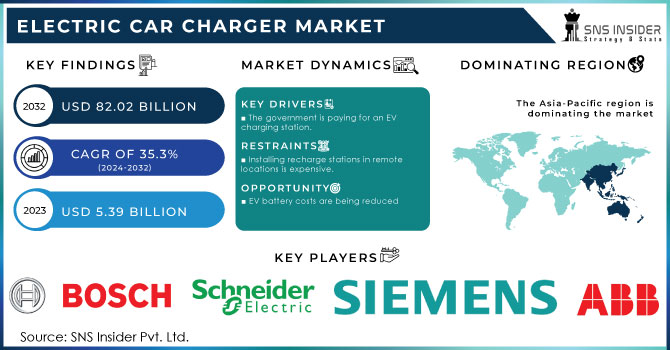

The Electric Car Charger Market size was valued at USD 7.64 billion in 2023 and is expected to grow to USD 55.45 billion by 2032 and grow at a CAGR of 24.64 % over the forecast period of 2024-2032. The growth of the market can be attributed to the following factors: growing adoption of electric vehicles (EVs), improving charging technologies and supportive government policies in favor of sustainable transportation. The only way to assuage consumer fears about charging accessibility and convenience is also the fastest: the rapid expansion of charging infrastructure. In addition, regulatory initiatives focused on carbon emissions reduction and energy efficiency improvement are also propelling market growth. Abundant industry examples signify the impact of electric car (EV) adoption on the environment and the change towards it can help lessen greenhouse ground emissions, thereby enhancing air quality. Collectively, these endeavors are ushering in a changing electric car charger market environment and mounting growth in forthcoming years as consumers alongside governments necessitate cleaner and more efficient means of movement.

Get more Information on Electric Car Charger Market - Request Free Sample Report

Drivers:

Empowering Electric Mobility and Commitment to Expanding Electric Car Charger Infrastructure

The electric vehicle (EV) market is growing rapidly, fueled largely by the rising appetite of consumers and supportive government measures. Last week, plans were revealed by the Ontario government to install more than 1,300 new EV charging stations in small and medium-sized communities across the province, marking another ingredient in a wider strategy to improve public charging infrastructure. Through this initiative, a USD 63 million investment focused on areas with populations of below 170,000 people including Indigenous communities. This should lessen range anxiety and create greater acceptance of EVs among residents. Such proactive steps not only back a transition to cleaner forms of transport but also help create a better energy ecosystem that includes all communities in the electro mechanics revolution.

Restraints:

Navigating Financial Impacts of High Infrastructure Costs in Electric Car Charger

The electric car charger market faces a significant restraint due to high infrastructure costs associated with the installation of charging stations, particularly fast chargers. These advanced charging solutions often require substantial capital investments for equipment, installation, and maintenance. Businesses and municipalities may find the financial burden prohibitive, especially in regions with limited budgets or competing infrastructure priorities. Additionally, ongoing operational costs, such as electricity and upkeep, further complicate the financial viability of establishing charging networks. This high initial cost can deter potential investors and slow the deployment of necessary charging infrastructure, ultimately hindering the widespread adoption of electric vehicles. Addressing these financial challenges is crucial for fostering a robust and accessible charging ecosystem.

Opportunities:

Rising demand for electric fleet charging solutions creates significant opportunities for specialized infrastructure as electric delivery and public transport fleets expand.

The integrated approach allows fleet managers to transition to electric trucks while optimizing operational efficiency. This is where EO Charging comes in, leveraging its 50 million PLUS charging sessions and over 100,000 charging units across >1700 sites and counting, globally. Yet even in states such as California, where local action has outpaced efforts from Washington; the current electrical grid Cape well relies on won’t handle the household needs of simultaneously charging thousands of EVs, particularly when forecasts show 30 million on the road by 2030. But a recent evaluation by California’s Energy Commission warned that improvements to charger and vehicle tech along with upgrades to the grid will be needed to lessen the burden on the grid. But the reality is that hooking the mega charging depots to the grid requires asking local utilities for increased capacity, which is one more project added to a queue of around 12,000 nationwide with waiting times stretching into years. This growing demand for fleet charging solutions opens significant opportunities in the electric car charger market, particularly as electric fleets in delivery, ride-sharing, and public transport gain momentum. Innovations in charging technologies, including next-generation wireless power solutions, further enhance the potential for specialized charging infrastructure, positioning the market for substantial growth.

