To Get More Information on E-tailing Solutions Market - Request Sample Report

The E-tailing Solutions Market size was valued at USD 18.21 Billion in 2023 and is expected to reach USD 56.77 Billion by 2032 and grow at a CAGR of 13.39% over the forecast period 2024-2032.

The E-tailing solutions market has experienced rapid growth in recent years, driven by the shift in consumer behavior toward online shopping. As e-commerce platforms continue to dominate, the demand for e-tailing tools and solutions that enhance the customer experience is higher than ever, with 20.1% of retail purchases occurring online in 2024, the digital transformation of retail is undeniable. Major players such as Amazon, holding 37.6% of the market share, underscore the competition within the e-tailing space, along with Walmart, Apple, and eBay, who have also captured substantial portions of the market. These e-commerce giants have reshaped business models, driving the adoption of advanced e-tailing solutions that enable seamless shopping experiences across multiple devices and channels. The influence of Amazon, AliExpress, and other platforms with high global traffic highlights the need for scalable, secure e-commerce infrastructure, optimized for high volumes of traffic and robust payment systems. As consumer demand grows, businesses require e-tailing platforms capable of integrating with backend systems for inventory management, shipping, and customer support.

Personalization is a key trend in the e-tailing market. By leveraging customer data and machine learning algorithms, businesses can provide personalized shopping experiences, offering tailored product recommendations based on purchase history and user preferences. This not only improves the user experience but also boosts conversion rates. Additionally, advanced Customer Relationship Management (CRM) tools integrated into e-tailing solutions help businesses engage with customers through personalized emails, push notifications, and AI-driven chatbots for real-time support, ensuring higher levels of customer satisfaction and loyalty.

Drivers

In recent years, consumers have increasingly preferred shopping online due to the convenience, variety, and competitive pricing that digital platforms offer. The growing use of smartphones and mobile applications has made shopping more accessible and easier than ever. People can now shop from anywhere at any time, without being limited by physical store hours or geographic location. Consumers are also increasingly drawn to the personalized shopping experience that online platforms offer. E-tailers like Shopify use advanced algorithms to track browsing habits and offer tailored product recommendations, making shopping more relevant to individual tastes and preferences. The ability to compare prices across different platforms, read customer reviews, and access a broader selection of products further fuels the demand for online shopping. As a result, both B2C and B2B companies are investing heavily in E-tailing solutions to meet the evolving expectations of consumers.

As the internet becomes more widely accessible across the globe, consumers in both developed and emerging markets are increasingly engaging in online shopping. Internet access is no longer a luxury but a necessity, with people from different demographic groups regularly using the web for shopping, social interaction, and entertainment. The adoption of smartphones has further accelerated this trend. Mobile commerce (M-commerce) is growing rapidly as consumers use their smartphones to browse products, make purchases, and even track deliveries. This shift has forced traditional brick-and-mortar retailers to adapt, offering mobile-friendly websites and applications to attract consumers who prefer shopping on their mobile devices. For example, Amazon's mobile app has revolutionized the shopping experience, allowing users to browse, purchase, and track deliveries seamlessly. Mobile apps also allow retailers to stay connected with customers through push notifications, special offers, and loyalty programs, creating a more personalized and engaging experience.

Restraints

The last-mile delivery process, which involves transporting goods from distribution centers to customers’ doorsteps, is often the most expensive and inefficient part of the supply chain. For e-tailers, managing inventory, ensuring accurate stock levels, and coordinating deliveries across a large geographic area can be daunting. Delays in delivery, especially during peak seasons or in remote locations, can lead to customer dissatisfaction and increased operational costs. Consumers today expect fast, affordable, and reliable shipping, and any failure to meet these expectations can result in negative reviews and lost business. Furthermore, the environmental impact of frequent deliveries, including packaging waste and carbon emissions, has come under scrutiny. E-tailers are under pressure to find sustainable and eco-friendly delivery solutions, which can add complexity and costs to their operations. As e-commerce continues to grow, addressing these logistics challenges will remain a key concern for E-tailing solutions.

By Solution

E-commerce platforms dominated the market with a market share of over 35% in 2023. These platforms offer retailers the framework to establish and oversee their online shops, incorporating payment gateways, product listings, customer administration, and shipping resources. Their scalability and compatibility with additional tools have rendered them a favored option for businesses looking to enhance their digital retail activities. Businesses like Shopify and WooCommerce have assisted both small and large retailers in creating and enhancing their online presence smoothly and effectively.

