Drug Testing Market Size:

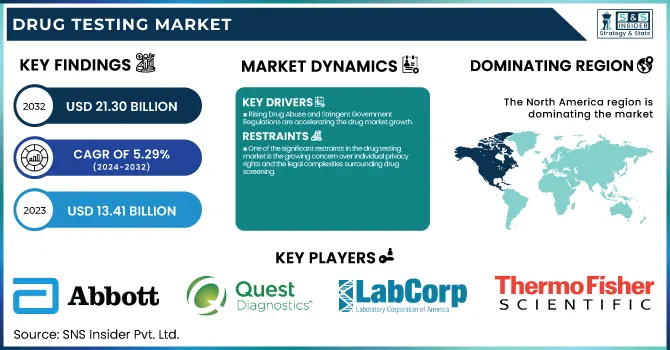

The Drug Testing Market size was valued at USD 13.41 billion in 2023 and is projected to reach USD 21.30 billion by 2032, growing at a CAGR of 5.29% from 2024-2032.

To Get more information on Drug Testing Market - Request Free Sample Report

The Drug Testing Market report provides distinct insights by reviewing drug prevalence and testing trends across regions, with a focus on differences in patterns of substance abuse and their influence on testing demand. It also examines the volume and growth of drug testing techniques (2020-2032), including a comparative analysis of urine, oral fluid, hair, and blood testing adoption by geographies. Furthermore, the report considers healthcare and workplace expenditures on drug testing (2023), categorized by government, commercial, private, and out-of-pocket expenditure, providing an in-depth analysis of financial levels and employer-initiated testing initiatives. These observations enable an inclusive analysis of the dynamic drug testing environment beyond conventional market expansion analysis.

Drug Testing Market Dynamics

Drivers

-

Rising Drug Abuse and Stringent Government Regulations are accelerating the drug market growth.

The growing incidence of drug use globally is a primary stimulus for the drug testing industry. The United Nations Office on Drugs and Crime (UNODC) reports that more than 296 million individuals used drugs in 2023, a 23% rise from the previous decade. This has been met with governments and regulatory agencies introducing more stringent workplace drug testing regulations, law enforcement testing, and compulsory drug testing for sportspersons. The U.S. Department of Transportation (DOT) and the Occupational Safety and Health Administration (OSHA) require drug testing in industries such as transportation and construction to maintain workplace safety. Moreover, nations such as Canada, Germany, and Australia have increased drug testing in law enforcement and medical environments. The interplay between increasing drug abuse and regulatory support is driving the need for sophisticated and quick drug testing solutions.

-

Technological Advancements in Drug Testing Methods propelling the market growth.

Technological innovations like portable testers, quick screeners, and minimally invasive collection methods for specimens are fueling market growth profoundly. Improved capabilities in mass spectrometry, chromatography, and biosensing have enhanced assay accuracy, sensitivities, and turnaround times. Thermo Fisher Scientific launched the CEDIA DAU assay in 2023, which has boosted multi-class detection capabilities. In addition, the emergence of saliva-based and hair follicle drug testing, with longer windows of detection, is increasingly popular in forensic and workplace environments. Quest Diagnostics and LabCorp are among the companies investing in analytics enabled by artificial intelligence to better interpret drug test results. These advancements are increasing the reliability, efficacy, and accessibility of drug testing, which is resulting in increased adoption across industries, from workplaces and healthcare establishments to law enforcement organizations.

Restraint

-

One of the significant restraints in the drug testing market is the growing concern over individual privacy rights and the legal complexities surrounding drug screening.

In some areas, such as Europe and portions of the U.S., employees are well protected by strict laws against intrusive workplace drug testing except when required by certain regulations. The European Court of Human Rights has also stressed the importance of proportionality in drug testing to prevent it from infringing on fundamental rights. Also, with cannabis being legalized in several U.S. states and nations such as Canada and Germany, employers encounter legal challenges in testing workers for marijuana, particularly when its use is legal for medicinal purposes. Litigation questioning workplace drug testing policies, as well as the controversy surrounding ethical concerns, pose uncertainties for businesses, constraining the growth of drug testing programs across industries.

Opportunities

-

The growing emphasis on workplace safety and student well-being is creating significant opportunities for the drug testing market.

The increasing focus on workplace safety and student health is generating substantial opportunities for the drug testing industry. Across industries, especially in transportation, construction, and healthcare, employers are imposing tighter drug testing policies to avert substance abuse-related accidents and liabilities. The U.S. Department of Labor estimates that drug use in the workplace costs American companies more than USD100 billion each year in lost productivity, absenteeism, and healthcare costs. Moreover, schools are also embracing drug testing programs to counter the increasing trend of teenage drug abuse. Nations such as the U.S., India, and China are enhancing their regulatory systems to promote frequent drug screening. With more organizations appreciating the value of routine drug testing in ensuring safety and efficiency, the need for sophisticated, non-invasive testing techniques is likely to increase substantially.