Challenges:

The lack of universally accepted standards for charging connectors and protocols leads to compatibility issues among different EV models and charging stations.

The EV (electric vehicle) market is known to have a plethora of challenges ahead owing to the fact there are no universal charging connector and protocol standards available. This lack of standardization may create complications with compatibility between different (EV) models and charging stations, which may frustrate customers and hinder the adoption of electric vehicles in a big way. In addition, some manufacturers use proprietary charging connectors, while others use different types, meaning that drivers are not always able to get compatible charging options. This fragmentation can discourage prospective EV buyers, who may be concerned they will not be able to conveniently recharge their vehicles. In addition, the myriad of charging technologies makes the creation of a cohesive charging infrastructure challenging, impeding market growth. To facilitate a smooth charging experience, involving the implementation of standardized protocols and connectors will incentivize consumers to embrace electric vehicles.

By Type

The Fast DC charging segment dominates the Electric Car Charger Market, accounting for around 60% of total revenue in 2023 . This significant share can be attributed to the growing demand for rapid-charging solutions that significantly cut down the amount of time electric-powered vehicles spend charging. An important factor to note is high power output, which offers faster charging, thus presenting an attractive proposition to operators in commercial applications and fleet operators, as well as those in urban environments, where it is essential to minimize down-time. Given the increase in adoption of EVs, the need for Fast DC charging infrastructure is only set to rise and establish its dominant position in the sector over the coming years.

The Fast AC segment is the fastest-growing segment in the Electric Car Charger Market, with projections indicating significant expansion from 2024 to 2032. This growth is driven by the growing acceptance of electric vehicles and the need for quick and cost-effective charging solutions. Fast AC chargers for residential and commercial are cheaper and more flexible chargers that have hit the market, looking to be the preferred choice with more segments opening up. With the advent of infrastructure and increased user demand for power, the Fast AC segment will dominate the total segment, supported by cost-effective charging technology and wider coverage.

By Vehicle Type

The On-board Charger segment dominated the Electric Car Charger Market with a revenue share of around 55% in 2023. This significant share is attributed to the crucial function of on-board chargers, which convert AC power from charge stations into DC power for EV batteries. With rising adoption of electric vehicles, the need for on-board charging systems that are efficient and effective is also increasing. These chargers are essential to the optimal performance of the vehicles and contribute to enriching the user experience, thus advancing charging technology, making it an integral part of the global growth of electric vehicles market.

The Off-board Charger segment is the fastest-growing category in the electric car charger market, projected to experience significant growth during the forecast period from 2024 to 2032. The demand for fast charging solutions that optimize the charging process and minimize downtime has led to substantial growth in this segment. On the other hand, off-board chargers are installed on charging stations (in public and private) and can provide more power than on-board chargers, allowing faster regrouping times. As the electric vehicle market continues to grow, and consumers look for easier and more efficient charging solutions, it is expected that the off-board charger segment will take an increasing share of the market, due to new developments in charging technology and charging infrastructure advancement.

By Application

The home segment holds the largest revenue share in the electric car charger market, accounting for approximately 61% in 2023. This dominance is primarily driven by the increasing adoption of electric vehicles (EVs) among consumers who prefer the convenience of charging at home. Home charging solutions, such as Level 2 chargers, allow EV owners to recharge their vehicles overnight, eliminating the need to visit public charging stations frequently. Additionally, the growing awareness of sustainable transportation and the availability of government incentives for home charger installations have further boosted this segment's appeal. As more consumers transition to electric vehicles, the demand for home charging solutions is expected to continue rising, solidifying the home segment's position as a key player in the electric car charger market.

