E-Pharmacy Market Report Scope & Overview:

Get More Information on E-Pharmacy Market - Request Sample Report

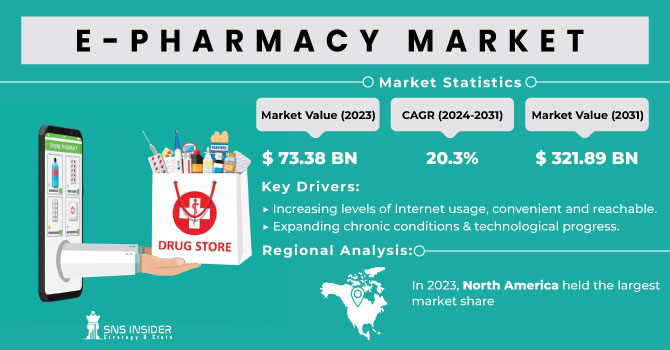

The E-Pharmacy Market size was estimated at USD 73.38 billion in 2023 and is expected to reach USD 321.89 billion by 2031 with a growing CAGR of 20.3% during the forecast period of 2024-2031.

An increase in tech-savvy consumers, improved digitalization of healthcare services, and increased internet penetration globally are the main factors propelling market expansion. The rise is also being fuelled by consumers who prioritise convenience and choose online shopping. The entire increase is anticipated to be fuelled by the healthcare sector's expanding usage of digital technologies and e-commerce. Venture capitalist Mark Cuban launched a digital pharmacy in January 2022 that provides more than 100 generic pharmaceuticals at a price that is entirely transparent. Chronically ill patients from nuclear families and patients who are unable to leave their homes benefit from the easier access offered by e-pharmacy. The industry is also predicted to grow as the number of seniors increases. A number of variables, such as convenience of use, increased digitalization, and an increase in Medicare enrollments, are contributing to the surge.

DRIVERS

-

Increasing levels of Internet usage, convenient and reachable.

-

Expanding chronic conditions & technological progress.

E-pharmacy has become more popular as a result of increased global internet usage and accessibility, which allows customers to simply buy prescriptions online. E-pharmacies draw busy people and people with restricted mobility since they provide 24/7 accessibility, doorstep delivery, and ease when ordering drugs. Globally, the prevalence of chronic ailments including diabetes, heart disease, and respiratory problems has grown, which is fueling demand for medicines and expanding the e-pharmacy business.

RESTRAIN

-

Regulatory obstacles Access to healthcare is restricted by opposition to change.

OPPORTUNITY

-

Expansion of the product line Integration of telemedicine Strategic alliances ageing population expanding

CHALLENGES

-

Maintaining client confidence and Logistics for last-mile deliveries.

-

Cost and pricing competition, Data privacy and security.

The validity and quality of the drugs, the availability of secure payment methods, and the rapid resolution of client complaints are all ways that e-pharmacy businesses may establish and maintain consumer confidence. Successful last-mile distribution of drugs requires efficiency and promptness. It's crucial to address logistical issues, including coverage of rural areas and transportation congestion. Since there is a lot of rivalry in the e-pharmacy market, pricing methods must be carefully maintained to preserve profitability and stay competitive.

IMPACT OF RUSSIA-UKRAINE WAR

The supply chains for pharmaceutical items may be disrupted if the war intensifies and results in geopolitical tensions or trade restrictions. The availability of pharmaceuticals is strongly dependent on the efficiency of the supply chain for e-pharmacies. Any supply chain hiccups might cause delays or drug shortages, which would have an effect on the e-pharmacy sector. Governments may impose additional rules or limitations on international trade, including pharmaceutical items, during periods of geopolitical unrest. The operations of E-Pharmacy businesses may be impacted by these regulatory developments, especially those that depend on overseas sourcing and delivery. E-pharmacies may have difficulties adhering to new laws and reacting to requirements that change.

Healthcare systems, including hospitals and traditional brick-and-mortar pharmacies, can be severely strained during armed situations. E-Pharmacy may be quite helpful in such circumstances in ensuring the continuity of pharmaceutical supply and healthcare services. People may turn to e-Pharmacy platforms more frequently as they look for alternatives to traditional pharmacies that are harmed by the conflict. The digital infrastructure needed for E-Pharmacy operations may be impacted if the war damages communication networks or infrastructure.