The E-commerce APIs segment is to expand rapidly during 2024-2032 because of the rising demand for businesses to incorporate different features like payment processing, customer data management, and inventory management. APIs facilitate smooth connections among various software and platforms, simplifying the process for businesses to improve their current systems or develop tailored solutions. Rapidly expanding firms such as Elastic Path and Sitecore lead the way by providing customized APIs that assist businesses in incorporating different third-party solutions into their e-commerce platforms.

By End-User

Fashion & Apparel dominated with a 30% market share in 2023 in the e-tailing solutions market. Top companies such as Zalando and ASOS utilize sophisticated e-commerce solutions to provide tailored shopping experiences, immediate stock information, and quick delivery options. Moreover, fashion companies such as Nike and H&M utilize AI and data analysis to enhance customer interaction and improve supply chain efficiency. The incorporation of social media platforms and virtual fitting features has improved the shopping experience, allowing this sector to lead the e-tailing market.

Food & beverages are anticipated to have the fastest growth rate during 2024-2032. Businesses such as Instacart and Amazon Fresh are spearheading this transformation by offering convenient online shopping platforms for grocery and fresh food deliveries. Applications from Walmart and Tesco provide functionalities such as order tracking, product personalization, and quick delivery, enhancing the accessibility of online grocery shopping. The expansion of subscription-based services, like Blue Apron, which provides meal kits, is further enhancing the industry.

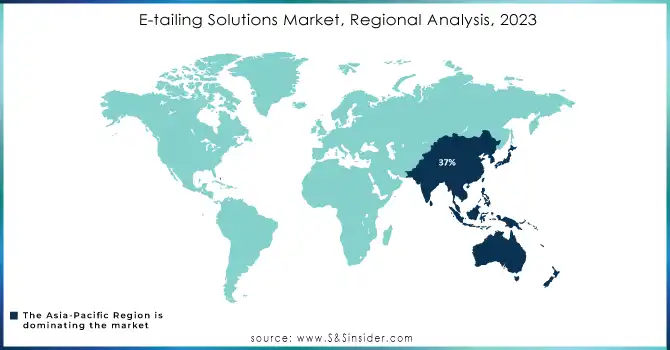

In 2023, Asia-Pacific dominated the e-tailing solutions market, accounting for 37% of the market share, due to swift digital adoption, rising mobile and internet usage, and a strong e-commerce framework. Significant economies such as China, India, and Japan have experienced substantial growth in online retail, due to a growing middle-class demographic and rising disposable income levels. Firms such as Alibaba, JD.com, and Flipkart utilize e-tailing solutions to optimize order processing, manage inventory in real-time, and improve customer experiences.

North America is expected to experience the fastest growth rate in the e-tailing solutions market from 2024 to 2032. Factors driving growth encompass extensive smartphone usage, consumer preferences for the convenience of online shopping, and the technological framework backing sophisticated e-commerce solutions. Major companies such as Amazon, Walmart, and Shopify propel growth by persistently innovating in e-commerce, especially utilizing AR/VR for immersive shopping experiences, AI for predictive analytics, and strong omnichannel integration.

Do You Need any Customization Research on E-tailing Solutions Market - Inquire Now

The major key players in the e-tailing solutions market are:

Shopify Inc. (Shopify Plus, Shopify Payments)

Salesforce.com, Inc. (Salesforce Commerce Cloud, Salesforce Order Management)

Oracle (Oracle Commerce, Oracle CX Cloud)

Digital River, Inc. (Digital River Global Payments, Digital River Monetization)

WooCommerce (WooCommerce Payments, WooCommerce Subscriptions)

BigCommerce Pty. Ltd. (BigCommerce Enterprise, BigCommerce Multi-Storefront)

Adobe (Adobe Commerce, Adobe Experience Manager)

eComchain (eComchain Enterprise, eComchain Marketplace)

Elastic Path Software Inc. (Elastic Path Commerce Cloud, Elastic Path for B2B)

Sitecore (Sitecore Experience Platform, Sitecore Commerce)

Magento (Adobe) (Magento Open Source, Magento Commerce)

PrestaShop (PrestaShop Cloud, PrestaShop Modules)

VTEX (VTEX Commerce, VTEX OMS)

SAP Commerce (SAP Commerce Cloud, SAP Marketing Cloud)

Kibo Commerce (Kibo Commerce Cloud, Kibo OMS)

Lightspeed (Lightspeed Retail, Lightspeed eCommerce)

Zyro (Zyro Website Builder, Zyro E-commerce)

3dcart (Shift4Shop) (3dcart Online Store, 3dcart Payment Gateway)

Volusion (Volusion Online Store, Volusion Analytics)

Big Cartel (Big Cartel Starter, Big Cartel Pro)

Amazon Web Services (AWS) – provides cloud infrastructure and hosting.