Challenges

-

The rapid evolution of synthetic and designer drugs poses a critical challenge for the drug testing market.

The speedy development of synthetic and designer drugs represents an acute challenge for the drug testing industry. New psychoactive substances (NPS), such as synthetic cannabinoids, fentanyl analogs, and designer stimulants, are regularly appearing, many times bypassing standard drug screens. More than 1,100 NPS have been reported worldwide, the United Nations Office on Drugs and Crime (UNODC) states, with new forms appearing on the market regularly. Standard drug panels fail to identify these drugs, creating the necessity for ongoing updates and advancements in drug testing technology. Users of such drugs also tend to switch to undetectable forms, making it even more challenging to prevent substance abuse. Drug testing companies and laboratories have to spend a lot on research and development to accommodate changing drug mixes, which results in higher expenses and operational challenges for drug testing companies globally.

Drug Testing Market Segmentation Analysis

By Product

The Consumables segment dominated the drug testing market with a 33.29% market share in 2023 on account of the repeated demand for test kits, reagents, and sample collection devices in different end-use environments. The repeated testing of employees in workplaces, police and law enforcement agencies, rehabilitation facilities, and hospitals fuels the demand for disposable and one-time consumables to provide accuracy and purity of drug testing. Widespread use of drug testing for urine and oral fluid, involving reagent strips, sample cups, and test cassettes, further boosted the dominance of the segment. Further, ongoing innovations in drug detection technologies like enzyme immunoassays and chromatography-based testing require high-quality reagents and calibration solutions, propelling the segment's growth. The rising prevalence of drug abuse and stricter regulatory conditions in the world also strengthen the demand for consumables in drug testing.

The rapid testing devices segment is expected to expand at the fastest rate during the forecast period because of the growing need for rapid, point-of-use drug screening methods. These instruments, such as portable drug analyzers and point-of-care testing kits, offer immediate test results, which are extremely useful for workplace drug testing, roadside law enforcement testing, and emergency medical use. Increasing demand for non-invasive testing technologies, like saliva rapid tests, also fuels the market. Furthermore, improvements in lateral flow immunoassay technology and digital drug screening instruments boost accuracy and user-friendliness, leading to increased adoption. As government programs encouraging drug-free workplaces become more prevalent and drug abuse policies are enforced more strictly, healthcare facilities and industries are quickly adopting rapid testing devices into their drug detection programs, driving segment growth.

By Sample

The Urine Samples segment dominated the drug testing market with a 75.23% market share in 2023 because of its popularity, affordability, and consistency in detecting a wide variety of drugs. Urine drug testing is most frequently utilized across industries, rehabilitation facilities, and law enforcement agencies because it can detect drug metabolites for an extended period. Regulating agencies like the U.S. Department of Transportation (DOT) and the Substance Abuse and Mental Health Services Administration (SAMHSA) require urine drug testing for safety-sensitive jobs, further propelling demand. Moreover, technology improvements in immunoassay-based urine test kits and lab confirmation methods, including gas chromatography-mass spectrometry (GC-MS), have improved detection sensitivity, solidifying its supremacy. The large number of regular drug tests performed in workplace and clinical environments continues to maintain the segment's market leadership.

The Oral Fluid Samples segment is anticipated to register the fastest growth during the forecast period with a 7.58% CAGR based on its ease of collection, non-invasive nature, and capability to detect recent drug consumption. Unlike urine testing, oral fluid drug tests are not dependent on specialized collection facilities or privacy, thus being very suitable for workplace and roadside drug testing. Advances in saliva-based drug detection technology, such as increased sensitivity and accuracy of lateral flow assays and laboratory confirmations, are pushing adoption. In addition, regulatory support and the growing popularity of oral fluid testing for compliance, including SAMHSA's recent approval of oral fluid testing for federally regulated employers, are fueling market expansion. As the demand for rapid, on-site drug testing and awareness of the advantages of saliva-based tests grow, this segment will grow exponentially in the years to come.

