Electric Construction Equipment Market Size:

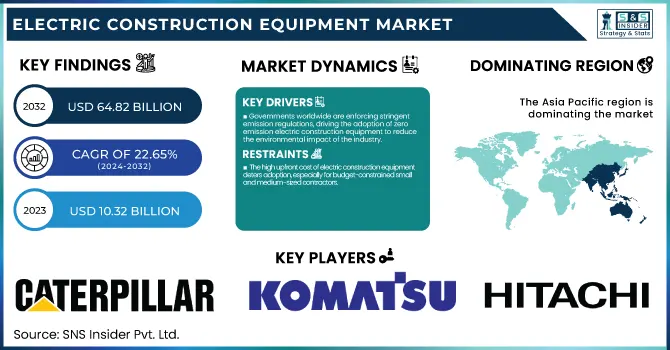

The Electric Construction Equipment Market size was valued at USD 10.32 billion in 2023. It is expected to grow to USD 64.82 billion by 2032 and grow at a CAGR of 22.65% over the forecast period of 2024-2032.

To Get more information on Electric Construction Equipment Market - Request Free Sample Report

The electric construction equipment market is experiencing significant growth, driven by a combination of environmental regulations, technological advancements, and economic benefits. Governments worldwide are enforcing stringent emission standards, compelling construction companies to adopt cleaner technologies, including electric machinery. The European Union aims to reduce net greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, with a goal of achieving net-zero emissions by 2050.

Technological advancements, particularly in battery technology, have enhanced the viability of electric construction equipment. Improvements in energy density allow batteries to store more energy in smaller, lighter packages, extending operational periods and reducing downtime. Faster charging solutions and increased durability under harsh conditions further contribute to the efficiency and appeal of electric machinery.

Economically, electric construction equipment offers lower operating costs compared to traditional diesel-powered options. In mining operations, for example, the use of electric machinery can significantly reduce ventilation costs in underground environments, leading to substantial savings. Additionally, the decreasing costs of lithium-ion batteries make electric equipment more affordable and competitive. The market is also influenced by the increasing demand for low-noise construction activities in residential areas, as electric equipment operates more quietly than conventional machinery. This trend is particularly relevant in urban settings where noise pollution regulations are strict.

Electric Construction Equipment Market Dynamics

DRIVERS

-

Governments worldwide are enforcing stringent emission regulations, driving the adoption of zero-emission electric construction equipment to reduce the environmental impact of the industry.

Governments across the globe are enforcing stringent emission regulations to combat climate change and reduce greenhouse gas emissions. The construction industry, a significant contributor to carbon emissions, is under increasing pressure to adopt sustainable practices. Electric construction equipment, with its zero-emission capabilities, has emerged as a key solution to meet these regulatory requirements. Initiatives such as the Paris Agreement and country-specific zero-emission mandates are accelerating the shift from diesel-powered machinery to electric alternatives. These policies aim to minimize the environmental impact of construction activities, encouraging manufacturers and contractors to invest in cleaner technologies. Additionally, urban areas with strict emission zones are further driving the demand for electric construction equipment, as they provide an eco-friendly option for operating in such regulated environments. By aligning with these regulatory frameworks, the electric construction equipment market is poised for significant growth in the coming years.

RESTRAINT

-

The high upfront cost of electric construction equipment deters adoption, especially for budget-constrained small and medium-sized contractors.

Electric construction equipment often comes with a significantly higher upfront cost compared to traditional diesel-powered machinery. This cost disparity is primarily driven by the expense of advanced battery technology, electric drivetrains, and research and development efforts involved in manufacturing these machines. For small and medium-sized contractors, who often operate on tight budgets, the initial investment required for electric equipment can be a significant deterrent. While electric machinery offers long-term savings through lower fuel and maintenance costs, these benefits may not immediately outweigh the high acquisition cost, particularly for contractors with limited capital or short project timelines. Additionally, the limited availability of affordable financing options and subsidies in some regions exacerbates the challenge. As a result, many contractors remain hesitant to transition to electric equipment, opting instead for the lower-cost and widely available diesel alternatives, despite their environmental impact.

Electric Construction Equipment Market Segmentation

By Type

Excavators segment dominated with the market share over 38% in 2023, due to their essential role in a wide range of construction tasks. These machines are commonly used for digging, trenching, material handling, and demolition, making them indispensable on construction sites. Their versatility and ability to handle heavy-duty tasks across various industries, such as infrastructure development, mining, and road construction, have made them a core component of construction fleets. As the demand for sustainable construction practices grows, the shift towards electric excavators is becoming more pronounced. Electric excavators offer significant advantages, including reduced emissions, lower operating costs, and quieter operation, making them more suitable for urban and environmentally conscious projects. The increased focus on reducing the carbon footprint of construction activities further strengthens the position of electric excavators in the market. As a result, this segment continues to lead in terms of both adoption and market share within the electric construction equipment sector.

By Battery Type

The Lithium-Ion battery segment dominated with the market share over 42% in 2023, due to its superior performance characteristics. Lithium-ion batteries offer a higher energy density, meaning they can store more energy in a smaller and lighter package, making them ideal for the heavy-duty requirements of construction machinery. This higher energy density translates into longer operational hours, reducing downtime and enhancing productivity. Additionally, lithium-ion batteries have a longer lifespan compared to alternatives like lead-acid batteries, resulting in fewer replacements and lower long-term operational costs. Their ability to charge faster is another key advantage, minimizing equipment downtime during charging cycles. These combined benefits make lithium-ion batteries the preferred choice for electric construction equipment, where efficiency, reliability, and cost-effectiveness are crucial.

