E-Cigarette Market Report & Overview:

The E-Cigarette Market size was valued at USD 23.28 billion in 2023 and is expected to grow to USD 37.36 billion by 2032 and grow at a CAGR of 5.40 % over the forecast period of 2024-2032.

Get E-PDF Sample Report on E-Cigarette Market - Request Sample Report

Several trends are pushing this growth, not least of which is changing consumer attitudes, given that many conventional smokers are making the switch to e-cigarettes for reduced health risks and increased convenience. Regulatory impacts are another key player, especially with municipal governments across several regions embracing guidelines that support or limit market growth. In addition, increasing knowledge of disposal and recycling trends is impacting consumer behavior, compelling manufacturers to embrace more sustainable operations. All these points shed light on the taste of the everchanging e-cigarette market, pointing to the necessity brands have to adapt to moving consumer expectations and regulatory structures.

E-Cigarette Market Dynamics:

Drivers:

-

Flavor Variety as a Catalyst for E-Cigarette Market Growth among Young Consumers.

Flavor variety is a pivotal driver in the e-cigarette market, particularly among younger adults seeking alternatives to traditional tobacco products. Research indicates that the diverse range of flavors significantly enhances e-cigarette appeal, with 84.9% of current users preferring flavored options, particularly fruit and candy flavors. The Centers for Disease Control and Prevention (CDC) reports that a majority of e-cigarette users are adolescents and young adults, with 2.55 million middle and high school students currently using e-cigarettes. The FDA’s 2020 ban on certain flavored products has redirected consumers towards disposable devices, which now dominate sales. Additionally, younger users are more likely to initiate vaping due to appealing flavors, believing fruit-flavored e-cigarettes are less harmful than traditional tobacco flavors. This dynamic underscores the importance of flavor innovation in the e-cigarette market while navigating regulatory challenges to align with consumer preferences.

Restraints:

-

Consumer confidence in the e-cigarette market is significantly impacted by growing health concerns.

Health concerns are a major constraint in the e-cigarette market, as growing awareness of possible dangers discourages people from using them. Studies emphasize adverse health effects associated with e-cigarette consumption, including nicotine dependency and pulmonary complications. "When young people are using e-cigarettes they can underestimate the addictive nature of nicotine, especially when they are taking a high dose of nicotine in the form of e-cigarette," he said. With reports of respiratory ailments and serious health events related to vaping sounding alarms among public health officials, consumer confidence has slid, too. With prospective users increasingly health and wellness-conscious, many avoid e-cigs, with concerns of addiction and respiratory risks assuredly lurking. As a result, this increased awareness puts pressure on the industry to change for the better, promoting safety and responsible advertising practices in order to restore consumer confidence and promote sustainable growth in the e-cigarette industry.

Opportunities:

-

Leveraging Market Growth and Consumer Trends in the E-Cigarette Market

Expanding product offerings in the e-cigarette market presents a significant opportunity to attract diverse consumer segments and adapt to changing preferences. Innovative flavors and formulations can engage various demographics, particularly younger adults seeking alternatives to traditional tobacco products. Research shows that flavor variety significantly influences e-cigarette usage, with a notable preference for fruity and dessert flavors among users. As regulations tighten, manufacturers can seize the opportunity to develop compliant products that meet consumer demands while ensuring safety and quality. Retail environments, both physical and online, serve as key advertising platforms for e-cigarettes, significantly impacting youth exposure. Data indicates that 68.6% of young adults reported past 30-day e-cigarette advertising/media exposure—most commonly seen on social media (43.4%) and at retailers (31.7%)—with e-cigarette advertising exposure associated with e-cigarette use. Moreover, young adults most frequently purchased e-cigarettes via vape shops and online, with 68% exposed to advertising at retailers and 41% online. After cigarettes, e-cigarettes are the most highly advertised tobacco product in stores.

Challenges:

-

Navigating Safety and Quality Challenges in the E-Cigarette Market

Due to the changing nature of regulations, ensuring product safety and quality continues to be a serious challenge for e-cigarette manufacturers. As regulatory bodies are paying more attention to consumer health, challenging compliance requirements are weighing on manufacturers' shoulders while ensuring quality products. Plus, the need to build and keep consumer trust, which is the foundation of customer loyalty and, ultimately, market success. Complaints about poor quality and unsafe products can result in negative publicity and reduced sales. It falls to manufacturers to institute rigorous quality control protocols and clear labeling practices to ensure consumers feel confident in the safety of their products. Furthermore, innovation in the industry is evolving at an unprecedented pace, forcing companies to continuously adapt their processes to comply with new regulations while safeguarding product integrity.

