Edge Computing Market Key Insights:

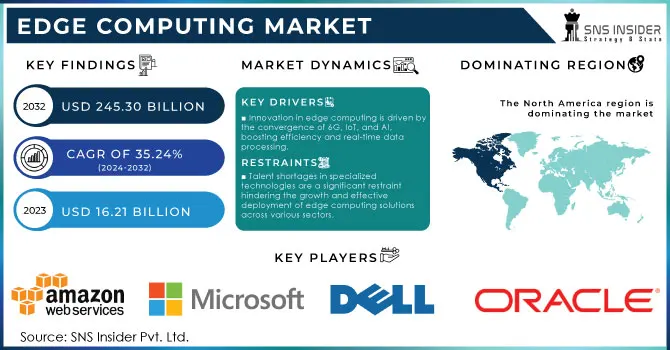

The Edge Computing Market size was valued at USD 16.21 Billion in 2023 and is expected to reach USD 245.30 Billion in 2032 and grow at a CAGR of 35.24% over the forecast period 2024-2032.

The edge computing market is experiencing remarkable growth, driven by the rapid deployment of 5G networks that enable the low-latency, high-bandwidth performance required for next-generation applications like autonomous vehicles, augmented reality (AR), virtual reality (VR), and remote healthcare. Industry data reveals that over 75% of enterprise-generated data will be processed outside traditional data centers, underscoring the growing reliance on edge solutions.

To Get More Information on Edge Computing Market - Request Sample Report

Moreover, edge computing is expected to contribute to significant cost savings, with organizations predicted to reduce cloud infrastructure expenses by 30-40% by leveraging edge technologies. Global investments in smart infrastructure are set to rise by 40%, particularly in countries like China, India, and South Korea, where the adoption of edge computing in smart cities, manufacturing, and utilities is accelerating. In North America, early adoption of 5G and Internet of Things (IoT) technologies across industries like healthcare, manufacturing, and retail ensures the region’s stronghold in the market. According to the International Data Corporation (IDC), global spending on edge computing is projected to reach USD 228 billion in 2024, a 14% increase from 2023, with continued double-digit growth expected through 2032.This growth is fueled by the increasing shift of artificial intelligence (AI) from training to AI inference, where edge computing plays a crucial role in delivering faster decision-making and reducing network congestion. Research VP at IDC, edge computing enhances operational efficiencies and enables new business models previously unattainable with centralized data centers. Key industries benefiting from edge computing include manufacturing, which uses edge for real-time monitoring and predictive maintenance, and utilities, where it enables more efficient management of critical infrastructure like electricity and water. Banking is the fastest-growing sector, driven by the adoption of AI-powered fraud detection and AI-optimized operations, demonstrating the transformative potential of edge computing across diverse sectors.

Edge Computing Market Dynamics

Drivers

- Innovation in edge computing is driven by the convergence of 6G, IoT, and AI, boosting efficiency and real-time data processing.

The edge computing market is significantly influenced by the convergence of several critical trends, primarily driven by the escalating demand for next-generation technologies such as 6G, IoT, and AI services. The Indian Ministry of Communications has recently urged telecom operators and startups to transition innovative technologies like edge computing from laboratories to practical applications, particularly within smart cities and Industry 4.0 frameworks. Reflecting a 14% increase from the previous year. The urgency for real-time data processing is paramount for industries aiming to fully exploit the capabilities of 5G networks and AI applications. Edge computing plays a crucial role by facilitating faster decision-making through localized data processing, which significantly mitigates latency—a vital requirement for autonomous driving, augmented and virtual reality (AR/VR), and remote healthcare services. As the edge ecosystem develops, organizations can expect savings of 30-40% on cloud infrastructure costs, marking a pivotal transition from centralized data management to decentralized solutions. Additionally, the integration of IoT-enabled devices and smart grids in sectors such as utilities and manufacturing enhances operational efficiency, enabling real-time monitoring and predictive maintenance. Notably, the banking sector emerges as the fastest-growing domain in edge computing expenditure, driven primarily by the advent of AI-driven services that bolster data processing and fraud detection capabilities. In summary, as organizations increasingly adopt edge computing, they unlock substantial opportunities for innovation and efficiency across various sectors, solidifying its vital role in shaping the future of digital infrastructure.

Restraints

- Talent shortages in specialized technologies are a significant restraint hindering the growth and effective deployment of edge computing solutions across various sectors.

The edge computing market is significantly restrained by a shortage of skilled professionals. Research indicates that nearly 90% of executives view talent shortages as the primary obstacle to adopting emerging technologies. The skills gap affects critical areas like cloud computing, with estimates suggesting up to 85 million jobs may remain unfilled globally due to this deficit. This challenge limits organizations' capacity to deploy and manage edge computing solutions, hindering innovation and operational efficiency. As the demand for advanced technologies rises, competition for skilled talent intensifies, complicating recruitment efforts. Addressing this talent gap through targeted training and education initiatives is crucial. Organizations investing in workforce development can ensure they have the necessary expertise to fully leverage edge computing, driving innovation across various sectors such as telecommunications, healthcare, and manufacturing. With a staggering 93% of UK businesses acknowledging a skills shortfall, prioritizing skill development is essential to unlock the full potential of edge computing and maintain a competitive advantage in a rapidly evolving digital landscape.