Stripe – provides payment gateway services.

PayPal – provides payment solutions for e-commerce transactions.

Square – provides point-of-sale and payment solutions.

Zendesk – offers customer service software.

Microsoft – offers cloud services via Azure, as well as enterprise software like Dynamics 365.

Google Cloud – offers cloud computing solutions.

HubSpot – provides marketing automation and CRM software.

Akeneo – offers Product Information Management (PIM) solutions.

ChannelAdvisor – provides e-commerce channel management software.

March 2023: Shopify Inc. launched Shopify Payments to offer better point-of-sale and payment processing tools for e-commerce businesses.

June 2023: BigCommerce, a prominent Open SaaS e-commerce platform for both rapidly growing and established B2C and B2B brands, has today revealed that it is enhancing its multi-storefront (MSF) capabilities to increase merchants' ability to connect with and sell to consumers no matter their location, language, or currency.

June 2024: Oracle and Shopify are dedicated to improving the customer experience by providing data-driven, integrated commerce solutions. Joint customers can now customize real-time shopping experiences and focused campaigns, alongside utilizing AI-driven recommendations and deals that are likely to engage and enhance conversions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 18.21 Billion |

| Market Size by 2032 | USD 56.27 Billion |

| CAGR | CAGR of 13.39% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Solution (E-commerce Platform, E-commerce APIs, Services) • By End-User (Food & Beverages, Fashion & Apparel, Health & Beauty, Electronics, Automotive, Home & Furniture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Shopify Inc., Salesforce.com, Inc., Oracle, Digital River, Inc., WooCommerce, BigCommerce Pty. Ltd., Adobe, eComchain, Elastic Path Software Inc., Sitecore, Magento, PrestaShop, VTEX, SAP Commerce, Kibo Commerce, Lightspeed, Zyro, 3dcart, Volusion, Big Cartel |

| Key Drivers | • The shift in consumer behavior towards online shopping is a major driver of the E-tailing solutions market. • The rapid growth of internet penetration and smartphone usage has played a crucial role in the rise of E-tailing solutions. |

| RESTRAINTS | • While online shopping offers convenience, delivering products to customers in a timely and cost-effective manner remains a complex task. |

Ans: The E-tailing Solutions Market is expected to grow at a CAGR of 13.39% during 2024-2032.

Ans: E-tailing Solutions Market size was USD 18.21 Billion in 2023 and is expected to Reach USD 56.27 Billion by 2032.

Ans: The shift in consumer behavior towards online shopping is a major driver of the E-tailing solutions market.

Ans: The E-commerce platform segment dominated the E-tailing Solutions Market.

Ans: North America dominated the E-tailing Solutions Market in 2023.

Table of Contents

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.2 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 E-tailing Solutions Operational Efficiency Metrics, by Region (2023)

5.2 E-tailing Solutions Customer Metrics (Historic and Future)

5.3 E-tailing Solutions Competitive Pricing Analysis (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. E-tailing Solutions Market Segmentation, by Solution

7.1 Chapter Overview

7.2 E-commerce Platform

7.2.1 E-commerce Platform Market Trends Analysis (2020-2032)

7.2.2 E-commerce Platform Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 E-commerce APIs

7.3.1 E-commerce APIs Market Trends Analysis (2020-2032)

7.3.2 E-commerce APIs Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3 Services

7.3.1 Services Market Trends Analysis (2020-2032)

7.3.2 Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.3 Professional Services