E-Cigarette Market Segment Analysis:

By Product

The rechargeable segment of the e-cigarette market has emerged as a dominant force, accounting for approximately 50% of the market share in 2023. There are various reasons for this growth, such as the increasing consumer demand for sustainability and cost-efficiency. Unlike disposable e-cigarettes, which are thrown away after use, rechargeable e-cigarettes are reusable and more cost-effective, as they enable the use of advanced battery technology and can be used many times. Moreover, such devices tend to offer better specifications, such as improved battery life and settings customization that cater to a wider audience, especially among technology enthusiasts. Increasing awareness of environmental issues has also contributed to the growth of this market, as consumers look to minimize waste generated by single-use consumer goods. As a result, this segment is likely to thrive in the following years.

The modular devices segment of the e-cigarette market is poised for rapid growth during the forecast period from 2024 to 2032. This growth is mainly driven by the growing consumer need for customization and personalization, which allows users to modify device settings and swap out components. For this reason, modular devices allow users to customize their individual vaping experience, which can lead to greater satisfaction and user engagement. In addition, as technology progresses and the performance of security features improves, these devices are increasingly available and attractive to both new and experienced vapers. This advance is projected to spur extensive market growth, making modular devices a major force in the E-Cigarette Market.

By Distribution Channel

The retail segment of the e-cigarette market is the dominant player, accounting for approximately 60% of the total market share in 2023. This substantial presence can be attributed to the widespread availability of e-cigarettes through various retail channels, including convenience stores, specialty vape shops, and online platforms. Retail environments provide consumers with immediate access to a diverse range of products, including different flavors, device types, and nicotine concentrations, catering to a broad spectrum of preferences. Furthermore, retail locations serve as significant venues for advertising, especially among younger demographics, influencing purchase decisions. As regulations evolve and marketing strategies adapt, the retail segment is likely to remain a critical driver of growth in the e-cigarette market, facilitating brand exposure and consumer engagement.

The online segment of the e-cigarette market is poised to experience rapid growth over the forecast period from 2024 to 2032. The industry has experienced this rapid growth due to the growing consumer preference for online shopping, especially among younger generations who value convenience and a broader range of product offerings. The easy availability of multiple e-cigarettes brands, flavors and devices on e-commerce platforms, along with promotional offers and deals, serves to make consumers more appetitive. And the anonymity of ordering online may encourage some who otherwise might be hesitant to buy e-cigarettes in brickand-mortar stores. Increasing internet penetration and growing number of digital payment options will continue to broaden the online segment, as it will capture a significant share in the market, thereby facilitating sales and increasing consumer engagement.

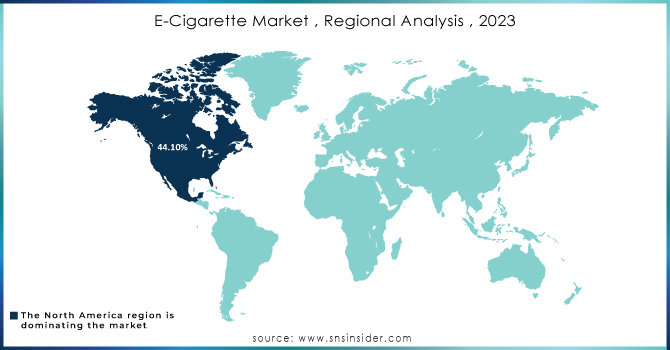

E-Cigarette Market Regional Analysis:

The North America region dominates the E-Cigarette Market, representing approximately 50% of total revenue in 2023. This substantial share is driven by high e-cigarette usage rates among adults, particularly among younger consumers looking for alternatives to traditional tobacco products. A well-established retail infrastructure, including a plethora of vape shops and online platforms, ensures easy access to diverse e-cigarette brands and flavors, further fueling demand. Moreover, innovations in product development, such as modular devices and unique flavor formulations, cater to evolving consumer preferences. Countries like the United States and Canada implement regulations that promote harm reduction, enhancing market growth. The U.S. stands out for its extensive advertising and marketing strategies, significantly boosting awareness and consumption. While regulatory challenges and health concerns regarding e-cigarette use pose potential obstacles, North America's adaptability to changing consumer dynamics will likely sustain its leadership position in the global e-cigarette market.