The commercial segment is the fastest-growing sector in the electric car charger market, projected to expand significantly from 2024 to 2032. This growth is due to the increasing demand for electric vehicle (EV) charging solutions at commercial sites, including retail locations, office complexes and public parking facilities. Charging infrastructure for utilizing electric vehicles or the public charging network is becoming a priority for businesses and other organizations to reach eco-friendly consumers and to contribute to sustainability goals. Moreover, companies are also investing in charging stations due to government initiatives to increase the adoption of EVs along with incentives. With the advent of more businesses adopting electric vehicle charging infrastructure, the commercial segment is poised for significant growth, mirroring the larger trend of electrification within the transportation landscape.

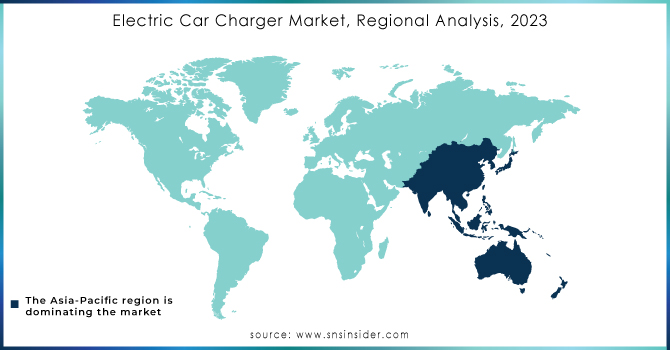

In 2023, the Asia-Pacific region emerged as a leader in the electric car charger market, accounting for approximately 44% of the total share. This dominance can be attributed to several factors, including rapid urbanization, significant government support for electric vehicle (EV) adoption, and a growing emphasis on sustainable transportation. Countries like China and Japan are at the forefront, investing heavily in charging infrastructure and promoting the use of electric vehicles. Initiatives such as subsidies for EV purchases, the development of extensive charging networks, and stringent emissions regulations contribute to the region's robust growth in the electric car charger market. Additionally, the increasing awareness of environmental issues among consumers is driving demand for EVs, further bolstering the need for reliable and accessible charging solutions in urban areas. This combination of factors positions the Asia-Pacific region as a key player in the global transition to electric mobility.

North America is emerging as the fastest-growing market for electric car chargers, due to rise in adoption of electric vehicles (EVs) and rising governmental policies. This growth is by major investments in charging infrastructure and a variety of government incentives to encourage EV adoption. At the forefront are the United States and Canada, which plan initiatives to expand charging networks, including fast chargers for highways and urban areas. The other reason is that automakers are designing more electric vehicle models than ever before, which in turn creates a higher need for effective charging solutions. Innovative charging technologies and business models, such as subscription services and public-private partnerships, are also being explored to improve accessibility. With heightened awareness of climate change and sustainability, consumers are increasingly inclined to adopt electric vehicles, positioning North America as a crucial market for electric car chargers in the future.

Need any customization research on Electric Car Charger Market - Enquiry Now

Some of the Major Players in Electric Car Charger Market along with their Product:

Leviton Manufacturing Co. Inc. - USA (Electrical Solutions, Charging Stations)

ABB Group - Switzerland (Power and Automation Technologies, EV Chargers)

Siemens AG - Germany (Electrification, Automation, and Digitalization, Charging Solutions)

Schneider Electric Corp - France (Energy Management and Automation, EV Charging Infrastructure)

AeroVironment Inc. - USA (Electric Vehicle Charging Solutions, Home and Public Chargers)

Blink Charging Co. - USA (EV Charging Network, Level 2 and DC Fast Chargers)

Bosch Automotive Service Solutions Inc. - Germany (Automotive Technology, EV Charging Equipment)

