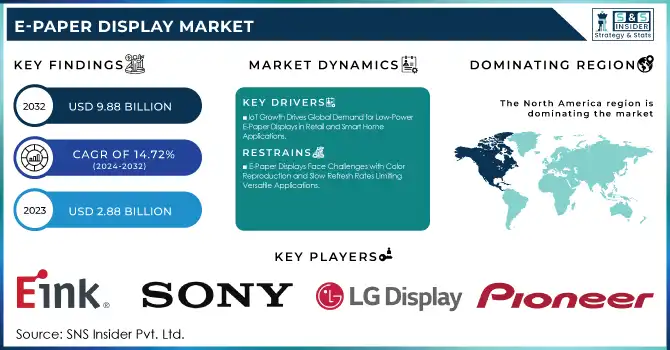

E-PAPER DISPLAY MARKET KEY INSIGHTS:

The E-Paper Display Market Size was valued at USD 2.88 Billion in 2023 and is expected to reach USD 9.88 Billion by 2032 and grow at a CAGR of 14.72% over the forecast period 2024-2032. The E-Paper Display market growth is mainly driven by the high demand for energy-efficient and eco-friendly display technologies. E-Paper devices draw way less power than standard LCD and OLED displays, which makes them great for devices like e-readers and wearables that rely on batteries. That leads to longer life batteries on the devices, and also an advantage for the consumers that care about green technology options.

To Get More Information on E-Paper Display Market - Request Sample Report

Moreover, the readability feature of technology under direct sunlight gives a boost to the overall user experience, which contributes towards its deployment across different sectors. E-Paper Displays use approximately 0.5 watts per hour, much lower than for LCDs, which can easily exceed 5W. E-paper e-readers represent more than 60% of the e-reader market as of 2023, as users prefer their longer battery life and better reading comfort. Equally impressive, E-Paper also shines when it comes to sunlight readability by obtaining contrast ratios of greater than 20:1 in daylight.

In addition, the retail space has adopted E-Paper Displays, especially Electronic Shelf Labels (ESLs), This enables them to practice dynamic pricing with their itinerary, adjust inventory, and reduce labor costs by making the process more efficient. The easy update of pricing and product information digitally means retailers have a leg up as it helps increase customer engagement and reduces paper label waste. In 2023, more than 40,000 retail stores around the world integrated Electronic Shelf Labels into their systems to facilitate their digital prices and inventory updates. Automation of price changes reduced labor costs for retailers from 25%, while dynamic pricing using ESL has resulted in a sales growth impact of up to 15% per item through the adjustment of prices based on demand and inventory levels. The increasing need for such innovations across industries integrating utility along with eco-friendliness is expected to bolster industry growth for e-paper displays.

MARKET DYNAMICS

KEY DRIVERS:

-

IoT Growth Drives Global Demand for Low-Power E-Paper Displays in Retail and Smart Home Applications

The growth of the Internet of Things and smart devices serves as one of the most significant factors accelerating the rise in demand for E-Paper Displays across the globe. With the ever-increasing number of connected devices, comes a demand for both low-power displays whilst also ensuring information is displayed in an intelligible fashion across multiple environments. Smart home and smart retail applications, where real-time updates and notifications matter, E-Paper Displays are well-suited. These find applications in smart labels, signage, or wearables that allow data to be communicated between these devices and end users. Worldwide, more than 14 billion IoT devices connected in 2023 and many of these products utilize low-power display technologies such as E-Paper for applications where permanent power is not feasible. IoT-ready E-Paper Displays, such as electronic shelf labels and digital signage in retail proved to speed up price and inventory updates by 85% compared with traditional monitoring methods. It will further create opportunities for E-Paper towards heightened adoption, as industries implement IoT-based solutions to improve overall operational efficiency.

-

E-Paper Display Fuel Digital Transformation in Retail Education and Healthcare with High Efficiency and Low Power

The rising demand for digital transformation across industries such as retail, education, and healthcare has emerged as a significant driver. From unique display solutions to contemporary operations, businesses perpetually want to embrace a streamlined form of functions through an outclass experience for their customers. As an example, retailers employ E-Paper Displays for dynamic pricing strategies as they can instantly change prices depending on the demand in the market or inventory levels. In education in the guise of e-power books and e-learning gadgets, this technology is providing a captivating alternative to printed text on a white page. Retail stores have widely adopted E-Paper Displays, with some chains deploying more than 10,000 electronic shelf labels in the same store which can enhance operational efficiency by as much as 25% via reduced manual labor and rapid response on price updates. E-Paper devices reduced power usage by 35% versus traditional tablets, increasing screen time and more than 60% prefer E-Paper to other tablet screens due to less eye fatigue and lower glare. Some examples are in healthcare where E-Paper signage has a life of 5 years on a single charge and is therefore ideal for stable displays within medical institutions.