The Asia Pacific region is poised to be the fastest-growing segment in the E-Cigarette Market during the forecast period from 2024 to 2032. A few factors, such as rapid urbanization, increasing disposable incomes, and growing awareness of alternative nicotine delivery systems in consumers, are responsible for this very rapid growth. Countries such as China, Japan, and India are seeing a major shift toward e-cigarettes as a less damaging alternative to traditional smoking, especially among the youth. In addition, the growth of domestic producers and the release of novel offerings suitable to local tastes are amplifying penetration across the market. E-cigarettes are also becoming ubiquitous as a result of government efforts to curb tobacco use. Thus, the Asia Pacific region is anticipated to witness them taking off considerably in terms of product availability and consumer adoption, cementing the status of the region in the global E-Cigarette Market.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

E-Cigarette Market Key Players:

Some of the Major Players in E-Cigarette Market along with their product:

-

Altria Group, Inc. (USA) - (Tobacco, E-cigarettes)

-

British American Tobacco (UK) - (Tobacco, E-cigarettes)

-

Imperial Brands (UK) - (Tobacco, E-cigarettes)

-

International Vapor Group (USA) - (E-cigarettes)

-

Japan Tobacco Inc. (Japan) - (Tobacco, E-cigarettes)

-

NicQuid (USA) - (E-liquids)

-

JUUL Labs, Inc. (USA) - (E-cigarettes)

-

Philip Morris International Inc. (USA) - (Tobacco, E-cigarettes)

-

R.J. Reynolds Vapor Company (USA) - (E-cigarettes)

-

Shenzhen IVPS Technology Co., Ltd. (China) - (E-cigarettes)

-

Shenzhen KangerTech Technology Co., Ltd. (China) - (E-cigarettes)

-

Nicotek LLC (USA) - (E-cigarettes)

-

NJOY Inc. (USA) - (E-cigarettes)

-

Reynolds American Inc. (USA) - (Tobacco, E-cigarettes)

-

ITC Limited (India) - (Tobacco, E-cigarettes)

-

J WELL France (France) - (E-cigarettes)

List of suppliers that provide raw materials for the e-cigarette market:

-

Fufeng Group (China)

-

Dow Chemical Company (USA)

-

BASF SE (Germany)

-

Glycerin Technologies (USA)

-

Alpha Aromatics (USA)

-

Flavorah (USA)

-

Capella Flavors (USA)

-

CigaTech (China)

-

Pinnacle Flavors (USA)

-

Huangshan Tianshan Pharmaceutical Co., Ltd. (China)

Recent Development

-

On June 21, 2024, the U.S. Food and Drug Administration authorized four menthol e-cigarette products from Altria Group Inc. and NJOY Inc., marking the first flavored vapes permitted on the market. The decision indicates that vape makers can demonstrate benefits for adult smokers that outweigh risks to youth.

-

On November 27, 2024, Philip Morris International Inc. celebrated the 10th anniversary of its IQOS product, which has contributed to a 46% drop in smoking prevalence in Japan since its launch. With over USD10 billion in annual net revenues, IQOS is available in over 70 markets and has helped approximately 22 million adults transition away from traditional cigarettes.

| Report Attributes | Details |

| Market Size in 2023 | USD 23.28 Billion |

| Market Size by 2032 | USD 34.36 Billion |

| CAGR | CAGR of 5.40 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Disposable, Rechargeable, Modular Devices) • By Distribution Channel (Online, Retail) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Altria Group, Inc. (USA), British American Tobacco (UK), Imperial Brands (UK), International Vapor Group (USA), Japan Tobacco Inc. (Japan), NicQuid (USA), JUUL Labs, Inc. (USA), Philip Morris International Inc. (USA), R.J. Reynolds Vapor Company (USA), Shenzhen IVPS Technology Co., Ltd. (China), Shenzhen KangerTech Technology Co., Ltd. (China), Nicotek LLC (USA), NJOY Inc. (USA), Reynolds American Inc. (USA), ITC Limited (India), J WELL France (France) |