Edge Computing Market Segmentation Analysis

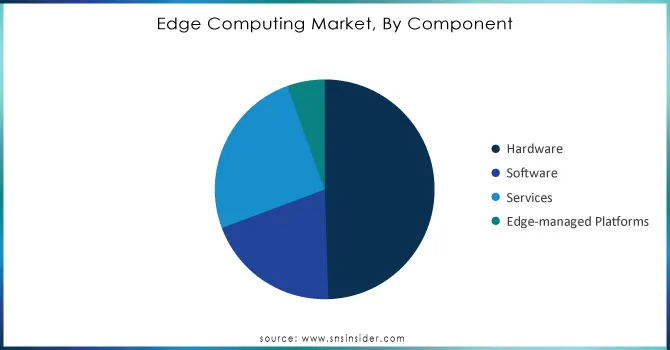

By Component

In 2023, hardware components accounted for approximately 50% of the edge computing market total revenue, driven by the increasing demand for robust infrastructures that facilitate localized data processing and real-time analytics. As organizations leverage edge computing to boost operational efficiency, essential hardware such as servers, routers, and IoT devices play a pivotal role. These components enable rapid data transfer, reduce latency, and support quick decision-making, particularly in sectors like autonomous vehicles, smart manufacturing, and healthcare. Technological advancements in hardware such as enhanced processing power and energy efficiency are also propelling investment in edge solutions. Businesses are adopting edge computing to effectively manage the extensive data generated by IoT devices, decreasing dependence on centralized cloud data centers. This shift alleviates bandwidth constraints and improves data security by keeping sensitive information closer to its source. Industries like telecommunications, retail, and healthcare further drive the demand for specialized hardware for edge applications, especially with the expansion of 5G networks, which require advanced infrastructure to support higher data rates and connectivity. As companies, embrace digital transformation, the critical role of hardware in the edge computing landscape becomes increasingly evident, highlighting its importance in fostering innovation and competitiveness in a data-centric environment.

Do You Need any Customization Research on Edge Computing Market - Inquire Now

By Application

In 2023, the Industrial Internet of Things (IIoT) represented approximately 35% of the edge computing market total revenue, underscoring its vital impact on industrial operations. By utilizing edge computing, IIoT facilitates real-time data processing from various connected devices and sensors, significantly boosting operational efficiency across sectors such as manufacturing, energy, and transportation. This integration allows for data analysis at the source, which minimizes latency and speeds up decision-making, essential for applications like predictive maintenance and automated quality control. As digital transformation accelerates, the demand for IIoT solutions is projected to rise, fueled by advancements in sensor technology and enhanced connectivity options, including 5G networks. Furthermore, IIoT enhances resource management and operational transparency, aligning with organizations' goals of reducing costs and promoting sustainability. By leveraging edge computing, businesses can effectively process large amounts of data from IoT devices, resulting in improved insights and more strategic decision-making.

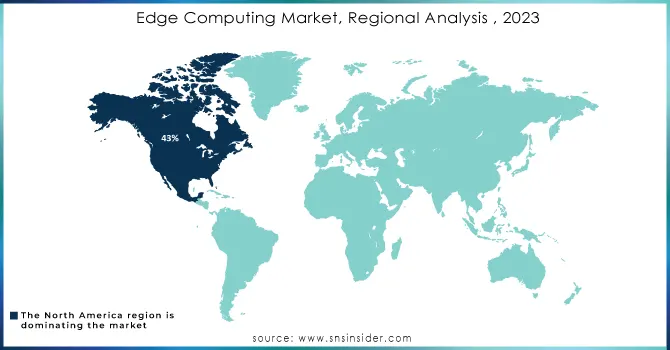

Edge Computing Market Regional Outlook

In 2023, North America represented about 43% of the edge computing market's revenue, solidifying its leadership in this fast-growing field. This dominance stems from its advanced technological infrastructure and the widespread implementation of IoT and AI solutions. The region's vibrant technology ecosystem, comprising both established companies and innovative startups, drives significant investment in edge computing. Additionally, the surging demand for low-latency applications across sectors like telecommunications, healthcare, and manufacturing propels market growth. The rollout of 5G networks further boosts connectivity, facilitating rapid data processing at the edge. Major players, including Microsoft and Amazon Web Services (AWS), have launched new edge services, while Cisco and IBM have introduced cutting-edge hardware and AI-enhanced solutions, reflecting North America's commitment to innovation in edge computing technologies.