RESTRAIN:

-

E-Paper Displays Face Challenges with Color Reproduction and Slow Refresh Rates Limiting Versatile Applications

A major limitation is the currently inferior color reproduction capabilities of E-Paper technology versus LCDs and OLEDs. Although color E-Paper displays have been developed, they rarely display the same level of brightness and detail as other types of display technologies limiting their use in applications that require high-fidelity visual content. Such a limitation may repel prospective consumers in verticals like advertisements and media, where visual character is the priority. Another hurdle is the sluggish refresh rates that accompany E-Paper Displays. While E-Paper is a (low power) technology that can be used to show images or scenes, it is not an ideal solution as fast-moving images such as video playback or graphics with high-frame rates will only work poorly due to the slowness of its response time compared to LCD and OLEDs. This constraint can confine the applications from utilizing E-Paper displays thus limiting access to different markets and may delay overall market expansion.

KEY SEGMENTATION ANALYSIS

BY TYPE

E-readers held the largest share of 39% in 2023 E-Paper Display owing to their ever-increasing popularity as portable reading devices that provide a user-friendly experience. Leveraging the benefits of long battery life, decreased eye strain, and impeccably great readability in direct sunlight, E-Readers entice consumers looking for a viable alternative to paper. E-readers have cemented their place in the market with further penetration of e-books and digital reading material catering to students, professionals, and voracious readers. This trend is backed up by the ongoing innovation in the area of E-Paper technology, improving display performance and capabilities.

Electronic Shelf Labels are projected to register the fastest CAGR during 2024–2032, owing to the increasing need for smart retail systems. With Electronic Shelf Labels, retailers can dynamically control pricing and product information, optimizing operational efficiency, and minimizing the cost of transaction labor caused by manual price changes. With retailers increasingly adapting to personalized pricing and real-time updates to improve customer experiences, the rate of ESL implementation is predicted to increase sharply by 2025. The rise in focus on sustainability and reduction of paper waste is another factor driving the use of ESLs, making it a perfect fit for 21st-century stores.

BY APPLICATION

Consumer and Wearable Electronics held a significant share in the E-Paper Display market, accounting for nearly 43% in 2023, and is estimated to be the fastest-growing application segment during the forecast period from 2024 to 2032. The prominent share is due to the rise of smart devices such as fitness trackers, smartwatches, and other wearables incorporating emerging technologies that work on E-Paper Displays for their energy efficiency and visibility. E-Paper technology consumes very little power, so it can be powered by a low-power battery for an extended period, making it suitable when long-lasting performance without recharging is needed frequently.

Moreover, growing health awareness among consumers and increasing disposable income in developing regions has invoked healthy technology devices therefore providing ample opportunity to E-Paper Display buyers in this segment. In addition, the trend of smart home devices and IoT applications is driving the demand for E-Paper Displays in consumer electronics. These displays deliver clear visuals under different ambient light conditions and can be integrated into devices such as smart labels, home automation panels, and more to provide data. The deployment of E-Paper across consumer and wearable electronics will be fueled over the next few years by advancements in E-Paper technology innovation, which have created new opportunities for A4–AD-based applications.

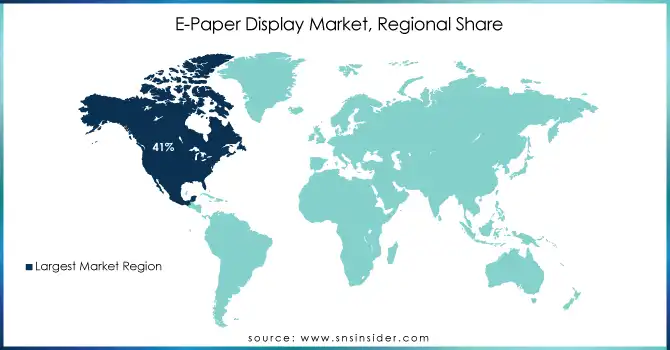

REGIONAL ANALYSIS

In 2023, North America held the greatest share of the E-Paper Display market at 41%. This dominance is mainly due to the developed technological infrastructure and high consumer demand for innovative electronic devices in the region. A prime example is that of E-Paper Displays popular for use in e-readers, especially within Amazon Kindle devices. The Kindle has greatly impacted the reading lifestyle in the region offering easy and seamless access to books for consumers through its vast digital book library. Moreover, North America is also expected to dominate the global market for E-Paper due to the rapid adoption of Electronic Shelf Labels (ESLs) by major retail chains in this region.

