market by Country

11.2.2North America Electric Forklift Market by Product Type

11.2.3 North America Electric Forklift Market by Class

11.2.4 North America Electric Forklift Market by End Use

11.2.5 USA

11.2.5.1 USA Electric Forklift Market by Product Type

11.2.5.2 USA Electric Forklift Market by Class

11.2.5.3 USA Electric Forklift Market by End Use

11.2.6 Canada

11.2.6.1 Canada Electric Forklift Market by Product Type

11.2.6.2 Canada Electric Forklift Market by Class

11.2.6.3 Canada Electric Forklift Market by End Use

11.2.7 Mexico

11.2.7.1 Mexico Electric Forklift Market by Product Type

11.2.7.2 Mexico Electric Forklift Market by Class

11.2.7.3 Mexico Electric Forklift Market by End Use

11.3 Europe

11.3.1 Eastern Europe

11.3.1.1 Eastern Europe Electric Forklift Market by country

11.3.1.2 Eastern Europe Electric Forklift Market by Product Type

11.3.1.3 Eastern Europe Electric Forklift Market by Class

11.3.1.4 Eastern Europe Electric Forklift Market by End Use

11.3.1.5 Poland

11.3.1.5.1 Poland Electric Forklift Market by Product Type

11.3.1.5.2 Poland Electric Forklift Market by Class

11.3.1.5.3 Poland Electric Forklift Market by End Use

11.3.1.6 Romania

11.3.1.6.1 Romania Electric Forklift Market by Product Type

11.3.1.6.2 Romania Electric Forklift Market by Class

11.3.1.6.4 Romania Electric Forklift Market by End Use

11.3.1.7 Turkey

11.3.1.7.1 Turkey Electric Forklift Market by Product Type

11.3.1.7.2 Turkey Electric Forklift Market by Class

11.3.1.7.3 Turkey Electric Forklift Market by End Use

11.3.1.8 Rest of Eastern Europe

11.3.1.8.1 Rest of Eastern Europe Electric Forklift Market by Product Type

11.3.1.8.2 Rest of Eastern Europe Electric Forklift Market by Class

11.3.1.8.3 Rest of Eastern Europe Electric Forklift Market by End Use

11.3.2 Western Europe

11.3.2.1 Western Europe Electric Forklift Market by Country

11.3.2.2 Western Europe Electric Forklift Market by Product Type

11.3.2.3 Western Europe Electric Forklift Market by Class

11.3.2.4 Western Europe Electric Forklift Market by End Use

11.3.2.5 Germany

11.3.2.5.1 Germany Electric Forklift Market by Product Type

11.3.2.5.2 Germany Electric Forklift Market by Class

11.3.2.5.3 Germany Electric Forklift Market by End Use

11.3.2.6 France

11.3.2.6.1 France Electric Forklift Market by Product Type

11.3.2.6.2 France Electric Forklift Market by Class

11.3.2.6.3 France Electric Forklift Market by End Use

11.3.2.7 UK

11.3.2.7.1 UK Electric Forklift Market by Product Type

11.3.2.7.2 UK Electric Forklift Market by Class

11.3.2.7.3 UK Electric Forklift Market by End Use

11.3.2.8 Italy

11.3.2.8.1 Italy Electric Forklift Market by Product Type

11.3.2.8.2 Italy Electric Forklift Market by Class

11.3.2.8.3 Italy Electric Forklift Market by End Use

11.3.2.9 Spain

11.3.2.9.1 Spain Electric Forklift Market by Product Type

11.3.2.9.2 Spain Electric Forklift Market by Class

11.3.2.9.3 Spain Electric Forklift Market by End Use

11.3.2.10 Netherlands

11.3.2.10.1 Netherlands Electric Forklift Market by Product Type

11.3.2.10.2 Netherlands Electric Forklift Market by Class

11.3.2.10.3 Netherlands Electric Forklift Market by Test Type

11.3.2.11 Switzerland

11.3.2.11.1 Switzerland Electric Forklift Market by Product Type

11.3.2.11.2 Switzerland Electric Forklift Market by Class

11.3.2.11.3 Switzerland Electric Forklift Market by End Use

11.3.2.1.12 Austria

11.3.2.12.1 Austria Electric Forklift Market by Product Type

11.3.2.12.2 Austria Electric Forklift Market by Class

11.3.2.12.3 Austria Electric Forklift Market by End Use

11.3.2.13 Rest of Western Europe

11.3.2.13.1 Rest of Western Europe Electric Forklift Market by Product Type

11.3.2.13.2 Rest of Western Europe Electric Forklift Market by Class

11.3.2.13.3 Rest of Western Europe Electric Forklift Market by End Use