7.3.3.1 Professional Services Market Trends Analysis (2020-2032)

7.3.3.2 Professional Services Market Size Estimates and Forecasts to 2032 (USD Billion)

7.3.4 Managed Services

7.3.4.1 Managed Services Market Trends Analysis (2020-2032)

7.3.4.2 Managed Services Market Size Estimates and Forecasts to 2032 (USD Billion)

8. E-tailing Solutions Market Segmentation, by End User

8.1 Chapter Overview

8.2 Food & Beverages

8.2.1 Food & Beverages Market Trends Analysis (2020-2032)

8.2.2 Food & Beverages Market Size Estimates and Forecasts to 2032 (USD Billion)

8.3 Fashion & Apparel

8.3.1 Fashion & Apparel Market Trends Analysis (2020-2032)

8.3.2 Fashion & Apparel Market Size Estimates and Forecasts to 2032 (USD Billion)

8.4 Health & Beauty

8.4.1 Health & Beauty Market Trends Analysis (2020-2032)

8.4.2 Health & Beauty Market Size Estimates and Forecasts to 2032 (USD Billion)

8.5 Electronics

8.5.1 Electronics Market Trends Analysis (2020-2032)

8.5.2 Electronics Market Size Estimates and Forecasts to 2032 (USD Billion)

8.6 Automotive

8.6.1 Automotive Market Trends Analysis (2020-2032)

8.6.2 Automotive Market Size Estimates and Forecasts to 2032 (USD Billion)

8.7 Home & Furniture

8.7.1 Home & Furniture Market Trends Analysis (2020-2032)

8.7.2 Home & Furniture Market Size Estimates and Forecasts to 2032 (USD Billion)

8.8 Others

8.8.1 Others Market Trends Analysis (2020-2032)

8.8.2 Others Market Size Estimates and Forecasts to 2032 (USD Billion)

9. Regional Analysis

9.1 Chapter Overview

9.2 North America

9.2.1 Trends Analysis

9.2.2 North America E-tailing Solutions Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.2.3 North America E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.2.4 North America E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.2.5 USA

9.2.5.1 USA E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.2.5.2 USA E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.2.6 Canada

9.2.6.1 Canada E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.2.6.2 Canada E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.2.7 Mexico

9.2.7.1 Mexico E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.2.7.2 Mexico E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3 Europe

9.3.1 Eastern Europe

9.3.1.1 Trends Analysis

9.3.1.2 Eastern Europe E-tailing Solutions Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.1.3 Eastern Europe E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.4 Eastern Europe E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.1.5 Poland

9.3.1.5.1 Poland E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.5.2 Poland E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.1.6 Romania

9.3.1.6.1 Romania E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.6.2 Romania E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.1.7 Hungary

9.3.1.7.1 Hungary E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.7.2 Hungary E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.1.8 Turkey

9.3.1.8.1 Turkey E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.8.2 Turkey E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.1.9 Rest of Eastern Europe

9.3.1.9.1 Rest of Eastern Europe E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.1.9.2 Rest of Eastern Europe E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.2 Western Europe

9.3.2.1 Trends Analysis

9.3.2.2 Western Europe E-tailing Solutions Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.3.2.3 Western Europe E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.4 Western Europe E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.2.5 Germany

9.3.2.5.1 Germany E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.5.2 Germany E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.2.6 France

9.3.2.6.1 France E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.6.2 France E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.2.7 UK

9.3.2.7.1 UK E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.7.2 UK E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.2.8 Italy

9.3.2.8.1 Italy E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.8.2 Italy E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.2.9 Spain

9.3.2.9.1 Spain E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.9.2 Spain E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.2.10 Netherlands

9.3.2.10.1 Netherlands E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.10.2 Netherlands E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.2.11 Switzerland

9.3.2.11.1 Switzerland E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.11.2 Switzerland E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.2.12 Austria

9.3.2.12.1 Austria E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.12.2 Austria E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.3.2.13 Rest of Western Europe

9.3.2.13.1 Rest of Western Europe E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.3.2.13.2 Rest of Western Europe E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.4 Asia-Pacific

9.4.1 Trends Analysis

9.4.2 Asia-Pacific E-tailing Solutions Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.4.3 Asia-Pacific E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.4 Asia-Pacific E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.4.5 China

9.4.5.1 China E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.5.2 China E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.4.6 India

9.4.5.1 India E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.5.2 India E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.4.5 Japan

9.4.5.1 Japan E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.5.2 Japan E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.4.6 South Korea

9.4.6.1 South Korea E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.6.2 South Korea E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.4.7 Vietnam

9.4.7.1 Vietnam E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.2.7.2 Vietnam E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.4.8 Singapore

9.4.8.1 Singapore E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.8.2 Singapore E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.4.9 Australia

9.4.9.1 Australia E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.9.2 Australia E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.4.10 Rest of Asia-Pacific

9.4.10.1 Rest of Asia-Pacific E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.4.10.2 Rest of Asia-Pacific E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.5 Middle East and Africa

9.5.1 Middle East

9.5.1.1 Trends Analysis

9.5.1.2 Middle East E-tailing Solutions Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.1.3 Middle East E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.4 Middle East E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.5.1.5 UAE

9.5.1.5.1 UAE E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.5.2 UAE E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.5.1.6 Egypt

9.5.1.6.1 Egypt E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.6.2 Egypt E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.5.1.7 Saudi Arabia

9.5.1.7.1 Saudi Arabia E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.7.2 Saudi Arabia E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.5.1.8 Qatar

9.5.1.8.1 Qatar E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.8.2 Qatar E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.5.1.9 Rest of Middle East

9.5.1.9.1 Rest of Middle East E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.1.9.2 Rest of Middle East E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.5.2 Africa