ChargePoint Inc. - USA (Charging Network, Level 2 and DC Fast Chargers)

Eaton Corporation - USA (Power Management, EV Charging Solutions)

Elektromotive Ltd. - UK (EV Charging Solutions, Public Charging Stations)

Evatran LLC - USA (Wireless EV Charging, Plugless Charging Systems)

General Electric Company - USA (Energy Infrastructure, EV Charging Stations)

Tesla Motors Inc. - USA (Electric Vehicles and Charging Infrastructure, Superchargers)

TurboDock - USA (Docking Solutions, EV Charging Stations)

Alfen N.V. - Netherlands (Energy Solutions, EV Charging Stations)

ClipperCreek Inc. - USA (EV Charging Equipment, Level 2 Chargers)

Delta Electronics Inc. - Taiwan (Power Electronics, EV Charging Solutions)

Efacec Electric Mobility S.A. - Portugal (EV Charging Solutions, Fast Chargers)

EV Safe Charge Inc. - USA (EV Charging Solutions, Home and Commercial Chargers)

EV Solutions Inc. - USA (EV Infrastructure, Charging Stations)

EVBox Group - Netherlands (Charging Solutions, AC and DC Chargers)

EVgo Services LLC - USA (Public Charging Network, Fast Chargers)

EVoCharge - USA (EV Charging Solutions, Level 2 Chargers)

EVSE LLC - USA (EV Charging Solutions, Public and Private Chargers)

NewMotion B.V. - Netherlands (EV Charging Network, Home and Business Chargers)

Tritium Pty Ltd. - Australia (DC Fast Charging Solutions, Fast Chargers)

Wallbox Chargers S.L. - Spain (Smart Charging Solutions, Home and Public Chargers)

Webasto Charging Systems Inc. - Germany (EV Charging Solutions, Residential and Commercial Chargers)

List of suppliers that provide raw materials for the electric car charger market:

Bosch

Siemens

Schneider Electric

ABB

General Electric (GE)

TE Connectivity

Nexans

LG Chem

Panasonic

Mersen

Sep 10, 2024, Schneider Electric has introduced Schneider Charge Pro, the next-generation Level 2 AC Commercial Electric Vehicle Charger engineered to provide energy-efficient and sustainable charging for commercial fleets and workplace environments. The EV market is estimated to increase 15-times by 2040, Schneider's integrated approach tackles the issues of market fragmentation and ineffectively installed equipment by delivering end-to-end solutions across installation, hardware, software and maintenance services

4 Dec 2024, Delta Electronics India signs MOU & collaborates with ThunderPlus for supply of high-efficiency 4kW rectifier modules for fast chargers used in low-voltage two-wheeler & three-wheeler electric vehicles in India. It has become an ever-increasing need for the electric mobility in the country considering the rapid growth of this segment and the introduction of more and more sustainable charging infrastructure.

| Report Attributes | Details |

| Market Size in 2023 | USD 7.64 Billion |

| Market Size by 2032 | USD 55.45 Billion |

| CAGR | CAGR of 24.64 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Slow AC, Fast AC, Fast DC) • By Vehicle Type(On-board Charger, Off-board Charger) • By Application(Home, Office, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Leviton Manufacturing Co. Inc. - USA, ABB Group - Switzerland, Siemens AG - Germany, Schneider Electric Corp - France, AeroVironment Inc. - USA, Blink Charging Co. - USA, Bosch Automotive Service Solutions Inc. - Germany, ChargePoint Inc. - USA, Eaton Corporation - USA, Elektromotive Ltd. - UK, Evatran LLC - USA, General Electric Company - USA, Tesla Motors Inc. - USA, TurboDock - USA, Alfen N.V. - Netherlands, ClipperCreek Inc. - USA, Delta Electronics Inc. - Taiwan, Efacec Electric Mobility S.A. - Portugal, EV Safe Charge Inc. - USA, EV Solutions Inc. - USA, EVBox Group - Netherlands, EVgo Services LLC - USA, EVoCharge - USA, EVSE LLC - USA, NewMotion B.V. - Netherlands, Tritium Pty Ltd. - Australia, Wallbox Chargers S.L. - Spain, Webasto Charging Systems Inc. - Germany. |

Ans: The Electric Car Charger Market is growing at a CAGR of 24.64% over the forecast period 2024-2032.