11.4 Asia-Pacific

11.4.1 Asia-Pacific Electric Forklift Market by country

11.4.2 Asia-Pacific Electric Forklift Market by Product Type

11.4.3 Asia-Pacific Electric Forklift Market by Class

11.4.4 Asia-Pacific Electric Forklift Market by End Use

11.4.5 China

11.4.5.1 China Electric Forklift Market by Product Type

11.4.5.2 China Electric Forklift Market by End Use

11.4.5.3 China Electric Forklift Market by Class

11.4.6 India

11.4.6.1 India Electric Forklift Market by Product Type

11.4.6.2 India Electric Forklift Market by Class

11.4.6.3 India Electric Forklift Market by End Use

11.4.7 Japan

11.4.7.1 Japan Electric Forklift Market by Product Type

11.4.7.2 Japan Electric Forklift Market by Class

11.4.7.3 Japan Electric Forklift Market by End Use

11.4.8 South Korea

11.4.8.1 South Korea Electric Forklift Market by Product Type

11.4.8.2 South Korea Electric Forklift Market by Class

11.4.8.3 South Korea Electric Forklift Market by End Use

11.4.9 Vietnam

11.4.9.1 Vietnam Electric Forklift Market by Product Type

11.4.9.2 Vietnam Electric Forklift Market by Class

11.4.9.3 Vietnam Electric Forklift Market by End Use

11.4.10 Singapore

11.4.10.1 Singapore Electric Forklift Market by Product Type

11.4.10.2 Singapore Electric Forklift Market by Class

11.4.10.3 Singapore Electric Forklift Market by End Use

11.4.11 Australia

11.4.11.1 Australia Electric Forklift Market by Product Type

11.4.11.2 Australia Electric Forklift Market by Class

11.4.11.3 Australia Electric Forklift Market by End Use

11.4.12 Rest of Asia-Pacific

11.4.12.1 Rest of Asia-Pacific Electric Forklift Market by Product Type

11.4.12.2 Rest of Asia-Pacific Electric Forklift Market by Class

11.4.12.3 Rest of Asia-Pacific Electric Forklift Market by Test Type

11.5 Middle East & Africa

11.5.1 Middle East

11.5.1.1 Middle East Electric Forklift Market by country

11.5.1.2 Middle East Electric Forklift Market by Product Type

11.5.1.3 Middle East Electric Forklift Market by Class

11.5.1.4 Middle East Electric Forklift Market by End Use

11.5.1.5 UAE

11.5.1.5.1 UAE Electric Forklift Market by Product Type

11.5.1.5.2 UAE Electric Forklift Market by Class

11.5.1.5.3 UAE Electric Forklift Market by End Use

11.5.1.6 Egypt

11.5.1.6.1 Egypt Electric Forklift Market by Product Type

11.5.1.6.2 Egypt Electric Forklift Market by Class

11.5.1.6.3 Egypt Electric Forklift Market by End Use

11.5.1.7 Saudi Arabia

11.5.1.7.1 Saudi Arabia Electric Forklift Market by Product Type

11.5.1.7.2 Saudi Arabia Electric Forklift Market by Class

11.5.1.7.3 Saudi Arabia Electric Forklift Market by End Use

11.5.1.8 Qatar

11.5.1.8.1 Qatar Electric Forklift Market by Product Type

11.5.1.8.2 Qatar Electric Forklift Market by Class

11.5.1.8.3 Qatar Electric Forklift Market by End Use

11.5.1.9 Rest of Middle East

11.5.1.9.1 Rest of Middle East Electric Forklift Market by Product Type

11.5.1.9.2 Rest of Middle East Electric Forklift Market by Class

11.5.1.9.3 Rest of Middle East Electric Forklift Market by End Use

11.5.2 Africa

11.5.2.1 Africa Transfusion Diagnostics Market by country

11.5.2.2 Africa Electric Forklift Market by Product Type

11.5.2.3 Africa Electric Forklift Market by Class

11.5.2.4 Africa Electric Forklift Market by End Use

11.5.2.5 Nigeria

11.5.2.5.1 Nigeria Electric Forklift Market by Product Type

11.5.2.5.2 Nigeria Electric Forklift Market by Class

11.5.2.5.3 Nigeria Electric Forklift Market by End Use

11.5.2.6 South Africa

11.5.2.6.1 South Africa Electric Forklift Market by Product Type

11.5.2.6.2 South Africa Electric Forklift Market by Class

11.5.2.6.3 South Africa Electric Forklift Market by End Use

11.5.2.7 Rest of Africa

11.5.2.7.1 Rest of Africa Electric Forklift Market by Product Type

11.5.2.7.2 Rest of Africa Electric Forklift Market by Class