9.5.2.1 Trends Analysis

9.5.2.2 Africa E-tailing Solutions Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.5.2.3 Africa E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.2.4 Africa E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.5.2.5 South Africa

9.5.2.5.1 South Africa E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.2.5.2 South Africa E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.5.2.6 Nigeria

9.5.2.6.1 Nigeria E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.2.6.2 Nigeria E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.5.2.7 Rest of Africa

9.5.2.7.1 Rest of Africa E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.5.2.7.2 Rest of Africa E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.6 Latin America

9.6.1 Trends Analysis

9.6.2 Latin America E-tailing Solutions Market Estimates and Forecasts, by Country (2020-2032) (USD Billion)

9.6.3 Latin America E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.6.4 Latin America E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.6.5 Brazil

9.6.5.1 Brazil E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.6.5.2 Brazil E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.6.6 Argentina

9.6.6.1 Argentina E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.6.6.2 Argentina E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.6.7 Colombia

9.6.7.1 Colombia E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.6.7.2 Colombia E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

9.6.8 Rest of Latin America

9.6.8.1 Rest of Latin America E-tailing Solutions Market Estimates and Forecasts, by Solution (2020-2032) (USD Billion)

9.6.8.2 Rest of Latin America E-tailing Solutions Market Estimates and Forecasts, by End User (2020-2032) (USD Billion)

10. Company Profiles

10.1 Shopify Inc.

10.1.1 Company Overview

10.1.2 Financial

10.1.3 Products/ Services Offered

110.1.4 SWOT Analysis

10.2 Salesforce.com, Inc.

10.2.1 Company Overview

10.2.2 Financial

10.2.3 Products/ Services Offered

10.2.4 SWOT Analysis

10.3 Oracle

10.3.1 Company Overview

10.3.2 Financial

10.3.3 Products/ Services Offered

10.3.4 SWOT Analysis

10.4 Digital River, Inc.

10.4.1 Company Overview

10.4.2 Financial

10.4.3 Products/ Services Offered

10.4.4 SWOT Analysis

10.5 WooCommerce

10.5.1 Company Overview

10.5.2 Financial

10.5.3 Products/ Services Offered

10.5.4 SWOT Analysis

10.6 BigCommerce Pty. Ltd.

10.6.1 Company Overview

10.6.2 Financial

10.6.3 Products/ Services Offered

10.6.4 SWOT Analysis

10.7 Adobe

10.7.1 Company Overview

10.7.2 Financial

10.7.3 Products/ Services Offered

10.7.4 SWOT Analysis

10.8 eComchain

10.8.1 Company Overview

10.8.2 Financial

10.8.3 Products/ Services Offered

10.8.4 SWOT Analysis

10.9 Elastic Path Software Inc.

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

10.10 Sitecore

10.9.1 Company Overview

10.9.2 Financial

10.9.3 Products/ Services Offered

10.9.4 SWOT Analysis

11. Use Cases and Best Practices

12. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

Key Segmentation

By Solution

E-commerce Platform

E-commerce APIs

Services

Professional Services

Managed Services

By End-User

Food & Beverages

Fashion & Apparel

Health & Beauty

Electronics

Automotive

Home & Furniture

Others

Request for Segment Customization as per your Business Requirement: Segment Customization Request

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of the Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Request for Country Level Research Report: Country Level Customization Request

Available Customization

With the given market data, SNS Insider offers customization as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

Criss-Cross segment analysis (e.g. Product X Application)

Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

Additional countries in any of the regions

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The Cinema Camera Market was valued at USD 16.58 Million in 2023 & is expected to reach USD 28.72 Million by 2032, growing at a CAGR of 6.34% by 2024-2032.

The Architectural Services Market Size was valued at USD 374.45 Billion in 2023 and is expected to reach USD 709.52 Billion by 2032 and grow at a CAGR of 7.41% over the forecast period 2024-2032.

The Network Security Market was valued at USD 22.2 billion in 2023 and is expected to reach USD 79.7 billion by 2032, growing at a CAGR of 15.29% by 2032.

The Digital Content Creation Market Size was valued at USD 29.34 Billion in 2023 and will reach USD 90.23 Billion by 2032 and grow at a CAGR of 13.37% by 2032.

Network Attached Storage Market was worth USD 31.71 billion in 2023 and is predicted to be worth USD 109.72 billion by 2032, growing at a CAGR of 14.82% between 2024 and 2032.

The Immersive Training Market was valued at USD 13.2 Billion in 2023 and is expected to reach USD 128.0 Billion by 2032, growing at a CAGR of 28.79% from 2024-2032.

Hi! Click one of our member below to chat on Phone