By Drug

The Cannabis/Marijuana segment dominated the drug testing market with 56.26% market share in 2023 on account of its extensive usage and regulatory requirements for workplace and roadside testing. As more regions have legalized the substance for medical and recreational purposes, the demand for regular testing has grown, especially in sectors that have stringent drug-free policies, such as transportation, healthcare, and law enforcement. Also, marijuana metabolites are detectable in urine and saliva for weeks, so routine testing is mandatory for compliance. Organizations and government agencies continue to mandate cannabis screening to maintain workplace safety and conformity with federal and employer-imposed drug testing requirements. The use of THC-specific testing kits has grown considerably, further establishing cannabis/marijuana as the most tested drug in drug tests.

The opioid segment is expected to witness the fastest growth during the forecast period because of the persistent opioid crisis and growing concerns regarding prescription drug abuse. The surge in opioid-related overdoses and fatalities has led governments and healthcare institutions to enforce stricter drug testing regulations. Policies like the U.S. Department of Health and Human Services (HHS) guidelines for increased opioid testing and the common use of opioid screening in rehabilitation facilities and hospitals are fueling market growth. Furthermore, progress in opioid detection technologies, such as highly sensitive immunoassay and mass spectrometry techniques, has enhanced test precision, resulting in increased adoption. With synthetic opioids such as fentanyl continuing to present threats to the public's health, the need for regular and accurate opioid drug testing is likely to increase substantially.

By End Use

The Drug Testing Laboratories segment dominated the drug testing market in 2023 because of its high level of accuracy, compliance with regulations, and extensive use in forensic, workplace, and healthcare applications. These labs employ sophisticated methods like gas chromatography-mass spectrometry (GC-MS) and liquid chromatography-tandem mass spectrometry (LC-MS/MS), which guarantee accurate and legally admissible outcomes. Numerous government agencies, law enforcement agencies, and major corporations depend on certified drug testing labs for confirmation analysis and regulatory needs. Furthermore, the rising rates of drug abuse, especially in safety-sensitive sectors such as transportation and construction, have created a demand for laboratory-based drug testing. The capability to handle high sample volumes with extensive toxicology analysis has established the leadership of drug testing laboratories in the industry.

The workplace segment is poised to be the fastest-growing throughout the forecast period based on the growth in the application of workplace drug testing programs among industries. Organizations are concentrating on having a drug-free workplace environment to improve productivity, minimize accidents at workplaces, and adhere to regulatory requirements. Transportation, construction, and healthcare industries have mandatory drug testing regulations, further spurring demand. The growing trend of pre-employment and random drug testing, along with the growth of instant and on-site test kits, is driving growth in this segment. Also, with the growth of remote work and hybrid job models, organizations are embracing flexible testing solutions, such as oral fluid and rapid test kits, to remain compliant. This trend toward more frequent, affordable, and on-site drug testing is projected to fuel the rapid expansion of the workplace drug testing market.

Regional Insights

North America dominated the drug testing market with a 52.25% market share in 2023 as a result of its strict workplace drug testing laws, high rates of substance abuse, and established healthcare system. The United States, in particular, has stringent drug screening measures for workers in transportation, healthcare, and law enforcement under the Department of Transportation (DOT) and Substance Abuse and Mental Health Services Administration (SAMHSA) guidelines. In addition, the opioid epidemic has fueled the need for drug testing, with more than 100,000 drug overdose fatalities registered in the U.S. in 2023 alone, reports the CDC. Companies, law enforcement, and rehab centers alike are investing more in sophisticated drug testing tools, such as instant and laboratory-based testing, further consolidating North America's market leadership.

Asia Pacific is experiencing the fastest growth in the drug testing market, with a 6.42% CAGR throughout the forecast period, caused by escalating rates of substance abuse, stringent workplace safety policies, and enhanced awareness of drug-related health hazards. China, India, and Australia are also implementing stricter drug screening policies in the business world, police, and schools. As per the United Nations Office on Drugs and Crime (UNODC), methamphetamine consumption has grown in Southeast Asia, fueling the need for comprehensive drug testing solutions. Also, urbanization and growing healthcare infrastructure are driving the use of drug screening technology. Government policies, including India's Narcotic Drugs and Psychotropic Substances Act and China's anti-drug policy, are also supporting market growth. With increasing disposable incomes and growing awareness, demand for easy, non-invasive drug testing solutions keeps growing in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players in the Drug Testing Market

-

Abbott Laboratories (Alere iCup Drug Screen, SoToxa Mobile Test System)

-

Quest Diagnostics (Employer Solutions Drug Testing, Quest Diagnostics Drug Testing Index)

-

Laboratory Corporation of America Holdings (LabCorp) (Substance Abuse Testing, LabCorp at Home Drug Test Kits)

-

Thermo Fisher Scientific Inc. (CEDIA Drugs of Abuse Assays, DRI Drug Testing Reagents)