Ans: The Electric Car Charger Market size was valued at USD 7.64 Billion in 2023.

Ans: The Electric Car Charger Market size is expected to reach USD 55.45 Billion by 2032.

Ans: Asia-Pacific is dominating in Electric Car Charger Market

Ans: The government is paying for an EV charging station and the increasing number of electric Cars.

Table of Content

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Technology Adoption

5.2 Policy and Regulation Impact

5.3 Environmental Impact

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Electric Car Charger Market Segmentation, by Type

7.1 Chapter Overview

7.2 Slow AC

7.2.1 Slow AC Market Trends Analysis (2020-2032)

7.2.2 Slow AC Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Fast AC

7.3.1 Fast AC Market Trends Analysis (2020-2032)

7.3.2 Fast AC Market Size Estimates and Forecasts to 2032 (USD Billion)

7.4 Fast DC

7.4.1 Fast DC Market Trends Analysis (2020-2032)

7.4.2 Fast DC Market Size Estimates and Forecasts to 2032 (USD Billion)

8. Electric Car Charger Market Segmentation, by Vehicle Type

8.1 Chapter Overview

8.2 On-board Charger

8.2.1 On-board Charger Market Trends Analysis (2020-2032)

8.2.2 On-board Charger Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Off-board Charger

8.3.1 Off-board Charger Market Trends Analysis (2020-2032)

8.3.2 Off-board Charger Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Electric Car Charger Market Segmentation, by Application

9.1 Chapter Overview

9.2 Home

9.2.1 Home Market Trends Analysis (2020-2032)

9.2.2 Home Market Size Estimates and Forecasts to 2032 (USD Billion)

9.3 Office

9.3.1 Office Market Trends Analysis (2020-2032)

9.3.2 Office Market Size Estimates and Forecasts to 2032 (USD Billion)

9.4 Commercial

9.4.1 Commercial Market Trends Analysis (2020-2032)

9.4.2 Commercial Market Size Estimates and Forecasts to 2032 (USD Billion)

10. Regional Analysis

10.1 Chapter Overview

10.2 North America

10.2.1 Trends Analysis

10.2.2 North America Electric Car Charger Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.2.3 North America Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.4 North America Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.2.5 North America Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.6 USA

10.2.6.1 USA Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.6.2 USA Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.2.6.3 USA Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.7 Canada

10.2.7.1 Canada Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.7.2 Canada Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.2.7.3 Canada Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.2.8 Mexico

10.2.8.1 Mexico Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.2.8.2 Mexico Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.2.8.3 Mexico Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3 Europe

10.3.1 Eastern Europe

10.3.1.1 Trends Analysis

10.3.1.2 Eastern Europe Electric Car Charger Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.1.3 Eastern Europe Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.4 Eastern Europe Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.5 Eastern Europe Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.6 Poland

10.3.1.6.1 Poland Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.6.2 Poland Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.6.3 Poland Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.7 Romania

10.3.1.7.1 Romania Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.7.2 Romania Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.7.3 Romania Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.8 Hungary

10.3.1.8.1 Hungary Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.8.2 Hungary Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.8.3 Hungary Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.9 Turkey

10.3.1.9.1 Turkey Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.9.2 Turkey Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.9.3 Turkey Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.1.10 Rest of Eastern Europe

10.3.1.10.1 Rest of Eastern Europe Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.1.10.2 Rest of Eastern Europe Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.1.10.3 Rest of Eastern Europe Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2 Western Europe

10.3.2.1 Trends Analysis

10.3.2.2 Western Europe Electric Car Charger Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.3.2.3 Western Europe Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.4 Western Europe Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.5 Western Europe Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.6 Germany