The Asia Pacific region is anticipated to witness the fastest CAGR during the forecast period of 2024 to 2032, mainly due to rapid urbanization and increased penetration of smart technologies. This trend is led by Nations like China and Japan, which invest heavily in smart devices and IoT solutions. The implementation of e-paper displays in consumer electronics including smart wearables and digital signage to facilitate energy efficiency and exceptional user experience are some major examples among others. In addition, the increasing focus on sustainable solutions in retail spaces is further driving ESL adoption in Asia Pacific as businesses are also aware that this technology offers paper waste reduction along with operational efficiency. The increasing prominence of home automation devices is a clear representation of the movement towards the smart age, thus providing a potential growth opportunity for the E-Paper Display Market in this region during the assessment years.

Do You Need any Customization Research on E-Paper Display Market - Inquire Now

Key Players

Some of the major players in the E-Paper Display Market are:

-

E Ink Holdings (E Ink Carta, E Ink Mobius)

-

Sony Corporation (Digital Paper, DPT Series)

-

LG Display (Flexible E-Paper Display, E-Paper Module)

-

Pervasive Displays (E-Paper Display Module, EPD Controller)

-

Plastic Logic (Flexible E-Paper Displays, QVGA Display)

-

CLEARink Displays (Bistable E-Paper Display, Interactive E-Paper)

-

Visionect (Joan, Visionect E-Paper Platform)

-

OED Technologies (E-Paper Display Solutions, E-Ink Displays)

-

Tianma Microelectronics (E-Paper Display, Low Power E-Paper)

-

Hanvon Technology (E-Reader, E-Paper Display Tablet)

-

Witdisplay (E-Paper Module, E-Ink Display)

-

E Ink Corporation (E Ink Pearl, E Ink Kaleido)

-

Reed Exhibitions (Smart E-Paper Display, Event Notification Displays)

-

Glo E-Paper (Smart E-Paper, Digital Signage)

-

Pioneer (E-Paper Reader, E-Paper Display)

-

Shenzhen Teyang Technology (E-Paper Solutions, Digital Shelf Labels)

-

Dai Nippon Printing (E-Paper for Signage, Retail Displays)

-

Kyocera Corporation (E-Paper Displays, E-Paper Sensors)

-

Avi-on (Smart E-Paper Display, Interactive E-Paper)

-

Pikachu Technologies (Wearable E-Paper Displays, E-Ink Products)

Some of the Raw Material Suppliers for E-Paper Display Companies:

-

Merck KGaA

-

BASF SE

-

Hodogaya Chemical Co., Ltd.

-

Huntsman Corporation

-

DIC Corporation

-

E Ink Holdings

-

Nippon Steel Chemical & Material Co., Ltd.

-

Toppan Printing Co., Ltd.

-

Showa Denko K.K.

-

Toshiba Materials Co., Ltd.

RECENT TRENDS

-

In June 2024, Samsung launched a new professional full-color e-paper display for digital signage, featuring ultra-low power consumption. The first model is an ultra-thin 32-inch screen, highlighting the company's focus on energy-efficient display technology.

-

In October 2024, PocketBook unveiled its new e-note device, the PocketBook Color Note, shortly after launching the PocketBook InkPad EO with a similar 10.3-inch Kaleido 3 display. This addition highlights PocketBook's commitment to enhancing its e-reader lineup.

-

In October 2024, BOOX launched its latest e-paper tablet, featuring the Go 10.3, which is lighter and thinner than the 2024 iPad Pro, ideal for note-taking. The thicker 7 model is the first in the series with a color display, designed for reading and using Android 12 apps on the go.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.88 Billion |

| Market Size by 2032 | USD 9.88 Billion |

| CAGR | CAGR of 14.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Auxiliary Display, Electronic Shelf Labels, E-Readers, Others) • By Application (Consumer and Wearable Electronics, Institutional, Media and Entertainment, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | E Ink Holdings, Sony Corporation, LG Display, Pervasive Displays, Plastic Logic, CLEARink Displays, Visionect, OED Technologies, Tianma Microelectronics, Hanvon Technology, Witdisplay, E Ink Corporation, Reed Exhibitions, Glo E-Paper, Pioneer, Shenzhen Teyang Technology, Dai Nippon Printing, Kyocera Corporation, Avi-on, Pikachu Technologies |

| Key Drivers | • IoT Growth Drives Global Demand for Low-Power E-Paper Displays in Retail and Smart Home Applications • E-Paper Displays Fuel Digital Transformation in Retail Education and Healthcare with High Efficiency and Low Power |

| Restraints | • E-Paper Displays Face Challenges with Color Reproduction and Slow Refresh Rates Limiting Versatile Applications |