In 2023, the Asia Pacific region emerged as the fastest-growing market for edge computing, driven by rapid industrialization, urbanization, and increasing adoption of IoT technologies. Countries like China, India, and Japan are at the forefront, with significant investments in smart city initiatives and digital transformation across sectors such as manufacturing, healthcare, and transportation. The proliferation of 5G networks enhances connectivity and enables real-time data processing, further accelerating edge computing growth. Additionally, local players and multinational corporations are innovating in edge solutions, contributing to the region's dynamic market landscape.

Key Players

-

Amazon Web Services (AWS) (AWS IoT Greengrass)

-

Microsoft (Azure IoT Edge)

-

Google Cloud (Anthos)

-

IBM (IBM Edge Application Manager)

-

Dell Technologies (Dell EMC Edge Gateway)

-

Cisco Systems (Cisco Edge Computing Solutions)

-

Hewlett Packard Enterprise (HPE) (HPE Edgeline)

-

Oracle (Oracle Edge Services)

-

NVIDIA (NVIDIA Jetson)

-

Intel (Intel IoT Platform)

-

Qualcomm (Qualcomm IoT Services)

-

EdgeConneX (EdgeConneX Edge Data Centers)

-

FogHorn Systems (FogHorn Edge AI)

-

Schneider Electric (EcoStruxure)

-

Siemens (MindSphere)

-

Veea (Veea Edge Platform)

-

Lumen Technologies (Lumen Edge Services)

-

Alibaba Cloud (Alibaba Cloud Edge Computing)

-

Zebra Technologies (Zebra SmartLens)

-

Aviatrix (Aviatrix Multi-Cloud Networking)

List of major suppliers, which provide cloud platform in the edge computing

-

Amazon Web Services (AWS)

-

Microsoft Azure

-

Google Cloud

-

IBM Cloud

-

Dell Technologies

-

Hewlett Packard Enterprise (HPE)

-

Cisco Systems

-

NVIDIA

-

Qualcomm

-

Intel

Recent Developments

-

On October 23, 2024, ZEDEDA and OnLogic announced a strategic partnership to launch OnLogic Powered by ZEDEDA, integrating rugged industrial-grade hardware with cloud-native edge orchestration software. This collaboration aims to simplify and secure the deployment and management of edge computing workloads for enterprises, accelerating time to value.

-

On October 24, 2024, Australian micro data center provider Zella DC launched the Zella Outback, a cutting-edge outdoor micro data center designed specifically for edge computing in extreme conditions. This innovative solution emphasizes reliability and performance, drawing inspiration from the rugged landscapes of Western Australia.

-

On October 23, 2024, Microchip Technology announced the launch of its PIC64HX microprocessor family, expanding its 64-bit portfolio to meet the growing demand for reliable embedded solutions in edge computing. Designed specifically for mission-critical applications across sectors such as aerospace, defense, and industrial, the PIC64HX addresses the unique requirements of intelligent edge designs.

-

On October 19, 2024, researchers highlighted the potential of organic electrochemical transistors (OECTs) as stretchable transistors for wearable devices, enabling in-sensor edge computing. Made from carbon-based materials, these neuromorphic transistors enhance electronic signal processing in skin-mounted devices like smartwatches and health monitors.

-

On October 16, 2024, experts emphasized that the rise of autonomous systems is pushing CIOs to integrate AI at the network edge into their 2025 strategies. A Gartner report indicates that 75% of CIOs are increasing their AI budgets this year, as edge computing becomes crucial for enabling real-time data processing and reducing cloud costs.

-

On October 22, 2024, Qualcomm emphasized its leadership in on-device generative AI, highlighting its role in mainstreaming spatial computing for hyper-personalization. The company's vision includes transforming app-centric experiences into innovative solutions, heavily relying on wearable technology such as smart glasses.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 16.21 Billion |

| Market Size by 2032 | USD 245.30 Billion |

| CAGR | CAGR of 35.24% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Hardware, Software, Services, Edge-managed Platforms) • By Application (IIoT, Remote Monitoring, Content Delivery, Video Analytics, AR/VR, Others), • By Industry Vertical (Industrial, Energy & Utilities, Healthcare, Agriculture, Transportation & Logistics, Retail, Datacenters, Wearables, Smart Cities, Smart Homes, Smart Buildings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Amazon Web Services (AWS), Microsoft, Google Cloud, IBM, Dell Technologies, Cisco Systems, Hewlett Packard Enterprise (HPE), Oracle, NVIDIA, Intel, Qualcomm, EdgeConneX, FogHorn Systems, Schneider Electric, Siemens, Veea, Lumen Technologies, Alibaba Cloud, Zebra Technologies, and Aviatrix. |

| Key Drivers | • Innovation in edge computing is driven by the convergence of 6G, IoT, and AI, boosting efficiency and real-time data processing. |

| RESTRAINTS | • Talent shortages in specialized technologies are a significant restraint hindering the growth and effective deployment of edge computing solutions across various sectors. |