10.3.2.6.1 Germany Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.6.2 Germany Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.6.3 Germany Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.7 France

10.3.2.7.1 France Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.7.2 France Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.7.3 France Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.8 UK

10.3.2.8.1 UK Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.8.2 UK Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.8.3 UK Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.9 Italy

10.3.2.9.1 Italy Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.9.2 Italy Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.9.3 Italy Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.10 Spain

10.3.2.10.1 Spain Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.10.2 Spain Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.10.3 Spain Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.11 Netherlands

10.3.2.11.1 Netherlands Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.11.2 Netherlands Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.11.3 Netherlands Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.12 Switzerland

10.3.2.12.1 Switzerland Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.12.2 Switzerland Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.12.3 Switzerland Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.13 Austria

10.3.2.13.1 Austria Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.13.2 Austria Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.13.3 Austria Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.3.2.14 Rest of Western Europe

10.3.2.14.1 Rest of Western Europe Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.3.2.14.2 Rest of Western Europe Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.3.2.14.3 Rest of Western Europe Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4 Asia Pacific

10.4.1 Trends Analysis

10.4.2 Asia Pacific Electric Car Charger Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.4.3 Asia Pacific Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.4 Asia Pacific Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.5 Asia Pacific Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.6 China

10.4.6.1 China Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.6.2 China Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.6.3 China Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.7 India

10.4.7.1 India Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.7.2 India Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.7.3 India Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.8 Japan

10.4.8.1 Japan Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.8.2 Japan Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.8.3 Japan Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.9 South Korea

10.4.9.1 South Korea Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.9.2 South Korea Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.9.3 South Korea Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.10 Vietnam

10.4.10.1 Vietnam Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.10.2 Vietnam Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.10.3 Vietnam Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.11 Singapore

10.4.11.1 Singapore Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.11.2 Singapore Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.11.3 Singapore Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.12 Australia

10.4.12.1 Australia Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.12.2 Australia Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.12.3 Australia Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.4.13 Rest of Asia Pacific

10.4.13.1 Rest of Asia Pacific Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.4.13.2 Rest of Asia Pacific Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.4.13.3 Rest of Asia Pacific Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5 Middle East and Africa

10.5.1 Middle East

10.5.1.1 Trends Analysis

10.5.1.2 Middle East Electric Car Charger Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.1.3 Middle East Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.4 Middle East Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.5 Middle East Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.6 UAE

10.5.1.6.1 UAE Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.6.2 UAE Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.6.3 UAE Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.7 Egypt

10.5.1.7.1 Egypt Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.7.2 Egypt Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.7.3 Egypt Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.8 Saudi Arabia

10.5.1.8.1 Saudi Arabia Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.8.2 Saudi Arabia Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.8.3 Saudi Arabia Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.9 Qatar

10.5.1.9.1 Qatar Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.9.2 Qatar Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.9.3 Qatar Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.1.10 Rest of Middle East

10.5.1.10.1 Rest of Middle East Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.1.10.2 Rest of Middle East Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.1.10.3 Rest of Middle East Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2 Africa

10.5.2.1 Trends Analysis

10.5.2.2 Africa Electric Car Charger Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.5.2.3 Africa Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.4 Africa Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.2.5 Africa Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.6 South Africa

10.5.2.6.1 South Africa Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.6.2 South Africa Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.2.6.3 South Africa Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.7 Nigeria

10.5.2.7.1 Nigeria Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.7.2 Nigeria Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.2.7.3 Nigeria Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.5.2.8 Rest of Africa

10.5.2.8.1 Rest of Africa Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.5.2.8.2 Rest of Africa Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.5.2.8.3 Rest of Africa Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6 Latin America

10.6.1 Trends Analysis

10.6.2 Latin America Electric Car Charger Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

10.6.3 Latin America Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.4 Latin America Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.6.5 Latin America Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.6 Brazil

10.6.6.1 Brazil Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.6.2 Brazil Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.6.6.3 Brazil Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.7 Argentina

10.6.7.1 Argentina Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.7.2 Argentina Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.6.7.3 Argentina Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.8 Colombia

