E-commerce Logistics Market Report Scope & Overview:

Get More Information on E-commerce Logistics Market - Request Sample Report

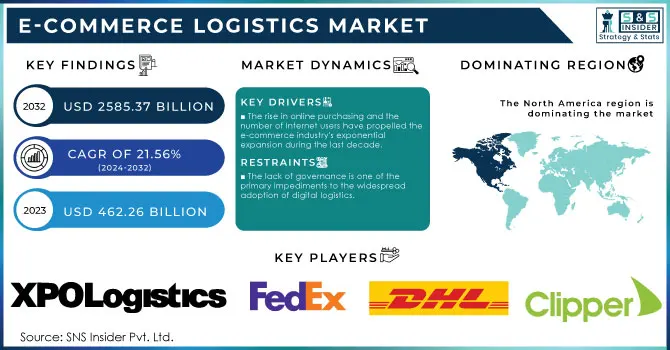

In 2023, the E-Commerce Logistics Market Size was valued at USD 462.26 billion. It is projected to grow significantly to USD 2585.37 billion by 2032, achieving a robust compound annual growth rate (CAGR) of 21.56% during the forecast period

The global e-commerce logistics sector has been changed by the ramifications of e-commerce websites and the availability of low-cost shipping. Furthermore, the popularity of C2C and B2C e-commerce websites has increased demand for international and local e-commerce logistics. The adoption rate of E-commerce Logistics Services has grown as digital technology has advanced. Factors driving market expansion include the emergence of cross-border e-commerce, sales of international goods, and increased internet usage, particularly in emerging nations.

During the forecast period, the booming e-commerce industry is expected to have a significant influence on market growth. Furthermore, in recent years, stronger interactions between suppliers and customers have supported market expansion. Regulatory difficulties, on the other hand, are likely to stifle market expansion throughout the projection period. With the changing principles of product distribution and technological improvements, supply chain solutions are being adapted to meet the needs of users. Furthermore, business analytics has aided logistics experts in speeding up and improving the efficiency of work operations.

MARKET DYNAMICS

KEY DRIVERS

-

The rise in online purchasing and the number of Internet users have propelled the e-commerce industry's exponential expansion during the last decade.

-

Because of the increase in e-commerce activity, logistics providers must work faster and more efficiently to execute tiny individual requests.

-

Customers anticipate accurate orders, same-day or same-hour shipping, and return policies when ordering online

RESTRAINTS

-

The lack of governance is one of the primary impediments to the widespread adoption of digital logistics.

-

The logistics industry's high levels of fragmentation need the creation of a logistics IoT standard.

OPPORTUNITIES

-

Putting self-driving trucks in shared and public places like highways and city streets might be the industry's next great step, helping to improve logistical operations and safety.

-

Self-driving vehicles can assist to revolutionize the way vehicles are manufactured, driven, employed, and maintained thanks to increasing technological developments in AI and increased substantial expenditures in the development of sensors and vision technologies.

CHALLENGES

-

The digitization of logistics processes necessitates significant capital expenditures, including the installation of automation equipment, software, and solutions. Existing procedures are highly expensive to replace.

-

Another issue impeding the growth of the digital logistics industry is the delayed adoption of many IoT platforms, numerous protocols, and a large number of APIs due to integration challenges.

IMPACT OF COVID-19

The COVID-13 epidemic has boosted the expansion of the e-commerce logistics sector, since e-commerce logistics enables businesses to meet the supply chain's high-capacity demand. COVID-13 has impacted communities all across the world, and governments and businesses are attempting to respond as quickly as possible to the pandemic's problems. However, beginning in the first quarter of 2020, the COVID-13 pandemic caused an uneven health scenario, with strong restrictions imposed over the world to maintain social separation and lockdown. As a result, in order to limit the pandemic, the majority of economies have implemented a total shutdown, resulting in a drop in corporate activities. The manufacturing and transportation sectors have been badly hit, causing massive supply chain disruptions. This epidemic, on the other hand, has accelerated the expansion of the e-commerce logistics industry, which is predicted to double in size during the forecast period.

MARKET ESTIMATION

In 2023, the international sector dominated the E-Commerce Logistics Market Share depending on the operational area, and this trend is projected to continue over the forecast period. Depending on the operational area, the domestic sector accounted for the biggest share in 2023, and this trend is likely to continue throughout the projection period. SMEs choose online trading to drive and diversify their exports in order to expand their market share and client base. By facilitating online presence and accessibility to worldwide consumers, this aids in enhancing societal advantages. Domestic e-commerce opens up a world of possibilities for small businesses and individuals interested in trade, lowering purchasing prices and increasing sales in both developed and developing nations. The domestic e-commerce logistics business benefits from this. However, in the next years, the domestic market is likely to increase the most.

KEY MARKET SEGMENTATION

By Service Type

-

Transportation

-

Warehousing

By Operational Area

-

International

-

Domestic

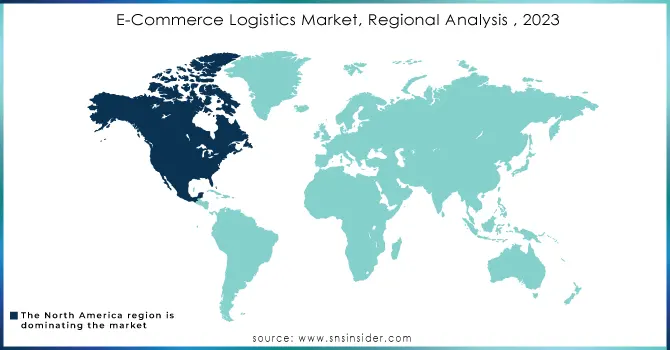

REGIONAL ANALYSIS

North America is made up of industrialized economies like the United States and Canada. One of the greatest contributors to the digital logistics business is North America. The presence of significant IT businesses and rapid technical breakthroughs, such as digitalization in the United States and Canada, are driving market expansion in this area. These nations' well-established economies allow them to spend extensively in cutting-edge digital logistics technologies and services. The backbone of the North American economy is commercial transportation and logistics. The digital logistics industry in North America is growing at a modest pace, thanks to factors such as regulatory changes such as the Compliance, Safety, and Accountability (CSA) Act and Hours of Service Solution (HOS) adjustments. The top three fastest expanding verticals are retail, utilities, and services, all of which are contributing to the adoption of digital logistics solutions.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

-

North America

-

USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

KEY PLAYERS

The Major Players are FedEx Corporation, PO Logistics, Inc., DHL International GmbH, Agility Public Warehousing Company K.S.C.P., Ceva Holdings LLC,Gati Limited, United Parcel Service, Inc., Clipper Logistics Plc., Kenco Group, Inc., Aramex International and Other Players.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 462.26 Billion |

| Market Size by 2032 | US$ 2587.37 Billion |

| CAGR | CAGR 21.56% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Service Type (Transportation, Warehousing) • by Operational Area (International, Domestic) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, +D11UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | FedEx Corporation, PO Logistics, Inc., DHL International GmbH, Agility Public Warehousing Company K.S.C.P., Ceva, Holdings LLC,Gati Limited, United Parcel Service, Inc., Clipper Logistics Plc., Kenco Group, Inc., Aramex International and Others. |

| Key Drivers | • Customers anticipate accurate orders, same-day or same-hour shipping, and return policies when ordering online |

| Market Opportunities | • Putting self-driving trucks in shared and public places like highways and city streets might be the industry's next great step, helping to improve logistical operations and safety. |