IMPACT OF ONGOING RECESSION

Recessions can prompt individuals to change their consumption patterns and seek more value-driven options. E-Pharmacy platforms that offer competitive pricing, generic alternatives, and loyalty programs may attract consumers looking to stretch their healthcare budget. E-Pharmacy companies that can effectively communicate their value proposition and cost-saving advantages may experience increased market share. Potential decrease in non-essential purchases during a recession, consumers may prioritize essential medications and reduce spending on non-urgent healthcare items, such as over-the-counter products and supplements. E-Pharmacy platforms that heavily rely on sales of non-essential healthcare items may face challenges in maintaining revenue levels.

REGIONAL ANALYSES

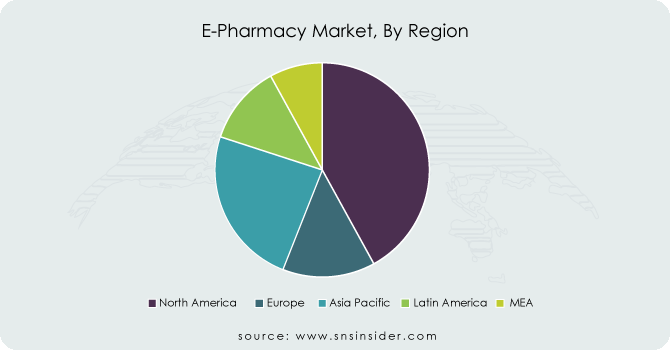

In 2023, North America held the largest market share. A few of the key factors influencing the expansion of the regional market are the rising acceptance of e-commerce, the rising elderly population, rising online sales, expanded healthcare infrastructure, and a favourable attitude towards the adoption of new technologies. Additionally, ePharmacy and the growing tendency towards the direct-to-patient model of Americans. A sizeable portion of the worldwide online pharmacy market is located in Europe. Due to the expanding elderly population, rising incidence of chronic illnesses, quick e-commerce expansion, and well-developed IT infrastructures, the e-Pharmacy market in Europe is predicted to grow throughout the projected period.

The region with the fastest CAGR is expected to be Asia-Pacific throughout the forecast period. Emerging economies like China and India have significant potential for growth because of their massive populations and rising government initiatives promoting the use of digital technologies. Because more public and private companies are taking strategic initiatives, it is anticipated that the market in Asia Pacific will grow faster in the next few years.

Do You Need any Customization Research on E-Pharmacy Market - Enquire Now

Key Players:

The major players are Kroger Co., Walgreen Co., Giant Eagle, Inc., Walmart, Inc., Express Scripts Holding Company, CVS Health, Optum Rx, Inc., Rowlands Pharmacy, DocMorris (Zur Rose Group AG), Cigna Corporation (Express Scripts Holdings), Amazon.com Inc., Axelia Solutions (Pharmeasy), Apex Healthcare Berhad (Apex Pharmacy), Apollo Pharmacy, Netmeds and others.

RECENT DEVELOPMENTS:

Amazon: Amazon announced its intention to start selling prescription drugs online in Japan in September 2022. It aims to collaborate with small and medium-sized pharmacies to offer a platform where users may receive online medicine administration instructions. Customers might have their medications delivered to their homes without going to a drugstore.

Walmart, Inc: Walmart Canada and Canada Health Infoway partnered in September 2022. 14 Walmart Canada pharmacies in Ontario, Alberta, Saskatchewan, and New Brunswick now have access to Infoway's PrescribeIT electronic prescription service, with plans to add more sites by the end of the year.

| Report Attributes | Details |

| Market Size in 2023 | US$ 73.38 Bn |

| Market Size by 2031 | US$ 321.89 Bn |

| CAGR | CAGR of 20.3% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Drug type (Prescription drug, Over-the-counter drug) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Kroger Co., Walgreen Co., Giant Eagle, Inc., Walmart, Inc., Express Scripts Holding Company, CVS Health, Optum Rx, Inc., Rowlands Pharmacy, DocMorris (Zur Rose Group AG), Cigna Corporation (Express Scripts Holdings), Amazon.com Inc., Axelia Solutions (Pharmeasy), Apex Healthcare Berhad (Apex Pharmacy), Apollo Pharmacy, Netmeds |

| Key Drivers | • Increasing levels of Internet usage, convenient and reachable. • Expanding chronic conditions & technological progress. |

| Market Restraints | • Regulatory obstacles Access to healthcare is restricted by opposition to change. |