10.6.8.1 Colombia Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.8.2 Colombia Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.6.8.3 Colombia Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America Electric Car Charger Market Estimates and Forecasts, by Type (2020-2032) (USD Billion)

10.6.9.2 Rest of Latin America Electric Car Charger Market Estimates and Forecasts, by Vehicle Type (2020-2032) (USD Billion)

10.6.9.3 Rest of Latin America Electric Car Charger Market Estimates and Forecasts, by Application (2020-2032) (USD Billion)

11. Company Profiles

11.1 Leviton Manufacturing Co. Inc.

11.1.1 Company Overview

11.1.2 Financial

11.1.3 Products/ Services Offered

11.1.4 SWOT Analysis

11.2 ABB Group

11.2.1 Company Overview

11.2.2 Financial

11.2.3 Products/ Services Offered

11.2.4 SWOT Analysis

11.3 Siemens AG

11.3.1 Company Overview

11.3.2 Financial

11.3.3 Products/ Services Offered

11.3.4 SWOT Analysis

11.4 Schneider Electric Corp

11.4.1 Company Overview

11.4.2 Financial

11.4.3 Products/ Services Offered

11.4.4 SWOT Analysis

11.5 AeroVironment Inc.

11.5.1 Company Overview

11.5.2 Financial

11.5.3 Products/ Services Offered

11.5.4 SWOT Analysis

11.6 Blink Charging Co.

11.6.1 Company Overview

11.6.2 Financial

11.6.3 Products/ Services Offered

11.6.4 SWOT Analysis

11.7 Bosch Automotive Service Solutions Inc.

11.7.1 Company Overview

11.7.2 Financial

11.7.3 Products/ Services Offered

11.7.4 SWOT Analysis

11.8 ChargePoint Inc.

11.8.1 Company Overview

11.8.2 Financial

11.8.3 Products/ Services Offered

11.8.4 SWOT Analysis

11.9 Eaton Corporation

11.9.1 Company Overview

11.9.2 Financial

11.9.3 Products/ Services Offered

11.9.4 SWOT Analysis

11.10 Elektromotive Ltd.

11.10.1 Company Overview

11.10.2 Financial

11.10.3 Products/ Services Offered

11.10.4 SWOT Analysis

12. Use Cases and Best Practices

13. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segments:

By Type

Slow AC

Fast AC

Fast DC

By Vehicle Type

On-board Charger

Off-board Charger

By Application

Home

Office

Commercial

Request for Segment Customization as per your Business Requirement: Segment Customization Request

Regional Coverage:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Detailed Volume Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Competitive Product Benchmarking

Geographic Analysis

Additional countries in any of the regions

Customized Data Representation

Detailed analysis and profiling of additional market players

The Robotic Arm Market Size was USD 28.04 Billion in 2023 and will reach to USD 81.83 Billion by 2032 and grow at a CAGR of 12.64% by 2024-2032.

The Virtual Reality in Retail Market Size was valued at USD 3.33 Billion in 2023 and is expected to grow at a CAGR of 26.2% to reach USD 26.28 Billion by 2032.

The Advanced Lead-Free Piezoelectric Materials Market was valued at USD 145.10 Billion in 2023 and is projected to reach USD 558.75 Billion by 2032, growing at a robust CAGR of 16.17% during the forecast period from 2024 to 2032.

The Smart Road Market size was valued at USD 17.85 billion in 2023. It is estimated to hit USD 145.34 billion by 2032 and grow at a CAGR of 26.24% over the forecast period of 2024-2032.

The Semiconductor Memory Market Size was valued at USD 122.35 Billion in 2023 and is expected to reach USD 273.03 Billion by 2032 and grow at a CAGR of 9.4% over the forecast period 2024-2032.

The Sputter Coatings Market was valued at USD 709 Million in 2023 and is projected to reach USD 1121.6 Million by 2032, growing at a CAGR of 5.23% from 2024 to 2032.

Hi! Click one of our member below to chat on Phone