11.5.2.7.3 Rest of Africa Electric Forklift Market by End Use

11.6 Latin America

11.6.1 Latin America Electric Forklift Market by country

11.6.2 Latin America Electric Forklift Market by Product Type

11.6.3 Latin America Electric Forklift Market by Class

11.6.4 Latin America Electric Forklift Market by End Use

11.6.5 Brazil

11.6.5.1 Brazil America Electric Forklift by Product Type

11.6.5.2 Brazil America Electric Forklift by Class

11.6.5.3 Brazil America Electric Forklift by End Use

11.6.6 Argentina

11.6.6.1 Argentina America Electric Forklift by Product Type

11.6.6.2 Argentina America Electric Forklift by Class

11.6.6.3 Argentina America Electric Forklift by End Use

11.6.7 Colombia

11.6.7.1 Colombia America Electric Forklift by Product Type

11.6.7.2 Colombia America Electric Forklift by Class

11.6.7.3 Colombia America Electric Forklift by End Use

11.6.8 Rest of Latin America

11.6.8.1 Rest of Latin America Electric Forklift by Product Type

11.6.8.2 Rest of Latin America Electric Forklift by Class

11.6.8.3 Rest of Latin America Electric Forklift by End Use

12 Company Profiles

12.1 Toyota

12.1.1 Company Overview

12.1.2 Financial

12.1.3 Products/ Services Offered

12.1.4 SWOT Analysis

12.1.5 The SNS View

12.2 Kion Group

12.2.1 Company Overview

12.2.2 Financials

12.2.3 Product/Services Offered

12.2.4 SWOT Analysis

12.2.5 The SNS View

12.3 Jungheinrich

12.3.1 Company Overview

12.3.2 Financials

12.3.3 Product/Services Offered

12.3.4 SWOT Analysis

12.3.5 The SNS View

12.4 Mitsubishi

12.4.1 Company Overview

12.4.2 Financials

12.4.3 Product/Services Offered

12.4.4 SWOT Analysis

12.4.5 The SNS View

12.5 Crown Equipment

12.5.1 Company Overview

12.5.2 Financials

12.5.3 Product/Services Offered

12.5.4 SWOT Analysis

12.5.5 The SNS View

12.6 Anhui

12.6.1 Company Overview

12.6.2 Financials

12.6.3 Product/Services Offered

12.6.4 SWOT Analysis

12.6.5 The SNS View

12.7 Komatsu

12.7.1 Company Overview

12.7.2 Financials

12.7.3 Product/Services Offered

12.7.4 SWOT Analysis

12.7.5 The SNS View

12.8 Hangcha

12.8.1 Company Overview

12.8.2 Financials

12.8.3 Product/Services Offered

12.8.4 SWOT Analysis

12.8.5 The SNS View

12.9 Doosan

12.9.1 Company Overview

12.9.2 Financials

12.9.3 Product/Services Offered

12.9.4 SWOT Analysis

12.9.5 The SNS View

12.10 Industrial Vehicle

12.10.1 Company Overview

12.10.2 Financials

12.10.3 Product/Services Offered

12.10.4 SWOT Analysis

12.10.5 The SNS View

13. Competitive Landscape

13.1 Competitive Bench marking

13.2 Market Share Analysis

13.3 Recent Developments

13.3.1 Industry News

13.3.2 Company News

13.3.3 Mergers & Acquisitions

14. Use Case and Best Practices

15. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Car Accessories Market size was valued at USD 9.2 billion in 2023 and is expected to reach USD 13.11 Bn by 2032 and grow at a CAGR of 4% by 2024-2032.

The Automotive Data Logger Market size was valued at USD 3.94 billion in 2023 and is expected to reach USD 7.80 billion by 2032 and grow at a CAGR of 7.89% over the forecast period 2024-2032.

The Boom Trucks Market Size was valued at $3.0. Billion in 2023 and is expected to reach USD 4.87 Billion by 2032 and grow at a CAGR of 5.44% by 2024-2032

The Skid Loaders Market size was valued at USD 10.03 billion in 2023 and is expected to reach USD 14.6 Billion by 2032, growing at a CAGR of 4.25% over the forecast period of 2024-2032.

Driveline Market was valued at USD 307.66 billion in 2023 and is expected to reach USD 575.20 billion by 2032, growing at a CAGR of 7.2% from 2024-2032.

The Cell to Pack Battery Market size was estimated at USD 18.53 billion in 2023 & is expected to reach USD 66.94 Bn by 2032 at a CAGR of 15.35% by 2024-2032.

Hi! Click one of our member below to chat on Phone