Electric Construction Equipment Market Regional Analysis

The Asia-Pacific region dominated with the market share over 32% in 2023, owing to factors such as rapid urbanization, increasing infrastructure development, and substantial government support for eco-friendly initiatives. Countries like China, Japan, and South Korea are at the forefront of adopting electric construction machinery. The region’s dominance is further fueled by technological innovations in electric vehicle technologies, as well as robust environmental policies that encourage the shift towards sustainable construction practices. These efforts aim to reduce emissions, enhance energy efficiency, and meet environmental targets, making Asia-Pacific a leader in the electric construction equipment industry.

North America is witnessing rapid growth in the electric construction equipment market, driven by the increasing adoption of electric vehicles (EVs) and construction machinery. This growth is fueled by stringent environmental regulations, a shift towards sustainability, and the rising demand for energy-efficient equipment. The U.S. and Canada, in particular, are leading this transition with substantial investments in electric construction machinery. Government incentives, regulatory pressures, and heightened environmental awareness among consumers and businesses are accelerating the adoption of electric equipment. This combination of factors is positioning North America as the fastest-growing region in the electric construction equipment sector.

Get Customized Report as per Your Business Requirement - Enquiry Now

Some of the major key players of the Electric Construction Equipment Market

-

Caterpillar Inc. (U.S.): (Cat 301.5 Electric Mini Excavator)

-

Komatsu (Japan): (PC30-7E0 Electric Mini Excavator)

-

AB Volvo (Sweden): (EC500 Electric Crawler Excavator)

-

Hitachi Construction Machinery Co., Ltd. (Japan): (ZX55U-6EB Electric Mini Excavator)

-

Deere & Company (U.S.): (John Deere 944K Hybrid Wheel Loader)

-

Sany Heavy Industry Co., Ltd. (China):(SY35U Electric Mini Excavator)

-

JCB (U.K.): (JCB 19C-1E Electric Mini Excavator)

-

HD Hyundai Infracore Co., Ltd. (South Korea): (HX85A Electric Crawler Excavator)

-

Kobelco Construction Machinery Co., Ltd. (Japan): (SK17SR-3E Electric Mini Excavator)

-

Liebherr (Switzerland): (Liebherr T 264 Electric Mining Truck)

-

Xuzhou Construction Machinery Group Co., Ltd. (China): (XCMG XE35U Electric Mini Excavator)

-

Yuchai Heavy Industry (China): (Yuchai Electric Wheel Loader)

-

Doosan Infracore (South Korea): (DX165W Electric Wheel Excavator)

-

CASE Construction Equipment (U.S.): (CASE 570N EP Tractor Loader)

-

Kubota Corporation (Japan): (Kubota U55-4 Electric Mini Excavator)

-

Terex Corporation (U.S.): (Terex TA300 Electric Articulated Dump Truck)

-

Manitou Group (France): (Manitou MT 625e Electric Telehandler)

-

Bobcat Company (U.S.): (Bobcat E165 Large Electric Excavator)

-

Sennebogen Maschinenfabrik GmbH (Germany): (Sennebogen 8170 E Electric Crawler Crane)

-

Wacker Neuson SE (Germany): (Wacker Neuson EZ17e Electric Mini Excavator)

Suppliers for (developing energy-efficient, zero-emission electric equipment, particularly excavators and dump trucks) on Electric Construction Equipment Market

-

Hitachi Construction Machinery

-

Caterpillar Inc.

-

Komatsu Ltd.

-

Volvo Construction Equipment

-

JCB

-

AILISHENG

-

Deere & Company

-

Kubota Corporation

-

Liebherr Group

-

Sany Group

RECENT DEVELOPMENT

In April 2024: Volvo Construction Equipment (Volvo CE) announced plans to launch the largest electric excavator in Japan, highlighting the company’s dedication to sustainability and innovation in construction machinery. This move is aimed at addressing the increasing demand for environmentally friendly equipment in the Japanese construction sector.

In March 2024: Sunstate Equipment Co., a subsidiary of Sumitomo Corporation, completed the full acquisition of Trench Shore Rentals, Inc., a prominent U.S. trench safety equipment rental company, with the goal of expanding their construction equipment business.

In October 2023: Nevada Gold Mines (NGM) formed a partnership with Komatsu Ltd. to acquire 62 Komatsu 930E-5 haul trucks over the course of 2023 to 2025, for use at the Carlin Complex and Cortez site in Nevada.

In September 2023: Albemarle Corporation and Caterpillar Inc. teamed up to advance sustainable mining technologies and operations. This partnership includes the deployment of Caterpillar battery-electric trucks and energy transfer solutions, with the aim of creating a zero-emissions lithium mine in North America and driving innovation for a more sustainable mining industry.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.32 billion |

| Market Size by 2032 | USD 64.82 billion |

| CAGR | CAGR of 22.65% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Excavators, Loaders, Cranes, Dozers, Others) • By Battery Type (Lithium Ion, Lead Acid, Others) • By Application (Construction, Mining, Material Handling, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Caterpillar Inc., Komatsu, AB Volvo, Hitachi Construction Machinery, Deere & Company, Sany Heavy Industry, JCB, HD Hyundai Infracore, Kobelco Construction Machinery, Liebherr, Xuzhou Construction Machinery Group, Yuchai Heavy Industry, Doosan Infracore, CASE Construction Equipment, Kubota Corporation, Terex Corporation, Manitou Group, Bobcat Company, Sennebogen Maschinenfabrik, Wacker Neuson SE. |

| Key Drivers | • Governments worldwide are enforcing stringent emission regulations, driving the adoption of zero-emission electric construction equipment to reduce the environmental impact of the industry. |

| Restraints | • The high upfront cost of electric construction equipment deters adoption, especially for budget-constrained small and medium-sized contractors. |