-

Drägerwerk AG & Co. KGaA (DrugTest 5000 Analyzer, Alcotest 9510)

-

Siemens Healthineers (Syva EMIT Toxicology Assays, Viva-ProE System)

-

F. Hoffmann-La Roche Ltd (cobas Integra 400 plus, KIMS Drug Testing Assays)

-

Bio-Rad Laboratories, Inc. (Tox/See Rapid Drug Screen Cup, Liquichek Urine Toxicology Control)

-

Alfa Scientific Designs, Inc. (Instant-view Multi-Drug Screen Test, Oral-View Saliva Drug Test)

-

Lifeloc Technologies, Inc. (FC Series Breathalyzers, EV30 Breath Alcohol Tester)

-

MPD Inc. (DrugCheck NxStep OnSite Urine Drug Test, DrugCheck SalivaScan Oral Fluid Drug Test)

-

OraSure Technologies, Inc. (Intercept Oral Fluid Drug Test, Q.E.D. Saliva Alcohol Test)

-

Psychemedics Corporation (Hair Drug Testing Services, PDT-90 Personal Drug Testing Kit)

-

American Bio Medica Corporation (Rapid TOX Cup II, OralStat Oral Fluid Drug Test)

-

AccuBioTech Co., Ltd. (Multi-Drug One Step Test Panel, Saliva Drug Test Cassette)

-

Premier Biotech, Inc. (OralTox Oral Fluid Drug Test, Premier Bio-Cup)

-

SureScreen Diagnostics Ltd. (Drugwipe Dual 5 Minute Test, Saliva Drug Testing Kit)

-

Wondfo Biotech Co., Ltd. (Multi-Drug Urine Test Cup, Saliva Drug Test Strip)

-

Healgen Scientific LLC (Multi-Drug Rapid Test Cup, SalivaScreen Oral Fluid Drug Test)

-

Innovacon, Inc. (One Step Drug Screen Test Card, Oral Fluid Drug Test Device)

Suppliers (These suppliers play pivotal roles in providing essential equipment and supplies for effective drug testing across various markets)

-

Abbott Laboratories

-

Fisher Scientific

-

AlcoPro

-

Drug Test Kit USA

-

Medline Industries

-

Halux Diagnostic

-

Rapid Detect

-

PinPoint Testing, LLC

-

ALCO-Safe

-

Bio-Rad Laboratories, Inc.

Recent Development

-

April 2024 – Labcorp revealed the strategic growth of its precision oncology portfolio, enhancing its dedication to cancer research and patient care across the world. The development accentuates Labcorp's commitment to scientific, diagnostic, and lab innovations to empower pharmaceutical, biotechnology, and clinical research collaborations in creating cutting-edge therapies.

-

Oct 2024 – Thermo Fisher Scientific will present its newest molecule-to-medicine advancements at CPHI Milan 2024 (Oct. 8-10) and sponsor industry-specific sessions. Speakers will explain how the company assists biotech and pharma companies throughout the entire spectrum of drug development, emphasizing its worldwide momentum.

-

Dec 2023 – Quest Diagnostics launched a new confirmatory testing panel for new psychoactive substances (NPS), testing 88 compounds from different classes of drugs, including designer opioids, benzodiazepines, stimulants, fentanyl analogs, and synthetic cannabinoids. The panel is designed to assist healthcare professionals in identifying drug abuse as the presence of synthetic drugs continues to grow in the U.S. supply, with xylazine and fentanyl analogs playing a significant role in the overdose epidemic.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 13.41 Billion |

| Market Size by 2032 | US$ 21.30 Billion |

| CAGR | CAGR of 5.29% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Consumables, Instruments, Rapid Testing Devices, Services) • By Sample (Urine Samples, Oral Fluid Samples, Hair Samples, Other Samples) • By Drug (Alcohol, Cannabis/Marijuana, Cocaine, Opioids, Amphetamine & Methamphetamine, LSD, Others) • By End Use (Drug Testing Laboratories, Workplaces, Hospitals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Abbott Laboratories, Quest Diagnostics, Laboratory Corporation of America Holdings (LabCorp), Thermo Fisher Scientific Inc., Drägerwerk AG & Co. KGaA, Siemens Healthineers, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc., Alfa Scientific Designs, Inc., Lifeloc Technologies, Inc., MPD Inc., OraSure Technologies, Inc., Psychemedics Corporation, American Bio Medica Corporation, AccuBioTech Co., Ltd., Premier Biotech, Inc., SureScreen Diagnostics Ltd., Wondfo Biotech Co., Ltd., Healgen Scientific LLC, Innovacon, Inc., and other players. |